10. From “Nuts & Bolts” to “Bits & Bytes”- The Evolution of Taiwan ICT in a Global Knowledge-based Economy

Ting-Lin LEE

________________________________________________________________________________

1. INTRODUCTION

1.1 Motivation and Objectives

As we have entered the information age and developed a digital economy, with the rapid

development of satellite communications, the universal penetration of the internet, and the

emergence of intelligent industries, ‘speed’ and ‘innovation’ have become the main factors spurring

industrial development. Taiwan, with its universal education, highly educated citizenry, high-quality

workforce, and facility in cultivating technical personnel, is very well positioned for the

development of knowledge-intensive high-technology industries. This is where Taiwan’s

comparative advantage lies.

Industry output by value of the ICT hardware sector and IT software sector respectively was

US$684.1 and 49.4 hundred million in 2004. The proportion of ICT expenditure to GDP was then

1.7 per cent. And according to a survey conducted by FIND, the number of internet subscribers

(internet access accounts) in Taiwan reached 9.98 million as of December 2004. In 2004, 61 per

cent of households in Taiwan were connected to the internet, and 81 per cent of Taiwan enterprises

had internet access. The bandwidth used for international internet connection in Taiwan exceeded

70 Gbps; there were over 5 million mobile internet subscribers in Taiwan; and the Taiwan

Taiwan’s ICT policy developments have had fruitful outcomes. In June 2002, the Taiwan

government proposed the "Two-Trillion and Twin-Star" programme to establish digital content as

one of the industries with an annual production value of over NT$1 trillion. Facing the changes of

the digital world, the Taiwan government has actively worked to promote digitization through a

number of initiatives in recent years to improve the nation’s IT proficiency and the competitiveness

of domestic IT industries. In May 2002, NICI (National Information & Communications Initiative

Committee) and other government agencies worked together to launch the “e-Taiwan Program” as a

part of the Challenge 2008 Program. With the need for a sound e-business framework and

application standards, DoIT of MoEA commissioned ACI of III1 to undertake long-term research

and promotion work with regard to the “E-Business Standard Research Plan”. Besides, in order to

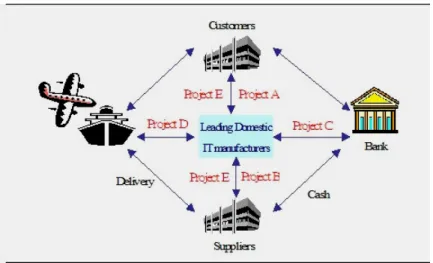

continually strengthen the enterprises’ digital capacities, projects A/B/C/D/E aim to create an

e-business supply chain system, lay the foundations for a new business model where “orders are

received in Taiwan, production can take place anywhere in the world”. In addition, the Taiwan

government proposed the “M-Taiwan Program” to promote a ubiquitous network and e-services in

Taiwan with a budget of NT$37 billion over five years. Fuller explanations of initiative policies for

ICTs will be presented in the following section.

Meanwhile, in contrast to other countries, the most special aspect of Taiwan lies in its deep

historical origins and geo-relations with Mainland China, which causes both sides to have an

at the present stage. All these complex factors help shape the intricate appearance of the

development process in the formidable Taiwan ICT industry. Later I shall try to give a more precise

account of the patterns of Taiwanese ICT investment in Mainland China.

1.2 Methodology and Analytical Framework for the Taiwan Study

This case study describes the development and transition of the whole knowledge-based economic

society in Taiwan, based on an analysis of the structure of the National Innovation System (NIS)

from the viewpoint of coevolution. In this study we shall focus on a particular industry (especially

ICTs), in a particular country, Taiwan, and thus a hybrid of national and sectoral systems. For

Taiwan case, the sectoral industry (ICTs) is embedded in the “national” innovation system, and is

nurtured and restricted by it. Moreover, the base and development of ICTs industry in Taiwan

originated from the IT industry’s prosperity (like as computer hardware industry). Regarding the

definition of ICT industry under this study mainly includes two parts: Information and electronic

(computer, motherboard, etc.), telecommunication (telephone, modem, and internet, etc.) and their

peripheral equipment and software. This term is sometimes extended to cover the notion of the

OECD’s definition. From the historically viewpoint, the rising and development of

telecommunication industry is based on the infrastructure, technology capabilities and its

knowledge accumulated by IT industry. It is hard to separate from historical aspect. In general

speaking, we can use IT to explain the concept of ICT partially. Although they are not the same in

nature, they have common components.

changes in the Taiwan NIS. Specific attention is devoted to the range of indicators, and to assessing

the related actors, agencies, organizational and institutional changes, as well as the conditions for

knowledge-based techno-economic growth observed in the period 1990-2005 (approx.). Section 4

devoted to the major industrial policies and governance in Taiwan. This part of the study explores

the related Taiwanese ICT programmes and other related initiatives: campaigns at the national level

to increase the level of ICT usage, FDI policies, financial and non-financial incentives to attract

higher participation among local and foreign companies to invest in the ICT industry. Section 5

addressed the role played by ICT. This section covers ICT sector’s evolution, availability of ICTs

that allow access to knowledge and communication, in particular the Internet (fixed, mobile,

wireless, etc.), access to and usage of ICTs (phone lines, number of personal computers, internet

users, internet hosts, etc.). Section 6 aims to describe possible strategies that Taiwan’s ICT industry

may choose in the face of the tendency to internationalization and globalization, and explain how

the development of Taiwan’s ICT industry should be adjusted. The paper finishes with the offshore

development of Taiwan’s ICT/IT in Mainland China in Section 7. This section aims to assess how

Taiwan IT manufacturers launched investment patterns, the forms of division of labour, and the

2. GROWTH DRIVERS SINCE 1990

2.1 Industrial structure change

To understand the development of the national industrial system, it will be most insightful to break

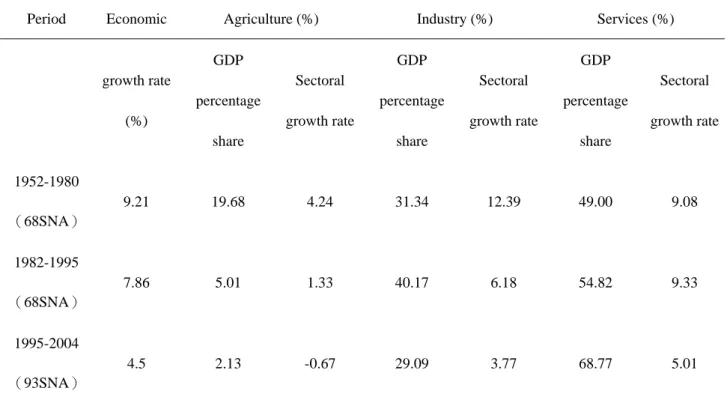

down Taiwan’s economic development into three stages as in Table 10.1 (Yu, 1999: 6-22).

Table 10.1: Economic Growth and Structural Change in Taiwan

Period Economic Agriculture (%) Industry (%) Services (%)

growth rate (%) GDP percentage share Sectoral growth rate GDP percentage share Sectoral growth rate GDP percentage share Sectoral growth rate 1952-1980 (68SNA) 9.21 19.68 4.24 31.34 12.39 49.00 9.08 1982-1995 (68SNA) 7.86 5.01 1.33 40.17 6.18 54.82 9.33 1995-2004 (93SNA) 4.5 2.13 -0.67 29.09 3.77 68.77 5.01

Source: ROC National Income (in Chinese). Taipei: Directorate General of Budget, Accounting and Statistics, Executive Yuan, R.O.C.

For many years the government has encouraged industry to engage in technology development. For

instance, every year the Ministry of Economic Affairs (MOEA) provides funding to non-profit

research institutions for the development and transfer to the private sector of “critical, common, and

forward-looking” technologies, and allows public and private enterprises to participate in

technological research projects. In order to encourage and support industrial R&D, the NSC has

within the Hsinchu Science-based Industrial Park, and also regularly provides market information

and technical assistance in order to reduce market risk and stimulate industry’s willingness to

engage in R&D work.

2.2 Trends in productivity

As to the cause of inferior performance of Taiwan’s labor productivity is associated with the

industrial structure and business operation mode. Taiwan’s industrial structure is largely

concentrated on so-called ICT domain in the “high-tech industry”, although in the past due to the

fast growth of ICT industry, Taiwan’s overall economic growth was supported. However, recent

years IT hardware industry is facing the threat of the late coming countries, the quick drop of

product prices and the constrain of large international companies, thus, the overall ICT industrial

added value and gross profit are gradually reduced. Additionally, the low growth of service sectors

and the low growth rate of labor productivity in recent years, which is even lower than the growth

rate of the manufacturing labor productivity (see Figure 10.1), have caused the insufficient growth

Figure 10.1: Average growth rate by sector in Taiwan, 1971-2004

2.3 Trends of Venture Capital and FDI

At the initial stages as Taiwan started to develop in the high-tech field, there was no venture capital

business. Thus, the government established the Development Fund of Executive Yuan in 1973 to

invest in venture capital and coordinated Chiang Tung Bank to provide refinance for venture capital.

However, the preliminarily introduced venture capital created only a few successful cases that led

the industrial development. The first venture capital company was established in 1984 after

reinvestment by Acer. The number of venture capital companies increased slightly to the early

1990s (Wu et al., 2002). The number of venture capital firms in Taiwan then grew to 259 in 2004.

Their accumulated capital increased from NT$200 million in 1984 to NT$ 184.5 billion in 2004,

growing over 922 times within two decades.

The investment in Electronic & Electrical Appliances by overseas Chinese and foreign companies

in Taiwan has had a tendency to rise gradually in recent decades. The year 2000 was a watershed, 7.2 5.8 5.71 9.20 9.60 4.83 5.50 9.36 9.2 3.31 3.30 7.00 8.25 4.40 4.90 11.30 3.61 3.70 4.77 12.10 0 2 4 6 8 10 12 14 1971-1987 1988-1994 1995-1999 2000-2004 2004 real growth rate % GDP Growth Rate Service Industry Manufacturing

reflecting the first rotation of political party in Taiwan, and when FDI attained high levels. However,

the political and economic situation after the political change (such as political infighting among

parties, the economic emergence of Mainland China and India, etc.) was not as good as anticipated;

and the cases and amounts of overseas Chinese and FDI have reduced year by year after 2001. In

2004 the total of approved cases dropped to the minimum since 2000 but increased considerably in

amounts. This phenomenon was mainly because the government opened up an increasing range of

sectors to foreign participation. This was particularly so in ICT, where there were changes to foreign

investment regulations, particularly in foreign ownership levels in the telecommunications sector.

3. THE TRANSFORMATIONS OF TAIWAN’S INNOVATION SYSTEM

The government played a central role in the transformation of economy and society. It has

implemented strong and coherent planning mechanisms for the economy, science and government,

and for close collaboration with the private sector, and has made a heavy investment in education,

research and infrastructure. The Ministry of Economic Affairs (MoEA) is chiefly responsible for

industrial technology applications research, and it transfers the results of research to the corporate

sector for product development and commercialization via technical assistance, information sharing,

and manpower training. To accomplish these goals, the MoEA relies on its own subordinate

research organizations, the research departments of state-owned enterprises, and research

organizations hired on a case-by-case basis. Industrial technology development work is conducted

strengthen interaction between industry, government, universities, and research institutions as a

means of promoting technological upgrading throughout the industrial sector. Besides, unique

institutional arrangements have been made, such as the quasi-governmental Institute for Information

Industry (III), which serves as a think-tank and research centre for both government and business.

Furthermore, government-constructed science parks support innovating and the incubation of new

ideas, build synergies among growing businesses, and make efficient use of the best available

human resources, facilitating growth and wealth generation, see Figure 10.2.

Figure 10.2: The interactions model among actors for promoting industrial technology upgrading

3.1 Trends in R&D Input

According to the annual Survey of National Science and Technology Activity, total public and

private R&D expenditures amounted to NT$197.6 billion, or 1.94 per cent of GNP in 2000, and

NT$ 260.9 billion, or 2.34 per cent of GNP in 2004. Furthermore, the nation’s total R&D spending

R&D expenditure as a percentage of GNP showed a gradual increase during the years from 1996 to

2004, although the growth rate of R&D expenditures declined sharply in 2000. However, the annual

average growth rates of these expenditures are only 6.5 per cent in the five most recent years.

Of overall national R&D spending of NT$260.85 billion in 2004, government agencies contributed

NT$88.47 billion (33.9 per cent), business enterprise NT$168.1 billion (64.4 per cent), higher

education NT$3.1 billion (1.2 per cent), private non-profit organizations NT$1.1 billion (0.4 per

cent), and foreign institutions just NT$60 million (0.0 per cent). As described, 64.4 per cent of R&D

funds came from enterprise in 2004. The proportion of enterprise R&D funds has tended to fall,

which differs from the increasing tendency in advanced countries, and Taiwan even lacks overseas

R&D investment (certain countries get 10 per cent from overseas R&D capital). Similarly,

according to the performing of R&D, the proportion by enterprises also has a tendency to fall year

by year.

3.2 Education System and Human Capital

Taiwan had a total of 162 higher education establishments in 2005 School Year (from

2005/8-2006/7), 89 of which were universities. The student population of higher education for the

same year was 938,648 students, 449,695 of whom belonged to the science and technology field,

including 2,165 doctoral students and 42,334 masters students (Ministry of Education website:

www.edu.tw, 2006). Compared with other nations, Taiwan has a higher registration ratio, with

education and training in accord with national competitiveness requirements (Tzeng and Lee, 2001).

development of the information industry.

An overview of the Taiwan educational system reveals that, in 2004, the government allotted 39.0

per cent of its budget to the higher education. Public education enrolment rates reached 99.2 per

cent in the 2004 School Year, an achievement that compares favourably with other nations.

Concerning the S&T indicators, Taiwan is rich in human resources. The number of researchers both

per ten thousand of population and per ten thousand of the labour force has constantly increased

over the preceding four years up to 2004 (Table 10.2).

Table 10.2: Numbers of Taiwanese researchers 1996-2004

Item / Year 1996 1997 1998 1999 2000 2001 2002 2003 2004

Numbers of researchers (persons) 53754 56419 62586 67165 69525 73239 80999 85166 91490

Researchers/ R&D personnel (%) NA NA NA 49.8% 50.5% 52.9% 53.9% 54.2% 54.3%

Researchers per 1000 population 2.5 2.6 2.9 3.0 3.1 3.3 3.6 3.8 4.0

Researchers per 1000 labour force 5.8 6.0 6.6 7.0 7.1 7.4 8.1 8.5 8.9

Data Source: Indicators of Science and Technology (Table 1-19 & 1-22), Republic of China, 2005

R&D personnel includes researchers, technicians, and supporting personnel. A total of 168,524

people were engaged in R&D work in 2004, and maintained an increasing trend over the preceding

years. The total for 2004 included 91,490 researchers (54.3 per cent), 59,583 technicians (35.4 per

cent), and 17,451 supporting personnel (10.4 per cent). In terms of the distribution of researchers,

sector, and 22,781 (87.7 per cent) in Higher education.

Among these researchers, 23,306 (25.47 per cent) held PhD degrees, and 38,912 (42.53 per cent)

Masters degrees. Similarly, the percentage of researchers with Masters and PhD degrees has also

increased. The proportion of researchers among all R&D manpower has hovered around 56.3 per

cent over the past 10 years.

3.3 Patents and Publications

In Taiwan, basic research is chiefly conducted at the Academia Sinica, the national laboratories,

various research centres, and university departments and graduate schools. The number of academic

papers published is a direct indicator of basic research. The number of Taiwan’s papers cited in the

SCI database has increased every year. In 2004, there were 14,989 articles cited by Taiwan’s authors

in the SCI database, ranking at 19 in the world. Outside of universities and colleges, most of

Taiwan’s engineering and applied research is conducted at the Industrial Technology Research

Institute (ITRI) and other public or non-profit research institutes (such as III for ICT). Over the past

decade, an excellent research record has been achieved in such areas as electronics, information,

communications, materials science, biology, agriculture, and food technology. There are 10,983

papers by Taiwan’s authors in the EI database in 2004, ranking 11 in the world.

Another tangible result of research on science and technology has been the number of patents

granted. Of the patents approved in 2004, 68 per cent were by Chinese nationals and 32 per cent by

(Table 10.3).

Table 10.3: Domestic patents applied for and granted, 2001-2004

Item

Patents applied for Patents granted

Total Compatriot Foreigner Total Compatriot Foreigner

2001 67,860 40,210 27,650 53,789 32,310 21,479

2002 61,402 35,926 25,476 45,042 24,846 20,196

2003 65,742 39,663 26,079 53,034 30,955 22,079

2004 72,082 43,020 29,062 49,610 33,517 16,093

Source: Indicators of Science and Technology (Table 7-2), Republic of China, 2005

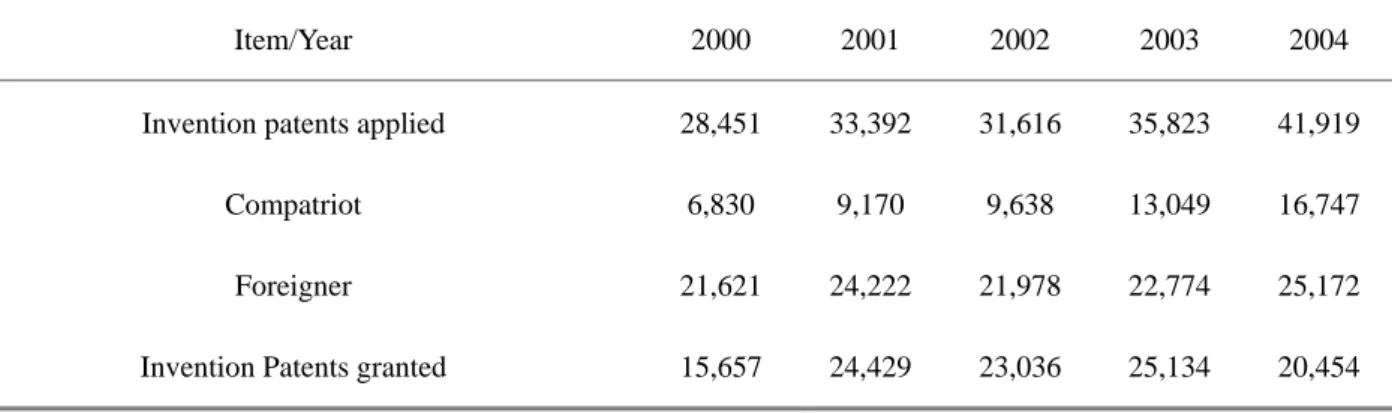

As for innovation patents, in 2004, there were 41,919 invention patent applications, of which

20,454 were approved. The number of patents granted in the US to assignees in Taiwan has

increased rapidly, as have patents granted in Taiwan, although a large share of the patents in Taiwan

is granted to foreigners. Table 10.4 shows indicators of research output of the period 2000-2004

(NSC, 2005:33-34). Table 10.5 shows indicators of research output of the period 2000-2004 (NSC,

2005:33-34).

Table 10.4: Patents 2000-2004

Item/Year 2000 2001 2002 2003 2004

Invention patents applied 28,451 33,392 31,616 35,823 41,919

Compatriot 6,830 9,170 9,638 13,049 16,747

Foreigner 21,621 24,222 21,978 22,774 25,172

Compatriot 3,834 6,477 5,683 6,399 7,521

Foreigner 11,823 17,952 17,353 18,735 12,933

Patents granted in U.S.P.O. 4,667 5,371 5,431 5,298 5,938

Source: 1. Indicators of Science and Technology (Table 7-3, 12), Republic of China, 2005; 2. Taiwan Intellectual Property Office, TIPO website (2006)

Table 10.5: Research Outputs Indicators, 2000-2004

Year Funding (NT$m) GDP deflator Cost (NT$m) Papers Patents Technical Reports Copyrights Technological Innovations Technology Acquisitions Technology transfers Technical services 2000 89,317 101 88,119 51,009 (579) 2,808 (32) 6,974 (79) 321 (4) 409 (5) 70 (1) 1,255 (14) 30,295 (344) 2001 58,330 100 58,330 42,587 (730) 1,327 (23) 6,974 (120) 57 (1) 271 (5) 60 (1) 1,091 (19) 32,990 (566) 2002 61,579 100 61,548 46,770 (760) 1,194 (19) 8,158 (133) 64 (1) 693 (11) 342 (6) 1,173 (19) 53,333 (867) 2003 66,738 103 65,091 46,586 (716) 1,024 (16) 9,150 (141) 3,828 (59) 474 (7) 142 (2) 1,962 (30) 61,770 (949) 2004 73,213 110 66,715 78,763 (1210) 1,774 (27) 8,740 (131) 2,632 (39) 1,958 (29) 32 (0.48) 1,534 (23) 23,615 (354)

Source: Central Government Scientific Technological R&D Performance, NSC, 2004:34

Note: Figures in brackets are results indicators expressing the relative quantity of results obtained for each NT$1 billion of input. Since there is a one-year time lag between resource input and result output for the items of “papers”, “patents”, and “technology transfers”, the results indicators for these items are consequently expressed as results (papers/items)/ cost during previous year; the remaining items are calculated on the basis of cost during the current year.

3.4 The role of research institutes

Since its inception in 1973, the ITRI has played a major role in upgrading Taiwan’s industrial

other high-tech industries, and helped traditional industries raise productivity. ITRI fosters young

companies and new technologies until they are able to survive on their own. Equally, since 1979, the

Institute for Information Industry (III) has been a key technology contributor to Taiwan’s ICT

industry. Its founding and continuing mission has been to increase Taiwan’s global competitiveness

through the development of its IT infrastructure and industry. In order to support leading-edge

research and speed up the pace of innovative breakthroughs, Taiwan has established a series of

open-type national laboratories. The Taiwanese government has always promoted cooperation

between industries and universities in recent years; however several problems remain in the

cooperation between industries and universities (this theme will be discussed in the following

section), so the interaction between industries and universities is largely confined to the supply of

talent. The share of enterprise investment in higher education R&D is much behind other countries.

3.5 The role of universities

The Taiwanese government has always promoted cooperation between industries and universities in

recent years; for example, the “TDP for Academia” which the Industrial Development Bureau in

MoEA brought out is a best policy action scheme. However, there are still several problems in the

cooperation between industries and universities at the present stage:

• The cognitive lag is great between industries and universities.

• Channels of communication between industries and universities are lacking.

• The research results are hard to commercialize.

system of professorial promotion is inflexible.

• Incentive mechanisms are insufficient to encourage scholars in academic circles to engage in

industry-university cooperation.

• No matter what the organizational scale or funds, the research in universities is insufficient.

Therefore, the interaction between industries and universities is largely confined to the supply of

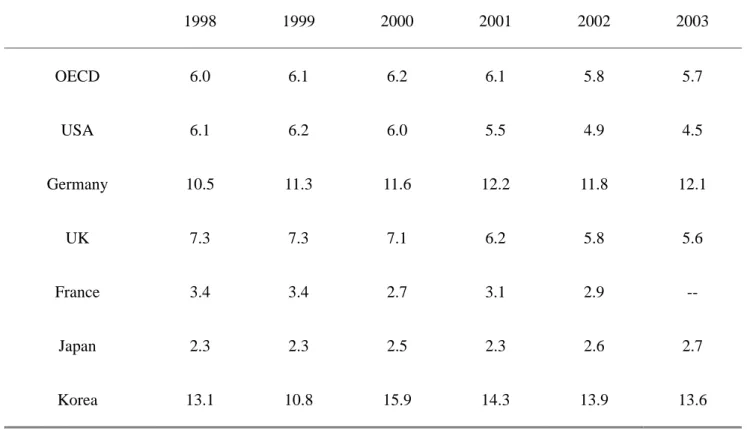

talent. The proportion of enterprise investment in higher education R&D (HERD) falls greatly

behind other countries, which shows that the linkage is still not enough between industry and

university; this phenomenon will result in the insufficiency of innovation sources in industry,

capacity is hard to promote, and the R&D results from universities are unable to be commercialized

(refer Table 10.6).

Table 10.6: Proportion of R&D funds in Higher Education coming from Enterprises, %

1998 1999 2000 2001 2002 2003 OECD 6.0 6.1 6.2 6.1 5.8 5.7 USA 6.1 6.2 6.0 5.5 4.9 4.5 Germany 10.5 11.3 11.6 12.2 11.8 12.1 UK 7.3 7.3 7.1 6.2 5.8 5.6 France 3.4 3.4 2.7 3.1 2.9 -- Japan 2.3 2.3 2.5 2.3 2.6 2.7 Korea 13.1 10.8 15.9 14.3 13.9 13.6

Singapore 4.1 5.3 6.0 4.3 2.5 4.0

Taiwan 3.0 4.8 4.1 3.2 3.3 4.2

Source: 1.OECD, Main Science and Technology Indicators, 2005

2.National Science Council, Indicators of Science and Technology R.O.C., 2004 Note: The Sector classification is in accordance with Frascati Manual, OECD

4. MAJOR POLICIES AND GOVERNANCE

4.1 Existing industrial policies

A dynamic, entrepreneurial and flexible private sector, made up largely of SMEs, has flourished in

this surrounding of government encouragement, while both good governance and sound

macroeconomic management by the government have earned the confidence of business. Next we

will describe the related initiative, policies and its contents.

4.1.1 Tax credits for R&D and personnel training

The MoEA is chiefly responsible for industrial technology research and its application. Apart from

the MoEA’s directly subordinate research units, the R&D department of state-owned enterprises and

independent research institutes undertaking commissioned projects are also engaged in industrial

R&D and technology transfer. Research institutes are employing technology acquisition, joint

research, foreign direct investments and strategic alliances to interact with foreign companies, and

research institutes as mechanisms to accelerate the industry’s technological development. In

addition, the government relies on administrative measures like subsidies, matching grants and

investment tax incentives to encourage industry to engage in R&D activities.

In accordance with the Knowledge Economics Development Act, the DoIT of MoEA launched

Taiwan’s SBIR promoting program, mostly referring to the US version of the SBIR, in Nov. 1998,

in order to enhance the private sector’s R&D competitiveness through promoting technological

innovation and utilizing Information Technology on one side, and providing tax incentives and a

subsidy of up to half of the cost of development and matching funds to resolve market failures and

uncertainties of technology development on the other side.

The types of research encouraged by this programme include: 1) Developing a brand new idea,

concept or new technology; 2) Applying an existing technology to a new application; 3) Applying a

new technology or business model to an existing application; 4) Improving an existing technology

or product upon various aspects. By 2010, the SBIR promoting programme may assist in achieving

the nationwide goal of Taiwan’s R&D rising to 3 per cent of GDP; and private sector R&D

increases up to 60 per cent, including 70 per cent from knowledge-based industries.

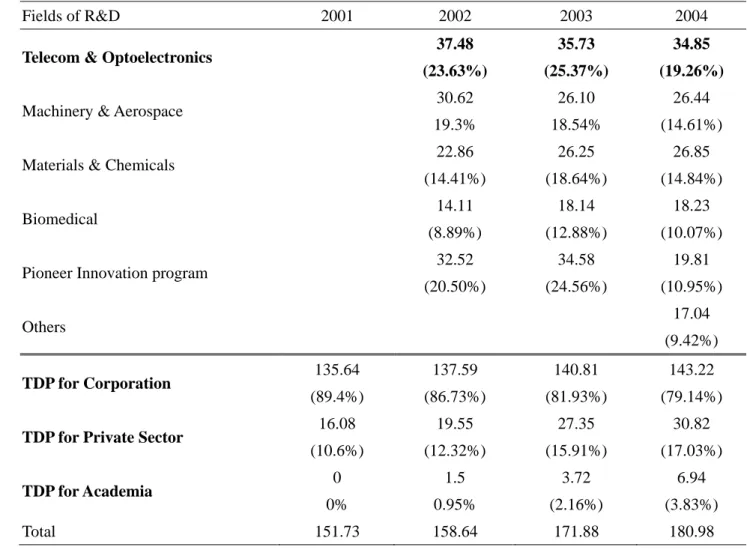

4.1.3 Technology Development Programs(TDP)

The DoIT is Taiwan’s science and technology development flagship. Its primary mission is to

promote industrial technology development to help create new national industries and help upgrade

Taiwan’s existing industries. Therefore, in cooperation with the Executive Yuan’s promotion of the

“scientific and technical development scheme”, the government began to implement “the given-case

program of MoEA scientific and technological research development” in 1979 (TDP for short). The

DoIT takes charge of examining and allocating the subvention funds as the main overall promotion

research institution (TDP-contracted Research Institutes for short) is authorized to assist in

industrial innovation, introduce each perspective, critical and compatible technology, and to bring

about the cooperation between manufacturing and studying in order to help industries upgrade and

change their type, strengthen their innovative R&D abilities, and increase their international

competitiveness. To sum up, TDP-contracted Research Institutes are to adjust domestic industries to

R&D innovation and prospective technology. On the contrary, the non-profit research institutes,

involving DoIT contracts with the private sector and academic organizations respectively, carry out

and develop basic and pioneer technologies that are then licensed to Taiwan’s industries.

Table 10.7: TDP expenditures 2001-04

Fields of R&D 2001 2002 2003 2004

Telecom & Optoelectronics 37.48

(23.63%)

35.73 (25.37%)

34.85 (19.26%)

Machinery & Aerospace 30.62

19.3%

26.10 18.54%

26.44 (14.61%)

Materials & Chemicals 22.86

(14.41%) 26.25 (18.64%) 26.85 (14.84%) Biomedical 14.11 (8.89%) 18.14 (12.88%) 18.23 (10.07%)

Pioneer Innovation program 32.52

(20.50%) 34.58 (24.56%) 19.81 (10.95%) Others 17.04 (9.42%) TDP for Corporation 135.64 (89.4%) 137.59 (86.73%) 140.81 (81.93%) 143.22 (79.14%)

TDP for Private Sector 16.08

(10.6%) 19.55 (12.32%) 27.35 (15.91%) 30.82 (17.03%) TDP for Academia 0 0% 1.5 0.95% 3.72 (2.16%) 6.94 (3.83%) Total 151.73 158.64 171.88 180.98 Unit: NT$ million

Source: DoIT/MOEA (2005)

4.2 Major new policies

The Executive Yuan’s current main tasks of policy implementation are to speed up the execution of

major national development projects and to advance toward the goals set out in the Challenge 2008

Six-Year National Development Plan.

4.2.1 Deregulation of telecommunications

Taiwan, in officially becoming a WTO member on January 1, 2002, aims to implement the

accession commitments and continue forwarding telecommunications liberalization policies. The

liberalization of telecommunications in Taiwan is an outgrowth of two policies, those regarding the

Asia-Pacific Regional Operations Center and the National Information Infrastructure, and is

opening up the island’s telecommunications market through a staged progression. In the first step

toward liberalization, the ownership of terminal equipment by subscribers was opened up in 1987.

Later in 1989, the step taken was the opening of the market to value-added services so as to provide

consumers with a diversity of such telecommunications services. The passage of three

telecoms-related laws in 1996 led to the formal separation of the Directorate General of

Telecommunications (DGT), which is in charge of telecommunications industry regulation, and the

Chunghwa Telecom Co., which is responsible for operating the telecoms business. This separation

more firmly established the policy directions for liberalization, and later further liberalization steps

After 1999, liberalization has continued in various fields of services, such as integrated fixed

network telecommunications, international submarine cable leased-circuit, local and long-distance

leased-circuit cable, resale business, and third-generation mobile telecommunications (3G). The

short-term objective of telecom liberalization is thus completed. After releasing 3G mobile

telecommunication business to the public in 2002, the government released all telecommunication

business and Taiwan’s telecom market has move into full liberalization.

There is one thing worth a mention in passing. In view of the global development of digital

convergence and the integration of the authorities regulating the telecommunications and

broadcasting sectors, the government held its 8th Strategy Research Board(SRB) meeting in 1998

and proposed the establishment of one regulatory body to oversee telecommunications, information

and broadcasting sectors within an integrated framework. The enactment of the Fundamental

Communications Basic Act on January 7, 2004 and the National Communications Commission

Organization Act on November 9, 2005, enabled the establishment of the National Communications

Commission (NCC) on February 22, 2006, thereby creating a governmental body for the regulation

of the telecommunications, information and broadcasting sectors.

In general, telecommunications liberalization policy in Taiwan has introduced competition

mechanisms successfully, revitalizing the telecommunications industry structure and leading to the

effective growth of telecommunications business. However the ratio of telecommunications

revenues to GDP, though gradually increasing, is still below the world average of 3.4 per cent,

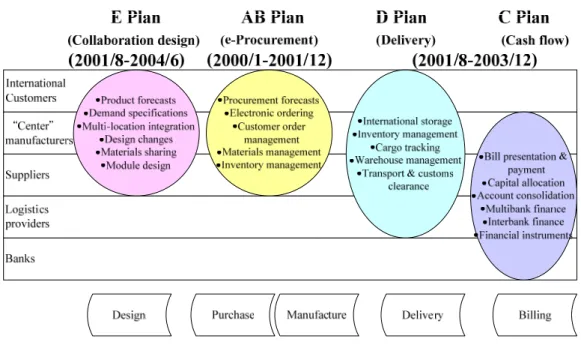

4.2.2 ABCDE program (FIND, 2004)

Recognizing the importance of information technology towards the upgrading of Taiwan’s

industrial competitiveness, in June 1999 the Executive Yuan expanded its existing industrial

automation project into a new "Industrial Automation and Electronic Business: iAeB Program".

While continuing to promote automation in production, warehousing, transportation and sales, the

MoEA was instructed to give priority to the establishment of B2B (Business to Business)

e-commerce systems, in order to build model e-business systems for both the supply chain and the

demand chain. In 1999 the DoIT formulated and began implementation of two pilot projects for

promoting e-business in the IT sector – Projects A and B. After implementation of Projects A and B

had been completed, in 2001 the MoEA began implementation of Projects C, D and E as a

continuation of Projects A and B. The aim of these new projects was to ensure the provision of

e-business services covering payment, accounts receivable management, on-line financing, global

inventory management, delivery tracking and collaborative design services in order to maintain the

competitive advantage of Taiwanese industry and meet industry’s evolving needs. The existing

e-business supply chain system would be used as the foundation for further integration of cashflow,

delivery systems and engineering collaboration, with the aim of strengthening the global logistics

management capability of Taiwanese industry and its competitiveness in international markets

(Figure 10.3). I would like to lay special emphasis on the project E which helps manufacturers to

transform themselves from OEM to ODM and to CDM (Contract Design Manufacturer), and on

companies’ R&D capabilities at the product development stage, developing collaborative design

business models that can meet the needs of the leading international IT vendors, to help to reduce

lead time and time to market, and to facilitate the smooth exchange and sharing of product

information and the rapid solution of the problems. It is clear that actors and relationships involved

in the ABCDE programs include buyer-supplier, complementary companies (such as financial

banks, logistic firms, etc.); knowledge flow among them is raised up to the period of “ideas design”

except the cash flow (refer to Figure 10.4).

Source: IT Applications Promotion Project, III / sponsored by DOIT, MOEA

Figure 10.4: Project Architecture for Taiwan’s ABCDE Projects

4.2.3 “Two Trillion Twin stars” programme

Aiming to build Taiwan as a “green silicon island”, the Taiwan government brought out a six-year

national development plan in mid 2002. To fulfil that goal, in 2002, the MoEA ran a four-year

“Two Trillion Twin stars” programme from 2002 to 2006. The programme will drive the

production value of Taiwan’s relatively mature semiconductor and flat-panel display (TFT-LCD in

particular) industries to NT$1 trillion (US$29.6 billion) for each – hence the term “Two Trillion”. It

also built the new digital content and biotechnology sectors into “star industries” – hence the name

“Twin star”. The ‘Two Trillion’ (semiconductor and flat-panel display) is already relatively mature,

According to Industrial Development Bureau, MoEA, the promotion of the “Two Trillion Twin

stars” programme begins from offering tax rewards, assisting in solving obstacles to investment

such as land, water, electricity, environmental protection, etc., integrating the government and

industrial resources, developing new products and new technology, establishing the complete

upstream and downstream industry system, as well as talent training; and in these ways improving

the competitiveness of the industry overall.

As for the industry development goals of “Two Trillion Twin stars”, the hope is that the

semiconductor industry can reach production values of NT$1.590 trillion, flat-panel display

industries NT$1.370 trillion, the digital content industry NT$0.370 trillion, and the biotechnology

industry NT$0.250 trillion in 2006

4.2.4 Policies for encouraging demand (E-Taiwan, M-Taiwan)

1. E-Taiwan: March on with a new vision

To embrace the global e-trend and confront all the challenges that cloud the future of Taiwan’s IT

industry – the impact of the global knowledge-based economy, outward-moving business and

decreasing total revenues, etc. – the Convenor of NICI of the Executive Yuan, working with many

chief officers from other government agencies, leading academies, research institutions, top

enterprises and civil organizations, has formulated the “e-Taiwan program” to counter all these

issues.

combined with nine other plans to form the so-called “Challenge 2008: the 6-Year National

Development Plan”. Not to overstate its importance, the “e-Taiwan Program” holds the key to the

complete success of “Challenge 2008”. There are five integral parts in this plan, i.e. “6 million

broadband users”, “e-Society”, “e-Industry”, “e-Government” and “e-Opportunity”. “6 million

broadband users” is expected to deliver the following results by 2007: (1) broadband network is

fully installed with implementation of IPv6 and wireless LAN environment, (2) small & medium

enterprises are mostly brought online, (3) safety standards, regulation, strategy and legislation are

properly installed and in full operation, (4) IC security enforcement is strictly observed and capable

of fostering the related industries, (5) CA cards have been successfully issued and commonly

accepted as a primary means of identification.

2. M-Taiwan (FIND, 2005)

The third IT revolution aims to forge the personal computers, internet and mobile communications

into a "Ubiquitous Network". By utilizing this network, the government, entrepreneurs and

end-users are able to get the information they need by any device, at any time and anywhere – more

efficiently, more conveniently, and giving better quality of life.

With the advantages of the world’s No.1 production value of WLAN products and mobile phone

penetration rates, the Taiwan government has actively promoted Mobile-competitiveness. The NICI

committee of Executive Yuan (Cabinet), Ministry of the Interior (MOI) and MoEA coordinated to

propose the “M-Taiwan Program” with a budget of NT$37 billion in five years. The “M-Taiwan

optical-fibre backbones, and execute the Integrated Beyond 3rd Generation (iB3G) Double Network

Integration Plan. It is also expected to shift Taiwan from an ‘e-nation’ to an ‘m-nation’, and to reach

the vision of “Mobile Taiwan, infinite application, and a brave new mobile world”.

4.3 Mode of Governance

4.3.1 Governance for Business – moving to ODM

Since the 1970s when foreign-owned firms started to invest in Taiwan, many Taiwanese

manufacturers became their original equipment manufacturer (OEM). Since the 1980s when

production of the first personal computers began, under the open system policy of IBM, some

Taiwanese manufacturers produced IBM-compatible computers with their own brands, such as

Multitech by Acer (renamed in 1987). Since then, the percentage of Taiwanese manufacturers

producing products with their own brands has increased only slightly.

As observed by Huang (1995), since 1989 when the US economy was in recession, the growth rate

of sales for Taiwanese computers with their own brand in the US market decreased almost to zero.

Especially in June 1992, when Compaq announced reduced prices of its all series products by up to

30-40 per cent, branded computer manufacturers in Taiwan were forced to give up their own brands.

However, at the same time, many European and American computer enterprises started to look for

the OEM that was able to control production costs efficiently. Thus, Taiwanese computer

manufacturers returned to the mainstream computer market by the way of the foundry. At the same

indicated that, before the 1990s, the competitiveness of Taiwanese manufacturers was already

recognized in terms of vertical specialization and internal management.

Since then, Taiwanese manufacturers have started to globalize and conduct direct investment in

Southeast Asia and China. By exporting intermediate goods, equipment, technology and

management knowledge to the Asia-Pacific area, Taiwanese enterprises started to export final goods

to the global market. On the other hand, Taiwanese enterprises also put their resources into product

design and became ODMs. In addition, since the middle 1990s, some big manufacturers with

famous computer brand names such as Dell and Compaq, started to utilize a strategy of

“built-to-order” which meant that, under their logistic information systems, customers could place

an order and receive products directly from various global locations (Wu et al., 2002).

In summary, the early days of manufacturing IT equipment in Taiwan on an OEM basis, the

percentage of Taiwanese manufacturers with their own brands has increased only slightly, contrary

to the notion of an evolution from OEM to OBM (own-brand manufacture). On the other hand,

Taiwanese enterprises put their resources into product design and became ODMs (own-design

manufacturers) and CDMs (collaborative-design manufacturers), while working to strengthen

collaborative design R&D management capability.

4.3.2 Governance for Government

In the early stage, the flow of knowledge or competence building came through the way

promoted the establishment of research institutions, not only introducing advanced technology and

knowledge but also researching and developing by themselves, and then transferring technology

from abroad, setting up spin-off companies, or floating talents; in these ways spreading knowledge

and technology to the whole of industry little by little. The industries begin to establish good

connections with Hsinchu Science Park and Silicon Valley at the same time.

In relevant governmental policies, the establishment of the Science Park and the ABCDE plan have

both been quite successful, with an important influence on the industries. However these

comparatively successful plans are mostly an extension of past achievements in manufacturing and

design. In addition, the liberalization of the telecommunication market has been quite successful,

especially for wireless communication; nevertheless, relevant results still need to be observed.

After the industries gradually set up their R&D competences, the great progress in industrial

technology means the whole innovative system has to be adjusted; for example, the research

institution must transform its roles, the function of universities must be improved and so forth.

Actually, the Taiwanese government has put more effort in this direction in recent years.

4.4 Knowledge flow and interactions with outside

The knowledge base and the learning processes have greatly affected organizational innovation

activities. In fact, the introduction and upgrading of these ICT products and technologies mainly

depend on the supply from other countries, not from domestic industrialists or research institutions.

In the early stages (1970s), Taiwan’s technologies used in production were mainly transferred from

quick development of the industry base at the very beginning. Research institutes are employing

technology acquisition, joint research, foreign direct investments and strategic alliances to interact

with foreign companies. Research institutes act as mechanisms to accelerate the industry’s

technological development. Thus, leverage and diffusion promotion were being exercised through

acquisition of equipment, through the movement and transfer of skilled staff. Then, technological

R&D capacity gradually accumulated through imitating, copying, or limitedly improving the

existing foreign products, and later, around 1990s, the IT industry gradually developed in-house

R&D capacity through self-directed effort, direct alliances, and joint ventures with foreign

companies. Meanwhile, domestic industrialists lean towards continuous innovation that raises

values, successively strengthening the efficiency of the production lines. Besides, some major

Taiwanese IT companies have tried to find ways to differentiate their products, with branding and

product design the two major strategies.

5. OVERVIEW OF THE ICT SECTOR

5.1 The ICT evolution from a Historical Perspective

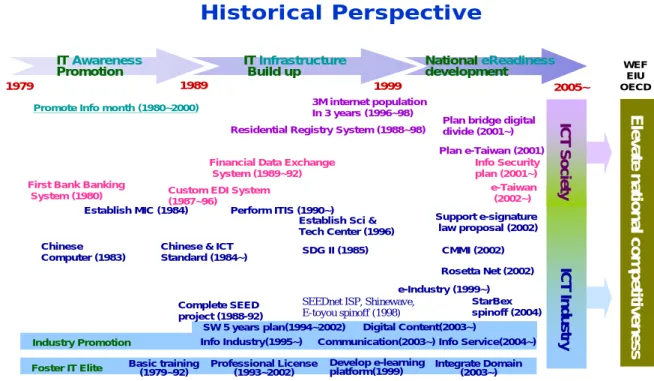

The development of the ICT industry/society can be divided into three stages generally (Figure 10.5:

Huang, 2005): The first stage (1979-1989) was the “IT Awareness Promotion”, which mainly

popularized the idea and application of information. Therefore, in IT talents training, III (Institute

for the Information Industry) cooperated with the National Youth Commission of Executive Yuan to

run various kinds of educational training, such as developing the professional information ability of

Chinese computer in 1983 in order to popularize the application of information technology. Besides,

III formulated the Chinese ICT Standards in order to popularize the utilization of a

Chinese-environment system for PCs. These measures were established as the most important

foundation of the Taiwan’s informatization. Besides, in 1988, supported by the MOEA, III started

the SEED Plan (Software Engineering Environment Development) for a duration of 4 years, whose

main purpose was to create a Seed Net based on the internet. This was the first to adopt a TCP/IP

internet communication agreement in the country before telecom liberalization; at the same time, it

was free for enterprises to apply for open connecting software for a Chinese work environment,

which promoted internet business applications in Taiwan (Ke, 2005). As for the social aspect of

ICTs, III set up the first banking information system and ran the “Information Month” activity; the

scale and content have increased year by year up to now.

The second stage (1989-1999) was that of “IT Infrastructure Building up”. III was mainly to

promote professional certificates and set up e-learning platforms in IT talent training. Taking the

budding of internet business applications in 1996 to be a start, the Executive Yuan established the

National Information Infrastructure (NII) and promoted projects of e-competitiveness. With respect

to ICT promotion, the Ministry of Transportation and Communications announced liberalization of

fixed network telecom industry in 1997, the Ministry of Finance liberalized online banking and

online inter-bank transfers began, and besides, Chunghwa Telecom launched a DSL service in 1999.

From 1996 to 1998, Taiwan reached the landmark of “Three Million Onlines in Three Years”, which

The third stage (1999-2005 ) is that of “National eReadiness Development”. IT talent training

included not only the e-learning platform as at the second stage but also the plan of cultivating ICT

talents in integrating relevant fields. In relation to ICT society, from 2001 to now, III assisted the

government to propose a blueprint of Digital Taiwan, which is expected to take e-experience from

urban areas to rural areas, from corporations to small businesses, from the hinterland to the world.

In addition, III set up the safe mechanism plan of information infrastructure in 2001, promoted the

“Law of e-Signature” in 2002, and planned the “e-Taiwan Program”, focused on accelerating the

establishment of a digital society and leading Taiwan to become one of the most advanced e-nations

in Asia.

Historical Perspective

WEF EIU OECD IT AwarenessPromotion IT InfrastructureBuild up National eReadinessdevelopment

1979 1989 1999 2005~

Industry Promotion Info Industry(1995~) Communication(2003~) Info Service(2004~)

Digital Content(2003~) SW 5 years plan(1994~2002)

Promote Info month (1980~2000)

Plan bridge digital divide (2001~) ICT S o ci et y IC T I ndust ry E le v at e nat ional c o m p et it iv eness

Residential Registry System (1988~98) 3M internet population In 3 years (1996~98)

Plan e-Taiwan (2001)

Establish MIC (1984)

Establish Sci & Tech Center (1996) Perform ITIS (1990~)

Support e-signature law proposal (2002)

Financial Data Exchange System (1989~92)

Complete SEED project (1988-92)

SEEDnet ISP, Shinewave, E-toyou spinoff (1998)

StarBex spinoff (2004)

First Bank Banking

System (1980) Custom EDI System (1987~96)

Info Security plan (2001~) e-Taiwan (2002~) Rosetta Net (2002) CMMI (2002) SDG II (1985)

Chinese & ICT Standard (1984~) Chinese

Computer (1983)

Foster IT Elite Basic training(1979~92) Professional License(1993~2002) Develop e-learningplatform(1999) Integrate Domain(2003~)

e-Industry (1999~)

Figure 10.5: Historical timeline of ICT development n Taiwan

In fact, during the past 20 years Taiwan has emerged as a leading producer of ICT products. The

World Economic Forum (WEF) published the Global Information Technology Report 2005-2006,

in which Taiwan ranked 7th in the Networked Readiness Index (NRI) out of 115 economies,

gaining 8 places up from previous year. In terms of all main sub-indices covered in each dimension,,

Taiwan as well ranked in the top five worldwide, placing 3rd for Market Environment, placing 3rd

for Individual Readiness, and 4th for Government Usage. Also noteworthy is the significant move

up to 10th place form 23rd in the Environment Component Index, a further evidence of the overall

positive environment for ICT development in Taiwan. In Usage Component Index (covering

Individual Usage, Business Usage, Government Usage), Taiwan again leapfrogged into 5th place in

the 2005-2006 Report, an improvement for the 11th place in 2004-2005. Indeed,

technology-intensive industries, mostly in ICT, now make up over half of Taiwan’s economy,

compared with less than a quarter in the late 1980s. Taiwanese manufacturers collectively produce

well over half the global supply of the devices that make up the core of the worldwide ICT industry

and infrastructure (Dutta & Lopez-Claros, 2005, 2006).

5.2.1 Technology Performance of ICTs Industry

Table 10.8 shows that the R&D investment of domestic industries mostly centres on the ICT

industry; the proportion of ICT R&D expenditures to whole-enterprise innovation expenditure

reached 70.3 per cent in 2004. However, the density of R&D investment in Taiwan’s high-tech

manufacturing and ICT industries is relatively lower than other countries. This phenomenon may be

operational scale of ICT-relevant industries is quite large, innovation investment is still relatively

low.

Table 10.8: R&D Expenditure and Personnel in the ICT Industry, 1999-2004

Year R&D Expenditure (Million NT$) Percentage of BERD

R&D Personnel R&D Researchers

Headcount FTE Headcount FTE

1999 72,128 59.0% 43,867 36,861 22,163 20,358 2000 78,483 62.4% 49,107 40,484 24,044 21,858 2001 85,893 65.9% 51,069 43,034 26,609 24,992 2002 94,914 68.0% 57,328 46,789 30,265 27,157 2003 104,555 69.5% 63,882 51,895 32,940 30,002 2004 118,032 70.3% 69,421 57,686 36,410 33,385

Source: Indicators of Science and Technology (Page: 38, Table 2-2-7), Republic of China, 2005

Note: The range of ICT is based on the definition of the OECD Frascati Manual, 2002; FTE= Full-Time Equivalents.

1) Information

The mobile computing age is predicted to have three major impacts: digital content will grow

explosively and diversely; integrated digital convergence will enter into mainstream services;

services will continue to go online and become more user-friendly. These three trends will

accelerate the development of user-friendly, smart, mobile and secure living environment

technology. The development of various types of information, communications and video products

will speed up the diffusion of the mobile computing age and user-centric applications and services.

Source: 2005 Yearbook of Science & Technology (NSC, 2005) Notes: Funiding is given as budget numbers. 1550.4 847.7 574.7 1101.3 683.7 250.4 318.8 251.2 190.5 723.8 4.4 2.3 2.1 4.4 2.1 0 200 400 600 800 1000 1200 1400 1600 1800 2000 2001 2002 2003 2004 0 1 2 3 4 5 Funding (NT$ Million) Manpower (Man-Year) Funding/Manpower

(NT$ Million)

Figure 10.6: Information R&D funding and manpower

2) Telecommunications

Society is expected to rely on broadband networks to sustain a thriving knowledge economy in the

coming age of deregulation, globalization, and digitization. Besides maintaining a competitive

telecommunications market and actively promoting the development of the broadband network

infrastructure so as to develop a sound ICT development environment, the Taiwan government also

aims to continue to pursue forward-looking telecommunications policies based on new ways of

thinking. It had promoted the reform of existing controls, and intended to accelerate the integrated

development of the telecom and broadcasting industries. In this way it is expected that Taiwan will

to R&D project funding and manpower is set out in Figure 10.7.

Source: Source: 2005 Yearbook of Science & Technology (NSC, 2005) Notes: Funiding is given as budget numbers.

5.4 47.7 55.4 57.9 75 20 29.7 79.8 69.1 46 0.3 1.6 0.7 1.1 1.2 0 20 40 60 80 100 2000 2001 2002 2003 2004 0 0.5 1 1.5 2 Funding (NT$ Million) Manpower (Man-Year) Funding/Manpower

(NT$ Million)

Figure 10.7: Telecommunications R&D funding and manpower

3) Electronics

With support from the government, the nation’s semiconductor industry has achieved impressive

results. Because the domestic electronics and information product industries have been able to

obtain steady supply of key parts and components, Taiwan has become one of the world’s leading

information product suppliers. However, in the face of stiff cost competition and increasing

emphasis on capital investment, the domestic semiconductor industry must boost its core

competitiveness in the future by focusing on emerging areas characterized by innovation and value

creation. As for the display industry – the other “Two Trillion and Twin Stars” industry – Taiwan is

and it has become a leading global high-tech product manufacturing and service centre. In order to

increase Taiwan’s technological autonomy further in this area, the government has implemented a

FPD promotion programme that should create a sound foundation for the development of the

display industry. Recent performance in relation to R&D project funding and manpower is set out in

Figure 10.8.

Source: 2005 Yearbook of Science & Technology (NSC, 2005) Notes: Funiding is given as budget numbers. 2341.4 1533.3 1144.3 1008.1 2183 347.6 248.8 244.5 204.4 327.8 6.7 6.2 4.7 4.9 6.7 0 500 1000 1500 2000 2500 2000 2001 2002 2003 2004 0 1 2 3 4 5 6 7 8 Funding (NT$ Million) Manpower (Man-Year) Funding/Manpower

(NT$ Million)

Figure 10.8: Electronics R&D funding and manpower

5.2.2 Industry Performance of the ICTs Industry

According to the “National Science and Technology Program Implementation Regulations” drafted

and approved by NSC in 1998, as response to Taiwan’s major socioeconomic and employment

needs, and in order to integrate up-, mid- and downstream R&D resources, there are three

programmes related to ICT, respectively Telecommunications, Digital Archives, and e-Learning.

1. The National Sci-Tech Program for Telecommunications was being implemented during the

years of 1998-2003 and 2004-2008 with total funding of NT$ 12.36 and 13.35 billion. Apart from

added the category of application services in an effort to establish a full range of telecommunication

systems technologies.

2. The National Sci-Tech Program for Digital Archives was being implemented during 2002-2005

with total funding of NT$ 2.78 billion. The primary goals of this programme contain the digitization

of the nation’s important artifacts and collections, and the use of a national digital archive to

promote cultural, social, industrial and economic development.

3. The National Sci-Tech Program for e-Learning is being implemented during 2003-2007 with

total funding of NT$ 4.01 billion. The programme’s goals are to increase citizens’ opportunities for

lifelong study, promote the development of e-learning industries, and encourage academic research

on e-learning. This programme also emphasizes social goals such as the promotion of e-learning at

the level of citizens and bridging the digital divide in Taiwan, as well as infrastructure support

through the Network Science Park for e-learning.

Table 10.9: National Science and Technology Programmes related to ICT

Programme Fiscal Year

Total Funding

(NT$ 100m)

FY2004 Statutory Budget

Number (NT$ 100m)

Telecommunications 1998-2003 123.6 20.2

2004-2008 133.5

Digital Archives 2002-2006 27.8 4.5

Source: 2005 Yearbook of Science and Technology, 2005: 25

Note: Total funding refers to the planned budget number after completion of project planning; annual budgets may be adjusted following review.

As can be seen from the Table10, the growth rate for whole IT hardware represents unstable

although the shipment vale steady increases from 2001 to 2005. The Notebook PC still has an

impressive track record among IT hardware. However, complying with the trend of heading China,

Taiwan’s information and electronic industries have been investing in China since 1990. Worse

than before, 79.5 per cent of the information hardware of Taiwan IT manufacturers was made in

China and it involves more than 80 per cent of the shipment value of Mainland China’s information

hardware. Regarding this transformation, I shall leave it to the section 7. Table 10.11 shows that the

shipment value of communication industry for each products increase gradually year by year,

especially for Mobile Phone, PDA and Mobile Handheld, 5-6 times more than the year of 2001.

Table 10.10: Shipment value of IT Hardware in Taiwan, 2001-05

Million US$ 2001 2002 2003 2004 2005 Notebook PC 12,239 13,922 16,809 21,831 30,301 Desktop PC 6,866 6,933 8,297 9,404 10,080 Motherboard 5,647 5,636 6,353 7,639 7,985 Server 1,040 1,324 1,559 1,837 2,060 LCD monitor 3,131 5,646 9,801 14,402 15,726 CDT monitor 5,240 4,544 3,804 3,492 2,059

DSC 1,132 1,003 1,476 1,972 2,777

ODD 2,107 3,146 3,297 3,544 3,700

Projector & Others N/A 285a 530a 5,479 5,600

IT Hardware Total 42,750 48,435 57,101 69,600 80,036

Growth Rate -9.1% 13.3% 18.0% 21.9% 16.2%

a

= projector only

Source: MIC website (2005/12)

Table 10.11: Shipment value of Communication Industry, 2001-05

Million US$ 2001 2002 2003 2004 2005 Mobile Phone 858 1939 3121 3644 4374 PDA 491 972 1190 1821 3240 Mobile Handheld 1349 2911 4311 5465 7541 WLAN 244 359 606 1341 1796 DSL 524 677 750 1179 1148

Cable Modem 470 455 299 482 727

Datacom 1238 1491 1655 3756 4011

Source: Advisory & Intelligence Service Program, III-MIC (2005/12)

5.2.3 Demand conditions

Taiwan, with medium-scale export competitiveness, manufacturing industry also behaves well in

the American and Japanese markets. In Taiwan, Electronic Components is the most competitive

industry in terms of exports. Taiwan is also a leader in the adoption and widespread use of ICTs, in

stimulating innovation, and in demonstrating their effectiveness.

As an export-oriented economy in a globalizing world, Taiwan demonstrates the advantages that

long-term strategic vision combined with adaptive management can confer. The export proportion

of high-tech industry accounts for approximately 42-45 per cent of all manufacturing industry

(Table 10.12); however, the export proportion of computer-relevant products has dropped year by

year in recent years. This phenomenon has partly to do with “the fast decline of product cost”

caused by the operation pattern of “accepting orders in Taiwan and manufacturing abroad” and

influenced by the global competitive environment and the rising of emerging markets (especial for

China).Fuller discussion of this issue will be presented in the section 7. Fortunately, there is a slight

increase for the sector of radio, television and communication equipment. It means the

communication industry still holds prosperity recently years.

% 1996 1997 1998 1999 2000 2001 2002 2003 2004

Manufacturing 100 100 100 100 100 100 100 100 100

High tech 34.28 36.51 38.94 41.84 45.46 43.20 43.18 43.03 42.53

Pharmaceuticals 0.20 0.19 0.18 0.17 0.12 0.13 0.13 0.13 0.13

Office, Accounting and Computing Machinery 16.57 18.27 20.06 20.57 19.88 19.72 18.14 14.64 11.24

Radio, Television and Communication Equipment 15.45 15.90 16.51 18.64 22.61 20.52 21.28 22.89 24.27

Medical, Precision and Optical Instruments 2.06 2.14 2.16 2.42 2.77 2.73 3.55 5.30 6.82

Aircraft and Spacecraft 0.00 0.01 0.03 0.04 0.08 0.11 0.07 0.06 0.07

Source: Export/Import data tape of R.O.C. 2004, calculated by TIER

5.3 Demand side of ICT

5.3.1 The Infrastructure of ICT

“Challenge 2008 – National Development Plan” was launched in 2002, by means of strategic

actions of e-government, e-industry, and internet society, and which were enlarged through

informational applications for each department and informational education training. Those above

had great help in improving the information environment and web services in Taiwan. Internet

services could be divided into three parts: government, business and personnel. The important

achievements included setting up a government service web (GSN), a government certification

mechanism, an official e-document exchange, an e-government service platform, e-government

portal, governmental website contents, thousands of official application forms, and several new

applications in enterprise were mainly supported by business itself, the government also provides

essential support, including “Projects A, B, C, D, and E”; “Demonstrated IT Application Research

Program”, and “Technology Research Program for Innovative Services”. Most of the support by

government involved integrating standards from industries, developing job application platforms,

and setting demonstrative applications, which amplified the leverage effects for industry.

5.3.1.1 Broadband Infrastructure

Broadband construction in Taiwan is divided into fixed line and wireless. For the fixed line, the

main development plan is the “6 million broadband users” of e-Taiwan. The annual goals of this

plan are set out in Table 10.13. In order to promote the application and development of wireless

broadband, the 2nd stage (five-year plan) of the “National Science and Technology Program for

Telecommunications” provided by NSC and the “M-Taiwan Plan” proposed by the MoEA, the

government might provide help. NSC expect to develop new relevant techniques by 2008, by doing

so, the users could surf among WLAN, GPRS and 3G; it could let at least 600,000 people have the

convenience of internet surfing and of using web phones to connect in an environment of wireless

networking. Besides, the goal of the “M-Taiwan Program” was to promote a ubiquitous network

and e-services in Taiwan.

Table 10.13: The planning of Internet Construction in Taiwan, 2002-07

2002 2003 2004 2005 2006 2007

International connection cable (Gbps) 150 200 200 200 250 250

FTTC fixed line area fibre coverage rate (%) 82.0 85.5 88.5 91.0 93.0 95.0

Broadband subscribers (10 thousand) 205 300 380 460 530 600

Source: Fan (2005)

5.3.1.2 Information and telecommunication security

In January 2001, the Executive Yuan set up the Contingency Centre of National Information and

Communication which is in charge of ICT infrastructure security and passed the "National

Information and Communication Infrastructure Security Mechanism Plan". Besides, the plan of “6

million broadband users” has a subordinate plan, “Setting up an ICT security environment”. The

government still activated other information security programmes:

1. Public Key Infrastructure(PKI): set up a “Promotion Task Force” to promote a citizen’s digital

certificate program, corporation certificate program, medical certificate program, etc.

2. Planned and set up government information exchange safety standards

3. Implemented related laws

4. Information safety technique research

5.3.2 The current status of the Information Society in Taiwan

readiness, as shown in education, R&D quality and internet penetration rate (Table 10.14). As for

the internet connection can be divided into 3 segments: home, business, and government (Table

10.15) :

Table 10.14: Status of Education, R&D, and Internet Application in Taiwan, 1996-2004

Unit 1996 1997 1998 1999 2000 2001 2002 2003 2004 Gross enrolment rate

of higher education (18-21)

% NA NA 56.1 31.0 68.4 77.1 83.4 90.2 ---

Literacy rate for over age 15 % 94.3 94.7 94.9 95.3 95.6 95.8 96.0 97.0 --- R&D Personnel 10,000 11.7 12.9 12.9 13.5 13.8 13.8 15.0 15.7 16.9 R&D/GDP % 1.80 1.88 1.97 2.06 2.06 2.17 2.21 2.45 2.54 Internet user 10,000 60 166 301 480 627 782 859 883 916 Internet penetration rate % 3 8 14 22 28 35 38 39 40 Broadband internet user 10,000 --- --- --- 2 23 114 213 289 360

Mobile internet user 10,000 --- --- --- --- --- 28 155 350 535

Source: Ke (2005: 29)

2. Mobile Internet users include WAP, GPRS, PHS or 3G

Table 10.15: Internet Connections of Taiwanese Homes, Business and Government, 2001-04

2001 2002 2003 2004

e-Government

Government agencies broadband penetration

rate

─ 78% 100% 100%

Government agencies website penetration

rate

─ --- 85% 85%

Government agencies online ─ 100% 100% 100%

e-Business

Corporate broadband penetration rate ─ 80% 90% 96%

Corporate website penetration rate ─ 22% 27% 36%

Corporate Internet penetration rate 44% 62% 79% 81%

e-Home

Home PC penetration rate ─ 72% 71% 73%