行政院國家科學委員會專題研究計畫 成果報告

採用線上財務服務的前置因素之研究:探討實體通路服務

對線上服務的影響

研究成果報告(精簡版)

計 畫 類 別 : 個別型 計 畫 編 號 : NSC 95-2416-H-004-054- 執 行 期 間 : 95 年 08 月 01 日至 96 年 07 月 31 日 執 行 單 位 : 國立政治大學國際貿易學系 計 畫 主 持 人 : 邱志聖 計畫參與人員: 碩士級-專任助理:王詩晴 碩士班研究生-兼任助理:林耕毅 大學生-兼任助理:鄭孝怡 處 理 方 式 : 本計畫涉及專利或其他智慧財產權,1 年後可公開查詢中 華 民 國 96 年 10 月 18 日

2006 NSC Report

The Antecedents of Online Financial Service Adoption: The Impact of Physical Banking Services on Internet Banking Acceptance

Jyh-Shen Chiou* College of Commerce National Chengchi University

Email: jschiou@nccu.edu.tw Tel: (02) 29393091 ext. 81039

The Antecedents of Online Financial Service Adoption: The Impact of Physical Banking Services on Internet Banking Acceptance

1. Introduction

Because of the Web’s cost-effectiveness, financial service firms are employing Web technology to replace or substantially diminish personal interaction in the provision of their services. However, recent cases show that the use of Web technology in financial services is not as promising as expected. According to research by the Customer Respect Group, an international research and consulting firm, one in six American users abandoned Web site banking, either because they were uncomfortable with its privacy, or because the company’s business practices were unclear. For those who stay with their online financial service, most of them are nervous about security [60]. Similar results are found in several other studies regarding online banking services [5]. For example, based on a survey of 2,000 retail banking customers, Durkin and O’Donnell [5,32,71] found that although all customers see Internet banking as important, most of them showed no desire to use e-banking solutions as a substitute for face-to-face interaction with their bankers.

Past research on consumers’ adoption of online services focused largely on the process and factors involved when a user adopted the new Web technology (e.g. [27,61,69]). Since more and more physical firms are extending their service to include online services [35,48,67], the exchange relationship may involve both the characteristics of real and virtual entities. As stated by Vatanasombut et al. [67], online companies still have to interact with customers outside the Web realm, and services at the physical branch will have an impact on online customers. Howcroft et al. [41] also found that consumers preferred a mix of delivery channels, rather than

relying exclusively on one single channel. Muthitacharoen et al. [57] demonstrated that a business’s strategy for employing sole online or hybrid channel could influence consumer’s preference on the choice of channel. Therefore, research which focuses solely on the aspect of online banking service may neglect the potential interactions and impacts of existing relationships between physical banks and their customers.

In addition, the scope of literature on customer relationship management has gradually broadened by focusing not only on customer retention but also on cross-buying behavior [11]. That is, besides considering the duration of a relationship and its association to customer retention, researchers have begun exploring the breadth of a relationship as reflected in cross-buying or add-on buying behaviors. Therefore, studying the impact of physical banking relationship on the adoption of Internet banking may enrich this research stream by providing insights regarding physical and virtual cross-buying behavior.

In sum, the study intends to explain the reasons for using Internet banking services by explicitly incorporating the impact of experiences users have had with physical banking services.. More specifically, it intend to establish whether or not trustworthiness and satisfaction with the physical bank, or specific asset investment in it, will lead to positive impacts on the intention to accept the bank’s Internet banking services, in addition to the perceived ease of use and perceived usefulness of the Internet banking service. Three theoretical foundations: transaction cost analysis (TCA), technology acceptance mode (TAM), and relationship marketing literature will be applied to develop the research framework. The first theory explains what inhibits the exchange between two parties; the second one has been largely used to discuss the process of adopting new technology, and the last one focuses on the importance of trust-building in exchange relationships. Specific hypotheses will be developed and tested in this study.

2. Conceptual framework and hypotheses

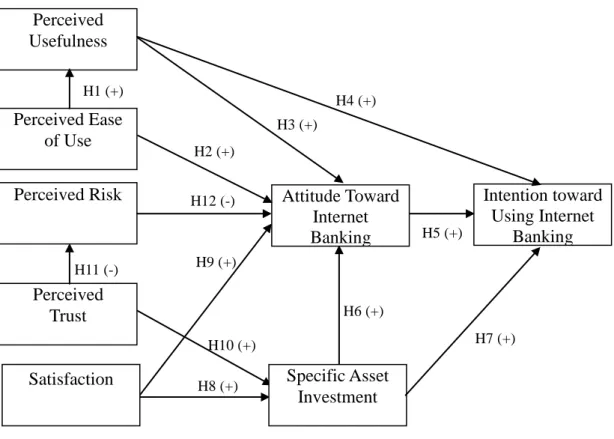

Figure 1 presents a model of consumers’ Internet banking acceptance, incorporating the impacts from physical banking services. The model integrated constructs from three literature foundations; these include perceived ease of use and perceived usefulness from TAM, asset specificity from TCA, and perceived risk, trust, and satisfaction from relationship marketing literature as antecedents for Internet banking acceptance attitude and intention. In addition to constructs from TAM, customers’ asset specificity toward the focal physical bank is hypothesized to influence their attitude and intention to accept the Internet banking service of the focal bank positively. In addition, overall satisfaction with the physical bank, and the perceived risk of Internet banking, are predicted to affect the attitude of accepting the focal bank’s Internet banking positively and negatively. Finally, trust in, and overall satisfaction with, a physical bank are hypothesized to influence a customer’s willingness to make specific investments in the physical bank positively.

--- Insert Figure 1 about here ---

2.1 Technology acceptance model

TAM is one of the most widely used models in studying the reasons a firm or an individual accepts new technology. It is based on the theory of reasoned action, proposed by Ajzen and Fishbein [3], which was concerned with the determinants of consciously intended behaviors [28]. In the model, perceived usefulness and perceived ease of use are related to the attitude toward acceptance of new technology, which in turn affects acceptance intention, and subsequently behavior. Perceived ease of use is defined as the degree to which the prospective user expects the

new technology to be free of effort. Perceived usefulness refers to the prospective user’s subjective likelihood that the use of the new technology will increase his/her performance [28]. The relationship between attitude and intention represented in TAM implies that, all else being equal, people form intentions to perform behaviors toward which they have a positive affect. However, unlike TRA, TAM proposes that ease of use (a belief element in the model) has a direct effect on behavioral intention.

TAM has been widely tested, with different samples in different situations, and has proved to be a valid and reliable model explaining new technology system acceptance (e.g. [1,51,54,66,68]). Mathieson [54] and Davis et al. [28] also found that TAM’s ability to explain attitude toward using an information system is better than TRA, and the theory of Planned Behavior (TPB). Several Internet banking studies have applied TAM as their theoretical foundation. Suh and Han’s [64] study supported the hypothesized relationship of TAM, in addition to the effect of trust. Pikkarainen et al. [61] found that perceived usefulness and the amount of information have direct and significant effects on Internet banking acceptance. However, their study didn’t include intention of Internet banking acceptance in their research model. Wang et al. [69] found that perceived usefulness, perceived ease of use and perceived credibility have a direct and significant effect on the intention toward using Internet banking. Perceived ease of use was also found to affect perceived usefulness and perceived credibility in their model. Based on the above discussion, it is hypothesized that:

Hypothesis 1: Customers’ perceived ease of use of Internet banking will positively affect their perceived usefulness of Internet banking.

Hypothesis 2: Customers’ perceived ease of use of Internet banking will positively affect their attitude toward using Internet banking.

their attitude toward using Internet banking.

Hypothesis 4: Customers’ perceived usefulness of Internet banking will positively affect their intention toward using Internet banking

Hypothesis 5: Customers’ attitude toward using Internet banking will positively affect their intention to use Internet banking.

2.2 Transaction cost analysis and relationship marketing

TCA focuses on transactions, and the costs attendant on completing transactions by one institutional mode rather than another [72]. The central claim is that transactions will be handled in such a way as to minimize the costs involved in carrying them out. According to TCA, one major attribute of transactions is asset specificity. Asset specificity refers to investments in physical or human assets that are dedicated to a particular supplier, and whose redeployment entails considerable switching costs [73]. That is, the idiosyncratic investment made to support a particular exchange relationship has a higher value to that exchange than it would have if it were redeployed for any other purpose. Therefore, as asset specificity increases, redeployability decreases, which increases dependency and the contracting hazard for the parties investing in a specific asset in the exchange relationship. Asset specificity may have different forms. It can be a physical asset, monetary asset, knowledge, personal relationship, skills, etc [74].

TCA has been applied mostly to analyze business-to-business relationships [26]. However, the same scenario happens in the business-to-consumer exchange situation. Take the banking industries, for example; one can easily find that many consumers will not be interested in new banking services, because most of them have built strong idiosyncratic assets with their current banks. These idiosyncratic assets may include procedural learning, award accumulation, and a personal relationship with the focal bank. The asset of procedural learning refers to the time and effort associated with the process of initiating a relationship and acquiring new skills or

know-how in order to use a new service [17]. The asset of award accumulation represents the financial benefits accumulated in being loyal to the focal bank, such as reduced loan interest, or above-market interest for loyal customers [17].

Finally, the asset of personal relationship is the affective asset associated with the bonds of identification that have been formed with those with whom the customer interacts [2,17]. Bonding relationships create value and incentive for customers to stay with their focal bank. Customers will lose all these idiosyncratic assets if they switch to other banks. Therefore, the higher the idiosyncratic asset a customer invests in a focal bank (such as personal relationship and procedure learning), the more likely she/he will be to adopt the focal bank’s Internet banking service rather than does it with new banking provider. The research by Chiou and Shen [19] found that consumers’ specific asset investment on in an Internet portal exerted a positive impact on loyalty intention. Their study also demonstrated that consumers’ specific asset investment on an Internet portal exerted a positive impact on loyalty intention. Thus, it is hypothesized that:

Hypothesis 6: Customers’ specific asset investment with the bank will positively affect their attitude toward using Internet banking.

Hypothesis 7: Customers’ specific asset investment with the bank will positively affect their intention to use Internet banking.

A consumer’s investment of specific assets in a service provider will increase dependency

on the provider and give the provider some control over the consumer [45]. The most prominent B2B solution offered by transaction cost analysis to safeguard specific asset investments is vertical integration [73]. However, unlike firms, it is very difficult for a consumer to vertically integrate the functions provided by the provider. Thus, the specific asset that customers dedicate to a supplier is common in practice, for example, if a bank provide a special interest rate loan for their consumers who have good credit or long term transaction relationship on it. This special

treatment may become a considerable asset affecting the satisfied customers who are asking for a loan from banks, because they will lose the competitive interest rate if switching to other banks. Therefore, rational customers are more likely to have further business with the company that they are satisfied to benefit for special reward. In addition to special treatment for retaining the customers, effective interaction between customers and bank’s employees is prominent factor to facilitate the transaction successful. This not only increases customer’s satisfaction, but also a worth asset of personal relationship that satisfied customers are willing to utilize when decide to have new financial service, because familiar salesperson is more likely to provide rapid response and comfortable transaction experience [21].

Previous empirical evidences also support that consumers’ satisfaction influenced their willingness to specific asset investment [19,20]. Therefore, rational consumers will try to avoid dependency on unsatisfactory relationships by reducing the buildup of asset specificity on the focal firm. On the other hand, if a consumer is satisfied with a bank, she/he will increase specific asset investment toward that bank. Therefore:

Hypothesis 8: Customers’ overall satisfaction with the physical bank will positively affect their specific asset investment in the bank.

In addition to its effect on specific asset investment, overall satisfaction also plays a role in predicting behavioral intention. Satisfied customers are more likely to purchase the same product/service repeatedly, to resist competitive offers from competitors, and to generate positive word of mouth [7,14,16,25,75]. More importantly, if a company’s service is reliable, customers should be more willing to purchase additional services [6,9,75]. Past researches also found that consumers’ favorable attitude toward existing shopping channel has the positive influence on their attitude toward using new service method, (e.g. [47,56,63]). Similarly, Bobbit and

Dabholka [12] suggest that consumers’ category-based affect toward using traditional self-service will raise their attitude toward using Internet shopping. Therefore, if a consumer is satisfied with the physical bank’s service, she/he will have a better attitude toward the bank’s other services, such as Internet banking. Thus:

Hypothesis 9: Customers’ overall satisfaction in the physical bank will positively affect their attitude toward using Internet banking.

Trust refers to the belief that another’s promise can be relied on, and that, in unforeseen circumstances, the other will act in a spirit of goodwill and in a benign way toward the trustor [30]. Basically, trust has three characteristics: ability, benevolence, and integrity [55]. Ability refers to whether the trustee has the capability to meet its obligations. Benevolence is the extra-contractual behavior of a party that enhances the well being of the receiving party. Integrity means that a trustor believes that a trustee makes agreements in good faith, tells the truth, acts ethically, and fulfills promises [30,49,64]. Financial service quality is highly ambiguous and contains intangible inherence. Customers are hard to predict and it’s difficult to monitor the service provider’s behavior throughout the transaction. Opportunistic activity undertaken by any party will increase the transaction cost. For example, when a consumer opens a deposit or checking account, she/he is exposed to potential loss as a result of insecure management or fraudulent behavior by employees. Rational consumers will try to avoid dependency on untrustworthy banks by reducing specific asset investments in the bank. On the other hand, a consumer will increase asset specificity with a provider that is trustworthy.

Hypothesis 10: Customers’ trust in the physical bank will positively affect their specific asset investment with the bank.

behavior [10]. Perceived risk is the nature and amount of risk a consumer perceives in contemplating a particular consumption decision [24]. When negative outcomes are likely, or when uncertainty is high, perception of risk increases. One of the most important sources of perceived risk in Internet business is perceived security. Perceived security can be the risk of using the Web to transmit sensitive information and a perception of insecurity in interacting with a focal firm [67].

Trustworthiness in the realm of Internet business is an important factor for e-commerce success [33,50,65]. Perceived trust of a bank as a whole is predicted to have effects on the perceived trust of the focal bank’s Internet banking services. A recent study by Gürhan-Canli and Batra [38] provides support for this assertion. In studying the effect of overall corporate image on product evaluation, they proposed that consumers perceive arguments about certain corporate dimensions (such as trustworthiness) as more diagnostic for purchasing decision making under conditions of high-perceived risk. Because relatively more diagnostic information tends to exert a disproportionate impact on judgment [34], they found that when risk is perceived to be high, consumers will evaluate a product more favorably in response to a strong (versus a weak) argument about corporate trustworthiness. Since Internet business involves a high-risk situation, when considering using the Internet service of a bank, consumers will rely more on the bank’s overall image of trustworthiness when they make their decision. Therefore, the trustworthy image of a bank as a whole may reduce the perceived risk of using the focal firm’s Internet banking services.

The study by Flavián et al. [35] also supports this assertion. In their study regarding the effect of corporate image on Internet banking, they found that corporate image is a factor that significantly influences the trust customers place in Internet banking services. Therefore, a

trustworthy image of the physical bank can reduce the perceived risk of using its Internet services. Therefore, it is hypothesized that:

Hypothesis 11: Customers’ trust in the bank will negatively affect their perceived risk of Internet banking.

Perceived risk is considered as an important factor in explaining barriers to online shopping [52,67]. As perceived risk increases, consumers engage in different types of risk reduction activities, such as searching for more information from interpersonal sources, and careful evaluation of alternatives [31]. Therefore, the intention to adopt a new technology will be contained [21].

Previous studies suggest that buying by phone or Internet is considered more risky than buying in real stores, and the perceived risk will affect the possibility that consumer shopping from online retailers [12,37]. For example, customers have to provide the certain private or security information for confirmation when being application or log-in online service, which is more likely to expose them into risk if opportunistic employees or crackers steal and misuse their data. Akaah et al. [4] addressed that consumers’ attitude toward various forms of marketing channel varies from the degree of their perceived risk. Forsythe and Shi [36] also found that perceived risk significantly influences Internet patronage behaviors among Internet browsers. Liebermann and Stashevsky [52] recorded similar results. In addition, Sathye [62] investigated the adoption of Internet business by Australian consumers and found that security is one of the most important obstacles to non-adoption. White and Nteli’s [71] also found that Internet banking customers regard the security of the bank’s Web site as the most important attribute. Finally, users are also concerned at the level of security which prevails when they provide sensitive information [70]. Thus:

Hypothesis 12: Customers’ perceived risk of Internet banking will negatively affect their attitude toward using Internet banking.

3. Methodology

3.1 Study objects and samples

Customers of physical banking were the objects for this study. Six trained interviewers were employed at two major banking districts in a major city in an Asia Pacific country. Data were collected over a one-week period covering only weekdays. Street intercept surveys were conducted because respondents were more likely to focus on dimensions that were important to them in evaluating the service quality provided by service providers. When customers are contextualized in the environment they are evaluating, they will be more involved with the content of the questionnaire. One in ten customers coming out of a bank was approached for personal interviewing. The respondents were asked to give overall evaluations of the bank with which they most often did business in the previous six months. The questions were followed by queries regarding the focal bank’s Internet banking service. Customers who had no idea about Internet banking at all were excluded from the samples. The questionnaire took about 15 minutes to complete. Altogether, a sample of 207 respondents was obtained. The response rate is around 15%.

Our sampling method was successful in soliciting respondents with varied personal characteristics. The profile of the respondents shows that they were diverse in age (less than 20 years of age, 4%; 21-30 years of age, 46%; 31-40 years of age, 30%; greater than 41 years of age, 20%). There was also a diversity in education (less than high school diploma, 18%; junior college, 21%; university or higher 43%); gender (43% male and 57% female); and in personal income (less than USD$ 6,500, 15%; USD$ 6501~19,000, 49%; USD$ 19,001~32,000, 21%;

USD$ 32,001 or higher, 11%). In addition, more than 60% of the respondents use the Internet every day and only 7% of them hardly use the Internet. Finally, about 25% of the respondents have used the focal bank’s Internet service in the past six months.

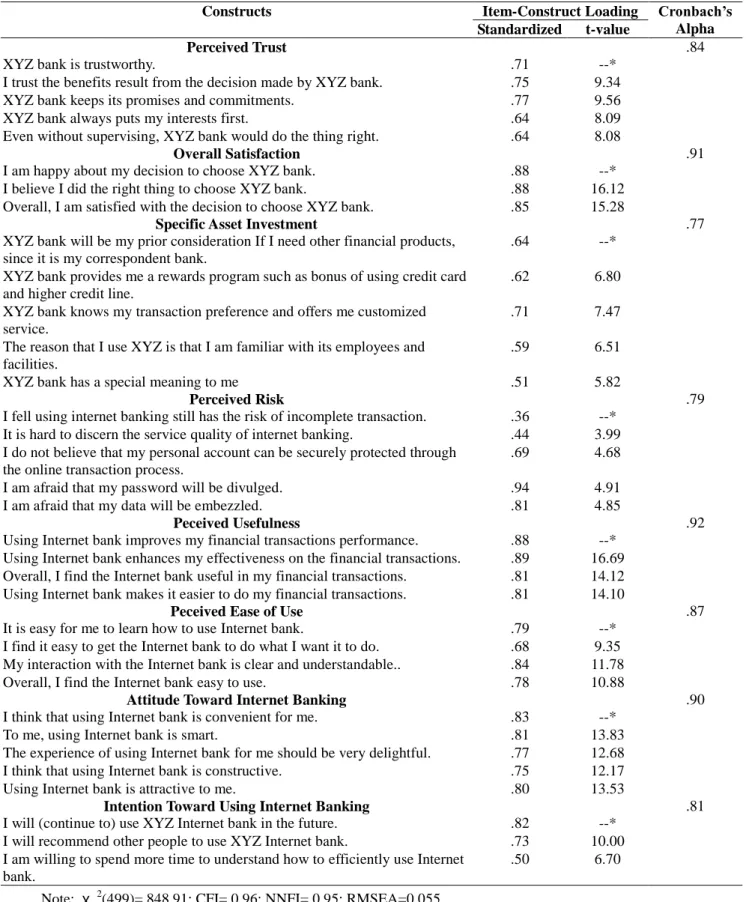

3.2 Measurement

All measures for the self-administrated questionnaire as are listed in Table 1. The scales were either based on previous research, or developed according to Churchill’s [23] recommendations. Five-point scales, “strongly agree” to “strongly disagree,” were used throughout the questionnaire. To ensure the bank that respondents thinking are appropriate for the study context while answering the each group of items, we solicit them to recall the bank that they indicated as most deal with in the beginning of the questionnaire.

--- Insert Table 1 about here ---

The measures of perceived usefulness, perceived ease of use, attitude toward Internet banking, and intention toward using Internet banking were adapted from Davis et al. [28] and Suh and Han [64]. The scales of perceived trust were modified from Suh and Han [64]. The measures of perceived risk were adapted from Liebermann [52], in that only the dimensions focusing on risk of Internet security and information misappropriation were included in the measurement. Overall satisfaction was taken from Oliver [59]. Finally, since asset specificity is context-relevant, potential measures of asset specificity were developed by following the format of previous studies [45,46], and consulting experts in the banking industry. A field pre-test was conducted to finalize the scales.

The model was tested using the two-step structural equation procedure [8]. First, we performed a Confirmatory Factor Analysis to evaluate construct validity in the measurement model, then a full SEM model was estimated to test the hypothesized relationships.

4. Results

4.1 Measurement model

Since all of the measures were multi-items, Confirmatory Factor Analysis (CFA) was employed to test the adequacy of the measurement model based on the criteria of overall fit, convergent validity, discriminant validity and reliability. We estimated the proposed measurement model using Lisrel 8.53. The results reported in Table 1 showed that χ 2(499) = 848.91; CFI = 0.96; NNFI = 0.95, both exceeded the recommended .90 threshold levels [13,42,43]. RMSEA (0.055) was lower than .08 as recommended by Hair et al. [39]. Thus, the overall fit of the measurement model was within acceptable levels. According to Anderson and Gerbing [8], convergent validity can be assessed by determining whether each indicator’s estimated pattern coefficient on its proposed underlying construct is significant (greater than twice its standard error). An examination of the indicator loadings indicated that all loadings were significant for its latent construct. Therefore, the convergent validity of the measurement model was reasonably good. In addition, The Cronbach reliabilities of all constructs were higher than 0.77, indicating an acceptable reliability [58]. These results exhibited support for the unidimensionality of the scales.

The most common test of discriminant validity is whether the confidence interval around the correlation between any two latent constructs does not include 1. Of our eight constructs tested for each object, no confidence interval reached 1, a result that indicated that discriminant

validity for both models was achieved. A more conservative test of discriminant validity involves comparing the χ2

values of models that constrain the phi value to be 1, and testing whether the constraint causes a significant decrease in fit. In all comparisons, the overall fit of the model was significantly changed, which again, demonstrated discriminant validity. While the measurement model holds adequate properties, we then examined the individual hypotheses by performing LISREL full model estimation.

4.2 Hypothesis testing of structural model

The results of the estimated structural model are depicted in Figure 1. The overall model fit is similar to the measurement model and surpasses the recommended index. An examination of the loadings of indicators on their respective latent constructs was highly significant and similar to the result in the CFA.

The relationships between the constructs were examined using structural coefficients in the model. The coefficients of hypothesis testing were presented in Table 2. Perceived ease of use was found to have significant impact on perceived usefulness (γ= .52, p < .01) and attitude toward Internet banking (γ= .14, p < .05). Therefore H1 and H2 were supported by the data.

While the hypothesized positive effect of perceived usefulness on attitude toward Internet banking was supported (γ= .69, p < .01), we did not find its significant impacts on intention toward using Internet banking (γ= .01, p > .05). In addition, the relationship between attitude toward Internet banking and intention toward using Internet banking was statistically significant (γ= .71, p < .01). Therefore Hypothesis 3 and 5 developed from TAM were supported by the data. However, H4 was not supported.

banking significantly (γ= .19, p < .05), but also influenced intention toward using Internet banking significantly (γ= .22, p < .05). Hence, Hypothesis 6 and 7 were supported by the data. Customers’ satisfaction was found to influence specific asset investment significantly (γ= .37, p < .01). However, its impact on attitude toward Internet banking is not significant (γ= -.05, p > .05). Therefore, Hypothesis 8 was supported, and the data failed to confirm Hypothesis 9.

In addition, perceived trust has a positively significant impact on specific asset investment (γ= .35, p < .01), which provides support for Hypothesis 10. The effect of perceived trust on perceived risk was found non-significant (γ = -.06, p > .05), thus Hypothesis 11 was not supported by the data. Finally, attitude toward Internet banking was significantly affected by perceived risk (γ= -.14, p < .05). Therefore Hypothesis 12 was supported by the data.

--- Insert Table 2 about here ---

5. Discussion and Implications

The results of this study show that the major antecedent variables in TAM are very successful in predicting the attitude and intention of Internet banking acceptance. That is, perceived ease of use and perceived usefulness of Internet banking significantly influence the attitude of customers towards accepting Internet banking, which, in turn affects the intention of Internet banking acceptance. Therefore, it is very important that a bank wishing to promote its Internet banking should educate its customers about the ease of using the Internet to do banking activities and show them the benefit of using Internet banking.

The results also showed that specific asset investment with an Internet bank exerts an important role in influencing the attitude and intention of Internet banking acceptance. As defined, a specific asset is the idiosyncratic investment made to support a particular exchange

relationship and has a higher value to that exchange than it would have if it were redeployed for any other purpose. Therefore, the idiosyncratic assets a customer uses to support the exchange relationship with the physical bank are very important for persuading customers to try its Internet banking services. Banks wishing to promote their Internet banking services should focus not only on Internet banking promotion, but should also try to encourage their customers to experience different aspects of the focal bank’s service, such as credit cards, investment, insurance, loans, etc, through traditional outlets, and establish personal relationships between the customer and bank employees. In the process of receiving different services, a customer will have greater knowledge about the focal bank and create a credit history advantage, and even a personal relationship with the bank. The more idiosyncratic assets a customer has invested in the focal bank, the higher the likelihood that the customer will try its Internet banking service. This finding may explain why banks which only offer an Internet banking service are not doing very well in the market [2,71].

The study also found that overall satisfaction with, and perceived trust in, the focal bank exerted positive and significant effects on customers’ willingness to invest specific assets with the focal bank. Therefore, in order to induce customers to invest specific assets in the bank, the focal bank has to increase the customer’s overall satisfaction and perceived trust. Without trust in, and overall satisfaction with, the focal firm, customers will avoid building specific assets with the bank, and reduce their incentives to use the focal bank’s Internet services.

The results demonstrate that perceived risk of Internet banking is an important barrier for the attitude toward Internet banking services. This result is consistent with previous research regarding Internet business. That is, a bank wishing to promote Internet banking should reduce the customer’s perceived risk of its Internet services to improve the attitude of accepting Internet

banking. A customer cannot have a positive attitude toward using the Internet banking service if he/she thinks the Internet banking service presents the risk of exposing personal credit data and the possibility of banking fraud.

It is somewhat surprising to find that perceived trust of the physical bank cannot reduce the perceived risk of the focal bank’s Internet banking service. Customers seem to separate trust in the bank and trust in new technology. As mentioned, one of the most important sources of perceived risk in Internet business is perceived security, which is the risk in using the Web to transmit sensitive information, and the perception of insecurity in interacting with the focal bank. Although customers may believe a bank is trustworthy, they may not trust the whole Internet security environment. Cho [22] separated perceived risk into two parts as for service provider and online media. His empirical results indicated that user’s trust in online service provider has significant impact only on the perceived risk of online service, not for the perceived risk with online environment. These findings may explain why perceived trust could not reduce the customers’ perceived risk outside the company. Therefore, it is not enough for a bank just to educate its customers about the security of their Internet service. The whole banking industry has to cooperate with the Internet world to devise trustworthy ways of doing banking service through the Internet. It is time to focus more on the security of the Internet, in addition to technological advancement.

Finally, the finding of the relationship between perceived usefulness and intention toward using an Internet bank is non-significant. Previous studies have also found this relationship to be weak [29,44,53]. Davis et al. [28] demonstrate that the direct influence of perceived usefulness on users’ intention will be greater when the user has been using the new system for a longer period of time, because usefulness is a performance measure that takes time, and actual use, to

assess. Although we excluded those who have no idea about Internet banking in the samples, not all our respondents were highly involved with Internet banking. This may explain why the relationship is insignificant in our study. In other words, the mix of respondents with different Internet banking usage status may offset the effect of perceived usefulness on intention toward accepting Internet banking.

This study contributed to service research in two ways. First, since more and more physical firms are extending their service to include online services, the exchange relationship may involve both the characteristics of real and virtual entities. This study explicitly considers the potential interactions between internet banking and the existing relationships between physical banks and their customers. Second, studying the impact of physical banking relationship on the adoption of Internet banking may enrich the relationship marketing research stream by providing insights regarding physical and virtual cross-buying behavior.

This study had several limitations. First, the study focused on the major variable from TAM, TCA, and relationship marketing literature. The research model did not consider other beliefs (such as perceived playfulness of the Internet banking service and service quality), and precedents of the major variables. Further research considering these factors could enhance the understanding of customer acceptance of Internet banking. The second limitation is the cross-sectional design employed. Cross-sectional data cannot test the proposed causal relationship in the model vigorously. To provide a stronger inference, the model developed and tested here could benefit from being tested in a longitudinal design. Third, the model was empirically tested in a Taiwanese sample. Different societies may have different attitudes toward new technology. Taiwan is a collectivist and risk-avoidance society [18,40]. Consumers in this kind of society may be less likely to accept Internet banking. Therefore, more empirical tests of

the proposed model in other societies are needed.

References

[1] D.A. Adams, R.R. Nelson, P.A. Todd, Perceived usefulness, ease of use, and usage of information technology: a replication, MIS Quarterly 16(2), 1992, pp. 227-253.

[2] R. Ahmad, A conceptualisation of a customer-bank bond in the context of the twenty-first century UK retail banking industry, International Journal of Bank Marketing 23(4), 2005, pp. 317-33.

[3] L. Ajzen, M. Fishbein, Attitude-behavior relations: a theoretical analysis and review of empirical research, Psychological Bulletin 84, 1977, pp. 888-918.

[4] I.P. Akaah, P.K. Korgaonkar, D. Lund, Direct marketing attitudes, Journal of Business Research 34(3), 1995, 211-219.

[5] S. Akinci, S. Aksoy, E. Atilgan, Adoption of internet banking among sophisticated consumer segments in an advanced developing country, The International Journal of Bank Marketing 22(2/3), 2004, pp. 212-232.

[6] E.W. Anderson, R.T. Rust, Customer satisfaction, productivity, and profitability: differences between goods and services, Marketing Science 16(2), 1997, pp. 129-145.

[7] E.W. Anderson, M.W. Sullivan, The antecedents and consequences of customer satisfaction for firms, Marketing Science 12(12), 1993, pp. 125-143.

[8] J.C. Anderson, D.W. Gerbing, Structural equation modeling in practice: a review and recommended two-step approach, Psychological Bulletin 103(3), 1988, pp. 411-423.

[9] L.L. Berry, A. Parasuraman, V.A. Zeithaml, Improving service quality in America: lessons learned, Academy of Management Executive 8(2), 1994, pp. 32-40.

[10] J.R. Bettman, Perceived risk and its components: a model and empirical test, Journal of Marketing Research 10(2), 1973, pp. 184-190.

[11] R.C. Blattberg, G. Getz, J.S. Thomas, Customer Equity: Building and Managing Relationship as Valuable Assets, Harvard Business School Press, Boston, 2001.

[12] L.M. Bobbitt, P.A. Dabholkar, Integrating attitudinal theories to understand and predict use of technology-based self-service: the Internet as an illustration, International Journal of Service Industry Management 12(5), 2001, pp. 423-450.

[13] K.A. Bollen, Structural Equations with Latent Variables, John Wiley and Son, New York, 1989.

[14] R.N. Bolton, A dynamic model of the duration of the customer’s relationship with a continuous service provider: the role of satisfaction, Marketing Science 17(1), 1998, pp. 45-65.

[15] R. N. Bolton, N.L. Katherine, P.C. Verhoef, The theoretical underpinnings of customer asset management: a framework and propositions for future research, Journal of the Academy of Marketing Science 32(3), 2004, pp. 271-292.

[16] R.N. Bolton, K.N. Lemon, A dynamic model of customers’ usage of services: usages as an antecedent and consequence of satisfaction, Journal of Marketing Research 36(2), 1999, pp. 171-186.

[17] T.A. Burnham, J.K. Frels, V. Mahajan, Consumer switching costs: a typology, antecedents, and consequences, Journal of the Academy of Marketing Science 31(2), 2003, pp. 109-126. [18] J.S. Chiou, Antecedents and moderators of behavioral intention: differences between the

United States and Taiwanese students, Genetic, Social, and General Psychology Monographs 126(1), 2000, pp. 105-124.

[19] J.S. Chiou, C.C. Shen, The effects of satisfaction, opportunism, and asset specificity on consumers’ loyalty intention toward Internet portal sites, International Journal of Service Industry Management 17(I), 2006, pp. 7-22.

[20] J.S. Chiou, C. Droge, Service quality, trust, specific asset investment and expertise: direct and indirect effects in a satisfaction-loyalty framework, Journal of the Academy of Marketing Science 31(4), 2006, pp. 1-15.

[21] J. Cho, Likelihood to abort an online transaction: influences from cognitive evaluations, attitudes, and behavioral variables, Information & Management 41(7), 2004, pp. 827-838. [22] V. Cho, A study of the roles of trusts and risks in information-oriented online legal services

using an integrated model, Information & Management 43(4), 2006, pp. 502-520.

[23] G.A. Churchill, A paradigm for developing better measures of marketing constructs, Journal of Marketing Research 16(1), 1979, pp. 63-73.

[24] D.F. Cox, S.U. Rich, Perceived risk and consumer decision making- the case of telephone shopping, Journal of Marketing Research 1(4), 1964, pp. 2-39.

[25] J.J. Cronin Jr., S.A. Taylor, Measuring service quality: a reexamination and extension, Journal of Marketing 55(3), 1992, pp. 55-68.

[26] R.J. David, S. Han, A systematic assessment of the empirical support for transaction cost economics, Strategic Management Journal 25(1), 2004, pp. 39-58.

[27] F.D. Davis, User acceptance of information technology: system characteristics, user perceptions, and behavioral impacts, International Journal of Man Machine Studies 28, 1993, pp. 475-487.

[28] F.D. Davis, R.P. Bagozzi, P.R. Warshaw, User acceptance of computer technology: a comparison of two theoretical models, Management Science 35(8), 1989, pp. 982-1002. [29] M.T. Dishaw, D.M Strong, Extending the technology acceptance model with

task-technology tit constructs, Information & Management 36(1), 1999, pp. 9–21.

[30] P.M. Doney, J.P. Cannon, An examination of the nature of trust in buyer-seller relationships, Journal of Marketing 61(2). 1997, pp. 35-51.

[31] G.R. Dowling, R. Staelin, A model of perceived risk and intended risk-handling activity, Journal of Consumer Research 21(1), 1994, pp. 119-134.

[32] M. Durkin, A. O’Donnell, Toward a model of adoption in Internet banking: strategic communication challenges, The Service Industries Journal 25(7), 2005, pp. 861-878.

[33] S. Elliot, S. Fowel, Expectations versus reality: a snapshot of consumer experiences with Internet retailing, International Journal of Information Management 20(5), 2000, pp. 323-336.

[34] J.M. Feldman, J. Lynch Jr., Self-generated validity: effects of measurement on belief attitude intention, and behavior, Journal of Applied Psychology 73(3), 1998, pp. 421-35. [35] C. Flavián, M. Guinalíu, E. Torres, The influence of corporate image on consumer trust: a

comparative analysis in traditional versus Internet banking, Internet Research 15(4), 2005, pp. 447-70.

[36] S.M. Forsythe, B. Shi, Consumer patronage and risk perceptions in Internet shopping, Journal of Business Research 56(11), 2003, pp. 867-75.

[37] P.L. Gillett, In-home shoppers: an overview, Journal of Marketing 40(4), 1976, 81-88. [38] Z. Gürhan-Canli, R. Batra, When corporate image affects product evaluations: the

moderating role of perceived risk, Journal of Marketing Research 41(2), 2004, pp. 197-205. [39] J.F. Hair Jr., R.E. Anderson, R.L. Tatham, W.C. Black, Multivariate Data Analysis,

Prentice-Hall, New Jersey, 1998.

[40] G. Hofstede, The culture relativity of organizational practices and theories, Journal of International Business Studies 14(3), 1983, pp. 75-89.

[41] B. Howcroft, R. Hamilton, P. Hewer, Consumer attitude and the usage and adoption of home-based banking in the United Kingdom, The International Journal of Bank Marketing 20(2/3), 2002, pp. 111-21.

[42] R.H. Hoyle, A.T. Panter, Writing about structural equation modeling, in R.H. Hoyle (Ed.), Structural Equation Modeling: Comments, Issues, and Applications, Sage Publications, Thousand Oaks, CA, 1995, pp. 158-176

[43] L.T. Hu, P.M. Bentler, Evaluating model fit, in R.H. Hoyle, (Ed.), Structural Equation Modeling: Comments, Issues, and Applications, Sage Publications, Thousand Oaks, CA, 1995, pp. 76-99.

[44] C.M. Jackson, S. Chow, R.A. Leitch, Toward an understanding of the behavioral intention to use an information system, Decision Sciences 28(2), 1997, pp. 357–389.

[45] S.D. Jap, S. Ganesan, Control mechanisms and the relationship life cycle: implications for safeguarding specific investments and developing commitment, Journal of Marketing Research 37(2), 2000, pp. 227-245

[46] A.W. Joshi, R.L. Stump, The contingent effect of specific asset investment on joint action in manufacturer-supplier relationships: an empirical test of the moderating role of reciprocal asset investment, uncertainty, and trust, Journal of the Academy of Marketing Science 27(3), 1999, pp. 291-305

[47] P. Korgaonkar, G.P. Moschis, Consumer adoption of videotext services, Journal of Direct Marketing 1(4), 1987, 63-71.

[48] K.C. Laudon, C.G. Traver, E-commerce: Business, Technology, Society, Pearson/ Addison-Westey, Boston, 2005

[49] D. Lee, M.J. Sirgy, J.R. Brown, M.M. Bird, Importers' benevolence toward their foreign export suppliers, Journal of the Academy of Marketing Science 32(1), 2004, pp. 32-48. [50] M. Lee, E. Turban, A trust model for consumer Internet shopping, International Journal of

Electronic Commerce 6(1), 2001, pp. 75-91.

[51] P. Legris, J. Ingham, P. Collerette, Why do people use information technology? a critical review of the technology acceptance model, Information & Management 40(3), 2003, pp. 191-204.

[52] Y. Liebermann, S. Stashevsky, Perceived risks as barriers to Internet and e-commerce usage, Qualitative Market Research 5(4), 2002, pp. 291-300.

[53] H.C. Lucas, V.K. Spitler, Technology use and performance: a field study of broker workstations, Decisions Sciences 30(2), 1999, pp. 291–311.

[54] K. Mathieson , Predicting user intentions: comparing the technology acceptance model with the theory of planned behavior, Information Systems Research 2(3), 1991, pp. 179-191. [55] R.C. Mayer, J.H. Davis, F.D. Schoorman, An integration model of organizational trust, The

Academy of Management Review 20(3), 1997, 709-734.

[56] R. Mehta, E. Sivadas, Direct marketing on the Internet: an empirical assessment of consumer attitudes, Journal of Direct Marketing 9(3), 1995, 21-32.

[57] A. Muthitacharoen, L.G. Mark, N. Suwan, Segmenting online customers to manage business resources: a study of the impacts of sales channel strategies on consumer preferences, Information & Management 43 (5), 2006, pp. 678-695.

[58] J.C. Nunnally, Psychometric Theory, 2nd ed., McGraw-Hill, New York, NY, 1978.

[59] R.L. Oliver, A cognitive model of the antecedents and consequences of satisfaction decisions, Journal of Marketing Research 17(4), 1980, pp. 460-469.

[60] B. Orr, We don’t get no respect, ABA Banking Journal 97(5), 2005, pp. 60-61.

[61] T. Pikkarainen, K. Pikkarainen, H. Karjaluoto, S. Pahnila, Consumer acceptance of online banking: an extension of the technology acceptance model, Internet Research 14(3), 2004, pp. 224-235.

[62] M. Sathye, Adoption of Internet banking by Australian consumers: an empirical investigation, The International Journal of Bank Marketing 17(7), 1999, pp. 324-334.

[63] S. Shim, M.Y. Mahoney, Electronic shoppers and nonshoppers among videt4x users, Journal of Direct Marketing 5(3), 1991, 29-38.

[64] B. Suh, I. Han, Effect of trust on customer acceptance of Internet banking, Electronic Commerce Research and Applications 1(3-4), 2003, pp. 247-263.

[65] D.M. Szymanski, R.T. Hise, e-Satisfaction: an initial examination, Journal of Retailing 76(3), 2000, pp. 309-322.

[66] S. Taylor, P. Todd, Understanding information technology usage: a test of competing models, Information Systems Research 6(2), 1995, pp. 144-176.

[67] B. Vatanasombut, A.C. Stylianou, M. Igbaria, How to retain online customers, Communications of the ACM 47(6), 2004, pp. 65-69.

[68] V. Venkatesh, F.D. Davis, A model of the antecedents of perceived ease of use: development and test, Decision Sciences 27(3), 1996, pp. 451-481.

[69] Y.S. Wang, Y.M. Wang, H.H. Lin, T.I. Tang, Determinants of user acceptance of Internet banking: an empirical study, International Journal of Service Industry Management 14(5), 2003, pp. 501-519.

[70] T.B. Warrington, N.J. Abgrab, H.M. Caldwell, Building trust to develop competitive advantage in e-business relationships, Competitiveness Review 10(2), 2000, pp. 160-168. [71] H. White, F. Nteli, Internet banking in the UK: why are there not more customers? Journal

of Financial Services Marketing 9(1), 2004, pp. 49-56.

[72] O.E. Williamson, Markets and Hierarchy: Analysis and Anti-trust Implication, The Free Press, New York, 1975.

[73] O.E. Williamson, The Economic Institutions of Capitalism: Firms, Markets, Relational Contracting, The Free Press, New York, 1985.

[74] O.E. Williamson, Comparative economic organization: an analysis of discrete structural alternatives, Administrative Science Quarterly 36(2), 1991, pp. 269-296.

[75] V.A. Zeithaml, L.L. Berry, A. Parasuraman, The behavioral consequences of service quality, Journal of Marketing 60(2), 1996, pp. 31-46.

Figure 1 Conceptual Framework H8 (+) H12 (-) H11 (-) H3 (+) H2 (+) H9 (+) H7 (+) H10 (+) Perceived Ease of Use Perceived Usefulness

Perceived Risk Attitude Toward

Internet Banking

Perceived Trust

Satisfaction Specific Asset

Investment Intention toward Using Internet Banking H1 (+) H6 (+) H4 (+) H5 (+)

TABLE 1 Measurement Model

Constructs Item-Construct Loading Cronbach’s

Alpha Standardized t-value

Perceived Trust .84

XYZ bank is trustworthy. .71 --* I trust the benefits result from the decision made by XYZ bank. .75 9.34 XYZ bank keeps its promises and commitments. .77 9.56 XYZ bank always puts my interests first. .64 8.09 Even without supervising, XYZ bank would do the thing right. .64 8.08

Overall Satisfaction .91

I am happy about my decision to choose XYZ bank. .88 --* I believe I did the right thing to choose XYZ bank. .88 16.12 Overall, I am satisfied with the decision to choose XYZ bank. .85 15.28

Specific Asset Investment .77

XYZ bank will be my prior consideration If I need other financial products, since it is my correspondent bank.

.64 --* XYZ bank provides me a rewards program such as bonus of using credit card

and higher credit line.

.62 6.80 XYZ bank knows my transaction preference and offers me customized

service.

.71 7.47 The reason that I use XYZ is that I am familiar with its employees and

facilities.

.59 6.51 XYZ bank has a special meaning to me .51 5.82

Perceived Risk .79

I fell using internet banking still has the risk of incomplete transaction. .36 --* It is hard to discern the service quality of internet banking. .44 3.99 I do not believe that my personal account can be securely protected through

the online transaction process.

.69 4.68 I am afraid that my password will be divulged. .94 4.91 I am afraid that my data will be embezzled. .81 4.85

Peceived Usefulness .92

Using Internet bank improves my financial transactions performance. .88 --* Using Internet bank enhances my effectiveness on the financial transactions. .89 16.69 Overall, I find the Internet bank useful in my financial transactions. .81 14.12 Using Internet bank makes it easier to do my financial transactions. .81 14.10

Peceived Ease of Use .87

It is easy for me to learn how to use Internet bank. .79 --* I find it easy to get the Internet bank to do what I want it to do. .68 9.35 My interaction with the Internet bank is clear and understandable.. .84 11.78 Overall, I find the Internet bank easy to use. .78 10.88

Attitude Toward Internet Banking .90

I think that using Internet bank is convenient for me. .83 --* To me, using Internet bank is smart. .81 13.83 The experience of using Internet bank for me should be very delightful. .77 12.68 I think that using Internet bank is constructive. .75 12.17 Using Internet bank is attractive to me. .80 13.53

Intention Toward Using Internet Banking .81

I will (continue to) use XYZ Internet bank in the future. .82 --* I will recommend other people to use XYZ Internet bank. .73 10.00 I am willing to spend more time to understand how to efficiently use Internet

bank.

.50 6.70

Note: χ 2(499)= 848.91; CFI= 0.96; NNFI= 0.95; RMSEA=0.055 *The loading was fixed.

TABLE 2

Results of the Proposed Model

Causal Path Hypothesis

(Expected Sign) Standardized Structural Coefficient t-value Hypothesis Testing Perceived ease of use → Perceived

usefulness

H1 (+) .52 6.52 Supported

Perceived ease of use→Attitude toward Internet banking

H2 (+) .14 2.05 Supported

Perceived usefulness → Attitude toward Internet banking

H3 (+) .69 8.93 Supported

Perceived usefulness→Intention toward using internet banking

H4 (+) .01 0.67 Not

supported Attitude toward Internet banking →

Intention toward using internet banking

H5 (+) .71 5.83 Supported

Specific asset investment → Attitude toward Internet banking

H6 (+) .19 2.15 Supported

Specific asset investment → Intention toward using internet banking

H7 (+) .22 2.97 Supported

Satisfaction→Specific asset investment H8 (+) .37 2.65 Supported Satisfaction → Attitude toward Internet

banking

H9 (+) -.05 -0.59 Not

supported Perceived trust → Specific asset

investment

H10 (+) .35 2.40 Supported

Perceived trust→Perceived risk H11 (-) -.06 -0.74 Not

supported Perceived risk→Attitude toward Internet

banking

H12 (-) -.14 -2.28 Supported Note: χ 2(512)=883.55, CFI=.96; NNFI=.95