北京行動地產網創業計劃書 - 政大學術集成

全文

(2) 北京行動地產網創業計劃書 Business Plan for Beijing Mobile Reality Inc.,China. 研究生:李慈瑩. Student: Tzu-Ying Lee. 指導教授:林我聰. Advisor: Woo-Tsong Lin. 國立政治大學. 學. ‧ 國. 立. 政 治 大. ‧. 商學院國際經營管理英語碩士學位學程 碩士論文. er. io. sit. y. Nat. A Thesis. n. a to International MBA Program Submitted iv l C n U NationalhChengchi University engchi. in partial fulfillment of the Requirements for the degree of Master in Business Administration. 中華民國一○二年六月 June 2013.

(3) TABLE OF CONTENTS Executive Summary ............................................................................................................ 1 1.. Company Background ................................................................................................ 4. 1.1. Mission .................................................................................................................. 4 1.2. Strategy ................................................................................................................. 4 1.3. Proposed Business Model ..................................................................................... 5 1.4. The Team ............................................................................................................... 5 2. Chinese Real Estate E-Commerce Market ............................................................... 7 2.1. Background ........................................................................................................... 7 2.2. Business Climate Analysis .................................................................................. 11 2.3. Conclusion .......................................................................................................... 15 3. The Opportunity ....................................................................................................... 16. 立. 政 治 大. ‧. ‧ 國. 學. 3.1. Background ......................................................................................................... 16 3.2. The Target Customers and Their Needs .............................................................. 17 3.3. Competitive Landscape ....................................................................................... 19 3.4. SWOT Analysis .................................................................................................... 27 4. Operations Plan ......................................................................................................... 28. n. al. er. io. sit. y. Nat. 4.1. Product/Service Offerings ................................................................................... 28 4.2. Service Providing Processes ............................................................................... 31 4.3. Strategy and Approach to the Market ................................................................. 36 4.4. Headquarter Office ............................................................................................. 36 4.5. Equipments .......................................................................................................... 36 4.6. Staffing Plan........................................................................................................ 37 5. Financial Projections ................................................................................................ 39. Ch. engchi. i n U. v. 5.1. Five Year Market Forecast.................................................................................. 39 5.2. Revenue Drivers and Cost Drivers ..................................................................... 42 5.3. Presentation of the Financial Forecast ............................................................... 44 6. Contingency Plans ..................................................................................................... 46 Glossary ............................................................................................................................. 47 Reference ........................................................................................................................... 49 Appendix A ........................................................................................................................ 51. i.

(4) List of Figures Figure 1: Proposed Business Model, Author Edit ................................................................. 5 Figure 2: The Value Chain of Real Estate Industry in China ................................................ 8 Figure 3: History of Chinese Real Estate Internet Service Development, Author Edited .. 10 Figure 4: The Value Chain of Chinese Real Estate E-Commerce....................................... 10 Figure 5: The Age Distribution of Real-Estate E-Commerce Website Users in Year 2012 13 Figure 6: The Estimated Business Size of Chinese 3rd Party Payment Settlement Using Mobile from 2009 to 2016 .......................................................................................... 14 Figure 7: An Overview of Real Estate Transaction and Parties Involved, Author Edited .. 16 Figure 8: List of Target Customers' Needs in Every Stage ................................................. 19 Figure 9: Chinese Real Estate E-Commerce Model Analysis ............................................ 20 Figure 10: Competitor Profile - EJU.com ........................................................................... 21 Figure 11: Competitor Profile - SouFun.com ..................................................................... 22 Figure 12: Competitor Profile - AnJuke.com ...................................................................... 23 Figure 13: Competitor Profile - HomeLink.com ................................................................ 24 Figure 14: Product and Service Offering Differentiation List of MyRealty.com ............... 26 Figure 15: SWOT Analysis of Beijing Mobile Realty Inc., Proposed Business Model ..... 27 Figure 16: Participants on Beijing Mobile Realty Inc. Website Platform, Author Edited .. 28 Figure 17: Service Offering Designs for Different User Groups of Myrealty.com ............ 30 Figure 18: Examples of User Interface Design Using GPS, Map and LBS on Smart Phone ..................................................................................................................................... 31 Figure 19: Examples of User Interface Design Using Baidu Map Search on the Website . 31 Figure 20: Process 1-Seller Applies to Post Property Listing to Be Handled by Staff of Beijing Mobile Realty Inc. .......................................................................................... 33 Figure 21: Process 2-Buyers Register Online for Further Information of Property Listing ..................................................................................................................................... 34 Figure 22: Consumers Purchase Service Provided by 3rd Party though MyRealty.com .... 35 Figure 23: Organization Structure of Beijing Mobile Realty Inc., ..................................... 37 Figure 24: Five Years Staff Plan of Beijing Mobile Realty Inc. ......................................... 38 Figure 25: Salary Plan of Beijing Mobile Realty Inc. ........................................................ 38 Figure 26: 2007~2012 Annual Trading Volume of Residential Property and NewlyConstructed Housing in Beijing .................................................................................. 39 Figure 27: 2010 Q1~ 2011Q2 Top 10 City or Province of Advertising Expenditure in Real Estate Websites ........................................................................................................... 40 Figure 28: Monthly User of Real Estate E-Commerce Websites in Year 2012 .................. 41 Figure 29: Market Size Assumption for the Next Five Years ............................................. 42. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. ii. i n U. v.

(5) Executive Summary MARKET The Chinese real estate industry has been in a rising trend for decades even though it has been through three center movement macro-economic regulations. In 2012 total real estate investment reached 72 trillion CNY and the sale of commercialized buildings was up to 64 trillion CNY with 14 trillion CNY in sales traded over internet. Real estate advertisement on real estate websites is around 0.84 billion CNY. The strong demand in property trading, due to the constant economic growth, high inflation rate and lack of investment instruments, has fostered a prospering real estate brokerage market. Currently, more than 100,000 agents. 政 治 大. and 8,000 agencies are working in high-trading-volume cities like Beijing and Shanghai.. 立. The quick adoption of topnotch IT technology in Chinese retail business also helps boost. ‧ 國. 學. real estate trading volume. Since 2011 Real estate websites have evolved from information sharing to e-commerce. Currently several giant website operators, such as Sino.com and Soufun.com, have invested heavily in forming online real estate trading businesses with. ‧. different business models.. Nat. sit. y. PROPOSED BUSINESS. io. er. Beijing Mobile Realty Inc., operate a real estate trading e-platform on both internet and mobile networks in Beijing, China. This platform will unite individual property sellers,. n. al. Ch. i n U. v. property buyers, brokers, related professionals and etc. that interest in processing real estate. engchi. transactions in residential and commercial property trading markets. The company applies the newest mobile marketing models including, O2O, Freemium and LBS into its software design to provide seamless online and offline assistance tailored for different customer requirements in every stage of his or her real estate trading process. The competitive advantages are the company’s independence and neutral platform that can provide unbiased, authentic, and professional property descriptions, including selling price evaluation, in multimedia formats such as video and map location-based services. OUR COMPETITIVE ADVANTAGES There are two major advantages that enable Beijing Mobile Realty Inc. to penetrate the competitive and saturated real estate e-commerce market in Beijing:. 1.

(6) 1. Product and service offerings are tailored to target customer’s needs. Authentic and professional descriptions of property in multimedia. Preliminary appraisal on the properties and regular updates on property prices. Easy to use, online automatic personalized service and sophisticated user interface Online and offline personal assistance provided by a skillful and dedicated staff Professional advisory services by qualified third parties, tailored for everyone’s needs in processing real estate property transactions One-stop shopping service, collecting necessary and up-to-date information and. 政 治 大 An Independent trading platform provides a risk free business environment for 立 advisory services on a single platform. 2.. every participant.. ‧ 國. 學. Due diligence on every participant and for-sale property Transparent procedure that is easy to monitor in every step of a transaction. ‧. Customers are protected by up to CNY 100,000 transaction risk free insurance. sit. y. Nat. MANAGEMENT TEAM. Each of the three founding partners, Scott Tam, Frank Chang and Sunny Lee, has more than. io. er. ten years experiences in different fields, and together, they form a well-rounded leadership. al. n. v i n C h people, infuses employed approximately four thousand e n g c h i U valuable experience and energy into. team. Scott’s thirteen years as Executive Manager in a well-known real estate agency, which the company’s critical development as a startup in competitive Chinese real estate trading. e-commerce market. FINANCIAL FORECAST Initial fund of 1 million CNY is provided by the three founders. In our plan, the company’s working capital will come from the founders’ initial investment and the Temporary Receipts for third party professional service. No bank loan is requested. The business is expected to turn profitable in year 3 and the revenue is expected to grow over to 10 million CNY. After year 5 the market share is expected to reach 7% and net profit is estimated to around 5 million CNY.. 2.

(7) Selected Ratio \ Year Total Asset Turnover. 1. 2. 1.32. 3. 1.95. 1.18. 4 0.82. 5 0.70. Return on Sales (ROS). 20.86%. 19.94%. 21.61%. Return on Asset (ROA). 24.66%. 16.33%. 15.09%. 103.03%. 59.26%. Return on Equity (ROE). 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 3. i n U. v.

(8) 1. Company Background 1.1.. Mission. Beijing Mobile Realty Inc., will operate a real estate trading e-platform that unites home sellers, buyers, related real estate professionals and etc., for processing real estate transactions. As a facilitator and independent 3rd party in real property trading, we provide necessary services in every stage of the selling process, including: assisting buyers or sellers, handling required legal procedures, and monitoring the entire real estate transaction process for risk control. Also, as a pioneer in developing location based applications on smart phones using 3G networks in China, the company will provide services over a seamless. 政 治 大 everywhere they go at any 立time they want. Our goal is to facilitate a low transaction cost,. combination of internet and 3G networks that will allow users to handle their transactions. Strategy. ‧. 1.2.. ‧ 國. China.. 學. minimum risk, and hassle free trading experiences for home sellers and buyers in Northern. Mobility Realty Inc. will succeed in the marketplace by providing low transaction costs,. Nat. sit. y. risk-controlled, and personalized online services in processing real estate trading. The. er. io. qualified and professional staff will provide high-quality and authentic multimedia property information and premium services for every party involved in a real estate transaction. The. n. al. Ch. i n U. v. company will partner with small or medium size companies in the real estate industry, such. engchi. as agencies, developers, and other real estate related service providers to collaborate in selling property. The company will also partner with major 3G network providers, including China Telecom and device providers, including HuaWei to provide a seamless mobile application for managing property selling procedures. These partnerships will provide real estate agents affordable and powerful mobile devices for their business needs. In contrast to the incumbents’ extensive geographic expansion strategy, Mobility Realty Inc. will focus on those mass transaction cities in Northern China, starting with Beijing. The company will firstly penetrate the residential property trading market before moving to the commercial property trading market in Beijing. After gaining an adequate business presence, the company will enlarge its service to high-end rental property within two years. Once gaining enough profit to open another office, the company will expand to other high-volume 4.

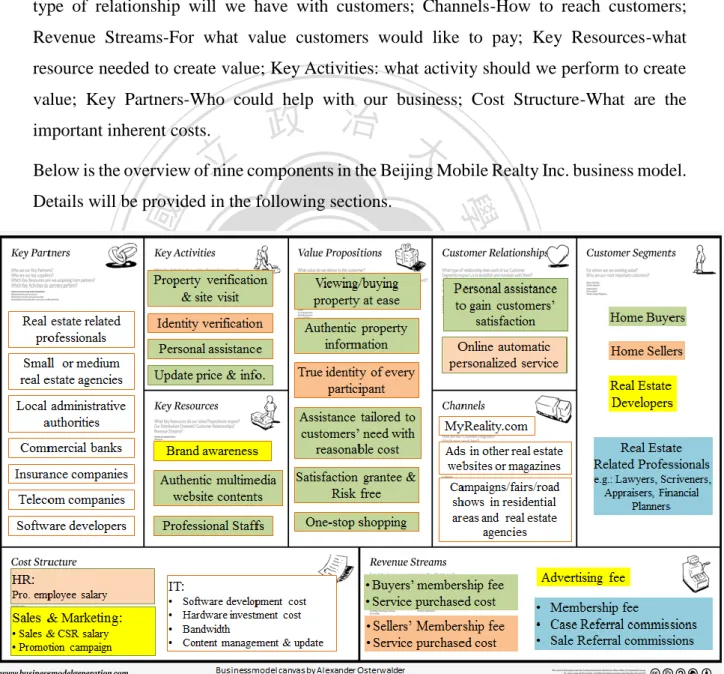

(9) trading cities in Northern China such as Tianjin, Chengduand DaLian.. 1.3.. Proposed Business Model. Based on the methodology proposed by Dr. Alexander Osterwalder in 2012, a business model consists of nine elements: Customer Segments-For whom are we creating value; Value Propositions-What value do we deliver to customers; Customer Relationships-What type of relationship will we have with customers; Channels-How to reach customers; Revenue Streams-For what value customers would like to pay; Key Resources-what resource needed to create value; Key Activities: what activity should we perform to create value; Key Partners-Who could help with our business; Cost Structure-What are the important inherent costs.. 立. 政 治 大. Below is the overview of nine components in the Beijing Mobile Realty Inc. business model.. ‧. ‧ 國. 學. Details will be provided in the following sections.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 1: Proposed Business Model, Author Edit. 1.4.. The Team. The three founders come from different domains and all have many years of experience in. 5.

(10) their professional fields. Their skills form a well-rounded team for Beijing Mobile Realty Inc. A general description of the background of each follows: Scott Tam Scott Tam graduated from XiAn Engineering College with Finance major in 1977 and is currently enrolled in a part-time EMBA program in HaiChung Technology University. He has more than 10 years working experience in real estate brokerages in different major cities in China. He has been employed at Century 21 in Shanghai, Bejijng and ShenZhen as regional General Manager, supervising over 4,000 employees. Prior to working at Century 21 he had worked for MLS China, Cisco Software, and ChungXin Corp. in GuangDong Province.. 立. 政 治 大. In Beijing Mobile Realty Inc., as a major founder, he is in charge of corporate strategy and. ‧ 國. 學. the development of the company. Frank Chang. ‧. Frank Chang graduated from Beijing Technology and Business University with an Electronic Engineering and Automation degree in 2000 and got an MBA degree in TsingHua. Nat. sit. y. University in Beijing in 2012. He has 9 years working experience in Information. io. er. Technology and is an experienced entrepreneur, having founded one software company developing mobile applications in 2009 and a website operating company in 2006.. al. n. v i n As a co-founder of Beijing Mobile C h Realty Inc., he isUin charge of website development and e gchi function design and manage outsourcenpartners. Sunny Lee Sunny Lee graduated from National Yunlin Institute of Technology and is currently enrolled in an IMBA program at National Cheng-Chi University in Taiwan. She has more than 12 years working experience as a Business System Analyst in High Tech companies in Taiwan. She optimizes internal corporate processes using operating software such as ERP or CRM systems. She also has great understanding of working in an international environment from. studying and travelling in foreign counties for approximately four years. As a co-founder of Beijing Mobile Realty Inc., she is in charge of logistics and administrative processes for the entire company.. 6.

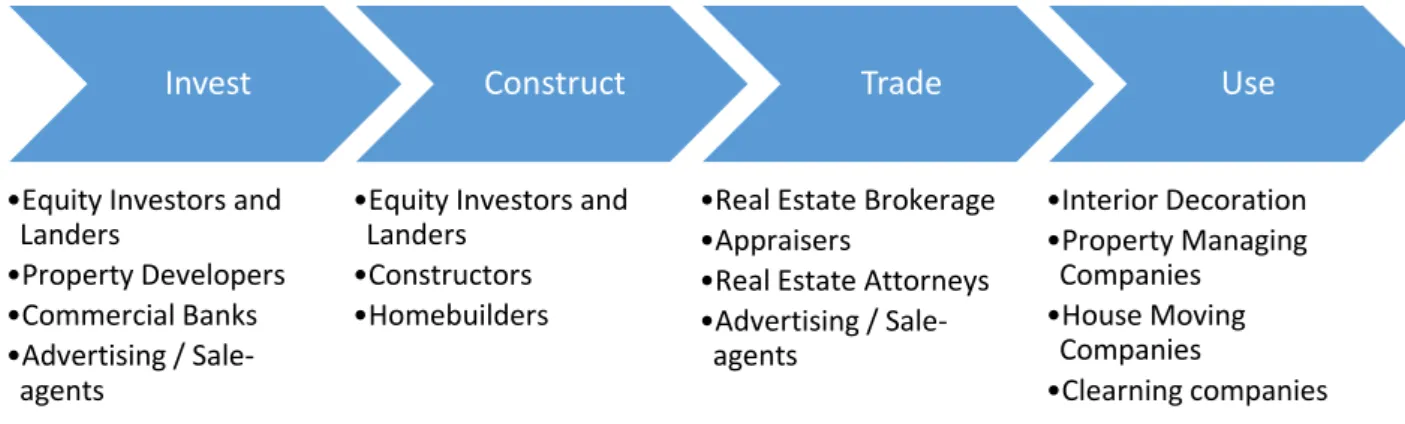

(11) 2. Chinese Real Estate E-Commerce Market 2.1.. Background. As a Communist society, housing construction and real estate property titles used to solely belong to local or central government. Citizens were assigned to a living place and granted non-exchangeable usage-only rights to a property by local governments or bureaus they worked for. After Prime Minister Deng XiaoPing’s 1978 speech indicated the possibility of private ownership, the Chinese government began to experiment with granting real estate property usage rights to private sectors for private financed housing construction projects in several cities and townships.. In September 1984, the country’s highest administrative. 政 治 大 commercialize real estate 立property usage rights and make them tradable. In May 1990 the. bureau, the State Council of Republic of China, issued an Interim Regulation 1 to. ‧ 國. 學. State Council issued an official regulation2 that ensured the separation of the titles of land ownership and land usage right. This regulation allows citizens to purchase the property usage rights to the land and buildings for up to 70 years, but the land titles are still owned. ‧. by government.. sit. y. Nat. Deng’s speech talk also changed real estate brokering from an underground economic activity into a legitimate business form. Furthermore in 1992, the State Council issued an. io. n. al. er. official statement3 identifying the real estate industry as an emerging industry of the third. i n U. v. industrial sector in China. The real estate business has become a fast growing industry in. Ch. engchi. every province in China and has fostered many new business forms, such as property development, construction, brokerages etc. Nowadays there are thousands of companies devoted to every aspect of real estate business in every province all over China. The entire industry value chain can be presented as follows:. Full name is《Interim Regulation for Some Problems on Reforming Building Indnstry and Management System of Infrastructure Construction》, Chinese name《国务院关于改革建筑业和基本建设管理体 制若干问题的暂行规定》 2 Full name is 《 Provisional Regulations of The People's Republic of China on Assigning And Transferring The Urban State-owned Land-use Right》, Chinese name is 《中华人民共和国城镇国有 土地使用权出让和转让暂行条例》 (国务院令第 55 号) 3 Full name is , 《Notice of the State Council on Some problem in developing Real Estate Industry》, Chinese name is 《国务院关于发展房地产业若干问题的通知》 (国发<1992>61 号) 1. 7.

(12) Invest. Construct. •Equity Investors and Landers •Property Developers •Commercial Banks •Advertising / Saleagents. •Equity Investors and Landers •Constructors •Homebuilders. Trade. Use. •Real Estate Brokerage •Appraisers •Real Estate Attorneys •Advertising / Saleagents. •Interior Decoration •Property Managing Companies •House Moving Companies •Clearning companies. Figure 2: The Value Chain of Real Estate Industry in China For more than 20 years, the entire real estate industry in China has been rapidly increasing.. 政 治 大 policies intended to suppress the market. In 2012 the total real estate investment was up to 立 7.2 trillion CNY, 14% of China 2012 nominal GDP, with 16.2% annual growth rate . 86% The government has constantly attempted to slow this rising trend by issuing a number of 4. ‧ 國. 學. of this investment was invested in commercialized buildings (商品房), including residential property (住宅), indemnificatory housing (保障性住房), commercial property (商业营业. ‧. 用房) and office buildings (写字楼/办公楼). Usage rights can be traded in the market for. y. Nat. all of these types of real estate. As the sale of commercialized buildings has grown to 6.4. n. al. er. io. economy. .. sit. trillion CNY in 2012, the real estate industry has become a pillar industry of the Chinese. i n U. v. The internet has played an ever more important role in real estate industry since 1998. Ch. engchi. because of quick adaptation of top notch information technology and telecommunication technology, and the young population structure in China, with 76.3% of citizens being aged from 15 to 595,. Information technology has helped in breaking the geographic barriers and allowed information to be distributed throughout China. This advantage also plays important role in overcoming the constraints imposed on real estate by its immovable nature. Although the. 4. Data source: National Real Estate Development and Sales in 2012 , National Bureau of Statistics of China , published at 2013-01-18 16:59:08, http://www.stats.gov.cn/english/pressrelease/t20130118_402867355.htm 5 Data source: 3-2a Age composition and dependency ratio of city population by region(I), Tabulation on the 2010 population Census of The People's Republic of China, Natioal Bureau of Statistics of China, http://www.stats.gov.cn/english/statisticaldata/censusdata/rkpc2010/indexch.htm. 8.

(13) buyer and seller are miles apart, real estate can be traded using the internet. Nowadays, the practice of doing business over the internet has been widely adopted by Chinese people. In 2012 internet had reached 0.56 billion people, 42% of China’s population. They use internet in every aspect of their life: communication, information searching, and shopping. The trading volume of e-commerce was up to 8,100 billion6 CNY in 2012, 38.5% of the 21,030.7 billion CNY total retail sales of consumer goods7, including 75.31 billion8 CNY of online advertising expense. There are also 0.42 billion9 3G telecommunication network users, 31.6% of its population, who contributed 55 billion 10 CNY in mobile commerce, including 6.35 billion11 CNY mobile advertising expense. Almost everything. 政 治 大 pushed Chinese real estate brokerages into a new era: real estate e-commerce. 立. can be traded over computer networks: apparel, 3C products, and real estate. This trend has. ‧ 國. 學. In August 2011, EJU.com, supported by famous search engine Sino, became the first independent real estate ecommerce website. EJU.com launched its business, which allowed home buyers buy online voucher for new built house. Since then, several real estate. ‧. ecommerce websites have built and fostered a steady increase in business using different. sit. y. Nat. business models. In 2012 these real estate ecommerce websites had offices in 23 Chinese cities and offered property listings in over 300 Chinese cities, serving approximately 2.74. io. n. al. er. million internet users all over China.12 The evolution of Chinese real estate e-commerce business can be classified as in the chart below:. Ch. engchi. i n U. v. Data source: P31, 2012 年中國網絡經濟總結報告, iResearch Consulting Group, 2013/01 Data source: http://www.stats.gov.cn/english/newsandcomingevents/t20130222_402874607.htm, 2013/5/28 8 Data source: P21, 2012 年中國網絡經濟總結報告, iResearch Consulting Group, 2013/01 9 Data source: P66, 2012 年中國網絡經濟總結報告, iResearch Consulting Group, 2013/01 10 Data source: P39, 2012 年中國網絡經濟總結報告, iResearch Consulting Group, 2013/01 11 Data source: P71, 2012 年中國網絡經濟總結報告, iResearch Consulting Group, 2013/01 12 Data source: P16, 中國房地產電子商務行業典型案例研究報告-易居購房網 2012 年簡版, published in 2013/3/15 6 7. 9.

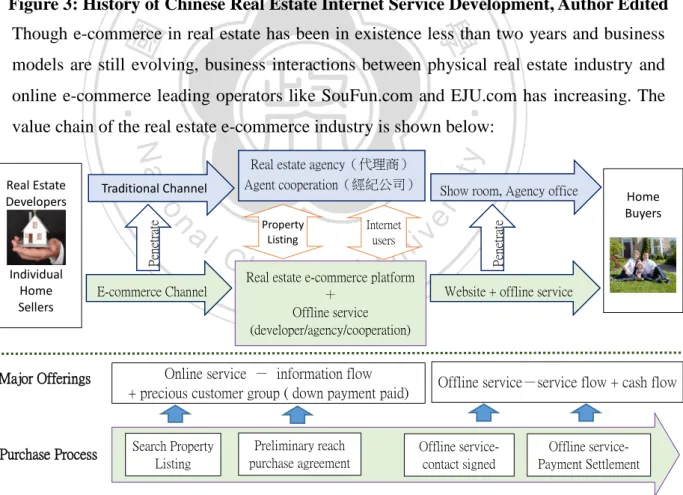

(14) 2007~2011 diverse development. 1998~2003 early start. Real estate websites applied more IT technologies, such as video online and web2.0, to improve real estate business. Homhow(家和網) and Koubei(口碑網) are the leading websites.. Internet was used as the medium in advertising for selling newly built property. Sino(新浪), Focus(焦點) and SouFun(搜房) are famous real estate news websites.. 2004~2007 Booming Internet marketing is well adapted in many aspects throughout the real estate industry. More than thousand firms provide real estate related online services.. 立. 2011/5/6 ~. Real Estate Ecommerce. Sina launched the first real estate brokerage website, house.sina, (新浪樂 居) which sold vouchers online to home buyers online.. 政 治 大. Figure 3: History of Chinese Real Estate Internet Service Development, Author Edited. ‧ 國. 學. Though e-commerce in real estate has been in existence less than two years and business models are still evolving, business interactions between physical real estate industry and. ‧. online e-commerce leading operators like SouFun.com and EJU.com has increasing. The. n. Penetrate. io. al. Ch. Internet users. Property Listing. engchi. i n U. Real estate e-commerce platform + Offline service (developer/agency/cooperation). E-commerce Channel. Major Offerings. Online service - information flow + precious customer group ( down payment paid). Purchase Process. Search Property Listing. Supporting Infrastructure. Industrial Policies. Preliminary reach purchase agreement. Network Hardware Constructions. Show room, Agency office. er. Traditional Channel. Individual Home Sellers. sit. Real estate agency(代理商) Agent cooperation(經紀公司). v. Home Buyers. Penetrate. Nat. Real Estate Developers. y. value chain of the real estate e-commerce industry is shown below:. Website + offline service. Offline service-service flow + cash flow. Offline servicecontact signed. Internet & Telecom. / Financial industry. Offline servicePayment Settlement. Credit Control System. Offline real estate industry. Figure 4: The Value Chain of Chinese Real Estate E-Commerce Data source: iResearch China E-Commerce in Real Estate Report, P.15, 2013/3/15. 10.

(15) In order to integrate the e-commerce with the physical real estate economy, real estate ecommerce website operators like EJU.com have successfully implemented O2O model (Online to Offline). They provide a platform linking every party involved in the real estate industry, including developers, agents, decorators and home movers, to provide one-stop shopping for home buyers and sellers. Consumers place their orders online for physical objects or services, and then customer service representatives will link them with suppliers to complete the transaction.. 2.2.. Business Climate Analysis. The development of the real estate industry in China is deeply influenced by central. 政 治 大 ("Political, Economic, Social, 立 Technological, and Legal”) model is applicable in predicting. government’s tight control and constantly changing regulations. Therefore, the PESTL. ‧ 國. 學. future market direction, volume and growth rate. 2.2.1. Political Factors. ‧. Because the price of housing is extremely important for China’s citizens and the price fluctuation will have great impact on everyone, including foreigners, the real estate industry. Nat. sit. y. in China is highly influenced and regulated by the central government. Three macro-. io. er. economic policies ( 宏 观 调 控 ) have been passed in year 1992, 1996 and 2004. Not surprisingly the request in tight control of house price rising has always been on the list.. n. al. Ch. i n U. v. Later on, the central government issued many regulations to regional governments. engchi. demanded for property price control and low-income housing security. The most recent one is the 2010 Eight Guidance (国八条)13. Currently the policies related to real estate industry are: A. financial policy of tightening bank credit: currently mortgage is limited to 60% of property value B. monetary policy of high lending interest rate to restrain the real estate investment C. tax policy of collecting property trading tax: currently every citizen can only own one house or apartment under his or her name. If home owner owns the property. 13Notice of the State Council on Resolutely Curbing the Soaring of Housing Prices in Some Cities《国 务院关于坚决遏制部分城市房价过快上涨的通知》 (国发〔2010〕10 号),2010/4/17. 11.

(16) for less than five years before trading it, he or she has to pay 20% property trading tax. D. land policy to increase the land supply for construction E. housing security policy for lower income citizens Though these policies have suppressed the investment on real estate and reduced the property trading volume, these policies also create demand from medium and lower income families. On the other hand, these policies also favor the home buyers by allowing them to require better services at a lower cost. We expect it to create a positive cycle in real estate e-commerce business to provide premium services.. 政 治 大. Last but not least, because the land supply is controlled by regional governments and the. 立. revenue from land usage right sales, plus the surcharges from real estate transaction is their. ‧ 國. 學. major income, a vigorous real estate trading market is welcomed by regional governments. 2.2.2. Economic Factors. ‧. As Chinese economics development evolves from fast growing into maturity, residential property trading volume (二手房交易量) has surpassed newly-constructed housing sales. y. Nat. sit. (新房销售量). This phenomenon has boosted the growth of the real estate brokerage sector.. er. io. In China the commercialized buildings (商品房) trading volume in 2012 is more than. al. v i n C hmostly from four mega (住宅) This trading volume was e n g c h i U cities, Beijing, Shanghai, Shenzhen and Guangzhou. In China’s capital city of Beijing, in year 2012 the commercial property n. 111,303.65 square meters. Of that, 98467.51 square meters (88.47%) is residential property.. trading is 1,943.74 square meters, 1.75% of the total for the country, with a 35.1% annual growth rate even though it dropped more than 10% in 2011 because of the government property purchase restriction. This phenomenon indicates the demand in real estate trading remains strong and unstoppable. 2.2.3. Social Factors In Chinese society, there are three major phenomenon that raise the demand for real estate: the desire of owning a house, the young population structure, and the preference for real estate investment. For many Chinese, owning a house is their ultimate goal in life. It is important for unmarried single males to have their own house, especially now that the. 12.

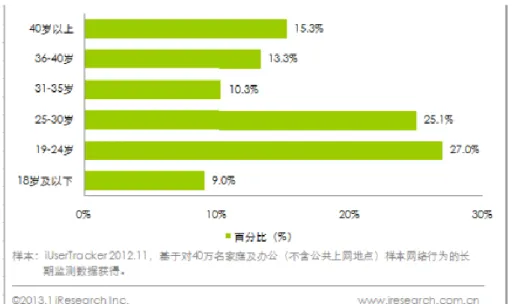

(17) population of single females is smaller than that of single males in China. The age range where housing is in demand has become aligned with the real estate website user profile. The research result below shows that among the real estate e-commerce users 64% are age 25 and above. They generally are well educated with medium-high income and live in highly developed commercial areas along the Chinese coast line.. 政 治 大. 立. ‧. ‧ 國. 學. Nat. Figure 5: The Age Distribution of Real-Estate E-Commerce Website Users in Year 2012. sit. y. Data source: iReasearch ( 2012/3/5) iReaserach China E-Commerce in Real Estate Report 2012, P.17. Finally, the tradition of saving has resulted in high saving rate in bank sector and a long-. io. n. al. er. standing tendency of property investment. As an old Chinese saying indicates: “Once you. i n U. v. own the land, you then have the fortune.” (有土斯有財) In major commercial cities like. Ch. engchi. Beijing or Shanghai, many citizens consider buying a house or even commercial property for rent as a secure investment that is tangible and controllable. 2.2.4. Technological Factors There are three major technologies that contribute to the growth of real estate ecommerce: the internet, mobile 3G networks, and smart phones. The research shows that 2012 Chinese smartphone sales are estimated to be 0.19 billion pieces with 169.4% annual growth rate14. The 2012 mobile network user volume was 0.42 billion people with 18% growth rate, while internet user volume reached 0.56 billion people.15 The increasing trend in mobile network use has resulted in a rise in the mobile e-commerce market, from 3.04 billion in 2011 to 14 15. Data source: iReasarch Group(Jan 2013) 2012 Chines network economic summary report, P.67 Data source: iReasarch Group(Jan 2013) 2012 Chines network economic summary report, P.66. 13.

(18) 13.03 billion in 2012.16 This dramatic increase is partly the result of 3rd party payment settlement applied from internet shopping to mobile shopping as shown in the figure below. The fast track development and heavy investments in top-notch information and telecommunication technology has shaped Chinese consumers behavior toward ecommerce.. 立. 政 治 大. ‧. ‧ 國. 學 y. Nat. sit. io. Figure 6: The Estimated Business Size of Chinese 3rd Party Payment Settlement Using Mobile from 2009 to 2016. n. al. er. Data source: iReasarch Group (Jan 2013) 2012 Chines network economic summary report, P.63. 2.2.5. Legal Factors. Ch. engchi. i n U. v. This fast growth in property trading has resulted in much misconduct in real estate brokerage practices, leading the Chinese government to issue new regulations in 2011, Administrative Measures for Real Estate Brokerage, providing detailed guidance17 regarding the operations of real estate agents, the realtors' behavior, as well as a list of prohibitions when conducting business. Some regional governments, such as Tianjin and Beijing, have established official websites for managing title transfer, payment settlement and mortgage applications in order to protect home buyers and sellers from real estate agent malpractice or deception. They have issued regulations that require buyer and seller in a real estate trading transaction apply to the 16 17. Data source: iReasarch Group(Jan 2013) 2012 Chines network economic summary report, P.69 Administrative Measures for Real Estate Brokerage (地产经纪管理办法), 2011/10/27. 14.

(19) official website for title transfer and also sign deeds of trust with the bureau to use assigned commercial banks for payment settlement. Some citizens complain that these regulations and extra procedures cause delay and waste money but some consider it is a safety measure for property trading. Although these regulations might cause a negative impact in the short-term realty brokerage market, they will foster the long-term healthy growth of professional real estate brokerage services.. 2.3.. Conclusion. 政 治 大. Although the real estate market in China is thriving with a huge trading volume, the real estate brokerage industry is still in its infancy. For instance, even though there are over one. 立. hundred thousand agents and more than eight thousand agencies, including branches, in , the house trading volume hasn’t exceeded that in the US or Taiwan yet.. ‧ 國. 18 . F. 學. Beijing. According to unofficial statistics, there are millions of real estate agents and over fifty. ‧. thousand agencies all over China, mostly in first-tier cities like Shenzhen, GungZhou, Shanghai and Beijing, so the potential for growth is quite strong.. y. Nat. sit. The development of information and telecom technology has helped boost the real estate. er. io. brokerage industry by increasing listing circulation to a wider audience of potential buyers.. al. n. v i n C hwill use topnotchUtechnology, providing location based company, Realty-on-Hand 1.0, engchi applications on smart phones using 3G networks. This mobile application allows consumers. The 3G telecom network will be another useful business tool for real estate brokerages. The. to search property listings easily. With the authentic and multimedia information of properties for sale, this software also helps real estate agents and agencies to manage the complexity of real estate brokerage processes, provide better customer service using up-todate telecom technology, and add a professional look to their service.. Data source: Xinhua News, 《办法》实施将破解房地产经纪行业三大问题, published at 2011-0128 18:08:22, http://news.xinhuanet.com/fortune/2011-01/28/PDK Mc_121037052.htm. 18. 15.

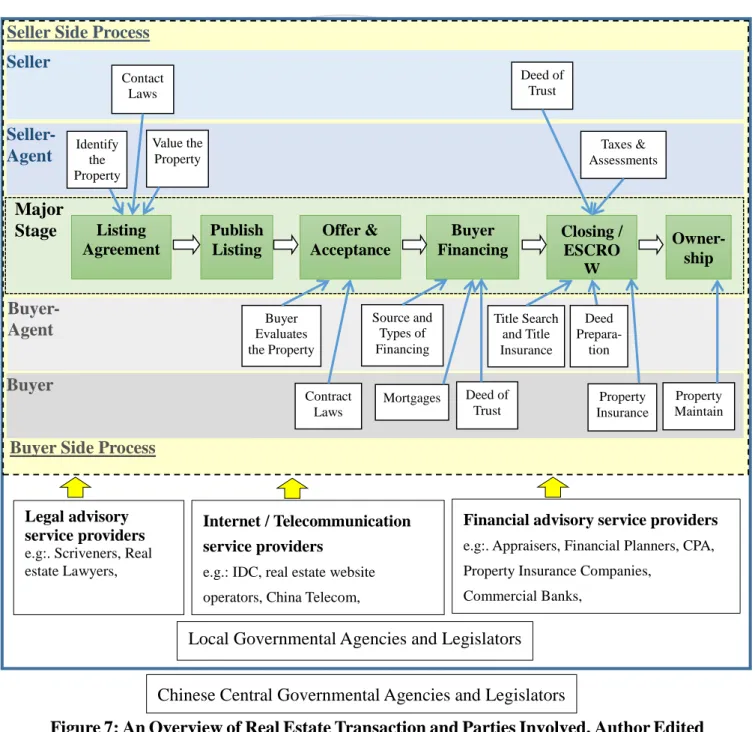

(20) 3. The Opportunity 3.1.. Background. The process of a real estate transaction in China, though it might vary from province to province, can be broken down into six different steps for both residential and commercial properties. Different parties in different steps will perform different tasks, require different information or assistance, focus on different aspects and need to comply with different legal requirements. The figure below provides an overview of the real estate transaction cycle. Seller Side Process. 政 治 大. Seller Contact Laws. io. al. n. Buyer. Offer & Acceptance. Buyer Financing. y. Nat. BuyerAgent. Publish Listing. Buyer Evaluates the Property. Source and Types of Financing. Closing / ESCRO W. sit. Listing Agreement. Taxes & Assessments. Title Search and Title Insurance. er. ‧ 國. Value the Property. ‧. Major Stage. Identify the Property. 立. 學. SellerAgent. Deed of Trust. iv n U Deed of. C h Contract Mortgages eLaws ngchi. Ownership. Deed Preparation. Trust. Property Insurance. Property Maintain. Buyer Side Process. Legal advisory service providers e.g:. Scriveners, Real estate Lawyers,. Internet / Telecommunication. Financial advisory service providers. service providers. e.g:. Appraisers, Financial Planners, CPA,. e.g.: IDC, real estate website. Property Insurance Companies,. operators, China Telecom,. Commercial Banks,. Local Governmental Agencies and Legislators Chinese Central Governmental Agencies and Legislators Figure 7: An Overview of Real Estate Transaction and Parties Involved, Author Edited 16.

(21) Due to the high value, uniqueness, and immobility of a real estate property, people tend to be cautious and spend lots of effort and time selling or buying a property. But the complex legal, technical, financial and tax issues related to real estate transactions force buyers or sellers to seek professional help in handling all of these affairs. For example, they need appraisers’ help in estimating the true value of a property, agents’ help in selling and showing the property to as many potential buyers as possible, lawyers’ help on title transfer and deed of trust, and the financial experts’ help in planning financing. Lastly, because of the knowledge required and pressure in managing all these steps, buyers or sellers need real estate agents’ or brokerages’ helps in controlling and speeding up the entire process,. 政 治 大 Though the value of a real estate agent’s role is recognized by the consumers, there is a 立 avoiding risks and hassles, and mostly importantly, finding them a real bargain in price.. serious distrust feeling clouding the Chinese real estate brokerages because of increasing. ‧ 國. 學. number of malpractice incidents in real estate trading markets. Such incidences of malpractice include false property information, failure to provide crucial information,. ‧. fraudulent payment, unlicensed activities, and unauthorized disclosure of clients’ private. y. Nat. information.19 Consumers are forced to pay higher transaction fees in doing business with. sit. reputable real estate agency chains, such as Homelink real estate agency (鏈家地產) or 5i5j. al. n. Eju.com(易居網).. er. io. real estate agency (我愛我家), or trusted real estate websites like Sofun.com(搜房網) or. Ch. engchi. i n U. v. Beijing Mobile Realty Inc. believes that providing reliable property listings and professional real estate services combined with the convenience of information technology can regain consumers trust in smaller real estate websites. Furthermore, we believe we can encourage small and medium agencies to leverage its trading platforms to share listings and co-sell real properties as a way of competing with those giants.. 3.2.. The Target Customers and Their Needs. Beijing Mobile Realty Inc., recognizes the following individuals or entities as the target customers, among the many participants in the real estate industry:. 19. Data source: 董 昕, 2012 年房地產政策回顧與評析, 中国房地产发展报告 No.10, 2013 年 4 月. 17.

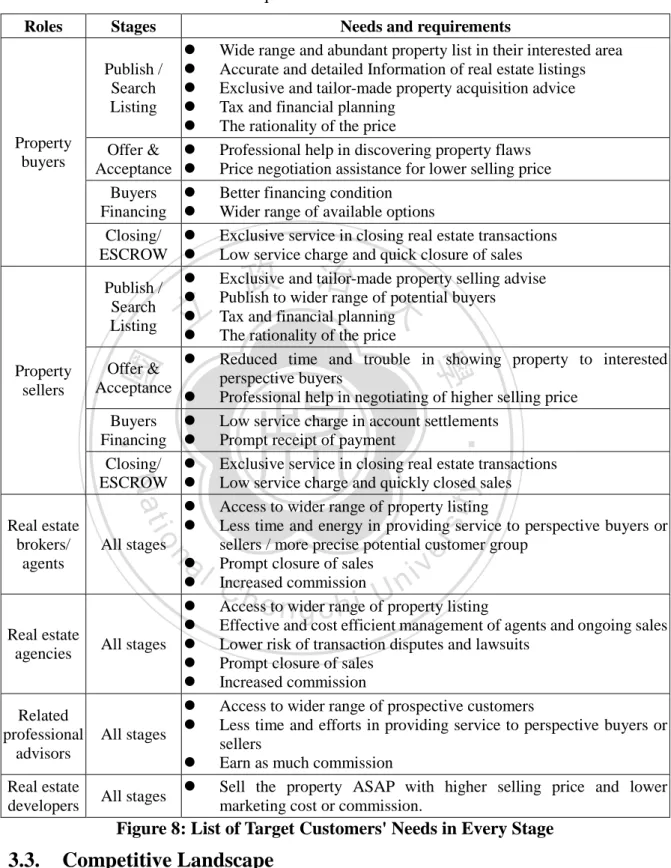

(22) A.. Direct individual customers: property buyers, property sellers, real estate brokers. B.. Indirect individual customers: real estate agents, real estate related professionals and advisors, such as scriveners, real estate lawyers, appraisers, financial planners, CPAs etc. Indirect corporate customers: real estate agencies, developers, commercial banks, property insurance companies etc.. 立. 政 治 大. 學 ‧. ‧ 國 io. sit. y. Nat. n. al. er. C.. Ch. engchi. 18. i n U. v.

(23) Different customs have different requirements. Below is the list of all their needs.. y. Nat. io. n. al. ‧. ‧ 國. 立. 政 治 大. 學. Property Offer & buyers Acceptance Buyers Financing Closing/ ESCROW Publish / Search Listing Offer & Property Acceptance sellers Buyers Financing Closing/ ESCROW Real estate brokers/ All stages agents Real estate All stages agencies Related professional All stages advisors Real estate All stages developers Publish / Search Listing. Needs and requirements Wide range and abundant property list in their interested area Accurate and detailed Information of real estate listings Exclusive and tailor-made property acquisition advice Tax and financial planning The rationality of the price Professional help in discovering property flaws Price negotiation assistance for lower selling price Better financing condition Wider range of available options Exclusive service in closing real estate transactions Low service charge and quick closure of sales Exclusive and tailor-made property selling advise Publish to wider range of potential buyers Tax and financial planning The rationality of the price Reduced time and trouble in showing property to interested perspective buyers Professional help in negotiating of higher selling price Low service charge in account settlements Prompt receipt of payment Exclusive service in closing real estate transactions Low service charge and quickly closed sales Access to wider range of property listing Less time and energy in providing service to perspective buyers or sellers / more precise potential customer group Prompt closure of sales Increased commission Access to wider range of property listing Effective and cost efficient management of agents and ongoing sales Lower risk of transaction disputes and lawsuits Prompt closure of sales Increased commission Access to wider range of prospective customers Less time and efforts in providing service to perspective buyers or sellers Earn as much commission Sell the property ASAP with higher selling price and lower marketing cost or commission.. sit. Stages. er. Roles. Ch. engchi. i n U. v. Figure 8: List of Target Customers' Needs in Every Stage. 3.3.. Competitive Landscape. Currently there are thousands of existing real estate websites that offer property listings in more than 300 cities in China. Competitors are mainly from two categories: pure real estate 19.

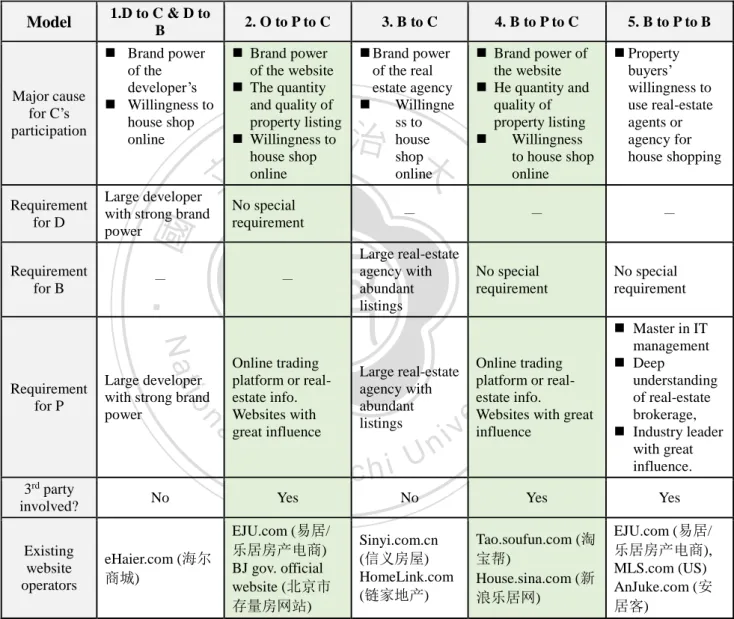

(24) website operators and real estate agent owned websites. , There are five major groups participating in Chinese real estate e-commerce, classified by the difference in business relationship: C (Consumer), B (Broker/Brokerage Firm), D (Developer), O (Owner), and P (Platform). The existing business models can be categorized into five categories as the chart below.. Brand power of the real estate agency Willingne ss to house shop online. Brand power of the website He quantity and quality of property listing Willingness to house shop online. Property buyers’ willingness to use real-estate agents or agency for house shopping. -. -. -. 政 治 大. No special requirement. Large developer with strong brand power. No. eHaier.com (海尔 商城). al. Ch. No special requirement. Online trading platform or realestate info. Websites with great influence. Master in IT management Deep understanding of real-estate brokerage, Industry leader with great influence.. No. Yes. Yes. Sinyi.com.cn (信义房屋) HomeLink.com (链家地产). Tao.soufun.com (淘 宝帮) House.sina.com (新 浪乐居网). Large real-estate agency with abundant listings. engchi. Yes EJU.com (易居/ 乐居房产电商) BJ gov. official website (北京市 存量房网站). No special requirement. y. Online trading platform or realestate info. Websites with great influence. Large real-estate agency with abundant listings. sit. -. n. Existing website operators. Brand power of the website The quantity and quality of property listing Willingness to house shop online. -. io. 3rd party involved?. 5. B to P to B. 立. Nat. Requirement for P. 4. B to P to C. ‧. Requirement for B. Large developer with strong brand power. 3. B to C. 學. Requirement for D. Brand power of the developer’s Willingness to house shop online. 2. O to P to C. er. Major cause for C’s participation. 1.D to C & D to B. ‧ 國. Model. i n U. v. EJU.com (易居/ 乐居房产电商), MLS.com (US) AnJuke.com (安 居客). Figure 9: Chinese Real Estate E-Commerce Model Analysis Data source: 中国房产电商发展趋势及企业参与策略研究 <Trend of Chinese real estate ecommerce development and enterprise penetration strategy research> , 2013, Author edited.. The business model Beijing Mobile Realty Inc, proposed belongs both in Models 2 and 4. Except the BJ government official website, the major competitors of MyRealty.com are from two groups: website operators, EJU.com, Sofun.com, AnJuke.com, and real estate agent owned website, HomeLink.com. 20.

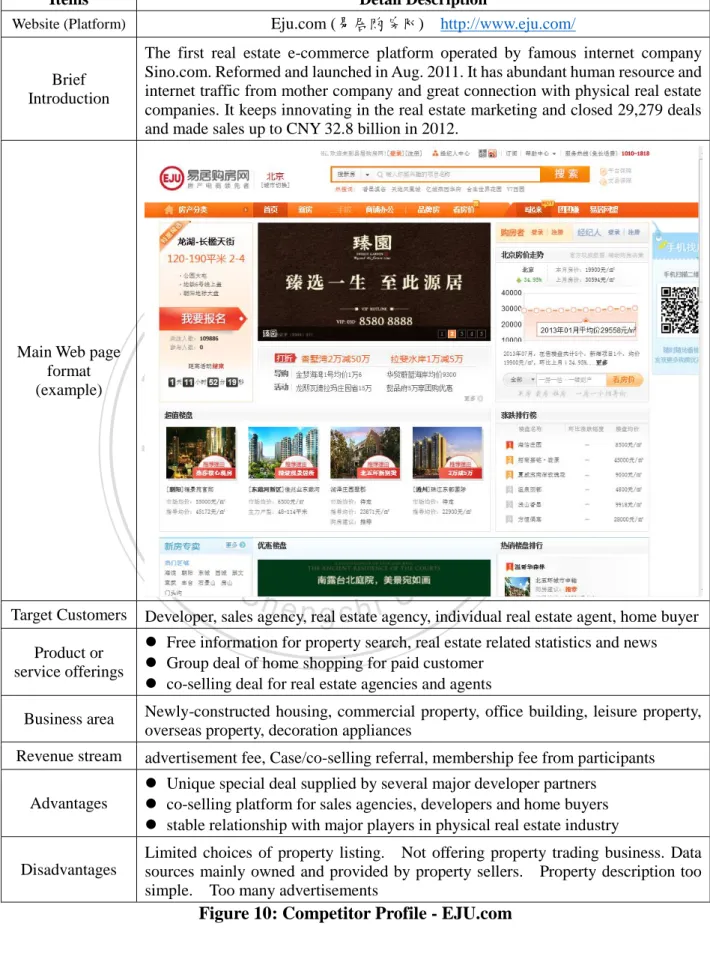

(25) Items. Detail Description Eju.com (易居购房网) http://www.eju.com/. Website (Platform). The first real estate e-commerce platform operated by famous internet company Sino.com. Reformed and launched in Aug. 2011. It has abundant human resource and internet traffic from mother company and great connection with physical real estate companies. It keeps innovating in the real estate marketing and closed 29,279 deals and made sales up to CNY 32.8 billion in 2012.. Brief Introduction. 立. ‧. ‧ 國. 學. Main Web page format (example). 政 治 大. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Target Customers. Developer, sales agency, real estate agency, individual real estate agent, home buyer. Product or service offerings. Free information for property search, real estate related statistics and news Group deal of home shopping for paid customer co-selling deal for real estate agencies and agents. Business area Revenue stream Advantages. Disadvantages. Newly-constructed housing, commercial property, office building, leisure property, overseas property, decoration appliances advertisement fee, Case/co-selling referral, membership fee from participants Unique special deal supplied by several major developer partners co-selling platform for sales agencies, developers and home buyers stable relationship with major players in physical real estate industry Limited choices of property listing. Not offering property trading business. Data sources mainly owned and provided by property sellers. Property description too simple. Too many advertisements. Figure 10: Competitor Profile - EJU.com. 21.

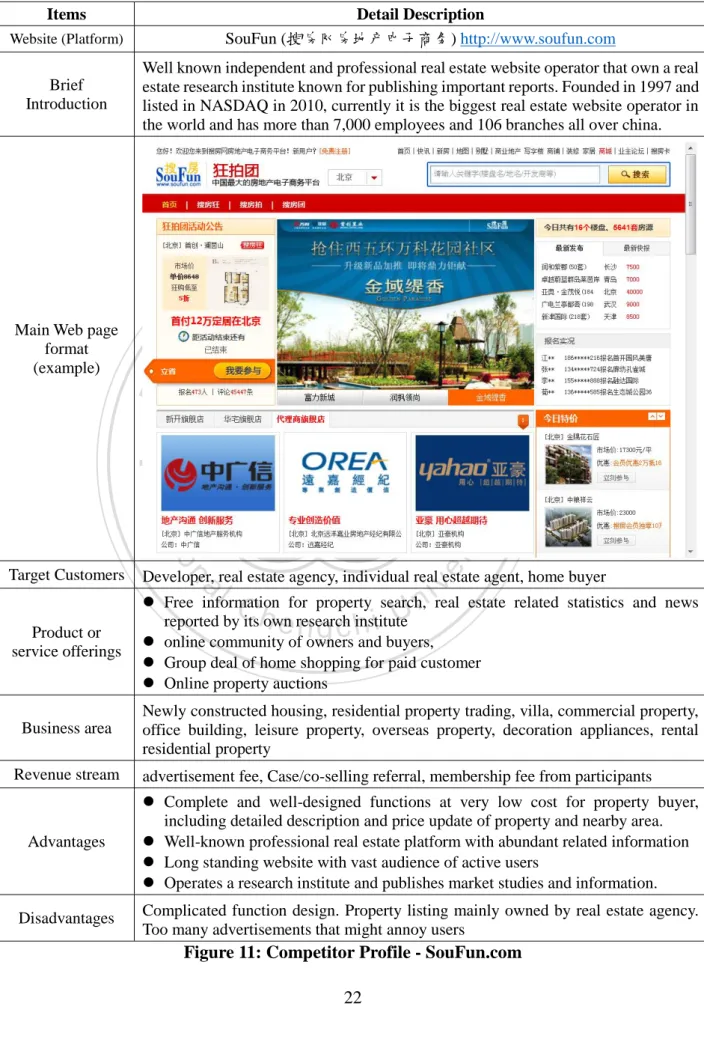

(26) Items. Detail Description SouFun (搜房网房地产电子商务) http://www.soufun.com. Website (Platform). Well known independent and professional real estate website operator that own a real estate research institute known for publishing important reports. Founded in 1997 and listed in NASDAQ in 2010, currently it is the biggest real estate website operator in the world and has more than 7,000 employees and 106 branches all over china.. Brief Introduction. 立. ‧. ‧ 國. 學. Main Web page format (example). 政 治 大. er. io. sit. y. Nat. al. v. Developer, real estate agency, individual real estate agent, home buyer. Product or service offerings. Free information for property search, real estate related statistics and news reported by its own research institute online community of owners and buyers, Group deal of home shopping for paid customer Online property auctions. Business area. Newly constructed housing, residential property trading, villa, commercial property, office building, leisure property, overseas property, decoration appliances, rental residential property. Revenue stream. n. Target Customers. Ch. engchi. i n U. advertisement fee, Case/co-selling referral, membership fee from participants. Advantages. Complete and well-designed functions at very low cost for property buyer, including detailed description and price update of property and nearby area. Well-known professional real estate platform with abundant related information Long standing website with vast audience of active users Operates a research institute and publishes market studies and information.. Disadvantages. Complicated function design. Property listing mainly owned by real estate agency. Too many advertisements that might annoy users. Figure 11: Competitor Profile - SouFun.com 22.

(27) Items. Detail Description. Website (Platform). AnJuKe 安居客 http://beijing.anjuke.com/. Brief Introduction. The first real estate website to target individual real estate agents, agencies and developers in selling residential property, including property trading and newly constructed housing. Established in 2007 in Shanghai, it employees around 1,500 people in 31 branch offices in major cities in China.. 立. ‧. ‧ 國. 學. Main Web page format (example). 政 治 大. er. io. sit. y. Nat. al. n. v i n C information Free property search, including U real estate price update h e nshopping g c hfori paid Group deal of home customer,. Target Customers. Developer, real estate agency, individual real estate agent, home buyer. Product or service offerings. Online advisor forums that answer consumers’ property related problems for free Multiple mobile apps for every user group. Business area. Newly-constructed housing, residential property trading, rental residential property. Revenue stream. Advantages. Disadvantages. advertisement fee, Case/co-selling referral, membership fee from participants . Simple and clear user interface design with professional look Customer oriented functions on website and mobile app. Specialized website/mobile functions for real estate agents. Different mobile apps for each user group using iOS or Android Long established platform unites real estate related professions Large online advisory member group which formed a high entry barrier. Limited property offering. Brand awareness is limited to real estate agents and limited property buyers. Figure 12: Competitor Profile - AnJuke.com 23.

(28) Items. Detail Description. Website(Broker). HomeLink 链家在线 (http://beijing.homelink.com.cn/ershoufang/). Brief Introduction. In Beijing it is the leading real estate agency with up to 30% market share of residential property trading. The company’s permanent emphasis on being authentic and professional gains mass consumers’ confidence, providing its brand value. Formed in 2001, it has more than 900 chain stores and 18,000 employees in Beijing and 7 other mass trading cities in China.. 立. ‧. ‧ 國. 學. Main Web page format (example). 政 治 大. n. al. er. io. sit. y. Nat Target Customers. Product or service offerings Business area Revenue stream. Ch. home sellers, home buyers. engchi. i n U. v. Free property information search, including real estate price update and area view Customer oriented website design with helpful information for property trading Specialized mobile apps only for real estate agents Residential property trading, rental residential property Commission. Advantages. Dominant brand power attracts more potential buyers and sellers with a higher success rate in sales Specializes in property trading in certain cities 100% authentic, detailed and reliable property descriptions with trustworthy agents.. Disadvantages. The conflict of interest prohibits it from establishing mutual relationship with other agencies and individual agents and limits its offering in property listing. The nature of the company as real estate agency limits its growth Limited property offering because it is not an open information sharing platform. Figure 13: Competitor Profile - HomeLink.com 24.

(29) Nowadays there is a calling for honesty and customer focus in the real estate brokerage industry. Reputable real estate websites like Homelink.com and Sofun.com have started to emphasis the accuracy of property descriptions and the selling price because of the resentment from websites users for the long lasting practice of providing false property descriptions. Also the proportion of advertisements on web pages is restrained to around 25% of a webpage so that website users can search for information more easily. The third change in the real-estate websites is the differentiation of business focus because the copycats can’t compete in the market anymore. After researching functions provided by existing well-known real estate websites, the. 政 治 大 the video introduction of a real-estate property and the rational suggested selling price. The 立. company has identified that two functions are seldom available in most real-estate websites:. company also discovered that description of a property is not detailed enough and picture. ‧ 國. 學. quality is not good enough. From the founders’ point of view, these features are important for home buyers, especially for serious consumers. Also from using functions on. ‧. competitors’ websites and their mobile tools founders discovered some points for. y. Nat. improvement, such as the user interface can be more user-friendly, the mobile application. sit. can be more aligned with its website functions. From general public’s point of view, the. al. n. buyers’ needs.. er. io. process flow design on website and mobile application can be more intuitive and tailored to. Ch. engchi. The company recognized a niche market and. iv n aUgood point. of penetration into this. competitive, over-crowded but promising market: real estate e-commerce website with reliable multimedia information and seamless mobile applications. The differentiation between proposed product offerings of Beijing Mobile Realty Inc. and the competitors can be categorized into three aspects: technology used, content information and Service offered. The figure below provides detail descriptions of its offering and target customer:. 25.

(30) Aspect. Existing offering (AS-IS). (*key factor). Proposed offering(TO-BE). Every website offers maps nearby search. Follow the competitors’ offering. *Location for general users using smart mobile & Base Service. GPS. Tech. Used. Every major website offer this function Follow the competitors’ offering Enhance the mobile app functions in serving user needs like AnJuKe.com for specialized apps for different user group both in iOS and Android users. for general users *Mobile App integration* AnJuKe.com and HomeLink.com have N/A. *Online video. Offering the online video function. Map search. Every website provide baidu map serach. Use google map search. Process integration using tech.. HomeLink provides necessary help and process online guide for real estate agents over smart phone. Provide similar functions like HomeLink.com but to all paid members. *Source of Content*. Mostly owned by real estate agents, except The content is owned and created HomeLink mostly by MyRealty.com. 立. 政 治 大. Mostly in photos and layout.. Standard format of every property: photos of every room & layout On-the-spot video filming by our staff or authorized partners. ‧ 國. ‧. The description item of a property is not Provide standard and professional property description format Descriptions of property for sale is creating negative user feeling verified by company’s staff onsite. standardized. *Information quality Eju and SouFun have too many ads,. y. Nat. Info. Content. 學. *Multimedia Homelink provide the real area view information with SOSO map support formats. n. Ch. engchi. er. io. al. Offer watch list for registered users Provide regulated listing and price update based on the watch list After user login, the list and ads will show accordingly to watch list. sit. Homelink provides free property price. update notification *Personalized content SouFun provide watchlist for both subscribe buyers and sellers. i n U. v. Most websites provide the trading price Offer reliable property apprisal done *Property of nearby property by our professional staff or partner apprised price SouFun provide automatic apprise tool on-the-spot Total solution support. Service offering. EJU & SouFun has home appliance Follow the competitors’ offerings but vendors & decorators with selected suppliers who have SouFun has bank mortgage application partnership with the company online. Online service Everyone provide service hotline support Homelink provide online chat service Offline service support. Everyone provides CSR answering customers’ calls SouFun has financial advisors. Follow the competitors’ offerings We have CSR and an advisory team: lawyer, financial planner and real estate agent to help members. *Transaction EJU.com offer 100% down payment refund Provide up to CNY 100,000 transaction risk control guarantee for its voucher and auction risk free insurance protection for every guarantee purchase made on MyRealty.com. Figure 14: Product and Service Offering Differentiation List of MyRealty.com 26.

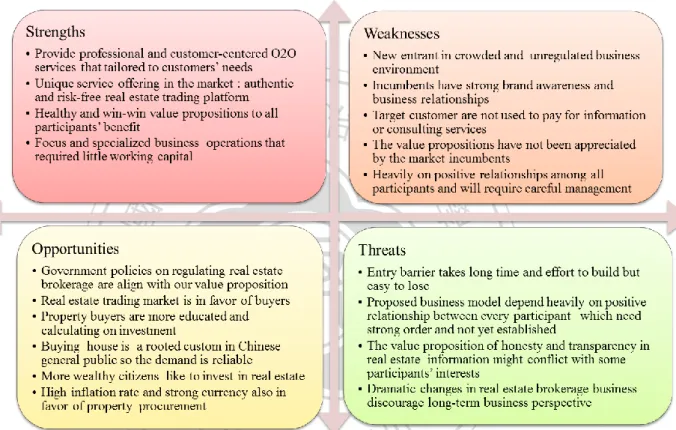

(31) 3.4.. SWOT Analysis. Currently the real estate internet market is dominated with several famous website operators and real estate agency chains. But real estate trading platform has just been developed in the past two years. Below is the SWOT analysis that founders consider important for their future movements, based on market research and competitive analysis.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 15: SWOT Analysis of Beijing Mobile Realty Inc., Proposed Business Model Beijing Mobile Realty Inc. will emphasize its detailed and professional property descriptions with real scene videos and photos, tailored counseling service for members and purchaser protection as the competitive advantages. As the new player into a crowded and developed market, Beijing Mobile Realty Inc. sees several challenges, yet also several opportunities that will enable its business to grow. By focusing on a niche market in only one mega city and avoiding head-to-head competition with those giant incumbents, the founders believe they will have more opportunity and time to build their business with their limited resources.. 27.

(32) 4. Operations Plan Beijing Mobile Realty Inc., will be incorporated with capital CNY one million and registered in Beijing, China in July, 2013. After six months in software development, the pilot product on Android platform, Realty-on-Hand v1.1, will be on the market from Jan. 2014, along with the real estate website, MyRealty.com.. 4.1.. Product/Service Offerings. Beijing Mobile Realty Inc. will operate a real estate e-commerce website, MyRealty.com, as a platform for connecting different participants in real estate trading transactions, from. 政 治 大. the real estate developers, brokers, appraisers, lawyers, to commercial banks. It also provides portable real estate transaction management software, Realty-on-Hand, to serve. 立. real estate agents’ needs in servicing property buyers and sellers. The relationship between. ‧ 國. 學. the company and affiliated companies or individuals is as below:. ‧. Technology service providers 1. Internet Network & Internet Data Center 2. 3G Telecom Network 3. Local Gov. own website for ESCROW and title transfer. n. al. er. io. sit. y. Nat. Info Providers (Home Sellers) 1. Property owners/companies 2. Independent Seller Agents 3. Real Estate Agencies 4. Property developers. Ch. n U engchi. iv. Info Receivers (Home Buyers) 1. Property buyers/companies 2. Independent Buyer Agents 3. Real Estate Agencies. Professional real estate related service providers: 1. Independent licensed real estate agents / brokers 2. Appraiser 3. Scriveners, Real estate Lawyers 4. Financial planners / CPA 5. Commercial Banks / Property Insurance Companies 6. Others: Home mover / Interior decorator /furniture sellers. Figure 16: Participants on Beijing Mobile Realty Inc. Website Platform, Author Edited. 28.

(33) For advertisers such as real estate developers, the company provides an effective place for their commercials or advertisements to a narrow target audience, according to the users’ watch list. The founders believe that these advertisements actually are useful information for those interested consumers. Using principles of customer relationship management (CRM), different user type will see different contents and active functions after logging into MyRealty.com. The entire service offerings provided by Beijing Mobile Realty Inc., on its website and web application can be itemized below. A.. The description of a property published by the website is standardized and is as detailed as necessary.. B.. 立. 政 治 大. All property listings published on other well-known real estate websites will be. ‧ 國. 學. aggregated on MyRealty.com with standardized format so that registered users can compare all property listing on one website .. The identity of all registered users will be verified. D.. All property listings published by the website will be validated and filmed by. ‧. C.. y. sit. E.. Nat. company staff on the spot.. Registered users can enjoy 24/7 property shopping experience remotely and. io. er. virtually by watching the video footage of the property. This is expected to save. al. n. v i n C create watch lists Uand personalize the content he or she Registered users can h engchi. them a tremendous amount of time and money in selecting the properties to visit. F.. needs so that they can get first-hand information once their watch list is updated.. G.. Registered users can purchase legal or financial services though MyRealty.com. All the transactions made on the website are eligible for up to CNY 100,000 transaction risk free insurance that guarantees the safety of payment and the quality of the service.. H.. Property listing will be evaluated by professional appeaser hired by the company. For paying subscriber the suggested selling price will be shown and updated regularly.. I.. For paying subscriber there will be free one-hour counseling service on any real estate transaction topic of concern to the customer. During the valid period the. 29.

(34) payer will be assigned one dedicated CSR in solving his or her issues. J.. All property sales conducted using MyRealty.com will be applied to ESCROW provided by Beijing government official website in guaranteeing the safety of title transfer and account settlement.. K.. Professional members can download a mobile application that is tailored to their requirements. They also can get discount in buying smartphone or using 3G network.. L.. Professional real estate agents can register for co-selling a property and earn commissions.. 治 政 大Realty Inc., meeting room to serve service charge they can use Beijing Mobile 立 these clients.. Professional members can price their services on MyRealty.com. With a small. 學. ‧ 國. M.. To serve different consumers with different degree of willingness to conduct online business, Beijing Mobile Realty Inc., has divided potential consumers into four groups and will use a. ‧. Freemium model in allocating the service offering as the table below:. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 17: Service Offering Designs for Different User Groups of Myrealty.com Last but not least, because of the nature of real estate, Beijing Mobile Realty will present property listings mainly using map search on the website and location-based service on mobile applications. This design is different from every incumbent in the market and should be more appealing and user friendly. The user interface will be similar like the pictures. 30.

(35) below:. 立. 政 治 大. ‧ 國. 學. Figure 18: Examples of User Interface Design Using GPS, Map and LBS on Smart Phone Data source: http://www.realtor.com/mobile/ipad, 2011/5/13. ‧. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 19: Examples of User Interface Design Using Baidu Map Search on the Website Data source: http://bj.58.com/ershoufang/ , 2013/6/1. 4.2.. Service Providing Processes. As a real estate trading e-platform, MyRealty.com product offerings, information and. 31.

(36) counseling service which can be delivered by internet or telephone, are intangible.. For the face to face counseling service, customers will come to company’s office. So when designing a process there are three major flows needing to be controlled: business flow, information flow, and cash flow. As the information flow, MyRealty.com plays a controller role in collecting information and monitoring every process step. All the purchase records, feedbacks and issues are traceable online for the consumers for five years. Regarding the cash flow, for all service purchases made through the website, MyRealty.com, or mobile application, Realty-on-hand, the payment will be made online using 3rd party. 政 治 大. settlement for user convenience. This payment will be sent directly to Beijing Mobile Realty. 立. Inc. as collateral from buyer to seller. After the purchase confirmation is made by consumers. ‧ 國. 學. then the payment will be transferred to service providers by the company. Beijing Mobile Realty Inc. provides necessary arbitration of any dispute is raised by either party and provides up to CNY 100,000 damage coverage to the consumers.. ‧. As the business flow, for registered or paid members, except advertisement publishing. Nat. sit. y. services, Beijing Mobile Realty Inc., integrates every prospective user with three major. io. er. processes: 1) Publish a property listing 2) Buyers register online for open house 3) Purchase professional advice online and then use services through internet or face-to-face. The. n. al. Ch. detailed processes are described below:. engchi. 32. i n U. v.

(37) 1) Publish a property listing. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 20: Process 1-Seller Applies to Post Property Listing to Be Handled by Staff of Beijing Mobile Realty Inc. 33.

(38) 2) Buyers register online for open house. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 21: Process 2-Buyers Register Online for Further Information of Property Listing 34.

(39) 3) Purchase professional advice service online and then use service by internet or face-toface. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 22: Consumers Purchase Service Provided by 3rd Party though MyRealty.com 35.

(40) 4.3.. Strategy and Approach to the Market. Beijing Mobile Realty Inc., will create the prestigious brand recognition using the premium services with affordable cost to its members and partners. After launching the website, the company will offer free trial services for its target customers in the first three months. In order to promote the concepts to the general public, and also to collect property for sales, the sales division will be divided into pairs and set to work in the field four days a week. The Company will provide them mobile services for communication, operating control, and the demo.. 政 治 大. During weekends the company also will organize fairs and road shows in local communities in Beijing to educate general public and discover potential home buyers and sellers.. 立. Headquarter Office. 學. ‧ 國. 4.4.. Headquarters will be located in downtown Beijing with spaces for 40 people, but because salesmen will work mostly outside on the field and communicate with company by its own. ‧. operating software and cell phone, one quarter of the spaces will be decorated as meeting rooms for its partner advisors while counseling members.. y. Nat. Equipments. io. sit. 4.5.. n. al. er. As an internet service provider and website operator, computer / mobile programs and. i n U. v. website performance are three key competitive advantages:. Ch. engchi. A. For software program developing, the initial investment is CNY 340,000 into two parts: 1) website design with customer relationship management function 2) mobile program on Android OS. There will be at least 4 fulltime employees modifying and maintaining the operation of the website. The company also has a strategic outsourced partner for improving software functions. B. For internet application servers and database: the initial investment is CNY 60,000 for 2 AP servers and 1 database server with plans to add one server each year. These servers will be placed in IDC and connected with at least 15 M bandwidth for video stream. C. All the sales and professional staff s will be equipped with smartphones or notebook 36.

(41) computers that allow them to work remotely, since most of their work will be performed out of the office. All in all the company will invest up to 40% of total revenue on hardware, software, and operations in managing and improving the software functions and service offerings.. 4.6.. Staffing Plan. For the first two years, the company will be managed entirely by its three founders. Initially, Scott Tam will be the CEO and also in charge of the Sales & Marketing Department. Frank Chang will be the Vise President of the IT Product Center and be responsible for the website. 政 治 大. operation and enhancement. Sunny Lee will be the Vice President of the Logistics Department and be responsible for the office operation and customer services. After the. 立. business expands to comercial property, a Vice President will be hired to manage Sales &. io. Marketing. Sales Personal. Software developing. n. al. Counselor Team. Ch. Hardware maintenance. engchi. Logistics (Sunny Lee). y. IT Product Center (Frank Chang). sit. Nat. Sales & Marketing (Scott Tam). Admin & HR. er. CEO (Scott Tam). ‧. ‧ 國. 學. Marketing Department. The Organization chart is as follows:. v & iFinance n U Accunting. Customer Service (CSR). Figure 23: Organization Structure of Beijing Mobile Realty Inc., Beijing Mobile Realty Inc., put its major resource in providing exclusive services to its members and partners by hiring certified advisors, such as real estate lawyers, financial planners and real estate brokers, and many customer service representatives. The detail five years staff plan is below:. 37.

(42) 25% Social benefit 0.43 8% rate:. Annual headcount Growth Rate: Annual salary growth rate:. 1. Year. Headcount Plan. 2. 3. Office Type Position \ Month 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 A Clerical worker. Staff at. Staff at. 2. 3. 4. 5. 6. 7. 8. 9. 10 11 12 Year 4 End Year 5 End. 1 1 1 2 2 2 3 3 3 3 3 3 2 3 3 3 3 3 3 3 3 3 3 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 4. 5. A Vice President. 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 3 3 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. 3. A President/CEO. 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1. 1. 1. 1. 1. 1. 1. 1. 1. 1. 1. 1. 1. 1. 1. 5. 5. 5. 5. 5. 5. 6. 6. 6. 7. 7. 7. 9. 12. 4. 4. 4. 4. 4. 4. 4. 4. 4. 4. 4. 4. 5. 7. 5. 5. 5. 5. 5. 5. 6. 6. 6. 6. 6. 6. 8. 10. Beijing T CSR Staff 1 1 1 2 2 2 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 5 5 5 Main T Senior CSR/Tech. Eng. 2 2 2 2 2 2 3 3 3 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 Office T Professional Advisers 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 S Sales personal. 3 3 3 4 4 4 4 4 4 5 5 5 6 6 6 6 6 6 7 7 7 7 7 7. 8. 8. 8. 8. 8. 8. 10 10 10 11 11 11. 14. 18. S Sales Manager. 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 1 1 1 1 1. 1. 1. 1. 1. 1. 1. 1. 1. 2. 2. 14 14 14 17 17 17 20 20 20 22 22 22 22 23 23 24 24 24 27 27 27 29 29 29 30 30 30 30 30 30 34 34 34 36 36 36. 46. 58. 4 4 4 5 5 5 6 6 6 6 6 6 5 6 6 6 6 6 6 6 6 7 7 7. 7. 8. 9. 7 7 7 8 8 8 10 10 10 11 11 11 11 11 11 12 12 12 13 13 13 14 14 14 14 14 14 14 14 14 16 16 16 17 17 17. 22. 29. 3 3 3 4 4 4 4 4 4 5 5 5 6 6 6 6 6 6 8 8 8 8 8 8. 16. 20. Headcount Total A Administrative. 政 治 大. 7. 7. 7. 7. 7. 7. 7. 1 7. 1 7. 1 7. 立 Figure 24: Five Years Staff Plan of Beijing Mobile Realty Inc. 9. 9. 9. 9. 9. 9. 11 11 11 12 12 12. 學. ‧ 國. Head count T Tech & Supprot Subtotal S Sales & Marketing. 7. 1. Because of its innovative business model and the large-scale population and ground coverage of Beijing, great numbers of sales people are required to promoting their concepts.. ‧. In order to provide professional services and advice, Beijing Mobile Realty Inc. will pay a premium salary to hire high-quality, skilled employees to serve its customers and partners.. y. Nat. Office. Sales. Rank O1 O2 O3 O4 O5 O6 S1 S2 S3 S4 S5. al. Title. Annual headcount Growth Rate:. Base. n. Type. 8%. er. io. Annual salary growth rate:. Ch. General Skill workers Professional Manager Vice President President Sales Senior Sales Asst. Sale Manager Sale Manager Sale Vice President. sit. Below is the salary plan for different job functions:. v ni. stock option. Max Salary. 2,800 5,000 7,000 8,000 10,000 contract base 11,000 contract base 1,500 2,000 2,500 3,000 3,500 contract base. engchi U. Figure 25: Salary Plan of Beijing Mobile Realty Inc.. 38. 15% 4,500 8,000 10,000 11,000 12,000 16,000 5,500 8,000 10,000 10,000 12,000. Mean Salary 3,500 6,500 8,000 8,500 11,000 13,000 5,000 6,000 7,000 8,500 10,000.

數據

相關文件

in building construction, soaring housing prices led to a substantial increase in property transfer fees and real estate developers’ margin, causing construction investment by

In the first quarter of 2009, the average transaction price of industrial units was MOP6,421 per square metre, up by 21.5% over the preceding quarter. The average price of office

With regard to the transaction of residential units under Intermediate Transfer of Title, the average price amounted to MOP44,935 per square metre in the fourth quarter of 2009, up

The majority (4,075 units valued at MOP9.2 billion) of these transactions were residential units that accounted for 55.5% of the total number of building units; besides, there were

Among these units, 37.4% (749 units valued at MOP1.53 billion) were new units e that were within the property tax exemption period. b In the analysis, the term “Real Estate”

1.學校網站 2.校系介紹 3.課程地圖

In the fourth quarter of 2003, 4 709 acts of deed were notarized on sales and purchases of real estate and mortgage credits, representing a variation of +19.6% in comparison with

A total of 13 847 contracts of sale and purchase of real estate were made in the first nine months of 2002, and their value amounted to 7.70 billion Patacas, representing variations