Supplier Evaluation and Selection Criteria in

the Construction Industry of Taiwan and Vietnam

Chengter Ho Phuong-Mai Nguyen

National Kaohsiung University Hanoi University of

of Applied Sciences Business and Management

R.O.C. Vietnam

Ming-Hung Shu

National Kaohsiung University of Applied Sciences

R.O.C.

Abstract

To improve the quality of construction projects, it is critical to establish a better in-frastructure in the modern society. Also an effective supplier chain management (SCM) is required in the construction industry to ameliorate the quality of construction projects. As means of achieving successful SCM, the supplier relationship management which is the key position of suppliers in construction supply chain should be enhanced first. In this paper, a set of supplier selection and assessment criteria was adapted from Kannan and Tan (2002), to design the questionnaire for practical survey in Taiwan and Vietnam. The questionnaire for this survey was designed to find out how companies in the construction industry of Taiwan and Vietnam manage their relationships with suppliers and the actual range and importance of each criterion. Four hundred questionnaires were mailed to Taiwan and Vietnam con-struction companies, 200 in each area. Data from the survey were analyzed by using SPSS software version 12 for Windows. Descriptive data analysis was conducted to investigate the actual rank of supplier evaluation and selection criteria. Hypothesis testing for equality of means was also used to discover the differences between Taiwan and Vietnam in rating the criteria. Findings from this research were consistent with the results of the study of Kannan and Tan (2002). The results confirmed that non-quantifiable criteria play a very important role in the selection process and that the construction companies of Taiwan and Vietnam have come to an agreement in most of the criteria. It is implied in this study that Vietnam construction companies can gain knowledge from Taiwan counterparts particularly in management field in the coming future.

Keywords: Supply Chain Management, Supplier Evaluation Criteria, Supplier Selection Criteria, Construction Industry.

Received September 2005; Revised January 2006; Accepted April 2006. Supported by ours.

1. Introduction

Suppliers have always been an integral part of a company’s management policy. Fur-thermore, when firms are allocating more resources to their core competencies and en-couraging the outsourcing of non-core activities they have more reliance and dependence on suppliers. It is increasingly important that companies have strong relationship with their suppliers to stay ahead of competition. The establishment, development and main-tenance of the relationship between exchange partners are crucial to achieving success (Morgan and Hunt (1994)).

In the current international competitive environment, many manufacturers are focus-ing on supplier management as a means for achievfocus-ing sustainable competitive advantage. Supplier management is defined as “organizing the optimal flow of high-quality, value-for-money materials or components to manufacturing companies from a suitable set of innovative suppliers” (Goffin et al. (1997)). It is crucial for several reasons. Suppliers can have significant influence on a manufacturer’s performance through their contribution to cost reduction, new product design and enabling the constant improvement of quality (Monczka et al. (1998)). Consequently, studies of supply chain management (SCM) are now increasingly concentrating on the relationships between organizations involved rather than the traditional physical flow of materials and products. The supplier selec-tion and evaluaselec-tion processes draw even more concern from scholars and practiselec-tioners. Many scholars have argued about what criteria should be considered when selecting and evaluating suppliers and the importance of each criterion in the process. For examples, Lambert and Pohlen (2001) indicated that traditionally many companies use logistics focused metrics to evaluate their current and potential suppliers such as lead time, fill rate, or on-time performance. Along with the development of SCM philosophy, the range of criteria evolved a lot but the three core items are still to be used such as cost, quality and delivery performance. Monzka et al. (1998) suggested eleven categories that should be used in initial supplier evaluation process: supplier management capability; overall personnel capabilities; cost structure; total quality performance systems and philosophy; process and technological capability, including the supplier’s design capability; environ-mental regulation compliance; financial capability and stability; production scheduling and control systems, including supplier delivery performance; information systems capa-bility (e.g., EDI, bar coding, ERP, CAD/CAM); supplier purchasing strategies, policies, and techniques; and longer-term relationship potential. Tracey and Vodermebse (1999)

studied supplier selection criteria and supplier involvement impact performance by us-ing survey method. They focused on three primary relationships: supplier criteria and supplier performance, supplier involvement and supplier performance, supplier perfor-mance and manufacturing perforperfor-mance. The importance of supplier selection criteria was tested through six items: product quality, product availability, delivery reliability, product performance, product cost and service after sale. Besides, Juhantila and Viro-lainen (2002) recognized that the process of managing business relationships during all respective stages is a critical success factor. From this study, good supplier attributes which clearly stand out are: high quality, delivery accuracy, responsiveness and service, low competitive cost and competitive price. In addition, Kannan and Tan (2002) used a survey (total of 4,500 surveys were mailed) to examine relationships between the per-ceived importance of supplier selection and assessment criteria for items being used in production and business performance. Based on literature sources, thirty criteria used in supplier selection were identified. These items reflect a variety of supplier attributes including costs, quality, delivery performance, capability and culture.

However there has not been any general set of standards for supplier selection and evaluation. Purchasing firms use several criteria which do not seem to be identical even though these firms are of the same industry. It is due to the characteristics of the firms, the goals of their production and many other reasons. More effort should be therefore put to study the application of supplier assessment and selection criteria in a real context. The construction industry of Taiwan and Vietnam is then chosen for empirical study in this research work. The main purpose of this study is to identify what criteria the construction firms in Taiwan and Vietnam are deploying to evaluate and select suppliers. Moreover, comparison will be done to see whether there are any geographical similarities and dissimilarities.

2. The Present Situations and Problems Faced of Construction Industry in Taiwan and Vietnam

Fragmentation is one of big common challenges in construction industry particularly in Taiwan and Vietnam leading to the demand for improvement in supplier relationship management. Numerous projects have derailed from their original schedule, thereby increasing the project cost to unrealistic values. One of the reasons being that the tra-ditional model of planning, scheduling, controlling and contracting have each of their

functions, as different islands. The future wars in the construction industry would be fought mainly on three grounds: technology, improvement in the value chain, and world-class management practices. Any organization trying to win in the competition would no longer have to change their traditional methods of conducting business. SCM in construc-tion industry offers a way to integrate the tradiconstruc-tional islands, particularly subcontractors and supplier skills and competencies in order to achieve performance improvement and thereby reducing the cost and rewarding the business supply chain with sustainable growth (Dainty et al. (2001b)). The co-operation between main contractors (assembler), subcontractors and suppliers are subjects of SCM, and development of these relation-ships within the supply system towards arrangements of lean supply and partnerrelation-ships (e.g. Lamming (1996), Dainty et al. (2001a)).

Moreover, manufacturing sector has saved billions of dollars by suitably applying SCM model and particularly managed well with their relationship with key suppliers. Cost savings has led to better performance and sustainable growth because saved resources are invested in core activities of the company. This fact urges construction companies to pay more attention to supplier relationship management to overcome fragmentation problem. Furthermore, the current situation of Taiwan and Vietnam construction industry also raise a claim to enhance supplier relationship management.

Taiwan’s diplomatic isolation has resulted in local contractors trying to be as self-sufficient as possible. However, Taiwanese construction companies have capacity to tackle only a third of the major projects in this island1. Thus there comes a need to attract international contractors and raise construction standards to international levels. Since the construction sector was opened to foreign firms in 1986, around 30 foreign companies have been established in Taiwan. Nowadays, Taiwan construction market reports the participation of more and more foreign companies. However, wide ranging opportunities for equipment and material suppliers are recorded due to the scale of ongoing and planned construction work in Taiwan. Although Taiwan produces its own materials such as cement, steel, glass, ceramics, window and door frames, locks and hardware, Taiwan manufacturers do not have the capacity to supply both the level of demand and meet the increasing requirement for high quality products. Therefore, imports of products such as plasterboard, tiles, cement, adhesives, paints, fillers and bathroom/kitchen fittings have shown exceptional growth recently with US and Japanese products doing well and will

1A report on Taiwan construction industry

continue to expand in the time to come. On construction equipment, Taiwan imports several of its requirements and three main suppliers for Taiwan are Japan, US and Germany, the main European supplier who are in fierce competition with one another.

Taiwan is striving to meet its aims of providing its citizens with a better way of life and becoming a commercial and financial hub in the Asia Pacific. To attain these objec-tives, infrastructure projects in Taiwan need to be completed in high quality standard, on schedule, and within budget. Consequently, the input of overseas expertise will be essential. Moreover, continued representations from Taiwan’s trading partners on the need for a more equitable operating climate will also bring pressure for change.

Construction supply chains in Taiwan currently lack a set of business-to-business (B2B) process standard in construction industry, which results in each member in supply chains (including Supplier, Construction Companies, Customers and End User) paying a great deal of additional cost. The construction industry has to recognize the B2B process and the vital role of relationships between the firms and their suppliers in order to help construction companies, suppliers and all the related parties to provide better products and services. Consequently, better understanding of the mentioned issues will lead construction companies to sustainable competitiveness through better supply chain operations.

Although the construction industry of Vietnam has quite long time of development, it is still weaker than neighboring countries’ counterparts such as Thailand, Malaysia, and Indonesia etc. The industry thus aims to consolidate its position in the economy and strengthen its capacity to compete better with other counterparts. The 1990-decade marks a miracle change of this industry. During the 1991-1995 Five Year Plan, the Vietnamese construction industry has done many attempts and created an active and right change in its development duty. This change has taken an important part in the implementation of the nation’s socio-economic development duties. Results of business and production activities of the construction industry are shown through the following branches: Construction material production, Building, Works of urban planning, Con-struction management, Infrastructure and urban service development. Current promi-nent features of this industry are labor redundancy and low quality of construction ma-terial production. Moreover, one of the biggest issues in Vietnam construction industry today is that the concept of supply chain seems to be equivocal to many managers. Con-struction firms are operating independently and do not have long -term relationship with suppliers. That situation explains why the industry is not developed as other countries.

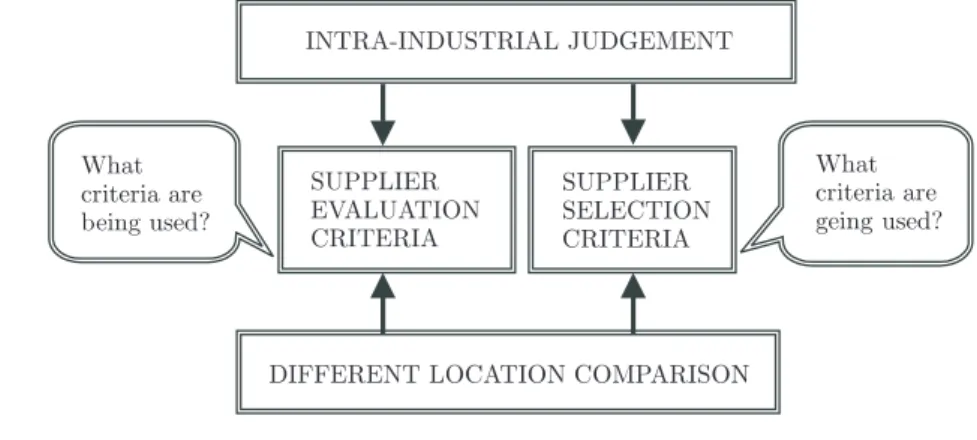

The fact shows that it is very important to manage supplier relationship by choosing the right criteria for the supplier evaluation and selection process particularly in con-struction industry of Taiwan and Vietnam. Thus the research constructs are supplier evaluation criteria and selection criteria. This research therefore attempts to discover how supplier selection and evaluation criteria are used in the construction industry of Taiwan and Vietnam. It adapts a list of criteria found from browsing previous studies and checks the importance of each item in the list through an empirical study in Taiwan’s and Vietnam’s construction industry. The research framework can be shown in Figure 1.

Figure 1. Research Framework.

3. Study of Supplier Evaluation and Selection Criteria

To achieve effectiveness in supplier selection process, a set of proper and meaningful criteria should be identified. Based on the Kannan and Tan (2002) research, we proposed a list of 13 criteria for supplier evaluation process and 30 for supplier selection process. Supplier evaluation criteria are grouped into 3 categories: delivery and service quality, information sharing and responsiveness. In each category, several variables are raised to measure performance of the whole category. As Kannan and Tan (2002) proposed, we use four variables to measure performance of the whole category: quick response time in case of emergency, problem, or special request; the flexibility to respond to unexpected demand changes; willingness to change their products and services to meet purchaser’s changing needs; willingness to participate in purchasing firm’s new product development and value analysis.

A proper set of supplier selection criteria supports purchasing firms. The Supplier selection criteria is divided into 6 groups namely the (1) Capability, (2) Ability to meet

buyers’ needs, (3) Honesty and Integrity, (4) Price, (5) Buyer- Supplier Fit, (6) Strategic Commitment of Supplier to Buyer. For each category, we followed the Kannan and Tan (2002) and suggested some variables to clearly identify their importance in the purchasing firm’s point of view. It is hard to apply any fixed set of criteria to evaluate and select suppliers. SCM practitioners base their choices on different criteria. There is no particular pattern for any firm. Therefore, purchasing firms must understand their firm’s context to effectively deploy evaluation and selection process.

3.1. Survey methodology

To acknowledge the differences of supplier evaluation and selection criteria that are being considered in Taiwan and Vietnam construction industries with those found from the previous studies, two sets of hypotheses are raised.

H1a: There is a consistency in the range of supplier evaluation and selection criteria in use, found from the empirical study in Taiwan and Vietnam with those of the previous researches.

H1b: There is no consistency in the range of supplier evaluation and selection criteria in use found from the empirical study in Taiwan and Vietnam with those of the previous researches.

H2a: There is a consistency in the level of importance of supplier evaluation and selection criteria in use found from the empirical study in Taiwan and Vietnam with those of the previous researches.

H2b: There is no consistency in the level of importance of supplier evaluation and selection criteria in use found from the empirical study in Taiwan and Vietnam with those of the previous researches.

Moreover this research also aims to discover the differences in using supplier evalua-tion and selecevalua-tion criteria in construcevalua-tion industry of two locaevalua-tions: Taiwan and Viet-nam. Consequently the following hypotheses are initiated. Hypothesis H3 is to test the difference in the range of the criteria.

H3a: The range of supplier evaluation and selection criteria used in construction industry of Taiwan and Vietnam is the same.

H3b: The range of supplier evaluation and selection criteria used in construction indus-try of Taiwan and Vietnam is not the same.

Hypotheses H4 and H5 are general hypotheses for all the evaluation and selection criteria to test the differences in the level of importance of the criteria between Taiwan and Vietnam.

H4a: The mean values of supplier evaluation criteria used in construction industry of Taiwan and Vietnam are equal.

H4b: The mean values of supplier evaluation criteria used in construction industry of Taiwan and Vietnam are not equal.

H5a: The mean values of supplier selection criteria used in construction industry of Taiwan and Vietnam are equal.

H5b: The mean values of supplier selection criteria used in construction industry of Taiwan and Vietnam are not equal.

Actually, for each criterion, there should be a pair of hypotheses to state the problem. The hypotheses have the format as follow:

Ha: Mean value of this criterion in Taiwan construction industry is equal to that in Vietnam.

Hb: Mean value of this criterion in Taiwan construction industry is not equal to that in Vietnam.

The hypotheses can also be written in this statistical form by using abbreviations.

µ : Mean Value

Ha: µT W = µV I E TW : Taiwan Hb : µT W 6= µV I E VIE : Vietnam

H4 and H5 that are mentioned above are got from the results of totalizing thirteen pairs of hypotheses for evaluation criteria and twenty nine pairs for the selection criteria.

The first main part includes 8 questions required to gather general data from the surveyed companies. These 8 questions are grouped into three subparts. All the questions except the first are multiple choice questions. The first subpart has three questions i.e.

questions 1 to 3. They are designed to know what industry the company is in, the position of the respondent in the company and the length of business operation of the company. The second subpart (question 4 to 6) has three questions relating to figures: (1) number of employees in the company, (2) paid-in capital and (3) estimated annual total revenue. Each question has four alternative answers ranging increasingly. The author intends to raise these questions, as these three figures help to identify the size of the company for further analysis in chapter 4. Then the author can decide whether these respondent companies meet the requirements of small and medium sized enterprises (SMEs) or not. A list of construction companies are randomly picked up from the industry indexes in Taiwan and Vietnam and a total of 400 construction companies of Taiwan and Vietnam are selected to be the sample for this study − 200 in Taiwan and 200 in Vietnam. The target respondents are managers and executives who have high responsibilities for man-ufacturing, and core activities in the company. These individuals are expected to know their companies better than others so that the validity and reliability of questionnaire surveys are ensured well.

A survey instrument using a self-administered approach is developed to collect data for this study. Through literature review, a basic survey questionnaire is designed and customized for construction firms, in two geographical areas of Taiwan and Vietnam. Therefore the survey questionnaires are translated from English into Vietnamese and Chinese, which are slightly different from the first part where a general company data is gathered. These differences have been mentioned in questionnaire design section in this chapter.

The survey’s first step was to pre-test the questionnaire for content validity and clar-ity with the participation of 3 academic members (1 professor from Taiwan for English and Chinese version and 2 professors from Vietnam for Vietnamese version) and 4 con-struction companies. Pretest questionnaires are not be used in subsequent analysis. The responses from the pre-test divulged that some minor items in the questionnaire should be revised. The first part- company general data - at the first time had the same al-ternative choices for both Taiwan and Vietnam then were changed to different ones. In the second and third parts of the questionnaire, some variables were reworded (particu-larly in Vietnamese version) for better clarity. No doubt for validity of the questionnaire content existed. All academic members agreed with the structure and content of the questionnaire.

The second step was to deliver a revised survey questionnaire to choose construction companies in Taiwan and Vietnam. A total of 400 questionnaires were mailed, 200 in Vietnam, and 200 in Taiwan. The method of delivery here was mailing which proved to have a higher response rate than the e-mailing but a lower rate than direct interviewing. The author chose this method as it was the most suitable method for this study consid-ering the constraints of time and cost. The total data collection period for this survey took two months including the pre-test .Thanks to the high interest and valuable help rendered by the respondents.

The survey started in September 2004 and ended in November 2004 including the pilot test and the final survey. It took almost two months to gather all data required. For the final survey, 400 questionnaires were mailed to construction companies in Taiwan and Vietnam - 200 in each location. In Taiwan, 35 out of 200 questionnaires were completed and returned to have a response rate of 17.5% and in Vietnam a total of 37 out of 200 questionnaires were returned back to have a response rate of 18.5%. These responses are used for the data analysis in following steps.

3.2. Major findings and discussion 3.2.1. History of sample companies

37.1% of Taiwan involved companies were established before 1986 while Vietnam, 16.2%. Most of the companies which responded from Vietnam were established between 1986 and 1995 accounting for 40.5% of the total number of companies. A few started their business after 2000. These figures reveal the fact that most construction companies are big ones and have long history of doing business.

3.2.2. Type of enterprises

The type of enterprise is defined by either of two standards: number of employees and paid-in capital or both of them. 54.3% of companies who responded where very small companies with less than 100 employees while 22.9% where large companies as they had more than 200 employees. Based on the paid-in capital criterion, 42.9% where large companies as they had more than NT$80 million paid-in capital while 37.1% very small and the rest where small and medium size enterprises.

For Vietnam construction companies, the two standards are slightly different. Most companies are of large size with more than 300 employees (accounting for 35.1% of the

highest position in evaluation process. In addition, commitment to quality and ability to meet delivery due dates are of the most importance in supplier selection process. This confirms the idea mentioned in previous study that non-quantifiable criteria usually have much more impact on the evaluation and selection process.

The t-test for equality of means help to answer the question about the dissimilarities between Taiwan and Vietnam construction companies in rating the criteria. As the sample size is large enough, the results of the survey have statistic significance. Therefore, decisions about the hypotheses H3a, H4a and H5a are believed to be confident. The third research objective is obtained with enough evidence.

6. Implications for Further Research

This research to some extent has completed the initial goals and made some contri-bution to Taiwan and Vietnam construction industry and academic studies. However, small sample size and time constraint are the limitations. In light of this research, there is much room for further investigation. Firstly, each industry has their own features and may have several different requirements from suppliers. Hence, further study should adjust the range of criteria to adapt to changes in the real context of construction indus-try. Secondly, further study will have more academic and practice value if it can expand the sample size. This study is limited in sample size due to the constraints of time and money so that survey results may neglect some minor aspects such as regional differences in the same location and differences caused by variety of enterprise size. Thirdly, the collected data in this study can be part of further study on the relationship of supplier evaluation and selection criteria with the construction company’s performance. Thus it is suggested to add some questionnaire items about the viewpoint of company man-agers of how these criteria are related to its business performance. Some of the factors to assess the firm’s business performance are: product quality, market share, financial ratios (return on assets, return on equity, and average inventory ratio, etc.), and overall competitive position in the market.

References

[1] Dainty, A. R. J., Briscoe, G. H. and Millett, S. J., Subcontractor Perspectives on Construction Supply Chain Integration. Supply Chain Management: An International Journal of Operations & Production Management, Vol.16, No.2, pp.183-196, 2001a.

[2] Dainty, A. R. J., Briscoe, G. H. and Millett, S. J., New Perspectives on Supply Chain Alliances. Construction Management and Economics, Vol.19, pp.841-848, 2001b.

[3] Giunipero, L. C. and Brewer D. J., Performance Based Supplier Selection Decisions System under Total Quality Management. International Journal of Purchasing and Materials Management, pp.35-41, 1997.

[4] Goffin, K., Szwejczewski, M. and New, C., Managing Suppliers: When Fewer Can Mean More. International Journal of Physical Distribution & Logistics Management, Vol.27, No.7, pp.422-436, (1997).

[5] Juhantila, O. P. and Virolainen, V. M., Buyers’ Expectation from Suppliers. Journal of Supply Chain Management, pp.1-25, 2002.

[6] Kannan, V. R. and Tan, K. C., Supplier Selection and Assessment: Their Impact on Business Performance. The Journal of Supply Chain Management: A Global View of Purchasing and Supply, pp.11-21, 2002.

[7] Lambert, D. M. and Pohlen, T. L., Supply chain metrics. International Journal of Logistics Man-agement, Vol.12, No.1, pp.16-32, 2001.

[8] Lamming, R., Squaring Lean Supply with Supply Chain Management. Journal of Business Logistics, Vol.9, pp.10-25, 1996.

[9] Monczka, R. M., Kenneth J. P., Robert, B. H. and Gary, L. R., Success Factors in Strategic Supplier Alliances: The Buying Company Perspective. Decision Sciences, Vol.29, No.3, pp.553-577, 1998. [10] Morgan, R. M. and Hunt, S. D.,The Commitment Trust Theory of Relationship Marketing. Journal

of Marketing, Vol.58, pp.37-43, 1994.

[11] Tracey, M. and Vonderembse, M. A., Building Supply Chains: A Key to Enhancing Manufacturing Performance. Mid America Journal of Business, Vol.5, No.2, pp.11-20, 2000.

[12] Van Goor, Watts, C. A. and Hahn, C. K., Supplier Development Program: An Empirical Analysis. International Journal of Purchasing and Materials Management, Vol.29, No.1, pp.11-17, 1993.

Authors’ Information

Chengter Ho is currently an Associate Professor in the Department of Industrial Engineering and Man-agement, National Kaohsiung University of Applied Sciences. He received his PhD in Industrial and Systems Engineering from the Ohio State University. His research interests are supply chain manage-ment, knowledge managemanage-ment, and product data management.

Department of Industrial Engineering & Management, National Kaohsiung University of Applied Sci-ences, Kaohsiung 807, Taiwan.

E-mail: hoc@cc.kuas.edu.tw TEL : +886-7-3814526 ext. 7113

Phuong-Mai Nguyen is currently a Lecturer in the Department of Business Management, Hanoi University of Business and Management, Vietnam. She received her MBA from National Kaohsiung University of Applied Sciences. Her research interests are operations management, supply chain management. Department of Business Management, Hanoi University of Business and Management, Hanoi, Vietnam E-mail: phuongmai2581@fpt.vn TEL : +84-4-9712898.

Ming-Hung Shu is a professor of Industrial Engineering and Management in National Kaohsiung Univer-sity of Applied Sciences, Taiwan. He received his PHD in industrial & manufacturing system engineering in 1996 from the University of Texas, Arlington, USA. He teaches quality engineering and management, fuzzy statistics, and logistics. His current work is to integrate the quality monitoring and diagnosis into the enterprise production management system.

Department of Industrial Engineering & Management, National Kaohsiung University of Applied Sci-ences, Kaohsiung 807, Taiwan.