多國籍企業國外直接投資成功因素之探討

全文

(2) Acknowledgement. For the successful completion of my thesis I would like to thank all those people who have helped me during the two years of studies in National University of Kaohsiung. This thesis would not have been possible without the constant support and guidance of Dr. Cheng, who not only served as my advisor but also encouraged and helped me throughout my academic program. His invaluable suggestion and profound wide range of knowledge helped deepen my knowledge and sharpened my writing skills, making me into a much better person. I really thank Dr. Cheng from the bottom my heart for his care, concern and guidance along the course of my studies. I would also like to thank my external examiner, Dr. Tung and Dr. OuYang whose invaluable suggestions and advice made my thesis more complete. I also extend my warmest gratitude to Dr. Yang, the dean of our department and all other professors and staff members for their valuable lessons and support. A special thanks to my dear seniors Xu Po-Pin, Liang Wen-Han and to my dear friends En-Keoung, Chen Wei and Lo Ching-Lung for their concern and care during the tenure of my stay in Taiwan. They have been a constant source of inspiration and support all through the way. I am really grateful to my beloved family, especially to my parents, my brother Te-Chieh and my sister Hsiao-Fong for their continuous support and encouragement. I am really thankful to God for giving me such a beautiful family who are always with me, without their support and love it would not have been possible to complete my thesis. Chung Lee-Fong (2012.07.26). i.

(3) The Discussion of Success Determinants of Multinational Enterprises for Foreign Direct Investment. Advisor: Dr. Cheng, Yu-Jen Institute of Business and Management National University of Kaohsiung Student: Chung, Lee-Fong Institute of Business and Management National University of Kaohsiung. Abstract Foreign Direct Investment (FDI) has received significant attention in the global business environment. Under the trend of international division of labor many Multinational Enterprises (MNEs) engaged in FDI to gain greater economic rent. This article adopts document analysis to figure out the determinants that may lead to MNEs success in FDI from perspectives of home country, host country, MNEs, and the global environment. The conclusions are shown as: (i) home country government active participation in various international trade agreements and expansion of political ties will provide a strong support for enhancing MNEs success in FDI; (ii) the presence of agglomeration economies, abundance of natural resources, infrastructural development, geographical pivot location, rules and regulations and also promotional incentives provided by government in host country would help in MNEs success when they endeavor in FDI; (iii) MNEs possessing cultural similarity, and ethnic network ties with host country, and gaining international experience would increases the probability of success in FDI; and (iv) The happenings of the global crisis such as financial crisis and Asian crisis can determine MNEs success in FDI.. Keywords: Foreign Direct Investment, Multinational Enterprises, Success Determinants. ii.

(4) 多國籍企業國外直接投資成功因素之探討 指導教授:鄭育仁 博士 國立高雄大學經營管理研究所 學生:鍾莉芳 國立高雄大學經營管理研究所. 摘要 在經營環境全球化的趨勢及國際分工的潮流下,使得國外直接投資受到重視。眾多 的多國籍企業為了獲得較高的經濟利益,紛紛進行國外直接投資活動。 本文採用文獻探討法,分別從母國、地主國、多國籍企業本身、和全球經濟環境等 觀點,討論多國籍企業在從事國外直接投資的成功因素。本文所得結論顯示:(1) 母國 政府積極簽定各種國際貿易協定和擴大國外政治關係,將會支持本國多國籍企業提升國 外直接投資的成功機率;(2) 地主國產生群聚經濟、擁有豐富的自然資源、基礎建設的 發展、處於地理上的樞紐位置、和地主國政府提供獎勵措施,將幫助外國多國籍企業在 地主國從事國外直接投資成功的機率; (3)多國籍企業擁有國際經驗、與地主國有文化 相似性或民族網絡關係,將會增加多國籍企業在地主國從事國外直接投資的成功機率; (4) 全球經營環境發生危機,如金融危機和亞洲金融風暴等,將能決定多國籍企業的國 外直接投資的成功。. 關鍵詞:國外直接投資,多國籍企業,成功因素. iii.

(5) Contents Chapter 1 Introduction. 1. 1.1 Research Background. 1. 1.2 Research Motivation and Research Objectives. 2. 1.3 Research Procedure. 4. 1.4 Contributions. 5. 1.5 Research Structure. 5. Chapter 2 Literature Review. 6. 2.1 Foreign Direct Investment. 6. 2.2 Motivation behind Foreign Direct Investment. 7. 2.3 The Significant Determinants of FDI. 9. Chapter 3 Determinants of MNEs Success in FDI. 19. 3.1 Home Country’s Perspectives. 19. 3.2 Host Country’s Perspectives. 22. 3.3 MNEs Perspectives. 28. 3.4 Global Environment Perspectives. 34. Chapter 4 Conclusion. 37. References. 38. iv.

(6) Chapter 1: Introduction 1.1 Research Background In recent years, the trend of international division of labor has led to economic interaction amongst firms across countries, resulting in increasing the level of international trade. The total global inflow of FDI in the years 2002 has increased from $1,971billion to $ 1,244 billion in the years 2010.1 The total global outflow of FDI in the years 2010 rose from $1,428.6 billion to $1,664.2 billion in the years 2011. 2 The recent ongoing trend towards FDI, prompted both home and host countries government to become a member or/and signatory of international institutions like GATT/WTO (World Trade Organizations), FTA (Free Trade Agreements), bilateral investment and other treaties that improves their trading relationships with partner countries and reduces trade barriers. These international institutions will also serve as a means to protect assets of foreign investors, or serve as a vehicle for MNEs to enter into a foreign country. This will result in an increased in the level of FDI, and also raise a country’s economic growth and social welfare. To enhance country attractiveness as location for FDI, governments have undergone rapid economic transformation by changing several economic policies such as, reduction in tax rate and tariff, domestic and international capital liberalization, privatization, and removing barriers to international capital flows. They have also established promotional policies such as setting up of Special Economic Zones (SEZs) to boost up exports. Due to certain prevalent condition in their countries, MNEs are prompted to undertake FDI. The factors that motivate MNEs to engage in FDI are to escape from strict environmental laws, high tariff rates, high wage rate and etc. so as to gain competitive advantage over their rival firms. In addition, MNEs may also seek investment in foreign countries to search for natural resources and human resources. Moreover, a search for newer market, upgraded. 1. http://www.unctad-docs.org/files/UNCTAD-WIR2011-Chapter-1-en.pdf (2012.08.09).. 2.. http:// unctad.org/en/PublicationsLibrary/webdiaaeia2012d19 en.pdf (2012.08.09).. 1.

(7) technology, and educated workforce are the other motives of MNEs. During their operation in a foreign country, MNEs often face liability of foreignness due to lack of information and international experience. To increase their success rates MNEs must build up social network with their foreign counterparts through establishment of subsidiary company, or by maintaining good relationships with domestic firms, as these domestic firms normally possess good knowledge about local market condition, and can provide necessary information with regard to investment. The setting up of subsidiary companies in a particular region will lead to formation of agglomeration economies whereby, firms coming from the same industry or same line of business tend to flock together leading to what is known as clustering activities. The formation of clustering activities will act as a signal to other potential investors about the business climate of that particular region, thereby increasing the attractiveness of a region/country as destination for FDI.. 1.2 Research Motivation and Research Objectives MNEs play a major role in bringing huge inflow of foreign capital, skilled labors, resources, and technology in the form of FDI. FDI increases the import and export level alongside increasing countries employment level and economic growth. In this modern world, fierce competition among MNEs both in the domestic as well as foreign market has pushed them to search for better opportunities in countries that best meet their requirements in terms of resources, technology, and market. Majority of MNEs that has undertaken FDI did not succeed due to their inadequate knowledge or information about a country economic and political structure. This has aroused an interest to find out the driven force and the underlying factors for MNEs success in FDI. The main objective of this paper is to find out the determinants that would enhance the probability of success in FDI undertaken by MNEs from four different angles as outlined below: 1) Home country government through various trade agreements, expansion of diplomatic ties and trade barriers will provide huge support for MNEs to engage in FDI.. 2.

(8) 2) The presence of abundance of factors in host country such as bountiful resources, political regime, governance infrastructure, presence of agglomeration economies as well as country location will enhance MNEs success in FDI. 3) MNEs by maintaining good political ties and undertaking lobbying activities with host country’s government as well as possessing good business ties with MNEs in host country, and also network linkage in the presence of ethnic ties will facilitate MNEs with the required information and hence increasing their success in FDI. 4) The happenings in the global environment taking the form of financial crisis, and changes in the business cycle, internet bubble as well as herding activities will determine FDI success rate of MNEs.. 3.

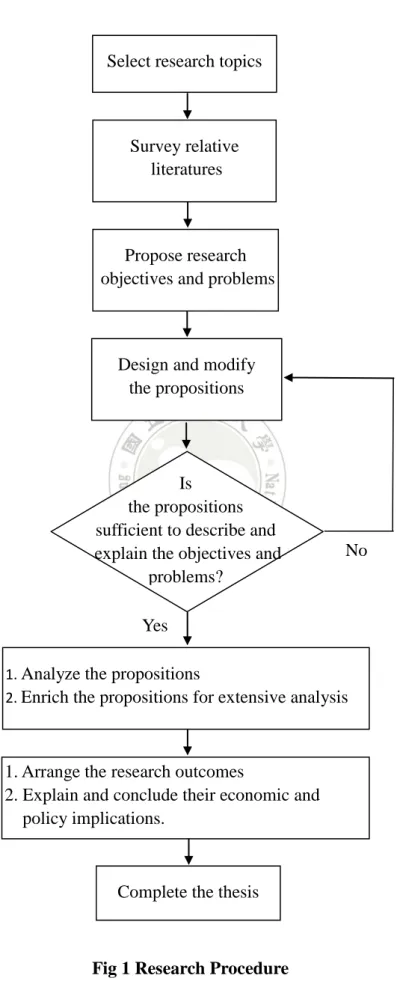

(9) 1.3 Research Procedure. Select research topics. Survey relative literatures. Propose research objectives and problems. Design and modify the propositions. Is the propositions sufficient to describe and explain the objectives and problems?. No. Yes 1. Analyze the propositions 2. Enrich the propositions for extensive analysis. 1. Arrange the research outcomes 2. Explain and conclude their economic and policy implications.. Complete the thesis. Fig 1 Research Procedure. 4.

(10) 1.4 Research contribution This study by providing a list of critical determinants will help in the decision making choice and locations for companies planning to invest in a foreign market and may also serve as guidelines for increasing the success of foreign venture.. 1.5 Research Structure The outline of the paper is divided as follows: Chapter 2 gives a brief overview of literatures related to FDI and its types, and what are the motives behind MNEs in undertaking such activities. In chapter 3, significant determinants behind every MNEs success from four perspectives as pointed out in chapter 2 will be raised in the form of propositions followed with a brief summary in chapter 4.. 5.

(11) Chapter 2: Literature Review 2.1 Foreign Direct Investment FDI is the investment activities of MNEs that operates overseas. According to IMF/OECD (2008),. 3. “FDI is the investment in a foreign country where foreign investor. owns at least 10% of the ordinary shares undertaken with the objective of establishing a lasting interest in the country.” According to Economy Watch (2010.6.30), “FDI is a type of investment that involves injections of foreign funds into an enterprise that operates in a country of origin different from the investor.”4 FDI is the flow of capital across national boundaries for maintaining control over production activities conducted by the firm’s overseas subsidiary, and for establishing service facilities and conducting business activities in a foreign market (Teng et al., 2001; Park, 2003). Lagendijk & Hendrikx (2009) considered FDI as prevailing form of corporate governance for gaining control over assets in a foreign country that are being achieved through property rights to foreign firms, whereby companies can exploit their ownership-specific advantages through a combination with location-specific advantages in a foreign country. Borensztein et al. (1998) regarded FDI in the presence of advanced technology as a tool used for transferring technology to increase economic growth of the host country rather than increase investment in the domestic market, thus having a negative effect on the economic growth of the home country. At the same time, due to poor absorptive capacity, FDI will crowd out domestic investment, external vulnerability and dependence, and destructive competition leading to concentration of power in the industry (Agosin & Mayer, 2000; Aitken & Harrison, 1999; Blomstrom & Kokko, 1995). The choice of choosing correct mode of entry into a foreign country is one of the very. 3. http://www.oecd.org/dataoecd/26/50/40193734.pdf (2010.11.29).. 4. http://www.economywatch.com/foreign-direct-investment/definition.html (2011.12.05).. 6.

(12) important strategic decisions that MNEs have to make. They can either choose to enter a market through Greenfield investment or Brownfield investment or FDI (Horizontal and Vertical). Beugelsdijk et al. (2008) separated FDI into two forms: (1) Horizontal FDI refers to production of goods in a foreign market that possesses some similarities with goods produced in the home market for the purpose of reducing transportation cost and trade barriers; (2) Vertical FDI refers to the fragmentation of production activities by outsourcing some of the production stages. In addition other authors like Klaus & Estrin (2001) defined another type of FDI: (1) Brownfield investment is a special type of acquisition whereby investor’s transferred resources will dominate over acquired firm resources; (2) Greenfield investment or project will provide investors an opportunity to create a completely new organization as per their requirements.. 2.2 The Motivation behind FDI For the purpose of attaining high return on economic rent, MNEs are driven to adopt FDI as an entry mode to gain access into foreign countries to seek for a new market, physical and/or human resources, technological know-how, and economies of scale and scope. These factors are the results of push and pull considerations.. A. Push Factors The three motivating factors that drive MNEs to engage in FDI are market-seeking, efficiency-seeking, and resource-seeking (Dunning, 1977, 1993). 1) Market-seeking is undertaken by firms in emerging economy to sustain the present market or to promote new market in countries that are in close proximity with each other to reduce transaction cost. 2) Efficiency-seeking is undertaken mainly to take advantage of different factor endowments, cultures, institutional arrangements, economic policies and market structures by concentrating the firm’s location only to a specific area to reap returns on the economies of scale and economies of scope.. 7.

(13) 3) Resource-seeking involves search for physical resources such as mineral oils and human resource, this also includes seeking specific technology like R&D for sustaining or advancing the firm’s global competitiveness. MNEs often choose investment locations that best meet their requirements. For penetrating into a foreign market MNEs would choose to opt for FDI in advanced industrial nations for increasing import level in host country. But if it is for procurement of resource advantages that can be exploited in export markets to increase trade surplus MNEs would prefer to endeavor in FDI in developing countries (Brouthers et al., 1996). In addition, maximization of profit MNEs would often take on illegal transactions like “capital flight” and “money laundering” (Perez et al., 2011).. B. Pull Factors Countries after having signed international trade agreements that provide certain investment provisions like tax incentives, tax holidays, tariff wall has been able to attract MNEs that are escaping from double taxation and or tariff jumping in their home country. Blonigen & Davies (2004) in their panel studies comprising of 88 countries between the years 1980-1999 on the Bilateral Tax Treaties on U.S inward and outward found due to tax reduction by tax authority such treaties are the driven force behind MNEs endeavoring in FDI. MNEs that are cost sensitive would often prefer to undertake investment in both developed and developing countries that have a high and low National Corporate Responsibilities (NCR) levels to search for low cost, skilled labor, better corporate governance infrastructure. Peng & Beamish (2007) by performing least squares regression (OLS) and random effect regression on 28 developing countries and 22 developed countries between the time period 1999-2003, examined the relationship between Japanese foreign direct investment (JFDI) and NCR environment in host countries found that, NCR level possess a positive relationship with FDI inflow into developing countries. However, MNEs with high Corporate Social Responsibilities wouldn’t prefer their investment in countries with weak environmental regulations, whereas MNEs with low CSR are more likely to go for. 8.

(14) investment (Dam & Scholtens, 2008).. 2.3 The Significant Determinants of FDI The decision making of MNEs with regard to investment in a particular country or region is determined by various factors and policies that differ in accordance with the country characteristics and the foreign investors’ requirements. How a host country can attract FDI depends on various factors such as abundance in physical and natural resource, government policies and so on. At the same time, the requirements of MNEs also play a significant role as they bring in advanced technology, skilled labor, and resources. MNEs to increase their chances of survival in a foreign country will utilize specific advantages such as product differentiation, managerial and marketing skills, innovation and technology and agglomeration economies to compete with rival firms so as to reimburse their cost of investment in a foreign country. The behaviors of MNEs for endeavoring in FDI are determined by heuristics behavioral rules such as herding, anchoring, and mental accounting (Pinheiro-Alves, 2011). MNEs to endeavor in FDI must satisfy the three conditions stated in the OLI paradigm (Dunning, 1993). (1) Ownership-specific advantages (O): are intangible assets such as property rights that tend to increase firms wealth and asset value. (2) Location-specific advantages (L): may favor either home or host countries such as spatial distribution of natural resources and markets, hence leading to an increase in the competitive advantages of firms. (3) Internalization advantages (I): reflect the ability of firms to exercise monopoly power over assets under their governance.. A. Home Country’s Perspectives Governments for enhancement of their country’s FDI level have become a member in international agreements like FTAs, PTAs, BITs, Customs Unions (CUs), and North. 9.

(15) American Free Trade Agreement (NAFTA) that are under the flagship of GATT/WTO. Taking active participation in international agreements will enable country’s government to provide a channel for early movers or late movers to gain entry into a foreign market. As stated by Buthe & Milner (2008) in their statistical analyses for 122 developing countries from 1970-2000, developing countries memberships in PTAs under the WTO has enabled them to received greater FDI inflow. In addition other scholars like Raff (2004) stated that creation of the European Customs Union in 1968 had led to significant inflows of FDI into US and Japan as well as FDI level in Mexico due to her active participation in NAFTA. Investment provisions agreements like BITs provide certain favorable treatments to foreign investors such as expropriation risk; disputes settlement and strong protection on property right will implant a positive impact on outward FDI as put forward by Egger & Pfaffermayr (2004) in their panel study on OECD countries outward stock of FDI. Developing countries being signatories in BITs have drawn in high amount of foreign investment (Tobin & Ackerman, 2011) and trade liberalization policies under NAFTA prompted several countries like the Latin American countries to open their market for foreign competition (Javalgi et al., 2010). The investment provision under NAFTA was mainly established to encourage FDI among member countries, as found by MacDermott (2007) in their examination on the relationships between RTAs and NAFTA on panel studies of OECD countries between the years 1982-1997.. B. Host Country’s Perspectives i. Geographical Distance Distance should be regarded as a measure of transaction cost for undertaking business activities in a foreign country (Bevan & Estrin, 2004). It is one of the most important factors considered by MNEs since market accessibility is one of the main motives in deciding location choice of FDI (Wei & Liu, 2001). Geographical proximity reduces managerial risk by lowering informational and managerial uncertainty, transportation, and monitoring cost (Davidson, 1980; Wei, 2004). Countries in proximate time zones with other countries are. 10.

(16) more adverse to competition as compared with countries that are at distant time zones (Stein & Daude, 2007). FDI flows are inversely related to the distance between home and host country as stated by Frenkelet et al. (2004) in their empirical studies on bilateral flows of 22 emerging industrial countries through application of gravity model. According to Wei (1995) a 1% increase in geographic distance will lead to a reduction in FDI by 0.39 %. It is one the most important factor considered by MNEs engaged in sourcing activities as pointed out by Pan (2003) in his study on FDI inflow in China between the years 1984 and 1996. ii. FDI Promotional Measures To attract foreign investors government that enter into tax sparing agreements provided under international agreements as discussed in the above sections and give certain incentives like tax incentives, tax holidays and imposition of tariff wall and corporate tax regime to their foreign counterparts will signal a favorable investment condition (Raff & Srinivasan, 1998; Simmons, 2003). The tax provisions under these agreements will have a positive influence on location choice of FDI as stated by Azémar et al. (2007) in their panel study of Japanese outbound FDI comprising of 26 developing countries between 1989 and 2000 found that high tax rate of 1% have decreased flow of FDI into Japan by 2.63%. This is an indication that tax rate imposed is one of the factors considered by Japanese firms while deciding on their location choice. Conversely, Egger et al. (2009) in their study on outbound FDI among OECD countries between the years 1991-2002 found that tax burden in home and host country are positively related to outbound FDI whereas it is negatively related with bilateral effective tax rates. For further enhancement of countries attractiveness as location of FDI, host country’s government has set up several FDI promotional measures like setting up of SEZs,5 Export Processing Zones (EPZs)6 and promotion of industrial parks. The coming up of such zones will serve as a promotion of economic growth (Ge, 1999) leading to overall economic 5. SEZs are duty free enclaves that are considered to be foreign territory for the purposes of trade operations and. duties and tariffs (Ge, 1999). 6. EPZs are areas set up inside developing countries to attract FDI meant for export-oriented production through. provision of incentives, and a barrier free environment to improve economic growth (Papadopoulos & Malhotra, 2007).. 11.

(17) development (Chaudhuri & Yabuuchi, 2010). Moreover, the presence of labor and capital in EPZs in developing countries will allows a country to be connected with the global economy and have the opportunity to attract FDI with minimum impact on the local economy. The presence of these zones (Wu, 2009) along with industrial parks will help in speeding up the economic growth of developing countries (Walcott, 2009) as foreign investors are drawn towards such areas to reap economic benefits like ease in communications, facilities that meet their requirement as well as access to labor pools. iii. Regime Types Host countries characteristics or regime types also play a key role in attracting foreign investors. Countries with democratic regimes are able to increase FDI level by giving strong protection of property right, reduction in transactions cost and risk incurred by foreign investors while holding back on MNEs oligopolistic or monopolistic behaviors, will assist MNEs to pursue for protection from foreign capital, thereby hampering FDI inflows (Li & Resnick, 2003). Other authors, Asiedu & Lien (2011) uses linear dynamic panel data model of 112 developing countries in the years 1982-2007 found that 90 countries due to their democratic regimes have received greater amount of FDI while others have a lower levels of FDI. This is an indication that democratic countries can receive either high or low level of FDI. iv. Governance Infrastructure A country with good governance will receive higher level of FDI (Morrissey & Udomkerdmongkol, 2011) whereas country with poor governance will deter both domestic investment and FDI due to high rates of return borne by companies; this was observed by Louie & Rousslang (2008) in their studies on 7,500 largest subsidiaries of US parent company in the years 1992, 1994 and 1996. Additionally, Seyoum (1996) based on empirical finding of 27 countries found that protection of intellectual property rights (IPRs) are one of the strong determinant when inward FDI is concerned. Other authors pointed out that strengthening of IPRs in developing countries will promote technology transfer particularly in large economies, and thus have a positive impact on FDI as found by Titus & Yin (2010) in. 12.

(18) their panel on 38 diverse countries from 1992-2005, followed by Yang & Cheng (2008) who through application of cournot duopoly model showed that either a strong IPRs protection or a higher tariff will attract FDI. A country is said to have good governance infrastructure if it can provide good communication facilities such as internet. Internet plays a very important role in bilateral FDI by enhancing transparencies in host country (Vinod, 1999). A 10% usage of internet is said to increase FDI inflow by 2% as observed by Choi (2003) on bilateral FDI of 14 source and 53 host countries. The network externalities created by internet have a two sided effect as observed by Ko (2007) in a two stage game model, the existence of negative network effect in developing countries discourages inward FDI whereas positive network effect reduces the distance effect on FDI and will attract more FDI. Of it internet is the most important channel of network effect especially for industries dealing with manufacturing and service (Lee, 2012). v. Financial Reforms Financial reforms that provide local capital at low interest rates draw in foreign investors (Tolentino, 2010; Takagi & Shi, 2011; Yang & Cheng, 2008; Biglaiser & Karl, 2006).Takagi & Shi (2011) studied Japanese FDI flows to Asian economies and found that devaluation in host country currency will increase FDI inflow whereas high exchange rate discourages it. Clegg & Scott-Green (1999) using comparable US and Japanese data on new FDI flows between the years 1984-89 found that, real depreciation in host country currency will have a positive effect on host country inward FDI due to an appreciation in home country currency. Similarly, Nagubadi & Zhang (2011) by using panel analysis between the years 1989-2008 for U.S. and Canadian forest industry found that bilateral FDI have a positive effect on the exchange rates and exchange rates volatility of host country. vi. Political Environment In countries, corruption and difference in level of corruption have a huge effect on both home and host countries (Habib & Zurawicki, 2002). Countries that have signed the OECD Convention on Combating Bribery of Foreign Public Officials in International Business. 13.

(19) Transactions7 attract relatively less FDI, as highly corrupted host countries are unlikely to receive FDI from home countries governed by laws against bribery, whereas countries with high level of corruption have higher level of FDI, as MNEs being exposed to high level of corruption at home country will seek for investment in countries with high corruption level (Cuervo-Cazurra, 2006). MNEs before going in for any kind of investment must take into account the perceived corruption level as found by Voyer & Beamish (2004) in their 29,546 investment sample studies investments of Japanese FDI in 59 countries industrialized and non-industrialized countries found that, absence of comprehensive legal and regulatory frameworks to curb deceitful activity would reduce FDI due to corruption. MNEs are also more likely to engage in such activity if and only if they posses social ties with government officials as stated by Collins et al. (2009) in their sample studies on Indian executives. Such falsified activities will slow down developing countries economic growth due to a reduction in investment level. On the other side, such activity has increased the investment level of newly industrialized economies in East Asia (Rock & Bonnett, 2004). It is one of the hindrances faced by developed countries and not less developed countries, but only under FDI as observed by Wei (2000) through sample studies of bilateral investment between 12 source countries to 45 host countries showed that the corruption level in host country will generate a negative impact on MNEs. Egger & Winner (2006) in their studies on 21 home and 59 developed and less developed host countries also found similar impact. Another group of scholars in their studies on the developed countries and developing countries found that corruption is also positively correlated with FDI (Egger & Winner, 2005). An increase of Corruption Perceptions Index (CPI) by 1 unit will result in an increase of per capita annual GDP growth rate of 1.7% for all countries between the years 1999-2004 (Podobnik et al., 2008). Asiedu (2006) in their panel study of 22 countries between the years 1984-2000 found a positive impact of corruption on FDI level in Africa. In general, corruption will hamper international trade, whereas paying of bribe to custom officer will 7. This convention seeks to assure a functional equivalence among the measures taken by parties to sanction bribery of. foreign officials, without requiring uniformity or changes in fundamental principles of a party’s legal system.. 14.

(20) enhance import (Jong & Bogmans, 2011). Cross-border investment between home and host countries has also been affected by corruption distance between two countries. Karhunen & Ledyaeva (2012) utilizing dataset comprising of 1,341 firms with foreign ownership in Russia found that corruption distance and anti-corruption legislation are positively related to the shares ownership in home country. Corruption alone is not to be blame, both corruption and FDI are correlated. Robertson & Watson (2004) from results obtained from Corruption Perceptions Index (CPI) for the years 1999 and 2000 has shown that a rapid change in FDI has increased corruption level. Besides the above stated factors there are also other factors such as openness to international trade, interest rates, exchange rates (Tolentino, 2010), institutional quality (Buchanan et al., 2012), and respect for human right (Shannon & Robert, 2007), visa regulations (Neumayer, 2011; Song et al., 2012), strict environmental laws and regulations (List & Co, 2000), natural resources, large market, inflation, an educated population, openness to FDI, and political stability (Asiedu, 2006) need to be considered.. C. MNEs Perspectives i. International Experience MNEs during their initial stage of entrance into a foreign market often face substantial “liability of foreignness” due to insufficient knowledge or lack of information about host market environment. Therefore MNEs in order to succeed must possess experiential knowledge since experiential learning will influence the location choice within host country (Zhu et al., 2012), especially general international experience (Li & Meyer, 2009). ii. Psychic Distance The decisions of MNEs to enter a foreign market crucially depend on their knowledge of the market in the host country. MNEs prefer to invest in countries that are psychologically close with their own. As put forward by O’Grady & Lane (1996): “There is an implicit assumption that psychically close countries are more similar and that similarity is easier for firms to manage than dissimilarity, thereby making it more likely that they will succeed in. 15.

(21) similar markets”. Through studies conducted on Middle East firms Cuervo-Cazurra (2011) stated that: “before going in for international expansion, MNEs from developing countries will choose either to expand in other developing countries having low psychic distance but high market attractiveness, or to expand in developed countries, having high psychic distance and low market attractiveness.” On the contrary, MNEs from developed countries for their first foreign entry may invest in other developed countries, having a low psychic distance and higher market attractiveness. iii. Ethnic Ties Firm’s nationality plays a very important role on the location choice of FDI (Ulgado & Lee, 2004). Top manager’s ethnic ties matters the most in facilitating MNEs FDI location choice as found by Jean et al. (2011) by using data of 88 Taiwanese business groups, while Tong (2005) through standard gravity model found ethnic Chinese networks have helped in the promotion of FDI especially in countries with high bureaucratic quality. iv. Lingusitics The presence of linguistics skills also has an important part to play in the field of FDI. Languages are used as an informal source of expert power in multinationals (Marschan-Piekkar et al., 1999), and as a tool in economic interactions and a vehicle for. transmission of cultural values (Selmier II & Oh, 2012). Similarities in language have helped in boosting up U.S. import level and China export level (Guo, 2004) and in addition (Oh et al., 2011) through empirical results obtained from standard gravity equation found that speaking in a common language increases FDI by reducing transaction cost (Melitz, 2008) leading to an increase in the level of trade flows (Egger & Lassmann, 2012). Conversely, differences in language will act as a barrier between two trading countries and are negatively correlated with bilateral trade (Lohman, 2011). v. Political Ties For smooth business operations in a foreign market, MNEs must maintain good business relationships with local governments and firms in the host country. MNEs in order to maximize profits would endeavor in lobbying activities in both home and host countries.. 16.

(22) MNEs that have higher board independence are more likely to engage in lobbying (Koh, 2011). Louie & Rousslang (2008) based on Business International index revealed that companies in order to procure lower withholding taxes on cross-border payments of dividends, interest and loyalties from host country often tend to lobbies for tax treaty so as to encourage FDI with the treaty partner. vi. Agglomeration Agglomeration by generating a positive externality in local area and increasing productivity and profit of MNEs has been recognized as one of the important determinants of location choices. Chen (2009) by using empirical model initiated that local specialization, urbanization economics, and foreign-specific agglomeration have strong and positive impact on industrial FDI location in China. MNEs are normally drawn towards areas having mixture of industrial cluster characteristics with an agglomeration of foreign firms as observed by Majocchi & Presutti (2009) in their studies on FDI distribution, comprising of 3,498 foreign firms in the manufacturing industry in Italy. Similarly, Head & Swenson (1995) utilizing the location choice model found that industry-level agglomeration benefits play an important role in location decisions of 751 Japanese manufacturing plants built in the United States since the 1980s.. D. Global Environment Any change in the global business climate will affect the investment pattern of foreign investment. To attract the right investors, host country firms must have a clear understanding of host country business environment (Deng et al., 1997), as business environment does hamper FDI as stated by Kinda (2010) in his firm-level data across 77 developing countries. The global crisis or global tsunami that took place in the midst of 2008 starting from the United States had hampered the global economy, causing unsteadiness in both financial and real markets (Erdogan et al., 2011). The Asian financial crisis that occurred since late 1970s had led to severe economic disruptions in Asian countries like Indonesia, Korea, Malaysia, Singapore, Taiwan, and Thailand (Webber, 2009) and thus caused a significant impact on the business cycle especially in Asian economies. The emergence of such crisis has led to global. 17.

(23) dollar liquidity (Rose & Spiegel, 2012) affecting access to credit by firms (Popov & Udell, 2012) and firms’ performance with respect to changes in business cycle, international trade, and external financing conditions, on firms' profits, sales and investment (Claessens et al., 2012). The onset of crisis will lead foreigners to herd more as compared with domestic investors (Bowe & Domuta, 2004). The formation of herding behavior is more evident in US and Latin American markets from May 25, 1988, through April 24, 2009 (Chiang & Zheng, 2010). Through the various lenses of literatures it is seen that MNEs success rate are highly dependent on a country demographic features, government promotional policies, global economic business environment, requirements, and business operations of MNEs.. 18.

(24) Chapter 3: Determinants of MNE’s Success in FDI Over the years, a boom in FDI has resulted in fierce competition among MNEs residing in different parts of the world. To compete with rival firms both in domestic as well as in foreign markets, MNEs are undertaking investment in countries that best suit their requirements. However, for the success of any FDI activities, both home and host country government must provide full support to MNEs, this is normally in the form of incentives, trade agreements, tax incentives and etc. Besides, other factors such as home and host country characteristics, global environment change as well as MNEs itself plays a significant role in FDI success. The document analysis method is adopted here, to set up and provide appropriate propositions concerning the key determinants for increasing MNEs success from the perspectives of home countries, host countries, MNEs, and global environment.. 3.1 Home Country’s Perspectives Home country government memberships in international trade agreements (BITs and NAFTA) will provide strong support for MNEs to engage in FDI by overcoming informational barriers (Raff & Kim, 1999) and solving FDI related issues like settlement of disputes, expropriation risk, and IPRs protection (Büthe & Milner, 2008; Egger & Pfaffermayr, 2004). Government investment expansion and diplomatic ties has led to diversification of economic relation away from increasing number of projects in neighboring countries (Harwit, 2000). Majority of firms especially those from emerging economies are using international trade as a springboard to acquire strategic resources with the aim of reducing market and institutional risk faced at home countries (Yiu et al., 2007). It can be seen that governmental support in the form of incentives and diversification of economic relation with other countries will encourage MNEs to engage in FDI. This raises proposition 1 as:. Proposition 1: Home Country government providing strong supports and/or incentives will promote MNEs’ success while engaging in FDI.. 19.

(25) In support of the above proposition, an in-depth analysis on the various key determinants that would promote MNE’s success during their endeavor in FDI is been discussed. For MNEs to undertake in any type of foreign trading activities, it is necessary to have strong governmental support, government can provide MNEs with important information that will be useful when undertaking investments in other countries. Government by taking active participation in international agreements such as BITs, NAFTA, and PTAs etc. can help MNEs to solve FDI related issues like expropriation risks, political outcries, removal of trade and investment barriers that MNEs might encounter when they undergo any types of cross border activities. Participation in international agreements has also been responsible for many developing countries being incorporated into the global capital and trade flows, leading to synchronization of business cycles with their main trading partners. For example, Mexico after coming under NAFTA due to elimination of non tariff barriers such as quotas, import licenses, reduction in tariff rates etc. has been able to attract greater inflows of FDI into export oriented assembly-line sector, banking, finance, energy and assembly line industry, but due to the small economy of Mexico the U.S. gained the least benefit (Ramirez, 2003). Under NAFTA the trading relationships between member countries has increased with trading activities in the U.S. being reoriented towards Mexico, this has led to economic integration and synchronization of business cycles between these two neighboring countries, whereby any changes in industrial activities in the U.S. will influence the demand for exports in Mexico and thus affecting the Mexican business cycles (Torres & Vela, 2003). Alternatively, NAFTA has also caused regional disparity between countries, leading to rich countries nearest to the region getting richer and poor countries getting poorer, and regions with dense population reaping the least benefits (Baylis et al., 2012). Besides creating a suitable platform for MNEs to endeavor in FDI, government can act as a pillar for MNEs success in FDI by providing them with necessary information and help them in solving any business disputes that are caused by social, political and economic environment. Many MNEs have lost their business deals due to lack of knowledge with regard to a country’s geographical variations, culture, business practices and so on. Moreover, government intervention also helps in overcoming any informational barriers that MNEs might encounter. 20.

(26) during their entry into a foreign market. For example, Taiwanese businessmen undertaking FDI in China often find difficulties in conducting business activities due to her complicated legal system. As one of the solutions, the government of Taiwan through the implementation of e-government facilities has provided on-line business legal contract to Taiwanese businessmen (Liao & Jeng, 2005). To expand international influences, countries are changing their destination for investment and are looking for opportunities in less developed countries or states that can offer full diplomatic ties as well as supports during voting time but on an occasional basis. For example, Taiwan diplomatic ties with Palau has increased the number of votes in Taiwan due to Palau’s membership in the United Nations and the increased tourist flow into Palau has created a vision in the minds of leader that setting up of tourism industry might be the right decisions (Harwit, 2000). Any action or policies undertaken by the government will have an impact on a country’s economy, this impact can be positive or adverse. When government impose economic sanctions like embargo, it will create an adverse impact on the country’s economy and lead to decline in investment growth rate, output per worker and capital. As a result of strict regulations on import, foreign investors often start to withdraw their investment from the country. For example, when the world imposed an embargo on South Africa to change its political system, many foreign companies withdrew or stopped their investments in the country, this caused an adverse affect on the economy, but when the embargo was lifted it led to an increase in average growth rates, investment, capital, and output due to tax relaxation (Coulibaly, 2009). Moreover, when the U.S. imposed an embargo on import of medicines on Cuba, it had resulted in a decline of mortality rates and nutritional levels on Cuba’s population which had caused rapid spread of infectious diseases (Garfield, 1997). Thus from the above discussions we can suffice that strong governmental support will help in facilitating MNEs success in FDI.. 21.

(27) 3.2 Host Country’s Perspectives FDI has pressurized governments to change their domestic economic policies for creating a suitable environment for foreign investors (Jensen, 2003). Government by providing tax incentives such as tax holidays, imposition of tariff walls (Raff & Srinivasan, 1998), lower corporate income tax rate (Klemm & Van Parys, 2012), and adopting various FDI promotional measures like SEZs, EPZs, and industrial parks (Chaudhuri & Yabuuchi, 2010; Wu, 2009; Walcott, 2009) has helped in speeding up the economic growth of countries. Moreover, host country with good infrastructural facilities (Kang & Lee, 2007), high respect for human rights (Richards et al., 2001), and her political regime (Asiedu & Lien, 2011; Li & Resnick, 2003) also enhanced herself as attractive destination for FDI. It can be said that host countries having abundance of favorable factors will help in draw in more foreign capital and lead to an increased FDI level in country. This raises proposition 2a as:. Proposition 2a:. Favorable business environment and attractive incentives provided by. host country’s government may facilitate the success of FDI undertaken by MNEs.. In support of the above stated proposition, a brief discussion on the significant determinants that will increase MNEs success in FDI is necessary. To pull in more foreign investment, government of host country will adopt various FDI promotional measures such as setting up several FTZs areas, will serve as an information and resource center for investors, helped cuts down information and communication cost as well as provides easy access to labor pools. To draw in huge amount of foreign investment such zones are connected to densely populated areas (cities) interlinked with good transportation and communication networks. For example, the affiliates of South Korean firms in choosing their location for FDI in China is being attracted to those regions approximated by economic zones, labor quality and transport infrastructure. This will have a positive influence on location decision of FDI (Kang & Lee, 2007).. 22.

(28) Governments through provision of attractive incentives such as profit tax exemption, accelerated depreciation, investment tax allowance, and subsidy for investment costs, (Nam & Radulescu, 2004), lower corporate income tax rate and longer tax holidays (Klemm & Van Parys, 2012) as well as concessionary tax rates (Tung & Cho, 2000) will attract foreign investors to invest in the country. For example, Buettner & Ruf (2007) found that tax incentives and statutory tax rates are important factors considered by German multinationals when choosing their location choice for FDI. Conversely, for transition economies tax incentives have no significant role to play in FDI (Beyer, 2002). Most important of all the country’s ability to attract FDI is determined by the country’s regime, that is whether country is a democratic or autocratic will define the patterns of FDI flows. Democratic countries have the abilities to attract more foreign investments, as such countries can insure their investors by lowering chances of imitation through strong IPRs protections, and due to their high respect for human rights they are less susceptible to political outcries that are bound to arise in any business activities (Shannon & Robert, 2007). Due to the presence of large number of veto players in the democratic political structure, the democratic countries will provide more credibility to foreign investors as well as minimize political risk i.e. tax and tariff rates (Yang & Cheng, 2008). However, the vast population and abundance of cheap skilled labor in democratic countries often lead to repression of human right, this is due to labor employed at a cheaper rate and restrained on MNEs oligopolistic or monopolistic behaviors. Thus creating a negative effect on the level of FDI in a country.. Due to rising environmental awareness several countries have tightened their pollution regulation policies against dirty industries that are normally present in unregulated economies that have opened their door to international trade. Such industries normally are not welcomed in countries with strict environmental laws, this is to protect the depletion of the natural resources of the country and instead dirty goods are imported from pollution haven industries. For example, Kahn (2003) found that the U.S. has been able to provide her citizens with a clean and healthy environment due to import of dirty goods from pollution haven countries like the African countries. From the above discussions it can be said that favorable business environment and. 23.

(29) attractive FDI promotional measures provided by countries can help in increasing MNEs success rate in FDI. The geographical location of host countries approximated by difference in time zones will create adverse affects on human, agriculture, business practices, country’s economic growth, communication and transportation networks due to distinct climatic conditions and they are also more susceptible to competition as compared with countries at distant time zones (Stein & Daude, 2007). Time differencence has been considered as one of the driving force behind international trade besides other factors like taste, technology and endowments (Marjit, 2007) and in determining industrial trade patterns (Kikuchi & Iwasa, 2010) especially business service trade (Kikuchi & Marjit, 2011). Countries in close proximity would lower informational and managerial uncertainty, transportation and monitoring costs (Davidson, 1980; Wei, 2004). Thus distance does indeed affect international trade and unequal geographical distribution increase wage inequality (Ma, 2006). The above discussions can be raised that geographical locations of countries will create conducive environment for FDI to take place as proposition 2b:. Proposition 2b: Host countries situated at pivot locations will facilitate the success of FDI by MNEs.. The motive of MNEs is to gain access to resources and markets for reaping the economies of scale and scope, and profit maximization. Due to rapid change in industrial trade patterns and consumer demands MNEs will choose industrial sites as per their requirements, this is irrespective of whether it is market or resource oriented. Therefore, countries with diverse economic and economic landscapes, suitable climatic conditions, population and manufacturing density alongside with good transportation facilities will attract more foreign investors and hence affect the overall business operations and firm’s performance. For example, Chadee et al., (2003) examined the location choice of foreign equity joint ventures dealing with service sectors in China found that normally business operations are located in large metropolitan cities due to the presence of advanced. 24.

(30) infrastructure and technology. On the whole, we can say that the geographical features of host countries will facilitate MNEs success in FDI by meeting their requirements as per their industrial activities. It has been recognized that the driving force for MNEs to engage in FDI differs across countries, this is in accordance with the nature of the business activities and requirements of MNEs. For FDI to take place three conditions must be satisfied as stated in OLI paradigm by Dunning (1977). The location of economic activity is determined by two groups of factors; the “centripetal forces” such as natural advantages of particular sites, market size, external economies, and pure external economies, while the “centrifugal forces” include market-mediated forces and non-market forces (Krugman, 1996, 1998). When undertaking FDI, MNEs need to consider factors such as market size, prospect for market growth, higher per-capita GDP growth, rapid infrastructural development, openness to trade, trade liberalization and high capital return (Wei & Liu, 2001; Asiedu, 2002). Thus from the above literatures it can be seen that presence of needed factors in host countries will increases the chances of MNEs success when they endeavor in FDI. This raises proposition 2c as:. Proposition 2c: Host countries having abundance factors which are needed by MNEs are more likely to succeed while engaged in FDI.. The ability of host countries to attract foreign investors is determined by several factors that a country can provide. To draw in more inflow of capital, the government must be willing to open the country to international trade, this can be done by becoming signatories in international institutions under the GATT/WTO. Such agreements will serve as a channel for firms to undertake investment in a foreign country by acting as an export base, and by giving certain favorable treatment it will help bring in huge foreign capital inflow. Rapid increase in international trade has prompted government of various countries to undertake radical transformation of trade reforms such as change in pricing structure and introduction of new techniques.. 25.

(31) Host countries approximated with abundance of resources, follow by large market size, GDP growth rate, and openness help draw in foreign capital. For example, Zhang & Daly (2011) in their studies on China outward FDI found that FDI, trade openness, market size and GDP growth rate are positively related with FDI, whereas resources are negatively correlated with FDI. Moreover, countries with high real per capita Gross National Product (GNP) and low deficit of balance of payment will also attract huge flows of FDI (Schneider & Frey, 1985). In addition, countries with large population density and resource availability will attract more foreign capital as firms can get labor at a lower cost due to huge supply of human capital and obtain available resources as per their requirements as well as large market size for marketing their products. On the other hand, unstable environment in countries governed by high political risk, inadequate social capital, lack of business entrepreneurs, managers and cultural block towards private savings and investment are some of the barriers that have prevented countries in Central and Western Europe from attracting FDI due to high country risk and unfriendly legal environment (Harri, 2000). In addition, bureaucracy in countries alongside with high corruption level often deters level of FDI in the country (Bénassy-Quéré, 2007). To summarize, it can be said that countries with abundance of favorable factors be it economic, social and political will attract greater amount of FDI, since they are in a position to meet the requirements of diverse groups of investors as compared with countries where due to certain obstacles will hinder promoting the FDI level of the country. On the whole, the success of MNEs is largely dependent on the country’s characteristics. Agglomerations by generating a positive externality in local area and increasing productivity and profit of MNEs have been recognized as one of the important determinants in deciding FDI location choices. The presence of agglomeration economies will reduce the research cost of MNEs that seek to operate their business operations in the same place within a foreign country (Birkinshaw & Hood, 2000), it will also contribute to the economic growth (Monseny & Olle, 2012) as huge number of firms are attracted towards such areas that have a combination of both industrial clusters and agglomeration (Majocchi & Presutti, 2009).. 26.

(32) From the above discussion, we can see that presence of agglomeration or clustering might facilitate MNEs’ success in FDI. This raises proposition 2d as:. Proposition 2d: The formation of agglomeration economies will facilitate MNEs success in FDI.. Agglomeration economies along with industrial development have a significant role to play while deciding location choice of FDI. The presence of such economies will help draw in foreign investors. Such areas interlinking the city’s core-periphery system with well diversified, comprehensive and interrelated system will enable firms to derive agglomeration benefits such as economies of scale, input sharing, infrastructure and manufacturing base and division of labor. Due to presence of intra-industry firms, it will induce firms to cluster and result in the formation of clustering activities. For example, Tuan & Ng (2004) found that agglomeration at core-periphery levels have affected the patterns of FDI flows in the nine Pearl River Delta economies that are in close proximity with Hong Kong. Firms to reduce their transportation cost tend to relocate their industries in regions or areas with good infrastructure, and good communication networks, densely populated region, and abundance of resources. Moreover, due to frequent interaction with related firms, MNEs from related industries will get useful knowledge and information. For example, Takeda et al. (2011) taking industrial structure of Yamagata in Japan found agglomeration of firms along the route 13 and Tohoku railroad signify the importance of transportation networks and inter-firm network as important determinant factor for FDI. Thus we can see that, gaining the benefit of economies of scale due to the presence of agglomeration economies will have a positive impact on MNEs foreign investment level. On the other hand, presence of agglomeration economies will result in negative network externality like increased congestion cost due to increased traffic flows in surrounding areas followed by increase in labor cost, land prices, scarce resources in the input markets as well as in the final market. Due to close proximity with firms from related industries, there is high chance of technology being imitated by rival firm’s leading to knowledge and technology. 27.

(33) spillovers. Moreover, clustering or agglomeration will enable employees to switch job within the same sectors. For example, Freedman (2008) revealed that clustering in software publishing industry will result in frequent change of jobs due to salary structures which is low at the beginning but becomes higher once the employees gain more experience. This signifies a negative impact of agglomeration on MNEs due to presence of diseconomies of scale. Overall, it can be seen that presence of agglomeration economies along with industrial clustering helps in determining MNEs success in FDI.. 3.3 MNEs Perspectives MNEs for smooth operations of their business in foreign market must build interpersonal relations with host countries firms as well as with the government officials. Managers by maintaining interpersonal ties with top executives of other firms as well as with government officials will help to improve the performance of organizations (Peng & Luo, 2000). Especially, during times of rapid technology change, building of business ties will be more efficient than political ties (Sheng et al., 2011). Furthermore, firms with higher board independence (Koh, 2011) to attain profit maximization (Jing et al., 2003) would engage in lobbying activities in both home and host countries. Along with encouraging FDI with treaty partners MNEs would lobby for tax treaties so that, lower withholding taxes on cross-border payments of dividends, interest and loyalties from host country can be obtained (Louie & Rousslang, 2008). From the above related literatures it can be said that MNEs by maintaining good relations with both host government and firms will facilitate their chances of success in FDI. Thus proposition 3a is proposed as:. Proposition 3a: MNEs that have political/business ties in host country are more likely to succeed while engaged in FDI.. Business ties are inter-organizational ties that firms build with main business partners in. 28.

(34) order to gain access to a much wider scope of knowledge, resources and complementary capabilities of partners engaged in innovative activities whereas political ties are informal social connections of firm’s with government administrative levels (Wu, 2011; Peng and Luo, 2000). The information accumulated from such ties will increase absorptive capacities and knowledge utilization of firms since such knowledge can be incorporated with the firm’s present knowledge. Building strong business ties enable MNEs to have close interactions with suppliers, manufacturers as well as with foreign counterparts they do business with, hence leading to transfer of knowledge and technology acquisition. MNEs by maintaining strong ties with suppliers will enhance their own innovative capabilities and strong relation with consumers, this will enable MNEs to adapt to the changing market trends through identification of new market needs. Maintaining good relations with business partners and suppliers is not sufficient to keep the organization running, what is more important is MNEs must also maintain strong network ties with government officials, this will provide investors with industrial information such as bank loans, tax breaks, and subsidies which are not easy to obtain without government support. Gaining an easy access to crucial information will increase the confidence of firms and they will be less hesitant to develop new products or technologies. Thus we can see that political ties plant a positive impact on firm’s performance. For example, Sheng et al. (2011) in their studies on 241 Chinese firms found that business ties are more affective in times of inefficient legal enforcement and rapidly changing technology. Conversely, political ties will lead to better performance only in times of weak governmental support and low technological turbulence. Too much political interference tends to reduce MNEs innovative capabilities as too much reliance on favorable treatment by government will decrease their incentives to improve their innovative efficiency and motivate MNEs to undertake illegal activities such as giving bribes to government officials that reduces their ethnic standards. MNEs apart from maintaining strong ties with both their business partners and host country government often chose to lobby with the government also. Lobbying is mainly a communication technique utilized by interest groups to create an influence on government. 29.

(35) officials privately or to get access to information within the same interest groups (Vercic & Vercic, 2012), it is normally conducted by both private and public sectors. Before undertaking any lobbying activities the lobbyist must be registered with the respective government agencies that they intend to influence. Lobbying activities conducted by foreigners will reduce imports trade barriers and hence shift trade policy in a direction that will enhance surplus of domestic consumers (Gawande et al., 2006). For example, the tobacco lobby enacted in the U.S. states legislature was a campaign held by tobacco industries for minimizing tax increase and legislation of clean indoor air to preserve company’s freedom in selling and advertising tobacco related products. The campaigns held by the tobacco lobbyist had excelled in preventing the states or government in enacting strict tobacco control laws and policies, and thus benefiting the tobacco industries, but causing harm to public health (Givel & Glantz, 2001). On the whole, it can be seen that maintaining strong business ties strengthen firm’s profitability, whereas too much reliance on political ties with government officials impede firm’s profitability and undertaking lobbying activities lead to maximization of firm’s profit but often at a cost. International experience is the knowledge accumulated by conducting business operations in foreign markets. The knowledge gathered from conducting business activities in different countries will help in the development of institutional knowledge (Chetty et al., 2006) and raise foreign investor’s equity position (Delios & Beamish, 1999), this will serve as a tool for enhancing alliance performance of firms through inter-firm knowledge transfer (Emdena et al., 2005). The experience of the top management plays an most important role in coping with the complexities caused by cultural distance (Hutzschenreuter & Horstkotte, 2012) and is considered as one of the most important factors as far as appointment of large corporations CEO are concerned (Magnusson & Boggs, 2006). Thus, it is sufficed that experience gathered by firms in conducting overseas business operations will help in facilitating MNEs’ success in FDI. Thus proposition 3b is proposed as:. 30.

(36) Proposition 3b: MNEs possessing good international experience are more likely to succeed while engaging in FDI. MNEs during their initial stage of entrance into foreign market are often faced with liability of foreignness in the host country due to differences in geographical, political and cultural aspects from their home country. MNEs throughout their investment period are often encountered with the challenge of communication (linguistics) with domestic firms, local suppliers and management, as well as discrimination by host country government, suppliers and consumers. For instance, the difficulties faced by Japanese affiliates in managing their U.S. employees have forced the exit of Japanese affiliates due to lack of experience in conducting their business operations in U.S. (Hennart et al., 2002). MNEs to build up their market presence must have a prior experience in host or other countries, for the knowledge accumulated will serve as valuable resources during MNEs expansion process which is often very expensive due to huge cultural gap between host and home countries firms. The experience gathered will help MNEs in obtaining accurate information of local market conditions, suppliers, and consumer demand in host countries. This will reduce the administrative costs of MNEs during their foreign operations and increased their preference for the existing projects in the country as compared with other investment options (Davidson, 1980). The international experience gained by MNEs is not sufficient for the success of any foreign investments, but instead sharing of international experience by top management level can help to remove complexity caused by cultural distance, hence enhance management team performance in FDI. Conversely, as firms get a better knowledge about host country market due to their long term of operation they tend to divert from the current market to a more distant market that are culturally less similar with their home country and thus have a negative impact on home country FDI level as put forward by Erramilli (1991) in his study on service firms in the U.S.. The knowledge of host market will also create a significant influence on MNEs mode of entrance that varies across family and non-family firms. Family firms due to lack of managerial capabilities would choose to partner with local firms through joint ventures. 31.

(37) whereas non-family firms, to keep an eye on their foreign subsidiaries would often adopt wholly owned subsidiaries, instead of seeking help from their local partners. For example, Kuo et al. (2012) in their study on public listed companies in Taiwan found that family firms while deciding on their mode of entrance are much more subjected to the influence of international experience than non-family firms. Overall, international experience possess by MNEs will increase their chances in FDI as they are in a much better position to acquire necessary information related to suppliers, local market conditions and demand due to good connection with partner firms in host countries as compared with MNEs with no prior experience in foreign market. While engaging in FDI, culture and ethnic ties also play a very important role in enhancing MNEs success in FDI. Host countries governed by low levels of uncertainty avoidance and high levels of trust will serve as attractive location for MNEs. But MNEs when undertaking FDI in the host country must maintain good diplomatic relationships (Tse et al., 1997) with their foreign counterparts. To increase their chances of success the presence of ethnic ties (Jean et al., 2011) and “Diasporas” (Tung & Chung, 2010) are very important as they serve as a channel of information exchange across national boundaries by lowering FDI cost. Therefore, it can be said that the presence of cultural similarities or/and ethnic ties with host countries firms will increase the chances of survival of MNEs in a foreign market. Thus raises proposition 3c as:. Proposition 3c: MNEs having cultural similarities or/and ethnic ties with host countries are more likely to succeed while engaging in FDI.. To understand proposition 3c more clearly it is mandatory to have a thorough discussions as to whether MNEs bearing similarity in culture or/and ethnic ties with host countries will increase their chances of success. In today’s world, the role played by culture is gaining significant importance in international trade as firms bearing cultural similarities (linguistics, custom, or religion) are much more trustworthy and easy to communicate, since they often have certain things in common, especially in historical ties (e.g. US vs UK; Taiwan. 32.

(38) vs Japan and China). MNEs to avoid chances of failure when investing in foreign market must bear strong social network and ethnic ties with host countries firms. Ethnic ties are informal social or personal networks bearing certain features like speaking a common language, nationality, ethnic groups and country of birth (Zaheer et al., 2009). The presence of ethnic ties in foreign countries serves to be an important channel for MNEs in home countries in obtaining accurate information about market condition, consumers taste and demand, business practices, rules and norms, supplier and buyers’ details, resource availability and so on in the host countries. The information obtained will be valuable resources for MNEs undertaking investment in foreign market due to their better understanding about host countries environment. Zaheer et al. (2009) in their study on ITEs industries of India found that Indian entrepreneurs in choosing FDI location will set up their industries in regions that have presence of ethnic ties. For smooth running of business operations in a foreign market, managerial ethnic ties are also important. Managers are the key personnel’s in a company that maintains regular contact with suppliers for ensuring continuous flows of goods, and interacts with customers to keep track on change in consumer’s demand and taste. The impact brought about by culture, especially linguistics links between home and host countries plays a very significant role especially in international trade where frequent interactions between MNEs in both countries are necessary. Most important of all, speaking the same native language in countries that bear certain similarities such as religion or historical ties, and speaking in common trade language (English) will be an added advantage when undertaking FDI (Oh et al., 2011), it can enhance bilateral trade flows by 40% (Egger & Lassman, 2012). Speaking a different language is an obstacle in international trade as in accordance with the Language Barriers Index (LBI), a 10% decrease in LBI might cause 7-10% down in trade flows between countries (Lohmann, 2011). The influence of language on international trade will differ in accordance with countries of origin, it might increase or decrease countries import and export levels. Guo (2004) found that language similarity will encourage exports in China but it increases import level in U.S. In summation it can be said that cultural similarities or/and ethnic ties are positively related with FDI.. 33.

(39) Though ethnic ties is one of the important factor that will help increase MNEs success in FDI, having strong networks tend to hamper MNEs performance sometimes. This is because firms can only see the demands of those within their network, as a result firms are uninformed about other better business opportunities otherwise is possible, if MNEs have a diverse network instead of restricted network. Hence referral benefits are omitted in ethnic ties (Burt, 1997). In summation, we can say that chances of success are higher in MNEs coming from same cultural background because people normally prefer to trade with those who speak in the same mother tongues due to cultural and historical ties and can trust them more as compared with people from different cultural background. Moreover, the presence of ethnic ties in foreign countries will act as a mechanism for MNEs in obtaining accurate information about host countries business, social and political environment.. 3.4 Global Environment With globalization, the world is undergoing a rapid transformation. MNEs are engaging fiercely in FDI to compete with rival firms to meet consumer demand for foreign products. This has resulted in change of international trade patterns. The happenings of financial tsunami, caused by the American subprime crisis and the bubble crash of the global real estate market in 2006-2007, has spread like wildfire, and results in global economic shrinkage (Hui & Chen, 2012), liquidity constraints (Blalock et al., 2008), and global dollar liquidity (Rose & Spiegel, 2012) will lead to co-movements of business cycles (Lee et al., 2003), and herding behavior in the global stock markets (Chiang & Zheng, 2010). From the above literatures it is seen that global environmental change and foreign disasters will generate a considerable impact on MNEs performance in FDI. This raises proposition 4 as:. Proposition 4: Global economic risk may affect MNEs success while engaging in FDI.. To further explain the proposition 4, a detailed discussion on how global environment. 34.

數據

相關文件

Students are asked to collect information (including materials from books, pamphlet from Environmental Protection Department...etc.) of the possible effects of pollution on our

S15 Expectation value of the total spin-squared operator h ˆ S 2 i for the ground state of cationic n-PP as a function of the chain length, calculated using KS-DFT with various

In consideration of the Government agreeing to grant a tenancy of the School Premises at a nominal rent to the IMC and providing financial subsidy, assistance and

Describe the purpose and types of expansion slots and adapter cards, and differentiate among slots for various removable flash memory devices Differentiate between a port and

Source: Kleinman, Liu and Redding (2020) International friends and enemies: Modelling the evolution of trade relationships since 1970... 外國直接投資 (FDI) from HK

The aims of this study are: (1) to provide a repository for collecting ECG files, (2) to decode SCP-ECG files and store the results in a database for data management and further

本研究除請教於學者專家外,在 1998 年版天下雜誌調查發布 在台灣地區 1000 大企業中,台鹽排名 414,在最賺錢的 50 家公 司中排名 13,但在最會賺錢的 50

This study therefore aimed at Key Success Factors for Taiwan's Fiber Active components Industry initiative cases analysis to explore in order to provide for enterprises and