國立臺灣大學管理學院企業管理碩士專班 碩士論文

Global MBA

College of Management National Taiwan University

Master Thesis

台灣科技品牌國際在地化的挑戰-以宏正自動科技為例 The Challenges of Taiwan Technology and Service Brands

When Doing Globalization – A Case Study of ATEN

王方銳 Fun Ray Wang

指導教授:郭瑞祥 博士 Advisor: Ruey-Shan Guo, Ph.D

中華民國 108 年 7 月

論文審定書

Acknowledgement

I would like to take this opportunity to thank some of the people that provided me with ongoing support and expertise, which made it possible to fulfill the purpose of this study.

First, I would like to thank my advisor Dean Guo for his outstanding support and knowledge from the business development and strategic management field, which provided me with valuable insights during the whole writing process.

Second, would also like to appreciate Chairman Kevin Chen for the advices that he gave me which expanded my perspective to my study reminding me of the details that are critical to Company ATEN.

Third, without all of the participants and interviewees from several ATEN customers that provided me with data, in-depth information of the respective market, my research and study would never be completed.

Finally, I would like to thank my Global MBA classmates for their continuous support and encouragement. They are my real hero and battle mates who have carried me through the ups and downs these years in my research, in my career and in my life.

Abstract

Small and medium-sized enterprises are the foundation of Taiwan’s Enterprises. With their flexible and efficiency manufacturing characteristics, SMEs are the most contributors for Taiwan’s economic growth. But in recent years, the growing wages caused manufacturing cost raise and Taiwanese firms faced the threat of severe global manufacturing competition. The situation has become increasingly difficult for many companies in Taiwan to stay in business. To build an own brand and go globally becomes an important strategy for Taiwan companies.

This study explores some possible challenges when a Taiwanese enterprise doing global business. A qualitative case study approach was employed in this study to focus on ATEN international (KVM worldwide #1 manufacturer) which attempt to build their brands in the international market.

The result shows that there will be three main challenge categories which might impact the Taiwanese companies going globally.

1. Internal challenges

● Local office v.s. trading business and Talent acquisition and retention 2. External challenges

● Knowledge of the market and Adaptability 3. Sales and Marketing related challenges

● Branding and promotion and Pricing strategy

Keywords: SME, KVM, Localization, Globalization, Internal and External Factors, Expansion, Business development, Pricing strategy, Talent management

Table of Contents

論文審定書 ... ii

Acknowledgement ... iii

Abstract ... iv

List of figures... vii

List of tables ... viii

Chapter 1: Introduction ...1

1.1 Background ... 1

1.2 Objective of Study ... 1

1.3 Research Questions ... 2

Chapter 2: Literature and References ...3

2.1 The KVM Industry overview ... 3

2.2 B2B business model & Revenue model ... 7

2.2.1 B2B Business Model Pricing Strategy ...7

2.2.2 B2B Business Model Partner and Channel Strategy ...8

2.2.3 B2B Business Model Promotion Strategy ...10

2.2.4 B2B Business Model Product Strategy ...11

2.3 Factors Influencing Strategy ... 12

2.3.1 External Factors and Five Force Analysis ...12

2.3.2 Internal Factors and SWOT Analysis ...14

2.4 Going Global ... 16

2.5 Overall organizational evaluation: a promising start ... 17

2.6 The managing role ... 19

2.7 The third-party coordinator ... 21

2.8 Developing a global B2B brand ... 23

3.2 Objectives ... 27

3.3 Data collection ... 28

Chapter 4: Case Study of ATEN ...30

4.1 Background Information ... 31

4.2 Business Structure ... 36

4.3 Cost and Sales Performances ... 37

4.4 Market expansion process ... 40

4.5 Challenges and Opportunities ... 48

Chapter 5: Conclusion & Recommendation ...51

5.1 Conclusion ... 51

5.2 Recommendation ... 53

5.3 Limitation ... 54

REFERENCES ...56

APPENDIX ...59

List of figures

FIGURE 1-KVMSWITCHES INDUSTRY CHAIN STRUCTURE ...4

FIGURE 2-THE SEGMENTED PRICING LOOP ...8

FIGURE 3-DECISION TREE FOR PARTNERSHIPS ...9

FIGURE 4-CRITERIA FOR SELECTING THE RIGHT PARTNERS ...10

FIGURE 5-FIVE FORCES ANALYSIS ...13

FIGURE 6-SWOTMODEL ...15

FIGURE 7-COMPARISON TABLE OF BRANCH AND SUBSIDIARY ...19

FIGURE 8-ATENPRODUCT LINES ...35

FIGURE 9-ATENBUSINESS STRUCTURE ...36

FIGURE 10-ATENGLOBAL BRANCH ...37

FIGURE 11-ATEN2019REVENUE ...38

FIGURE 12-EPS&ROE ...40

FIGURE 13-MARKET EXPANSION STEPS ...40

FIGURE 14-ITMARKET SIZE V.S.GROWTH OUTLOOK ...42

FIGURE 15-2018EMEAANNUAL BUSINESS PLAN ...42

FIGURE 16-SAMPLE OF COUNTRY ANALYSIS ...43

FIGURE 17-SWOT ANALYSIS FOR THE TARGET COUNTRY ...43

FIGURE 18-THE SEGMENT PRICING LOOP ...45

FIGURE 19-SAMPLE OF CHANNEL MAP ...46

FIGURE 20-TEAM ORG CHART ...47

FIGURE 21-FUTURE TREND OF AV+IT ...49

List of tables

TABLE 1-KVMSWITCHES CLASSIFICATION AND APPLICATION (BY WORK PATTERN) ...3

TABLE 2-KVMSWITCHES CLASSIFICATION AND APPLICATION (BY APPLIED RANGE) ...4

TABLE 3-SOCIAL TIES,FIRM SIZE AND INTERNATIONAL EXPERIENCE ...21

TABLE 4-INTERVIEWEE OVERVIEW ...27

TABLE 5-ATENREVENUE FROM 2013 TO 2017 ...38

TABLE 6-ATENMONTHLY REVENUE IN 2018 ...39

TABLE 7-ATENSOLUTION AND FOCUSED AREA ...44

Chapter 1: Introduction

1.1 Background

According to the March 2019 exporting report from Ministry of Economic Affairs, there are 41% of exports products were belong to electronic devices and component category, which represented the highest amount of all exporting range. However, as a manufacturer or a brand owner, exporting our products doesn’t means the end of the business. To make sure the brand’s localization and business sustainability, we still need to carefully manage some strategic activities, such as product specifications, maintain reasonable price, secure channel efficiency, provide customer services, conduct brand communication...etc. Based on my experience at ATEN, an established Taiwanese company in the KVM industry, spending 5 years in oversea business development, establish 6 branch offices, we found out there were so many challenges for branding globally, including culture shock and structural impact. For example, how to evaluate business value locally by using Taiwanese mentality (C/P value), how to adapt local business methodology to meet target market’s requirement…..etc. Therefore, we like to leverage this study to find out all the possible challenges of global branding of Taiwanese company. Hope we can provide some valuable finding as stepping stone for all the Taiwanese new comer heading to the global market.

1.2 Objective of Study

The purpose of this case study is to understand and analyze the internal and external factors of challenges for Taiwan technology and service brands when doing globalization and how these factors affect Company ATEN, a 40 years-old KVM / Pro-AV manufacturer which is based in Taiwan. Intensive market research on the current condition and future trends and a comprehensive understanding of Company ATEN and the related forces will be analyzed with Five Forces Analysis and SWOT models to provide in-depth insight. Finally, the suggestions made for all the other IT companies which tend to do global business.

1.3 Research Questions

The research questions below are to be answered in order to fulfill the purpose of this thesis.

Research Question 1: What are the challenges for a company that intends to expend their business to another countries?

Research Question 2: What are the key factors for a company to conquer the above- mentioned challenges?

Chapter 2: Literature and References

2.1 The KVM Industry overview

A KVM switch (with KVM being an abbreviation for "keyboard, video and mouse") is a hardware device that allows a user to control multiple computers from one or more keyboard, video monitor and mouse. Although multiple computers are connected to the KVM, typically a smaller number of computers can be controlled at any given time.

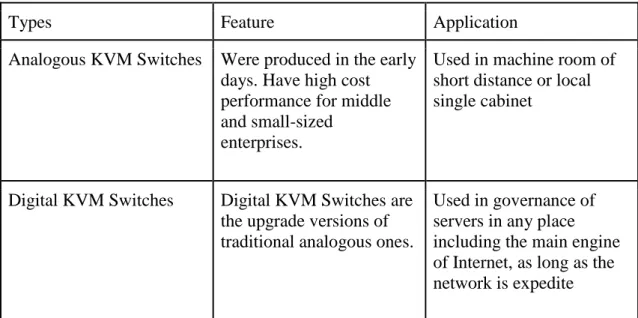

(Table 1 - KVM Switches Classification and Application by Work Pattern)

That is to say KVM switches are for simultaneous control of multiple computers from a single or multiple set of keyboard, video monitor and mouse. (Table 2 - KVM Switches Classification and Application (by Applied Range)

Table 1 - KVM Switches Classification and Application (by Work Pattern)

Types Feature Application

Analogous KVM Switches Were produced in the early days. Have high cost performance for middle and small-sized

enterprises.

Used in machine room of short distance or local single cabinet

Digital KVM Switches Digital KVM Switches are the upgrade versions of traditional analogous ones.

Used in governance of servers in any place including the main engine of Internet, as long as the

Table 2 - KVM Switches Classification and Application (by Applied Range)

Types Feature Application

Low-end KVM Switches Only have a few ports and can just control a few main engine. The price is also cheap.

Can be used in SOHO and small-size network.

Middle-end KVM Switches Have about 8~16 ports and can be switched freely between different operating system platforms

Widely used in small and medium-sized enterprise network

High-end KVM Switches Have at least 32 ports. Most of them govern main engines based on network IP.

Widely used in large-size network.

Source: QYResearch KVM Switches Research Center, Feb. 2014

Figure 1 - KVM Switches Industry Chain Structure

Source: QYResearch KVM Switches Research Center, Feb. 2014

The KVM industry emerged in response to the steady increase in usage of computers and networking technologies. Demand in the KVM market is relatively stable, as there are very few substitute products available.

Data compiled by market research firm VDC indicates that annual shipment volume in the global KVM market, as a whole will continue to rise steadily. Growth will be particularly high in the over-IP KVM segment. The key factors contributing to market growth are outlined below: (Figure 1 - KVM Switches Industry Chain Structure)

Convenience: KVM products make it easy and convenient for IT managers to implement centralized control of multiple PCs and servers. KVM products facilitate the sharing of resources, help to save space, are easy to operate and reduce management costs, making for improved work efficiency.

A global market: With business enterprises continuing to expand their global networks and establish new sites overseas, KVM products can be used to resolve issues affecting servers and related equipment on a real-time basis.

Continuing investment in IT hardware: Companies all over the world continue to deploy new IT hardware; KVM products facilitate efficient management of corporate IT infrastructure.

The growth in the server market and the integration of server platforms: KVM products can be used to manage large numbers of servers. With the continued growth of the server

but very expensive sever, KVM products provide a way for firms to connect these multiple cost-effective servers, and facilitate more efficient server management.

Economic growth in Asia and in other emerging markets: The strong economic growth in Asia and in emerging markets in other parts of the world has led to a steady increase in demand for data management solutions both in the private sector and in government.

KVM products can help both government agencies and business enterprises to implement efficient data management; as a result, demand for KVM products has been growing rapidly in Asia and in emerging economies elsewhere.

Demand deriving from the growth of the Internet: The emergence of the Internet has made it possible for IT personnel to manage servers remotely from any location. At the same time, falling product prices have made medium-sized enterprises more wiling to purchase over-IP KVM products, which in turn has created higher profit margins for KVM product vendors.

Low-price personal computers: The prices of personal computers have been dropping fast following the Moore’s law. Nowadays it is common for a person to own more than one computer, which indirectly boosts the demands for SOHO KVM switch. The A/V interface also shifts gradually from VGA analog interface to DVI/HDMI digital interface.

Emergence of cloud computing: Cloud computing provides a brand-new computational framework and enables users to enjoy convenient services anytime and anywhere. The emergence of cloud computing service is a major trend in recent years along with maturing software, hardware and transmission technology. The cloud computing

infrastructure is essentially a large data center, which will have high demands for IP-based remote control products.

The Growing Importance of Information Security: With the dramatic growth of the Internet, exchanging information has become steadily more convenient. However, from the point of view of IT managers, protecting data security has become much more challenging. The restricted connectivity characteristic of KVM switch products means that adopting KVM devices can substantially enhance information security, preventing unnecessary online connections and reducing the risk of data leaks.

2.2 B2B business model & Revenue model

2.2.1 B2B Business Model Pricing Strategy

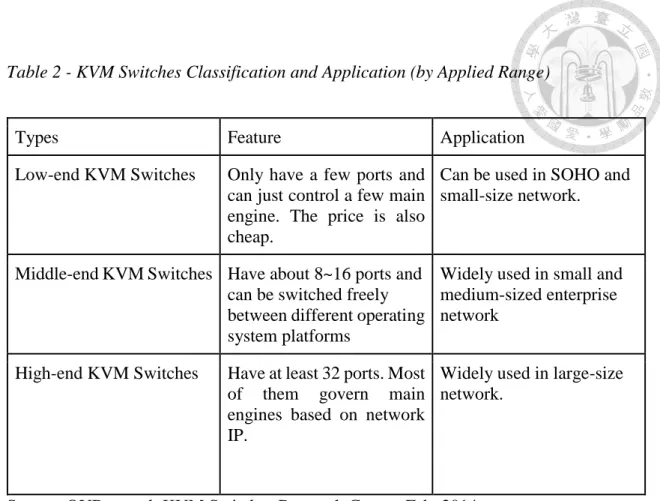

Pricing is an iterative process that requires a customer-first approach and more than just guesswork to get it right. When introducing new products, technology product managers must evaluate the merits of different pricing models to determine their best strategy (Figure 2 - Key Principles for Setting an Effective Pricing Strategy, Gartner)

Setting prices requires an understanding of two fundamental things: how your customers perceive your product's value, and how your pricing strategy aligns with your company's business goals. (Figure 2 -Key Principles for Setting an Effective Pricing Strategy, Gartner)

Figure 2 - The Segmented Pricing Loop

Source: How to Select the get the optimized pricing point

2.2.2 B2B Business Model Partner and Channel Strategy

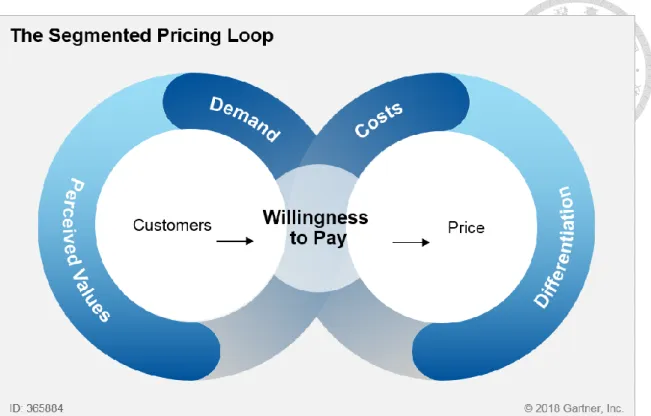

How to select the right partner and implement the suitable channel strategy is the key for entering any territory. (Figure 1 - Decision Tree for Partnerships Decision Tree for Partnerships and Figure 2 - Criteria for Selecting the Right Partners.) There are 3 points need to be considered.

Market— How suitable is the channel partner in fulfilling your market aspirations? Is it a major partner in the vertical or segment, and is it well-known within that segment?

Capabilities— What capabilities does the channel partner have for selling, servicing, supporting and marketing your product in the desired customer base?

Business— What is the business structure of the prospect partner? For example, does it have cash to invest in selling and supporting an additional product within its portfolio?

Culture— This is an often-overlooked area for selecting the right channel partner for your program. If the culture of the partner does not fit with yours, then conflict can arise early in the relationship. Consider how these partners approach their customers, how employees rank their employer (look at Glassdoor, for example) and whether they are used to partnering.

Figure 3 - Decision Tree for Partnerships

Source: How to Select the Right Channel Partners for Resell and Support

Figure 4 - Criteria for Selecting the Right Partners

Source: How to Select the Right Channel Partners for Resell and Support

2.2.3 B2B Business Model Promotion Strategy

From ‘The B2B Customer Life Cycle for Technology Products and Services, Gartner’.

To improve marketing planning and segmentation, technology product marketers should:

● Support the self-directed information search that B2B buyers prefer by increasing investment in account-based marketing (ABM), advocacy marketing and influencer programs.

● Support customers in their decision process by building flexibility into sales processes and marketing programs that guide customers based on where they are in their decision process.

● Establish a path that helps the customer quickly capture value by emphasizing activities that provide a great experience as the life cycle transitions from buying to owning. This is a good way to get a head start on retention and growth.

TSPs need to understand this new approach and change their marketing, sales and delivery strategies accordingly. Continuing to apply dated sales and marketing tactics is a recipe for declining revenue and frustrated customers. Instead, TSPs that adapt their approach to engage on the buyers' terms and guide buyers along their journey will gain increased revenue, shorter sales cycles and happier customers.

2.2.4 B2B Business Model Product Strategy

From ‘Managing Your Hardware Portfolio Through the Next Downturn,Gartner’

Technology general managers investing for growth and profitability:

● Map your hardware portfolio for recession and recovery.

● Create portfolio plans for both optimized sales and working capital efficiency.

● Do not yield to discounting as an alternative to portfolio reshaping.

● Create clear portfolio funding models for capturing postrecovery growth.

● Use the downturn to pursue new products and services.

2.3 Factors Influencing Strategy

Most companies look at both external and internal factors prior to developing strategies and making important decisions for the company. In reality, both the industry structure and the firm’s resources have influential impacts in forming the company’s strategy adaptation, however, these forces are much more complex in different industries, scenarios and settings. Thus, it is important for managers to decide on which forces are their top priorities to tackle with when shaping its combat strategy.

2.3.1 External Factors and Five Force Analysis

Porter (1980) proposed that a company’s success depends on how well it has positioned itself in the industry so that the external forces will benefit or do the least harm to it.

Therefore, it is essential for companies to observe their competitive environment to adjust their competitive strategies accordingly, to decide what kind of investment or divestment to execute to thrive in a certain degree of competition intensity of an industry. Hence, the study of the structure of the industry is the fundamental to understand how the industry evolves, and the most common way to study the industry structure is to look into Porter’s five forces (1979) (Figure 3 - Five Forces Analysis). The five forces are rivalry among existing competitors, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, and threat of substitute products.

● Rivalry among existing competitors: This force determines on how competitive or profitable an industry is. It is one benchmark on the competitive intensity of the market itself.

● Threat of new entrants: this force determines how easy or difficult it is to enter a particular industry. If the industry is profitable and there are little barriers to enter, rivalry soon intensifies, and vice versa.

● Bargaining power of suppliers: Strong bargaining power for the suppliers allow them to sell higher priced or lower quality materials to their buyers.

● Bargaining power of buyers: If the buyers holds the power to bargain, it could demand a higher quality or a lower price, sometimes even with additional favors and conditions or services.

● Threat of substitute products: This force is threatening when buyers can easily find other alternative products with better pricing or better quality to switch over to.

Besides studying the five forces of the industry itself, a company will also choose its strategy based on its competitor’s strategies and the impacts of the competitor’s directions and decisions. Based on competitor’s movement, a company can then offend or defend correspondingly. Indications of how well an industry is performing could also be revealed by studying competitor’s competitive behaviors and directions.

2.3.2 Internal Factors and SWOT Analysis

To capture external opportunities and to lower threats, a company needs to optimize and leverage is resources to gain competitive advantages. The internal environment of the company determines its capability to grow and outcompete its own competitors in the same industry in order to create profits. SWOT matrix (Figure 6 - SWOT model) allows the company to evaluate its internal strengths and weaknesses, and identify opportunities and threats accordingly.

● Strengths: are the internal resources and attributes that support a successful outcome of the firm.

● Weaknesses: are the internal resources and attributes that work against a successful outcome of the firm.

● Opportunities: are external factors the firm can capitalize on or use to its advantages.

● Threats: are external factors that could potentially put the firm at risk and jeopardize it.

Figure 6 - SWOT Model

Source: HBR website

Some other internal factors that are considered also includes the financial resources (funding, financial supports, investment opportunities, sources of income), physical resources (scale, geographic location, equipment and facilities, assets, technology), human resources (employees, training programs, talent attractions, productivity), technology and innovation capability (patents, know-hows, developed products), operations, company culture and reputation, etc.

competencies is the key in the development of competitive strategy and the assurance a company’s survival.

2.4 Going Global

Since the 1980s, the information industry has become the paramount engine of economic growth in Taiwan. Whilst many countries have experienced rapid development of their information sectors over the past two decades, the growth of Taiwan’s information industry has outpaced the majority of its international counterparts, making Taiwan the world’s third largest producer of information products. Taiwan’s achievements in high- tech production are best understood as the outcome of local firms’ abilities to leverage and align local and international networks. (Shin-Horng Chen (2002) Global Production Networks and Information Technology: The Case of Taiwan, Industry and Innovation, 9:3, 249-265) The manufacturers not only endeavored to export their products to foreign countries, with the rising awareness of globalization, they also advanced their ambition and started expanding their empires overseas. Expertize is gained through taking calculated risks. Decision making for business developing manager includes the overall organizational systematic management and business model shift according to cultural features. In the following paragraphs, we will look into references that discuss overall systematic management with focuses on the organizational entity, the managing role, the third-party initiator, and we will also examine literature that discuss about developing global B2B business.

2.5 Overall organizational evaluation: a promising start

The questions to explore when starting an overseas site is not as outwardly as a “where”

question, but rather a “where, what, and why” complex question. The underlying contexts in this question are:

• Which region?

• What kind of the entity to implement this overseas site, considering what advantages?

• Why are the risks in making this decision worthwhile?

The business development manager must research and evaluate the advantages and risks that come along with different region choices, to make sure a promising start of an overseas site. Here we take an example to discuss legal and fiscal considerations suppose that Romania is a potential choice of overseas sites:

According to Law 105/1992, the subsidiary implanted abroad has its own nationality, distinct from the commercial company that established it. The fundamental difference between these two entities is described by the status of legal personality.

• The subsidiary is an independent company with legal personality to the parent company under its control; the branch is not an entity with its own legal personality (i.e. it does not act autonomously and does not have a stand-alone existence) but is part of the organic

• The subsidiary has its own patrimony, while the branch has only a few assets necessary to carry out the activity assigned to it by the parent company.

• The subsidiary is registered with the Trade Registry with a minimum social capital provided by law for the form of the company under which it is incorporated; The branch also registers with the Trade Registry, but it does not have to have a minimum social capital, it only benefits from the patrimony (the mass of goods) that is attributed to it by the parent company.

• The subsidiary’s object of activity may be distinct from that of the parent company because legally the subsidiary’s company is a distinct company from the parent company;

Instead, the branch may have an object of activity and can therefore only carry out the activities of the parent and its parent in its own business.

• The subsidiary is subject to the law of the State in which it has its registered office because it is an independent, stand-alone society, unlike the branch subject to the national law of the parent company which has established it and is identified by reference to its registered office.

• The subsidiary acts in its own name in relations with third parties, while the branch acts only in the name and on behalf of the parent company.

(Gianina Craciun, 2017, www.adecoadvisory.com)

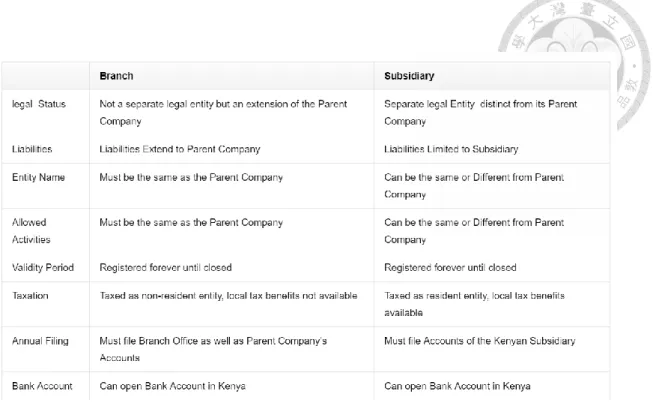

There is also another research conducted by East Africa Business Consultants, making a comparison of setting up a branch and a subsidiary in Kenya (Figure 7 - Comparison Table of Branch and Subsidiary)

Figure 7 - Comparison Table of Branch and Subsidiary

Source:https://www.eastafricabusinessconsultants.com/2018/03/15/branch-vs- subsidiary-company-registration-in-kenya/

2.6 The managing role

Human capital is one of the core competences for high-tech companies to maintain their competitive advantages in the knowledge economy. However, owing to the changing nature of knowledge workers in high-tech industry, jobs cannot be easily delineated especially for jobs in the management level. As globalization and technology advance, cross-functional tasks are also increased while new jobs are also constantly created. The requirements of employees’ quality in high-technology companies are increasingly strict,

(Chen-Fu Chien, Li-Fei Chen, Data mining to improve personnel selection and enhance human capital: A case study in high-technology industry, Expert Systems with Applications 34 (2008) 280–290) It is an inevitable dilemma on deciding whether to move managers from headquarters to the overseas subsidiary or branch, or to hire and cultivate local managers. The former might be more capable of delivering headquarters’ policy and further enforcement, as well as knowledge transfer, and even being able to feedback the locally-embedded knowledge assets for global use, innovation by local units can also be leveraged for regional application. (Kazuhiro Asakawa, Managing local knowledge assets globally: the role of regional innovation relays, Journal of World Business, Volume 38, Issue 1, February 2003, Pages 31-42); while the later might excel at communicating and emphasizing with local employees without the language and cultural barriers. The local managers are also expected to be more knowledgeable at local market, and active at local social networks.

Regardless of the above-mentioned preference of the managing candidates, setting up an overseas site definitely means creating a new team. This manager must equip cross- culture knowledge and communication skills to facilitate global liaison, a personality that strives for success under unfamiliar environments, and strong leadership that motivate the team. A prestigious research has revealed that the leadership must understand that a diverse workforce will embody different perspectives and approaches to work, and must truly value variety of opinion and insight. In additions, the organizational culture must create an expectation of high standards of performance from everyone, and stimulate person development. (Making Differences Matter, A New Paradigm for Managing Diversity, David A. Thomas and Robin J. Ely, Harvard business review · January 2006).

2.7 The third-party coordinator

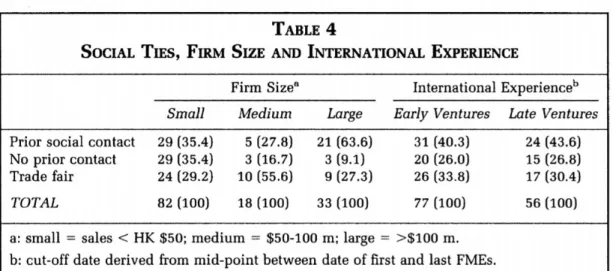

Another critical role that participates in this overseas business node is a third-party initiator. The awareness of the trading opportunity may first be noticed by neither the potential exporter nor the potential importer but by some mutually related third party, such as a government agency, bank, or business associate. If this entrepreneurial third party provides a brokerage or middleman role by bringing the potential transacting parties together, another kind of initiation scenario is realized. Research has been conducted regarding the relations between social ties and firms of different sizes and international experiences, and the results are listed as the chart below (Table 3 - Social Ties, Firm Size and International Experience.)

Table 3 - Social Ties, Firm Size and International Experience

There is also evidence in the literature to show that internationalization is more strongly affected by the characteristics of the decision-maker or management team than other variables such as firm size and age. (Axinn 1988; Reuber and Fischer 1997). Therefore, a long-lasting trusting relationship that has already been built between the intermediators and the local customers could simplify the process of negotiation as long as the commission is reasonable.

Aside from the obvious, here we introduce another piece of insight from a comprehensive research based on business ethics in the Middle-East areas:

Business ethics are culture specific and what is considered normative in one culture may be considered unethical in another. In Arab countries, favoritism, nepotism, and personal connections have a significant impact on managers’ decisions (for a review of research, see Atiyyah, 1992). This is usually explained in terms of cultural factors such as strong kinship ties and obligations that expect individuals to give preference to family. David Weir (1993) suggests that there is a distinguishable Arab managerial paradigm built on the notion of “trading” that emphasizes kinship and networked market orientation. In Israel, political patronage is fairly widespread. The close ties between the various elites including economic and political elites also result in favoritism.

(Dove Izraeli, Business Ethics in the Middle East, Journal of Business Ethics, October 1997, Volume 16, Issue 14, pp 1555–1560)

2.8 Developing a global B2B brand

Strong brands are recognized by marketing managers and academicians as important sources of competitive advantage (Aaker, 2002; Keller, 2008). Companies developing brand strategies for building strong business-to-business (B2B) brands face great challenges triggered by the nature of B2B branding. In addition to considering multifaceted branded offerings and complex organizational decision-making processes, brand strategies implemented in this context should facilitate long-term relationships between multiple stakeholders within and outside the company (Glynn, 2012; Mudambi, 2002; Mudambi et al., 1997; Webster and Keller, 2004). To succeed in the complex market environment, marketing managers need to understand the impact of different stakeholders on critical outcomes of their branding efforts, including brand value (Jones, 2005; Leitch and Richardson, 2003).

The literature on B2B branding emphasizes that marketing managers should develop brand strategies by considering the key components of brand value, which are supported by organizational culture and core values (Vallaster and Lindgreen, 2011). During the implementation of brand strategies, they should communicate these aspects of brand value to multiple stakeholders in a consistent manner (Lynch and de Chernatony, 2007).

The company-centred approach to B2B branding highlights the important roles of marketing managers, employees and customers in this process (Kuhn et al., 2008;

Mudambi et al., 1997). Nevertheless, the long-term success of B2B brands in a global

other stakeholders, such as distributors, resellers, partners and so on (Gyrd-Jones et al., 2013).

(Veronika Tarnovskaya, Galina Biedenbach, (2016) "Multiple stakeholders and B2B branding in emerging markets", Qualitative Market Research: An International Journal, Vol. 19 Issue: 3, pp.287-309)

A global brand – in other words, one that expresses the same values in all of its markets and owns a similar position vis‐à‐vis its competitors around the world – creates several critical advantages, including:

• improved efficiency in costs for new product development and R&D because their outputs create revenues globally and not just locally or regionally;

• increased leverage with channel partners, especially in the packaged goods sector, which faces the constant parallel challenge of a consolidating and globalizing retail industry;

• economies of scale in marketing communication because copy can be produced along identical guidelines, and even shared, across markets; and

• improved alignment across the organization, boosting speed to market, work force flexibility, and the sharing of best practices.

That is the theory, anyway. The reality often proves quite different. In our experience, almost all companies that own “global” brands are actually struggling to achieve those theoretical economies of scope and scale. Because there is no common segmentation across national borders, different country organizations within the same global firm have

no way to compare their views of the target consumer; it is as if they are all speaking different languages (which, almost literally, they are). The good news is that companies can tear down this segmentation tower of Babel and lay the foundation for an effective global brand. To do so, however, most companies will need:

• a different process for coordinating brand development;

• a revised consumer research methodology; and

• a clearer definition of the roles of and relationship between the center and the regions.

Global branding must be driven by collaboration among local markets, both with each other and with central marketing. Because local markets do face unique competitive challenges, each country organization should bring to the table data on its own market.

(Jennifer Barron, Jim Hollingshead, (2004) "Brand globally, market locally", Journal of Business Strategy, Vol. 25 Issue: 1, pp.9-14)

Chapter 3: Research Methodology

3.1 Design

The purpose of the research is to discuss what would be the possible key factor for a Taiwanese company, like ATEN, to approach global market based on customer responses in interviews, in order to achieve stronger growth / faster breakeven in an emerging market. Usually, the quantitative research methods are deployed to address a specific hypothesis, while the open-ended qualitative methods ae designed to allow unexpected finding to emerge (Bryman, 2012). Therefore. Qualitative research with open-ended questions is adopted. We wish to see if individual perspectives yield any important observations about the overall key factors of challenge while any Taiwanese company expand their business globally.

Interview questions are designed based on Value Proposition Models to clarify pains and gains. Questions are designed in two versions.

The first for those interviewees who provide some basic information and more open- discussion, in order to collect all the possible factor in their specific regions. The second one for those interviewees is to understand the weight of those factors, in order to clarify the importance of all those factors or challenges they are encountering.

All the interviews and questionnaires are designed in English, but for some of the interview were conducted in Chinese, the native language of few interviewees.

3.2 Objectives

According to the target audience selection, the interview objectives are separated into two groups. Total interview list as below Table 4 – Interviewee Overview

● First group of target customers, who are 25 – 35 years old, dedicated handling ATEN business. Mainly Sales or PM function.

● Second group of target customers, who are above 50 years old. CEO/COO/Founder of company.

Table 4 - Interviewee Overview

Organization Current Status Location Position Date

Interview Duration

(approx.

min) WTC

23 years exclusive distributor with ATEN, focusing on GCC market

UAE CEO Jan. 10, 2019 90 minutes

DCS

15 years exclusive VAD, value-added distributor) with ATEN, focusing on Israeli market

Israel Product

Manager Jan. 15, 2019 40 minutes

Raymond Computers

32 years exclusive distributor with ATEN, focusing on Iranian market

Iran Founder May 25, 2019 70 minutes

OASIS

10 years distributor with ATEN,

focusing on Egypt and North Africa market.

Egypt Sales Director Feb. 10, 2019 90 minutes

ATEN, focusing on Singapore market

ALPHASONIC KFT.

10 years distributors with ATEN. Carry many brands’

solution. Focusing on Eastern Europe market

Hungary VP of Sales Feb. 15, 2019 80 minutes

CUBIX

3 years distributor with ATEN. Has many sub-

distributors to cover the Indian market.

India Owner May. 20, 2019 100 minutes

MACROCARE

2 years distributor with ATEN, has multi-channel conflict issue with ATEN

Thailand

Procurement / Product manager

Jan. 5, 2019 60 minutes

MorocoAVS

New distributor with ATEN, only

focusing on Pro-AV business. Target Morocco and central

& south Africa market

Morocco COO May. 28, 2019 120 minutes

COLAN

30 years exclusive distributor with ATEN. Represent 80% of KVM market leader in Russia.

Russia CEO May. 30, 2019 70 minutes

Source: Self-made for this thesis

3.3 Data collection

To understand all the possible factors / challenges for a Taiwanese company (in this case, ATEN) doing global business with those partners in different regions, and try to eliminate the regional bias / functional bias / human emotional bias, interviews are conducted with 2 target groups with no previous notification or any business impact during that interview period.

To gain detail information about user experience and in-depth feedback, all the interviewees were invited to a nice and cozy environment for the open-minded discussion.

Lastly, we have re-clarified with each of them, all the data collected was based on their real business experience, no matter dealing with ATEN or any other Taiwanese company.

Chapter 4: Case Study of ATEN

In this chapter, we will take a closer look into a dominant player in the KVM industry, ATEN. A company background will be presented first, followed by its business structure and financial performance, and last yet most importantly, the focus falls on its market expansion strategy. There will be a step-by-step process guidance instructed in this section.

The information provided in this chapter is based on the summarized responses collected from the interviewed partners and my personal expertise after serving 5 years as the Sales Director in ATEN.

The interview questions that we explored are listed below, with brackets of numbers as indexes, which suggest the correlated context in following sections:

1. Would you give an overview of KVM industry from your perspective? (4.1) 2. Based on question 1, what stage do you think that KVM industry is currently at?

Growing, stable, or declining? (4.1/4.5)

3. How would you describe ATEN’s role in the KVM market globally? Or in your region? (4.2/4.3)

4. What makes you consider ATEN as a trustworthy partner to work with? What do you see in their operation? (4.2)

5. What are the aspects that you evaluate when searching for a foreign cooperative partner? (4.4)

6. What makes ATEN a strong competitor in your evaluation? (4.3/4.4)

7. What did you observe in terms of the process that ATEN’s strategy in initiating, securing, and maintaining their business? (4.4)

8. Please define the need that drive you to searching for a data management solution.

(4.5)

9. What are strengths that ATEN should hold on to? what are the threats to watch out? and maybe strategize for a transformation? (4.3 /4.4/4.5)

10. Please give recommendations for those companies who are interested in entering a foreign market in the KVM industry. (4.5)

4.1 Background Information

ATEN, established in 1979, is specialized in connectivity and management solutions in accessing and sharing technologies. ATEN consolidates all of its products and services under one brand – ATEN, in order to provide an efficient and consistent service standards.

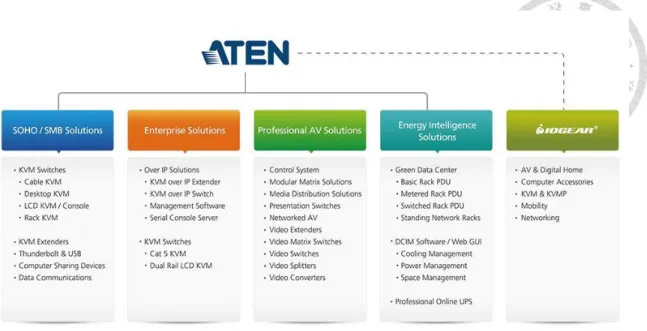

The ATEN brand consists of innovative solutions applied to connectivity, professional audio/video, and green energy, for consumers, small/home offices (SOHO), small to medium sized businesses (SMB), and enterprise customers.

ATEN´s SOHO and SMB solutions offer a series of cable KVM, desktop KVM, and LCD KVM products. The Enterprise solutions offer a series of Over IP solutions that allow customers to effectively manage IT infrastructure from anywhere in the world. The Professional Audio / Video line offers integrated video solutions for home and professional use for a variety of uses including corporate, education, hospitality, commercial and home theater applications. The recently developed Green Energy line

offers energy-saving solutions for the data center with a range of intelligent PDUs that provide real-time energy management and performance indicators locally and remotely.

ATEN specializes in connectivity and management solutions. We distribute our products through a global sales network to meet a broad range of customer needs. ATEN delivers and we care about our customers. We are committed to the best customer support in the industry.

ATEN International Co., Ltd. has been making every endeavor towards the implementation of "Corporate Social Responsibility" and is always attentive to topics that stakeholders are concerned about. We hope to bring a positive impact to the environment, society and governance with the company’s power, and aim to achieve a better future by working together with all our stakeholders.

Facing the rise of business digitization and intelligence, ATEN utilizes its Professional Audio/Video (Pro A/V) and IT technology advantages to launch "AV Meets IT" in order to take charge of two major trends - instant integration and sharing of visual data, and intuitive control - and to help businesses carry out high definition, instant data sharing, and improve management efficiency as well.

ATEN achieves close to 60% gross margin performance through sophisticated management methods and the presence of a global network. In 2017, two new sales bases were established in Poland and India, making ATEN’s number of sales subsidiaries and offices globally reach 16. The company will continue to establish sales-oriented subsidiaries or offices to explore local markets and provide

ATEN’s Strength of expanding global market

● ASIC Design Center

By designing our own Application Specific Integrated Chip (ASIC), ATEN is able to deliver its unique KVM switch features at competitive-cost to the consumer while maintaining our high mark of quality

● Total Automation

ATEN's state of the art warehouse is equipped with automated storage for computerized retrieval of over 2500 component boxes. Each product work order receives precision handling from its inception to its completion, nearly eliminating manufacturing defects.

● The High Tech Advantage

The newest addition to ATEN's Surface Mount Technology (SMT) equipment, this Siemens HS-50 mounter, has further increased factory output while minimizing downtime. Each of ATEN's seven SMT lines is maintained by a staff of trained technicians for additional quality control and operational maintenance.

● Uncompromising Quality

ATEN's on the fly multi-angle read Automated Optical Inspection (AOI) system represents the first wave of quality control for PCB surface, solder joint and component defects. ATEN technicians monitor each stage of PCB production guaranteeing smooth operation and the highest quality finished product.

ATEN employees represent our most valuable resource. We believe the highest quality products can only come from the happiest employees. ATEN profit sharing, manageable work hours, and an ergonomic and clean work environment have all contributed to retaining the loyalty we expect and receive from our staff.

● The True Mark of Craftsmanship

ATEN's 3 tiered assembly line is designed for efficient production over the expanse of 3 floors within our factory. This unique design streamlines assembly and inspection and allows for a cleaner and more organized factory environment. Each ATEN product begins its life in a storage bin of components, passing through each floor of the factory and each rigorous inspection before it is packaged, tested and sent out for distribution.

● Worldwide #1 market leader in terms of KVM industry

● 40 years excellence since 1979

● Total 4 product lines (Figure 8 - ATEN Product Lines)

● 18 Sales office worldwide, including Belgium / United Kingdom / Russia / Japan / China / Korea / United States / Australia / Turkey / Poland / India ….etc.

● 24 Global Showrooms

● 3 R&D centers in Taiwan, Canada and China

● More than 570 global patents

● 171M+ USD annual revenue in 2018

● 1600+ employee worldwide

Figure 8 - ATEN Product Lines

Source: ATEN Website: https://www.aten.com/

4.2 Business Structure

Figure 9 - ATEN Business Structure

Source: ATEN Website: https://www.aten.com/

While setting a branches or subsidiaries, the initial department will be Sales Division, and The GM office staff will be involved in some key decision making, such as location pick, budget control, Legal related issues …etc. (Figure 9 - ATEN Business Structure)

Sales team will do the complete market research and pick up the target regions, then find out the suitable channel partners to secure the minimum revenue.

Then GM office staff will start working with sales team for all other administration detail.

Then Sales team will prepare the estimated revenue and arrange the headcount plan.

Once the local GM is recruited, he will build up his own team and prepare the localized business plan with HQ’s supervision and quarterly review. (Figure 10 - ATEN Global Branch)

Figure 10 - ATEN Global Branch

Source: ATEN Website: https://www.aten.com/

4.3 Cost and Sales Performances

In the past 10 years, ATEN struggled for the 5 billion NTD revenue target. This became a bottleneck, no matter we have tried several ways, such as mixed product portfolio, new product development, multiple channel structure, extra marketing promotion...etc. In

plan. (Figure 11 – ATEN 2019 Revenue, Table 5 ATEN Revenue from 2013 to 2017 , Table 6 – ATEN monthly revenue in 2018 and Figure 13 – EPS & RoE )

Figure 11 - ATEN 2019 Revenue

Source: ATEN Website: https://www.aten.com/

Table 5 - ATEN Revenue from 2013 to 2017

Source: ATEN Website: https://www.aten.com/

Table 6 - ATEN Monthly Revenue in 2018

Monthly Revenue in 2018

Month Consolidated Revenue

(NT$ thousands)

January 430,934

February 385,670

March 456,892

April 415,672

May 400,750

June 444,651

July 405,285

August 421,510

September 393,242

December 449,222

Total 2018 revenue 5,172,965,000

Source: Self-made for this thesis, data from ATEN public information

Figure 12 - EPS & RoE

Source: ATEN Website: https://www.aten.com/

4.4 Market expansion process

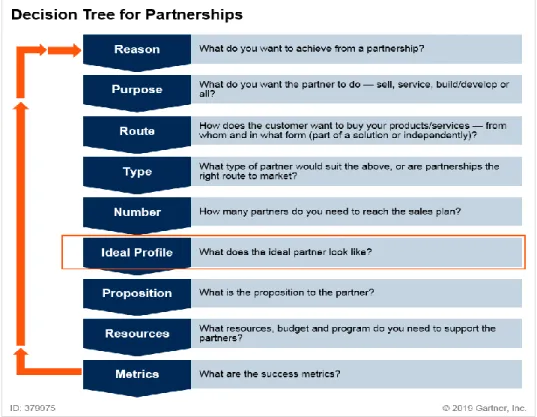

To do the market expansion and establish a branch office, enclosed the certain steps.

Figure 13 - Market Expansion Steps

Source: Self-made for this thesis Select territory

1. General information and 2nd hand data collection (Figure 14 - IT Market Size v.s.

Growth Outlook)

2. Field survey & first hand interview

Step-By-Step Consideration points

Select Territory

Conflict within the region

Logistic center possibility

Select Country Culture Payment Business

potential

Local talent pool Select Entry

Point GDP component STP analysis Five force

analysis Define Right

Pricing

Revenue v.s.

Margin Hidden cost Competitor

Define Right Partner

Channel efficiency

Willingness &

Capibility Long-term trust Recruit Local

Team Empowerment Trust matters Communication KPI set-up

Figure 14 - IT Market Size v.s. Growth Outlook

Source: Self-made for this thesis

3. Prepare the territory ABP (Annual business plan)

Figure 15 - 2018 EMEA Annual Business Plan

Source: Self-made for this thesis

Select country

1. Field survey (2 weeks business trip will be conducted, meeting with several local key influencer, including Government officer / Military people / Taiwan Embassy / Local media / Local partner / related association …etc (Figure 17 - SWOT analysis for the target country)

2. General information and 2nd hand data collection (Figure 16 - Sample of Country Analysis)

Figure 16 - Sample of Country Analysis

Source: HKTDC Research 2017.Sept.14

Figure 17 - SWOT analysis for the target country

Source: Self-made for this thesis

Select entry point

Find the most-suitable solution for the target market, and continuously fine-tuned the solution. Sometimes, the tailored-made solution is required for certain application. For example: Pipeline monitoring in oil refinery / Remote management for the harsh environment. (Table 7 - ATEN Solution and Focused Area)

Table 8 - ATEN Solution and Focused Area

ATEN Solution and focused area Versatile Applications Vertical Markets

Digital Signage Broadcasting & Media

Control Rooms Government

Meeting Rooms Corporate

Classrooms Transportation

Data Centers Education

Production Lines Hospitality

Manufacturing Source: Self-made for this thesis

Define the right pricing

1. Discuss with potential customers and find out “Willing-to-pay” price range via several face-to-face meeting and POC (proof-of-concept) process. (Figure 18 - The Segment Pricing Loop)

2. Discuss with HQ and get their support and approval.

3. Sign the pricing agreement with identified partner 4. Maintain healthy pricing in the local market.

Figure 18 - The Segment Pricing Loop

Source: How to Select the get the optimized pricing point

Define the right partner

1. Through local association / Social media platform / personal referral 2. Work with local media and marketing agency

3. Participate exhibition and roadshow 4. Joint-marketing with strategic partner

5. Prepare the channel map (Figure 4 - Sample of Channel Map)

Figure 19 - Sample of Channel Map

Source: Self-made for this thesis

Recruit the local team

It is an inevitable dilemma on deciding whether to move managers from headquarters to the overseas subsidiary or branch, or to hire and cultivate local managers.

The former might be more capable of delivering headquarters’ policy and further enforcement, as well as knowledge transfer, and even being able to feedback the locally- embedded knowledge assets for global use, innovation by local units can also be leveraged for regional application.

while the later might excel at communicating and emphasizing with local employees without the language and cultural barriers. The local managers are also expected to be more knowledgeable at local market, and active at local social networks. (Figure 5 - Team org chart)

Regardless of the above-mentioned preference of the managing candidates, setting up an overseas site definitely means creating a new team. This manager must equip cross- culture knowledge and communication skills to facilitate global liaison, a personality that strives for success under unfamiliar environments, and strong leadership that motivate the team. A prestigious research has revealed that the leadership must understand that a diverse workforce will embody different perspectives and approaches to work, and must truly value variety of opinion and insight. In additions, the organizational culture must create an expectation of high standards of performance from everyone, and stimulate person development

Figure 20 - Team Org chart

Source: Self-made for this thesis

4.5 Challenges and Opportunities

From market point-of-view

Judging from the current state of the global KVM switch market, data center central management solution still constitutes the KVM market mainstream, and represent the main driver of growth. In the past, North America was by far the largest market for data center central management solution.

However, with the rapid pace of development of the Internet and the advances that have been achieved in technology, there has recently been significant growth in demand for KVM switches in Asia and Europe, particularly from financial institutions. With the consumer and enterprise-class KVM markets more or less saturated, demand for replacement of existing KVM switches is derived mainly from the upgrading of interface specifications. There has been a gradual shift away from analog VGA interface towards DVI (Digital Visual Interface) or Display Port interface, which can provide users with better, more stable image quality.

Meanwhile, ATEN also noticed that, the KVM market will be partially taken over by software-based solution, such as VMware / Hyper-V …etc.

We gradually migrate our focus from KVM to Pro-AV, which including Digital Signage / Meeting Room / Broadcasting / Video Wall…etc solutions.

The Pro-AV industry was dominated by few key players, such as Extron / Crestron / BARCO ….etc. They have been concentrated in this Pro-AV industry for more than 30 – 50 years, and with complete range of solutions. For ATEN, this will be brand-new industry, full of opportunity, but also full of challenge.

From solution point-of-view, ATEN is transforming from product oriented to solution- oriented. We will based on customers’ requirement and provide the best-of-breed solution by working with several strategic partners, to avoid price competition and spec.

comparison.

Figure 21 - Future Trend of AV + IT

Source: Self-made for this thesis

2019 marks ATEN’s 40th Anniversary since the business was established in 1979.

ATEN’s success is anchored upon our dedication to AV/IT technologies, and our commitment to sustained innovation and achieving excellence, all fueled by a passion for bringing better connectivity to the world.

Being “customer-centric” is ATEN's most important asset, making ATEN the preferred brand of many customers worldwide. ATEN will continue to work with customers to achieve excellence.

Chapter 5: Conclusion & Recommendation

5.1 Conclusion

Going global is an inevitable issue for most of Taiwanese IT company, since the domestic market is relatively small. However, there are many challenges and unclear roles and responsibility for them establishing a sales office or subsidiary worldwide.

From the chapters above and the results of the interview, we can summarize the challenging key factors as below.

Internal challenges

● Local office v.s. trading business

● Talent acquisition and retention External challenges

● Knowledge of the market

● Adaptability

Sales and Marketing related challenges

● Branding and promotion

● Pricing strategy

Furthermore, once the sales office / subsidiary is ready, they might still frustrate from how to distribute responsibilities between HQ and local team.

Product Marketing HQ

⚫ Market Research

1. Collect info from all regions 2. Info convert out

3. Decision making

⚫ Launch Plan

1. Target goals ($ & Qty) 2. S/T/P strategy

3. USP, competitor info..

4. Sales kit (spec sheet, manual..)

⚫ Global Sharing Platform

1. Collect feedback from all regions 2. Update to Global Sharing

Platform

Local

⚫ Market Research

1. Local market info research 2. Competition analysis 3. Feedback to HQ

⚫ Launch Plan 1. Local pricing 2. Inventory 3. Training

⚫ Local Feedback

1. Success story/case study 2. Customer & sales’ feedback

Service & Support HQ

⚫ Fast support

1. Request form template (E- service/support platform) 2. Scenario simulation 3. On time answer

4. Acceptable answer required 5. Better communication between

RD and support team

⚫ Test tool

1. Purchase of new tools

⚫ Training

1. Integrate FAQ for worldwide problems and use it as DB 2. Make training material &

schedule

3. Technical training

Local

⚫ Fast support

1. follow-up request form (scenario clearly description & technical issue follow up)

2. solve customer confidential issues 3. extended warranty

4. local customer Q&A 5. provide service as solution

⚫ Test tool

1. Test product with tool box before open internal case in the e-support

⚫ Training

1. Translate specific training to a user language

Channel Management HQ

⚫ Target 2nd tier Brand 1. Develop Global Account

management mechanism 2. Develop CRM system

⚫ Partner Engagement 1. ACS & ACP

2. Global marketing website

⚫ Channel Motivation 1. Pricing support 2. Tech support

Local

⚫ Target 2nd tier Brand

1. Target 2nd tier of worldwide top brands

2. CRM reports

⚫ Partner Engagement 1. Stock control

2. RRP(recommended retail price)&

RDP (recommended distribution price)

3. Fast Delivery 4. Co-marketing

⚫ Channel Motivation

1. Pricing control & Rebate Program

2. Tech support Marketing Promotion

HQ

⚫ Digital Marketing

1. Initiate digital strategies, concept, 2. build up infrastructure,

3. data analysis and insights 4. Financial Sponsor

⚫ SI/VAR Engagement

1. Provide sufficient information (i.e. market research, competitor

research, Global SI sharing, training guide)

⚫ Brand Marketing

1. Brand strategy, image, vision

Local

⚫ Digital Marketing 1. Localize content,

2. SEO/SEM/Affiliate marketing, 3. Social Media/email marketing 4. Budget planning

⚫ SI/VAR Engagement 1. Training/Events/

2. Incentive program/

3. create success story & case study

⚫ Brand Marketing

1. Utilize HQ’s content and deliver message via events and digital marketing

Product Development HQ

⚫ Long term research

1. Develop/design products based on RO feedbacks

⚫ Product Design intuitiveness 1. Modify and create products

⚫ Time To Market

1. Invest in R&D and selected technology (i.e. what’s next after HDMI 2.0)

Local

⚫ Long term research

1. Feedbacks on Products, user demand and typical applications 2. Representative market to set

Product Direction

⚫ Product Design intuitiveness 1. Test new products on the market

and provide user feedbacks

⚫ Time To Market

1. Report future potential applications

5.2 Recommendation

1. Setting a subsidiary is more costly and risky than setting a sales office, and the ROI (Return On Investment) also takes longer period of time. In the beginning, if the company doesn’t have strong cash flow and healthy financial status, maybe sales office is a better approach.

2. Talent management is one of the KSF (Key successful factor) of market expansion.

employees and expatriates manager. We can’t deny that the expatriate plays an important communication bridge between HQ and local office, however, it’s not helping for the localization.

3. Trust is something really matters for any Taiwanese company expand their business worldwide. Trust the local GM can give them the topmost respect and authority to maximize the business result. Trust the local partners can make them feel like ATEN is in the same boat, and they will do their level best for you.

4. Branding is a long journey which usually takes 5 to 10 years to get the positive result.

As a Taiwanese company, we need to be more patient and continuously make noise in the market. There’s no shortcut doing branding, and the marketing budget need to be planned and executed Uninterruptedly.

5. Adaptability shows how flexible your company is. Especially nowadays, people are talking about the “agile” concept. Different countries, especially emerging markets, have different ways of doing business. There is no general business SOP can be implemented into all the market, and we have to adapt their way of working in order to achieve the best result.

5.3 Limitation

Since this case study is focused on understanding and analyzing the challenge while doing global business through different academic frameworks and customer feedback, it could be seen as a limitation due to the human’s perception bias.

There may be undiscovered characteristics of the ATEN or different territories that the recommendations may not be applicable. Furthermore, each industry (in this case, KVM

industry) varies and may alter as the change due to the market demand of other external factors of the business environment which may also deescalate the industry itself from the declining. Since time is a major inhibitor, further observations and research studies for the next few years are still needed to conclude if the proposed approach and strategic framework actually works for ATEN and other related IT companies.