國 立 交 通 大 學

企業管理碩士學位學程

碩士論文

越南行動手機銀行之採用影響因素的探討

Influencing factors on adoption of

Mobile banking in Vietnam

研 究 生:杜氏莊

指導教授: 唐瓔璋 教授

Influencing factors on adoption of

Mobile banking in Vietnam

研究生:杜氏莊

指導教授:唐瓔璋 教授

Student: DO Thi Trang Advisor: TANG Ying-Chan

國 立 交 通 大 學

企業管理碩士學程

碩士論文

A Thesis

Submitted to Department of Global Master of Business Administration Program College of Management

National Chiao Tung University in partial Fulfillment of the Requirements

for the Degree of Master

in

Business Administration

July 2011

Hsinchu, Taiwan, Republic of China

i

ABSTRACT

Although mobile banking has been introduced in Vietnam market since 2003, reports on mobile banking service in Vietnam show that the percentage of mobile banking user among mobile subscriptions is still very low and potential user may not be using this service, despite their availability. Thus, the objective of this research is to identify the factors determining Vietnamese users‟ acceptance of mobile banking.

This study applied Technology Acceptance Model (TAM), which has been considerably used to predict whether an individual will accept and voluntarily use information technology, with focus on two important factors: perceived ease of use and perceived usefulness. Supported by literature review, the study extended TAM by adding more factors: perceived risks, facilitating condition and personal innovativeness in technology which are predicted to have noticeable impact on mobile- banking adoption in Vietnam.

Data collected from 159 respondents in Vietnam were tested against the extended TAM, using SPSS software. The result strongly supported all the hypotheses in predicting users‟ intention to adopt mobile banking and indicated important role of personal innovativeness in technology in turning users‟ intention to actual usage.

The study also suggested bankers and mobile network providers in Vietnam utilizing marketing communication tools to encourage personal innovativeness factor in order to increase the actual adoption rate of mobile banking.

ii

中文摘要

雖然手機銀行從 2003 年就在越南市場推出,但是根據銀行業報告,手機銀行的使用比例 在行動手機用戶中比例仍然非常低,潛在用戶不接受使用這項服務,儘管的可用性。因此, 本研究的目標是探討關鍵因素影響到用戶對於行動手機銀行的接受度。本研究應用科技結 接受模型(TAM), 已普遍用來預測個人是否會接受並主動利用資訊科技,專注於兩個重 要因素:感知的易用性和感知的有用性。支持文獻,研究延長 TAM 通過添加更多的因素: 感知風險,創新的條件和個人創新,預計將有顯著影響到在越南採用移動銀行。 收集的數據來自 159 受訪者對越南進行了測試擴展 TAM,採用 SPSS 軟件。結果強烈支持 所有的假設針對用戶的打算使用手機銀行,並表示在從打算到實際上是用途徑中個人創由 非常重要的作用。 這項研究還建議銀行和移動網絡供應商利用在越南的營銷傳播工具,以鼓勵個人創新的因 素來提高實際應用率的移動銀行服務。 關鍵詞:移動銀行,越南,TAM 模型,個人創新iii

ACKNOWLEGEMENT

It is difficult to express my deep gratitude to my advisor- Prof. Tang Ying-Chan for his inspiration and great efforts in helping me coming up with the topic and guiding me in generating my idea into an academic research. I would love to have more chance working under his advice in the future.

I would like to express my special thank to Kenny Liao, who helped me get through the difficulty in learning and using SPSS software and now become my friend. I would have lost in SPSS without him.

I send my appreciation to Prof. Jinsu Kang, Prof. Keevin Huang, Prof.Lin Rong-He, Prof. Tseng Fang-Dai for spending time in reading and correcting my thesis. I have learnt a lot from their advices.

I also take this opportunity to express my thank to my best friends- Tam Dao and Binh Tran for supporting me in everything. Also, I could have not done all without my GMBA classmates and friends. They are my family in Taiwan.

iv

TABLE OF CONTENTS

ABSTRACT ... i

中文摘要 ... ii

ACKNOWLEGEMENT ... iii

List of Tables ...vi

List of Figures...vi

Chapter 1: Introduction ... 1

1. Research background and motivation ... 1

2. Research objectives ... 4

3. Research flow ... 4

Chapter 2: Overview of mobile banking ... 6

1. Mobile banking concept ... 6

2. Services on Mobile Banking ... 8

3. Advantages of Mobile Banking ... 10

4. Architecture of mobile banking... 11

5. Popularity of mobile banking ... 12

6. Overview of mobile banking service in Vietnam ... 13

Chapter 3: Literature Review... 16

1. Technology Acceptance Model ... 16

2. Research on Mobile banking ... 18

3. Constructs of the model ... 20

3.1. Perceived usefulness... 20

3.2. Perceived ease of use ... 22

3.3. Perceived risks ... 23

3.4. Facilitating conditions ... 24

3.5. Personal innovativeness in information technology ... 25

Chapter 4. Research Design and Methodology ... 26

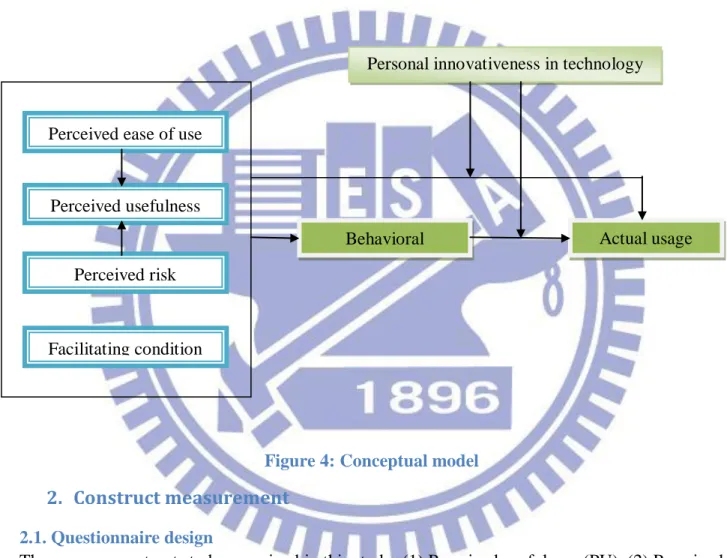

1. Conceptual model design ... 26

2. Construct measurement ... 28

2.1. Questionnaire design ... 28

v

3. Data processing ... 29

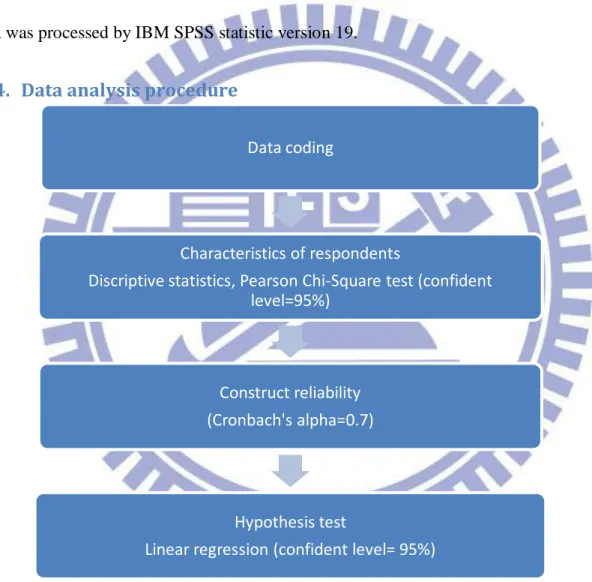

4. Data analysis procedure ... 30

Chapter 5. Data analysis and results ... 31

1. Data collection ... 31

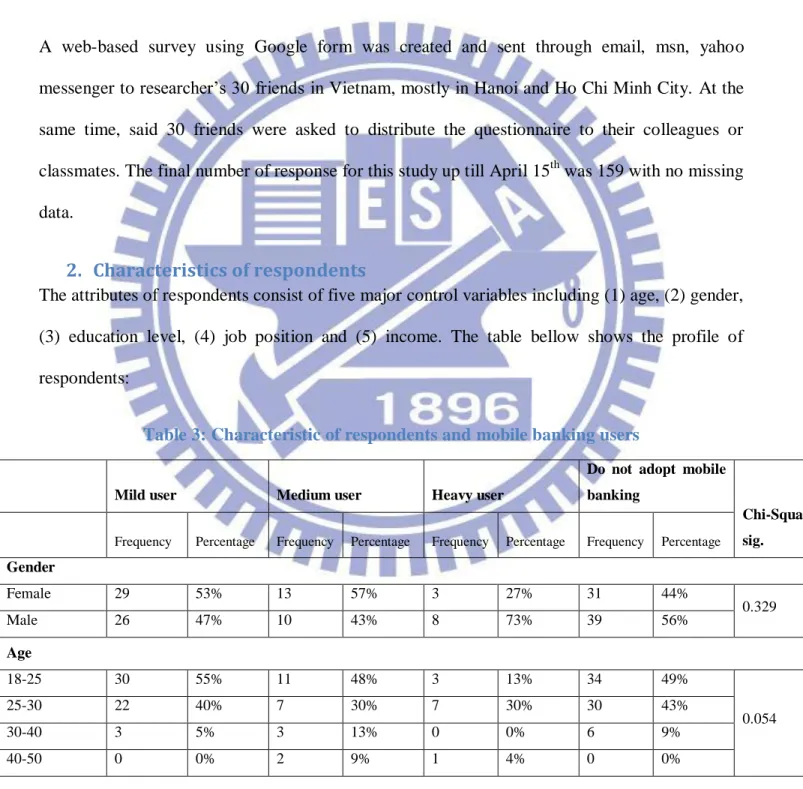

2. Characteristics of respondents ... 31

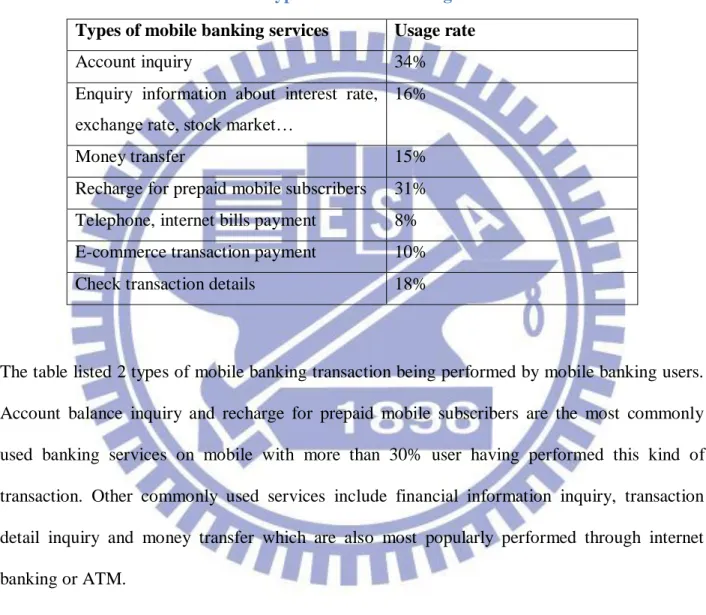

1. Mobile banking usage status ... 33

1.1. Rate of adoption... 33

1.2. Types of banking services performed through mobile phone ... 34

1.3. Advantages and disadvantages of mobile banking ... 34

2. Constructs reliability ... 35

3. Hypothesis tests ... 36

3.1. Relationship between TAM constructs ... 36

3.1.1. Direct effect of TAM constructs on Behavioral Intention ... 36

3.1.2. Relationship between BI and USAGE: H7... 38

3.1.3. Direct effect of TAM constructs on mobile banking usage (USE) ... 39

3.2. Moderator affect of Personal innovativeness in technology ... 39

Chapter 6. Conclusion and Implication ... 45

1. Conclusion ... 45

2. Implication ... 46

Reference... 49

vi

List of Tables

Table 1: Vietnam Mobile Subscribers... 3

Table 2: Research on Mobile Banking ... 18

Table 3: Characteristic of respondents and mobile banking users ... 31

Table 4: Types of mobile banking service ... 34

Table 5: Cronbach's Alpha results ... 35

Table 6: TAM constructs on Behavioral Intention- Summary of regression results... 36

Table 7: BI and USAGE- Regression result ... 38

Table 8: TAM constructs on USAGE- Summary of regression results ... 39

Table 9: Moderating effect of PIT- Summary of regression results ... 40

Table 10: Summary of T-test results (Compare mean to 6) ... 43

Table 11: Pearson Chi-Square test results ... 44

List of Figures Figure 1: Research flow ... 5

Figure 2: Mobile banking architecture ... 11

Figure 3: TAM model ... 17

Figure 4: Conceptual model ... 28

Figure 5: Data processing procedure ... 30

1

Chapter 1: Introduction

1. Research background and motivation

Technology has transformed the way people doing business in general and banking industry in particular. The rapid development of mobile internet and recent introduction of mobile banking service have stimulated the banking and financial sectors towards encouraging customer to bank on-line, 24/7. With the improvement of mobile technologies and devices, mobile banking has been considered as a salient system because of such attributes of ubiquity, convenience and interactivity (Turban et al., 2006). Nowadays, users are able to access to banking system at anyplace and at anytime to conduct banking service conveniently with their mobile devices.

For definition, Mobile banking, also referred to as cell phone banking, is the use of mobile terminals such as cell phones and personal digital assistants (PDAs) to access banking networks via the wireless application protocol (WAP). Through mobile banking, users can access banking services such as account management, information inquiry, money transfer, and bill payment (Luarn & Lin, 2005). Compared with Internet-based online banking services, mobile banking is free of temporal and spatial constraints. Users can acquire real-time account information and make payments at anytime and anywhere. This trend of mobile banking indicates a remarkable potential to the banking industry. Banks can improve their service quality and reduce service costs with an opportunity to convert mobile phone user into banking users.

Mindful of this, recently, more and more banks have provided mobile access to financial information throughout Europe, the United States, Japan and other Asian country. In Vietnam, penetration rate of mobile phone is close to 100% of total population which indicates a

2

remarkable potential to banking industry. Bank can retain existing banking users by providing a new window of communication (mobile banking) apart from original traditional system and have an opportunity to convert mobile phone users into banking users. Nevertheless, the increasing popularity of mobile banking will attract new customer for banks, especially in remote areas where it is not easy for set-up a branch or provide internet banking.

Following the trend, almost major domestic and international banks in Vietnam have cooperated with mobile network providers to offer mobile banking service to their clients, which is believed very helpful to improve their brands, retain existing customers, and acquire new customers by upgrading the quality of services and nature of customer relationship management. However, reports on mobile banking show that potential users may not be using the system or the usage is very limited despite their availability.

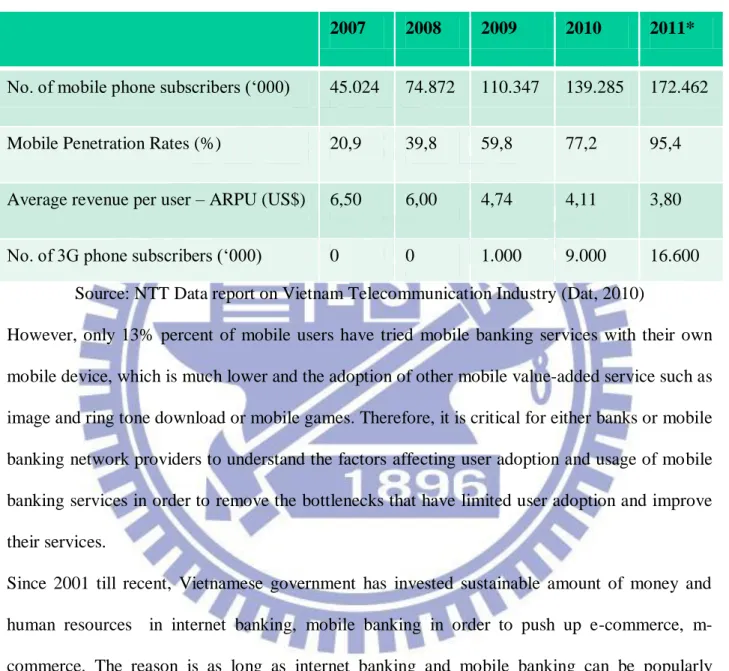

According to the Ministry of Plan and Investment‟s report on telecommunication, Vietnam added 1 million mobile phone subscribers in the first 2 months of 2011, increases the figure of mobile phone users reached 168.6 million, an increase of 32.5% compared to the same period last year (VNPT, 2011). Mobile penetration rates till the end of 2011 is estimated to hit 95.4%, equal to more than 172.4 million subscribers. This number increases everyday and Vietnamese people are more willing to afford for a high- end cell phone enabling them to use attractive value- added services (Dat, 2010). At the same time, mobile operators started suffering from decreasing average revenue per unit of mobile subscription resulted from the price war in different ways between operators. All together make mobile users become profitable target for number of business such as m-commerce, m-advertising, m-games… as well as mobile banking.

3

Table 1: Vietnam Mobile Subscribers

(* means estimated value)

2007 2008 2009 2010 2011*

No. of mobile phone subscribers („000) 45.024 74.872 110.347 139.285 172.462

Mobile Penetration Rates (%) 20,9 39,8 59,8 77,2 95,4

Average revenue per user – ARPU (US$) 6,50 6,00 4,74 4,11 3,80

No. of 3G phone subscribers („000) 0 0 1.000 9.000 16.600 Source: NTT Data report on Vietnam Telecommunication Industry (Dat, 2010)

However, only 13% percent of mobile users have tried mobile banking services with their own mobile device, which is much lower and the adoption of other mobile value-added service such as image and ring tone download or mobile games. Therefore, it is critical for either banks or mobile banking network providers to understand the factors affecting user adoption and usage of mobile banking services in order to remove the bottlenecks that have limited user adoption and improve their services.

Since 2001 till recent, Vietnamese government has invested sustainable amount of money and human resources in internet banking, mobile banking in order to push up e-commerce, m-commerce. The reason is as long as internet banking and mobile banking can be popularly adopted, the government will achieve its goal of eliminating cash in daily payment. However, the ultimate success of mobile banking looks like depending more on consumer‟s perception and whether they are willing to use it. Although there are past literatures on adoption of mobile banking, many of these studies have focus on European countries or the US, the other focus on

4

third world countries in Africa where mobile banking is employed to serve people in remote county, the research on fast growing country like Vietnam remains few. Therefore we are motivated to conduct this study investigating the factors that influence users‟ adoption of mobile

banking in Vietnam.

2. Research objectives

The extant research will try examine the validate determinants of user adoption of mobile banking, utilizing constructs from previous researches as in integrated model. In particular, more new constructs namely perceived risk, facilitating condition and personal innovativeness in technology will be added to original constructs of TAM model which are perceived ease of use, perceived usefulness. The relationship between constructing factor and behavioral intention and usage will be examined to answer the following questions:

What are important factors influencing on the user adoption and usage of mobile banking? Given that there are many factors can influence the usage of mobile banking, the result from this study is believed to allow decision makers in banks to focus on the factor which will increase the adoption rate.

What create the barrier from user‟s intention for preference of mobile banking to actual usage?

What can be done by banks and other players to encourage users‟ adoption?

3. Research flow

To examine factors influencing user adoption, this study acquired survey data from current and potential users of mobile banking service in Vietnam. Hypotheses on relationship among variables will be tested with support from SPSS software. The research flow is presented as below:

5

Figure 1: Research flow

Chapter one outlines the research background, motivation and objectives of this study. Chapter two will provide an overview of mobile banking in general and the situation of mobile banking in Vietnam in particular. Literature review will be conducted in chapter three. In this part, apart many of previous studies will be reviewed to support the conceptual research framework. In chapter 4, research methodology with questionnaires designs and sampling will be explained. Chapter five will present data analysis process and results. Finally, chapter six opens for results discussion, suggestion and practical implication of this study.

Introduction

Industry review

Literature review

Research design and methodology

Data collection

Data analysis and results

6

Chapter 2: Overview of mobile banking

1. Mobile banking concept

Mobile banking, also known as M-banking, cell phone banking, is a term used for perform banking service such as account balance checks, transaction history, transfers funds, bill payment and other banking transaction through a mobile phone (Durkin et al., 2003)

The earliest and simplest form of mobile banking is SMS (Short Message Service) banking which allows users to request for and receive information on their account balances via SMS. With the introduction of the first primitive smart phones with Wireless Access Protocol (WAP) support enabling the use of the mobile web in 1999, the first European bank- Norwergian started to offer mobile banking on this platform to their customers.

Presently, Mobile Banking is being deployed using mobile applications developed on one of the four following channels

- IVR (Interactive Voice Response) - SMS (Short Messaging Service) - WAP (Wireless Access Protocol)

- Standalone Mobile Applications Clients

Mobile banking on Interactive Voice Response service operates through pre-specified numbers that banks advertise to their customers. Customer's make a call at the IVR number and are usually greeted by a stored electronic message followed by a menu of different options. Customers can choose options by pressing the corresponding number in their keypads, and are then read out the corresponding information, mostly using a text to speech program.

7

Mobile banking based on IVR has some major limitations that they can be used only for Enquiry based services. Also, IVR is more expensive as compared to other channels as it involves making a voice call which is generally more expensive than sending an SMS or making data transfer (as in WAP or Standalone clients).

Mobile Banking on SMS uses the popular text-messaging standard to enable mobile application based banking. The way this works is that the customer requests for information by sending an SMS containing a service command to a pre-specified number. The bank responds with a reply SMS containing the specific information. For example, customers of the ACB Bank in Vietnam can get their account balance details by sending the keyword „ACBBAL' and receive their balance information again by SMS. One of the major reasons that transaction based services have not taken of on SMS is because of concerns about security. The main advantage of deploying mobile applications over SMS is that almost all mobile phones are SMS enabled.

WAP uses a concept similar to that used in Internet banking. Banks maintain WAP sites which customer's access using a WAP compatible browser on their mobile phones. WAP sites offer the familiar form based interface and can also implement security quite effectively. The banks customers can now have an anytime, anywhere access to a secure reliable service that allows them to access all enquiry and transaction based services and also more complex transaction like trade in securities through their phone. Mobile Banking users access the bank's site through the WAP gateway to carry out transactions, much like internet users access a web portal for accessing the banks services.

User who has been using internet banking on their personal computer will find WAP banking very helpful because it provide more convenient access to their information. However, WAP

8

banking also give inconsistent user experience due to varying connection speeds and personal handset conditions.

Mobile banking on Standalone mobile applications allows user to perform the whole range of banking service through a mobile application pre-installed in their handset. Standalone mobile applications are the ones that hold out the most promise as they are most suitable to implement complex banking transactions like trading in securities. They can be easily customized according to the user interface complexity supported by the mobile. One requirement of mobile applications clients is that they require to be downloaded on the client device before they can be used, which further requires the mobile device to support one of the many development environments like J2ME or Qualcomm's BREW.

Mobile banking on Mobile Applications is believed as the future of mobile banking because it can provide variety of services, especially advanced value- added services which benefit customer the most and also generate main revenue for providers (Infogile Technology, 2007)

2. Services on Mobile Banking

Banks offering mobile access are mostly supporting some or all of the following services:

Account Information

• Mini-statements and checking of account history • Alerts on account activity or passing of set thresholds • Monitoring of term deposits

• Access to loan statements • Access to card statements

9 • Insurance policy management

• Pension plan management

Payments & Transfers

• Domestic and international fund transfers • Micro-payment handling

• Mobile recharging

• Commercial payment processing • Bill payment processing

Investments

• Portfolio management services • Real-time stock quotes

• Personalized alerts and notifications on security prices

Support

• Status of requests for credit, including mortgage approval, and insurance coverage • Check book and card requests

• Exchange of data messages and email, including complaint submission and tracking

Content Services

• General information such as weather updates, news • Loyalty-related offers

10

3. Advantages of Mobile Banking

The biggest advantage that mobile banking offers to banks is that it drastically cuts down the costs of providing service to the customers. For example in US, an average teller or phone transaction costs about $2.36 each, whereas an electronic transaction costs only about $0.10 each. Additionally, this new channel gives the bank ability to cross-sell up-sell their other complex banking products and services such as vehicle loans, credit cards etc.

For service providers, through mobile messaging and other such interfaces, banks provide value added services to the customer at marginal costs.

The most obvious advantage of mobile banking is the anywhere/anytime characteristics of mobile services. A mobile is almost always with the customer. As such it can be used over a vast geographical area. The customer does not have to visit the bank ATM or a branch to avail of the bank‟s services. Research indicates that the number of footfalls at a bank‟s branch has fallen down drastically after the installation of ATMs. As such with mobile services, a bank will need to hire even less employees as people will no longer need to visit bank branches apart from certain occasions. The use of mobile technologies is thus a win-win proposition for both the banks and the bank‟s customers.

The banks add to this personalized communication through the process of automation. For instance, if the customer asks for his account or card balance after conducting a transaction, the installed software can send him an automated reply informing of the same. These automated replies thus save the bank the need to hire additional employees for servicing customer needs.

11

4. Architecture of mobile banking

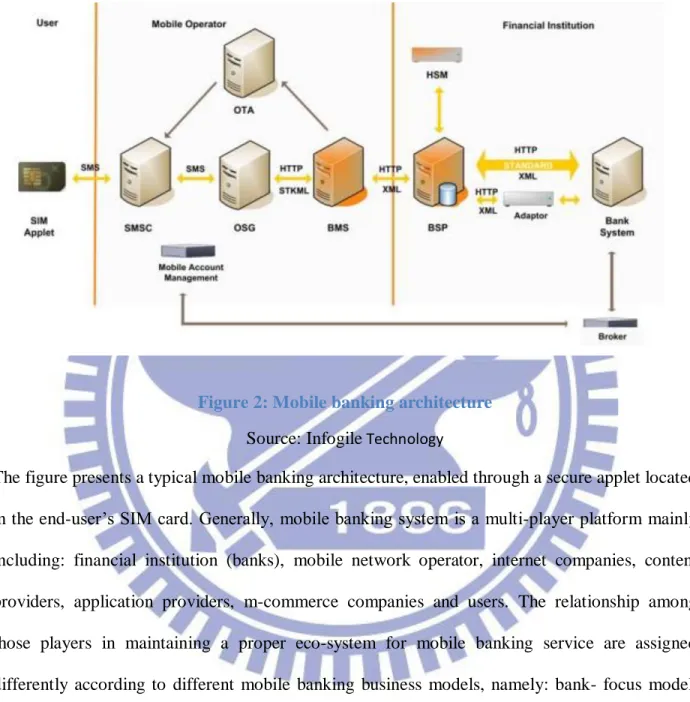

Figure 2: Mobile banking architecture

Source: Infogile Technology

The figure presents a typical mobile banking architecture, enabled through a secure applet located in the end-user‟s SIM card. Generally, mobile banking system is a multi-player platform mainly including: financial institution (banks), mobile network operator, internet companies, content providers, application providers, m-commerce companies and users. The relationship among those players in maintaining a proper eco-system for mobile banking service are assigned differently according to different mobile banking business models, namely: bank- focus model, bank- led model and non-bank led model (Infogile Technology, 2007). The bank- focus model emerges when a traditional bank use mobile banking as an additional channel for its existing customers to perform a limited banking services. The bank-led model offers distinct alternative to conventional branch- based banking in that customer conducts financial transactions at a whole

12

range of retail agents through a mobile phone. This model is applied to increase to financial outreach to remote areas or distinct market, which is significant cheaper than establish a bank branch. The non-bank led model limits bank‟s role as a safe-keeping fund while all other functions will be conduct by non-bank (e.g. Telecommunication Company) who has direct contact with individual customers. In Philippine, Ghana, South Africa and India, where establishing a bank branch is not applicable, Bank-led model is the most popular model. In case of Vietnam, mobile banking is firstly designed as additional exposure channel of banks with customer; therefore, bank- focus model takes place.

5. Popularity of mobile banking

Mobile banking is gaining popularity over the world. For instance, it is believed that mobile technology has solidified enough to the point of having 25% of US mobile phone users adopting mobile banking technology. Nowadays in US, about 1,000 banks now offer mobile banking, out of approximately 30,000 financial institutions in the nation. A few of the top features being utilized are notifications of low balances, overdrafts, suspicious activity, fraud alerts, and credit limits.

According to 2010 white paper from Juniper Research, the number of worldwide mobile phone users who perform mobile banking will double from 200 million in 2010 to 400 million in 2013. The Far East and China currently account for about half of global mobile banking users, and that percentage will remain virtually flat as the number of users increases globally. Western Europe accounts for the second-highest percentage of users and the Middle East and Africa and North America ties for the third-highest percentage..Especially, Africa has been utilizing mobile banking as the main channel to reach and serve client in remote areas where setting a bank branch or office is too costly and unsecured. Mobile banking is also anticipated to play a key role in

13

bringing financial services to people in the Middle East and Africa. In Europe and North America, the technology will mainly serve as an extension of existing online banks as mobile handsets become more widely used for Internet access. By 2015, Berg Insight forecasts that mobile banking will attract 115 million users in Europe and 86 million users in North America.

According to the same paper, mobile banking will reach 816 million users in 2011, generate 37 billion USD revenue, recording as 13 times of that number in 2007. We share the same belief about promising future of mobile banking thanks to the global trend changing from 2G to 3G standards and the penetration of smart-phone which will encourage the uptake of mobile banking.

6. Overview of mobile banking service in Vietnam

Mobile phone has been developing at lightning speed and changing almost every aspect of our daily life. Particularly in financial industry, the internet boom and the appearance of more and more smart phones have allowed customers to use banking services at a long distance, thus making bank branches become deserted. In 2009, Bank of America was forced to close 10 percent of its 6,100 branches throughout the United States due to the dramatic increase in transactions via mobile phones and the internet (Review, 2009). However, this is not the case with Vietnam, despite it having among the highest telecommunications growth rates in the world (Dat, 2010).

Asia Commercial Bank (ACB) bank is the first bank introducing Mobile Banking service to Vietnam market in 2003. The move of ACB at that time was consider as “pioneer”, opening a new era of competition on technology oriented services in Vietnamese banking industry.

Since the first day of operation, ACB has indentified a vision to become the best commercial retail bank in Vietnam with customer- centric strategy. Target customers of ACB are individuals,

14

small and medium enterprises (SMEs). Year 2003 is a remarkable year of ACB when they tried to launch e-banking, phone- banking, mobile banking and home banking at the same time in order to compete over state-owned commercial banks.

At the early day of service, ACB bank account owner had to sign a contract of using Mobile Banking service. With a password provided by ACB, user could activate mobile banking service from their phone and use SMS to request for account balance, information about interest rate, exchange rate, and deposit money to their Visa Electron, Master Electronic or Citimart cart…By innovative service, ACB at that time attracted a lot of new customers. Its success was encouraged my Government in effort to break the Vietnamese habit of using cash and followed by other commercial banks. After ACB, other domestic banks like TienPhong- Bank, DongABank, Sacombank and Techcombank also activated their mobile banking service as an additional channel to communicate with current customers.

At that time, a primitive form of telephone banking worth mentioning is Vinaphone‟s EasyTopUp, which allows prepaid mobile phone subscribers with Sacombank credit cards to buy top-up cards via SMS. In mid-May 2009, TienPhongBank launched its Mobile Banking service to enable customers to make account inquiries, transfer money and pay internet fees with the aid of software installed in mobile phones. In addition, customers receive automatic notification about changes in the balance of their accounts. Set up by FPT Telecommunication Corporation (FPT), VMS (MobiFone), and VINARE (Vietnam National Reinsurance Corporation), TienPhongBank inherited strong capacity from Vietnam‟s two giants in information technology and telecommunications.

15

In more advanced level of service, Online transaction has been piloted by both Techcombank and DongABank. Clients need to have an account at DongABank, a mobile phone using GSM network and supporting JAVA software in order to register for the SMS banking service. The services provided include money transfer, prepaid cards purchase, online payment and electronic deposits. Techcombank allows customers to make payment through SMS, with customers simply sending a text message to give instructions to the bank.

Now all commercial banks in Vietnam are providing mobile banking service, in partnership with 7 mobile network providers and other payment service providers. However, mobile banking is still limited with non-financial service.

Currently, in a sustainable effort to reduce cash in daily transaction, Vietnamese government believed that mobile banking is one of the promising solutions for that issue. Either banks or mobile network providers have been pushed to participate in this game. So far, 100% banks in Vietnam are providing mobile banking services, in cooperation with one or all mobile network providers (State Bank, 2010). Mobile banking has become prior topic in most of banking conference and on media. For instance, the upcoming 14th Banking Vietnam conference in May, 2011 will focus on this topic under the theme of “Governance and Risk Management, Security in Banking system and Non-cash payment especially Mobile payment” (www.bankingvn.com.vn, 2011). However, mobile banking popularity and usage is still fairly questionable which also encourages this study.

16

Chapter 3: Literature Review 1. Technology Acceptance Model

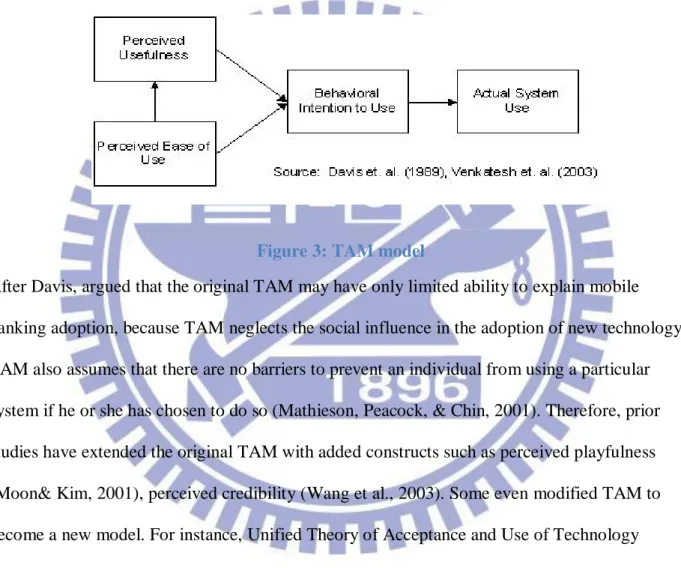

One of the most common models used by researchers in the study about adoption of innovation technology is Technology Acceptance Model (TAM). TAM, firstly established by Davis, was often used to the test computer applications as computer adoption, word processors (Davis, 1989). TAM later has been expanded used for internet, e-mail, WWW, GSS, intranet, e-commerce, m-commerce, e-learning, e-book (Al-Gahtani & King, 1999; Davis, 2007; Horton et al., 2001; Kim & Han, 2008; Porgieter & Kang, 2010) under different situations (e.g, time and culture) with different control factors (e.g. gender, education…). Since mobile banking technology is considered as innovation technology, applying TAM model for this study should be most suitable. In the other hand, TAM is chosen, because it is appreciated as the most parsimonious and widely accepted model (Srite & Karahanna, 2006) to examine adoption decisions at an individual level.

TAM proposed that both the perceived usefulness and perceived ease of use can be used to predict the attitude towards using new technology, which in turn affects the behavioral intention to use the actual system directly (Davis, 1989; Venkatesh et al., 2003). Perceived usefulness is defined by Davis, 1989 as „„the prospective user‟s subjective probability that using a specific application system will increase his or her job performance within an organizational context” and perceived ease-of-use is defined as „„the degree to which the prospective user expects the target system to be free of effort”. Thus for users of mobile banking, they will adopt the system if they believe the system will bring benefits such as reducing time spent on going to bank and improving efficiency (Rao & Troshani, 2007). Also, if users feel that mobile banking is easy to use and free of hustle, then the chances of them to use the system will be greater

17

Obviously, perceived usefulness is related to productivity but perceived ease-of-use is related to effort. These two dimensions will influence an individual‟s attitude that result in his/her behavioral intention, which affect his/her actual usage of technology (Davis, 1989). In addition, perceived ease-of-use affect perceived usefulness because the easier technology is to be used, the more useful it will be.

Figure 3: TAM model

After Davis, argued that the original TAM may have only limited ability to explain mobile banking adoption, because TAM neglects the social influence in the adoption of new technology. TAM also assumes that there are no barriers to prevent an individual from using a particular system if he or she has chosen to do so (Mathieson, Peacock, & Chin, 2001). Therefore, prior studies have extended the original TAM with added constructs such as perceived playfulness (Moon& Kim, 2001), perceived credibility (Wang et al., 2003). Some even modified TAM to become a new model. For instance, Unified Theory of Acceptance and Use of Technology (UTAUT model) aimed to explain users‟ intention to use an information system and their subsequent usage behavior, holding four key constructs performance expectancy, effort

expectancy, social influence, and facilitating conditions) as direct determinants of usage intention and behavior (Venkatesh et al., 2003). The variables of gender, age, experience, and

18

voluntariness of use are posited to moderate the impact of the four key constructs on usage intention and behavior (Venkatesh et al.,2003).

In more recent research on internet banking or mobile commerce, researchers also applied TAM as the base model and extend the model by including other variables, such as perceived risk, perceived financial cost, perceived self- efficacy, government support (Luan, &Lin, 2006; Wu &Wang, 2005, Yiu et al., 2007). Motivated by those researches, this study also found that TAM model must be the most suitable theory could explain users‟ behavioral intention and actual usage of mobile banking in Vietnam.

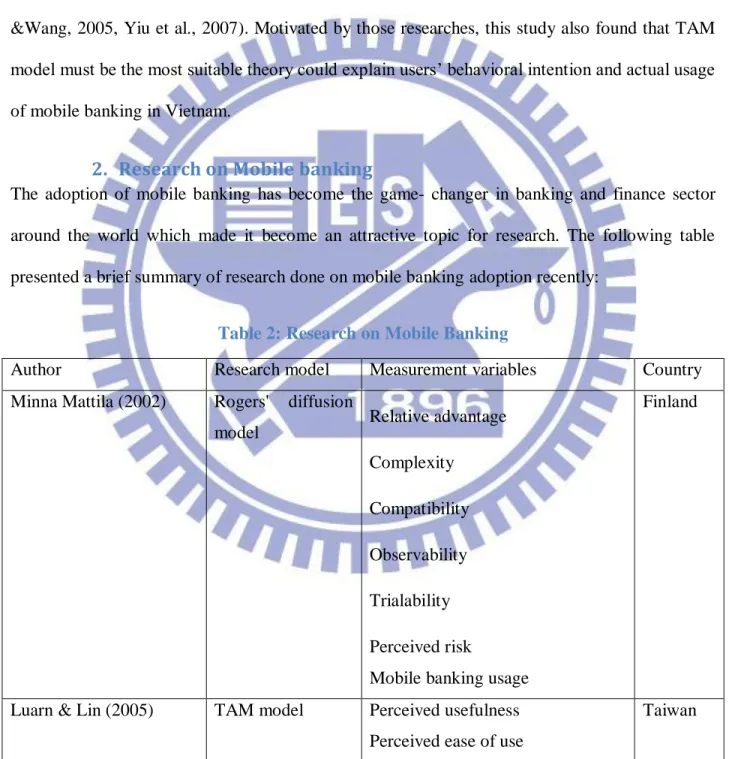

2. Research on Mobile banking

The adoption of mobile banking has become the game- changer in banking and finance sector around the world which made it become an attractive topic for research. The following table presented a brief summary of research done on mobile banking adoption recently:

Table 2: Research on Mobile Banking

Author Research model Measurement variables Country

Minna Mattila (2002) Rogers' diffusion

model Relative advantage Complexity

Compatibility

Observability

Trialability

Perceived risk

Mobile banking usage

Finland

Luarn & Lin (2005) TAM model Perceived usefulness Perceived ease of use

19

Perceived credibility Perceived self- efficacy Perceived financial cost Behavioral Intention Sulaiman et al., (2007) Rogers' diffusion

model

Demographic

Personal innovativeness Mobile banking adoption

Malaysia

Gu & Lee (2009) TAM model Perceived usefulness Perceived ease of use Trust

Behavioral Intention

Korea

Crabbe, Standing, & Standing (2009)

TAM model Perceived usefulness Perceived ease of use Perceived elitisation Perceived credibility Facilitating conditions

Sustained usefulness and sustained usage

Ghana

Riquelme, Hernan E.; Rios, Rosa E (2010)

TAM model Perceived of relative advantage Perceived risk

Social norms

Perceived ease of use Perceived usefulness Behavioral Intention

Singapore

Either using Roger‟s diffusion model or TAM model, previous research shared the same point of using perceived usefulness, perceived ease of use and perceived risk or trust in mobile banking system as the main construct for research model. Other variables such as facilitating conditions or

20

personal innovativeness were also taken into consider depending on each country‟s problem situation.

We could not find any empirical study on mobile banking in Vietnam although it has been introduced for 10 years. Most of the discussions about mobile banking in Vietnam are presented in term of news report or expert opinion on banking industry newspaper or forum. Therefore, more systematic study about this important topic is needed.

Responding to previous researches, this study will also use TAM as based model and include more additional variables which are believed to be important for In order to increase the predictive power of TAM in measuring the mobile banking adoption in Vietnam, additional construct were added to the original factors- perceived usefulness and perceived ease of use. The new factors included in this study are believed to play potential influences on adoption behavior of mobile banking users:

Perceived risk (Pikkarainen, 2004)

Facilitating conditions (Crabbe, Standing, & Standing, 2009)

Personal innovativeness in technology (Rogers, 1995; Agarwal & Prasad, 1998; Lu, Yu, Liu, & Yao, 2003).

3. Constructs of the model

3.1. Perceived usefulness

Perceived usefulness is known as performance expectancy when people think that based on advantages of innovation, information technology (IT) can help them enhance productivity and aid work performance (Davis, 1989; Davis, 2007).

21

Liao and Cheung (2002) in their study about electronic banking measured perceived usefulness in a multi dimension with vast variables such as transaction speed, use-friendliness, user experience, accuracy, convenience, etc.

The importance of perceived usefulness has been widely recognized in technology adoption in past study. Jeyaraj et al. (2006) in their review of technology adoption studies from 1992-2003, found that of the 29 studies on technology adoptions, perceived usefulness was found to have significant influence on the user‟s intention to adopt and technology.

Perceived usefulness is also one of the common factors applied in existing electronic banking study. Guriting and Ndubisi, 2006; Laforet and Li, 2005; Liao and Cheung, 2002 have approved the significant effect of perceived usefulness on adoption intention, where perceived usefulness is known as advantage of innovation over existing banking channels. Pikkarainen et al, 2004, in their study of online banking in Finland, found that perceived usefulness is one of the most significant influence on the intention to use online banking among the consumers. Moreover, Polatoglu and Ekin, 2001 pointed out the greater the perceived usefulness of using electronic banking service, the more likely that electronic banking will be adopted. Evidently, Luarn and Lin (2005) examined that perceived usefulness has significant impact in the development of initial willingness to use mobile banking.

This study found that Davis‟s definition of perceived usefulness most applied where perceived usefulness means that the application is found available and helpful for customer at anytime and anyplace, allowing them to conduct their needed banking services more efficiently and encourage them to take part in more banking transactions.

22

3.2. Perceived ease of use

Perceived ease of use is defined as “the degree to which a person believes that using a particular system would be free of effort” (Davis, 1989). Innovative technology system that is perceived to be easier to use and less complex will have a higher likehood of being accepted, and used by potential user (Davis, 1989). Besides perceived usefulness, perceived ease of use has also been validated as important determinant in adoption of a lot of information technologies, such as intranet (Chang, 2004), WWW (Lederer, Maupin, Sena, & Zhuang, 2000), online banking (Wang, Wang, Lin, & Tang, 2003), and wireless internet (Lu, Yu, Liu, & Yao, 2003). Rogers, 1995 also pointed out that the complexity of one particular system will discourage the adoption of an innovation.

Consult (2002) noted that perceived ease of use refers to the ability of consumers to experiment with a new innovation and evaluate its benefits easily. He also affirmed that the drivers of growth in electronic banking are determined by the perceived ease of use which is a combination of convenience provided to those with easy internet access, the availability of secure, high standard electronic banking functionality, and the necessity of banking services.

In Vietnam, as (Hoang, 2003) pointed out, Vietnamese users have little experience in using the internet and therefore the ease of use of the online banking web site might influence their adoption decision. According to Thatcher & Perrewe, 2002, the ease of use of a new system is perceived differently among different level of knowledge and age of user where high education and young users are not hesitated to try a new IT system while low education or older users find IT systems complicated.

23

This study define perceived ease of use as degree who people learn about using and come to utilize mobile banking in their daily life without paying too much effort. We will try to investigate the extent to which perceived ease of use determined user‟s intention and usage of mobile banking service. At the same time, we will also investigate the positive effect of perceived ease of use on perceived usefulness.

3.3. Perceived risks

Perceived risk‟s origin was back into 1960 when .Bauer firstly introduced the concept of perceived risks as a combination of uncertainty plus serious of outcome involved (R. Bauer, 1960). So far, perceived risk has been applied in many researched on consumer behavior and developed multi- dimension construct where risks are divided into financial, psychological, physical and social loss (Featherman & Pavlou, 2003;SM & B., 2003; J & L.B, 1972; Lu, Yu, Liu, & Yao, 2003). However, the separation perceived risks into sub dimensions was agued to be lack of accuracy and perceived risk is over all difficult to capture because it‟s very individual subjective (Wang, Wang, Lin, & Tang, 2003).

However, none of study has refused the role of risk on consumer‟s decision to adopt a new technology. In more relevant research about internet banking, perceived risk has been approved as an important attitudinal factor that influences adoption behavior and mainly focuses on transaction security risk or privacy risk (Kim & Prabhakar, 2004; Laforet S, 2005; Polatogu & Ekin, 2001). According to Yiu,, Grant, & Edgar, 2007, using e-payment customers always concern about the transaction process and perceived threats to privacy and personal information leak. Similar in mobile banking service, for each time using mobile banking, users has to depend of their trust on either banks or mobile network and other content providers. Therefore, we believe that perceived risk is very important variable which critically influences on consumer‟s

24

adoption decision, while perceived risk will be measured from the perspective that includes two main concerns: transaction stability and personal information (Wang, Wang, Lin, & Tang, 2003; Yiu, Grant, & Edgar, 2007).

In our study, referring to Pillarainen‟s research, four items measuring people‟s trust on

transaction stability and the protection of personal information were designed.

3.4. Facilitating conditions

Facilitating conditions refer to how an individual believes an existing infrastructure would support his or her use of the information system (Venkatesh, Morris, Davis, & Davis, 2003). Thompson, Higgins, and Howell (1991) proposed that facilitating conditions could be an important factor impacting technology acceptance and usage.

Previous study measured facilitating conditions in two main dimensions including technology support and government support. Goh , 1995 suggests that, as supporting technological infrastructures become easily and readily available, Internet commerce applications such as banking services will also become more feasible. Goh‟s study also suggested that the government can play an intervention and leadership role in the diffusion of innovation. The greater the extent of perceived government support for electronic commerce, the more likely that Internet banking will be adopted.(Tan & Teo, 2000).

In more recent research (Crabbe, Standing, & Standing, 2009) again supported that acilitating conditions and demographic factors also have obvious effects on mobile banking adoption in Ghana.

We do think that support from both technological infrastructure and government is critical for mobile banking adoption since it involved multi-players who are taking different roles in the

25

game. Facilitating in our study will cover user‟s technology condition itself, the support from two main players which are banks and telecommunication companies and the legal support from government.

3.5. Personal innovativeness in information technology

Personal innovativeness was referred in Rogers‟ research (1983) as an important factor which decide why some individual are by their nature are more willing to take risk of trying innovation why others are suspicious of new idea and hesitant to change their current practice (Rogers, 1983). More recently studies segment potential adopters of innovation into innovators, early adopters, early and late majority adopters and laggards (Rao & Troshani, 2007; Yi & Park, 2006). The segmentation in potential adoption is decided by demographical factors, social influence, personality and the involvement of media (Hoyer & Maclnnis, 2008).

Previous study added personal innovativeness in technology as a direct construct to TAM model which resulted in the conclusion that higher PIT higher positive intention to use new system (Lu, Hsu, & Hsu, 2005). However some other researches considered PIT as a moderator that can moderates the impact of perceived belief of use on technology usage (Agarwal & Prasad, 1998; Ndubisi, 2005).

Since we view mobile banking as a disruptive technology innovation which fills in the niche that internet banking and physical bank service leave to deliver to customer the convenient connectivity and mobility, personal innovativeness logically will influence on user‟s adoption decision. In this study, responding to Agawal and Prasad‟s findings, we adopt personal innovativeness as a moderator and discuss the impact of demographic factors on PIT.

26

Chapter 4. Research Design and Methodology

1. Conceptual model design

Literature review has shown the relationship between constructs where perceived usefulness, perceived ease of use, perceived risk and facilitating has direct influence on mobile banking use. There are extensive research provides evidence of significant effect of usefulness on behavioral intention and usage (Davis F. , 1989; Hu, Chau, Sheng, & Tam, 1999; Jackson, Chow, & Leitch, 1997; Venkatesh & Morris, 2000). The ultimate reason people exploit mobile banking systems is that they find them useful.

Prior studies have also shown that there is a positive relationship between perceived ease of use and usage intention (Guriting & Ndubisi, 2006); (Luarn, P., & Lin, 2005; Wang, Wang, Lin, & Tang, 2003; Kleijnen & Wetzels, 2004; Ramayah, Dahlan, Mohamad, & Ling, 2003). At the same time, perceive ease of use will increase degree of perceived usefulness.

Perceived risk has been historically found to have negative effect on users‟ intention to adopt a new technology (Suh & Han, 2002; Doney & Cannon, 1997). In a study of online banking (Aladwani, 2001) potential customers ranked internet security and customer‟s privacy as the most important future challenges that banks are facing. Similar hypothesis about negative influence of perceived risk on user‟s intention and usage is proposed here.

Regarding to facilitating condition which covers both technology conditions and government support, it is proposed to have positive effect on consumer‟s intention and usage.

The moderating effects of personal innovativeness in technology on relationship between constructs are also included in hypothesis tests.

27

In summary, this research proposes the following hypotheses:

H1: Perceived ease of use has a positive impact on behavioral intention to use mobile banking

H2: Perceived usefulness has a positive impact on behavioral intention to use mobile banking

H3: Perceived risk has a negative impact on behavioral intention to use mobile banking

H4: Facilitating conditions has a positive impact on behavioral intention to use mobile banking

H5: Perceived ease of use has a positive impact on perceived usefulness

H6: Perceived risk has a negative impact on perceived usefulness

H7: Behavioral intention has positive effect on mobile banking use

H8: Perceived ease of use has a positive impact on mobile banking usage

H9: Perceived usefulness has a positive impact on mobile banking usage

H10: Perceived risk has a negative impact on mobile banking usage

H11: Facilitating conditions has a positive impact on mobile banking usage

H12a: Personal innovativeness has a moderation effect between perceived ease of use and mobile banking usage

H12b: Personal innovativeness has a moderation effect between perceived usefulness and mobile banking usage

H12c: Personal innovative has a moderation effect between perceived risks and mobile banking usage

28

H12d: Personal innovativeness has a moderation effect between facilitating conditions and mobile banking usage

H12e: Personal innovativeness has a moderation effect between behavioral intention and mobile banking use

Figure 4: Conceptual model

2. Construct measurement

2.1. Questionnaire design

There seven constructs to be examined in this study: (1) Perceived usefulness (PU), (2) Perceived ease of use (PEU), (3) Perceived risk (PR), (4) Facilitating conditions (FC), (5) Personal innovativeness in technology (PIT), (6) Behavioral intention (BI) and (7) Mobile banking usage (USE). This study applied multiple items to measure those constructs. Seven point Likert was used to all question items of first five constructs, ranging from strongly disagree (1) through neutral (4) to strongly agree (7).

Perceived ease of use

Perceived usefulness Perceived risk Facilitating condition Behavioral intention Actual usage Personal innovativeness in technology

29

Behavior intention and Mobile banking use are surveyed directly by asking which item of mobile banking service respondents intend to use or have been using.

Other sections of the questionnaire were designed to investigate respondent‟s banking behavior, their understanding status of mobile banking service providing currently in Vietnam and demographic information.

2.2. Pilot study

A pilot study was undertaken using an array of people that included two MBA students, two material science Ph.D students, a former bank employee, two free traders. Such a diverse group was chosen, as cell phone users are many and diverse. The main purpose of the pilot was to ensure the questionnaire adequately addressed the relevant issues, that it was easy to understand, the sequence of questions were reasonable, and that it had been professionally compiled. The participants were asked to fill in the questionnaire, and add any other comments on how the

questionnaire could be improved.

After the pilot study, wording of the questionnaire and additional introduction about mobile banking at the beginning of the survey were revised and added.

3. Data processing

Google online survey provides detail time stream of respondents as well as a spreadsheet of all responses. The spreadsheet was later coded for easier analysis.

One point would be given for each item of service that respondent chosen indicating their behavioral intention of using mobile banking service. The range of measurement is from 1 to 8. Mobile banking usage was coded depending respondent‟s chosen items under question 1 of section 3- Mobile banking.

30 None of item was chosen: non-user (coded as 0)

1 till 2 items were chosen: mild user (coded as 1)

3 till 4 items were chosen: medium user (coded as 2)

5 items and above were chosen: heavy user (coded as 3)

Data was processed by IBM SPSS statistic version 19.

4. Data analysis procedure

Figure 5: Data processing procedure

Data coding

Characteristics of respondents

Discriptive statistics, Pearson Chi-Square test (confident level=95%)

Construct reliability (Cronbach's alpha=0.7)

Hypothesis test

31

Chapter 5. Data analysis and results

1. Data collection

The questionnaire items of this study were revised from previous researches and took 5 weeks to collect, starting from March 7th to April 15th of 2011. Questionnaires using double translating method were translated into Vietnamese to make it easier to respondents.

A web-based survey using Google form was created and sent through email, msn, yahoo messenger to researcher‟s 30 friends in Vietnam, mostly in Hanoi and Ho Chi Minh City. At the same time, said 30 friends were asked to distribute the questionnaire to their colleagues or classmates. The final number of response for this study up till April 15th was 159 with no missing data.

2. Characteristics of respondents

The attributes of respondents consist of five major control variables including (1) age, (2) gender, (3) education level, (4) job position and (5) income. The table bellow shows the profile of respondents:

Table 3: Characteristic of respondents and mobile banking users

Mild user Medium user Heavy user

Do not adopt mobile banking

Chi-Square sig.

Frequency Percentage Frequency Percentage Frequency Percentage Frequency Percentage

Gender Female 29 53% 13 57% 3 27% 31 44% 0.329 Male 26 47% 10 43% 8 73% 39 56% Age 18-25 30 55% 11 48% 3 13% 34 49% 0.054 25-30 22 40% 7 30% 7 30% 30 43% 30-40 3 5% 3 13% 0 0% 6 9% 40-50 0 0% 2 9% 1 4% 0 0%

32 Education level Vocational school 0 0% 0 0% 0 0% 0 0% 0.351 Senior high school 0 0% 0 0% 0 0% 0 0% University/Col lege 44 80% 17 74% 9 39% 46 66% Master 11 20% 5 22% 1 4% 20 29% Doctorate 0 0% 1 4% 1 4% 4 6% Employment Worker 0 0% 0 0% 0 0% 0 0% 0.000 Company employee 17 31% 11 48% 5 22% 19 27% Free trader 0 0% 0 0% 2 9% 0 0% Manager 2 4% 3 13% 0 0% 0 0% Student 30 55% 7 30% 4 17% 45 64% Other 6 11% 2 9% 0 0% 6 9% Income Less than 200USD 15 27% 4 17% 0 0% 14 20% 0.019 From 200-500USD 12 22% 9 39% 4 17% 21 30% From 500-1000USD 7 13% 4 17% 3 13% 7 10% More than 1000USD 1 2% 2 9% 2 9% 0 0% No income 20 36% 4 17% 2 9% 28 40%

The table does not show much different percentage between male and female respondents (52% and 48%), with majority are between 18 to 30 years old, followed by those of thirty to forty years old. Seventy percent of the respondents have on in the process to get bachelor diploma while 29% respondents has higher master or doctorate degree.

33

Students occupied more than half of observations (54%), the rest are working as employee in a company (33%) and some are running their own business. Fifty seven people, equally to thirty six percent of the respondents have no income since they are still college or graduate students. Half of the respondent has monthly income less than 500 USD, with 30% has more than 200 USD. More than ten percent of ten percent of the respondents (14%) has relative high income in Vietnam urban community (from 500 to 1000USD). More than half of the observations have been using mobile phone for over 5 years; the rest has at least 1 year using experience.

The characteristics of mobile banking users were identified by examining the relationship between the respondent‟s demographic profiles and whether they adopt mobile banking service.

Pearson Chi-Square with confident level of 95% was employed to test the variance of usage of population under demographic variables. It was found that there is no difference in mobile banking usage among population in term of gender, age and education level (p-values are higher than 0.05). However, employment position and income status indicated significant variance in population usage (p-value are lower than 0.05). Mobile banking is observed to be most popular among students and company employees, with monthly income lower than 500USD. The possible explanation is that students and company employees are also target group of internet transaction (www. Saigonmoney.com)

1. Mobile banking usage status 1.1. Rate of adoption

The survey enquired whether the respondents have used mobile banking and how often they use it to obtain the current rate of adoption of mobile banking. The result showed relative higher adoption rate (44.02%) than previous report from media (13%). It could be biased by the sampling group who are mainly young people (91% of respondents are younger than 30).

34

However this penetration rate is still much lower than in other developing countries as China, Philippines, India…

1.2. Types of banking services performed through mobile phone Table 4: Types of mobile banking service

Types of mobile banking services Usage rate

Account inquiry 34%

Enquiry information about interest rate, exchange rate, stock market…

16%

Money transfer 15%

Recharge for prepaid mobile subscribers 31% Telephone, internet bills payment 8% E-commerce transaction payment 10%

Check transaction details 18%

The table listed 2 types of mobile banking transaction being performed by mobile banking users. Account balance inquiry and recharge for prepaid mobile subscribers are the most commonly used banking services on mobile with more than 30% user having performed this kind of transaction. Other commonly used services include financial information inquiry, transaction detail inquiry and money transfer which are also most popularly performed through internet banking or ATM.

1.3. Advantages and disadvantages of mobile banking

Respondents were requested to point out advantages and disadvantages of mobile banking transaction. The results showed that the possibility of performing banking service anywhere, anytime, saving time and travel cost are the most important advantages that respondents see in mobile banking. In contrast, more than 50% of respondents think that the security concerns,

35

instability of mobile network and “Not everybody‟s phone is facilitated to use mobile banking” are the main inhibitors of adoption of mobile banking in Vietnam.

2. Constructs reliability

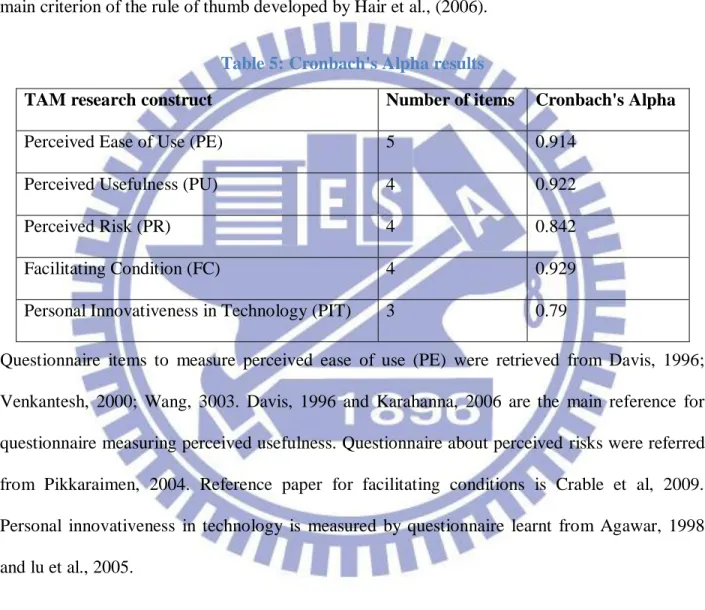

Reliability test was applied to observe and verify the internal consistency analysis, following the main criterion of the rule of thumb developed by Hair et al., (2006).

Table 5: Cronbach's Alpha results

TAM research construct Number of items Cronbach's Alpha

Perceived Ease of Use (PE) 5 0.914

Perceived Usefulness (PU) 4 0.922

Perceived Risk (PR) 4 0.842

Facilitating Condition (FC) 4 0.929

Personal Innovativeness in Technology (PIT) 3 0.79

Questionnaire items to measure perceived ease of use (PE) were retrieved from Davis, 1996; Venkantesh, 2000; Wang, 3003. Davis, 1996 and Karahanna, 2006 are the main reference for questionnaire measuring perceived usefulness. Questionnaire about perceived risks were referred from Pikkaraimen, 2004. Reference paper for facilitating conditions is Crable et al, 2009. Personal innovativeness in technology is measured by questionnaire learnt from Agawar, 1998 and lu et al., 2005.

Cronbach's alpha is well known as an internal consistency estimate of reliability of test scores. Because intercorrelations among test items are maximized when all items measure the same construct, Cronbach's alpha is widely believed to indirectly indicate the degree to which a set of items measures a single unidimensional latent construct.

36

According to Hair et al., (2006) and other researches, Cronbach‟s alpha is recommended to be at least 0.70, indicating high reliability. The reliability test results above show very high Cronbach‟s

alpha (from 0.79 to 0.922), representing strong internal consistency between five different identified constructs. All five constructs will be kept for further analysis.

3. Hypothesis tests

3.1. Relationship between TAM constructs

3.1.1. Direct effect of TAM constructs on Behavioral Intention

Linear regression test with confident level of 95% took place in examining the linear relationship among perceived easy of use (PE), perceived usefulness (PU), perceived risk (PR), facilitating conditions (FC) and behavioral intention of using mobile banking. The effect of perceived ease of use and perceived risks on perceived usefulness was also tested by linear regression.

Table 6: TAM constructs on Behavioral Intention- Summary of regression results

Hypothesis Beta p-value

H1: Perceived ease of use has positive effect on Behavioral intention (PE-BI) 0.512 0.000 H2: Perceived usefulness has positive effect on Behavioral intention (PU-BI) 0.511 0.000 H3: Perceived risks has negative effect on Behavioral intention (PR-BI) 0.302 0.014 H4: Facilitating conditions have positive effect on Behavioral intention (FC-BI) 0.527 0.000 H5: Perceived ease of use has positive effect on perceived usefulness (PE-PU) 0.848 0.000 H6: Perceived risks has negative effect on Perceived usefulness (PR-PU) 0.543 0.000 The results show that four independent variables (adoption factors for mobile banking) namely, perceived ease of use, perceived usefulness, perceived risks and facilitating conditions do have

37

significant effect on dependent variable (Behavioral intention to use mobile banking), which is similar to finding in other researches on TAM model.

When respondents increase 1 percent in their perceived ease of use, perceived usefulness of mobile banking and belief in supported facilitating conditions, their using intention will increase by 0.512; 0.511 and 0.527 respectively. It can be interpreted that consumers are more willing to adopt mobile banking when they understand the advantages of it when compared to traditional ways of banking and see the improvement in efficiency that mobile banking brought to them. In the same way, if consumers find that they can learn mobile banking easily, then they will more likely to experience it.

In term of perceived risks, moving from 1 to 7 in Likert scales means increase degree of risk-averse; therefore positive beta (0.302) with significant level of 0.014 indicates that people seeing more risks in mobile banking will decrease their intention of using (H3 would be approved). As shown in this result, trust on security and privacy of mobile banking service will influence user‟s intention to adopt mobile banking.

Finding that facilitating conditions significant determinant (beta= 0.527, p-value= 0.000) to predict behavioral intention to use mobile banking is consistent with Tan and Teo (2000) studies. The sustainable support from banks, mobile network providers and especially government will significant increase user‟s willingness to adopt mobile banking.

Perceive easy of use was found to have positive effect on perceived usefulness, with coefficients value is 0.848 and significant level at 0.000. Positive linear relationship indicates that people think that mobile banking is easy to use will see mobile banking more useful for their lives than people who give low score on the easy of mobile banking.

Perceived risk is also found have negative effect on perceived usefulness of mobile banking, with significant level of 0.000 and coefficients at 0.543. According to the survey design, we can see

38

that people who less believe in the secure of mobile banking e-co system will find mobile banking less useful.

3.1.2. Relationship between BI and USAGE: H7

Table 7: BI and USAGE- Regression result

Model Unstandardized Coefficients Standardized Coefficients t Sig. 95.0% Confidence Interval for B

B Std. Error Beta Lower Bound Upper Bound 1 (Constant) .791 .173 4.575 .000 .450 1.133

BI .010 .032 .026 .327 .744 -.052 .073 a. Dependent Variable: USE

Linear regression was also employed to test the direct effect of Behavior intention on actual usage of mobile banking. The result showed positive correlation coefficient between BI and actual USAGE. However, with significant level of 0.744> 0.05, it was found that behavioral intention does not have significant effect on mobile banking usage, therefore H7 would not be supported. The result indicates there is a barrier from behavioral intention to actual use of mobile banking which means customer will probably not adopt mobile banking regardless of how good they perceived about it. Further examinations would be performed to investigate this barrier.