Oxford Conference Series | January 2018

5th Academic International Conference on Multi-Disciplinary

Studies and Education

3rd Academic International Conference on Business,

Economics and Management

AICMSE & AICBEM 2018 (Oxford) Conference Proceedings

AICMSE

Oxford

and 3rd Academic International Conference on Business, Economics and Management

AICMSE & AICBEM 2018 (Oxford) Conference Proceedings

22nd- 24th January 2018

General Editor: Dr. Ramandeep Kaur Chhina

Associate Editor(s): Prof. Dr. Abdul Ghafur Hamid, Dr Avnita Lakhani, Dr Monika

WIECZOREK-KOSMALA, Dr. Indianna Minto-Coy, Dr. Nitin Upadhyay, Dr. Poomintr Sooksripaisarnkit, Dr. Rajesh Sharma, Dr. Zhixiong Liao, Dr. Zinatul Zainol, Ms. Florence Simbiri-Jaoko, Ms. Mercy Khaute, Prof. Tshepo Herbert Mongalo, Dr. Joanna Błach, Miss. Kate Masih

Copyright © 2018 FLE Learning Ltd All rights reserved. No part of this publication may be

reproduced or transmitted in any form, or by any means, or stored in any retrieval system of any nature without the prior permission of the publishers.

Permited fair dealing under the Copyright, Designs and Patents Act 1988, or in accordance with the terms of a licence issued by the Copyright Licensing Agency in respect of photocopying and/or reprographic reproduction is excepted.

Any application for permission for other use of copyright material including permission to reproduce extracts in other published works must be made to the publishers and in the event of such permission being granted full acknowledgement of author, publisher and source must be given.

Disclaimer

Whilst every effort has been made to ensure that the information contained in this publication is correct, neither the editors and contributors nor FLE Learning accept any responsibility for any errors or omissions, quality, accuracy and currency of the information, nor any consequences that may result. FLE Learning takes no responsibility for the accuracy of URLs of external websites given in this publication nor for the accuracy or relevance of their content. The opinions, advices and information contained in this publication do not necessarily reflect the views or policies of the FLE Learning.

Format for citing papers

Author surname, initial(s). (2018). Title of paper. In Conference Proceedings of the 5th Academic International Conference on Multi-Disciplinary Studies and Education and 3rd Academic International Conference on Business, Economics and Management,, (pp. xx-xx). Oxford, January 22nd- 24th, 2018.

AICMSE & AICBEM © 2018 FLE Learning Ltd ISBN: 978-1-911185-57-4 (Online)

TABLE OF CONTENTS

THE DETERMINANTS OF AIRPORT OPERATIONAL STRATEGIES TOWARDS THE REGIONAL SUSTAINABLE APPROACH: A CASE STUDY OF PALMERSTON NORTH

AIRPORT ... 8

Eswaranathan Ehambaranathan and ShagesheelaMurugasu ... 8

FINANCIAL REGULATIONS AND INSOLVENCY RISK OF ISLAMIC AND CONVENTIONAL BANKS OF PAKISTAN ... 18

Shumaila Zeb ... 18

ROLE OF HUMAN RESOURCE MANAGEMENT PRACTICES IN THE DEVELOPMENT OF MINT COUNTRIES: IMPLICATIONS FOR PAKISTAN ... 27

Muhammad Saad and Sana Ahmed ... 27

THE RELATIONSHIP BETWEEN CUSTOMER-ORIENTED SERVICE BEHAVIOR,

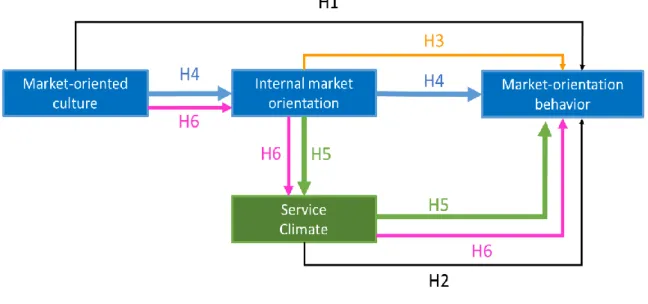

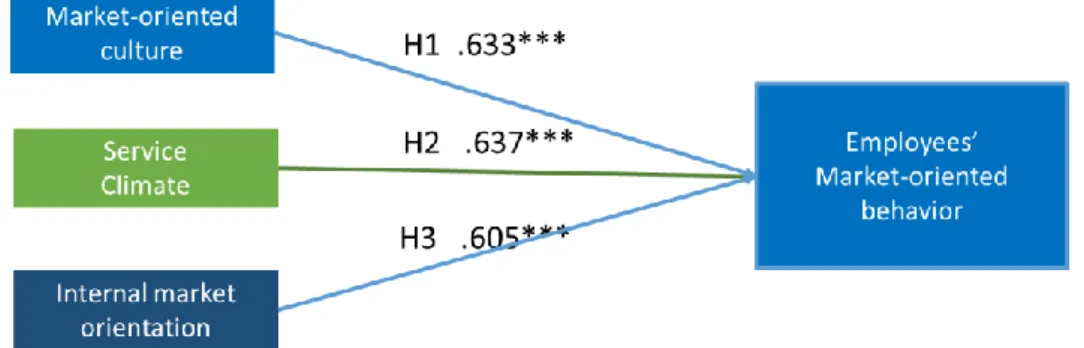

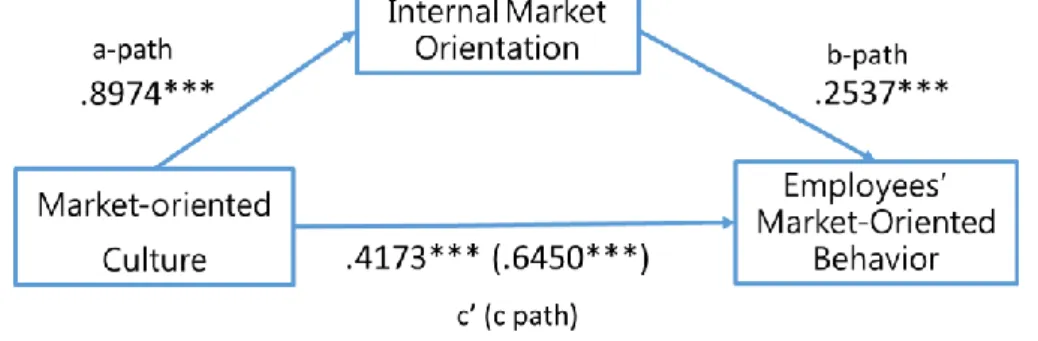

INTERNAL MARKET ORIENTATION, AND SERVICE CLIMATE ... 36

Shun-Ching Horng and Ling-Hua Weng ... 36

THE IMPACT OF GREEN INNOVATION ON ORGANIZATIONAL PERFORMANCE IN

DIFFERENT INDUSTRIES OF PAKISTAN ... 48

Maira AsiF, Naheed Anwar and Sana Ahmed ... 48

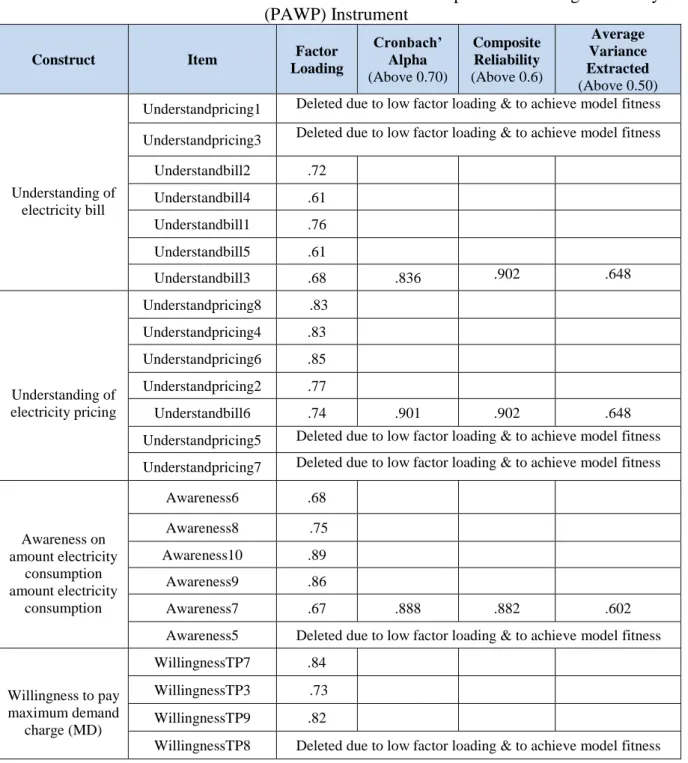

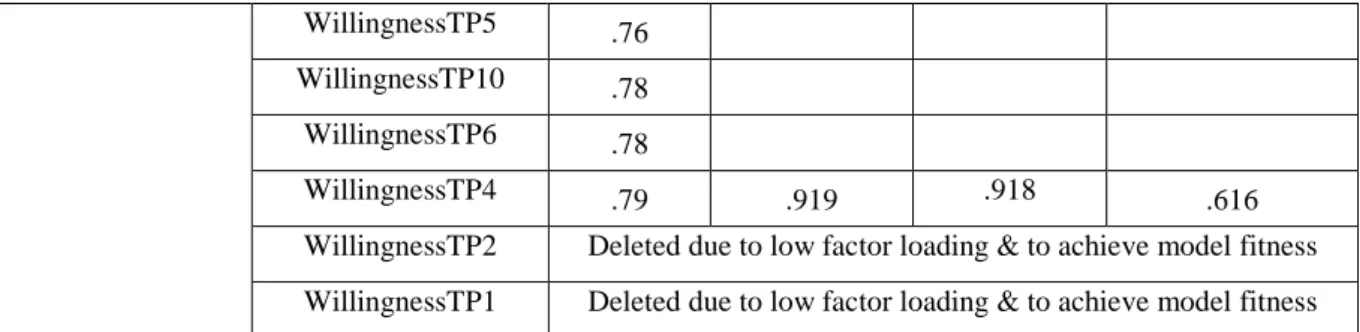

VALIDATION STUDY OF PUBLIC ACCEPTANCE ON WILLINGNESS TO PAY (PAWP) ON MAXIMUM DEMAND (MD) CHARGE IN MALAYSIA ... 57

Wan Muhammad Zainuddin Wan Abdullahand Wan Nur Rahini Aznie Zainuddin ... 57

A PROPOSED MODEL TO IMPROVE PUBLIC PARTICIPATION TOWARDS RENEWABLE ENERGY DEVELOPMENT (PPRED) IN MALAYSIA THROUGH VALIDATION STUDY ... 69

Wan Nur Rahini Aznie Zainuddin and Wan Muhammad Zainuddin Wan Abdullah ... 69

COMPETITIVE PRODUCT PRICING, EXTENDED PRODUCER RESPONSIBILITY,

SUSTAINABILITY AND THE CIRCULAR ECONOMY ... 81

SUKHRAJ S. TAKHAR and KAPILA LIYANAGE ... 81

A CONCEPTUAL MODEL FOR DEVELOPMENT NEEDS OF MIDDLE MANAGERS IN

M.S. Mughal, A.D. Ross AND D.J. Fearon ... 95

BETWEEN ‘BECOMING LIKE-NATIVES’ AND ‘MULTILINGUALS’: A

POSTSTRUCTURALIST ORIENTATION TO IMAGINED IDENTITY AND AGENCY ... 103

SOUAD SMAILI ... 103

A SYSTEMATIC REVIEW OF RESEARCH UNDERTAKEN INTO THE USE OF DIGITAL STORYTELLING AS A PEDAGOGICAL TOOL IN THE LANGUAGE CLASSROOM ... 113

Lizzie AbderrahimAnd Fatih Mehmet Cigerci ... 113

UN GLOBAL COMPACT: IMPLEMENTING LABOUR STANDARDS FOR THE ELIMINATION OF DISCRIMINATION IN EMPLOYMENT AND OCCUPATION ... 125

FATMA DEMİR ... 125

COST VERSUS PERFORMANCE BASED EMPLOYEE HR ATTRIBUTIONS AND TASK PERFORMANCE MODERATED BY CORE SELF-EVALUATIONS: EVIDENCE FROM A

COLLECTIVIST CULTURAL CONTEXT ... 133

Dr. Amna Yousaf ... 133

EXPLORING UNDERGRADUATE NURSING STUDENTS’ PERCEPTIONS ABOUT USING PORTFOLIOS IN NURSING EDUCATION ... 133

Dr. Maha Al-Madani ... 133

INDONESIAN LANGUAGE LEARNING AS A FOREIGN EDUCATION: A COMMUNICATION APPROACH IN CULTURE ... 134

Mrs. Rita Destiwati ... 134

THE EFFECTS OF HUE AND CHROMA COMBINATIONS ON PURCHASE INTENTION: A VIRTUAL REALITY EXPERIMENTAL RESEARCH ... 134

Prof. Guntalee Ruenrom and Dr. Ake Pattaratanakun ... 134

EUROPEAN ENTREPRENEURIAL ACTIVITY IN A CHANGING MACROECONOMIC

ENVIRONMENT ... 135

Dr. Irina Bilan and Dr. Angela Roman, Associate Professor ... 135

INVESTIGATING THE RELATIONSHIP BETWEEN EXCESS LIQUIDITY AND

Mr. Tianyu WANG and Kui-Wai Li ... 136

INFORMATION CONTENT OF RISK AND ASSETS PRICING ... 136

Mr. Omar Almania ... 136

BOARD DIVERSITY, FINANCIAL PERFORMANCE AND CORPORATE GOVERNANCE ... 137

Mr. Ahmad Algafari ... 137

HRO EFFECTIVENESS: A SERVICE PERFORMANCE PERSPECTIVE... 137

Ms. Siew Chen Sim ... 137

FRONTIER MARKETS AND SUBPRIME FINANCIAL CRISES: AN ECONOPHYSICS APPROACH ... 138

Ms. Wahbeeah Mohti, Andreia Dionísio, Isabel Vieira and Paulo Ferreira ... 138

ASSET SPECIFICITY AND PARTNERS’ OPPORTUNISTIC BEHAVIOR: COMPARATIVE EFFICACY OF CONTRACT AND TRUST ... 139

Ms. Chenxi Shi, Mr. Hongjiang Yao, Prof. Wenxue Lyu, Mr. Yiming Zhang and Dr. Yongqiang Chen, Professor 139 ENVIRONMENTAL HEALTH: DEVELOPMENT RESERVOIR OF JATIGEDE ... 140

Dr. Junardi Harahap and Prof. Dr. Opan S Suwartapradja ... 140

ECONOMIC IMPLICATIONS OF ACADEMIC PERFORMANCE OF TERTIARY EDUCATION STUDENTS IN VOCATIONAL AND SCIENCE EDUCATION COURSES ... 140

Mr. Taiwo Olayanju and Mr. Ebenezer Oje ... 140

CITIZENSHIP EDUCATION THROUGH NON-FORMAL LEARNING IN KOREA ... 141

Dr. Sun Young Park ... 141

FACULTY DEVELOPMENT IN EGYPT IN THE 21ST CENTURY: AN EXPLORATORY STUDY. ... 141

Ms. Noran Eldebecky ... 141

DISTANCE BETWEEN THE STATE AND ITS PEOPLE : THE CASE STUDY OF PRIMARY DROPOUT ISSUE IN LAOS ... 142

INTERNATIONAL ENVIRONMENTAL LAWS AND HUMAN RIGHTS ISSUES ... 142

Dr. Sushil Gupta and Ms Poonam Dhawan ... 142

VALIDITY OF MIXED METHODS APPROACH IN ISLAMIC STUDIES : SAUDI JUVENILES' SYSTEM AS A CASE STUDY ... 143

Mr. Hajed Alotaibi ... 143

THE IMPACT OF GLOBALIZATION ON OBESITY ... 143

Ms. Keiko Kanno ... 143

CRYPTOCURRENCY, THE SOCIO-LEGAL AND FINANCIAL IMPACTS ON GLOBAL ECONOMY ... 144

Dr. Hemant Garg and Mr. Vattanpreet Singh Sandhu ... 144

ANALYSIS OF CHARACTER EDUCATION IMPLEMENTATION AMONG ADOLESCENT . 144 Mrs. Sitti Hutari Mulyani Tari, Krisnova Nastasia, Mutiana Pratiwi, Henny Julius, Rio Andhika Putra, Billy Hendrik, Muhammad Ridwan and Khaidzir Ismail ... 144

DRUG VIOLENCE: CAN ITS PRESENCE BE TURNED INTO A POSITIVE DEVELOPMENT? THE CASE OF TEJALPA, A DRUG VIOLENCE HOT SPOT IN CENTRAL MEXICO ... 145

Ms. Luisa Isabel Hernández González ... 145

COMMUNITY EMPOWERMENT BASED ON CULTURE AND LIVESTOCK: AN ANALYSIS OF ECONOMIC EMPOWERMENT IN RESPECT TO THE IMPACT OF DEVELOPMENT .. 146

Dr. Junardi Harahap and Endang Sujana ... 146

IMPACT OF GST ON INDIAN FMCG SECTOR ... 146

Mr. Rishi Bafna ... 146

IDENTIFYING THE ECONOMIC EFFECT OF PRIVATIZATION ON HEALTH SECTOR ... 147

Mr. Lakshay Goel ... 147

WOMEN ENTREPRENEURSHIP IN INDIA: CHALLENGES AND STRUGGLES ... 147

AN INTELLIGENT SYSTEM FOR FINANCIAL DISTRESS PREDICTIONS ... 148

Prof. Shian-Chang Huang ... 148

A-SCORE: DEVELOPMENT AND TESTING OF AUGMENTED DISTRESS PREDICTION MODEL: A COMPARATIVE STUDY ON DEVELOPED AND EMERGING MARKET ... 148

Ms. Sumaira Ashraf Dr. Elisabete G.S. Félix, Assistant Professor; and Dr. Zélia Serrasqueiro, Professor ... 148

LIST OF LISTENER ... 149

Prof. Linda Cornwell ... 149

Ms. Mihye Lee ... 149

02- BF27-5634

THE DETERMINANTS OF AIRPORT OPERATIONAL STRATEGIES TOWARDS THE REGIONAL SUSTAINABLE APPROACH: A CASE STUDY OF PALMERSTON NORTH AIRPORT

ESWARANATHAN EHAMBARANATHAN1 AND SHAGESHEELAMURUGASU2

ABSTRACT

Over a century ago, airports then were almost not existent, and its function was undoubtedly unknown to many. Today, airports are essential in every city as airports integrate with individuals, the economy and environment as well as portray the symbol of growth. Similarly, Palmerston North Airport in New Zealand has been providing commercial and general aviation services since the 1930s. Thus, this paper is designed to explore the importance of this airport in the region as well as highlight its past and present operational activities and strategies. The secondary findings indicate that this airport was recognised as an international airport but now only serve the domestic market. Since its operations, the airport has faced several achievements and failures. So, based on its past and present strengths as well as weaknesses, this paper concludes this airport’s future operational opportunities and threats as well as it’s determinants towards the region sustainability.

Keywords: Operations Management, Airport, Sustainability, Palmerston North Airport INTRODUCTION

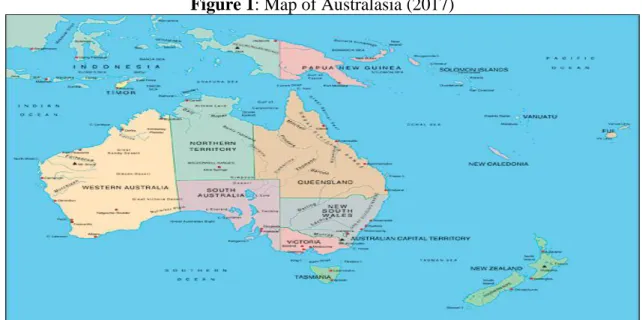

Palmerston North Airport is located in the Manawatu regionwhich is also situated in the lower region of the North Island of New Zealand. New Zealand has two main islands which are known as North Island and South Island. Therefore, New Zealand is an island nation as the country in the Pacific Continent, and geographically, New Zealand is not located in a strategic location as the country is situated in Southwestern Pacific Ocean and is a distance away from most of the countries in the region. Thus, New Zealand does not share any land borders with other states, and New Zealand nearest neighbours such as Australia and Fiji are 3 hours away via flight.

1 Universal College of Learning, New Zealand. E-Mail: -n.ehambara@ucol.ac.nz 2 Universal College of Learning, New Zealand. E-mail: - s.murugasu@ucol.ac.nz

Figure 1: Map of Australasia (2017)

Figure 2: Map of New Zealand (2017)

Meanwhile, New Zealand is the home for 4.8 million people. Due to the small market, the New Zealanders or also known as the Kiwis rely heavily on exports and imports. New Zealand is one of the largest dairy producers in the world and the most significant commodity exported in 2016 was milk powder, butter and cheese worth 11.2 billion in New Zealand Dollars. The total commodity and services export and import in 2016 were valued at 70.1 billion and 66.4 billion in New Zealand Dollars (Statistics New Zealand, 2017).

Therefore, the geographic isolation and economic needs have made the aviation industry an essential gateway for the country. Due to these reasons, the recent globalisation in the aviation industry in New Zealand is one of the critical and growing sectors to date. Over the past years, particularly in the commercial aviation community, it has been witnessing significant social and economic growth. The sharp increase in trade, tourism as well as migration has supported the air services which uses almost 14 percent of New Zealand exports (Ministry of Transport, 2017). Interestingly, there has been a sharp increase in tourist and

demand towards commercial aviation over the recent years because New Zealand is known for itsbeautiful and friendly environment (Fountain, 2016).

The commercial aviation community in New Zealand includes air transport, air rescue, air ambulances services, aircraft design and manufacture, services and engineering as well as aviation airports (Aviation New Zealand, 2016). In most situations, the growth of airports is vital for the regional economy and environmental sustainability. Similarly, airports in New Zealand is the major transportation hub that normally consists of runways, buildings, aircrafts that aim to promote direct and indirect employment through trading, tourism, education and other industries in the regions (De Neufville, 2016). Thus, in 2014, most of the New Zealand airports have been improving their operational efficiency to maintain regional growth but also have been experiencing regression in technology. The significant factors that have contributed to the efficiency would be the airport hub status, airport operating hours and airport ownership (Kan Sui et al., 2014)

The aviation airports in New Zealand are associated with New Zealand Airports Association. The membership of this association comprises of 31 airports across New Zealand. The council owns most of these airports through the joint ventures between the council and The Crown or privately owned (NZ Airports Association, 2017). Meanwhile, the Airways Corporation of New Zealand Limited traffic services is sole air traffic services provider in New Zealand which is wholly owned by the Crown. The Crown also holds approximately 53 percent majority shares in Air New Zealand Limited which is the national flag carrier of New Zealand (Ministry of Transport, 2017).

Similarly, the Palmerston North City Council (PNCC) entirely owned that Palmerston North Airport Limited (PNAL). In recent years, the main activities of this airport have been providing airport facilities to its users who are airport users and airlines (Palmerston North Airport Limited, 2016). Palmerston North is a city located almost centrally in the North Island (Statistics New Zealand, 2014). Meanwhile, it is a most prominent city in Manawatu region which its economic strength derives from various sectors such as education, bio-industry, defence and distribution. Palmerston North is the home for numerous distribution providers as the city is strategically reachable via roads. The city is 2 hours away from Wellington in the South, 6 hours away from Auckland in the North, 2.5 hours away from Napier in the East and 3 hours away from the New Plymouth in the West. The city is also accessible via rail which is also an essential stop for passengers and freight.

Despite being an important city in the region today, Palmerston North was actually known as an isolated village during the early 19 centuries. In fact, only in 1871 the word “North” was included in order to differentiate another town Palmerston which is located in South Island. Meanwhile, Palmerstonwas named in honour of the former British Prime Minister, Viscount Palmerston. The population in Palmerston North was only 800 in 1877 but after the presence of railway, the area witnessed a sharp increase in population as the population grew to 6000 in 1900. By 1930, Palmerston North was officially known as a city and the population reached 20,000. During this period of time, Palmerston North played an important role in the New Zealand’s economy particularly in the agricultural industry. Thus, transportation services were essential and improvement especially on air services wasvery much required towards the regional sustainability (New Zealand Tourism Guide, 2017).

However, at present, the population and small market demand havecertainly not encouraged the growth of the airport. The current population of Palmerston North is only 83,500 and the Manawatu region is the home for 135,000(Palmerston North City Council, 2017). Thus, with the small population, businesses and people in Palmerston North have been experiencing difficulty in pushing for a bigger airport. Nevertheless, the airport which has a

long history in place, reaffirms its ability to meet full potential in future as well as to grow and progress to achieve regional stability.

PAST OPERATIONAL ACTIVITIES AND STRATEGIES

Palmerston North airport started its activities back in the 1930s. A year after Palmerston North was officially proclaimed as a city, Milson Aerodrome Society an essential association in the region created the airfield site and subsequently in 1936, the Union Airways provided the first commercial air services at this airfield (Palmerston North Airport Limited, 2016). During the same period, Dominion Airlines Limited officially launched its first daily air service between Hastings to Gisborne (Reader's Digest New Zealand, 2001). A few years later, the Palmerston North City council purchased the site. On 16 January 1936, daily flights were established between Palmerston North and Dunedin though New Zealand’s first trunk air service (Reader's Digest New Zealand, 2001).

In the 1940s, this airport was used as the military field and only in 1950s, the National Airway Corporation or known as NAC extended its air services to the airport. Therefore, to meet the demand, the runway and terminal building were constructed according to the requirements. In 1958, the airport was jointly owned by the Palmerston City Council and The Crown. During 1975 to 1979, the airport had significant runway extension and constructions done due to the Boeing 737 services that were provided by the NAC. 1989, PNAL was formally formed, and in 1992, a new terminal building was opened. Subsequently, in 1996, the airport was at its peak of its operation when Freedom Air initiated its commercial flight services to Brisbane and Sydney, Australia and recognised Palmerston North airport as an international airport. In 2006, Palmerston North City council regained its full ownership by purchasing all of its airport shares. Therefore, everything seemed perfect, and the airport was heading towards greater heights. However, due to the global and domestic economic pressure, in 2008 the Freedom Air had to shut down its operations, and Palmerston North airport had suffered the most as it had to close the international flights' routes. Since then for many years, Air New Zealand was the only airline service provider for the Palmerston North Airport. Meanwhile, in 2012, the airport is considered to be operating efficiently alongside with five other airports in New Zealand with an increase of productivity level at 3.4% which was above the 2.6% average level (Kan Sui, et al., 2014). Thus, in 2016, Jetstar a low-cost airline, began its domestic operations at the Palmerston North Airport. Besides, Air New Zealand and Jetstar, currently the Origin Air also operates the Palmerston North – Nelson routes. Thus, at present, the airport is busy with its domestic operational activities.

PRESENT OPERATIONAL ACTIVITIES AND STRATEGIES

The transformation of inputs such as raw materials into outputs which produces goods and services is known as operation management. Therefore, the operational management activities are vital for any organisation as it provides relevant stakeholders with the appropriate information to improve the productivity and quality as well as reduce the operating cost of the products or services (Heizer and Render, 2014a). Similarly, operational activities in airports are essential because it provides the opportunity for the relevant members to make critical operational strategies to improve the existing system. In the context of Palmerston North Airport, location and layout strategies are crucial towards the growth and sustainability of the airport and its region. The United Nations in 2005 defined sustainability through a framework that includes the three pillars which are economic, environmental and social (Chopra and Meindl, 2016). So, this report will be emphasising and associating the two components which are the economy and environmental component. The location strategy in this report will highlight the current location and facilities of this airport as well as its strength and weaknesses. Meanwhile, the facilities are also being discussed in the layout strategy which explores the existing layout as well as its benefits and challenges.

LOCATION STRATEGY AND CONNECTIVITY SERVICES

50% of the operating expenses usually is determined by the location. Thus, revenue, as well as the tangible and intangible cost of the organisation, are dependable on the area. The factors that affect places are labour productivity, political risk, values and culture as well as proximity to markets, suppliers and competitors (Heizer and Render, 2014b).

At present, the Palmerston Airport caters approximately 40 flights each day to 5 different cities across New Zealand. The available flight services are to New Zealand’s important cities such as Auckland, Hamilton, Wellington and Christchurch which is mainly operated by Air New Zealand. Meanwhile, budget airways, Jetstar Airlines provides its only flight services to Auckland and Origin Air has recently started their flight operation to Nelson. As a result, the Manawatu regional air travellers are offered choices in order to fly to these major cities in New Zealand. However, travellers who wish to fly abroad are frequently required to fly to Auckland or Wellington to catch their international flights.

Besides, flight services, the Palmerston North airport together with Fieldair Holdings, an aircraft maintenance company based in Palmerston North have collaborated with New Zealand Post for freight services from Auckland to Christchurch. The Auckland-Palmerston North-Christchurch route seems vital due to the Manawatu region that is strategically located in the lower North Island (Stuff New Zealand, 2016). Therefore since 2016, the increasing number of passengers to Palmerston North as well as the city being a hub for distribution and logistics have provided positive indicators towards the regional economy and environment. As a result, investors have been pouring into the region lately. Palmerston North is now well recognised as the lower North Island’s distribution hub which is yet to boost the employment and businesses in the area (New Zealand Herald, 2017).

However, the airport has its limitation as it currently has only one active runway with a total length of 1902 meters. Thus, only limited types of aircrafts could operate at this airport at any point of time. Aircrafts such as Bombardier Q300 with the capacity of 50 passengers and Aerospatiale ATR72 with the capacity of 68 passengers are the general operating aircrafts at this airport (Air New Zealand, 2017). Meanwhile, for freight services, Boeing 737 are being used frequently (Stuff New Zealand, 2016).

The airport is also connected by bus services. For an instance, the Intercity busis the most extensive bus network that connects the airport with other major cities in New Zealand. Thus, the airport is linked from the Square in the Palmerston North city via the InterCity bus service from or to cities such as Wellington, New Plymouth, Napier and others. Besides buses, cars are commonly used by the local visitors and passengers to and from the airport. The car park at the airport could accommodate 102 vehicles. As illustrated in image 1, the airport also offers to drop off zone for drivers as well as provides several types of parking services such as general car parking, long-stay parking, secure car parking, valet parking and mobility car parking. According to the Palmerston North Airport (2017), the car parking rates are competitive compared to other airports in the lower North Island. Forinstance, the pricing for long-stay parking starts NZD 5.50 per day and 15 minutes free parking offered to all drivers at the general car park. Meanwhile, the passengers drop zone is just 20 meters across from the terminal, and the secure car park provides additional security services. The Valet car parking services are designed personalised for each customer. Car rental, taxis and shuttle bus services are also available for the travellers and public.

Image 1: Palmerston North Airport (2017) LAYOUT STRATEGY AND TERMINAL SERVICES

Operating efficiency occurs through the existence of substantial layout. In operations management, there is seven common layout strategy which are office, retail, warehouse, fixed position, process-oriented, work cell and product oriented (Heizer and Render, 2014c). The Palmerston North Airport has fixed-position layout whereby the operations of remains in one location and the resources such as workforce, machines and materials integrated into the airport area. Meanwhile, the airport also has a process-oriented layout as the airport currently handles a variety of services. In addition, the airport facilities and equipment’s are placed to deal with a range of services and accommodate the reasonable volume of passengers.

At present, the airport operating hours especially the airport terminal changes daily as it only opens between 5 a.m. and closes 30 minutes after the last arriving or departing flight. Despite being a small airport, the airport is equipped with several facilities. The essential facilities such as the passengers' check-in counters, departure and arrival hall as well as baggage claim area and airport help desk are located on the ground floor (Palmerston North Airport, 2017). As stated in image 2, at the arrival hall, an express café is available for the public which operates from 5 a.m. until the last flight arrives. It is known as the Touch and Go Café because it is a perfect location to get quick coffee and snack for arriving passengers. The ground floor is also home to a shop which is known as the relay/lotto shop. The store is tailored for passengers and is just located beside the check-in counters that sells a range of products such as maps, newspapers, books, magazines, food, drinks and other essential product for travellers. The ATMs, as well as toilets including baby changing rooms, unisex and accessible toilets, are also located on ground floor.

Image 2: Palmerston North Airport (2017)

Meanwhile, the first floor as illustrated in image three is equipped with café that operates every day and seven days a week between 5 a.m. until the last flight departs. The café is situated perfectly as it offers passengers and public a great view of the airfield. The café best place for relaxation as it offers several USB charging ports and known for its wheelchair friendly services. Air New Zealand regional lounge, as well as the airport offices and conference rooms, are located on this floor.Overall, the terminal also offers free wifi network as well as with two public telephone, tablet or laptop charging station areas.

Image 3: Palmerston North Airport (2017)

LOCATION OPPORTUNITIES AND LAYOUT THREATS

Palmerston North Airport is a critical facility that facilitates the economic development and plays an essential infrastructure for the region. One of its opportunity is its location strategy. The location strategy of this airport provides significant opportunities from the perspective of revenue and cost. The revenue focus is based on the volume of passengers and airfreight services as well as physical and non-physical quality.

Therefore, as highlighted before, the airport is situated in the central of lower North Island which is accessible to various major cities such as Napier, New Plymouth and

Wellington. Thus, the airport can be seen a great location to be an efficient logistics and distribution hub as the airport services are supported by a reliable and regular rail and road transport. Palmerston North Airport is seen as the perfect hub as well as transit for goods to be delivered to other cities in the lower North Island region. The smaller capacity airports from other neighbouring airports such as the Napier and New Plymouth airport provides a competitive advantage for the Palmerston North airport. The environment, particularly the weather condition in Wellington also provides opportunities for the Palmerston North Airport to be a better option. Due to the location at the edge of Cook Straits, Wellington has been experiencing severe weather such as heavy wind. The windy weather in Wellington has caused several flight disruptions at Wellington International Airport. As a result, over the recent years, many flights at the Wellington International Airport have been delayed, rerouted and even cancelled. In fact, despite being the capital city of New Zealand, Wellington has been regarded as among one of the windiest city in the world.

Therefore, the proximity of the airports in this region provides clustering opportunity to the Palmerston North Airport. According to Heizer and Render (2014b), clustering occurs when competing companies are operating near to each other for operational benefits. Thus, in the case of Palmerston North Airport, the grouping may stimulate high traffic flows and increase the volume of passengers.

Therefore, due to its current location, this airport has also high potential to serve a high volume of logistics providers and passengers as the gateway. As highlighted, despite being a small airport, Palmerston North Airport is well equipped with suitable facilities. The public access especially the public transport, parking services, lighting as well as other facility services in and off the location tends to create a positive physical quality image and brand for this airport. The airport supported is also by transparent management, secure environment, well established operational policies which serve as the non-physical location quality. Meanwhile, the airport’s location is also subjected cost focus. The airport provides opportunities for its users to have added advantage towards reducing tangible cost. Due to its strategic location, business organisations can experience a reduction in their transporting and shipment cost of raw materials and finished goods.

Palmerston North Airport also faces threats towards sustainability through its current layout strategy. Palmerston North is only equipped with a single active short runway. Thus, bigger aircrafts especially international flights may not be able to operate at this airport. Besides that, the airport is currently experiencing limited space in its current terminal which it is not prepared to engage with a larger number of passengers.

In addition, The Palmerston North Airport is currently being served by three airlines which are Air New Zealand, Jet star and Origin Air. Thus, the airport is highly dependent on these airlines as its major source of revenue. Thus, the airport faces greater economic pressure. For instance, if the airlines or nation were to face financial crisis undoubtedly the airport will face serious economic consequences which may lead economic disaster.

CONCLUSION

Palmerston North Airport is an important transportation hub in the region. The past and present operational activities and strategies prove that the airport has been providing remarkable commercial and general aviation services. However, the economic challenges, as well as the small population, has driven away from the airport from the growth which used to be an international airport. Therefore, the airport faces significant operational opportunities and threats in future. The location of this airport could be a fundamental operational strategy supported by appropriate regional economic growth andstable environment. Therefore, the location strategy can improve the airport’s operations as well as serve as the crucial ingredient for its momentum of growth domestically and internationally in future. However, the layout

remains the challenge for this airport. The single and small runaway stays as the potential threat for this airport. Moreover, the small airport with limited services is not sufficient to handle a large volume of passengers. Therefore, it is vital for the local authorities and airport management to improve the existing layout to meet domestic and eventually the global demand. Therefore, significant investment is required as the Palmerston North airport has its full potential to be a dominant regional airport as well as regain its international airport status.

REFERENCE

Air New Zealand (2017) Operating fleet as at 31 August 2017. [Online]. Available from: https://www.airnewzealand.co.nz/fleet [Accessed 20 October 2017]

Aviation New Zealand (2016) Aviation New Zealand. [Online].

Available from: http://www.aia.org.nz/ [Accessed 10 August 2017]

Chopra, S. and Meindl, P. (2016) Supply chain management: strategy, planning, operation. Harlow: Pearson Education Limited.

De Neufville, R. (2016) Chapter 4: airport systems and planning. In: L. Budd and S. Ison, (eds.). Air transport management: an international perspective.Abingdon: Routledge, 61-77.

Fountain, J. (2016) Just here for the scenery? chinese holidaymakers and wine tourism in New

Zealand. Adelaide, Ehrenberg-Bass Institute for Marketing Science.

Heizer, J. and Render, B. (2014a) Chapter 1: operations and productivity. In: Operations

management: sustainability and supply chain management. Harlow: Pearson Education

Limited, 40-59.

Heizer, J. and Render, B. (2014b) Chapter 8: locations decisions. In: Operations management:

sustainability and supply chain management. Harlow: Pearson Education Limited,

362-377.

Heizer, J. and Render, B.(2014c) Chapter 9: layout decisions. In: Operations management:

sustainability and supply chain management. Harlow: Pearson Education Limited,

391-415.

Kan Sui, W. H., Gilbey, A. and Balli, H. O. (2014) Estimating airport efficiency of New Zealand Airports. Journal of Air Transport Management, 35(c), 78-86.

Ministry of Transport (2017) International air services.[Online].

Available from: http://www.transport.govt.nz/air/ [Accessed 10 October 2017]

New Zealand Herald (2017) Provida's national centres in syndication offer. [Online]

Available from:

http://www.nzherald.co.nz/property/news/article.cfm?c_id=8&objectid=11922746 [Accessed 05 February 2018].

New Zealand Tourism Guide (2017) Palmerston North history, s.l.: New Zealand tourism guide.

NZ Airports Association (2017) NZ airports association.[Online].

Available from: https://www.nzairports.co.nz/about-us/ [Accessed 20 December 2017] Palmerston North Airport Limited (2016) Annual report 2016, Palmerston North: Palmerston

North Airport Limited.

Palmerston North Airport (2017) Airport services: Palmerston North airport.[Online]. Available from: https://pnairport.co.nz/services [Accessed 20 December 2017].

Palmerston North City Council(2017) An introduction to Palmerston North. [Online].

Available from:

https://www.pncc.govt.nz/news-events-and-culture/our-city/an-introduction-to-palmerston-north/ [Accessed 22 December 2017]

Reader's Digest New Zealand (2001) New Zealand yesterdays. Reader's digest (New Zealand): Auckland.

Statistics New Zealand (2014) 2013 Census quickStats about a place: Palmerston North city, Wellington: Statistics New Zealand.

Statistics New Zealand (2017) Global New Zealand: year ended december 2016, Wellington: Statistics New Zealand.

Stuff New Zealand (2016) New freighter service to start flying through Palmerston North

airport. [Online].

Available from: http://www.stuff.co.nz/business/82648002/new-freighter-service-to-start-flying-through-palmerston-north-airport [Accessed 24 December 2017]

11-BF21-5578

FINANCIAL REGULATIONS AND INSOLVENCY RISK OF ISLAMIC AND CONVENTIONAL BANKS OF PAKISTAN

SHUMAILA ZEB1

ABSTRACT

The proposed study aims to investigate insolvency risk of conventional and Islamic banks of Pakistan. Furthermore, it empirically estimates the effect of already implemented financial regulations on the insolvency risk of banks. The banks are divided into four sub-samples i.e., large, small, medium, and Islamic banks as per their asset structure. To carry out the empirical analysis, a balanced bank-level panel data covering the period 2008-2016 is used. The Z-score methodology is employed for calculating the insolvency risk of each bank. The panel regression is used to investigate. The empirics reveal that the financial regulations enforced by State Bank of Pakistan have significant impacts on the insolvency risk of banks. The results further indicate that Loan ratio and Reserve ratio are positively, while current ratio and non-performing loan ratio are negatively significant to the insolvency risk of all banks. However, capital adequacy ratio does not affect the insolvency risk of banks of Pakistan. The results provide useful insight to the regulators and policy makers regarding the efficacy of already implemented financial regulations on the conventional and Islamic banks of Pakistan.

Keywords: Financial Regulations, Z-score, Insolvency Risk, Conventional Banks, Islamic

Banks

INTRODUCTION

Financial regulations are important measures of safety and soundness for the commercial banks. The financial regulations are generally publicized by government regulators to shelter investors, sustain systematic markets, and endorse financial stability of financial institutions specifically banks within the country. Financial regulations might range from setting minimum capital standards, making inspections periodically, and investigating any sort of misconduct. The conventional and Islamic banks just follow whatever financial regulations are imposed on them by their respective central banks and regulatory bodies. Minimal efforts are being done to investigate the already implemented financial regulations are actually beneficial for the insolvency risk of conventional and Islamic banks or not.

Although it is extensively believed that stricter banking regulations and supervision will improve the resilience of the financial sector. However the empirical evidence on the relationship between financial regulations and insolvency risk of banks is mixed. For instance, Demirgüç-Kunt and Detragiache (2011) failed to find a significant relationship between country’s compliance with the Core Principles for Effective Bank Supervision as issued by the Basel Committee on Banking Supervision (BCPs). The banking risk was measured by the using the Z-score. In contrast, a survey conducted by the World Bank came up with totally different empirical results. The study of Klomp and de Haan (2012) reported that financial regulations did not significantly affect the low risk banks. However, financial regulations are significantly related with the high risk banks.

Most of the previous literature on the impact of financial regulations on risk taking activities of banks focused more on the industrialized economies ( Delis and Staikouras, 2011; Klomp and de Haan, 2012) or they used a sample of advanced and emerging economies like

1 Assistant Professor, Shaheed Zulfikar Ali Bhutto Institute of Science and Technology, Islamabad campus, Islamabad,

González, 2005; Barth et al., 2013). However, in the recent years some studies have been published that examine the impact of financial regulations on banking risk in non-industrialized economies (Ben Naceur and Omran, 2011; Klomp and de Haan, 2014).

There is another important issue gaining importance in the literature on the impact of financial regulations on insolvency risk is whether the impact of financial regulations on the insolvency risk varies among different types of banks. Furthermore, there is also need to investigate that either financial regulations impact Islamic banks in a similar manner or not. More specifically, this study aims to fill this gap that either financial regulation affects different type of banks differently or not.

The banking sector of Pakistan contributes significantly in its economic growth and development. A great emphasis is being made on the implementation and imposition of financial regulations keeping in view all the recommendations of Basel committee. The financial regulations are regulated and imposed in order to protect and boost the confidence level of both the consumers and investors in any economy. More precisely, the financial regulations are imposed to safeguard the financial sector against systemic risk, protecting consumers from high prices, and to attain some societal objectives, including stability (Llewellyn, 1999).

The main objective of this study is to empirically examine the relationship between already implemented financial regulations and insolvency risk of conventional and Islamic banks of Pakistan. A good understanding of the relationship between the variables will help for good policy formulation as well as capital regulation in the banking sector of economy. Furthermore, this study also investigates the impact of financial regulations on the insolvency risk of Islamic banks of Pakistan as well. In order to estimate the objective, the study used Z score to examine the insolvency risk of conventional and Islamic banks. The study used quarterly data of commercial banks from 2008 to 2016. Furthermore, the study estimated panel data analysis to determine the empirical relationship between already implemented financial regulations and insolvency risk of conventional and Islamic banks of Pakistan. The study used capital adequacy ratio (CAR), current ratio (CR), non-performing loans to total loans (NPL), total loans to deposit ratio (LD) and reserve ratio (ReR) as financial regulation variables to investigate the relationship between financial regulations and insolvency risk of commercial and Islamic banks.

The study is significant for the academics, practitioners, and financial regulators to have deep understanding of insolvency risk when examining the efficacy of already implemented financial regulations on conventional and Islamic banks. The study is providing more insight about the efficacy of already implemented financial regulations on the insolvency risk of banks. Furthermore, it facilitates to provide concrete information to academia on banking system insolvency. Unlike various studies, our study has classified commercial banks of Pakistan on the basis of their total asset structure. According to the Banking Survey 2013 of KMPG, the study classified banks into large, medium, small, and Islamic banks. The Islamic Banks of Pakistan are also incorporated in the sample to see the difference between conventional banks and Islamic banks.

The findings suggest that stricter banking regulation decreases banking risk. The empirical results reveal that an increase in nonperforming loan to total loans (NPL) ratio can reduce insolvency risk of all commercial banks of Pakistan. A higher reserve ratio (RR) implies higher greater insolvency risk for all banks of Pakistan. However, capital adequacy ratio (CAR) is insignificant with insolvency risk of commercial banks of Pakistan. For small banks, the loan to deposit ratio (LD) reduces as insolvency risks increase. The current ratio (CR), nonperforming loans to total loans (NPL), loan to deposit ratio (LD) and reserve ratio (RR) are significant for large banks while capital adequacy ratio (CAR) for insolvency risk of large banks. All the ratios are significant for insolvency risk of medium banks while capital adequacy

ratio (CAR) and current ratio (CR) are insignificant for the insolvency risk of small banks. Furthermore, CAR, CR, and LD are found statistically significant for the insolvency risk of Islamic banks as well. These variables are found to have negative relationship with the insolvency risk of Islamic banks of Pakistan.

The study is organized as follows. Chapter 2 describes review of literature; Chapter 3 discusses the data description, empirical specification of the model, and variables construction respectively. The empirical results are discussed in Chapter 4. Chapter 5 concludes the study with relevant policy recommendations and suitable way forward.

LITERATURE REVIEW

The existing empirical literature provides the mixed results about the relationship between the financial regulations and insolvency risk of financial institutions specifically banks. Besanko and Kanatas (1996) and Blum (1999) found that more stringent capital requirements enlarge insolvency risk of banks while Fernandez and Gonzalez (2005) proved that more strict capital requirements can influence insolvency risk of banks. Similarly, Awdeh, El-Moussawi, and Machrouh (2011) empirically examined that increase in capital can significantly increase insolvency risk of banks.

There are certain other variables investigated by the various studies. Like, Mercieca, Schaeck, and Wolfe (2007) investigated the effect of diversification and bank size on risk adjusted performance and insolvency risk of European credit institutions. They used sample of 15 countries consisting 755 small banks for the time period 1997 to 2003. The small banks were classified on basis of their turnover and number of employees. The Z score was used to calculate insolvency risk. The results revealed that earning diversification did not affect profitability of small banks. Similarly, banks with less diversification had low solvency risk. Similarly, Deelchand and Padgett (2009) examined the relationship between risk and capital for Japanese cooperative banks. They concluded that inefficient banks had more capital and riskier. Another study conducted by Murari (2012) examined insolvency risk for 80 banks of India for 2005 to 2009. He found that probability of book value bankruptcy of Indian banks decreased over the period of time. He further proved that probability of book value bankruptcy of public sector banks was lower than private and foreign sector banks. Similarly, Das (2012) investigated insolvency risk of commercial banks of India for the period 1998 to 2007. He concluded that Indian private banks were most risky, while foreign banks were least risky. Lepitit and Strobel (2013) investigated the probabilistic foundation of linkage between Z score and insolvency risk of commercial banks of G20 countries. He found a negative relationship between insolvency risk and Z score.

There are few studies for the identification of determinants of insolvency risk as well. One of those studies include Klomp and De Haan (2015) examined 1238 banks of 94 developing and emerging countries to explore the impact of risk on the regulations of banks. The risk of the bank was measured using Z score. They proved that strict regulations and increased supervision results in the increase of risk faced by the banks. However, they also proved that effectiveness and efficiency of financial regulations and supervision also depends upon the structure of banks. The activity restrictions reduced the risk faced by the large banks, while the liquidity restrictions was found to be significantly related with the z score values of unlisted commercial banks of developing and emerging countries.

Following the similar pattern, Zhang, Xie, Lu, and Zhang (2016) investigated the determinants of financial distress in large financial institutions of United States. The financial distress of the 629 Bank Holding Companies (BHC) was calculated using Z-Score and Distance to Default (DD). The study was conducted for the time period 2003 to 2013. The results proved that short term whole sale funding, non-interest income, and Tier 1risk based capital ratio are important determinants of financial distress.

Laeven and Levine (2009) examined the relationship between bank risk taking activities, bank governance, and the banking regulations. Specifically, they empirically investigated how governance and banking regulations jointly adds on the risk of individual banks. They used a sample of largest 279 banks in 48 countries. They found that right mix of cash flow played a significant role in the risk-taking activities of bank. They further proved that effect of banking regulation varies with the bank governance structure.

Pong, Bokpin and Andoh (2016) empirically examined the relationship between disclosure and risk-taking of banks in Ghana for the period 2007-2011.The study used panel regression model and relate risk-taking to disclosure, controlling for bank size, profitability, liquidity and treasury bill rate. Disclosure scores from a disclosure index were used as a measure of disclosure. Similarly, Z-score was used as a measure of total risk. Treasury bill rate, profitability and liquidity were found statistically significant with the risk-taking activities of banks of Ghana.

Zeb and Sattar (2017) examined to what extent bank structure matters for the impact of financial regulations on insolvency risk of banks using a sample of 21 banks of Pakistan. Their findings imply that financial regulations are significantly related with the profit efficiency and financial stability of commercial banks of Pakistan. However, their sample did not include Islamic banks.

DATA DESCRIPTION, EMPIRICAL FRAMEWORK AND METHODOLOGY Sample and Data Description

The study examined a balance panel of 26 banks of Pakistan. Moreover, the study used quarterly data for the time period 2008 to 2016. The financial statements data are collected from the website of respective banks and State Bank of Pakistan (SBP).

Most of the previous studies have categorized commercial banks as private, public and/or Islamic banks as per their time of founding. This classification of banks may not be very helpful to examine the effectiveness of financial regulations and insolvency risk. Therefore, the study has categorized the sample banks as per their total asset structure. The sample of this study includes 6 large size, 8 medium size, 7 small size and 5 Islamic banks of Pakistan.

Empirical Specification of Model

The Z score measures the stability of financial institutions by indicating the distance from insolvency, profitability, and leverage of commercial banks. Furthermore, Z score used probability of default being extracted by Roy (1952) and further developed by Goyeau and Tarazi (1992). It can be written as follows

Probability of default = Prob (π < - E), (1)

Further, we divide it by total assets and obtain returns on assets, such as: Prob (π/A≤ -E/TA) =Prob (ROA ≤-E/TA) , (2)

where ROA is return on assets, E is equity, and TA is total assets of financial institution Prob [(ROA- µROA)/ σROA≤ (-λ-µROA)/ σROA] =Prob [(ROA- µROA)/ σROA<-Z] , (3)

Where µROA and σROA are mean and standard deviations and Z = (E/A + µROA)/ σROA is

parameter of bank fragility. Eventually, Z-score is calculated as follows:

𝑍 − 𝑠𝑐𝑜𝑟𝑒 = (𝐸

𝐴+ 𝜇𝑅𝑂𝐴)/𝜎𝑅𝑂𝐴 ,(4)

A higher value of Z-score indicates the greater stability of the respective financial institution or commercial bank. Pervious literature employing the Z-score as a measure of

insolvency risk or financial stability include Sundaresan (2013), Jarrow (2009), Houston et al. (2010) and Beltratti and Stulz (2012).

Empirical Model

In order to estimate the fixed effects model with Z-score, as dependent variable – a measure of insolvency risk, the following equation is estimated:

it it it it it it it i it CAR CR LD NPL R T score Z 1 2 3 4 5 Re 6 , (5)

In the above equation, for ith banks over tth time period, CAR stands for capital adequacy ratio, CR for current ratio, LD for loan to deposit ratio, NPL for non-performing loans to total loans ratio, ReR for reserve ratio and T for year of establishment.

VARIABLES CONSTRUCTION

Z-score is taken as a dependent variable. The value of Z-score is obtained from estimating the

Equation (4). The independent and control variable definitions are illustrated below.

Capital Adequacy Ratio (CAR)

Capital Adequacy Ratio (CAR) is considered as an international standard to measure bank’s risk of insolvency due to excessive losses. SBP has also given minimal capital requirement of 10% to all the commercial banks of Pakistan which is in accordance with Basel. Islamic banks have to maintain CAR of 8%. The commercial banks which do not meet this requirement have to undergo some penalty from the central bank. We calculated CAR by dividing capital of the bank with the risk weighted assets of bank.

Current Ratio (CR)

The liquidity problem usually arises when the bank is unable to accommodate its reduction in liabilities or increase in funds on the assets side of the statement of financial position (Athanasoglou et al., 2006). The banks having with low liquidity ratio means that there is a high tendency of bankruptcy. The State Bank of Pakistan revised it from 15% to 18% since 2006 to enable the bank to advance more loans. We calculated this ratio by dividing current assets to current liabilities

Reserve Ratio (ReR)

Reserve ratio (ReR) is the amount of cash that a bank has to keep up with the central bank. As

per the central bank policy, each bank must have a certain proportion of this cash in its reserve. We calculated this ratio by dividing cash to deposits.

Loan to Deposit Ratio (LD)

Loans to deposit ratio (LD) declined to 60 percent in April 2012 from about 67 percent in April 2011. Banks invest about 44 percent more funds mostly in government treasury bills, bonds, stocks, and other approved securities. We calculated this ratio by dividing total loans of banks to its total deposits.

Non-Performing Loan Ratio (NPL)

Non-performing loan ratio (NPL) is basically the percentage of the loan amount that the bank has set aside as provisions to meet the worst-case scenario where the loan might have to be written off it when loan becomes irrecoverable. It is the amount of funds which the bank has set aside for its bad debts. It is calculated by dividing the non-performing loans of banks to its total loans.

Time (TT)

This variable is used as a control variable. It is the total age of banks measured in quarters.

ANALYSIS AND RESULTS

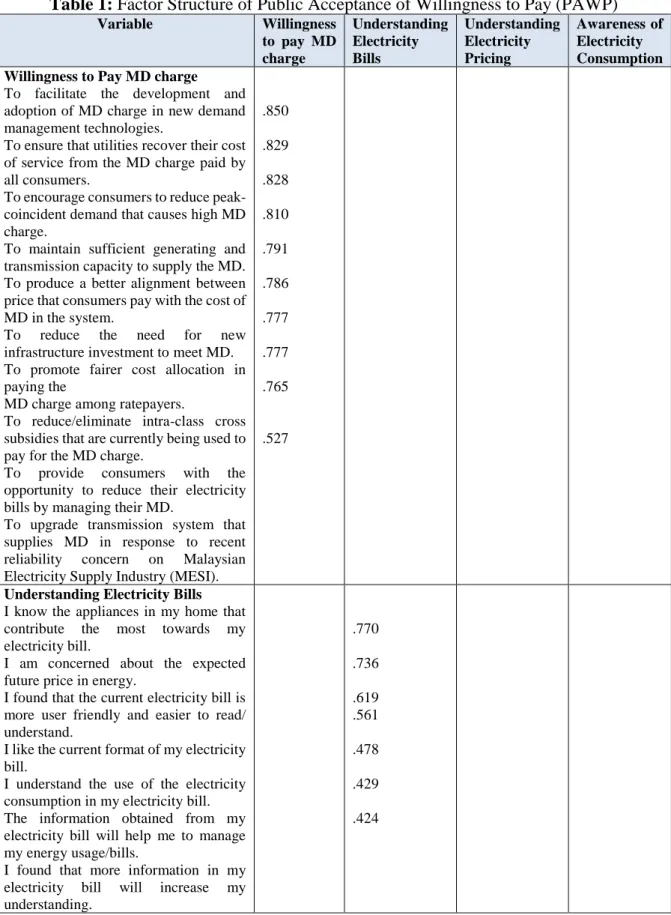

We empirically estimated equation 5 for all banks, large, medium, small, and Islamic banks through panel regression analysis. The pooled, fixed, and random effects regression was applied to equation 5. The panel regression was repeated for all, large, small, medium, and Islamic banks. The fixed effect was selected on the basis of Hausman test. Table 1 describes the empirical results for all banks, large banks; medium, small, and Islamic banks being selected for empirical analysis.

Table 01

Fixed Effects Estimation for Financial Regulation Effects on Insolvency Risk

Dependent Variable: Z-score

All Banks Large Banks Medium Banks Small Banks Islamic Banks CAR -0.21 [0.22] 0.61 [0.73] -0.67 [0.17]*** 0.37 [0.54] -0.43 [0.10]*** CR -0.20 [0.09]** -0.94 [0.29]*** -0.54 [0.25]** -0.25 [0.42] -0.33 [0.11]** LD 0.32 [0.11]** -0.32 [0.06]*** -0.24 [0.07]*** -0.37 [0.19]* -0.42 [0.07]*** NPL -0.39 [0.09]*** -0.63 [0.18]*** -0.71 [0.23]*** -0.35 [0.15]** -0.68 [0.11]*** ReR 0.27 [0.10]** 0.40 [0.10]*** 0.19 [0.13] 0.62 [0.25]** 0.28 [0.19] TT 1.42 [0.19]*** 2.66 [1.66] 0.50 [0.25]** 0.57 [0.11]** 0.32 [0.47] Observations 856 216 256 224 160 Adjusted R2 0.67 0.47 0.57 0.61 0.65 F-stat 32.51 13.54 9.67 11.23 18.92 Prob (F stat) 0.00 0.00 0.00 0.00 0.00 Hausman (p) 0.00 0.00 0.00 0.00 0.00 Autocorrelation (Wooldridge test) (p) 0.24 0.33 0.25 0.40 0.54 Heteroscedasticity (Huber/White test)

Heteroscedasticity robust standard error estimates are used

Note: The table represents the results of panel data regression of all banks, large, medium, small, and Islamic

banks. The heteroscedasticity robust White (1980) standard error is used for the estimation of linear panel. The coefficients and standard errors are presented in the table. The Wooldridge test is used for the autocorrelation. The p values are given in parenthesis. Hausman test is applied to select fixed effect or random affects estimator. Hausman test p value is also given. *, **, *** present the significance level at 10 percent, 5 percent and 1 percent, respectively.

The above analysis describes overall insolvency risk situation in all banks, which are selected for the analysis. In this way, empirical results based on entire sample information, being used for analysis, once at a time does not precisely describe the need and importance of required component of the analysis. In order to resolve this ambiguity, we classified the entire sample into large, medium, small, and Islamic banks.

The current ratio, loan to deposit ratio, non-performing loan ratio, reserve ratio and Time appears to be economically and statistically significant for all the banks of Pakistan. The current ratio, loan to deposit ratio and non-performing loan ratio appears to be negatively related with

the insolvency risk of banks of Pakistan. The capital adequacy ratio is insignificantly related with all the banks of Pakistan.

Turning into the other samples of the study, some interesting facts were revealed about the financial characteristics being employed in the study. The capital adequacy ratio appears to be negative but significantly related with the medium and Islamic banks of Pakistan. Other things remains constant, one unit change in the capital adequacy ratio of the medium banks decrease the insolvency risk of medium banks by 0.67 units on average. Similarly, increase in the CAR of Islamic banks leads to decrease in the insolvency risk of Islamic banks.

The current ratio appears to be significantly negatively related with the insolvency risk of large and medium banks of Pakistan. The result suggests that this ratio is more important for the large and medium banks. The current ratio is also economically and statistically significant for the Islamic bank as well. The result implies that increase in the current ratio leads to decrease the insolvency risk of large, medium, and Islamic banks. The current ratio of small banks appears to be insignificantly related with the insolvency risk. Similarly, the loan to deposit ratio seems to have negative relationship with the insolvency risk of large and medium banks of Pakistan. Other things remain unchanged; one unit increase in the current ratio of large banks tends to decrease the insolvency risk of the banks by 0.94 units on average. The loan to deposit ratio donot seems to affect the insolvency risk of small banks of Pakistan. The non-performing loan ratio is also negatively related with the insolvency risk of large, medium, small and Islamic banks. The results imply that increase in the non-performing loan ratio tends to decrease the insolvency risk of the banks.

The reserve ratio is found positive and significantly related with the insolvency risk of large, medium and small banks of Pakistan. Other things remains constant, one unit increase in the reserve ratio will increase the insolvency risk of large banks by 0.40 units, medium banks by 0.19 units and small banks by 0.57 units on average. The reserve ratio does not appear to be significantly related with the Islamic banks.

CONCLUSION

The SBP announces a set of guidelines in the form of prudential and financial regulations for the banking industry covering almost every aspect of banking. The study aims to investigate how already implemented financial regulations affect insolvency risk of conventional banks of Pakistan. Our study is important for the policy makers, regulators, and practitioners of Pakistan to obtain the efficacy of already implemented financial regulations as far as insolvency of conventional banks of Pakistan is concerned.

The capital adequacy ratio is found insignificant for insolvency risk of large banks. CAR is also insignificant for insolvency risk of small banks as well but is significant for insolvency of medium banks. The current ratio is also insignificant for insolvency risk of small banks. A higher Reserve Ratio implies greater insolvency risk for all banks. Our results give a fair idea that financial regulations must be implemented keeping a certain criterion in mind like as we distinguished banks in this study on the basis of their total asset structure. It is need of the hour to strengthen the regulatory framework and enhance supervisory capacity for dealing with large banks. Since the analysis reveals that insolvency risk is based on capital adequacy ratio, current ratio and reserves ratio, nonperforming loans to loans ratio and loan to deposit ratio. Therefore, based on findings and conclusions, it is evident that all financial obligations are essential for insolvency risk.

There are different tools that might be used to check insolvency risk of the conventional banks like Capital Adequacy Ratio itself can be used as a tool for measuring insolvency risk of a conventional bank. Few other ratios might be tested in the future like leverage ratio which is a part of Basel III.

REFERENCES

Awdeh, A., El-Moussawi, C. and Machrouh, F. (2011) The effect of capital requirements on banking risk. International Research Journal of Finance and Economics, 66, 133-146. Barth, J.R. et al. (2013) Do bank regulation, supervision and monitoring enhance or impede

bank efficiency? Journal of Banking & Finance, 37(8), 2879-2892.

Besanko, D. and Kanatas, G. (1996) The regulation of bank capital: Do capital standards promote bank safety? Journal of financial intermediation, 5(2), 160-183.

Blum, J. (1999) Do capital adequacy requirements reduce risks in banking? Journal of Banking

& Finance, 23(5), 755-771.

Das, K.C. (2012) Banking Sector Reform and Insolvency Risk of Commercial Banks in India.

IUP Journal of Applied Finance, 18(1), 19.

Deelchand, T. and Padgett, C. (2009) The relationship between risk, capital and efficiency: Evidence from Japanese cooperative banks. [Online]. ICMA Centre Discussion Papers

in Finance DP2009-12. Available from:

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.506.5256&rep=rep1&type=p df [ Accessed 31 January 2018].

Delis, M.D. and Staikouras, P.K. (2011) Supervisory effectiveness and bank risk. Review of

Finance, 15(3), 511-543.

Demirgüç-Kunt, A. and Detragiache, E. (2011) Basel Core Principles and bank soundness: Does compliance matter? Journal of Financial Stability, 7(4), 179-190.

Fernández, A.I. and González, F. (2005) How accounting and auditing systems can counteract risk-shifting of safety-nets in banking: Some international evidence. Journal of Financial

Stability, 1(4), 466-500.

Gonzalez, F. (2005) Bank regulation and risk-taking incentives: An international comparison of bank risk. Journal of Banking & Finance, 29(5), 1153-1184.

Goyeau, D. and Tarazi, A. (1992) Évaluation du risque de défaillance bancaire en Europe/An Empirical Investigation of Bank Risk in Europe, 249-280. [Online]. Revue d'économie

politique. Available from:

https://www.researchgate.net/publication/5059314_An_Empirical_Investigation_on_Ba nk_Risk_in_Europe [Accessed 31 January 2018].

Klomp, J. and De Haan, J. (2012) Banking risk and regulation: Does one size fit all? Journal

of Banking & Finance, 36(12), 3197-3212.

Klomp, J. and de Haan, J. (2014) Bank regulation, the quality of institutions, and banking risk in emerging and developing countries: an empirical analysis. Emerging Markets Finance

and Trade, 50(6), 19-40.

Klomp, J. and De Haan, J. (2015) Bank regulation and financial fragility in developing countries: Does bank structure matter? Review of Development Finance, 5(2), 82-90. Kuranchie-Pong, L. et al. (2016) Empirical evidence on disclosure and risk-taking of banks in

Ghana. Journal of Financial Regulation and Compliance, 24(2), 197-212.

Laeven, L. and Levine, R. (2009) Bank governance, regulation and risk taking. Journal of

financial economics, 93(2), 259-275.

Llewellyn, D. (1999) The economic rationale for financial regulation. London: Financial Services Authority.

Mercieca, S., Schaeck, K. and Wolfe, S. (2007) Small European banks: Benefits from diversification? Journal of Banking & Finance, 31(7), 1975-1998.

Murari, K. (2012) Insolvency Risk and Z-Index for Indian Banks: A Probabilistic Interpretation of Bankruptcy. The IUP Journal of Bank Management, 11(3), 7-21.

Naceur, S.B. and Omran, M. (2011) The effects of bank regulations, competition, and financial reforms on banks' performance. Emerging markets review, 12(1), 1-20.

Roy, D. (1952) Quota restriction and goldbricking in a machine shop. American Journal of

Sociology, 57(5), 427-442.

Zeb, S. and Sattar, A. (2017) Financial regulations, profit efficiency, and financial soundness: empirical evidence from commercial banks of Pakistan. Pakistan Development Review, 56(2), 85-103.

Zhang, Z. et al. (2016) Determinants of financial distress in large financial institutions: Evidence from US bank holding companies. Contemporary Economic Policy, 34(2), 250-267.

13-BD20-5657

ROLE OF HUMAN RESOURCE MANAGEMENT PRACTICES IN THE DEVELOPMENT OF MINT COUNTRIES: IMPLICATIONS FOR PAKISTAN

MUHAMMAD SAAD1 AND SANA AHMED2

ABSTRACT

This paper is a descriptive research to analyse the human resources management practices of a group of four high growth rate economies namely; Mexico, Indonesia, Nigeria and Turkey. These countries have achieved stability in the economic, political and socio-cultural context while establishing themselves in an international industrial and business arena. The paper analyses the social and cultural forces that have constantly played a significant role in the implementation of human resources management practices by applying Hofstede’s framework. The findings are related to the role of these similar forces in shaping the human resources management practices in Pakistan.

Keywords: Human resource practices, Hofstede’s framework, MINT countries, Pakistan INTRODUCTION

Mexico, Indonesia, Nigeria and Turkey have shown tremendous economic development. With Purchase Power Parity (PPP) of these countries likely to increase in the near future, these countries will attract a lot of foreign attention and investment by multi-national corporations as well as trade agreements. Though these countries have accomplished substantial economic and human development success, their human resources management practices still lag behind to the economies of not only the developed countries but also the BRIC nations i.e. Brazil, Russia, India and China. These MINT nations have their geographical location as an advantage along with primary economic factors playing a very significant role in their growth. These factors are making big companies to invest in these markets but they fail to realize the challenges that these companies have to face due to existing human resources management policies.

This paper looks at the varying human resources management practices adopted by small, medium and large companies in Nigeria and Mexico, Indonesia, Turkey and how these human resources management practices shape the business strategies of various multinational and local players in these countries with discussion on implications for Pakistan.

LITERATURE REVIEW Mexico

With labor force growing at an annual rate of 2.53 percent, the agricultural sector in Mexico continue to shrink as the process of urbanization continues with mass migration of people to major cities like Mexico City and Guadalajara, Monterrey, Puebla, and Tijuana. Unskilled and semi-skilled labor makes up half of the entire labor force. The education index of 0.7214 is better than the average in the world and is one of the major reasons for considering Mexico as one of the biggest emerging markets in the world. The GNP per capita in PPP terms comes out

1 NBS, National University of Sciences and Technology, Pakistan. E-mail: - muhammadsaad@outlook.com

2 MPA, Quaid-i-Azam University, Pakistan, MSc (Research), LSE, U.K. Assistant Professor, Faculty, Management and HR

NBS, National University of Sciences and Technology, Pakistan. E-mail: - sana.ahmed@nbs.nust.edu.pk

3 Human Development Report for Mexico 2015 4 Human Development Report for Mexico 2015