最佳股市穩定機制之決定(II)A Model of Optimal Stabilizing Mechanism (II)

全文

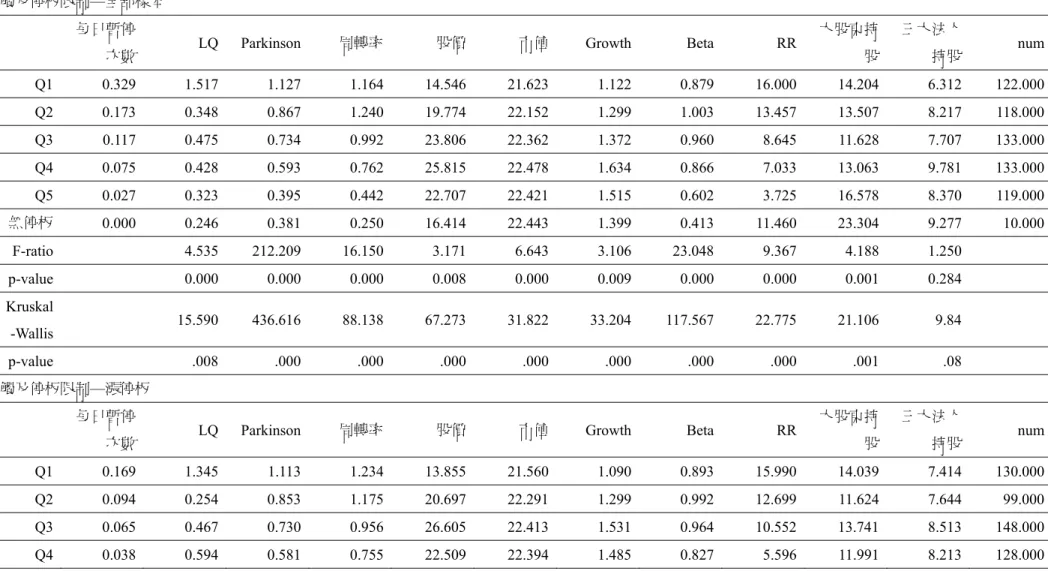

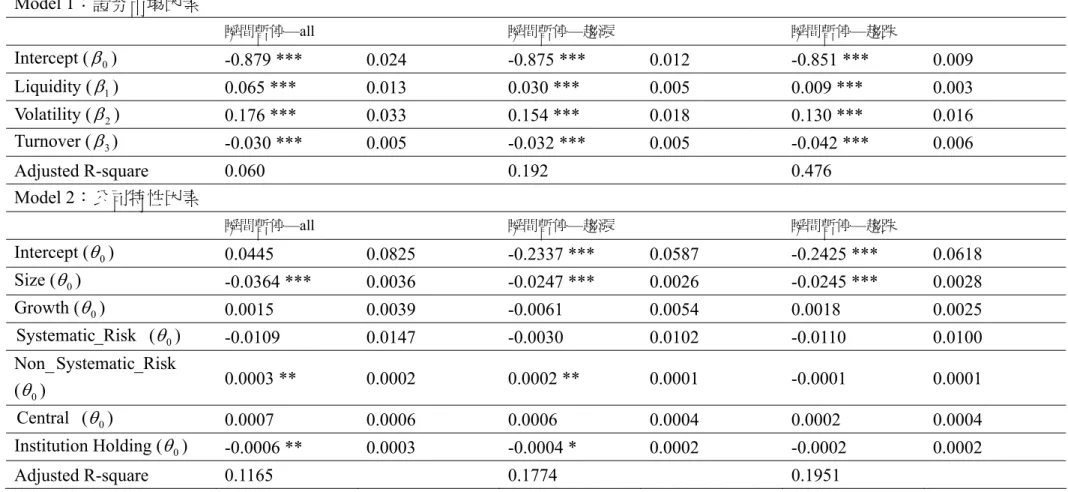

數據

相關文件

(1988a).”Does futures Trading increase stock market volatility?” Financial Analysts Journal, 63-69. “Futures Trading and Cash Market Volatility:Stock Index and Interest

Let and be constants, let be a function, and let be defined on the nonnegative integers by the recu rrence. where we interpret to mean either

證明比較鬆的upper bound或lower bound來慢慢 接近tight

Strassen’s method is not as numerically stable as 基本法..

The ES and component shortfall are calculated using the simulation from C-vine copula structure instead of that from multivariate distribution because the C-vine copula

使用 AdaBoost 之臺股指數期貨當沖交易系統 Using AdaBoost for Taiwan Stock Index Future Intra-.. day

This thesis applied Q-learning algorithm of reinforcement learning to improve a simple intra-day trading system of Taiwan stock index future. We simulate the performance

• As n increases, the stock price ranges over ever larger numbers of possible values, and trading takes place nearly continuously. • Any proper calibration of the model parameters