科技部補助專題研究計畫成果報告

期末報告

創新的臺灣:臺灣企業發展與生產網絡--臺灣製藥業的創

新與發展(第 2 年)

計 畫 類 別 : 整合型計畫 計 畫 編 號 : NSC 101-2420-H-004-011-MY2 執 行 期 間 : 102 年 01 月 01 日至 102 年 12 月 31 日 執 行 單 位 : 國立政治大學國家發展研究所 計 畫 主 持 人 : 王振寰 計畫參與人員: 碩士班研究生-兼任助理人員:孫家偉 碩士班研究生-兼任助理人員:謝任翔 博士後研究:吳翰有 報 告 附 件 : 出席國際會議研究心得報告及發表論文 處 理 方 式 : 1.公開資訊:本計畫涉及專利或其他智慧財產權,1 年後可公開查詢 2.「本研究」是否已有嚴重損及公共利益之發現:否 3.「本報告」是否建議提供政府單位施政參考:否中 華 民 國 103 年 03 月 27 日

中 文 摘 要 : 本計畫研究臺灣製藥產業的傳承與創新。臺灣的製藥產業源 於 1930 年代,迄今為止,臺灣的製藥業仍多以家族經營的中 小企業、且以銷售國內市場為主的型態。但另方面,從 1990 年代開始出現的生技製藥業,則以歸國科學家的創業及國際 連結為主,它們與傳統製藥業有極大差別,不論資金來源、 知識類型、市場型態、和國家支持程度,都屬於兩個不同的 世界。本研究以企業史的觀點,探討臺灣製藥業發展的歷程 中,其知識和技術如何學習?第一代家長如何培育第二代, 而第二代又如何接掌企業,甚至持續進行企業擴張,其決策 和能力的培育機制為何?為何這些製藥業家族不能或不願跨 足生技製藥業?進一步,本研究也將探討生技製藥業的創新 網絡,包括創業者、資金來源、與研發機構和國際大藥廠之 間的關係,並與傳統製藥業做對照。本研究將選擇傳統製藥 業兩家和生技製藥業兩家作為個案來研究,並凸顯之間的差 異,並進一步探討其創新的不同類型。 中文關鍵詞: 臺灣製藥業、生技產業、創新、中小企業、企業史

英 文 摘 要 : The purpose of this research project is to study the development of Taiwan's pharmaceutical industry. Taiwan's pharmaceutical industry started in the 1930s, most of the firms up till now are family owned and domestic market oriented. But on the other hand, there has been a new development in the

bio-pharmaceutical sector in which most of the firms were created by returned scientists, they have frontier knowledge, targeted at international market and gained resources from venture capital, and most of all, the support from the state. The two sectors of the pharmaceutical industry belong to separated worlds. This study will adopt the business history approach to study the development of Taiwan's pharmaceutical industry, by asking the following questions: where did the knowledge come from? How had the founder educated the second generation to take over the enterprise? How has the second generation kept running the enterprise without losing its

competitiveness? Why have those pharmaceutical firms had not engaged into the biotech sector? Moreover, this study will investigate those newly formed bio-pharmaceutical firms' technological networks, financial resources, their relationship with global

Pharmas in order to compare with those traditional family-owned firms. This research will select at least two firms for depth case study in order to show the similarities and differences between the two sectors of Taiwan's pharmaceutical industry.

英文關鍵詞: Taiwan's pharmaceutical industry, Bio-pharmaceutical industry, Innovation, Small and Medium Enterprises, Business history

行政院國家科學委員會補助專題研究

計畫

□期中進度報

告

■期末報告

「創新的臺灣:臺灣企業發展與網絡:台灣製藥業的創新與發展」

計畫類別:□個別型計畫 ■整合型計畫

計畫編號:

NSC 101-2420-H-004-001-MY2

執行期間:101 年 1 月 1 日至 102 年 12 月 31 日

執行機構及系所:國立政治大學國家發展研究所

計畫主持人:王振寰 講座教授

共同主持人:

計畫參與人員:吳翰有(博士後研究員)

孫家偉(兼任助理)

謝任翔(兼任助理)

本計畫除繳交成果報告外,另含下列出國報告,共 ___ 份:

□移地研究心得報告

□出席國際學術會議心得報告

□國際合作研究計畫國外研究報告

處理方式:除列管計畫及下列情形者外,得立即公開查詢

□涉及專利或其他智慧財產權,□一年■二年後可公開查詢

中 華 民 國 103 年 3 月 6 日

II III 1 3 (1) 4 (2) 31 (3) 68 (4) 107 (5) 143 172 173

NSC 101-2420-H-004-011-MY2

2009 2010

2012/01/01 2013/12/31

1. Wang, Jenn-hwan. “Towards A Platform Builder: the State’s Role in Taiwan Biopharmaceutical Industry”,

"The Asian Developmental State: reexaminations and new departures" 2013 12 16-17

2. Wang, Jenn-hwan. “Towards A Platform Builder: the State’s Role in Taiwan Biopharmaceutical Industry”

"Geo-political Economies of East Asia." 2013 8 22-23

3. Wang, Jenn-hwan. Forthcoming. “Developmental State in Transition: The State and the Development of Taiwan’s Bio-pharmaceutical Industry.” In Developmental State for the 21st Century, eds. C. K. Lee, and Michelle Williams. London: Routledge. 4. 2013 2013 2013 11 31 12 1 5. 2013 2013 5 18

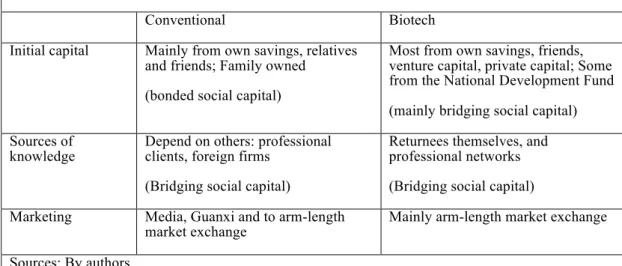

6. Wang, Jenn-hwan., and Han-yo, Wu. 2013. “Social Capital and the Emergence of Taiwan’s Pharmaceutical Industry: Comparing conventional and biomedicine firms.”

2013 3 8-9

7. 2012

1

Introduction

The developmental state thesis has been widely regarded as the major paradigm for explaining the rapid growth of the East Asian economies (Amsden 1985; Evans 1995; Haggard 1990; Wade 1990; Weiss and Hobson 1995; Woo-Cumings 1999). Based on Gerschenkron’s theory of the advantage of relative backwardness, this thesis argues that, in order to rapidly catch up with the developed economies, the states in late industrializing countries have to facilitate industrialization by either nurturing a small number of domestic firms to compete in the world market or by attracting huge numbers of foreign firms into the domestic market to diffuse technologies to local firms. Although this ‘developmental state’ thesis has successfully explained the rise of several East Asian economies, it has nevertheless encountered two major challenges in explaining the transformation of these economies. The first challenge comes from the political democratization process; this has brought interest groups into the political arena that have largely reduced the discretionary power of state bureaucrats. The second challenge comes from the nature of the innovation-based economy in which state bureaucrats may not have sufficient frontier knowledge in making adequate decisions to lead the economy. Thus the developmental state model may be useful in explaining an economy that is based on imitation for catching up, but it may not be very fruitful in accounting for the process of economic transition towards highly uncertain, front-edge and innovative industries (cf. Breznitz 2007; Wang 2007; Wang, Chen, and Tsai 2012; Wong 2004, 2005).

This chapter discusses the transformation of the Taiwanese state in promoting the development of the biotechnology industry in general and the biopharmaceutical industry in particular. Biotechnology has recently been recognized as one of the most dynamic engines that can drive the world economy towards a new stage. Being representative of the knowledge-based economy, biotechnology has also become one of the pillar industries that both the developed and developing countries are pursuing to advance their economic growth. Among the many different sectors in biotechnology, the biopharmaceutical industry is regarded as the most valuable industry in that it can generate most of the added value created in biotechnology-related industries. The typical features of this biopharmaceutical industry are its high risk, high input, and high return. The sheer dream of generating high returns has itself attracted many midlevel developed countries to follow in the steps of advanced economies to develop the biopharmaceutical industry in order to escape from the painstaking, low-profit-margin path of development that has characterized the manufacturing sector. Taiwan is no exception.

Having been influenced by the global tendency to promote biotechnology, the Taiwanese state also began to regard biotechnology as one of its pillar industries in the early 1980s. Nevertheless, despite the state’s involvement in promoting this industry, it achieved only a very small degree of success before the new millennium. It was only from the mid-1990s, when the state passed the law for the Promotion Programme for Biotechnology, known simply as the Biotech Action Plan (1995), that

the state’s determination was felt and the biotechnology industry began to take off. Currently many new science-based firms have been created and a number of new drugs are undergoing clinical trials and in the process of receiving US patents (Chen 2007). Although this achievement is not as dazzling as that of the semiconductor industry, which the state has been promoting since the 1980s (Mathews and Cho 2000), it still indicates that the state has moved ahead in transforming itself to be able to engage in this highly uncertain and innovative industry as compared with the case in the 1980s.

This chapter argues that there are two major factors which simultaneously contributed to the state’s failure and moderate success in helping give birth to the biopharmaceutical industry. The first was the industrial structure of the global pharmaceutical industry. In the past, the pharmaceutical companies had to engage in all stages of new drug development, namely the basic research and development (R&D), preclinical and clinical trials and marketing stages. Nevertheless, this vertically integrated process has, since the 1990s, been dramatically diversified into different segments, whereby many parts of the process can be outsourced. It is against this backdrop that Taiwan, India and China, among others, took advantage of the opportunity to engage in the biopharmaceutical industry in order to upgrade their economies. The second factor that affected the state’s effectiveness in developing the biopharmaceutical industry was the way in which the state intervened. Since innovation-based industries were full of uncertainty and there was none from which they could learn, state bureaucrats did not have enough information and knowledge to

help these industries develop. They either tended to use a model similar to one they were familiar with or adapted to the new environment by learning from networking with scientists and related stakeholders. In this way, the state learned to become a platform or node embedded in the global-local networks that link possible actors together to generate possible approaches, which however, they may not be certain will result in successful development. The state in this sense clearly cannot be the leader but must become an enabler of the development of the innovation-based industries.

I argue that the state’s failure in developing the biopharmaceutical industry in the former stage was due to the inadequacy of the Taiwanese state in terms of its ability to engage in this highly innovative industry by means of a top-down state leadership approach as well as the inability of Taiwanese firms to engage in this highly concentrated industry dominated by a few very large vertically integrated firms. At present, the Taiwanese state has been able to learn to take advantage of the window of opportunity through the opening of the global value chain by the global biopharmaceutical industry and by transforming itself into a platform builder, although in an incremental manner, which links various actors together to foster the emergence of the industry. This type of state

has fewer ingredients of state leadership in public–private networking, and places more emphasis on the importance of letting the market actors coordinate themselves. Thus, the state is still developmental in that it sets the development project as its policy priority and sets up a platform for interaction, but it then becomes a facilitator rather than an industrial leader. (Wang, Chen

and Tsai 2012, 485)

Nevertheless, I argue that the state’s transformation has largely been pushed by the Taiwanese scientists’ global networks rather than by the state bureaucrats’ farsighted planning. State bureaucrats have had to make choices in order to upgrade the economy. On this occasion, they depended on the scientific community to help to formulate the policies that, in turn, have enhanced the elements that are favourable to the development of this innovation-based industry.

Latecomers, Innovation and the State

Although the Gerschenkron version of the developmental state has its shortcomings in terms of accounting for the state’s role in fostering the economic transitioning towards innovation-based industries, as discussed above, the postdevelopmental statist theories nevertheless provide more fruitful clues to study the transition. The postdevelopmental state theorists argue that the state’s ability to lead the economy is not based on its authoritarian leadership but rather on its networking power. According to this approach, the state’s capability is based on its embeddedness in society rather than on policies implemented from above. State bureaucrats implement economic policies through social and policy networks that motivate the involvement of private capital, but they still retain some degree of autonomy in terms of the final decision making. The state’s leadership is thus based on building network relationships with businesses that have a feedback loop, so that policies can be discussed and transmitted beforehand. The state is insulated but not isolated from the society (Weiss and Hobson 1995).

This postdevelopmental statist approach goes beyond the state-society dichotomy and looks into the detailed mechanisms through which state bureaucrats interact with social groups and embed themselves in the society through which they bring about successful industrialization. Nevertheless, the postdevelopmental statist approach has not yet provided a persuasive case that can successfully show how a developmental state can lead its economy in the direction of innovation-based industries through the mechanism of ‘embeddedness’. For example, Tsui-Auch (2004) in a recent article, shows that although the Singaporean state still retained its autonomy and a coherent pilot agency in leading the development of biotechnology through the mechanisms of networking and austere steering, the results show only a very limited degree of success. The author argues that because the state wants to exhibit outstanding performance in the short term in order to justify its policymaking, the nearsighted bureaucratic requirements have thus severely contradicted the long-term and uncertain nature of the development of biotechnology. Through this case study, Tsui-Auch clearly argues that a coherent pilot agency with strong steering power in coordinating global-local networks is not a necessary condition for developing an innovative industry.

As another example, Ó Riain’s (2000) study on the Irish state in leading its economy towards the development of its information technology (IT) industry shows that a flexible developmental state is needed. This new type of developmental state is different from the bureaucratic developmental state in that it is flexible and embedded

in multiple levels of professional-led networks that, as a consequence, have brought about the development of an indigenous industry (Ó Riain 2000, 186). However, in general, what Ó Riain’s flexible developmental state thesis has shown is that the Irish state has been successful in developing the IT industry by enabling it to become fully integrated into the global production networks. He has shown little in terms of the issues to do with how the developmental state utilizes global-local networking to steer the Irish IT industry in the direction of innovation.

In order to develop innovation-based industries, the state has to be more of an enabler and a supporter than a leader. State agencies should act as flexible facilitating agents and should motivate private agents as much as possible to develop broadly defined and open-ended collaborations that facilitate knowledge flows. In this way they can induce the formation of multiplexed networks among the domestic and international financial and production networks and thereby build up innovation-based industries (Breznitz 2007, 29–31). This type of state can be referred to as a networking or a platform state, which is not very different from the neodevelopmental statist thesis. The development of this platform state is based on an evolutionary process that involves learning and the restructuring of power; because the state has no source from which to learn, it has to adapt to a new environment through trial and error. As Breznitz (2007, 31) contends,

at first, the network is hierarchical, but in the course of co-evolution I expect to find the network becoming denser and more heterarchial … with the state moving from a position of controlling the network to a position of … an

important node within a bigger and much more multiplex, larger, and diffused network.

In sum, the state can no longer be the leader in the developing innovation-based industries because it does not have frontier knowledge. Neither can the state pick the winners within the industries to develop because there are no winners to pick from. The state’s role now is to become a facilitator that can make it possible for information to flow on behalf of the stakeholders so as to create possible knowledge innovations, although such innovations cannot be guaranteed. In order to facilitate knowledge creation, the state must establish favourable institutional frameworks for the building of dense networks that promote the flow of information and learning. The state must now establish an innovation milieu that can induce R&D institutes to work with firms, facilitate venture capital to support innovative firms and improve conditions for firms to become linked to global innovation networks. The typical feature of an innovation-based industry is its high degree of uncertainty, as is the state’s choice in launching a new innovation-based industry. The state’s transformation in creating an innovation-based industry involves a process of uncertainty that can depend only on building global-local scientific networks.

The Transformation of the Global Biopharmaceutical Industry

The process of developing a new drug, from its discovery to FDA approval and to marketing, is a long process which involves basic scientific research in the initial stage, clinical trials in the middle stage and marketing in the final stage. All these

need strong capability in basic scientific research and global marketing strength, and few firms in East Asian countries, even Japanese firms, are able to establish a strong foothold in this area. In 2005, the 10 largest pharmaceutical firms generated net profits ranging from US$3.6 billion to as much as US$10.4 billion. The most profitable pill, Lipitor, a cholesterol-reducing product of Pfizer, had sales of US$12.1 billion in 2005 alone (DCB 2006, 181). It is because of expectations of high profits like these that many countries dream of entering this industry in order to upgrade their economies.

In the past, pharmaceutical companies adopted the full vertical integration approach in developing new drugs. Since the whole process can take about 12 to 15 years to complete and the total cost may amount to as much as US$800 million, very few companies in developing countries have the financial ability to enter the new drug exploration game. As a result, the world market has been dominated by a very small number of U.S. and European firms. Nevertheless, the molecular revolution since the 1980s has dramatically changed the process of developing new drugs (Comanor 2007; Dosi and Mazzucato 2006; Pisano 2006). During the past three decades, there has been a marked shift from the trial-and-error approach to drug discovery to one that attempts to use a scientific understanding of the biology of a particular disease to find the drugs for it (Nightingale and Mahdi 2006, 74–75; Comanor 2007, 55–58). This revolution in terms of the drug discovery process, plus institutional innovation in the United States, has dramatically changed the way in which the pharmaceutical industry is organized.

In the 1980s, a series of laws were passed in the United States to support scientists and universities to collaborate more closely with private firms, including the Bayh-Dole Act (1980), the Steveson-Wydler Technology Innovation Act (1982) and the National Competitiveness Technology Transfer Act (1989). As a consequence, many scientists became scientist-entrepreneurs and established new firms to engage solely in R&D as well as to sell their research results to big pharmaceutical firms before clinical trials were performed (Dosi and Mazzucato 2006; Pisano 2006). On the other hand, owing to the increasing cost involved in R&D, large pharmaceutical companies had the incentive to outsource this function to the emerging scientific research firms. A vertically disintegrated industrial structure was therefore created. As a result, these science venture firms have now become integrated into the commodity chain controlled by the big firms and they function like R&D departments of these firms (Nightingale and Mahdi 2006, 76).

The pace of outsourcing by the big pharmaceutical firms has been increasing rapidly in recent years owing to the sky-high cost of R&D. Now these big firms have the incentive to outsource their R&D activities to firms outside of the United States, such as those in Israel, Ireland, India, China, Korea and Taiwan. It has been estimated that outsourcing to these countries has been able to reduce R&D costs by 50% to 80% (DCB 2007, 67). This transformation of the global pharmaceutical industry has created a window of opportunity for the late-industrializing countries to enter this new science-based industrial arena.

The Top-Down State-Led Approach That Failed in the 1980s

Taiwan began to promote the development of biotechnology in the early 1980s, but it achieved only a very small measure of success. Although many pharmaceutical-brand multinational corporations (MNCs) had established branches in Taiwan before the 1980s, they had rarely diffused knowledge to local firms and local firms acquired their knowledge mainly through reverse engineering instead of through licensing from the MNCs. Therefore local pharmaceutical firms mainly produced generic or traditional Chinese herbal drugs for the domestic market.

Influenced by the global tendency to promote biotechnology, the Taiwan state also began to regard biotechnology as one of its pillar industries in the 1980s. In 1982, biotechnology was identified by the Council for Economic Planning and Development (CEPD) and the Executive Yuan’s Science and Technology Development Plan to be one of eight key technologies that would be developed. There were two major reasons behind this decision. The first was the competitive pressure from the nearby countries, as evidenced by the Singaporean and South Korean governments’ ambitious plans to develop their biotechnology industries. The second reason was that the state wanted to use this opportunity to upgrade the technological level of the domestic pharmaceutical firms. The state wanted to lead the development of the biopharmaceutical industry by using the mechanisms that were similar to those that promoted the semiconductor industry.

Since biotechnology was an industry that involved intensive R&D activities, the National Science Council was given major responsibility for promoting and coordinating the industry’s development, including recruiting scientists from abroad and screening technologies that could be imported and disseminated to local firms. The Development Centre for Biotechnology (DCB) was founded in 1984 and was designed to copy the successful model of the Industrial Technology Research Institute (ITRI, which was founded in 1974) so as to link the upstream R&D functions with the local downstream manufacturing firms. The state during this period set up two state-owned firms to produce hepatitis B and C vaccines, intending to acquire and accumulate related knowledge through this project.

As in the case of other frontier technologies, the major research funding for biotechnology mainly came from the state. Nevertheless, this research funding was very limited compared with that for the semiconductor industry. According to official statistics, the state’s budget to support the development of biotechnology in the first decade (1982–1991) following the launch of the project increased from NT$106 million to NT$2.77 billion, whereas the number of staff members working on this project also increased from 223 to 1,551. However, in relative terms, these figures were very small, even smaller than those for a medium-sized pharmaceutical firm in the international market. In contrast, the state devoted much more resources to the IT industry during the same period. The funding for IT increased from NT$1.42 billion to NT$14.6 billion, and the related personnel increased from 1,192 to 5,238 (NSC 1992). All these figures for the IT industry were much bigger than those for

biotechnology. As Wong (2005) observed, R&D funding in biotechnology was not a priority during the 1980s. Most of the state’s efforts were channelled towards information technology.

The Industrial Development Bureau of the Ministry of Economic Affairs was responsible for the promotion and implementation of industrial policies. Since biotechnology had already been regarded as one of the pillar strategic industries since 1982, many tax and policy incentives were generously granted so as to induce private firms to step in. The state also established a semiofficial organization – the Taiwan Biotechnology Organization – to encourage private firms to enter this industry. As in the case of the semiconductor industry, the state adopted a state spinoff approach to nurture the domestic pharmaceutical firms, which resulted in two state-owned firms producing the most needed hepatitis B and C vaccines. Again, as in the semiconductor industry, the state sought an international firm that was well known in the vaccine industry from which it would acquire the needed technologies. In 1984, the DCB collaborated with Sanofi Pasteur of France with the intention of transferring its plasma vaccine technologies on hepatitis B and C to a state-owned pharmaceutical firm. The Development Fund of the Executive Yuan invested in this firm, Baosheng Pharmaceutical, which was located in the Hsinchu Science-based Industrial Park. In the same year, it began to produce the vaccine, which was mainly supplied to the domestic market. Although the state-owned firm had acquired the then state-of-the-art technologies, it was not able to continue to catch up with the updated technologies on an ongoing basis. After a few years, its technological level stagnated. The state finally

decided to purchase new vaccines from abroad and this firm was closed by the state in 1995 ( Lin 1997; Yang and Lo 1999, 302–324).

The way in which the state promoted the biopharmaceutical industry during that period was a purely state-led one in which the state decided the policy, allocated the resources, set up a bridging institute and even established the firm to produce the vaccines. This model, however, had many aspects that were not conducive to the biopharmaceutical industry’s development.

First, the state’s planning agency had during that time channelled more resources into the IT industry than into the biotechnology industry. Moreover, the IT industry was strongly supported by K.T. Li (the main architect of Taiwan’s developmental state) and the then Premier Y. S. Sun (Mathews and Cho 2000). They not only strongly supported the development of the IT industry but also used their own social networks to recruit overseas Chinese who worked for major US IT firms to either return to Taiwan or become advisors to the Executive Yuan. Because of these factors, the development of the IT industry received not only strong official support from the state but also informal support from strong coordinators who could manage various ministries that were in charge of carrying out the state’s projects. By contrast, the biotechnology project was not so fortunate. Although it was listed among the eight pillar industries, the biotechnology industry did not have a strong supporter behind it that was could coordinate the various ministries. Neither did it have a strong figure that could form networks with overseas Chinese who had working experience with

major pharmaceutical multinationals. The major technocrats who all had backgrounds in industrial engineering had little knowledge of biotechnology. Even worse, owing to the lack of frontier knowledge, except in the case of the hepatitis B and C vaccines, the limited research funds provided by the National Science Council were allocated to various fields without any clear priorities.

Second, although the DCB was assigned the role of acting as a bridge with the intention of translating the results of the R&D into products and transmitting the resulting knowledge to private firms, it turned out that the DCB had become another basic science research institute. The main idea in establishing the DCB was to copy the ITRI model, but such an approach ignored the technological differences between the IT and biopharmaceutical industries. It was easier for IT products to be commercialized, and the IT value chain – from R&D, to pretesting, to pilot production and to mass production – was also much shorter than that of drugs. Not only were new drugs not easy to develop, but once they had been developed they still needed a long period of time for pretests and clinical trials in order to obtain the various government departments’ approval. However, the Taiwanese state at that time did not have that knowledge, and it sought to fit all of the industries it intended to promote into the same IT model. As a consequence, the DCB was forced to produce academic papers in order to meet the evaluation requirement without having the luxury of investing in the long-term process of developing new drugs that had a high probability of failure.

Third, the state had heavily relied on state-owned firms to produce hepatitis B and C vaccines and had not encouraged private firms to step into this industry. The state bureaucrats regarded the existing small and medium-sized pharmaceutical firms as too weak to develop new drugs and produce vaccines. In fact, they had not even tried, through the use of tax incentives, to persuade existing firms to collaborate with R&D institutes to develop new drugs. As a result, most of the existing pharmaceutical firms were merely producing generic drugs or Chinese herbal drugs without having been involved in the state’s new projects.

Finally, it was also very clear that the global industrial structure of the pharmaceutical industry during that period was not very favourable to newly industrializing countries engaging in this science-based industry. The value chain of the pharmaceutical industry at that time was still dominated by a few big multinationals that adopted a vertically integrated approach. The global outsourcing approach was just in the beginning stage. Under these circumstances, latecomer firms did not have the opportunity to enter this money-burning industry. The long process involved in developing a new drug also complicated matters, so that the DCB was not able to play a similar role to that of the ITRI in the case of the IT industry. The DCB was also unable to identify new drugs and then seek the help of the big international pharmaceutical firms to obtain the technology and transfer it to local private firms. Neither was it able to develop a new drug by itself and then transfer it to local firms.

By learning from its earlier failures as well as from the transformation that took place in the U.S. pharmaceutical industry after the 1980s, the Taiwanese state modified its approach and strategies in promoting the development of biotechnology in 1995. Between the launch of the Promotion Programme for Biotechnology (1995) and the very recent state project (The Biotechnology Take Off Package, 2009), the Taiwanese state gradually changed its policies and strategies so that they became based on the structure of the global value chain. In contrast with the former stage, the state’s role has now changed from being the leader to being the network builder as well as from being the main actor to becoming a supporter. In a very general sense, the state’s novel actions have been to seek to build the networks that can link scientists, firms and financiers together in order to generate the dynamic synergy needed to develop the biopharmaceutical industry. However, the route taken in this transition has been very rocky and many coordination problems still need to be solved. These are discussed further on.

The Taiwanese state’s transformation has had to do with two concurrent tendencies in Taiwan’s political economy. The first involved the democratization process, through which the state’s leading role in economic development has been in decline. This democratization process has led to a situation in which the state’s economic planning agencies, the CEPD in particular, almost lost their guiding and leadership function in the process of economic planning. The challenges have come about not only from the Legislative Yuan, where elected lawmakers voiced their own or their represented interests, but also from localities where local interests might resist the economic

planning of the CEPD or the policies implemented by the executive branches of the state. One of the best examples was the anti-Bayer environmental incident, when the central state invited and received a promise from Bayer, the German chemicals manufacturer, to invest in Taichung County (located in central Taiwan). This triggered strong reactions from local environmental organizations, which in turn led the county government to support the environmental groups and to resist adopting the central state’s decision. Bayer finally decided not to invest in Taiwan and moved the plant to China.

Second, along with the political democratization process, the Kuomintang (KMT) regime, which created the Taiwanese developmental state, lost the presidential election to the Democratic Progressive Party (DPP) in 2000. The DPP regime has been well known for its proneoliberal approach as opposed to a state-direct approach to the economy and for advocating Taiwan’s independence (Wang 2006). This had two major impacts on the development of the biotechnology industry. The first impact was that the KMT regime’s plan with regard to economic development was largely revised. The KMT regime’s decision to revise its policy on biotechnology had to do with its recruitment of prominent scientists overseas who would return to Taiwan to enhance and facilitate the development of science and technology. Among them, two were very significant. The first one was Dr Cheng-Wen Wu, a prominent specialist in virus oncology, who returned to Taiwan in 1988 to serve as the director of the Institute of Biomedical Sciences at Academia Sinica. Because of him, the KMT regime began to revise its biotechnology policies and planned to set up a new

National Health Research Institute (copied from the National Institutes of Health model for the United States) in 1996, which in turn would convince even more prominent scientists to come back (Wu 2006). The second was the return of the Nobel Laureate Yuan-Tseh Lee, who was then a professor at the University of California at Berkeley, to serve as the president of the prestigious Academia Sinica in 1994. Owing to his good academic connections with global and overseas Chinese in the United States, Lee convinced many internationally renowned scientists to return to Taiwan to work at Academia Sinica. These scientists had a great impact on the revision of biotechnology policies in the later years of the KMT regime. However, owing to the regime shift, the policies drawn up were either reevaluated or postponed. Second, the DDP regime’s proneoliberal approach to the economy also had a great impact on the development of biotechnology. The new director of CEPD in the new government (2000–2002) even cancelled the regular monthly meeting of the advisory board and downgraded the importance of cross-ministerial meetings in decision making. The successor to this position in the state hierarchy followed suit. As a result, the leading role exercised by the CEPD in the economy was greatly reduced. The result was that there was no leading state agency that could coordinate economic policies, which was a typical feature of the former KMT regime.

Nevertheless, it was clear that Taiwan’s economy had to be transformed into a knowledge-based economy and that the state still needed to facilitate this transformation. Indeed, the DPP regime put itself in a very awkward position by simultaneously holding onto its beliefs in the neoclassical economic doctrines while

also intending to move toward a knowledge-based economy. The state was in the process of finding a new model, but the state leaders had no clear ideas as to how to achieve the economic transformation. The chaotic coordination problems therefore continued in both policymaking and implementation. This feature was particularly apparent in the state’s plans to promote the biopharmaceutical industry. On the one hand, the state wanted to develop this industry and set up goals to achieve it; on the other, the state did very little to coordinate the activities of the various agencies or to promote the industry’s development in a more efficient way. As a result, the development of the biopharmaceutical industry was left in the hands of those returnees who had enough knowledge and enthusiasm to push the state to promote the industry.

As has already been mentioned, the return of prominent scientists such as Dr. Cheng-Wen Wu and Dr. Yuan-Tseh Lee had a great impact on the development of biotechnology in the later years of the KMT regime. They continued to recruit and attract more prominent scientists to return. The current president (2006) of Academia Sinica, Dr. Chi-Huey Wong, who is an internationally renowned specialist in bioorganic and synthetic chemistry, was recruited by Lee to work at the Genomics Research Centre in 2000. Another scientist, Dr. Michael M. C. Lai, a prominent specialist in molecular biology, was recruited by Lee in 2003 to work at Academia Sinica. These people’s social networks had a snowball effect in that they attracted more and more biotech people working in the United States to return. This situation was very similar to that of the IT industry in its earlier stages, when the returnees

contributed extensively to the networking relationship between Taiwan and the United States (Amsden and Chu 2003; Mathews and Cho 2000; Saxenian and Hsu 2001).

As a result of the participation of these specialists in biotechnology in the policy networks, many unsuitable laws and bureaucratic regulations began to be modified. For example, since 1997 the state has held the Strategic Conference on the Biotechnology Industry on an annual basis, bringing together not only local and overseas scientists but also firms and state bureaucrats to discuss issues related to the development of biotechnology. The status of the annual conference had been largely elevated since 2005, when it was singled out to become the Strategic Consular Committee for Biotechnology under the Science Advisory Group of the Executive Yuan, which stood alone as the most important committee in contrast with the Strategic Consular Committee of Science and Technology for the rest of the high technologies. Moreover, a biotechnology advisory group was formed afterwards to streamline the administrative work of a large number of state research agencies, such as Academia Sinica, the Ministry of Education, the National Science Council, the Ministry of Economic Affairs, the Council of Agriculture, the Ministry of Finance, the Environmental Protection Administration, the DCB, the ITRI and the Department of Health. Later, the National Health Research Institute and the Biomedical Engineering Centre of the ITRI (established in 1999 and renamed the Biomedical Engineering Research Laboratories in 2006) also joined this group, so that all related departments of the state would become part of the streamlining process. The latest

change was the legislation in the form of the Biopharmaceutical Act of 2007, which was the single most important law that had ever been designed for a specific industry. This act recognizes the fact that developing a new drug is so different from the activities of an industrial manufacturing firm that many tax incentives have been extended to help defer the expenses of R&D activities, of recruiting university professors (they were also given a certain degree of freedom to collaborate with private firms), of allowing university professors to create their own venture capital firms and of purchasing expensive R&D equipment. This law was the Taiwanese version of the Bayh-Dole Act of the United States, which was passed in 1980.

Along with the streamlining of the state policies and coordination functions, there were two other state actions that were particularly important to the promotion of the biotech industry. The first was the construction of biotechnology parks around the island after 2000 in order to create a cluster effect. Although many of the parks were creations of political campaigns revolving around periodical elections, there were still successful cases that indeed generated positive effects. The most successful case was the Biotechnology Plaza in the Nankang district of Taipei city, which was founded in 2003. This state-of-the-art facility was located near R&D resources and institutes such as the Academia Sinica, the DCB and many major medical centres. Furthermore, the National Health Research Institute, the National Science Council and the Biotechnology and Pharmaceutical Industries Promotion Office also established a presence in the park. The Nankang site has been focusing on biopharmaceutical research and has now become the key biotechnology cluster in Taiwan.

The second state action that was important for the development of the biopharmaceutical industry was the state’s input of financial resources. Since the implementation of the Biotech Action Plan in 1995, the state has channelled more financial resources into the biotech industry than it did before. The state’s actions include channelling resources from the Development Fund into a few exemplar firms, inviting privately owned venture capital companies with funding from the Development Fund to form new venture capital firms (NDF 2007–2009) and using tax incentives to induce capital to invest in biotechnology, as well as enhancing the special projects that call for collaboration between firms and universities. The financial support has increased over the years, from NT$6.7 billion in 1997 to NT$21.5 billion (approximately US$660 million) in 2006, which was approximately a 3.2-fold increase (IDB 2007, 117). Moreover, about NT$9 billion was invested in 20 different new biotech firms by venture capital firms (TVCA 2007).

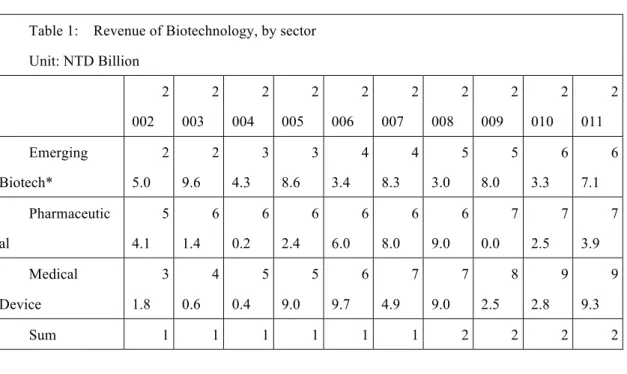

The state’s active role in promoting biotechnology has attracted much overseas and domestic investment to this industry. In 2006, there were 253 companies in Taiwan’s emerging biotech sector, with a total revenue of US$1.21 billion, of which many were created by overseas returnees from the United States; almost all of them were small and medium-sized companies. In addition, many of the newly established biotech firms were created after the late 1990s and were in the biopharmaceutical industry (cf. Chen and Wang 2009).

The state’s active new role in building global-local networks has created an environment in which many new science firms have emerged to develop new drugs or to engage in some segments of the value chain, such as producing active drug ingredients or contracting manufacturing for global branded firms. Currently, there are many newly established science firms that have contracted out their research results to large foreign pharmaceutical firms, who have then proceeded to apply to the US FDA for approval (Tseng 2008). There are a few reasons for the global linkage and the local delinkage of these emerging science firms. The first is that even though the state has tried to use its administrative power to persuade venture capital firms to enter the industry, Taiwanese venture capital firms lack the patience capital to finance such long procedures in developing new drugs. To them, the biopharmaceutical industry is a high-risk and money-consuming industry that has little guarantee of success. In addition, the state’s Development Fund should be distributed to a large number of firms rather than being concentrated on one or two firms. As a result, the new science firms are all very small and do not have enough resources to follow all the procedures in developing new drugs.

Second, many of the scientists who have come back from the United States, where they had worked for a long time, are very accustomed to the buy-and-sell model in the biopharmaceutical industry. The Taiwanese state’s policies to encourage the building of the biotech industry, plus the state’s active recruitment, have provided them with the incentive to come back. These scientists tend to think that creating the biopharmaceutical industry at the current stage is more important than building the

domestic industry, which may require a long time to become viable (Wong 2007). Therefore a link with the domestic firms, which is now missing, may have to be forged in order to develop the biopharmaceutical industry.

Third, Taiwanese firms have lacked the experience to do the research that is necessary to develop new drugs and, as a result, most of the new firms have concentrated on basic scientific research and left the applied research to the global firms. Moreover, the Taiwanese pharmaceutical firms are currently too small to handle the whole value chain process and they can produce only generic drugs. Although the DCB was designed to engage in translation research, it has not yet accumulated enough experience in this regard. The DCB has turned out to be just another R&D institute that has not developed the ability to engage in translation research (Yung 2009, 17). As a result, the new science firms can develop only new candidate drugs and sell them to big global firms in exchange for handsome royalties (DCB 2006).

To sum up, compared to the former stage, the state in this period has given up the role of top-down leadership and instead has become an enabler that has tried to encourage firms to enter the industry and has sought to link them up with R&D institutes and the global knowledge community. However, this transformation has not proceeded in a smooth manner and the political democratization process as well as the DPP regime’s neoliberal economic strategies have hampered the biotechnology industry’s smooth development owing to the lack of policy consistency and effective coordination. It has mainly been because of the scientists’ networks and their efforts in persuading and

pushing the state to implement effective policies that the formation of an environment conducive to the biotechnology industry has finally resulted.

Conclusion

This chapter compares the different approaches that the Taiwanese state adopted in developing the biopharmaceutical industry in the 1980s and in the period after the mid-1990s. It argues that the state’s failure in developing this science-based industry in the former period has to do with the top-down state-leadership approach, the lack of leadership and effective coordination, as well as the unfavourable international industrial structure that was dominated by a few giant global firms. In addition, the state during that period had invested limited resources in the biotechnology industry, with the consequence that the biopharmaceutical industry had achieved very little up to the mid-1990s.

From the mid-1990s on, owing to the democratization process and the lessons learned from the former failures, the Taiwanese state began to adopt a different approach. However, the regime shift hampered the new industry’s smooth development. In addition, the DPP regime’s administration in its initial stages further hampered the biotechnology industry’s smooth development as a result of the lack of an effective policy and coordination. It was, however, mainly the scientists’ networks and their efforts in persuading and pushing the state to implement effective policies that finally resulted in the formation of an environment conducive to the development of the biotechnology industry. The state finally became a platform builder, which has helped

to nurture the emergence of new science firms; these have been integrated into the global value chain controlled by a few branded pharmaceutical firms.

Therefore the transformation of the state in fostering the development of the biopharmaceutical industry has largely benefited from the involvement of those prominent scientists and their push for the modification of laws and policies. The DPP regime lacked key politicians who could coordinate different state bureaucracies to promote the biotech industry and it also did not have the vision or capability to plan the economy owing to its proneoliberal approach to the economy. These shortcomings caused the biopharmaceutical industry to develop in a less efficient manner. The passing of the Biopharmaceutical Act of 2007 indicated that the Taiwanese state’s support for biotechnology had moved to a new stage at which much more flexible approaches were designed specifically for this industry.

Nevertheless, owing to the existing industrial structure and the lack of capital, Taiwan’s development of the biopharmaceutical industry has resulted in its becoming only a segment of the global value chain controlled by giant foreign firms. The small Taiwanese science firms do not have the financial ability to proceed through all the stages in the process of the development of new drugs and they therefore tend to sell their candidate drugs to large global pharmaceutical firms. The irony has been that the state thus actually subsidizes the R&D activities of the global giants and the small science firms have neither the intention to work with the existing local pharmaceutical firms nor the capability to integrate with them. The state’s efforts in developing

this innovation-based industry have essentially resulted in it being the R&D segment of the giant global firms.

Note

1 This chapter is a partial result of a project supported by the National Science

Council of Taiwan (97-2410-H-004-077-MY3). It is also an expanded version of a comparative study of Taiwan, Korea, and China on the development of the

biopharmaceutical industry (see Wang, Cheng, and Tsai 2012).

2

1980 B 1995 2005 1 2009 2 TFDA 2011 2009 2011 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 1 2

2009 199-200 2011 GMP 3 generic drug 4 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 3 4 Bioequivalence BE

Biosimilar

2011

NSC-101-2420-H-004-011-MY2

GMP

National System of Innovation NSI Lundvall 1992 NSI

NSI

holistic !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

3-1

1980 B B 1981 1982 B 1984 B 1994 B 1999 1995 2003 2005 BioTaiwan Committee, BTC 2009 5 2007 2008 2010 35% !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 5

15% 2012 Ibid. I II (1) (2) (3)

(4) (5) (6) 2012 1 1 3-2 2010 27,088 20,798 15,482 63,368

19,460 254 1.3% 14,647 212 1.4% 11,786 61 1% 254 186 275 6 (1) (2) (3) 7 1999 Taiwan Medtech Fund, TMF

50 20% 10 20% 10 60% 30 TMF 2012 6 16 75% 37.5 20% 10 TMF SIC 11 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 6 7

2012 10 17 5 10 8 BVC 9 1995 99% 2002 7

2010 Diagnosis Related Groups, DRGs

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

8 2012 9

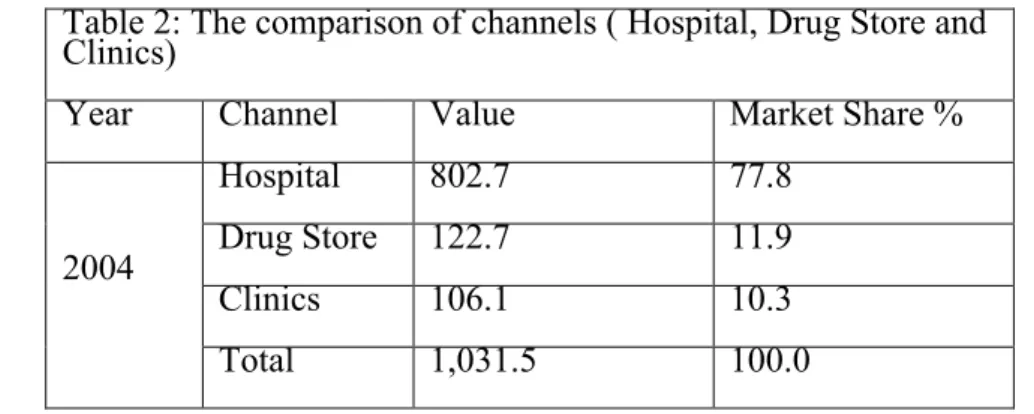

1017 4-1 1995 2004 2009 1 1 2004-2009 2004 802.7 77.8 9.0 122.7 11.9 5.7 106.1 10.3 14.0 1,031.5 100.0 9.1 2005 799.3 76.6 -0.4 134.3 12.9 9.4 109.6 10.5 3.3 1,043.2 100.0 1.1 2006 844.2 78.1 5.6 137.9 12.8 2.7 98.3 9.1 -10.3

4-2 10 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 10 1,080.4 100.0 3.6 2007 855.6 78.0 1.3 152.0 13.9 10.3 89.4 8.1 -9.0 1,097.0 100.0 1.5 2008 931.1 78.4 9.0 168.3 14.2 10.7 87.8 7.4 -1.8 1,187.2 100.0 8.2 2009 971.3 78.2 4.3 180.1 14.5 7.0 90.7 7.3 3.3 1,242.1 100.0 4.6 2011 104

15 16 2009 2 2 2009 106 1999 2011 ! ! ! CDE HTA ! ! ! ! ! ! ! ! ! !

11 40% 1 25 100-500mL 22 500mL 25 15 2009 2010 1. PIC/S GMP FDA/EMA BA/BE BE 2. 1996 622 2003 944 2008 1250 2004 21.6% 12.3% 17.7% 18.9% 14.2% 18.9% 2009 16,700 6800 2400 80 100 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 11

1200 40% 480 12 BA/BE 2 1999-2009 2009 60.5% BE 2006 17.1% 15.5% 24.2% 2005-2010 2007-2010 2005-2008 9.0% 2009 2010 8.5% 7.9% 2012 2 1998-2009 % 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 51.4 54.1 55.3 55.9 57.5 57.9 57.1 58.3 59.9 60.6 60.5 BE 13.5 14.2 15 15.3 15.1 15.6 16.8 17.1 15.6 15.3 15.4 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 12

35.1 31.7 29.7 28.8 27.5 26.6 26.2 24.6 24.4 24.1 24.2 2012 220 2012 BA/BE 13 4-3 1962-1984 150 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 13

1984

Drug Price Competition and Patent Term Restoration Act14

Abbreviated New Drug Application BE 15 10 12-15 5% 15-20%16 2005 2009 3 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 14 15 16

3 2009 % 32.7 79.4 7.1 51.2 11.3 7.7 26.3 62.7 3.3 22.7 7.4 7.0 22.1 100 7.1 67.8 13.9 11.5 19.3 84.4 17.1 45.3 15.3 5.8 19.9 90.7 12.8 29.3 2.8 5.4 2010 p.356 original …… 17 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 17

2009 2010 2009

2010 Norvasc Lipitor 2009 Diovan

2010 Plavix 4 2010 17% 15% 14% 14% 11% 71% 2011 4 2010 20 % 2010 2009 1 1 Norvasc Pfizer 22.63 -20.9 2 2 Lipitor Pfizer 15.79 8.7 3 4 Plavix Sanofi-Aventis 14.82 6.6 4 10 Herceptin Roche 14.19 64.1 5 5 Glivec Novartis 13.36 7.5 6 3 Diovan Novartis 12.17 -14.5 7 6 Crestor AstraZeneca 12.07 16.0 8 24 Baraclude BMS B 11.92 95.4 9 12 Enbrel Pfizer 11.00 36.0 10 67 Januvia MSD 10.10 185.8 11 57 Pegasys Roche B 9.83 146.9 12 8 Kogenate FS Bayer Schering 9.42 3.1 13 11 Nexium AstraZeneca 8.74 5.2

14 9 Recormon Roche 8.61 -4.2 15 15 Tazocin Pfizer 8.27 7.2 16 80 Humira Abbott 7.77 146.7 17 27 Forteo Lilly 7.74 34.7 18 21 Tarceva Roche 7.64 15.1 19 16 Iressa AstraZeneca 7.61 2.5 20 7 Amaryl Sanofi-Aventis 7.56 -19.9 2011 25 “ ” 18 19 evidence !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 18 19

…… 20 3 20 brand equity, …… 20 BA/BE BE BA cGMP 2012 21 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 20 21

BA/BE BA/BE 8 9 …… 22 2012 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 22

GMP

1994 1993 1997 1999 2001 2005 2007 2011 GMP GMP GMP 5-1 198026 2010 214 14,645 68.4 2010 657.2 2010 657 5 5 2006-2010 2006 2007 2008 2009 2010 2011 f 72.6 93.1 101.8 122.1 159.0 30.2% 176.7 400.8 413.9 414.1 447.2 430.5 -3.7% 416.9 50.1 55.7 57.7 57.9 67.7 16.9% 76.9 523.5 562.7 573.5 627.3 657.2 4.8% 670.5 2011 2011 20 6 2010 650 121.2 528.8

6 2006-2010 2006 2007 2008 2009 2010 32.1 41.9 36.0 43.5 48.5 11.5% 438.8 484.1 506.6 576.3 608.8 5.6% 0.4 0.3 0.8 0.9 0.7 -22.2% 471.3 526.2 543.3 620.7 658.0 6.0% 19.1 35.8 48.6 54.3 60.2 10.9% 45.4 60.7 42.3 51.9 57.0 9.8% 2.6 3.1 3.8 3.5 4.0 14.3% 67.1 99.6 94.7 109.7 121.2 10.5% 2011 2011 21 2010 10 2% 12 1.9% 13 1.8% 7

7 2010 % 2010 2009 1 1 Pfizer 132.54 -3.12 10.5 2 3 Novartis 78.04 10.38 6.2 3 5 Roche 75.76 16.63 6.0

4 6 Merck Sharp & Dohme 73.21 16.07 5.8

5 2 Sanofi-Aventis 71.96 -0.41 5.7 6 4 GlaxoSmithKline 61.38 -7.88 4.9 7 7 AstraZeneca 53.41 -0.15 4.3 8 8 Bayer Schering 36.56 -2.12 2.9 9 9 Lilly 36.30 18.92 2.9 10 10 24.69 1.56 2.0 11 11 Bristol-Myers Squibb 24.12 5.18 1.9 12 12 23.56 4.21 1.9 13 14 22.78 8.92 1.8 14 13 Janssen-Cilag 22.74 1.56 1.8 15 17 Novo Nordisk 20.94 18.14 1.7 16 16 Astellas Pharma 19.47 0.90 1.6 17 15 Takeda 19.11 -4.98 1.5 18 22 Abbott 18.75 20.27 1.5 19 23 Baxter Healthcare 18.70 12.11 1.5 20 21 Merck Serono 17.19 5.52 1.4 851.23 67.69 4.5 2011 Pp.26-27

5-2 1938 1950 1970 1949-1981 1982 -5-2-1 1949-1981 2011 1945

2001 1946 41,658 1948 113,308 1952 673,275 Ibid. 1953 2011 1950 1960 23 Ibid. 1959 7 9 177 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 23

1960 1961 1948 24 1970 749 2001 GMP 2005 56 24 2012 5-2-2 1982 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 24

GMP

1982 GMP

GMP 1982 CGMP 1995 PIC/S 2007 25

26 1973

1970 Overall Quality Improvement

Good Manufacturer Practice, GMP 1969

GMP WTO GMP 1974 WTO GMP 1977 GMP GMP 1979 GMP GMP 2011 1981

Good Manufacturer Practice, GMP

1982 1

GMP GMP GMP

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

25 26

5 GMP 1989 GMP GMP GMP Ibid. GMP OTC 27 Teva !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 27

28 5-3 GMP GMP TFDA 2012 GMP 149 21 44 PIC/S GMP 29 2014 PIC/S GMP 30 2013 1 1 PIC/S 43 31 PIC/S 32 2012 10 3294 PIC/S GMP 2009 10 PIC/SGMP 80% 2015 1 1 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 28 29 30 31 32

PIC/S GMP 33 GMP GMP 34 GMP GMP GMP GMP 35 GPM 600 600 GMP GMP !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 33 34 35

GMP 36 GMP GMP GMP FDA 37 GMP 2001 WTO 2004 cGMP cGMP PIC/S GMP PIC/S GMP PIC/S 38 FDA FDA FDA GMP 39 GMP PIC/S GMP PIC/S !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 36 37 38 39

40 GMP cGMP PIC/S GMP GMP GMP GMP 1990 ECFA 41 5 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 40 41

42 43 GMP 2009 2011 GMP assets …… !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 42 43

44

2009 2011

GMP

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

3

2011 45 2001 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 45 TPID1201 2012-3-221982 GMP Good Manufacturing Practice 46 2013 GMP cGMP PIC/S47 PIC/S PIC/S GMP 48 1995 2010 2012 2012 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 46 81 81 GMP GMP GMP GMP GMP … GMP OHP008 2012-1-4 47!PIC/S 1970 (EU) ! (GMP)

Pharmaceutical! Inspection! Convention! and! Pharmaceutical!Inspection!CoFoperation!Scheme PIC/S!GMP

GMP

PIC/S 43 !

48 2013 3 7 48

2011 2,100 1% 49 Chandler 1977 Chandler 2011a 2011b 2011 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 49 2012a/6/22

MBA

2011 2011

2011 Collins and Porras 2007

2011 7

developmental state Amsden 1989 Deyo 1987 Evans 1995 Gold 1986 Haggard 1990 Johnson 1982 Wade 1990 Weiss ed. 2003 White ed. 1988

Woo-Cumings 1999 2003 1997

1994 1990

Berger and Lester eds., 2005 1990 2000 2001 1989 Shieh 1992 1993 1993 1999 1999 Chen 2007 Cheng 1996 2005 1994 1990 1996 IC IC 2010 2007 2010 2009 2003 2008 2001

2008 1990

2002 2005 1999 2001

2006 2005 2004 2005

Gereffi and Korzeniewicz eds. 1994 Pan 1998

1999 1999 2003 Hamilton edit. 1996 2000 2007 2010 GMP 50 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 50

2011 701.6 128.3 5.5 51 2009 2009 2010 1 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 51

1 IC PIC/S GMP 1949 1970 1950 1945 1946

2001 1952 1953 1951-1956 170 Ibid. 1956 1961 600

Ibid. 1960 1962 1962 1963 1964 1964 1964 1970 750 20 50 1975 1980 1990 1980

1982 Good Manufacturing Practice

GMP

1995 229 GMP

PIC/S 1980 1990 1990 Wang forthcoming 1987 Bioavailability BA Bioequivalency BE BA/BE 1993 2000 Bridging Study

2010 2000 1995 1995 99% 2002 7 2010 Diagnosis Related Groups, DRGs

1017 1995 OTC 2004 2011 1996 622 2003 944 2008 1250 2004 21.6% 12.3% 17.7% 18.9% 14.2% 18.9% 2009 2012

16,700 6,800 2,400 80 100 52 1,200 40% 480 53 BA/BE 2 1999-2009 2009 60.5% BE 2006 17.1% 15.5% 24.2% 2005-2010 2007-2010 Phizer 2005-2008 9.0% 2009 2010 8.5% 7.9% 2012 2012 BA/BE !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 52 2013 7 23 53 2010/3/15

2 1998-2009 % 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 51.4 54.1 55.3 55.9 57.5 57.9 57.1 58.3 59.9 60.6 60.5 BE 13.5 14.2 15 15.3 15.1 15.6 16.8 17.1 15.6 15.3 15.4 35.1 31.7 29.7 28.8 27.5 26.6 26.2 24.6 24.4 24.1 24.2 2012 220 GMP PIC/S BA/BE 2012

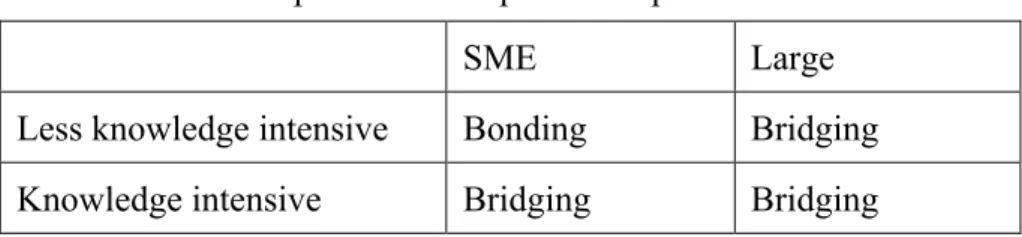

2×2 3 A B C D Wong 2011

3 / B A C D 2012 1 2 5 15

Yung Shin Pharm YSP

2006 84

2013

54 1942 1949 55 2013 1952 Ibid. 56 1960 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 54 TPID1202 2012/4/20 55 56

1965 57 2013 58 59 Ibid. 60 1970 GMP GMP GMP 61 GMP 1986 GMP !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 57 TPID1202 2012/4/20 58 TPID1202 2012/4/20 59 TPID1202 2012/4/20 60 TPID1202 2012/4/20 61 TPID1202 2012/4/20

2004 cGMP FDA 2007 MHLW 2009 PIC/S GMP FDA 2013 1978 1989 FDA 75% 1993 GMP 1993 93% 7% 77% 2012 36 7141 62 1974 1985 1988 1990 GMP 2004 2013 1990 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 62 http://www.ysp.com.tw/ysp/AboutYSP-Biz.aspx?tc=1d

1992 Carlsbad Walgreen CVS 20 1980 1990 150 200 20 63 1990 1999 1994 64 API 1999 GMP 2009 FDA 65 2013 2010 17% 66 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 63 TPID1203 2012/5/2 64 65 1994 2006 2008 66 TPID1202 2012/4/20

HAC HAC 2001 165 67 2004 2011 2012 4 68 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 67 2012 68 3 2012b/4/5

4 2012b/4/5 U. C. Pharma 69 1965 1986 1941-201370 71 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 69 TPID1208 2012/6/6 70 2013 10 15 74 71 2012

SS

72

2010

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

OTC 1982 GMP GMP Ibid. 73 GMP GMP 74 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 73 TPID1003 2012/5/2 74 TPID1208 2012/6/6

GMP 75 HOYU Suzulex 76 OTC PIC/S GMP !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 75 TPID1203 2012/5/2 76 TPID1208 2012/6/6

77 OTC FDA GMP 2012 PIC/S GMP 15 GMP

Taiwan Biotech Co.

1932 1945 1955 1962 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! 77 TPID1208 2012/6/6