國立臺灣大學管理學院會計研究所 碩士論文

Department of Accounting College of Management

National Taiwan University Master Thesis

企業社會責任與併購溢價

Corporate Social Responsibility and M&A Premiums

杜曼瑋 Mang-Wei Tu

指導教授: 陳坤志 博士 Advisor: Kun-Chih Chen, Ph.D.

中華民國 108 年 6 月

口試委員會審定書

摘要

本研究以 904 筆美國國內併購案件為研究對象,探討併購案件當中被收購方 之企業社會責任表現與併購溢價之關聯,並基於股東理論及企業能力理論分析被 收購方之企業社會責任對於收購方之成本效益。實證結果顯示,被收購方之企業社 會責任表現會與併購溢價呈現負相關,即被收購方在企業社會責任上之努力將損 害收購方的股東利益。然而,本研究進一步發現,被收購方之獲利能力與經營能力 對於其企業社會責任表現與併購溢價之關係有正向調節效果,顯示當被收購方之 財務表現良好時,會減緩被收購方企業社會責任表現對併購溢價之負向影響。本研 究為企業社會責任與併購議題之文獻增添了新的發現,並提醒併購市場的參與者 需更加關注企業社會責任對於併購溢價之影響。

關鍵字:企業社會責任、併購、併購溢價、股東理論、企業能力理論

Abstract

This study investigates the association between targets’ CSR and M&A premiums

by using a domestic sample of 904 M&A deals in the U.S. In line with the shareholder theory and capabilities-based theory, this research finds a significant and negative relation between targets’ CSR and premiums, suggesting targets’ CSR engagement destroys the

value of the firm in M&A deals. In addition, a positive moderating effect of firm performance on the impact of targets’ CSR on premiums is revealed. The result indicates higher profitability and operating ability alleviate the acquirer’s concern toward targets’

CSR. Overall, this study adds to the body of literature on the effect of CSR under the context of M&A and sheds light on the adverse influence of CSR in deal valuation.

Keywords: CSR, M&A, premium, shareholder theory, capabilities-based theory

Contents

口試委員會審定書 ... i

摘要 ... ii

Abstract ... iii

Contents ... iv

List of Tables ... v

1. Introduction ... 1

2. Literature Review ... 5

2.1 Corporate Social Responsibility ... 5

2.2 Corporate Social Responsibility and M&A ... 8

3. Hypotheses Development ... 14

3.1 CSR and M&A premiums ... 14

3.2 The moderating role of firm performance ... 19

4. Research Design ... 23

4.1 Data and Sample ... 23

4.2 Measures ... 26

4.2.1 M&A premiums ... 26

4.2.2 CSR engagement ... 26

4.2.3 Firm performance ... 27

4.2.4 Control variables ... 28

4.3 Model specification ... 34

5. Main Results ... 36

5.1 Descriptive Statistics and Correlation Analysis ... 36

5.2 Hypotheses testing ... 40

6. Additional tests ... 45

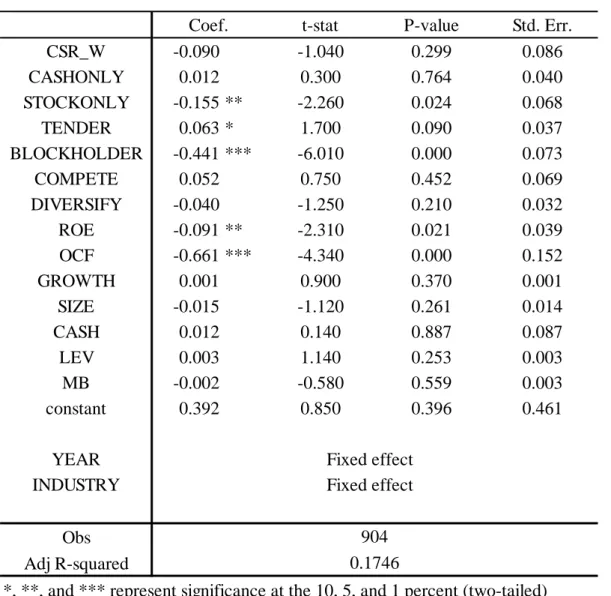

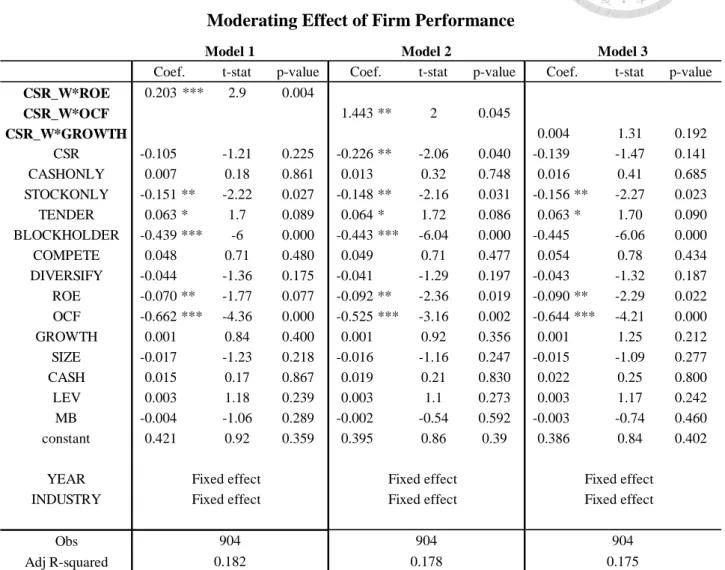

6.1 Alternative CSR measurement ... 45

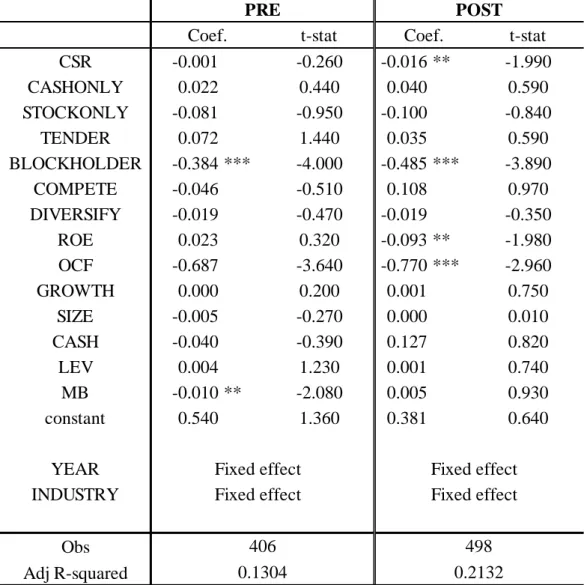

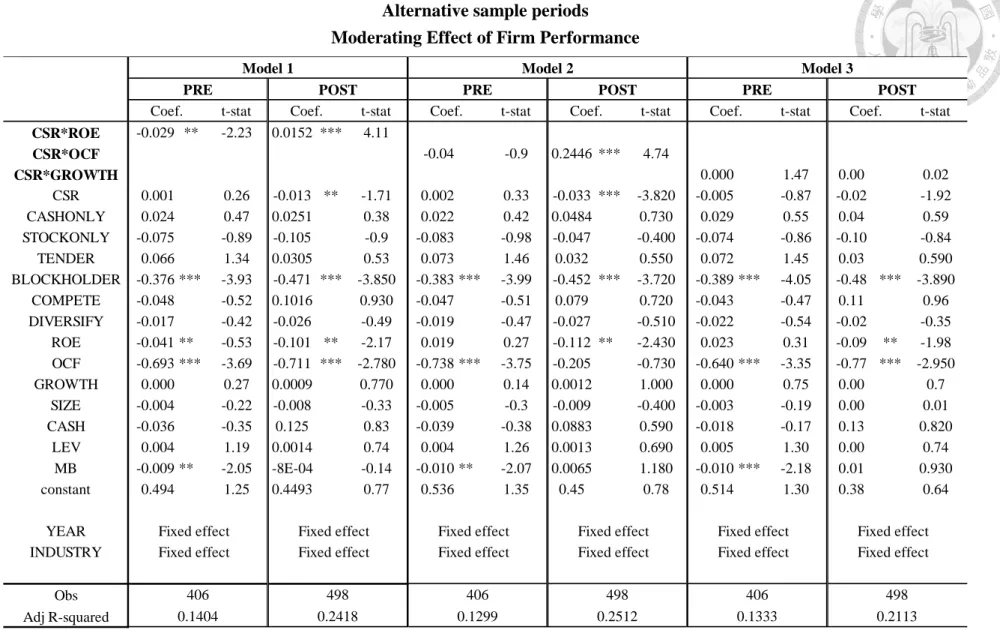

6.2 Alternative sample periods ... 48

7. Conclusion ... 51

References... 54

List of Tables

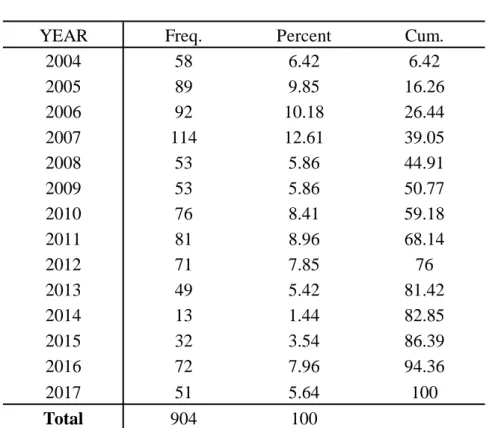

Table 1 Sample Yearly Distribution ... 25

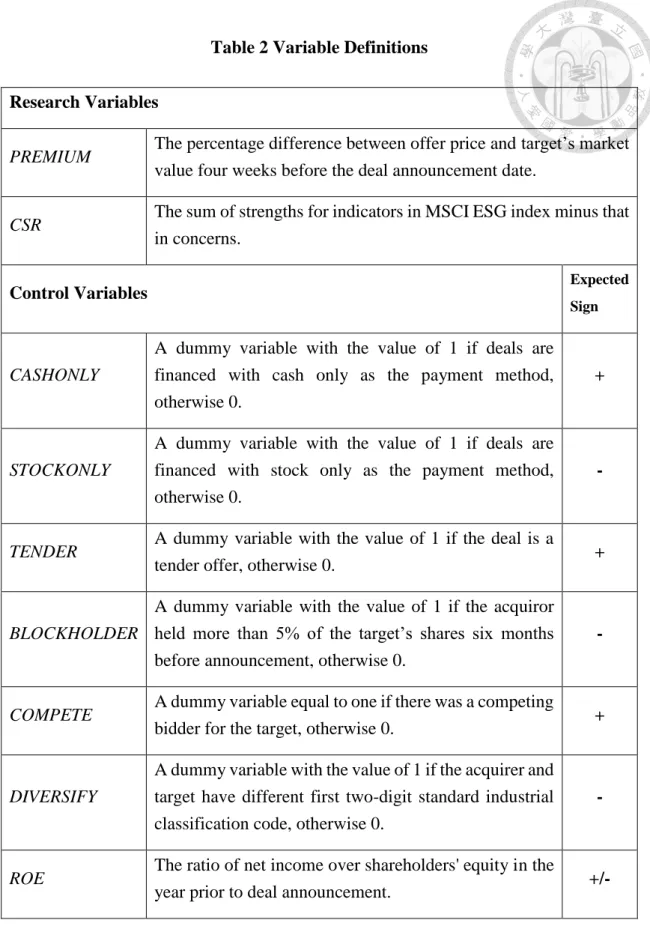

Table 2 Variable Definitions ... 32

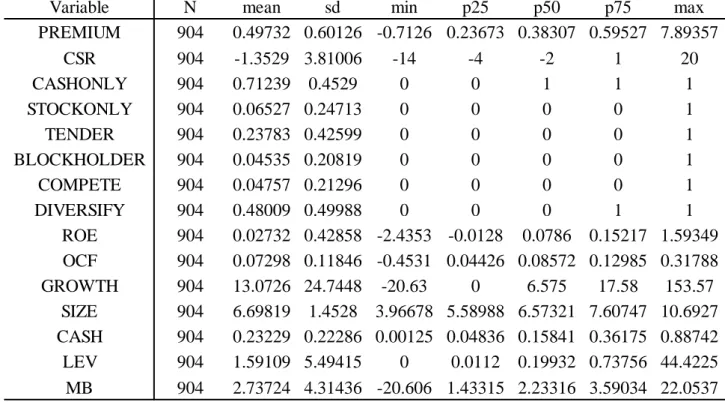

Table 3 Descriptive Statistics ... 37

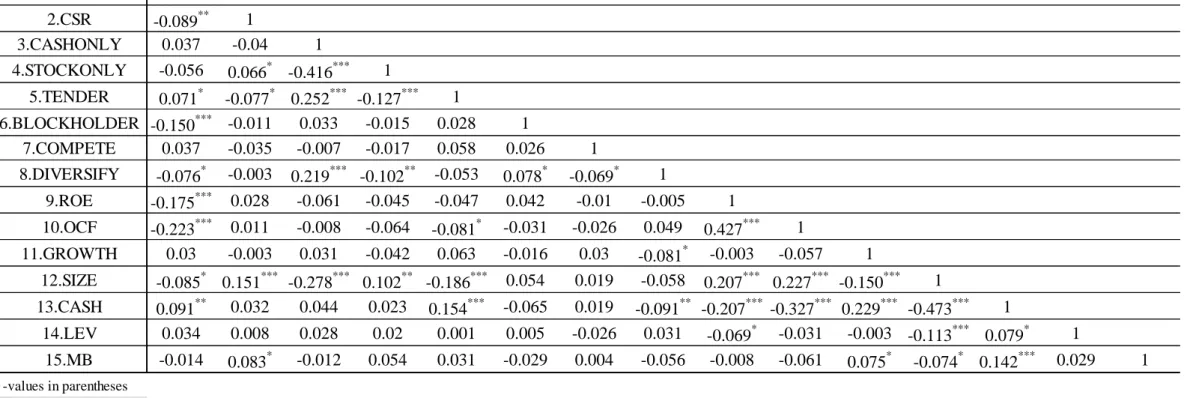

Table 4 Correlation Matrix ... 39

Table 5 Target's CSR Engagement and M&A Premiums ... 42

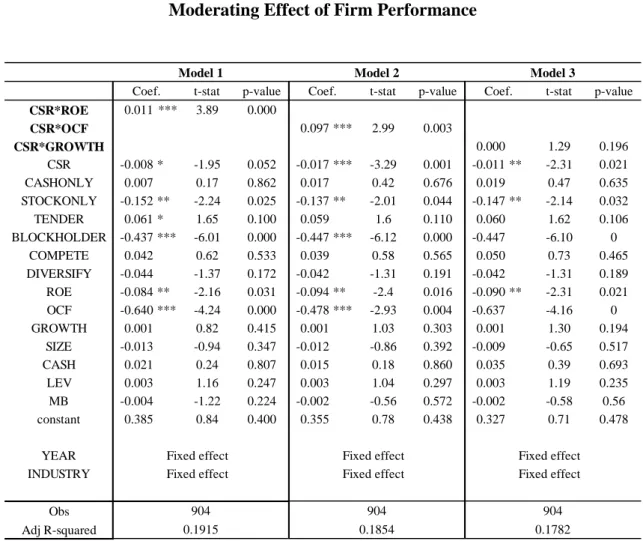

Table 6 Moderating Effect of Firm Performance ... 44

Table 7 Alternative CSR measurement for Target's CSR Engagement and M&A Premiums ... 46

Table 8 Alternative CSR measurement for Moderating Effect of Firm Performance ... 47

Table 9 Alternative sample periods for Target's CSR Engagement and M&A Premiums ... 49

Table 10 Alternative sample periods for Moderating Effect of Firm Performance ... 50

1. Introduction

Merger and acquisition (M&A) is an important approach for companies to acquire resources and seek opportunities to expand. Meanwhile, the growing attention on corporate social responsibility (CSR) has made this topic become a significant factor in

M&A deals. PwC (2012) has conducted a survey to assess trade buyers’ attitude toward CSR on M&A activities. Respondents of the survey consider target’s CSR engagement

influential to the occurrence, valuation and integration of the deal, and thus more due diligence on CSR are expected to be developed at the onset of the transaction. As M&As are experiencing a boom in recent years, the impact of CSR on M&A deals requires more investigation. In the M&A trend report released by Deloitte (2019), over 76 percent of M&A executives in U.S corporations foresee an uptick in deal flows. The growth in M&A deals is particularly striking given the market results cited in the report: M&A deals has increased by 50 percent in 2018 comparing to that in the prior year.

Due to the fact that CSR and M&A are both vast and complicated topics, extant literature lacks an assertive archetype to determine whether CSR is value-enhancing or value-destroying. A classic debate stands between the stakeholder theory (Freeman, 1984) and shareholder theory (Friedman, 1970). While the former suggests companies should

take care of all the related parties to establish a mutually beneficial relationship, the latter argues CSR is a divestment of wealth from shareholders to stakeholders. Apart from the two opposing views, it is also challenging to measure the impact of CSR on financial performance as researchers fail to reach conclusive results from empirical evidence (Griffin & Mahon, 1997; Jiao, 2010; Waddock & Graves, 1997). CSR under the context of M&A has further problematized the issue by involving the transfer of CSR from target to acquirer, and the cost and difficulty of integrating targets’ CSR could be material.

Furthermore, very limited literature addresses the question of how acquirers distinguish targets’ CSR in M&A deals. As a result, the acquirers’ perception to the value of targets’

CSR becomes a topic worthy of further investigation.

This paper examines acquirers’ perception on targets’ CSR engagement through the premium assigned in M&A deals. As CSR is an intangible asset whose value is hard to be evaluated and recognized by the market, (Blowfield & Murray, 2014; Parisi &

Hockerts, 2008), using the M&A premiums representing the bid payment exceeding the market value to investigate the issue would be particularly insightful. Acquirers often exercise large amount of due diligence for the target, and qualitative evidence (PwC, 2012) suggests acquirers take CSR into consideration in their evaluation. Targets’ CSR will thus

be recognized and reflected in the premiums. The M&A premiums therefore invites a possible approach to capture acquirers’ perception on targets’ CSR.

By using a sample of 904 domestic M&A deals in the U.S, merging deal information, CSR engagement information and financial information from SDC, MSCI ESG and Compustat respectively, a significant and negative relation is found between targets’ CSR engagement and M&A premiums. The result is consistent with the shareholder’s view, suggesting targets’ CSR consumes resources at the expense of the acquirers’ shareholders.

It also stands for the fact that targets’ CSR engagement could be difficult and costly for future integration, and might attenuate the takeover gains from deploying acquirers’

capability (Berchicci, Dowell, & King, 2012). The second finding of this study suggests there is a positive moderating effect of targets’ performance on the relation between CSR and premiums. The stronger the target performs in profitability and operating ability, the less negative perception the acquirer posits on CSR. This finding reveals the fact that acquirers approve targets’ CSR more where the target achieves higher financial objectives.

This research has three main contributions. First, it adds to the scarce literature on CSR and M&A premiums by focusing on the evaluation of targets’ CSR and including comprehensive indicators in MSCI ESG database. Second, this study finds empirical

evidence consistent with the shareholder’s view and calls attention on the potential value- destroying effect of CSR on corporations. Third, participants in the M&A market may gain insights from this study and introduce more thorough evaluations on the cost and benefit derived from targets’ CSR engagement.

The remainder of the paper is organized as follows: Section 2 presents the literature review of existing research on related topics. Section 3 displays development of two hypotheses in this study. Section 4 describes the data, sample, measures and models for the research. Section 5 shows the descriptive statistics, correlation matrix and results for hypotheses testing. Section 6 demonstrates two additional tests and section 7 concludes the study.

2. Literature Review

2.1 Corporate Social Responsibility

Corporate social responsibility (CSR) has gained great attention in the academic community in recent years, and thus attracts scholars using different approaches to conduct research on the topic. Although there is growing literature investigating CSR from different dimensions, there lacks a dominant paradigm to determine whether CSR engagement is beneficial or adverse to corporations for CSR is a topic of great complexity and versatility. CSR related research in business studies can be roughly classified into three domains. The first domain is the conceptualization of CSR, which focuses on the evolutionary path of theories in the development of CSR and the legitimacy of firms engaging in CSR activities (Lee, 2008). The second domain lies in the strategic implications of CSR, aiming to provide a framework for analyzing CSR as an approach to stakeholder management and resource allocation (McWilliams, Siegel, & Wright, 2006). The third domain of CSR research intend to find out the capabilities of CSR to influence firm value, investigating whether and how CSR makes an impact on financial performance and firm valuation (Malik, 2015).

As all three domains of CSR research present disputes and mixed statements on CSR,

it is difficult to address whether CSR has positive or negative impacts on corporations.

For research on the conceptualization of CSR, the most vastly recognized definition comes from McWilliams and Siegel (2001), who define CSR as “situations where the

firm goes beyond compliance and engages on actions that appear to further some social good, beyond the interest of firm and that which is required by law.” This has brought out

an ever-contested debate on the legitimacy of a firm to undertake CSR activities. From the stakeholder theory (Freeman, 1984), since a variety of constituents will have impact on the outcome of a firm, a firm cannot focus exclusively on the interests of stockholders but must satisfy its duty to all stakeholders with whom the firm is explicitly or implicitly associated. The stakeholder theory implies that CSR activities will develop a positive relationship with stakeholders who will support the firm to achieve objectives in return.

On the other hand, the shareholder theory (Friedman, 1970; Jensen, 2001) argues that engaging in CSR is not in line with the objective of maximizing wealth of the shareholders and will distract a company from developing its core competence, causing wastes on its resources.

For studies on CSR’s strategic implications, Baron (2001) states that other than plain

altruistic purposes, firms engage in CSR as a means of providing public good in

conjuncture with their marketing strategy. Studies have also found that CSR causes significant impact on a firm’s reputation (Minor & Morgan, 2011) and customer relation

(Murray & Vogel, 1997) , creates association with brand name (McWilliams & Siegel, 2001) and therefore could constitute a resource to form sustainable competitive advantage (Orlitzky, Siegel, & Waldman, 2011). However, since the conduct of CSR is highly discretionary and its actual bonds with business strategy is difficult to verify due to its intangible nature (Parisi & Hockerts, 2008), CSR engagement could be a result of management entrenchment (Cespa & Cestone, 2007) and even leads to conflicts between owners and managers (Tafel-Viia & Alas, 2009), presenting severe agency problems where managers engage in CSR activities to serve their own interest at the expense of shareholders (Barnea & Rubin, 2010; Barrios, Fasan, & Nanda, 2014).

Studies on the capability of CSR to influence firm value also fail to reach a consistent conclusion. Extant literature tends to identify the potential effect of CSR activities on financial performance such as profitability or market value, but while some claim a positive association between CSR and financial performance (Fatemi, Fooladi, &

Tehranian, 2015; Godfrey, Merrill, & Hansen, 2009; Griffin & Mahon, 1997; Jiao, 2010), some argue there is a negative association (Flammer, 2015; Friedman, 1970; Griffin &

Mahon, 1997) and still some suggest there is no clear connection (Barnett, 2007;

McWilliams & Siegel, 2000; Waddock & Graves, 1997). The inconclusive results for the relation between CSR and financial performance may be attributed to the fact that the cost of CSR engagement might exceeds the benefit it can create as it consumes an abundant of resources in a corporation (Alexander & Buchholz, 1978) . Moreover, it is also highly challenging to measure, report and verify the return of CSR on corporations (Blowfield & Murray, 2014).

2.2 Corporate Social Responsibility and M&A

As M&A is an important form of corporate development, extant literature suggests M&A is taken as an approach to enhance acquirers’ value through integration with the target to create synergies in operation efficiency, financial advantage, economic of scale and strategic alignment (Al‐Sharkas, Hassan, & Lawrence, 2008; Auerbach & Reishus,

1987; Calipha, Tarba, & Brock, 2010). As CSR is argued to have impacts on a corporation’s value through the channel of influencing its business strategy (McWilliams

et al., 2006) and financial performance (Malik, 2015), studies pose the importance of CSR in the context of M&A from several perspectives, which can be mainly separated into four streams: the choice of targets, deal completion, post-M&A performance and wealth

effect.

For the effect of CSR on the choice of targets, the acquirer’s propensity to purchase a target with high or low CSR engagements differs under the capabilities-based theory.

The capabilities-based theory (Capron, 1999; Kaul & Wu, 2016) suggests two sources of creating value through M&A deals: deploying or accessing capabilities. If CSR is a capability the acquirer wants to gain from the target, there is higher probability for the acquirer to buy high CSR firms in hope to enhance the acquirer’s stakeholder management strategy (Wickert, Vaccaro, & Cornelissen, 2017). On the other hand, Berchicci et al. (2012) find evidence to support the fact that CSR is a capability the acquirer wants to deploy, and thus it prefers targets with inferior CSR qualities so that more potential gains would be created through the improvement of the acquired firm.

Researchers also find that targets’ reputation is a determinant to acquirers’ decision on target selection as it acts as a predictor of achieving market-based objectives (Dollinger, Golden, & Saxton, 1997; Saxton & Dollinger, 2004).

Studies also indicate that there exists a relationship between CSR and M&A completion. Deng, Kang, and Low (2013) find that comparing to low-CSR acquirers, high-CSR acquirers took less time to complete a merger and are also more likely to

succeed by analyzing the observed probability of completion and duration between announcement date and effective date. Arouri et al. (2019) use risk-arbitrage spreads as a proxy for deal uncertainty in M&As and concluded that M&As undertaken by high-CSR acquirers would be characterized by less uncertainty, resulting in higher probability of completion.

Existing literature also finds relation between CSR and post-merger performance.

Since stakeholders are affected by and aware of M&A activities, the post-M&A integration process is sensitive to stakeholder behavior that will ultimately cause impact on the acquirer (Kato & Schoenberg, 2014). Deng et al. (2013) use changes in operating cash flow to measure operating performance and finds that acquirers with high CSR performance enjoy larger increases in post-merger operating performance and realize positive long-term stock returns.

Whether CSR makes an impact on shareholder wealth is another stream of research under the M&A context. Liang, Renneboog, and Vansteenkiste (2017) find out there is a positive relation between shareholder returns and strong employee engagement in M&A deals. Deng et al. (2013) states that there would be higher returns for merger announcement and weighted-average portfolio of acquirers and targets in mergers

initiated by high-CSR acquirers because of greater stakeholder satisfaction. As this study exploits CSR research through the stream in shareholders’ wealth effect by focusing on how CSR makes an impact on M&A premiums, prior research by Gomes and Marsat (2018) and Qiao and Wu (2019) are closest to the topic.

Gomes and Marsat (2018) use an international sample of 588 M&A deals to study the association between targets’ CSR engagement and bid premiums. They apply CSR

information from ASSET4 database and find that the overall CSR performance as well as the two underlying dimensions, social and environmental performance, all pose a positive impact on M&A premiums. They further their research by distinguishing domestic and international M&A deals to examine the potential effect of cross-border nature. While acquirers generally assign value for environmental performance, they only approve social performance in cross-border deals. They argue targets’ CSR involvement helps reduce the acquirer’s exposure to information asymmetry and targets’ specific risk by revealing

more stakeholder information and higher CSR performance lessens harmful impacts caused by materialization of negative events. They also discover the impact of different CSR dimensions varies under domestic and international deals.

Qiao and Wu (2019) on the other hand, also conduct a research on the effect of target

firms’ CSR on acquisition premiums, but they focus on cross-border deals and use CSR

data from the MSCI ESG database. By analyzing a sample of 252 international acquisitions, they find a positive relation between targets’ CSR engagement and premiums. Hence, to complement the cross-border nature of their sample, they extend the research by investigating the moderating effect of institutional factors arising from differences in regulation, culture and social recognition. Results show institutional factors weaken the positive effect of CSR on premiums as the foreign acquirer would reduce the

value paid for CSR when institutional distance widens. The study explains the contribution of CSR to premiums from a strategic angle, indicating targets’ CSR helps

enhance corporation image, solidify the expansion base for business and obtain support from third party.

This research also aims to study the effect of targets’ CSR on M&A premiums but differs from Gomes and Marsat (2018) and Qiao and Wu (2019) in several domains. First, this paper examines how the acquirer evaluate targets’ CSR in a domestic setting where both targets and acquirers are U.S corporations. Focusing on domestic M&A deals largens the sample to 904 deals and concentrates the propositions on more profound determinates to the impact of CSR on premiums by eliminating interruptions from cross-border effect.

Second, different from Gomes and Marsat (2018), this study collects CSR information

from MSCI ESG database. Lastly, the development of this paper varies from prior studies and thus lead to different focus and interpretation on the relationship between targets’

CSR and M&A premiums. Gomes and Marsat (2018) develop its propositions through a risk management perspective for CSR reduces the targets’ specific risk in a deal. Qiao and Wu (2019) applies the resource-based perspective and institutional theory to

emphasize the impact of CSR as a strategic asset in a cross-border setting. This study, on the other hand, carves a new space from analyzing the cost and benefit of deriving targets’

CSR through the acquirer’s perspective, and posits the potential value-destroying effect

of CSR to shareholders in the acquiring firm.

3. Hypotheses Development

3.1 CSR and M&A premiums

This study investigates CSR in the context of M&A by examining the impact of targets’ CSR performance on premiums in M&A deals. For an acquirer, one of the most crucial parts in an M&A deal comes to the determination of the bidding price for the target, and premiums refer to the extra price exceeding the target’s real market price that the acquirer is willing to pay (Simonyan, 2014). Premiums capture the intangible asset that is difficult for the market to identify and the synergetic sources the acquirer presumes to derive from integration of two parties. By applying the resource-based view in CSR related literature, companies engage in CSR for the purpose of sustaining competitive advantage by building reputation and enhancing stakeholder relations (Fombrun &

Shanley, 1990; Kato & Schoenberg, 2014; McWilliams & Siegel, 2011; Minor & Morgan, 2011). Therefore, CSR is most likely to be an important source of strategic asset that is difficult to price and identify because of its intangible nature (Parisi & Hockerts, 2008).

However, in the process of target valuation in M&A deals, as non-identifiable asset will be assessed, and CSR engagement would have an impact on synergies which result a difference in post-merger performance (Deng et al., 2013; Kato & Schoenberg, 2014),

premiums could be a fair measure to capture the value of CSR as an strategic asset of the target and how the acquirer evaluate its impact on post-merger integration.

Since the main purpose of M&A is to maximize shareholder wealth of the acquirer through strategic integration with the target (Al‐Sharkas et al., 2008; Calipha et al., 2010), premiums assigned by the acquirer would reflect whether the target’s CSR engagement is considered an asset to generate benefit for the shareholder or a cost that lead to a decrease in shareholder wealth. CSR engagement can be interpreted through the contract theory (Coase, 1952; Hodgson, 1998) which determines firms to be a nexus of contracts between its stakeholders in exchange of resources. That is, the target devotes itself to fulfilling its responsibility to related parties with its business and gains more support from its stakeholders. Since M&As involve a change in ownership of those contracts from the target to acquirer, those nexus of contracts developed by the target could be either valued or devalued by the shareholders of the acquiring firm under the different context of two opposing views on CSR, the stakeholder’s view and shareholder’s view.

By applying the stakeholder’s view (Freeman, 2010; McWilliams & Siegel, 2001),

the transfer of contracts from targets could be beneficial to the acquirer from three aspects in the M&A deal. First, targets’ CSR engagement enhances the acquirer’s reputation and

image by sending a message to the market that the acquirer treasures CSR engagement and is willing to maintain the CSR practice (Qiao & Wu, 2019). Second, targets’ CSR engagement presents a stronger stakeholders’ commitment and helps reduce deal uncertainty by gaining an easier access to stakeholders’ support for the M&A (Arouri, Gomes, & Pukthuanthong, 2019). Third, the contracts reinforce the acquirer’s ability to facilitate the process of post-merger M&A integration by alleviating obstacles in forming alliance with stakeholders, leading to larger synergies in operation performance (Deng et al., 2013). As a result, the acquirer would assign more value to targets’ CSR engagement and offers a higher M&A premium.

Alternatively, the nexus of contracts inherited from the targets would be troublesome and value-destroying under the shareholders’ view. From the shareholder’s view (Friedman, 1970; Jensen, 2001), the contracts demonstrate more obligations to fulfill, which indicate more resources being consumed for dedication to stakeholders other than the shareholders. As the maintenance of those CSR engagement can be costly and challenging in both implementing and reporting (Blowfield & Murray, 2014), the acquirer may consider those contracts a burden rather than an asset. Furthermore, if the inherent binding between the target and its stakeholders is strong and unshakable, the stakeholders

might oppose strongly to the shift of ownership which may put the existing contracts at stake. This would soar costs in negotiation and increase uncertainty to the deal, and the post-M&A integration would also become highly challenging as it is tough for the acquirer to meet the standards of the previous contracts and form alliance with targets’

stakeholders. Besides, from the capabilities-deployment perspective, the higher the CSR performance of the target, the lower the takeover gains could be produced from advancement of CSR practices. In this case, targets’ CSR engagement would be devalued by the acquirer and lead to a decrease in M&A premiums.

Although prior studies suggest there is a positive link between CSR and M&A premiums and stand for the stakeholder’s view (Gomes & Marsat, 2018; Qiao & Wu,

2019), they use an international sample of M&A deals and attribute the positive link to cross-border effect where international M&A deals are exposed to higher risk in information asymmetry resulting from culture and compliance difference. They argue that targets’ CSR engagement could offer positive signals such as higher goodwill and lower specific risk to improve acquirers’ knowledge, facilitate the completion, and further provide a base for expansion in a foreign country. However, since this study focuses on domestic M&A deals, the two firms do not encounter difficulties caused by difference in

language, culture or law compliance. Thus, the benefit brought by CSR engagement to decrease high risk of information asymmetry is diminished in a domestic setting. Apart from the different nature of sample, through a resource-based perspective, CSR engagement forms an strategic asset to sustain competitive advantage (Orlitzky et al., 2011) whose returns result in non-financial and intangible benefits that are highly uncertain and difficult to measure (McWilliams et al., 2006; Parisi & Hockerts, 2008). In contrast, the expenditure on maintaining CSR activities is certain in the divestment of resources from shareholders to stakeholders and CSR engagement might even cause conflicts between stakeholders and shareholders arising from agency problems (Barnea

& Rubin, 2010). Therefore, by using a domestic sample and introducing a deeper cost and benefit analysis of inheriting targets’ CSR, this study argues that the shareholder’s view

would fit more and the acquirer would devalue targets’ CSR engagement as the shareholder’s purpose in M&A deals is to maximize their own wealth (Calipha et al.,

2010).

The following hypothesis is proposed in an alternative form:

H1: Targets’ CSR engagement is negatively associated with M&A premiums.

3.2 The moderating role of firm performance

In CSR related research, a classic question lies in whether firms “do well by doing good,” or “do good by doing well” (Morrissey, 1989). In the “do well by doing good”

context, CSR creates value in that CSR engagement helps firms achieve better performance. CSR engagement assists the firm to reach its financial goal so that firms should prioritize their endeavors in CSR. In contrast, from the “do good by doing well”

perspective, CSR engagement creates value whereas firms accomplish their goal in profit maximization. Before firms attain their financial objectives, CSR engagement would be treated as a burden, a plain divestment of resources at the expense of shareholders.

Under the shareholder’s view, CSR is unlikely to be valued as it transfers profit from

shareholders to other stakeholders. The development for the first hypothesis of this study

suggests in domestic M&As, acquirers might perceive the target’s CSR to be value- destroying and therefore predict the target’s CSR engagement to have a negative

association with the M&A premiums. As a result, it is of low probability that the acquirers adopt the “do well by doing good” viewpoint when assessing target’s CSR. However, if

the acquirer approves the argument of “do good by doing well,” there is a chance the acquirers would perceive the target’s CSR to be an asset in the M&A deal and assign

more value to the target’s CSR when the target demonstrates stronger firm performance.

Since this study develops the first hypothesis based on the shareholder’s view, further

examination on the perception of the acquirer’s shareholders to the “do well” and “do good” question can be made by investigating the moderating role of the target’s firm

performance on M&A premiums. Prior studies have shown that some moderating factors are associated with the premiums related to CSR engagement that the acquirer is willing to pay for. Qiao and Wu (2019) examined the institutional factors as a moderating effect to M&A premiums, and found those factors significantly impact the acquirer’s perception on the value of target’s CSR in cross-border M&A deals since institutional and cultural distance impedes the mutual knowledge of the two parties and thus negatively affect the acquirer’s evaluation of target’s CSR. Gomes and Marsat (2018) introduce an interaction

term between CSR and cross-border variable and find cross-border effect exerts significant influence on the CSR performance in the social dimension

This study proposes a positive moderating effect of firm performance on the

relationship between targets’ CSR and M&A premiums. When the acquirer approves the

“do good by doing well” perspective, the target’s firm performance will affect the acquirer’s evaluation of the target’s CSR. Since the target’s characteristics of firm

performance such as profitability, operating efficiency and growth would have affected the success of M&A deal by influencing the acquirer’s assessment on the value of the target (Beitel, Schiereck, & Wahrenburg, 2004; Campa & Hernando, 2004; Skaife &

Wangerin, 2013), when the target presents a higher strength in those characteristics, the excellent firm performance might convince the shareholders of the acquirer that the target’s CSR engagement is based on the premise that the target has superior ability in generating profit, operating business and accelerating sales. Presenting a more favorable

order by identifying priorities in financial objectives in business strategy reduces the acquirer’s concern toward targets’ CSR practice. When assessing the target’s CSR, the

acquirer might not consider maintaining those CSR engagement a burden that costs tremendous on stakeholder management, nor presume the CSR practice a result of management entrenchment. Instead, drawing on high firm performance of the target, the acquirer might recognize targets’ CSR as icing on the cake and approve its effect on elevating the acquired firm in intangible aspects such as enhancing reputation and forming competitive advantage.

The following hypotheses are proposed in an alternative form:

H2(a) Targets’ profitability positively moderates the relationship between targets’

CSR engagement and M&A premiums.

H2(b) Targets’ operating ability positively moderates the relationship between targets’

CSR engagement and M&A premiums.

H2(c) Targets’ growth potential positively moderates the relationship between targets’

CSR engagement and M&A premiums.

4. Research Design

4.1 Data and Sample

As this study focuses on the relationship between target’s CSR engagement, M&A premiums, and moderating effect of firm performance, the sample is derived through multiple steps from three main databases for information on CSR, M&A activities and financial data. To measure CSR engagement, this research relies on the MSCI database of environmental, social and governance (ESG), formerly referred to as the Kinder, Lydenburg, Domini (KLD) database. The MSCI database is widely used in academic literature for measuring CSR (Deng et al., 2013; Qiao & Wu, 2019; Van de Velde, Vermeir, & Corten, 2005; Watson, 2015) as it introduces a set of indicators to provide information on CSR performance of more than 3000 companies around the world. Data of M&A deals is extracted from the Securities Data Corporation (SDC) database, a major source of M&A activities across the world, which is also widely applied in M&A related research. Lastly, financial information is collected from Compustat, a database of financial, statistical and market information on active and inactive global companies throughout the world.

Due to the fact that the MSCI database undertook a major modification to expand its

coverage in 2003 and updated the annual CSR index to 2016 at the date of data collection for this research, an M&A sample from SDC ranging from 2004 to 2017 is picked as this research uses CSR performance in the year prior to the M&A deal announcement to measure the CSR engagement of the target. The M&A deals are filtered by the following criteria: (1) Both the targets and acquirers are publicly listed companies in the U.S. (2) The deal value is higher than one million U.S dollars. (3) The percentage of shares acquired in the transaction exceeds 50%. By this step, the initial sample derived from SDC comes to 3,366 M&A deals. Next, data from MSCI database and SDC are merged and deals with no records in ESG indicators are removed, which reduce the sample to 1,227 transactions. Thirdly, the sample is matched with Compustat to get necessary financial information. A sample of 904 deals were eventually maintained after removing the missing values.

YEAR Freq. Percent Cum.

2004 58 6.42 6.42

2005 89 9.85 16.26

2006 92 10.18 26.44

2007 114 12.61 39.05

2008 53 5.86 44.91

2009 53 5.86 50.77

2010 76 8.41 59.18

2011 81 8.96 68.14

2012 71 7.85 76

2013 49 5.42 81.42

2014 13 1.44 82.85

2015 32 3.54 86.39

2016 72 7.96 94.36

2017 51 5.64 100

Total 904 100

Table 1 Sample Yearly Distribution

4.2 Measures

4.2.1 M&A premiums

The M&A premiums (PREMIUM) are calculated by the percentage difference between offer price and the target’s market value four weeks before the deal announcement date. This measure is consistent with prior research in M&A premiums to capture the payment surpassing the market value with a four-week time lag to avoid distortion from takeover announcement and value deviation caused by leakage of information right before the announcement (Eckbo, 2009; Reuer, Tong, & Wu, 2012).

4.2.2 CSR engagement

The CSR engagement of the target (CSR) is measured by summing the scores the target gets in the three different aspects: Environment, Social and Governance. Each aspect can be further divided into two parts, strengths and concerns. Strengths present positive CSR indicators, concerns for negative ones. Some indicators which are only assigned to a very limited number of companies are deleted in this research and 136 indicators are maintained. The distribution of indicators, each having a binary value as 0 and 1, are as followed. The environment aspect is comprised of 19 strength indicators and

indicators, the governance aspect with 9 for strengths and 11 for concerns. Consistent

with Deng et al. (2013); Qiao and Wu (2019), the overall CSR score are aggregated to measure the target’s CSR engagement by adding up the indicators for strengths minus

those for concerns.

4.2.3 Firm performance

The measure of firm performance is decomposed into three domains mentioned in the development for the second hypothesis, which are profitability, operating ability and growth potential. Following prior research (Beitel et al., 2004; Choi & Harmatuck, 2006;

McGuire, Sundgren, & Schneeweis, 1988), the following financial information of the target acts as proxies for the three domains.

(a) Profitability: measured by return on equity (ROE), calculated by dividing net income over shareholders' equity in the year prior to deal announcement.

(b) Operating ability: measured by net operating cash flow (OCF), scaled by book value of total asset in the year prior to deal announcement.

(c) Growth potential: measured by sales growth rate (GROWTH), which is the percentage change of net sales within three years prior to the deal announcement.

4.2.4 Control variables

The regression model also includes a list of variables which might influence the M&A premiums according to extant literature. The variables can be separated into three levels as followed.

(a) M&A deal level

CASHONLY: A dummy variable with the value of 1 if deals are financed with cash

only as the payment method, otherwise 0. The M&A premiums might increase as the deal is completed by an all-cash payment as it indicates there is less risk in misevaluation and therefore the acquirer is willing to bear complete risk after the combination (Sudarsanam

& Mahate, 2003).

STOCKONLY: A dummy variable with the value of 1 if deals are financed with

stock only as the payment method, otherwise 0. If the deal introduces high probability of inaccurately valuing the target, the premiums decrease as the acquirer tend to share risk with the target by using an all-stock payment. (Sudarsanam & Mahate, 2003).

TENDER: A dummy variable with the value of 1 if the deal is a tender offer,

otherwise 0. Premiums would usually be higher to create incentive for the targets’

shareholders to sell their shares when the acquirer openly proposes to purchase majority control (Eckbo, 2009).

BLOCKHOLDER: A dummy variable with the value of 1 if the acquiror held more

than 5% of the target’s shares six months before announcement, otherwise 0.When the

acquirer holds more than five percent of shares in the target before M&A, the premiums might decrease as the acquirer possesses more bargaining power (Ayers, Lefanowicz, &

Robinson, 2003).

COMPETE: A dummy variable equal to one if there was a competing bidder for

the target, otherwise 0. When two or more bidders compete for the same target, the premiums might increase because of multiple bidding (Walkling & Edmister, 1985).

DIVERSIFY: A dummy variable with the value of 1 if the acquirer and target have

different first two-digit standard industrial classification code, otherwise 0. When the acquirer and target belong to different industries, it would be more difficult to integrate and therefore may cause a decrease in premiums (Ahern & Harford, 2014).

(b) target characteristic level

SIZE: A variable measured by natural logarithm of book value of the target's total

asset in the year prior to deal announcement. The size of the target might be negatively associated with the premiums because larger targets increase difficulty in integration(Calipha et al., 2010) .

CASH: A variable measured by cash and marketable securities over total assets in

the year prior to deal announcement. Cash held by the target represents higher liquidity and therefore might increase M&A premiums (Bena & Li, 2014).

LEV: A variable measured by total debt over total assets in the year prior to deal

announcement. The leverage ratio of the target is also controlled in prior research (Deng et al., 2013; Gomes & Marsat, 2018), but it could either increase or decrease premiums as a target heavily in debt can be attractive in the eyes of bidders who seek to create earnings by restructuring corporate finance.

MB: A variable measured by the ratio of market value to book value in the year

prior to deal announcement. According to prior research, the variation of market to book ratio can be a proxy for good market performance (Beitel et al., 2004) or high

positive or negative.

ROE, OCF, GROWTH: when the proxies for firm performance act as control

variables in the model, they might be either positively or negatively associated with the dependent variable, PREMIUM. While good firm performance might increase premiums assigned by the acquirer, inherent outstanding performance may also reduce potential takeover gains as the acquirer expects less profit generated from target reorganization (Berchicci et al., 2012; Capron, 1999; Gomes & Marsat, 2018).

(c) Fixed effect level

In addition to variables for M&A deal level and target characteristics, year fixed effect (YEAR) and industry fixed effect (IND) are also controlled to avoid influence by market fluctuation and industry variation.

Table 2 Variable Definitions

Research Variables

PREMIUM The percentage difference between offer price and target’s market value four weeks before the deal announcement date.

CSR The sum of strengths for indicators in MSCI ESG index minus that in concerns.

Control Variables Expected

Sign

CASHONLY

A dummy variable with the value of 1 if deals are financed with cash only as the payment method, otherwise 0.

+

STOCKONLY

A dummy variable with the value of 1 if deals are financed with stock only as the payment method, otherwise 0.

-

TENDER A dummy variable with the value of 1 if the deal is a

tender offer, otherwise 0. +

BLOCKHOLDER

A dummy variable with the value of 1 if the acquiror held more than 5% of the target’s shares six months before announcement, otherwise 0.

-

COMPETE A dummy variable equal to one if there was a competing

bidder for the target, otherwise 0. +

DIVERSIFY

A dummy variable with the value of 1 if the acquirer and target have different first two-digit standard industrial classification code, otherwise 0.

-

ROE The ratio of net income over shareholders' equity in the

year prior to deal announcement. +/-

OCF The ratio of net operating cash flow over book value of

total asset in the year prior to deal announcement. +/- GROWTH The percentage change of net sales within three years

prior to the deal announcement. +/-

SIZE The natural logarithm of book value of the target's total asset in the year prior to deal announcement. - CASH The ratio of cash and marketable securities over total

assets in the year prior to deal announcement. + LEV The ratio of total liability over total assets in the year

prior to deal announcement. +/-

MB The ratio of market value to book value in the year prior

to deal announcement. +/-

4.3 Model specification

The Ordinary Least Square (OLS) regression model is applied to test the hypotheses.

Formula (1) is constructed for testing the first hypothesis to explore the association of target’s CSR engagement and M&A premiums.

Formula (2a), (2b), (2c) are constructed for testing the second hypothesis to examine the moderating effect of firm performance on the association of target’s CSR engagement and M&A premiums.

𝐏𝐑𝐄𝐌𝐈𝐔𝐌𝐢,𝐭= 𝛽0+ 𝛽1𝑪𝑺𝑹𝒊,𝒕−𝟏+ 𝛽2𝐶𝐴𝑆𝐻𝑂𝑁𝐿𝑌𝑖,𝑡+ 𝛽3𝑆𝑇𝑂𝐶𝐾𝑂𝑁𝐿𝑌𝑖,𝑡+ 𝛽4𝑇𝐸𝑁𝐷𝐸𝑅𝑖,𝑡 + 𝛽5𝐵𝐿𝑂𝐶𝐾𝐻𝑂𝐿𝐷𝐸𝑅𝑖,𝑡−1+ 𝛽6𝐶𝑂𝑀𝑃𝐸𝑇𝐸𝑖,𝑡−1+ 𝛽7𝐷𝐼𝑉𝐸𝑅𝑆𝐼𝐹𝑌𝑖,𝑡−1 + 𝛽8𝑅𝑂𝐸𝑖,𝑡−1+ 𝛽9𝑂𝐶𝐹𝑖,𝑡−1+ 𝛽10𝐺𝑅𝑂𝑊𝑇𝐻𝑖,𝑡−1+ 𝛽11𝑆𝐼𝑍𝐸𝑖,𝑡−1

+ 𝛽12𝐶𝐴𝑆𝐻𝑖,𝑡−1+ 𝛽13𝐿𝐸𝑉𝑖,𝑡−1+ 𝛽14𝑀𝐵𝑖,𝑡−1+ 𝐼𝑁𝐷𝑖+ 𝑌𝐸𝐴𝑅𝑡+ 𝜀𝑖,𝑡 (1)

𝐏𝐑𝐄𝐌𝐈𝐔𝐌𝐢,𝐭= 𝛽0+ 𝛽1𝑪𝑺𝑹𝒊,𝒕−𝟏𝒙𝑹𝑶𝑬𝒊,𝒕−𝟏+ 𝛽2𝐶𝑆𝑅𝑖,𝑡−1+ 𝛽3𝐶𝐴𝑆𝐻𝑂𝑁𝐿𝑌𝑖,𝑡 + 𝛽4𝑆𝑇𝑂𝐶𝐾𝑂𝑁𝐿𝑌𝑖,𝑡+ 𝛽5𝑇𝐸𝑁𝐷𝐸𝑅𝑖,𝑡+ 𝛽6𝐵𝐿𝑂𝐶𝐾𝐻𝑂𝐿𝐷𝐸𝑅𝑖,𝑡−1

+ 𝛽7𝐶𝑂𝑀𝑃𝐸𝑇𝐸𝑖,𝑡−1+ 𝛽8𝐷𝐼𝑉𝐸𝑅𝑆𝐼𝐹𝑌𝑖,𝑡−1+ 𝛽9𝑅𝑂𝐸𝑖,𝑡−1+ 𝛽10𝑂𝐶𝐹𝑖,𝑡−1 + 𝛽11𝐺𝑅𝑂𝑊𝑇𝐻𝑖,𝑡−1+ 𝛽12𝑆𝐼𝑍𝐸𝑖,𝑡−1+ 𝛽13𝐶𝐴𝑆𝐻𝑖,𝑡−1+ 𝛽14𝐿𝐸𝑉𝑖,𝑡−1

+ 𝛽15𝑀𝐵𝑖,𝑡−1+ 𝐼𝑁𝐷𝑖+ 𝑌𝐸𝐴𝑅𝑡 + 𝜀𝑖,𝑡 (2a)

𝐏𝐑𝐄𝐌𝐈𝐔𝐌𝐢,𝐭= 𝛽0+ 𝛽1𝑪𝑺𝑹𝒊,𝒕−𝟏𝒙𝑶𝑪𝑭𝒊,𝒕−𝟏+ 𝛽2𝐶𝑆𝑅𝑖,𝑡−1+ 𝛽3𝐶𝐴𝑆𝐻𝑂𝑁𝐿𝑌𝑖,𝑡 + 𝛽4𝑆𝑇𝑂𝐶𝐾𝑂𝑁𝐿𝑌𝑖,𝑡+ 𝛽5𝑇𝐸𝑁𝐷𝐸𝑅𝑖,𝑡+ 𝛽6𝐵𝐿𝑂𝐶𝐾𝐻𝑂𝐿𝐷𝐸𝑅𝑖,𝑡−1

+ 𝛽7𝐶𝑂𝑀𝑃𝐸𝑇𝐸𝑖,𝑡−1+ 𝛽8𝐷𝐼𝑉𝐸𝑅𝑆𝐼𝐹𝑌𝑖,𝑡−1+ 𝛽9𝑅𝑂𝐸𝑖,𝑡−1+ 𝛽10𝑂𝐶𝐹𝑖,𝑡−1 + 𝛽11𝐺𝑅𝑂𝑊𝑇𝐻𝑖,𝑡−1+ 𝛽12𝑆𝐼𝑍𝐸𝑖,𝑡−1+ 𝛽13𝐶𝐴𝑆𝐻𝑖,𝑡−1+ 𝛽14𝐿𝐸𝑉𝑖,𝑡−1

+ 𝛽15𝑀𝐵𝑖,𝑡−1+ 𝐼𝑁𝐷𝑖+ 𝑌𝐸𝐴𝑅𝑡 + 𝜀𝑖,𝑡 (2b)

𝐏𝐑𝐄𝐌𝐈𝐔𝐌𝐢,𝐭= 𝛽0+ 𝜷𝟏𝑪𝑺𝑹𝒊,𝒕−𝟏𝒙𝑮𝑹𝑶𝑾𝑻𝑯𝒊,𝒕−𝟏+ 𝛽2𝐶𝑆𝑅𝑖,𝑡−1+ 𝛽3𝐶𝐴𝑆𝐻𝑂𝑁𝐿𝑌𝑖,𝑡 + 𝛽4𝑆𝑇𝑂𝐶𝐾𝑂𝑁𝐿𝑌𝑖,𝑡+ 𝛽5𝑇𝐸𝑁𝐷𝐸𝑅𝑖,𝑡+ 𝛽6𝐵𝐿𝑂𝐶𝐾𝐻𝑂𝐿𝐷𝐸𝑅𝑖,𝑡−1

+ 𝛽7𝐶𝑂𝑀𝑃𝐸𝑇𝐸𝑖,𝑡−1+ 𝛽8𝐷𝐼𝑉𝐸𝑅𝑆𝐼𝐹𝑌𝑖,𝑡−1+ 𝛽9𝑅𝑂𝐸𝑖,𝑡−1+ 𝛽10𝑂𝐶𝐹𝑖,𝑡−1 + 𝛽11𝐺𝑅𝑂𝑊𝑇𝐻𝑖,𝑡−1+ 𝛽12𝑆𝐼𝑍𝐸𝑖,𝑡−1+ 𝛽13𝐶𝐴𝑆𝐻𝑖,𝑡−1+ 𝛽14𝐿𝐸𝑉𝑖,𝑡−1

+ 𝛽15𝑀𝐵𝑖,𝑡−1+ 𝐼𝑁𝐷𝑖+ 𝑌𝐸𝐴𝑅𝑡 + 𝜀𝑖,𝑡 (2c)

5. Main Results

5.1 Descriptive Statistics and Correlation Analysis

Table 3 shows the descriptive statistics for the whole sample of 904 observants. All continuous variables are winsorized at 1% and 99% percentiles in prevention of deviation by extreme values. The table presents the mean, standard deviation, max and minimum values, as well as values in the first, second, and third quantile of all research and control variables. Most of the deals observed positive M&A premiums, and the average premiums paid is about 50 percent. For the deal level variables, about 70 percent of the deals are purely cash financed whereas only a few deals are delivered by stock-only consideration. About one-fourth of the takeovers are acquired through tender offer and only a few bidders in the sample held more than five percent shares of the target before the M&A. A low ratio of deals has more than one potential bidders. Forty-eight percent of the deals are cross-industry as the acquirer and target belongs to different industries.

For the firm level control variables, the average return on equity of the target in the year before the deal is about 3 percent, operating cash flow to total asset ratio 7 percent and net sales growth rate 13 percent, but the standard deviation presents a high variation among observants. The size, cash ratio and debt ratio vary across different targets as

shown in the quantiles. The market to book ratio comes to an average of 2.7 and the majority of targets’ market value exceeds book value.

Table 4 provides the correlation matrix for all variables. The correlation between target CSR and premiums is significant and negative, suggesting the target’s CSR

engagement decreases the M&A premiums. This finding preliminarily verifies the expectation of hypothesis 1. By applying the commonly used cut-off threshold of 0.8, all coefficients are well below the value. A test of the variance inflation factor (VIF) also shows all values are lower than 3. Thus, multicollinearity is not a serious problem in this study.

Variable N mean sd min p25 p50 p75 max PREMIUM 904 0.49732 0.60126 -0.7126 0.23673 0.38307 0.59527 7.89357

CSR 904 -1.3529 3.81006 -14 -4 -2 1 20

CASHONLY 904 0.71239 0.4529 0 0 1 1 1

STOCKONLY 904 0.06527 0.24713 0 0 0 0 1

TENDER 904 0.23783 0.42599 0 0 0 0 1

BLOCKHOLDER 904 0.04535 0.20819 0 0 0 0 1

COMPETE 904 0.04757 0.21296 0 0 0 0 1

DIVERSIFY 904 0.48009 0.49988 0 0 0 1 1

ROE 904 0.02732 0.42858 -2.4353 -0.0128 0.0786 0.15217 1.59349 OCF 904 0.07298 0.11846 -0.4531 0.04426 0.08572 0.12985 0.31788 GROWTH 904 13.0726 24.7448 -20.63 0 6.575 17.58 153.57

SIZE 904 6.69819 1.4528 3.96678 5.58988 6.57321 7.60747 10.6927 CASH 904 0.23229 0.22286 0.00125 0.04836 0.15841 0.36175 0.88742 LEV 904 1.59109 5.49415 0 0.0112 0.19932 0.73756 44.4225 MB 904 2.73724 4.31436 -20.606 1.43315 2.23316 3.59034 22.0537

Table 3 Descriptive Statistics

Table 4 Correlation Matrix

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

1.PREMIUM 1

2.CSR -0.089** 1

3.CASHONLY 0.037 -0.04 1

4.STOCKONLY -0.056 0.066* -0.416*** 1

5.TENDER 0.071* -0.077* 0.252*** -0.127*** 1

6.BLOCKHOLDER -0.150*** -0.011 0.033 -0.015 0.028 1

7.COMPETE 0.037 -0.035 -0.007 -0.017 0.058 0.026 1

8.DIVERSIFY -0.076* -0.003 0.219*** -0.102** -0.053 0.078* -0.069* 1

9.ROE -0.175*** 0.028 -0.061 -0.045 -0.047 0.042 -0.01 -0.005 1

10.OCF -0.223*** 0.011 -0.008 -0.064 -0.081* -0.031 -0.026 0.049 0.427*** 1

11.GROWTH 0.03 -0.003 0.031 -0.042 0.063 -0.016 0.03 -0.081* -0.003 -0.057 1

12.SIZE -0.085* 0.151*** -0.278*** 0.102** -0.186*** 0.054 0.019 -0.058 0.207*** 0.227*** -0.150*** 1

13.CASH 0.091** 0.032 0.044 0.023 0.154*** -0.065 0.019 -0.091** -0.207*** -0.327*** 0.229*** -0.473*** 1

14.LEV 0.034 0.008 0.028 0.02 0.001 0.005 -0.026 0.031 -0.069* -0.031 -0.003 -0.113*** 0.079* 1

15.MB -0.014 0.083* -0.012 0.054 0.031 -0.029 0.004 -0.056 -0.008 -0.061 0.075* -0.074* 0.142*** 0.029 1

p -values in parentheses

* p < 0.05, ** p < 0.01, *** p < 0.001

5.2 Hypotheses testing

The outcome of the first hypothesis (H1) is shown in Table 5. H1 tests the relationship between targets’ CSR engagement and M&A premiums. The table reports that the coefficient on CSR which represents targets’ CSR engagement is -0.009, and the p-value is 0.048. The negative and significant coefficient suggests when the target’s CSR score in MSCI index is increased by 1 unit, the M&A premiums will decline by 0.9 percent. The result is consistent with the expectation in hypothesis 1, and stands for the shareholder theory. For the shareholders of the acquirer, the deeper the target involves in CSR activities, the more value-destroying the M&A deal will be. The result supports the shareholder theory which argues that CSR engagement is a transfer of wealth from shareholders to other stakeholders (Friedman, 1970; Jensen, 2001). In an M&A deal, the acquirers manifest this fact by offering lower premiums associated to targets’ CSR engagement.

Targets’ CSR, a nexus of contracts transferred to the acquirer is perceived as a costly expenditure that deprives the combined group’s resources. Possible explanation to this

fact might be as followed. First, when the target reveals more engagement in CSR, the acquirer might need to spend more on negotiating with the stakeholders as they would

oppose the deal more strongly in fear of jeopardizing their interest. Next, the target’s CSR engagement imposes duty on the acquirers by forcing them to meet obligations in CSR reporting and implementation. As fulfilling these obligations might consume much resources, the acquirer will lower their valuation toward the target. Moreover, when the

target has already set a high standard in CSR practice, the acquirer might find it hard to form alliance with the target’s inherent stakeholders. Hence, the solid network of CSR

constructed by the target would also cost the acquirer more when they want to shift the target’s resources to other potential counterparts since they need to pay a higher price in

breaking the connections with targets’ inherent stakeholders. These reasons above all raise uncertainty and cost for the deal completion and post-M&A integration. In addition to the shareholder theory, under the context of capabilities-deployment assumption of M&A (Berchicci et al., 2012; Capron, 1999), targets with higher CSR performance would become less attractive since limited value-enhancement can be realized through refinement of targets’ CSR. Therefore, in line with the empirical result, when the target performs better CSR engagement, the acquirer lowers the bid premiums in an M&A deal.

For control variables, all variables are in line with expected sign while some do not present a significant impact on the dependent variable.

CSR -0.009 **

CASHONLY 0.014

STOCKONLY -0.149 **

TENDER 0.061

BLOCKHOLDER -0.445 ***

COMPETE 0.046

DIVERSIFY -0.040

ROE -0.090 **

OCF -0.660 ***

GROWTH 0.001

SIZE -0.010

CASH 0.022

LEV 0.003

MB -0.002

constant 0.345

YEAR INDUSTRY

Obs 904

Adj R-squared 0.1775

0.602 0.454

*, **, and *** represent significance at the 10, 5, and 1 percent (two-tailed) confidence levels.

Fixed effect Fixed effect

0.003 0.460 -4.340

0.870 -0.750

0.798

0.003 0.152 0.001 0.014 0.087 0.251

0.501 0.209 0.022 0.670

-1.260 -2.290

0.260 1.150 -0.520

0.750

0.037 0.073 0.069 0.032 0.039 1.630

-6.070

0.000 0.382 0.455 0.104 0.000

0.004 0.040 0.068 0.048

0.720 0.030

Coef. t-stat P-value Std. Err.

Target's CSR engagement and M&A premiums

-1.980 0.360 -2.180 Table 5 Result for H1

Table 6 reports the regression results for the second hypotheses, H2(a), H2(b), H2(c).

Each hypothesis tests the moderating effect of firm performance in different domains, which are profitability, operating ability and growth potential. H2(a) predicts a positive moderating effect of profitability on the relationship between target’s CSR engagement and M&A premiums. Model 1 shows the coefficient of the interaction term is 0.011, positive and statistically significant at 1% confidence level. This provides support for H2(a), indicating the negative association between targets’ CSR engagement and M&A premiums would be alleviated whereas the target presents stronger profitability. In Model 2, the coefficient (0.097) is also positive and significant at 1% confidence level, referring the fact that the operating ability proxied by the target’s net operating cash flow also has a positive moderating effect on targets’ CSR and premiums. Although in model 3, the moderating effect of sale growth is not significantly evident, the empirical results in model 1 and 2 suggest targets’ firm performance exercises positive moderating effect to reduce the negative impact of targets’ CSR. The acquirer perceives the target’s CSR engagement to be less value-destroying when the target has demonstrated strength in profitability and operating ability. This could be explained through the fact that acquirer alleviates doubts on CSR engagement under the “do good by doing well” context. That