國 立 交 通 大 學

財務金融研究所

碩 士 論 文

主併公司經理人併購後之薪酬變化因素分析

Determinants of Acquiring CEOs‟

Post-Acquisition Compensation

研 究 生:羅郁喬

指導教授:林建榮 博士

主併公司經理人併購後之薪酬變化因素分析

Determinants of Acquiring CEOs‟ Post-Acquisition Compensation

研 究 生:羅郁喬 Student:Yu-chiao Lo

指導教授:林建榮 Advisor:Jane-Raung Lin

國 立 交 通 大 學

財務金融研究所

碩 士 論 文

A ThesisSubmitted to Graduate Institute of Finance College of Management

National Chiao Tung University in partial Fulfillment of the Requirements

for the Degree of Master

in Finance June 2011

Hsinchu, Taiwan, Republic of China

i

主併公司經理人併購後之薪酬變化因素分析

研 究 生:羅郁喬

指導教授:林建榮 博士

國立交通大學財務金融研究所碩士班

摘要

本研究針對 1993~2006 年間在美國進行的併購案件做分析,研究主併公司的經 理人薪資報酬在併購後的變化程度,並且加入三大因素: 1. 公司績效表現 2. 併購案特質 以及 3.公司治理能力, 去探討其與經理人的報酬結構及報酬變動 的關連性。本文並同時加入併購完成時的狀態去分別研究成功與失敗的併購案件, 檢視其支付給經理人的報酬是否有顯著差異。 研究結果指出: 1. 經理人在成功併購的案子完成後,不管公司併購後該年績效表現如何,經理 人的薪資報酬都有所增加。 2. 併購案件的條件特質也會影響經理人報酬,有雇請專業顧問公司協助併購或 是併購金額相對公司價值比例較小的案件,主併公司會給予其經理人較高的酬勞。 3. 對於成功完成併購但公司績效不彰的主併公司而言,若其公司治理能力越佳 則經理人所拿到的薪酬越少,此結果顯示公司治理扮演著有效監督的角色。 關鍵字:併購、經理人報酬、併購案特質、公司治理、公司績效。ii

Determinants of Acquiring CEOs‟ Post-Acquisition Compensation

Student:Yu-chiao Lo Advisor:Jane-Raung Lin

Graduate Institute of Finance

National Chiao Tung University

Abstract

This study explores the determinants of executive compensation changes after acquisitions. I employ panel data regression models with control of industry-level and time-specific fixed effects to evaluate the change of CEOs compensation subsequent to acquisitions. Through the pay-performance sensitivity analysis, this study finds that CEOs can earn more if the acquisition is successfully completed regardless of firm performance. Further, bid characteristics also matter: Acquiring firms with the assistance of advisors or having smaller relative deal size are more likely to compensate their CEOs more incentives. Finally, corporate governance mechanism plays a vital role in aligning managers‟ and shareholders‟ interests. In particular, acquiring firms that completed successful deals but with poor performance afterward may compensate their CEOs less if they have strong corporate governance mechanism.

Key Words: Acquisition; CEO Compensation; Bid Characteristics; Corporate

iii

致謝

在書寫致謝頁的同時,我腦中浮現了六年來在這座風城所發生的點

滴故事,從懵懂又青春洋溢的大一新鮮人,到完成人生第一本著作論

文即將踏入職場當社會新鮮人,這段精華歲月我在交大度過,創造了

很多有笑有淚的回憶。首先要感謝恩師 林建榮博士的指導,讓我在

構思論文的過程中受益匪淺,思考激盪的過程比實際寫作時還來得更

珍貴,能讓自己在這些年的所學實際應用在感興趣的題材上盡情揮灑,

並在面對困難勇於解決問題。也謝謝口試委員鍾惠民教授、陳達新教

授、陳勝源教授的珍貴指教,讓我的論文可以更加完整。此外,也要

謝謝財金所九八級同學們,在碩士生涯中跟能跟大家一同學習、討論

真是很難得的緣份。謝謝總是跟我一貣奮鬥的同門師兄弟文傑、慶華、

碩傑,以及總是互相鼓勵打氣無論大小事都能談的蛙仔、小魚,也謝

謝從沒忘記瑞典查默思酒吧幫在異國流浪擁有革命情感的查、郁晴,

樂於指導我計量問題的猛龜、幾摳、小花,共同分享生活心情的岳芳、

小咪、芋頭、姝婷,一貣討論投資市場現況的阿迪、俊明、Ted,因

為你(妳)們,讓我的研究生活過得多采多姿。也要特別感謝一路走來

始終陪伴在我身旁的 Hale,不管是分隔地球的兩端或經歷多少挫折,

你總是讓我感到安心、充滿力量,一貣創造了很多難忘故事。最後要

向我最愛的家人們致上最深的感激,謝謝爸爸媽媽總是包容著我,也

總是不厭其煩地聽著我叨絮著生活中的所有事情,在經濟上也支撐著

我,讓我沒有後顧之憂,在最沮喪的時候也總是貼心地安慰鼓勵我,

讓我有勇氣去面對更多挑戰,也謝謝兩個弟弟的照顧,雖然我是大姐,

卻總是像任性的小妹一樣要你們幫忙很多小事情。

最後最後,這篇論文我想要獻給最疼愛我的外婆。雖然在我撰寫論

文時您不幸辭世,讓這篇著作在充滿淚水的狀況下完成,但我想要您

知道,您的孫女拿到碩士學位了噢!希望您在天上也能覺得驕傲。我

一直都會這麼努力地好好生活著!

期許自己能帶著交大人積極進取的精神,貢獻一己所學並回饋社會。

iv

Contents

摘要 ... i Abstract ... ii 致謝 ...iii Contents ... iv List of Tables ... v I. Introduction ... 1II. Literature Review and Hypothesis ... 3

III. Sample and Empirical Design ... 7

1. Sample Selection ... 7

2. Sample Characteristics ... 8

3. Empirical Design ... 10

4. Regression Models and Variable Definition ... 11

4.1 Firm Performance and CEO compensation after an acquisition ... 11

4.2 Bid Characteristics and CEO Post-Acquisition Incentives ... 12

4.3 Anti-takeover Provisions and CEOs Compensation After The Acquisition ... 14

IV. Empirical Results ... 15

1. Changes in CEO Pay-Performance Sensitivity after an Acquisition ... 15

2. Bid Characteristics and CEO Pay after the Acquisition ... 16

3. Anti-takeover Provisions and Post-Acquisition Pay-For-Performance ... 18

V. Robustness Analysis ... 19

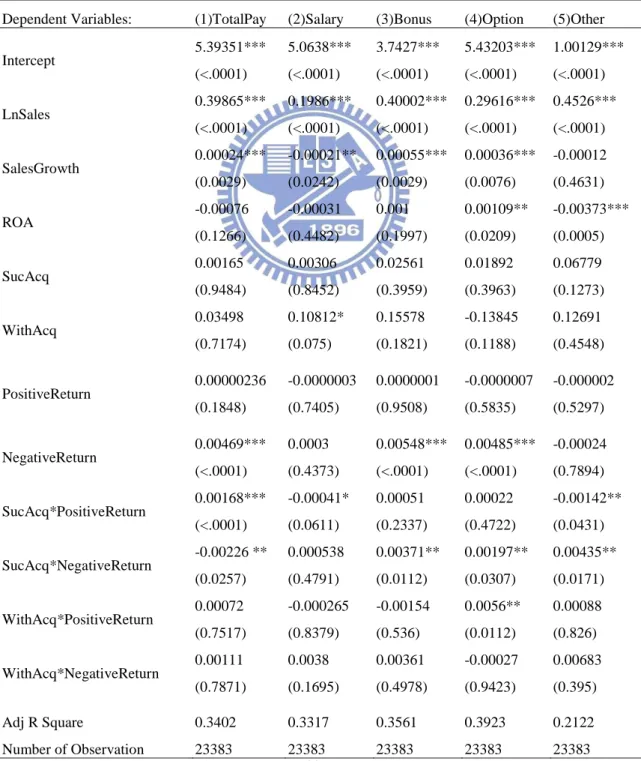

1. Decomposition of CEOs‟ Compensation ... 19

2. More Implications in Bid Characteristics ... 20

VI. Conclusion ... 22

v

List of Tables

Table 1: Distribution of Corporate Acquisitions across Time and Industries,

1993-2006. ... 24

Table 2: Descriptive Statistics of Acquiring Firms ... 26

Table 3: Descriptive Statistics of Acquiring Firm with G-index Data ... 28

Table 4: Changes in CEO Pay-Performance Sensitivity after the Acquisition ... 29

Table 5: Bid Characteristics and CEO Post-Acquisition Pay ... 30

Table 6: Anti-Takeover Provisions and CEO Post-Acquisition Pay ... 31

Table 7: Changes in the form of CEOs‟ Compensation after Acquisitions ... 33

1 I. Introduction

The separation of ownership and control has long been recognized as the source of the agency problem between executives and shareholders since the publication of Jensen and Meckling (1976).A vast of academic literature has focused much attention on how managerial ownership and compensation design can effectively align manager and shareholder interests. As new incentives instruments increase, the compensation structure of top executives leads to many empirical studies that examine how the payment method relates to firms‟ performance, and how CEOs‟ attitude toward undertaking significant corporate resource allocation. This paper explores whether top managers‟ compensations have impact on their decision to make large external investments, that is, acquisition. As Moeller, Schlingemann, and Stulz(2005) report, acquisition decisions may be the most important corporate resource allocation plans that managers make and may generate potential large destruction to firm shareholders, it is necessary to understand top executives‟ incentives in acquisition activities. If CEOs receive unreasonable payment after acquisitions, the shareholders‟ rights and firm values may be unpleasantly influenced. Thus, this study aims to investigate CEOs post-acquisition compensation change, including different factors such as firm performance, deal characteristics, and corporate governance.

CEOs pay-performance sensitivity has been widely documented in many researches. Datta, Iskandar-Datta, and Raman(2001) indicate that a strong positive relation exists between acquiring CEOs‟ equity-based compensation and merger performance. Harford and Li (2007) find that managers are financially better off from making acquisition decisions. However, only few studies discuss the differences in pay-performance between successful and withdrawn bids. Thus this study divides the acquisition deals into two groups: one is successfully completed transaction, and the other is the deals that are finally withdrawn by the acquiring firms.

Next, bid characteristics include the unique features of every acquisition. This study investigates the effect of cash payment, the use of advisors, and relative acquisition size on CEOs compensation subsequent to acquisitions. As examined in pay-performance sensitivity, this study also investigates the interactions between bid characteristics and the status of an acquisition. How different the successful and withdrawn deals behave in compensating their CEOs is studied in this paper.

2

G-index, which is constructed by Gumpers, Ishii, and Metrick (2003), to proxy for corporate governance. It is an important factor to examine the incentive alignment theory between shareholders and managers. Garvey and Milbourn (2006) further show that only firms with weak shareholder protection exhibit strong asymmetry in compensation benchmarking. And literatures also report that firms with weaker corporate governance mechanism are prone to suffer larger losses from an acquisition announcement. These arouse the interest of this study to make further research to investigate whether the corporate governance mechanism provides sufficient protection for shareholders and thus effectively supervise their CEOs.

The estimation results present several significant indications. First, acquiring CEO‟s payment is more affected by firm‟s negative return. That is, if the acquiring firm has poor performance, its CEO suffers losses in compensation. Further, for successful acquisitions, CEOs can earn more regardless of the performance of the acquiring firms. In this situation, acquiring firms award CEOs for their outstanding performance in the acquisition bid.

Moreover, the bid characteristics show significant impact on CEOs compensation. In a successful and cash payment acquisition, CEOs earn less. The similar result appears in the withdrawn and cash payment deals. CEOs are more likely to suffer compensation losses if the acquisition payment is totally in cash. The use of advisors also enhances CEOs post-acquisition payments. The assistance of professional advisors contributes to better evaluation for conducting an acquisition. CEOs may earn more incentives for making the decision to consult advisors. The last bid characteristic, relative acquisition size, implies that larger relative acquisition size more likely results in acquisition withdrawn. CEOs, especially in successful transactions, may suffer payment declines when the price of acquisition is much higher compared to the acquiring firms‟ market value.

Finally, this study verifies that corporate governance has significant impact on CEOs‟ post-acquisition compensation. For successful acquisitions with poor performance, CEOs earn less if the acquiring firms have strong corporate governance mechanism. Therefore, in this situation, corporate governance aligns CEO‟s and acquiring firm‟s interests, which is consistent with previous corporate governance literatures.

3

literature review for managerial compensation and builds the hypotheses. Section III presents the sample selection process, descriptive statistics, and design of empirical models. Section IV summarizes the estimation result and examines the developed hypotheses. In Section V, robustness check and present the regression result are presented. Section VI concludes the findings in this study and suggests further research directions.

II. Literature Review and Hypothesis

After Jensen and Meckling (1976) present that the separation of ownership and control leading to many potential conflicts of interest between shareholders and corporate managers, many literatures have focused much attention on how to reduce agency costs and align managers‟ and shareholders‟ interests. The explosive growth in the grants of equity-based incentives (option and restricted stock grants) to corporate managers (Murphy (1999)) has motivated extensive studies of the payment structure of corporate CEOs. Defusco, et al. (1990) report that the adoption of executive stock options induces an increase in the managerial risk-taking and transfers in wealth from bondholders to stockholders. Yermack (1995) analyzes stock option awards to CEOs and indicates that companies tend to provide greater incentives from stock options when their accounting earnings contain large amounts of noise.

In addition to the change in the payment structure, the relation between managerial incentives and corporate acquisitions has long been an issue for research. Since corporate acquisitions are among the largest investments and can lead to heightened conflicts of interest between managers and shareholders, many researchers design various models to estimate the manager pay-performance sensitivities after acquisition activities. Datta, Iskandar-Datta, and Raman (2001) report a strong and positive relation existing between acquiring managers‟ equity-based incentives and acquisition performance. Bliss and Rosen (2001) show that CEOs‟ wealth and compensation usually increase after a large bank acquisition, even though the acquirors‟ stock price suffer from declining. Masulis, et al. (2009) examine how divergence between insider voting and cash flow rights affect managerial extraction of private benefits of control. They discover that as the divergence widens, CEOs receive higher compensation and managers make shareholder value-destroying acquisitions more often. This study includes three determinants that may have impact on CEOs‟ post-acquisition

4

compensation. The first determinant is firms‟ performance subsequent to acquisitions. To further investigate post-acquisition pay-for-performance sensitivities, Harford and Li (2007) explore how compensation policies following mergers affect a CEO‟s incentives to pursue a merger. Their results show that acquiring CEO‟s pay and overall wealth become insensitive to negative stock performance, while it rises in step with positive stock performance, after conducting an acquisition. Comparing to taking major capital expenditures, CEOs are more rewarded to undertake acquisitions.

This study examines whether acquiring CEOs‟ compensation are sensitive to stock performance after an acquisition. Are CEOs unaffected from companies‟ poor performance? The answer to this doubt leads to the first hypothesis:

(H1) Acquiring CEOs’ compensation are aligned with acquiror’s post-acquisition

performance. CEO earn more when the acquiring firm performs well, otherwise, CEOs suffer decline in compensation as punishment of poor performance.

If hypothesis 1 is accepted, CEOs need to take the responsibility of the acquisition. If the performance is good, CEOs can earn more. Otherwise, CEOs suffer declines in compensation. This implies that the alignment of CEOs‟ and shareholders‟ interests exists, which is consistent with many corporate governance literatures.

In addition to acquiring firm‟s post-acquisition performance, the status of an acquisition also matters when it comes to compensating CEOs. Many literatures address the research of successfully completed transactions but only few studies focus on withdrawn acquisitions. This study includes both successful and withdrawn acquisitions to make comparison and analysis. Previous studies indicate that managers are more likely to withdraw acquisitions that generate less favorable market reactions. (Luo(2005), Chen, Harford, and Li(2007), Paul(2007)). Masulis, et al. (2009) present that acquiring firms with higher leverage are less likely to withdraw their proposed deals. However, they do not assess the impact on CEO‟s compensation. In withdrawn deals, CEOs may be punished for poor leading skills, or CEOs may be unaffected since the withdrawn deals prevents the acquiring firms from great amount of payment. On the other hand, does a successful acquisition promise the awards for managers? Or does the extra cost of acquisition fee limit the CEOs‟ compensation?

5

or Withdrawn) of acquisition have impact on CEO incentives:

(H2) CEOs that complete successful acquisitions receive more incentives as their

rewards for accomplishing a deal, while the CEOs compensation in withdrawn acquisitions is unaffected by the status of a deal.

Hypothesis 2 provides an assumption that CEOs‟ compensation will increase after successful acquisitions, but are not affected if the acquisitions are withdrawn. Although in withdrawn cases, CEOs may be punished for poor leading performance, the acquiring firms simultaneously prevent a large amount of payment, which may be an increasing factor of CEOs‟ payment. Thus this study suggests that CEOs‟ compensation is not affected if the acquisitions are withdrawn.

Many academic researches show that bid characteristics play an important role in acquisition assessment. Hayward (2002) employs different bid characteristics, such as relative acquisition size, contested bid, cash payment, and use of advisor, to examine whether acquisition experience contributes to the following acquisition performance.

To further investigate the factors that may affect CEOs compensation in an acquisition situation, this study includes cash payment, the use of advisor, and relative deal size as the bid characteristics variables to generate the following hypotheses:

(H3.1) Cash payment acquisitions have negative impact on CEO incentives. CEOs

receive less compensation after the acquisition if the payment method is merely in cash.

Cash payment acquisition is defined as the acquisition that provides 100% cash offer to the target firm. If the method of payment includes stock payment or a combination of cash and stock, then it is not categorized as Cash Payment. Loughran and Vijh(1997) suggest that stock financed acquisitions generated significantly lower returns than cash financed ones. However, this study focuses on the substantial cash outflow in acquisition deals, which may negatively affect CEOs‟ compensation. The hypothesis 3.1 thus presents a negative relation between cash payment and CEOs‟ compensation.

6

(H3.2) The use of advisor helps increasing CEO compensation since the advisors can

provide professional assistance and enhances the feasibility and profitability analysis when undertaking an acquisition. These may generate the more incentives for CEOs.

Hypothesis 3.2 shows the use of advisor may enhance CEOs‟ compensation. Since hiring professional advisors generally provide the acquisition with better and facilitated evaluation, acquiring firms may award CEOs for making the decisions of using advisors. Thus the hypothesis suggests a strong positive relation between CEOs‟ compensation and the use of advisor.

(H3.3)Relative deal size is negatively related to CEO payment. Since the

disgorgement of acquiror’s fund may be unbalanced, the larger the relative acquisition size, the fewer the CEOs compensation.

Relative deal size is the final purchase price of the acquisition as a percentage of the market capitalization of the acquiring firm at the time of acquisition announcement. Thus, relative deal size counters for the importance of the deal. If the relative size ratio is large, the acquiring firm tolerates higher pressure of the acquisition. In the mean while, the fund requirements of acquisitions with high relative deal ratio may result in negative influences on CEOs‟ compensation. Hypothesis 3.3 depicts that CEOs who conduct acquisitions with larger relative deal sizes may suffer compensation declines.

Moreover, the relation between corporate governance and CEOs compensation has long been discussed from many literatures. Core, et al. (1999) show that there is an association between the level of CEO compensation and corporate governance. They suggest that firms with weaker governance have greater agency problems and CEOs in such companies may extract greater compensation. Harford and Li (2007) report similar result that bidding firms with stronger boards retain the sensitivity of their CEOs‟ compensation to poor performance following the merger. Basu, et al. (2007) point out that top executive pay is higher in firms with weaker corporate governance mechanism in Japan.

7

method of corporate governance evaluation varies. Gumpers, Ishii, and Metrick (2003) construct a broad index, G-index, of antitakeover provisions with five governance rules (delay, protection, voting, state, and other) for a total of 24 possible provisions. Higher G-index value represents that the shareholders have lower power in comparison with managers, and vice versa. This study employs G-index as the proxy of corporate governance to evaluate the change of CEOs compensation after an acquisition. Thus, the fourth hypothesis is developed as follows:

(H4) CEOs receive more incentives after an acquisition if the acquiring firms have

higher G-index, that is, with weaker corporate governance mechanism. On the contrary, acquirors with lower G-index compensate more to their CEOs.

In hypothesis 4, G-index provides the link between corporate governance mechanism and CEOs‟ compensation. Acquiring firms with lower G-index are less likely to compensate their CEOs with substantial incentives after the acquisition due to the better quality of corporate governance mechanism. On the other hand, acquiring CEOs can earn more if the acquiring companies have higher G-index since CEOs have much power compared to shareholders‟ in these situations.

III. Sample and Empirical Design 1. Sample Selection

The original sample includes all completed and withdrawn U.S. acquisitions with announcement dates between January 1, 1993 and December 31, 2006 and with the deal value over 1 million US dollar as identified from the Mergers and Acquisitions database of SDC (Securities Data Company). The first step retrieves 45046 successful deals and 4632 withdrawn cases. Since the acquiring firms must have available accounting information from Compustat, and executive compensation data from Standard and Poor‟s ExecuComp for analysis, this screening process leads to 5776 successful deals and 410 withdrawn deals, respectively. This study further omits the repeated deals from the same company that has the same completed or withdrawn year. That is, if the acquiring firms successfully complete several deals in the same year, then we exclude the repeated deals. The final acquisition sample consists of 3725 successful deals and 252

8 withdrawn deals.

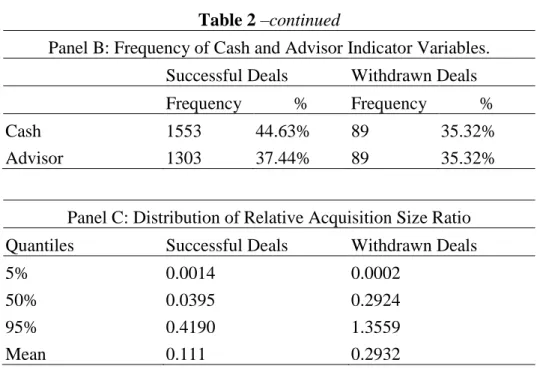

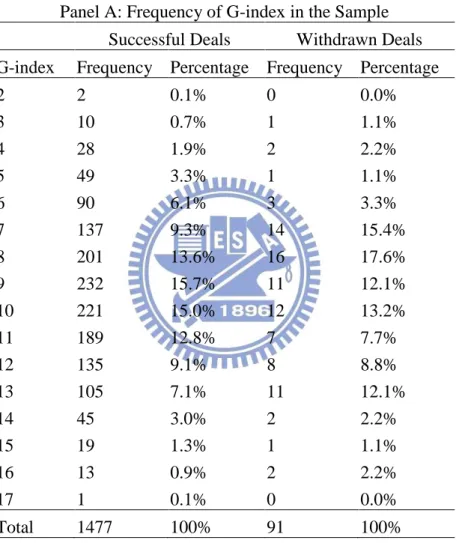

In addition, this study retrieves the information of G-index from the IRRC (Investor Responsibility Research Center) database to investigate the relation between anti-takeover provisions and CEOs‟ payoff. The IRRC database provides annual data for the years 1990, 1993, 1995, 1998, 2000, 2002, and 2004 on corporate antitakeover provisions for about 1,500 firms primarily drawn from the S&P 500 and other large corporations. After combining the G-index data, the sample includes 1477 successful deals and 91 withdrawn deals for examining the sensitivity of anti-takeover provisions and CEOs‟ compensation.

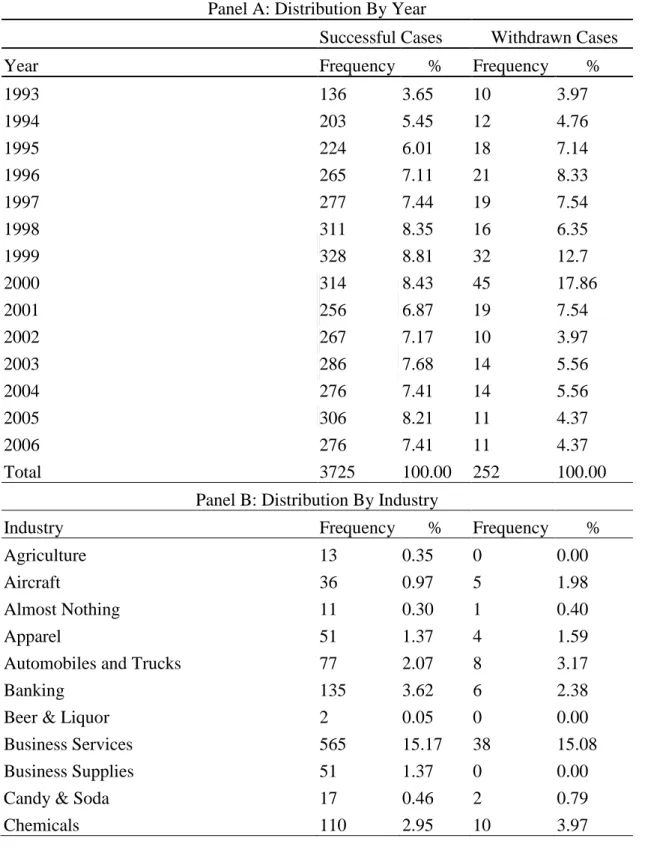

Table 1 summarizes descriptive statistics of the sample of 3725 successful bids and 253 withdrawn deals. Panel A reveals that acquisitions tend to be highly cyclical and related to business expansion cycle. During the dot-com bubble period (1997-2000), the number of successful and withdrawn acquisitions both increased apparently. Companies engaged in acquiring activities thus stimulate the amount of bids. Particularly for withdrawn transactions, in 1999, the percentage of withdrawn cases raised drastically almost twice as much as in the previous year, which corresponds to the explosion period of internet bubble. Besides, the sample period coincides with the aggregate merger wave. Panel B gives an industry breakdown of corporate acquisitions. The industries with the largest number of transactions are business services, and the percentage is around 15% in both successful and withdrawn samples. This is consistent with the finding in Bliss and Rosen(2001) that the business service industry experiences massive consolidation over the sample period.

--- Insert Table 1 Here---

2. Sample Characteristics

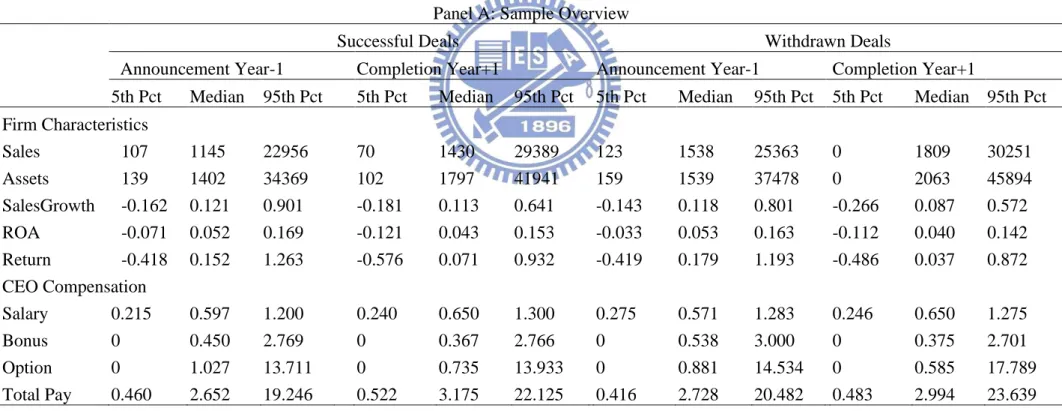

In Table 2, panel A reports financial information and CEO compensation measured both at the fiscal year-end prior to the announcement of acquisitions, and the year after the acquisition completion. For both successful and withdrawn deals, the median acquiring firms in the prior year of acquisition announcement are quite large, with book value of total assets equivalent to 1.145 billion in successful deals and 1.538 billion in withdrawn deals, respectively. Acquiring

9

firms also perform well, with averagely high sales growth rate and annual stock return compared to contemporary market returns. The median value of sales growth rate is around 12% for both successful and withdrawn transactions. The stock return prior to bid announcement year are 15.2% and 17.9% in median values for successful and withdrawn deals, respectively, which are significantly greater than the market return.

Panel B shows the frequency of bid characteristics for cash acquisition and the use of advisors. For successful deals, the percentage of cash acquisition is higher than that of withdrawn deals. Nearly forty-five percent of successful deals in this sample are 100% cash transactions. The same situation also appears in the second characteristics, the use of advisors. The percentage of consulting advisors is slightly higher for acquiring firms that completed successful deals.

In Panel C, the summary statistics of another bid characteristic, Relative Acquisition Size, is reported. Panel C presents the extreme conditions, 5th and 95th quantiles, to examine the change of Relative Acquisition Size ratio in the sample. Since the Relative Acquisition Size is defined as the deal value divided by the market value of the bidders, the ratio represents the importance of the deal for the acquirors. In the 5th quantile group, there is no significant difference between the successful and withdrawn cases. However, as the quantile increases (the relative acquisition size rises), the ratio in withdrawn transactions is apparently higher than in successful deals. The relative size ratio is around 0.3 in withdrawn cases in median; whereas the successful deals has 0.04 in median value. In 95th quantile, the relative size ratio in withdrawn deals is three times more than that in successful cases. The mean value of relative size ratio also shows similar result. This indicates that in the withdrawn situations, the relative acquisition size is much higher compared to the successful cases. This corresponds to our intuition that the company suffers from larger risks when conducting larger acquisition plans. If the aqcuiror has no sufficient preparation or capability, then the deals are more likely to be withdrawn or halt.

10

Since the relation between CEOs compensation and corporate governance is another focal point in this study, Table 3 presents the G-index of acquiring firms for successful and withdrawn deals. Panel A shows the frequency of G-index. After requiring the G-index data, the sample size shrinks to 1477 and 91 for both successful and withdrawn transactions compared to original sample. For both successful and withdrawn transactions, over half of the sample acquirors have the G-index value in the range from 7 to 10. However, to further analyze the distribution in withdrawn deals, more acquirors have higher G-index compared to successful transactions. Nearly 17% of the sample in withdrawn cases have the G-index over 13, while 12.5% in successful cases. From Gumpers, Ishii, and Metrick (2003), the higher the G-index, the weaker the corporate governance, so acquirors with weaker supervising regulation are prone to withdraw acquisitions.

Further, Panel B presents the average return from different G-index level in successful and withdrawn deals. Following the previous studies (Gompers, Ishii, and Metrick(2003), Core, Guay, and Rusticus(2006)), this study separates the sample into Dictatorship (High G-index) and Democracy (Low G-index) groups. The Dictatorship groups indicates that their managers have strongest power, and with High G-index (G-index 14), whereas the Democracy groups has strongest shareholder power with Low G-index (G-index 5). From Table 3, the average positive return of Low G-index (Democracy) group are both much higher than that in High G-index (Dictatorship) group regardless of successful or withdrawn cases. This is in line with the previous literature that companies with higher G-index are more likely to earn less (Harford, Mansi et al. (2008)). However, due to the limited withdrawn sample, the results from negative return do not show the consistency.

--- Insert Table 3 Here---

3. Empirical Design

This study includes thousands of acquisition deals from different industries and the sample period is from 1993 to 2006, so the sample data is a combination of cross-sectional and time-series types. This study employs panel data models to evaluate the relation between CEOs compensation and firm performance, bid

11

characteristics, and corporate governance after an acquisition. To model fixed effect, in panel data, dummy variables in the OLS model that present the industry-specific and time-specific fixed effect in the intercept terms are incorporated. This study employs two-way fixed effect model that both considering industry and year fixed effect to formulate the following estimation models. In the next section, panel data set is used to introduce regression models for evaluating the sensitivity of CEOs compensation with firm performance, bid characteristics, and corporate governance.

4. Regression Models and Variable Definition

4.1 Firm Performance and CEO compensation after an acquisition

Equation (1) is the regression model for examining the impact of firm performance on CEOs‟ compensation.

The left-hand-side variable is the logarithm of CEO‟s total pays in company i for year t, and the right-hand-side are the firm characteristics variables and deal status dummies applied as the independent variables. This study estimates the model based on panel data set that includes all ExecuComp firms over the entire sample period. The estimation takes industry and year fixed effects into account to examine both individual-specific effects and time effects. This study includes 48 Fama-French industry dummies (Fama and French (1997)) to control for the difference in the demand for managerial talent.

This study expects that larger firm with higher growth opportunities will demand higher quality managers and thus will offer higher pay. This study proxies firm size and growth opportunities by logarithm of sales and sales

growth rate respectively. Previous literatures suggest that the level of

12

this study employs ROA and the annual stock market return to evaluate the sensitivity between firm performance and CEO pay. Since the positive and negative returns may result in different consequence when it comes to CEO incentives evaluation, this study divides the returns into two categories:

Positive Return and Negative Return. Positive Return (Negative Return) is

the fiscal year stock return from year t-1 to t if the stock return is positive (negative), and it is set to zero otherwise. This contributes to clarifying the pay-performance sensitivities. If the coefficient of negative return is positive, the CEO compensation is accordingly declined with firm performance.

Moreover, to assess the pay differential that acquiring CEOs realize after the acquisition, this study introduces the variable Acq to denote the year after the deal completion year. This study expects that under different situations, the composition and policy for CEO incentives may differ accordingly. Thus this study employs SucAcq and WithAcq to denote the year after the completion year of successful deals and the withdrawn deals respectively. That is, is equal to 1 if the company i conducted a

successful acquisition deal that completed at year t-1, otherwise the value is set to 0. The same rule applies to .

To capture the possible differential sensitivity of pay to performance for sample firms after the acquisition in different situations, this study creates the interaction term of the return variables and the acquisition indicator variables. The interaction term, , for instance,

represents the group of firms that completed a successful acquisition with positive stock return. Four interaction terms are thus appear in the model since there are two deal status indicator variables and two return variables.

4.2 Bid Characteristics and CEO Post-Acquisition Incentives

Bid characteristics play an important role in acquisition evaluations. Previous literatures include bid characteristics to assess the post-acquisition firm performance. This study further examines the post-acquisition payment sensitivity. Equation (2) to (4) shows the modification of equation (1) by adding different bid characteristics into the original regression model.

13 The first introduced characteristics variable in equation (2) is Cash. Cash is a dummy variable whose value is equal to one if the acquiring firm conducts 100% cash offer to acquire the target firm. If the method of payment includes stock payment or a combination of cash and stock, the Cash variable takes the value of 0. The past research suggests that stock financed acquisitions generated significantly lower returns than cash financed ones (Loughran and Vijh, 1997).

In acquisition cases, the advisor firms play an important role. An acquiring firm may lack of acquisition skills and thus use an advisor to assist on the transaction. For more important deals, acquiring firms are more likely to employ professional advisor firms to assist them. Thus this study introduces the second indicator variable, Advisor, to examine whether the use of advisor firms affect CEO compensation. Advisor is set equal to one if the acqiror uses the advisor service, and equal to zero, otherwise. Equation (3) presents the regression model that includes Advisor dummy.

The third deal characteristics variable is RelativeAcqSize. RelativeAcqSize is the final purchase price of the acquisition as a percentage of the market capitalization of the acquiring firm at the time of acquisition announcement. For acquiring firms,

14

RelativeAcqSize ratio, the more important the acquisition. If an acquiring firm

decides to acquire a company that is much bigger than itself, this may arouse the disgorging issues of firms‟ available fund. If the Relative Size is extremely large, the CEO compensation may be inevitably influenced, both in the composition structure or the way of payments. Equation (4) consists of RelativeAcqSize for estimation.

4.3 Anti-takeover Provisions and CEOs Compensation After The Acquisition

This study further examines the relation between anti-takeover provisions and CEOs compensation. The boards have the power to decide the structure of CEO compensation, and even to provide downside protection of CEO when it comes to unpleasant situations. Therefore this study uses the corporate governance proxy to investigate the possible changes in CEO compensation after an acquisition. In previous literatures, many researchers used different proxies for measuring the level of corporate governance. Gompers, Ishii, and Metrick(2003) constructed a broad index, G-index, of antitakeover provisions using five governance rules for a total of twenty four possible provisions. The five governance rules are delay, protection, voting, state, and other. The index employs a point scale from one to twenty four. For every firm, the index adds one point for every added provision that restricts shareholder rights, which means the managerial power is enhanced. The index with highest value has the weakest shareholder rights, and the index with lowest value has the strongest shareholder rights. The G-Index is pervasively used in measuring the power between shareholder and CEOs, thus this study employs G-index as corporate governance proxy for the following estimation. Equation (5) shows the regression model considering corporate governance proxy.

To further investigate the effect of firm performance, this study also includes the PositiveReturn and NegativeReturn variables to examine the interaction impact on CEO payoff. Equation (6) includes the both GIndex and the interaction terms.

15

IV. Empirical Results

This study consists of three main regression results for previous estimation models. Firstly, this study examines the CEO pay-performance sensitivities, including bidders‟ post-acquisition stock performance. And the second model considering three bid characteristics in panel data regressions. Cash payment, the use of advisor, and relative acquisition size are the factors that may affect CEOs pay after acquisitions. The final part in this section discusses the corporate governance role in compensating CEOs after an acquisition. This study employs G-index to proxy the corporate governance factor and to investigate how anti-takeover provisions affect managers‟ post-acquisition payment.

1. Changes in CEO Pay-Performance Sensitivity after an Acquisition

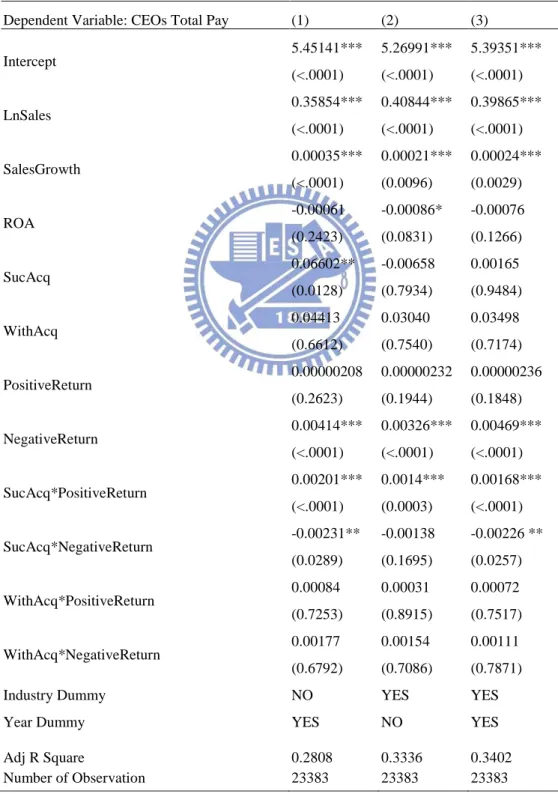

The first factor examined is bidders‟ post-acquisition performance. Since there is no reason to believe that compensation will be symmetrically set for positive and negative performance, I include the dummy variables to distinguish the relation between CEO wealth and firm performance. In addition, the status of acquisition also has different impacts on CEO incentives. Whether an acquisition is successful or is withdrawn may affect the policy or composition of CEO compensation. Thus Table 4 presents the results of the equation (1).

In Table 4, the first column has the time fixed effect and the second column includes the industry fixed effect, while the third column has both two-way fixed effects. As the fixed effect increases, the adjusted R square reaches 0.34 from 0.28, which symbolizes the increase of explanatory power. Across the three models,

16

compensation. This corresponds to agency theory that the level of CEO pay should be an increasing function of firm performance. Firms with larger sales and higher potential to grow are inclined to offer higher compensation for exceptional managers. Further, to investigate the coefficient of return variables, the result shows that CEO pay is more strongly related to negative returns rather than positive returns. Thus CEOs pay is more likely to be lowered after poor returns. This is line with our intuitive that CEOs will be penalized for poor performance. The result also matches the hypothesis 1 that acquiring CEOs‟ compensation is aligned with firm performance.

However, the negative coefficient on the interaction of negative post-acquisition stock returns for successful deals ( ) indicates that

for successful cases, the acquiring CEO can earn more even the firm suffers from negative returns. For successful cases, both the positive return and negative return significantly contributes to CEO pays, which can be regarded as the firms award their CEOs for achieve an acquisition goal successfully. Nevertheless, the interaction terms in withdrawn cases do not show significant result compared to successful deals.

---Insert Table 4 Here---

2. Bid Characteristics and CEO Pay after the Acquisition

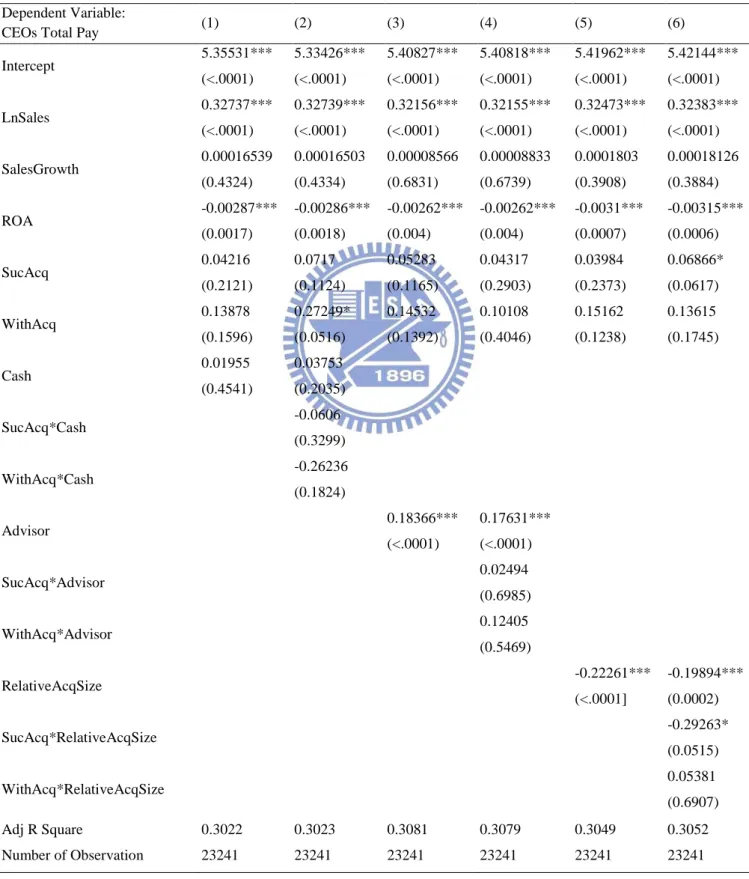

The above result shows that the status of acquisition and the post-acquisition firm performance has impact on CEO compensation. To further investigate how other factors may influence CEO pay under the merge situations, this study employs bid characteristics to examine the sensitivity of CEO post-acquisition compensation. Three bid characteristics included are Cash, the Use of Advisor, and Relative Acquisition Size. To examine whether the interactions have any effect on compensation and wealth changes, equation 2 to 4 are constructed to undertake panel data regression. In particular, this study also introduces the industry and year fixed effects to prevent fluctuations. Table 5 summarizes all the regression result of equation 2 to 4.

As in the above section, the following regression also includes the interaction term to examine the differences between successful deals and withdrawn cases. First, the result of Cash regression model shows that no matter in successful or

17

withdrawn cases, the CEO compensation is negatively affected according to the negative coefficient of the interaction terms (SucAcq*Cash and WithAcq*Cash). Although the result is not very significant, it still provides the direction of what will happen to CEO pay if the acquiror decides to conduct a 100% cash acquisition program. The negative relation between cash acquisition and CEO pay may result from the fund disgorge effect. If the firm conducts a cash acquisition, then it needs much fund to pay, which may result in unpleasant decline in CEO pay. This corresponds to hypothesis 3.1 that cash payment has negative impact on CEOs payment. However, the acquiror firm may compensate their CEO in another way, for example, the employee options. Thus the decomposition of these CEO pay can help to declare the changes in CEO pay after a cash acquisition.

Next, the advisor indicator variable presents a strongly positive relation with CEO pay, which means that the use of advisor enhances CEO‟s compensation. The possible explanation is that advisor companies provide sufficient and professional services during the dealing period, which also intensify the confidence of the acquiring firm to make a good deal. This confidence may become the trigger of paying more incentives to CEO. No matter the outcome is successfully acquired or not, the CEO will be compensated from the adoption of advisors. Hypothesis 3.2 that regards advisor as positive factor of CEOs payment is thus accepted.

The third bid characteristic model is to examine the RelativeAcqSize factor. In Table 4, the significantly negative coefficient shows that the deal size indeed have impact on CEO pay. As the importance of the deal increases, the supplanting effect becomes more serious. Relatively larger deals are more likely to be withdrawn, consistent with the evidence reported by Luo(2005) and Masulis, Wang et al. (2009). The acquiror needs to offer sufficient fund to complete the deal but in the meanwhile the acquiring CEO may receive fewer incentives due to the short of fund. To further investigate the interaction term, the successful deals with larger relative acquisition size are more likely to decrease their CEO pay, while the withdrawn cases do not suffer the same consequence. Because the successfully acquisition results in substantial cost after the acquisition, the impact on CEO pay is more strong compared to the withdrawn deals. Hypothesis 3.3 that relative deal size is negatively related to CEO‟s compensation is partly accepted in

18 the situation of successful deals.

---Insert Table 5 Here---

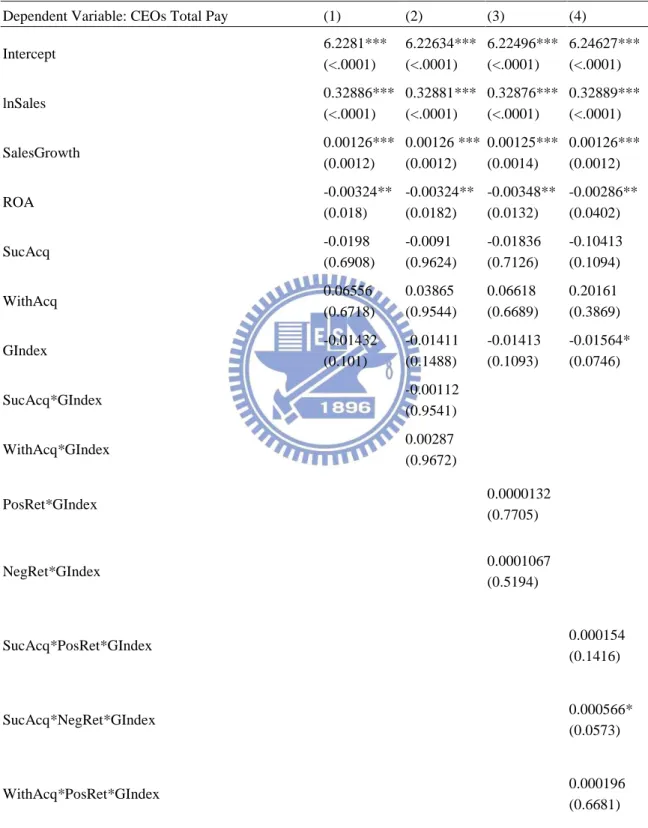

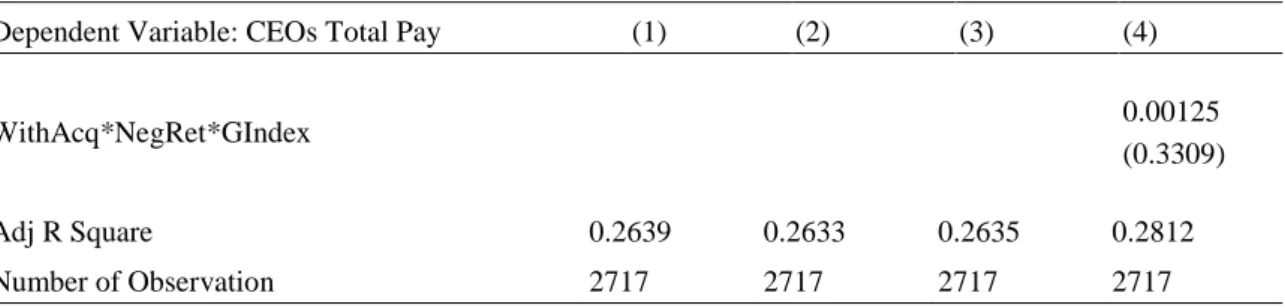

3. Anti-takeover Provisions and Post-Acquisition Pay-For-Performance

The final part of this section discusses the role of corporate governance in CEOs compensation subsequent to acquisitions. As previously addressed, this study employs Gumpers, Ishii, and Metrick‟s G-index as the proxy of corporate governance effect and construct equation 5 and 6 to examine the role of corporate governance. Equation 5 includes only the G-index value and the interaction effect between the status of bid and G-index. Equation 6 adds positive (negative) return interaction terms for further investigation.

Since the G-index counts for the power of shareholder, the higher G-index value implies that the managers can dominate more resources, and they may even treat themselves with more incentives. From hypothesis 4, in post-acquisition period, CEOs from higher G-index firms are more likely to earn much compensation due to the lack of strong supervising power. However, Masulis, Wang, and Xie(2007)suggest that the G-index is related to stockholder reaction of merger announcements, with higher G-index firms suffering larger losses on the announcement of a takeover attempt. Harford et al. (2008) also shows that firms with weaker corporate governance have lower cash holdings. Though CEOs in firms with higher G-index have more power to raise their own payoff, they may face fund shortage problem when their companies are suffering large losses after an acquisition.

Table 6 summarizes the result of estimation models considering G-index. Model 1, the first column, includes only G-index, without interaction term. It indicates a negative coefficient on G-index variable. This is contrast to hypothesis 4 that CEOs earn more if the company has higher G-index. However, this corresponds to the previous literature that firms with higher G-index may suffer large losses from acquisition announcement, and thus have negative impact on CEOs compensation.

However, to further check the model 2, the withdrawn deals have no negative coefficient in G-index interaction term as in successful cases. Since bidding firms with weak corporate governance are not encountering large losses due to the

19

withdrawn announcement, their CEOs are also prevented from compensation declines. When it comes to the relation between return and CEO compensation considering G-index, model 4 shows a complete result. A significant and positive coefficient in SucAcq*NegRet*GIndex implies that the shareholders‟ role is more important in the acquisitions that are successfully completed but with poor performance. In this situation, CEOs can earn more if the firm has lower G-index, that is, shareholders have weak supervising power.

--- Insert Table 6 Here---

V. Robustness Analysis

In this section, robustness tests are designed to investigate more details between CEO‟s payment and related determinants. First, decomposing CEOs‟ compensation and undertaking panel regressions as in previous sections to examine the pay-performance sensitivities and probable changes of executives‟ compensation structure. Next, to make further research in bid characteristics, this study introduces two new indicator variables: Hostile and Contested to investigate whether CEO‟s compensation is affected by a hostile takeover or a competitive bid.

1. Decomposition of CEOs‟ Compensation

For better understanding of CEOs‟ incentives after a merger, this section decomposes managers‟ compensation into salary, bonus, options, and other payments and conduct panel data regressions by using the natural log of CEOs‟ incentives as the dependent variables.

---Insert Table 7 Here---

In Table 7, model 2 to model 5 present the estimation result. In addition, this section also uses the percentage change of total payment as the dependent variable. However the unreported result shows that the explanatory power is too poor and no significant impact exist. The first column in Table 7 reviews the regression result from previous section, which uses the logarithm of CEO‟s total compensation as the response variable. To compare the explanatory power, Model 4(Option) has the highest adjusted R squares, which is nearly 0.4, where Model

20

5(Other Compensation) has lowest explanatory power. Next, the coefficient of LnSales in each model is significant and positive, which is similar to the regression result of total payment.

Companies with larger sales are willing to compensate their CEOs in many payment forms. The ROA also shows significantly positive relation with bonus and options. This corresponds to previous literatures(Lewellen et al.(1987), Smith and Watt (1992), Gaver and Gaver(1993), Mehran(1995)) that firms with larger growth opportunities tend to pay more stock-based compensation to their managers for the purpose of interests alignment. In successful deals, CEOs receive positive but not significant excess payment in all forms. However, in withdrawn cases, CEOs earn less option awards. To check the firm performance variables, the result reports that negative returns destroy CEOs‟ salary, bonus, option, and total payment as described in the previous section. That is, managers suffer incentive declines if firms perform poorly. Moreover, the firms that completed successful deals and with positive return raise their CEOs‟ bonus and options. The use of equity-based compensation is aimed to inspire managers to work hard for firm performance and future awards. In withdrawn cases, CEOs receive lower salary and bonus regardless of the firm performance while option grants to these CEOs are increasing. However, the interaction terms of withdrawn and performance show insignificant results.

To summarize, Table 7 provides a more sophisticated discussion of CEO‟s pay-performance sensitivity after an acquisition. The result extents the original model and develops comprehensive analysis of different incentive mechanisms. 2. More Implications in Bid Characteristics

In addition to the three bid characteristics indicated in previous sections, this section employs another two indicator variables, hostile takeover and contest bid, to examine the possible effects on CEOs compensation. Hostile takeover is a dummy variable set to one when the acquisition is conducted in a hostile manner. A hostile deal in SDC M&A database is defined as the case that the board officially rejects the offer but the acquiror persists with the takeover. Contested bid is also an indicator variable that equals to one if the acquirors encountering competitors in the process of acquisition, and set to 0 otherwise. This factor is often found to reduce acquiror return since the price of the target is bid up in these

21

situations (Hayward and Hambrick, 1997). In Table 8, panel A shows the frequency of these two characteristics in the study sample. It is apparent that in withdrawn deals, the ratios of hostile takeover and contested bid are much higher compared to those in successful deals. In the case of withdrawn deals, relatively more transactions have the hostile takeover or competitive bid features. This result is similar to the study of Kau et al. (2008) and Masulis et al. (2009) that hostile bids and competitive bids are more likely to be withdrawn.

Next, we conduct similar panel regressions as in the previous section and the panel B summarizes the result. The positive and significant coefficient of Hostile variable indicates that CEOs receive more incentives if the acquiring firms undertake a hostile takeover. However, after considering the acquisition status, CEOs are not treated indifferently in hostile takeovers. Though the insignificant coefficients of the interaction terms (SucAcq*Hostile and WithAcq*Hostile) show weak explanatory power, the result describes that CEOs suffer compensation losses after a successful and hostile acquisition. The reason may be that firms start to encounter problems after a hostile acquisition and thus result in negative impact on CEOs compensation. In contrast, the hostile takeovers that are withdrawn do not have negative effect on CEOs‟ total compensation.

Further, Model 3 and Model 4 provide the results that contested bids have positive impact on CEOs‟ compensation. Though previous literature indicates that competitive bids are more prone to be withdrawn, the competitiveness simultaneously implies the possible potential of the acquisitions. If acquiring firms successfully acquired the bid after competition, the value of the acquisition may possibly contribute to firm performance, and result in the increase of CEOs‟ payment. However, the results are both not significant at all.

To summarize, in comparison with the three bid characteristics, cash payment,

the use of advisors, relative deal size, used in previous sections, hostile takeovers

and contested bid provide less explanatory power in evaluating CEOs‟ post-acquisition payment.

22 VI. Conclusion

In their comprehensive examination of CEO pay, Harford and Li (2007) report that „CEO‟s wealth rises in step with positive stock performance after a merger‟, and corporate governance plays an important role to „retain the sensitivity of bidding CEOs‟ compensation to poor performance following the acquisition‟. The findings in this study are similar. After collecting acquisition and CEOs‟ compensation data from 1993 to 2006, this study investigate the different triggers that may change CEOs‟ payment after mergers.

First this study examines executive pay-performance sensitivity after an acquisition. The result finds that CEO‟s payment is more negatively affected if the acquiring firm has negative return after the acquisition. This corresponds to our intuitive that CEO earns less if firm has poor performance. In addition to stock return, this study also divides the deals into two groups according to their status to distinguish the differences between successful and withdrawn transactions. The results indicate that in successful acquisitions, CEOs can earn more payment no matter the firm performance is good or not. CEOs may be compensated for their accomplishment to achieve a successful transaction.

Further, three bid characteristics, cash, advisor, and relative acquisition size, are included to explore the relation between CEOs‟ compensation and the conditions set in a bid. In successful and cash payment deals, CEOs earn less after the transaction. The possible explanation is that acquiring firms may have fund shortage after purchasing a target with cash, thus have a decline pressure on their CEOs‟ compensation. On the other hand, CEOs in withdrawn and cash payment cases also suffers decreasing payment. It may be regarded that the acquiring firm has insufficient cash to realize the acquisition with cash payment announcement, and this problem may also have negative impact on CEOs‟ compensation.

The use of advisor adds professional assistance for acquiring firms when conducting an acquisition. The regression consequences present that the use of advisors enhances CEOs payment regardless of the status outcomes (successful or withdrawn). Since the adoption of advisors may reflect CEOs decision-making and leading skills, the acquiring firm may also compensate their CEOs for hiring professional advisors.

23

more likely to be withdrawn. For acquiring firms with greater relative acquisition size and successfully completed a deal, their CEOs suffer payment declines. Since the bidding firm should pay substantial amount for a successful transaction with relatively larger acquisition size, it may face the fund shortage, and thus decrease CEO‟s compensation.

The final discussed subject in this study is the relation between corporate governance and CEO‟s post-acquisition compensation. Consistent with previous literature (Masulis, Wang et al. (2007)), firms with weaker governance suffers losses from acquisition announcement and their CEOs are also more likely to encounter payment declines. In particular, corporate governance is more important in the situation that acquiror completes a successful transaction but with poor post-acquisition performance. CEOs in firms that accomplish successful deals but result in unpleasant performance are prone to earn more when the corporate governance mechanism is weak.

This study documents possible factors that may affect CEOs‟ post-acquisition payment and complements recent researches of executive compensation. However, there are still aspects that are deserved further study. One possible direction is to further investigate withdrawn cases. Since there are few literatures discussing the withdrawn bids, to explore the related factors that arouse a withdrawn deal contributes to making acquisition decisions. Furthermore, current compensation schemes of executives are still inefficient to solve the agency problems. How to align both shareholders‟ and managers‟ rights under different acquisition conditions is always an important issue. Besides, the mechanism to measure corporate governance varies, thus using different measurements for corporate governance proxies are good methods to sophisticate this study.

To summarize, this study enhances not only our understandings of the determinants of executive compensation considering acquisition events, but also highlights the importance of corporate governance in solving agency problems.

24

Table 1: Distribution of Corporate Acquisitions across Time and Industries, 1993-2006.

The sample consists of 3725 successfully completed bid and 252 withdrawn deals with deal value over 1 million U.S. dollar. The sample period is during January 1, 1993 to December 31, 2006. The acquirors are listed in Mergers and Acquisitions database from Securities Data Company and have executive compensation data in Standard and Poor‟s ExecuComp database. The industry classification follows Fama and French(1997).

Panel A: Distribution By Year

Successful Cases Withdrawn Cases

Year Frequency % Frequency %

1993 136 3.65 10 3.97 1994 203 5.45 12 4.76 1995 224 6.01 18 7.14 1996 265 7.11 21 8.33 1997 277 7.44 19 7.54 1998 311 8.35 16 6.35 1999 328 8.81 32 12.7 2000 314 8.43 45 17.86 2001 256 6.87 19 7.54 2002 267 7.17 10 3.97 2003 286 7.68 14 5.56 2004 276 7.41 14 5.56 2005 306 8.21 11 4.37 2006 276 7.41 11 4.37 Total 3725 100.00 252 100.00

Panel B: Distribution By Industry

Industry Frequency % Frequency %

Agriculture 13 0.35 0 0.00

Aircraft 36 0.97 5 1.98

Almost Nothing 11 0.30 1 0.40

Apparel 51 1.37 4 1.59

Automobiles and Trucks 77 2.07 8 3.17

Banking 135 3.62 6 2.38

Beer & Liquor 2 0.05 0 0.00

Business Services 565 15.17 38 15.08

Business Supplies 51 1.37 0 0.00

Candy & Soda 17 0.46 2 0.79

25

Table 1, Panel B-- Continued

Coal 5 0.13 0 0.00 Communication 91 2.44 10 3.97 Computers 174 4.67 8 3.17 Construction 38 1.02 3 1.19 Construction Materials 84 2.26 5 1.98 Consumer Goods 63 1.69 6 2.38 Defense 20 0.54 3 1.19 Electrical Equipment 19 0.51 2 0.79 Electronic Equipment 352 9.45 12 4.76 Entertainment 13 0.35 0 0.00 Fabricated Products 5 0.13 0 0.00 Food Products 67 1.80 4 1.59 Healthcare 78 2.09 4 1.59 Insurance 124 3.33 7 2.78 Machinery 96 2.58 6 2.38

Measuring and Control Equipment 95 2.55 13 5.16

Medical Equipment 133 3.57 13 5.16

Non-Metallic and Industrial Metal Mining 9 0.24 1 0.40

Personal Services 36 0.97 0 0.00

Petroleum and Natural Gas 209 5.61 8 3.17

Pharmaceutical Products 154 4.13 7 2.78

Precious Metals 7 0.19 0 0.00

Printing and Publishing 45 1.21 1 0.40

Recreation 33 0.89 3 1.19

Restaraunts, Hotels, Motels 59 1.58 6 2.38

Retail 143 3.84 13 5.16

Rubber and Plastic Products 15 0.40 3 1.19

Shipbuilding, Railroad Equipment 1 0.03 0 0.00

Shipping Containers 8 0.21 1 0.40

Steel Works Etc 61 1.64 4 1.59

Textiles 21 0.56 1 0.40 Tobacco Products 2 0.05 1 0.40 Trading 103 2.77 2 0.79 Transportation 55 1.48 9 3.57 Utilities 146 3.92 17 6.75 Wholesale 93 2.50 5 1.98 Total 3725 100.00 252 100.00

26

Table 2: Descriptive Statistics of Acquiring Firms

Panel A presents the summary statistics of the sample as in Table 1, which consists of 3725 successfully completed bid and 252 withdrawn transactions announced between Jan 1, 1993 and Dec 31, 2006. All data are obtained at the year-end either before the announcement year or after the acquisition completion. Variables in firm characteristics and CEO compensation are measured in millions unit. Panel A summarizes the median, 5th and 95th percentile values. Sales is the market value of total sales in year t. Assets is the book value of total assets in year t. SalesGrowth is the change ratio of total sales from year t-1 to t. ROA is the accounting return on assets, calculated as the earnings before interest and taxes to total assets. Return is the annual stock return during the fiscal year. CEO compensation variables include annual Salary and Bonus. Option is the value of options granted in year t. Total Pay is the sum of salary, bonus, other annual compensation, value of restricted stock granted, value of new stock options granted during the year, long-term incentive payouts, and all other compensation. In Panel B, the sample shows the frequency and percentage of cash payment and the use of advisors in both successful and withdrawn samples. Panel C demonstrates the distribution of relative acquisition size. Relative acquisition size is the deal size divided by the market value of the bidder. Panel C uses the extreme quintiles to investigate the variances in different relative deal size.

Panel A: Sample Overview

Successful Deals Withdrawn Deals

Announcement Year-1 Completion Year+1 Announcement Year-1 Completion Year+1

5th Pct Median 95th Pct 5th Pct Median 95th Pct 5th Pct Median 95th Pct 5th Pct Median 95th Pct Firm Characteristics Sales 107 1145 22956 70 1430 29389 123 1538 25363 0 1809 30251 Assets 139 1402 34369 102 1797 41941 159 1539 37478 0 2063 45894 SalesGrowth -0.162 0.121 0.901 -0.181 0.113 0.641 -0.143 0.118 0.801 -0.266 0.087 0.572 ROA -0.071 0.052 0.169 -0.121 0.043 0.153 -0.033 0.053 0.163 -0.112 0.040 0.142 Return -0.418 0.152 1.263 -0.576 0.071 0.932 -0.419 0.179 1.193 -0.486 0.037 0.872 CEO Compensation Salary 0.215 0.597 1.200 0.240 0.650 1.300 0.275 0.571 1.283 0.246 0.650 1.275 Bonus 0 0.450 2.769 0 0.367 2.766 0 0.538 3.000 0 0.375 2.701 Option 0 1.027 13.711 0 0.735 13.933 0 0.881 14.534 0 0.585 17.789 Total Pay 0.460 2.652 19.246 0.522 3.175 22.125 0.416 2.728 20.482 0.483 2.994 23.639

27

Table 2 –continued

Panel B: Frequency of Cash and Advisor Indicator Variables. Successful Deals Withdrawn Deals

Frequency % Frequency %

Cash 1553 44.63% 89 35.32%

Advisor 1303 37.44% 89 35.32%

Panel C: Distribution of Relative Acquisition Size Ratio Quantiles Successful Deals Withdrawn Deals

5% 0.0014 0.0002

50% 0.0395 0.2924

95% 0.4190 1.3559

28

Table 3: Descriptive Statistics of Acquiring Firm with G-index Data

In panel A, the frequency of acquirors with G-index data shows the distribution in both successful and withdrawn transactions. G-index is constructed by Gumpers, Ishii, and Metrick (2003) to evaluate the antitakeover provisions of companies. G-index is pervasively employed to measure the power between shareholders and managers. Panel B provides the average return of successful and withdrawn deals in different G-index groups. Following previous literatures (Gumpers, Ishii, and Metrick (2003), Core, Guay, and Rusticus(2006)) , High G-index is defined as the value of G-index over 14, and the G-index value under 5 is categorized in Low G-index. Return is the yearly stock return of the company. Negative (Positive) Return represents the average Negative (Positive) stock return in a year of the acquiring company.

Panel A: Frequency of G-index in the Sample Successful Deals Withdrawn Deals G-index Frequency Percentage Frequency Percentage

2 2 0.1% 0 0.0% 3 10 0.7% 1 1.1% 4 28 1.9% 2 2.2% 5 49 3.3% 1 1.1% 6 90 6.1% 3 3.3% 7 137 9.3% 14 15.4% 8 201 13.6% 16 17.6% 9 232 15.7% 11 12.1% 10 221 15.0% 12 13.2% 11 189 12.8% 7 7.7% 12 135 9.1% 8 8.8% 13 105 7.1% 11 12.1% 14 45 3.0% 2 2.2% 15 19 1.3% 1 1.1% 16 13 0.9% 2 2.2% 17 1 0.1% 0 0.0% Total 1477 100% 91 100%

Panel B: Aquiror‟s Return in Different G-index Level for Successful and Withdrawn Cases Negative Return Positive Return Return

Successful Deals High G-index -23.18% 34.19% 11.62%

Low G-index -32.98% 55.14% 4.40%

Withdrawn Deals High G-index -18.67% 26.91% 8.24%