DEVELOPING SUPPLY CHAIN DYNAMIC CAPABILITY TO

REALIZE THE VALUE OF INTER-ORGANIZATIONAL

SYSTEMS

Chang, Hsin-Lu, National Chengchi University , No.64, Sec. 2, Jhihnan Rd., Wunshan

District, Taipei City 116, Taiwan (R.O.C.), hchang@mis.nccu.edu.tw

Chen, Chien-Hui, National Chengchi University , No.64, Sec. 2, Jhihnan Rd., Wunshan

District, Taipei City 116, Taiwan (R.O.C.), 94356010@nccu.edu.tw

Su, Cheng-Hsuan, National Chengchi University , No.64, Sec. 2, Jhihnan Rd., Wunshan

District, Taipei City 116, Taiwan (R.O.C.), 94356016@nccu.edu.tw

Abstract

In face of increasingly complex supply chain, firms are taking steps to develop different kinds of inter-organizational systems (IOS) to facilitate information sharing and sustain competitive competency. These systems are expected to provide great business value, however many of them do not fulfill the expected promise as these systems are relatively more complicated and the usage is across supply chains. Built upon process theory and the view of dynamic capability, this study defines two types of supply chain dynamic capability (SDC) -- supply chain integration capability and supply chain cooperation capability and proposes that SDC plays a significant role in determining IOS performance. A general survey is conducted in Taiwan PC industry to validate the research model. A linear regression is used to testify the hypotheses. The results show that improving SDC can create greater IOS performance. Furthermore, supply chain integration capability has stronger moderating effect of IOS performance than supply chain cooperation capability. These findings contribute to the literature by confirming the influence of SDC on IOS performance and also by showing which SDC is of primary importance to firms.

Keywords: Inter-organizational systems, dynamic capability, supply chain integration, supply chain cooperation

1

INTRODUCTION

The Inter-Organizational Systems (IOS) play an important role between companies. Compared with traditional communication mediums such as phones or faxes, IOS not only cut down the working hours, but also eliminate the manual errors by handwriting. According to the Institute for Information Industry in Taiwan (2001), the usage of e-procurement systems in Taiwanese PC industry has hugely reduced procurement time to 18 minutes per order, improved stock level from 36 days to 20 days, and decreased 66% of the manual errors averagely every month.

In view of the high business potential of IOS, both researchers and practitioners have started to explore the ways to maximize the business value of IOS. However, for IOS investors it is usually difficult to determine which part of the revenue is gained from IOS investments. For example, the process theorists argue that the improved firm performance due to IT investments can only be achieved if firms successfully change their processes (Soh and Markus, 1995). They think that for a well-designed IT, appropriate use is equally important and propose that IT should fit firm’s task so that IT can play its role in a best way.

While appropriate use and task fit have been heavily discussed in the studies of IT investments, some other researchers start to notice that IT investment alone can not make organizations more effective unless they are accompanied by complementary organizational capabilities (Teece et al. 1997). For instance, to successfully realize the value from IT, firms require the capability to integrate their business processes, learn the best practices, and transform the old systems to new. Resource-based theorists term these capabilities as dynamic capability, the firm’s ability to use the internal and external resources to adjust the rapidly changing environments (Teece et al. 1997).

This approach, however, focuses only on individual firm’s internal capabilities without considering the capabilities that extend beyond the firms’ boundaries. The motivation of this study is therefore to understand dynamic capability at the level of supply chains. We define the concept of supply chain dynamic capability (SDC) and explore how SDC complements with IOS to maximize business value. In the sections that follow, we begin with a discussion on how IT investment impacts firm performance. Next, we provide an overview of process view and dynamic capability that form the theoretical basis of our work. We then develop our research framework, highlighting the concept of SDC. Following this, we build hypotheses representing the relationships between IOS investment, SDC, and firm performance. We test our hypotheses with the structural modelling technique, using data collected from managers in

2

LITERATURE REVIEW

2.1 IT Investment and Firm Performance

Typically, IT is evaluated at an aggregated level by linking IT expenditure directly to output measures such as productivity, profitability, and consumer value. For example, Loveman (1994) uses theory of production to estimate IT productivity. Grounded by theory of competitive strategy, Brooke (1992) argues that IT can contribute to more profits if it can not be replicated easily or it can make product differentiation. Barua et al. (1995) also posit that the only way IT can lead to sustained profits is to help the industry build barriers to entry. Furthermore, Hitt and Brynjolfsson (1996) use three measures to present the business profitability of IT: return on assets (ROA), return on equity, and total shareholder value. They also attempt to measure the customer value of IT by applying the microeconomic theory. They argue that when the price of IT declines, benefits are created not only because of the lower price for investments but also the new investments in IT that create additional

surplus. Moreover, Sircar et al. (2000) propose that IT can bring better sales, more assets, and improved markets.

Some researchers, however, do not think IT can directly result in better firm performance. According to Barua et al. (1995), they argue that firm level analysis may not provide meaningful guidelines to management because the analysis attempts to aggregate the impact of IT over many applications. They believe the effectiveness of IT is not uniform across all activities such as innovation, production, and marketing. Many other researchers also agree that the IT investments can not obtain financial outcome directly. These researchers apply process theory to explain the value conversion process between IT investments and firm performance. Their research is summarized in the following section.

2.2 Process View of IT Value

Markus and Soh (1993) are among the first attempts to investigate the barriers of IT value conversion. They find that IT expenditure can not directly contribute to firm performance because IT inputs can be wasted for the poor internal IT management. Similarly, Lucas (1993) proposes that task fitness and appropriate use of IT are the two necessary, but not sufficient elements to deliver firm performance. This concept has been further elaborated by Grabowski and Lee (1993) as “strategic fit,” fit between applications, strategic type, and cost structure. Accordingly, Markus and Soh (1993) add IT assets between IT expenditure and firm performance to explain the appropriate use of IT and posit that firm performance is affected by IT assets and other variables.

The IT assets model by Markus and Soh (1993) is further extended by Beath et al. (1994). They propose the concept of “leveraging IS processes” and argue that IT assets in terms of human, relationship, and technology deliver the business value by affecting three critical business processes: cycle time of development, productivity of operations, and strategic alignment of planning. These processes are more clearly explained by Sambamurthy and Zmud’s model (1994). In their model, corporate raw materials, including data, IT, knowledge of how to apply it, and so on are transformed to IT impacts through IT management roles and processes. These IT impacts can be shown as new/improved products and services, transformed business processes, enriched organizational intelligence, and dynamic organizational structures, which are necessary to improve the business value. Grounded by the process view indicated above, Barua et al. (1995) propose a two-stage valuation model, and demonstrate that the impacts of IT investments have positive influence at lower level in the organization and they can be traced and measured as five intermediate variables: capacity utilization, inventory turnover, relative inferior quality, relative price, and new product. They argue that IT impacts would be realized in these valuables first and conversed to firm performance such as ROA, market share, and shareholder value afterwards. The idea is applied by Lee et al. (1999) to evaluate the performance of warehouse as the result of adopting the EDI system. Instead of measuring firm-level financial performance, this research uses inventory level and stockouts level as indicators of IT impacts. If the two levels both decrease, it means that the system can help the firm and its partners have a better forecast. Then the firm will not only save the inventory cost, but also avoid the probability of losing the chance to sell more products.

In summary, the process view of IT value believes that IT investment can not increase firm performance directly. IT investment should fit firm’s task, and be appropriately used by employees before it delivers business values. When IT improves critical business processes such as reducing the time to deliver an order or to enhance the innovation of their products and services, firm can obtain better financial performance.

2.3 Dynamic Capability

Although process view of IT value has recognized the significance of IT impacts on organizational processes, it does not consider the impacts across organizational boundaries (Barua et al. 1995). Since

IOS is one kind of IT that involves the management of relationships among organizations. The performance of IOS can be constrained by the surrounding competitive and dynamic environment. Resource-based theorists suggest a set of dynamic capabilities that enable firms to cope with a complex and volatile environment (Grant 1996). According to Teece et al. (1997), dynamic capabilities are the firm’s abilities to integrate, build, and reconfigure internal and external competences to address rapidly changing environments. The definition is further refined by Eisenhardt and Martin (2000) that dynamic capabilities are the firm’s processes to integrate, reconfigure, gain, and release resources to match and even create market change.

Since dynamic capabilities can be seen as a series of innovative firm processes, according to process view we can argue that IOS performance may be improved if firms can enhance their dynamic capabilities. One recent research attempts to link IT investment with dynamic capabilities of firms (Rai et al. 2006). In their model, IT investment is transformed into two dynamic capabilities: IT integration capability and Process integration capability. Similarly, Banker et al. (2006) use a plant information system as an example to show that companies can enhance their manufacturing capabilities like just-in-time (JIT) manufacturing and customer & supplier participation (CSP) programs through system development. Their results show plant performance in product quality, product time to market, and plant efficiency becomes better by the IT and IT-enabled dynamic capabilities.

Above literature, however, focuses only on individual firm’s internal capabilities without considering the capabilities that extend beyond the firms’ boundaries. Hence, we develop the concept of Supply Chain Dynamic Capability (SDC) and propose that SDC can enhance the performance impact of IOS investment. The research framework is described in the next section.

3

RESEARCH FRAMEWORK

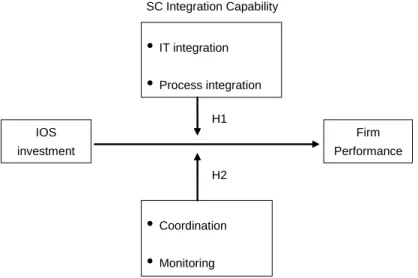

Our research framework is shown in Figure 1. The independent variable is IOS investment, which comprises all the required equipment, including hardware and software. Hardware comprises personal computers, servers, Internet enablers, and so forth. Software consists of the applications to support the tasks (Riggins and Mukhopadhyay 1994, Bensaou and Venkatraman 1995). Firm performance is the dependent variable, considering financial and relational improvement. We use productivity, business profitability, and consumer satisfaction to capture this construct (Hitt and Brynjolfsson, 1996). SDC are moderating factors. We highlight two components of SDC: supply chain integration capability and supply chain cooperation capability, which we will discuss in details in the section below.

IOS investment Firm Performance

•

IT integration•

Process integration•

Coordination•

Monitoring SC Integration Capability SC Cooperation Capability H1 H2Figure 3-1. Research framework

3.1 Supply Chain Integration Capability

Research on dynamic supply chains shows that firms require integration of processes and IT to counter uncertainties arising from competitive environment (Malhotra et al. 2005, Rai et al. 2006, Wang et al. 2006). Two specific domains of integration have been identified: supply chain process integration and

supply chain-related IT integration. From the dynamic capability perspective, integrated supply chain

processes are the source of performance differences in strategic alliances, virtual corporation, and technology collaboration. They are “routines for gathering and processing information, for linking customer experiences with engineering design choices, and for coordinating factories and suppliers” (Teece et al. 1997). Firms with higher levels of supply chain process integration are expected to be more aware of their environment (Malhotra et al. 2005). This in turn increases their capability to respond to supply chain dynamics.

Supply chain process integration cannot be implemented without the support of a well-integrated IT platform. Supply chain-related IT integration refers to the extent to which a firm has established data consistency throughout its supply chain and integrated its function-specific Supply Chain Management (SCM) applications with each other and with related Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) applications (Rai et al. 2006). In such integrated application infrastructures, firms have the ability to interface function-specific supply chain applications with each other in real time and integrate or synthesize information collected from their supply chain partners (Ranganathan et al. 2004). Supply chain-related IT integration is therefore the foundation for end-to-end management of supply chain, and a strategic weapon to deal with today’s hypercompetitive supply chain environment (Kalakota and Robinson 1999).

Past literature has told us that IOS can bring better firm performance if the IOS can work closely with current systems (Bensaou and Venkatraman 1995, Riggins and Mukhopadhyay 1994), link with as many trading partners as possible (Bensaou and Venkatraman, 1995), and integrate with business processes (Bensaou and Venkatraman, 1995). Rai et al. (2006) also mention that firms’ financial indicators can be enhanced if there is an integrated supply chain. We propose the following hypothesis:

H1: The degree of supply chain integration capability moderates the influence of IOS investment on firm performance.

3.2 Supply Chain Cooperation Capability

Many supply chain performance-enhancing technologies and innovations are driven by inter-firm cooperation activities. For example, many new product designs in the grocery industry can be traced to the pursuit of CPFR (collaborative planning, forecasting and replenishment) programs, by which retailers and manufacturers co-operate the best plans for product promotion and for introducing new products. From the dynamic capability perspective, the efficiency of inter-firm cooperation is dependent on inter-firm coordination and inter-firm monitoring and control. Inter-firm coordination is defined as the mechanisms which reduce the coordination costs between the firm and its partners. According to previous research, firms with good coordination with trading partners can reduce transaction costs, negotiation costs, and uncertainty about the opportunistic behavior, thereby having a positive effect on performance. Furthermore, better coordination between two parties allows them to work out difficulties such as power conflict, low profitability, and so forth. Hart and Saunders’s (1998) study utilizes the electronic dyadic as the unit of analysis (e.g., dyadic partnerships between two large target customers and their respective suppliers) to investigate how to affect EDI use and electronic partnerships further. They discover that a good inter-firm coordination is an important way for firms to take advantage of the opportunities while mitigating the threat of vulnerabilities posed.

Inter-firm monitoring and control is defined as the mechanism which monitors and controls the potential risks of supply chain cooperation. There are many internal and external risks that may affect the relationship between enterprise and trading partners and the performance of the supply chain. From the internal perspective, past literature refers that increasing the degree of inter-firm cooperation involves transaction risks for managing the interactions and results in underinvestment in explicit cooperation among supply chain members (i.e. the potential benefits of cooperation are not achieved), or in the interaction being managed within a single organization (potentially advantageous production economies from outside suppliers are sacrificed). Based on Clemons and Row (1992) and Kumar and van Dissel (1996), there are three major sources of transaction risk: transaction-specific capital, asymmetries in information, and loss of resources control. The transaction-specific capital is investment by one party that has little or no value in uses other than the specific interaction for which it was undertaken. Returns on such sunk-capital can often be appropriated by the other party, particularly in situations of high uncertainty that necessitate incomplete contracts. The second source of transaction risk, information asymmetry, arises due to the lack of information in supply chain related activities. Asymmetries in information can create problems in monitoring performance, which can increase transaction risk. The ability to arbitrage is presently enabled by information asymmetries inherent in the current coordination structure. The third source of transaction risk, loss of resource control, occurs when resources are transferred as part of the relationship and they cannot be returned or controlled in the event of the termination of the relationship. Unlike transaction-specific capital, the resources concerned are not sunk, but have values in other transactions. Further, information and know-how are the most important resources subject to loss of resources control, since firms are very difficult to control access and subsequent utilization of such resources. To reduce such risks, Clemons and Row (1992) suggest that transaction risks can be resolved by reducing the level of transaction-specific capital and by reducing the cost of monitoring and control among separate firms. Furthermore, pre-established concurrency control and security mechanisms can also reduce the possibility of transaction risks (Kumar and van Dissel 1996).

From the external perspective, uncertainty about the environment creates adaptation and information processing problems for a firm in the supply chain. For instance, owing to the volatility of demand, the company usually can not react to order change efficiently due to lack of timely information (Clemons and Row 1993). Bensaou and Venkatraman (1995) recognize that the uncertainty about the environment would create adaptation and information processing problems for a firm in the supply chain. In their work, different levels of uncertainty and complexity with corresponding different ways of cooperation are discovered and the findings show that the focal firm needs more commitments,

more specific technology investment, and longer period of contract to control and maintain their commercial exchange with trading partners while under a more dynamic and uncertain environment. As IOS often involves joint development efforts between firms and their trading partners, companies that cooperate with trading partners are able to benefit from their experiences with IOS, and thus, they may be more favorable to adopt these technologies and to use them in the cooperation activities (Sanchez and Perez 2005). In addition, IOS can encourage coordination by helping firms share confidential or proprietary information such as forecasts and order information with trading partners (Angeles and Nath 2000, Syer and Singh 1998, Soliman and Janz 2003). Monitoring is also an important mechanism to complement IOS investment. Researchers have mentioned that IOS can have better performance if firms and their partners can establish clear norms for business behaviors (Bensaou 1997, Dyer and Singh 1998), follow the industrial standards (Clemons and Row, 1992), and explicit regulations to measure the trading performance on a regular time schedule (Kumar and Van Dissel, 1996). We propose the following hypothesis:

H2: The degree of supply chain cooperation capability moderates the influence of IOS investment on firm performance.

4

RESEARCH METHODOLOGY

4.1 Operationalization of constructs

Four types of constructs need to be operationalized: (1) firm performance, (2) IOS investment, and (3) SDC. Table 1 gives the details of their measurements.

Components Items Measurements of IOS investments

IOS Investments

II1 Degree of technology investment in IOS (Riggins and Mukhopadhyay 1994) II2 Establishment of IT infrastructure (Bensaou and Venkatraman 1995, Iskandar, Kurokawa, and LeBlanc 2001) II3 Establishment of applications to support tasks (Bensaou and Venkatraman 1995) Components Items Measurements of Supply Chain Integration Capability

IT Integration SCI1 Degree of IOS integration with current enterprise systems (Bensaou and Venkatraman 1995, Riggins and Mukhopadhyay 1994) Process

Integration SCI3

Degree of IOS integration with each process, including procurement, manufacturing, materials management, and collaborative design processes. (Bensaou and Venkatraman 1995, Riggins and Mukhopadhyay 1994)

Components Items Measurements of Supply Chain Cooperation Capability

Coordination

SCC1 Related technologies and systems to gather information. (Clemons and Row 1993) SCC2 Sharing confidential or proprietary information (Angeles and Nath 2000, Syer and Singh 1998, Soliman and Janz 2003) SCC4 Successful implementation experience (Clemons and Row 1992) SCC6 Sending the timely, accurate, and complete information (Angeles and Nath2000)

Monitoring

SCC8 Pre-established security mechanisms (Kumar and van Dissel 1996) SCC9 Follow the industrial standard (Clemons and Row 1992)

SCC10 Explicit regulations to measure trading performance (Kumar and van Dissel 1996) Components Items Measurements of Firm Performance

Firm Performance

FP1 Profitability FP2 Productivity

FP3 Customer satisfaction

Table 1. Measurements for Constructs

4.2 Data Collection

The empirical verification of the proposed research framework is undertaken using a web questionnaire. We select a sample population of Taiwanese companies in PC and electronics industries since they have averagely higher adoption rate of IOS than other industries. Our target respondents are the staffs who have used e-procurement systems to transact with their supply chain partners, including the personnel who are in charge of procurement at the buyer side, and the sales representatives at the seller side. We mail to 825 professionals with a website linkage. The period for collecting data lasts for a month, and 160 returned. After deleting the ones without sufficient data, we get usable and complete 145 questionnaires. Therefore, the response rate is 17.57%.

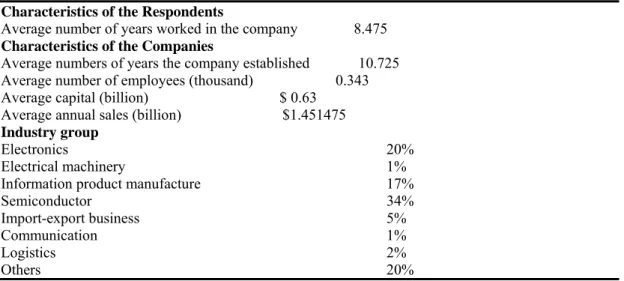

According to the profile they provided, we summarize the sample characteristics as the Table 2 below.

Characteristics of the Respondents

Average number of years worked in the company 8.475 Characteristics of the Companies

Average numbers of years the company established 10.725 Average number of employees (thousand) 0.343 Average capital (billion) $ 0.63

Average annual sales (billion) $1.451475 Industry group

Electronics 20%

Electrical machinery 1%

Information product manufacture 17%

Semiconductor 34%

Import-export business 5%

Communication 1% Logistics 2% Others 20%

Table 2. Characteristics of the study sample

4.3 Measure assessment

Factor analysis, reliability and validity analysis are conducted to evaluate the measurement properties of constructs. All the factor loadings are larger than 0.35, which meets Churchill (1979)’s requirements. The item-total correlation ranges from 0.639 to 0.816, suggesting these items are significantly correlated with the domain of their construct (Mahmood and Soon 1991). Except supply chain integration, with an acceptable reliability of 0.728, each of other factors has a Cronbach α

coefficient over 0.8. An overall reliability of the model is 0.946. The collective evidence suggests that the constructs demonstrate good measurement properties.

5

RESULTS AND DISCUSSION

5.1 Results

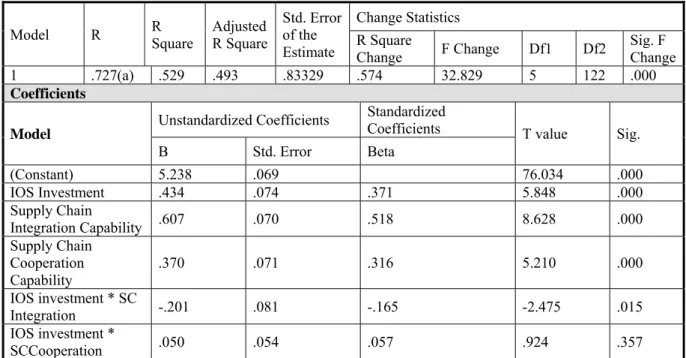

Linear regression is used to testify our hypotheses. As Table 3 shows, although supply chain integration capability can significantly moderate the impact of IOS investment on firm performance, with p<0.1, however, supply chain cooperation capability does not have the same moderating effect. The result supports Hypothesis 1, but rejects Hypothesis 2. We then conduct another linear regression analysis to testify the moderating effect of two proposed cooperating mechanism: supply chain coordination and monitoring. Table 4 indicates that the significant values of the two items are 0.034, 0.33. We also find supply chain coordination has significant moderating effect, with p = 0.015, but supply chain monitoring has insignificant moderating effect, with p = 0.440. Consequently, we can conclude that the result partially supports Hypothesis 2 that supply chain coordination is a significant moderator of IOS performance.

Model R R Square Adjusted R Square

Std. Error of the Estimate

Change Statistics R Square

Change F Change Df1 Df2 Sig. F Change 1 .727(a) .529 .493 .83329 .574 32.829 5 122 .000 Coefficients

Model Unstandardized Coefficients

Standardized

Coefficients T value Sig.

B Std. Error Beta (Constant) 5.238 .069 76.034 .000 IOS Investment .434 .074 .371 5.848 .000 Supply Chain Integration Capability .607 .070 .518 8.628 .000 Supply Chain Cooperation Capability .370 .071 .316 5.210 .000 IOS investment * SC Integration -.201 .081 -.165 -2.475 .015 IOS investment * SCCooperation .050 .054 .057 .924 .357

Note: Dependent Variable is Firm Performance

Table 3. Model of Full Factors

Model R R Square Adjusted R Square Std. Error of the Estimate Change Statistics R Square

Change F Change Df1 Df2 Sig. F Change 2 .727(a) .529 .493 .83329 .529 14.709 9 118 .000 Coefficients

Model Unstandardized Coefficients

Standardized

Coefficients T Value Sig.

B Std. Error Beta (Constant) 4.176 .449 9.298 .000 Supply chain coordination -1.036 .483 -1.088 -2.147 .034 Supply chain monitoring .410 .419 .537 .978 .330 IOS Investments -.293 .160 -.250 -1.828 .070 Supply chain monitoring * IOS investment -.057 .073 -.565 -.775 .440 Supply chain coordination * IOS investment .220 .085 1.962 2.577 .011

a. Dependent Variable: Firm Performance

Table 4. Model of supply chain cooperation capability

5.2 Discussion

From the statistical result, this study confirms that well-developed SDC can make IOS investment deliver better firm performance. More specifically, firm performance can be much improved if the introduction of new IOS can easily integrated with current enterprise systems and well embedded into the firm’s daily operation activities, such as logistics, procurement, material management, and collaborative design. On the other hand, with better supply chain coordination mechanism, a firm and its supply chain partners are willing to share confidential and proprietary information, such as the forecast, blueprints of products, and sales condition to each other. Consequently, they can jointly develop more complicated and collaborative IOS and deliver better firm performance.

The result of our study also indicates that supply chain monitoring mechanism does not play equally significant role in moderating the relationship between IOS investment and firm performance. We observe that the average mean value for the items of supply chain monitoring is 5.11, which is higher than those of supply chain coordination (the mean value for supply chain coordination is 4.90). It suggests that supply chain monitoring mechanisms such as security mechanisms, industrial standards, and explicit performance measurements are commonly existed throughout the marketplace. As a result, while supply chain monitoring mechanisms are increasingly a prerequisite for IOS development, they do not have actual influence over firm performance. Furthermore, although a good supply chain monitoring mechanism can complement IOS to enhance the degree of cooperation, the resulting competitive advantage for firm may not be sustainable, since other competitors may already adopt the same mechanism and undercut any potential benefit which can be derived by the firm.

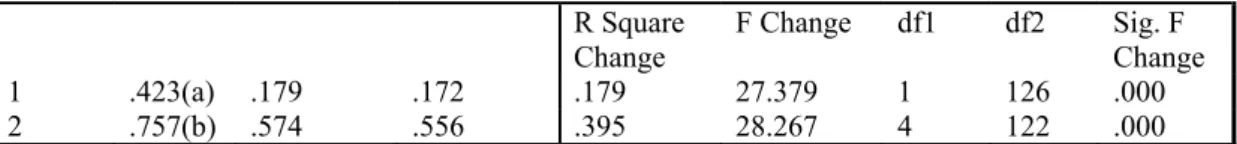

Our study also further justifies that IOS investment can not directly lead to firm performance. Moreover, SDC can help IOS deliver better firm performance. We use the following two models to explain this finding (Table 5). Model 1 includes only one predictor – IOS investment, supposing that IOS investment can directly affect firm performance. The second model adds two moderators -- supply chain integration capability and supply chain cooperation capability in addition to IOS investment. The result shows that Model 2 can explain 40% more of firm performance than Model 1. The result of the finding not only supports the process view of IT value but also extends the process view to consider IT value at the level of supply chains.

Model R R Square Adjusted

R Square Change F Change df1 df2 Sig. F Change 1 .423(a) .179 .172 .179 27.379 1 126 .000 2 .757(b) .574 .556 .395 28.267 4 122 .000

Model 1: Predictors: IOS Investments; Dependent variable: Firm Performance

Model 2: Predictors: IOS Investments (II), Supply chain integration capability (SCI), Supply chain cooperation capability (SCC), II * SCI, II * SCC

Table 5. Model Comparison

6

CONCLUSION

Prior researchers propose that IT investment can lead to firm performance (Brooke, 1992). Other studies, however, find it difficult to evaluate the benefits resulted from IT. Such conflicting view of IT value motivates us to investigate the value conversion process between IT investments and firm performance. Process view has asserted that well-designed IT should fit the firm’s tasks, and be used appropriately (Lucas 1993, Grabowski and Lee 1993). Barua et al. (1995) propose that IT investment has positive influence at operational level first, then bringing in better market share and ROA through operational improvement. Inspired by process view, this study aims to find out how IOS can help firms sustain their competency under a fast-changing environment. Built upon the dynamic view of resource-based theory, we propose two dynamic capabilities in supply chain management – supply chain integration capability and cooperation capability and develop a research model to examine the impact of both SDC on the relationship between IT investment and firm performance.

We collect data from 145 manufacturers in PC industry in Taiwan because this industry has a higher IOS adopting rate than other industries. Through the data analysis, this study proves that the relationship between IT investments and firm performance is significantly moderated by supply chain integration capability and supply chain coordination capability. More specifically, IOS investment in a supply chain with high degrees of integration and coordination can produce better firm performance. The result of findings also implies that in order to obtain better IOS performance firms have to integrate the IOS with current information systems and business processes and ensure that they are embedded well. Besides, to realize IOS value, it is important for firms to well coordinate with its trading partners, providing a mechanism for sharing important information such as inventory, sales condition, or forecast. These can make firms have a faster response to the market, enhancing their competitive advantage. Our study also shows that building a monitoring mechanism may not be very critical to the IOS investment, because monitoring mechanisms such as explicit regulations and performance measures have been widely adopted by Taiwan PC industry. The finding, however, can be further justified in cross-industry survey in the future.

The research model provides future investigators with a threshold to explore the dynamic capability concept. In addition to supply chain integration and supply chain cooperation, there are some other important dynamic capabilities such as learning (Tippins and Sohi 2003). Besides, the data collection in this study focuses on manufacturers in PC industry in Taiwan. Cross-industries and cross-countries survey can be pursued to further verify the results.

References

Banker, R.D., Bardhan, I.R., Chang, H., and Lin, S. (2006). Plant information systems, manufacturing capabilities, and plant performance. MIS Quarterly, 30(2), 315-337.

Barua, A.C., Kriebel, T., and Mukhopadhyay, T. (1995). Information technology and business value: An analytical and empirical investigation. Information Systems Research, 6(1), 3-23.

Bensaou, M. and Venkatraman, N. (1995). Configurations of interorganizational relationships: A comparison between U.S. and Japanese automakers. Management Science, 41(9)

Clemons, E., and Row, M. (1992). Information Technology and Industrial Cooperation: The Changing Economics of Coordination and Ownership. Journal of Management Information Systems, 9(2), 9-28.

Clemons, E., and Row, M. (1993). Limits to Interfirm Coordination through Information Technology: Results of a Field Study in Consumer Packaged Good Distribution. Journal of Management Information Systems, 10(1), 73-95.

Churchill, G. A. (1979). A Paradigm for Developing Better Measures of Marketing Constructs. Journal of Marketing Research, 16(1), 64-73.

Dyer, J. H, and Singh, H. (1998). The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Academy of Management Review, 23(4), 660-679. Eisenhardt, K.M. and Martin, J.A. (2000). Dynamic capabilities: What are they? Strategic

Management Journal, Oct/Nov, 1105

Grant, R.M. (1996). Prospering in dynamically-competitive environments: Organizational capability as knowledge integration. Organization Science, 7(4), 375-387.

Hart, P. J., and Saunders, C. S. (1998). Emerging Electronic Partnerships: Antecedents and Dimensions of EDI Use from the Supplier’s Perspective. Journal of Management Information Systems, 14(4), 87-111.

Hitt, L.M., Brynjolfsson, E. (1996), Productivity, Business Profitability, and Consumer Surplus: Three Different Measures of Information Technology Value. MIS Quarterly, June, pp. 121-142.

Kalakota, R., and Robinson, M. (1999). E-Business: Roadmap for Success, Massachusetts: Addison-Wesley.

Kumar, K., and van Dissel, H. G. (1996). Sustainable Collaboration: Managing Conflict and Cooperation in Interorganizational Systems. MIS Quarterly, 20(3), 279-300.

Mahmood, M. A., and Soon, S. K. (1991). A Comprehensive Model for Measuring the Potential Impact of Information Technology on Organizational Strategic Variables. Decision Sciences, 22(4), 869-897.

Malhotra, A., Gosain, S., and Sawy, O.A. (2006) Absorptive capacity configurations in supply chains: Gearing for partner-enabled market knowledge creation. MIS Quarterly, 29(1), 145-187.

Rai, A., Patnayakuni, R., and Seth, N. (2006). Firm performance impacts of digitally enabled supply chain integration capabilities. MIS Quarterly, 30(2), 225-246.

Ranganathan, C., Dhaliwal, J.S., and Teo, T.S. (2004). Assimilation and diffusion of web technologies in supply-chain management: An examination of key drivers and performance impacts.

International Journal of Electronic Commerce, 9(1), 127-161.

Riggins, F.J. and Mukhopadhyay, T. (1994). Interdependent benefits from interorganizational systems: Opportunities for business partner reengineering. Journal of management information systems, 11(2), 37-57.

Sircar, S., Turnbow, J.L., Bordoloi, B. (2000). A framework for assessing the relationship between information technology investments and firm performance. Journal of management information systems, 16(4), 69-97.

Sol, C., and Markus, M.L. (1995) How IT creates business value: A process theory synthesis. In Proceedings of 16th International Conference on Information Systems, Amsterdam, 29-41. Teece, D.J., Pisano, G., and Shuen, A. (1997) Dynamic capabilities and strategic management.

Strategic Management Journal, 18(7), 509-533.

Tippins, M.J., and Sohi, R.S. (2003). IT competency and firm performance: Is organizational learning a missing link? Strategic Management Journal, 24(8), 745-761

Wang, E.T., Tai, J.C., and Wei, H. (2006). A virtual integration theory of improved supply-chain performance. Journal of Management Information Systems, 23(2), 41-64.