Department of Business Administration

I-Shou University

Master Thesis

Service Quality and Satisfaction for

Corporate Consumer: The Case Study of

Vietinbank

Advisors :

Dr.

Jiin-Ling

Lin

Co-advisor

: Dr. Dang Huy Nguyen

Graduate Student : Nguyen Thi Thu Hang

Acknowledgements

Grateful and sincere appreciation is hereby expressed to a number of individuals who took time and efforts to assists in the development of study. Firstly, I want to send my deepest thanks to my advisors, Prof. Jiin Ling Lin and Dr. Nguyen Quang Huy, who supported and gave many valuable ideas to me to complete this research paper. I think their efforts are undeniably important to the development of this research paper. Secondly, participants of the research are highly appreciated, as their answers and feedbacks bring valuable primary data to my research. They also gave me advices to improve this paper, and this research cannot be done without them in expanding my knowledge. Thirdly, I want to mention the support of my admirable husband, who always encourages me to complete this research paper. I feel lucky to have him and other members of my family staying by my side to overcome difficulties during the researching process. Last but not least, the research paper is done thanks to the support of teachers and lecturers at Hanoi University of Business and Technology and I-shou University. They taught me many priceless ideas and gave the rightful research direction, which are extremely important to me in the researching process.

Abstract

This study aims to examine service quality and satisfaction for Vietinbank’s corporate consumers. The researcher collected data, presented descriptive statistics and conducted reliability analysis, regression analysis and ANOVA. It should be noted that customers’ service quality was impated by 6 quality service factors (Staff conduct, Trust, Convenience, Price competitiveness, Assurance, Empathy). Results show that there is a difference between numbers of transactions and satisfaction for corporate customers at Vietinbank, Hanoi Branch. The recommendation and limitation about the study also discussed in the end.

Key words: Service quality, customer satisfaction, corporate customers, Vietinbank.

Table of content

Acknowledgements ... i

Abstract... ii

Table of content ... iii

List of Table ...v

List of Figure ... vi

CHAPTER I: INTRODUCTION...1

1.1 Research background ...1

1.2. The objectives and tasks of the thesis ...2

1.3. Research questions and scope of research ...2

1.4 Research contribution ...3

CHAPTER II:LITERATURE REVIREW ...4

2.1 Background information of VietinBank, Hanoi branch...4

2.2 Overview of corporate customers of commercial bank ...5

2.3 Overview of service quality ...6

2.4. Customers’ satisfaction ... 11

CHAPTER III: METHODOLOGY... 14

3.1 Research framework ... 14

3.2 Sample collection: ... 15

3.3. Instrument design: ... 16

3.4.1 Reliability analysis ... 19

3.4.2 Regression analysis ... 19

3.4.3 ANOVA ... 19

CHAPTER IV: ANALYSING AND FIDING ... 20

4.1 Descriptive statistics ... 20

4.1.1 Rate of Response ... 20

4.1.2 Consumer behavior information ... 20

4.1.3 Scale analysis ... 21

4.2 Reliability analysis ... 23

4.3 Regression result ... 25

4.4 ANOVA result ... 31

CHAPTER VCONCLUSION ... 34

5.1. Summary of the research... 34

5.2 Recommendations ... 34

5.3 Thesis contribution ... 35

5.4 Limitation of the research ... 36

REFERENCES ... 37

List of Table

Table 3.1 Coding data ... 16

Table 4.1 Consumer behavior information ... 21

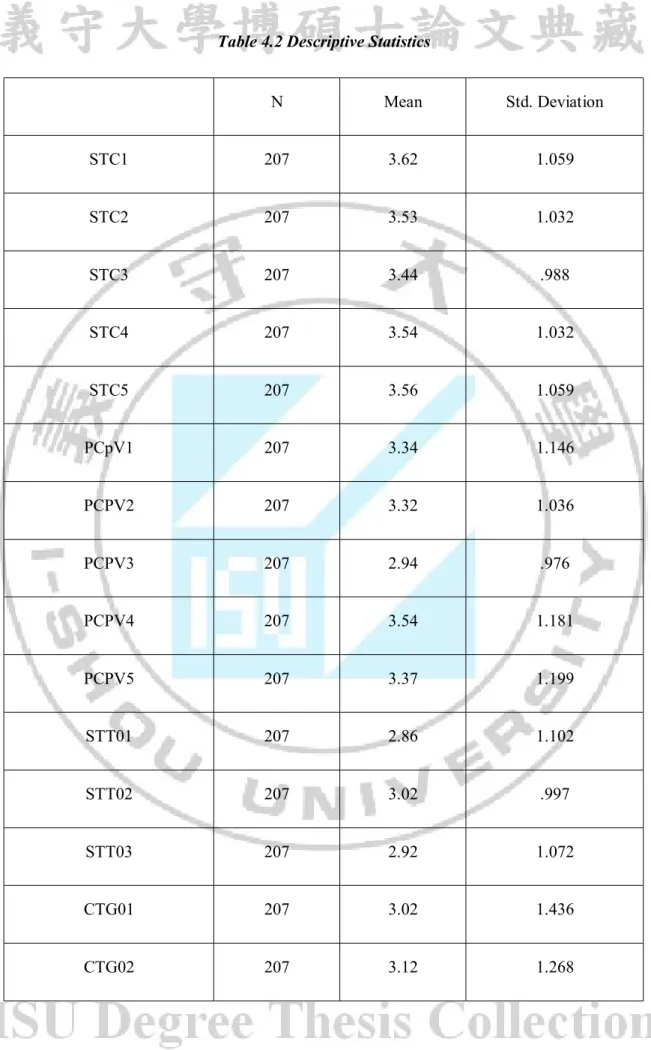

Table 4.2 Descriptive Statistics ... 22

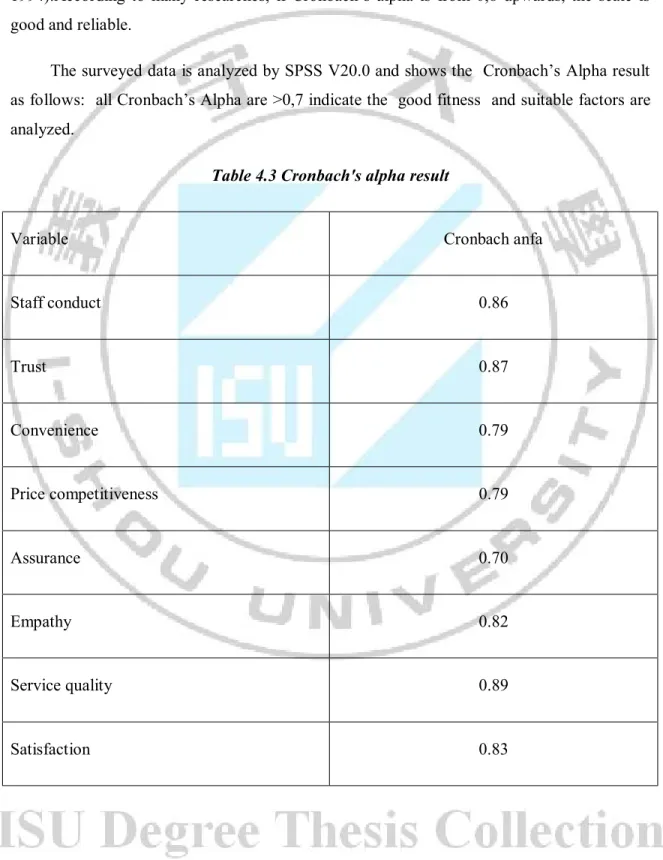

Table 4.3 Cronbach's alpha result ... 24

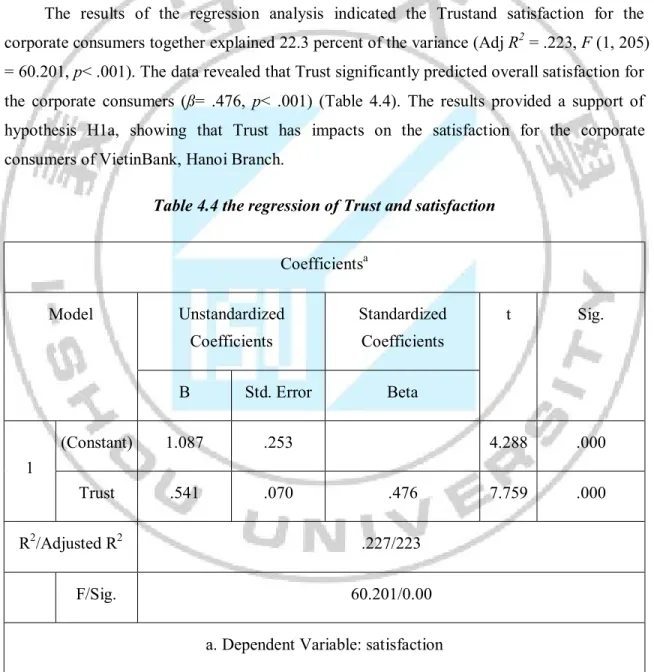

Table 4.4 the regression of Trust and satisfaction ... 25

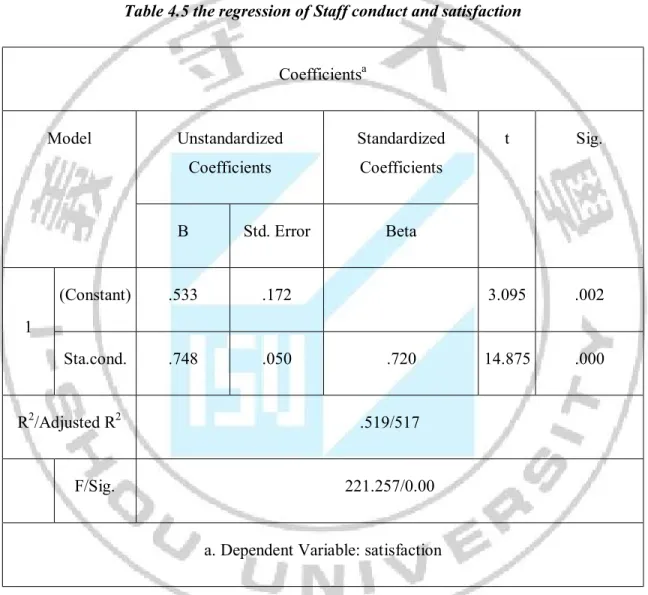

Table 4.5 the regression of Staff conduct and satisfaction ... 26

Table 4.6 the regression of Convenient service and satisfaction ... 27

Table 4.7 the regression of Price and satisfaction ... 28

Table 4.8 the regression of assurance and satisfaction ... 29

Table 4.9 the regression of Empathy and satisfaction ... 30

Table 4.10 the regression of Service quality and satisfaction ... 31

Table 4.11 difference between time with bank and satisfaction ... 32

Table 4.12 difference between numbers of transactions and satisfaction ... 33

List of Figure

Figure 2.1: The SERVQUAL model ...8

Figure 2.2: Proposed service quality model ... 10

CHAPTER I: INTRODUCTION

1.1 Research background

Nowadays the economic integration and free trade is taking place widely, the competition among banks is also becoming fiercer. Customers are the key to the existence and development of a bank. To increase competitiveness, an organization must continuously improve its service and meet customers’ demands. Whichever bank is prestigious and gain customers’ trust will have a firm background for development (Giau, 2013). It is undeniable that, the success of a bank depends greatly on its ability to provide satisfactory services.

A bank can have business customers such as state enterprises, private enterprises, partnership, FDI companies, liability limited companies or individual or household customers, in which corporate customers are fewer but contribute a large proportion to the income of the bank (Leung, S., 2009).. Corporate customers have a great demand for financial support and banking services, therefore, they have frequent transactions with the bank (Giau, 2013).Therefore, the services implemented for corporate customers are also feasible and have large scope. In addition, this group of customers bring higher profit to the bank due to the large number and large value of their transactions.VietinBank in Hanoi branch is one of the largest branches of VietinBank

(

Duc & Thien, 2013).Therefore, it is assigned with very high business targets, especially targets in capital mobilization, loan and profit.Regarding to the report of the recent trend of economy development, Vietnam Bank for Industry and Trade (VietinBank), in Hanoi Branch, has put an emphasis on developing corporate customers. Those effecorts have brought outstanding results. At the same time it has also revealed many limitationssuch as demand the branch to overcome difficulties to develop and improve competitiveness in the current marketVietinBankin Hanoi branch has faced lots of challenges to overcome these limitations in order to enhance its competitiveness in the market. Therefore, increasing customers’ satisfaction, especially corporate customers, is crucial to the benefits sake for the bank (Duc & Thien, 2013). Due to this reason, this study will analyze the relationships between service quality andsatisfaction for the corporate consumer in Banking: The case of VietinBank in Hanoi, Vietnam.1.2. The objectives and tasks of the thesis

The purpose of this study is examining the relationships between service quality and satisfaction for the corporate consumer in Banking: The case of VietinBank in Hanoi, Vietnam. On the basis of the analysis of credit service quality to consumer satisfaction, several solutions to increase corporate customers’ satisfaction at VietinBank, Hanoi Branch were be recommended. .

1.3. Research questions and scope of research

Research questions and hypothesis were listed in below:Research questions1: Does factors of credit service quality have impacts on satisfaction of corporate customers at VietinBank, Hanoi Branch?

H1a: Trust is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch .

H1b: Staff conduct is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1c: Convenient service is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1d: Price is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1e: Assurance is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1f: Empathy is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1g: Service quality has impact on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

Research questions 2: Doesconsumer behavior informationhas impactson satisfaction ofcorporate customers at VietinBank, Hanoi Branch?

H2a: There is a difference between time with bank and satisfaction for corporate customers at VietinBank, Hanoi Branch.

H2b: There is a difference between numbers of transactions and satisfaction for corporate customers at VietinBank, Hanoi Branch.

1.4 Research contribution

By the examining the literature of service quality and customer satisfaction this research will give the model of the relationship between the service quality and customer satisfaction. The testing hypothesis result will give the recommendation for the banking manager in general and Vietinbank in particular. Also this thesis will contributes the academic theories of banking service in Vietnam. As the service banking still limited studies in Vietnam in practical as well as academicals.

CHAPTER II:LITERATURE REVIREW

2.1 Background information of VietinBank, Hanoi branch

In Vietnam, the definition of commercial banks changed in different phases of economic development. According to State laws of banks, Credit Co-operatives and Financial Companies in 1990, commercial banks was an organization for trading money; their major and frequent activities were to receive and return customers’ deposit and used the amount of deposit for loans, discounts and payment. Meanwhile, according to the Law of Credit Organizations (1990), commercial banks are credit organizations that conduct all kinds of money business activities and their main activities were to receive deposits and used the deposit for payment services. In 2003, the Law of Credit Organizations stated that commercial banks were credit organizations that were allowed to implement all banking activities and relevant business activities. Later in 2010, the Law of Credit Organizations added that commercial banks were credit organizations that were allowed to implement all banking activities and other relevant business activities for profit purposes. Commercial banks are a money-trading business that conducts such activities as capital mobilization, giving loans, investment and other services (Vu & Turnell, 2010). The source of capital includes owner’s equity, customers’ deposits, loans, commission and payment. Loan and investment activities are the two most important capital-utilizing activities that play a decisive role in the existence or failure of banks. Capital exploitation and usage activities include treasury and fund items, loans, investment and other capital usage activities.Vietnam Bank for Industry and Trade (Vietinbank) was separated from the State Bank of Vietnam and founded in 1988. Currently, the Bank has a widespread network all over the nation, including 3 Operations Centers, 141 branches and over 700 transaction offices. Its major activity was to mobilize capital and gave short-term loans to State enterprises; it now has had a variety of activities such as, mobilizing capital from economic organizations; mobilizing capital from savings account; issuing bonds in Vietnam Dong and foreign currencies; giving loans of different terms in Vietnam Dong and foreign currencies to all economic participants; buying and selling jewelries; buying and selling foreign currieries; paying money sent from overseas; international payment and guarantee service. Clients of VietinBank Hanoi Branch are important customers who are state enterprises, corporations

such as the State Treasury, Vietnam Steel Corporation. These customers always receive the privelege from the Branch; they have had many years working with VietinBank Hanoi Branch and have used the services of the Branch since the very first days of establishment. They contribute a large part to annual profit of the Branch. (Vietin Bank, 2014). At the moment, corporate customers constitute a large proportion of customers who use credit services of the bank. The thesis is going to analyze deeply such issues as, who corporate customers are and and how to improve corporate customers’ satisfaction.

2.2 Overview of corporate customers of commercial bank

According to Article 4, Enterprise Law 2005, “An enterprise is an economic organization with a private name, assets, transaction offices and business registration to implement business activities.”Enterprises, after issued with a business registration certificate, have legal standings and are legally recognized and can go into operation. During its operation, enterprises have demands for capital or payment services so they will surely use banking services.It means that, “Corporate customers of commercial banks are enterprises that have demands for products and services of the bank to use during their business opeations”. In other words, enterprises are customers of banks.According to the “Basic Marketing” textbook of National Economics University (2013), “Enterprises serve customers and customers are the people that decide the success or failture of the enterprises” According to website tratu.baamboo.com: “Customers buy the products and use the services from the sellers or the service providers.” (Retrived from http://www tratu.baamboo.com)

According to “Business strategies of commercial businesses” textbook of National Economic University (2013), “Customers are people to be served; they bring profits to the companies as well as success and sustainable development of the enterprises“.

For a bank, customers participate in both phases; they supply capital buy opening a savings account, buying bond and also consume capital by borrowing money, using bank services. The bank and customers have a two-direction relationship of supporting each other’s development. The success or failure of customers will decide the existence and development of the banks (Thang & Quang, 2005).

Different from individual customers, corporate customers are fewer in number, their purchase power is much bigger and higher number of transactions. Therefore, the relationship between the bank and corporate customers is usually closer and two-way relationship. Therefore, the relationship between customer and bank organizations is often closer and is mutual relationship, mutual binding (Thang & Quang, 2005). . They are educated customers whose purchases are to serve their businesses or certain functions, therefore, they pay much attention to profit, cost reduction, negotiation about prices, or ask for discounts or have certain requirements such as supply plan, quantity, quality and location (Nguyen & Phuong, 2011).Therefore, banks should base on customers’ expectations to satisfy to the maximum customers’ demands.

2.3 Overview of service quality

Service is a popular concept in marketing and business. There are many definitions of service, but according to Zeithaml (2000, p.68)“Services are behaviors, processes and methods to implement a certain task, to create values for customers, to satisfy their demands and expectations.”. It can be argued that, the quality of a product or a service is reflected through the level that it satisfies consumers’ demands and the financial benefit it brings to the supplier.

According to Lewis and Booms’ (1983, p101): “Quality is the measure of the appropriateness of the service with customers’ expectations. Providing a quality service means meetings customers’ expectations on a reasonable basis”.Parasuraman, Zeithaml, and Berry ‘s theory(1988) defines the quality of a service as “the level of difference between consumers’ expectations and their perception of the results of the service”.

For services, the assessment of quality is more difficult because services have different characteristics with tangible products. The theory of service marketing includes three basic characteristics are intangible, heterogeneous and not separating (Zeithaml, et al, 2006).

Firstly, the majority of services are considered intangible products. Services can not weighing, measuring, counting, testing or inspection before purchase, with intangible reasons, the company feels very difficult to understand customer perception of how to service and service quality evaluation.

Second, heterogeneous services, especially those services have high levels of human labor. The reason is that the operation of services often varies from service providers, from

customers, and the quality of service provided is not equal for each day, month and year of business (Vargo & Lusch, 2004).. It requires a consistent quality of staff would also be very difficult to ensure. The reason is what the company intends to serve it can be completely different from what the customer receives.

Third, production and consumption of many services are inseparable. Quality of service cannot be produced in factories, then move the status quo to customer service. For these services have high labor content, the quality of services shown in the interaction between customers and employees of the company providing the service.

Within the limit of a thesis, this paper is going to introduce some typical models for evaluating the quality of bank services; analyze the models and apply these models into introducing a suitable model to be applied in real-life research to improve customers’ satisfaction.

As the economy gets more and more developed, the role of services is also becoming more and more important; and service has become the research object of many different fields: economics, cultural studies, and law, administration and management studies. Therefore, there many narrow and extended definitions of service, as well different interpretations.

However, Within the scope of this study, service are all the behaviors, procedures and methods to carry out a value for customers and satisfy their expectations and demands when using the services at the Vietinbank. This study use the model of Parasuraman, Zeithaml and Berry, (1985) with the modification by reviewd other studies for developing the model of this study.

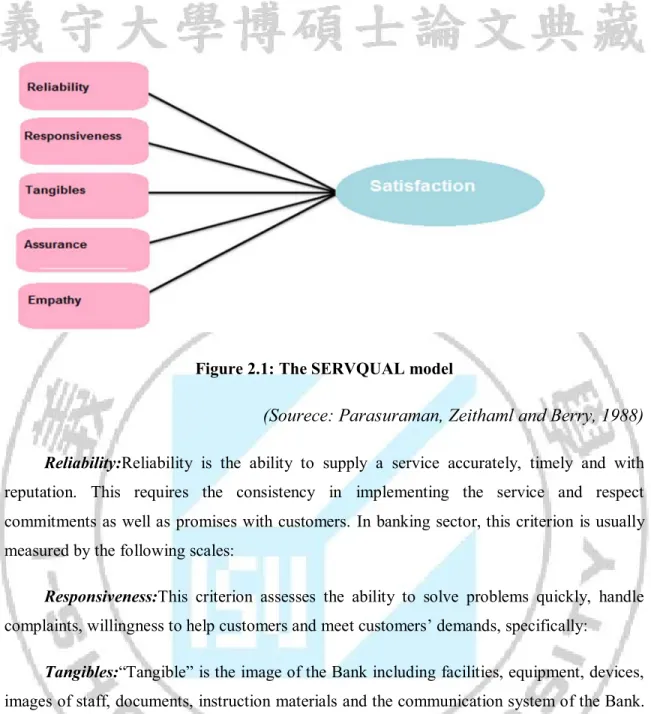

The SERVQUAL model of Parasuraman, Zeithaml and Berry (1988) was established on the notion that the service quality perceived is the comparison between customers’ expectations and perception. SERVQUAL is a 22-item instrument that assesses two main dimensions of service quality: outcome and process in 5 criteria: reliability, responsiveness, tangibles, assurance and empathy:

Figure 2.1: The SERVQUAL model

(Sourece: Parasuraman, Zeithaml and Berry, 1988)

Reliability:Reliability is the ability to supply a service accurately, timely and with

reputation. This requires the consistency in implementing the service and respect commitments as well as promises with customers. In banking sector, this criterion is usually measured by the following scales:

Responsiveness:This criterion assesses the ability to solve problems quickly, handle

complaints, willingness to help customers and meet customers’ demands, specifically:

Tangibles:“Tangible” is the image of the Bank including facilities, equipment, devices,

images of staff, documents, instruction materials and the communication system of the Bank. In otherwords, “tangible” is everything that customers can see with their eyes and feel with their senses; this criterion can be affected specifically:

Assurance:Assurance is the trust and prestige of customers, created by the professional

service of the staff, staff’s professional knowledge, elegant style and good communication skills, which assures customers whenever they use the bank’s services:

Empathy:Empathy is the caring for the customers, providing individual attention to

customers, making the customers feel important and that they are welcomed all the time. The human factor is the key to this success and the more bank cares for their customers, the more empathy increases:

SERVPERF model (Cronin and Taylor, 1992) The SERVPERF model was developed

on the basis of SERVQUAL model, but it assesses the service quality on the basis of the service conducted (performance-based), not basing on the difference between expectation and perception.

Gronroos model for service quality: Service quality is evaluated on two criteria, FSQ:

Functional Service Quality and TSQ: Technical Service Quality; service quality is influenced greatly by corporate image. Gronrooslisted 3 influencing factors on service quality: functional service quality, technical service quality and corporate image (FTSQ model).

Technical service quality:Is the quality that customers receive through the contact with

the business and is it perceived by customers? In other words, technical service quality is the result of interactions between business and customers, in which business provides services (what?) and customers perceive the service. There are five 5 criteria to evaluate this factor: Problem-solving skill, - Professional skills, Working level. Facilities, Information storage system.

Functional service quality:Functional service quality reflects how service is done and

how it is provided. Between the two above qualities, functional service quality has a more important role and it is reflected through the following criteria: Convenience of transactions, Behaviors, Attitude, Business organization, Contact with customers, Service style,

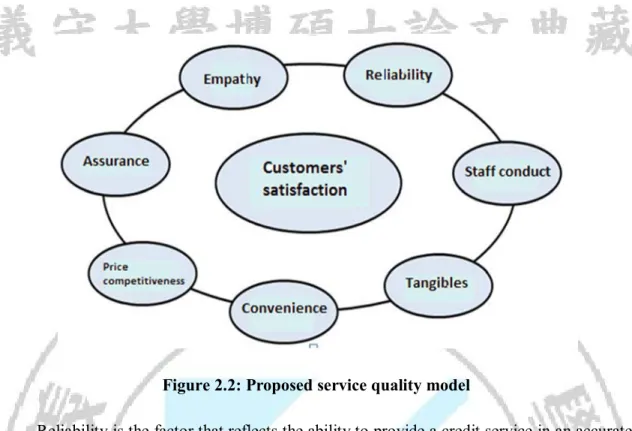

Basing on the advantages and disadvantages of the models, the author will propose the following model to be used in the research. The first influential factor on customers’ satisfaction is identified to be the quality of credit grant, due to generalized factors in Gronroos model, factors in Servqual model such as Reliability, Staff conduct, Tangibles, Convenience, Assurance, and Empathy. The second influential factor is Price in CSI model and factors basing on Kano model. Basing on such models, the author proposed the factors to be used in the scale for measuring customers’ satisfaction with credit grant service of the bank as follows:

Figure 2.2: Proposed service quality model

Reliability is the factor that reflects the ability to provide a credit service in an accurate, timely and reliable manner. To have reliability, the service provider needs to be consistent in granting credit as well as respect commitment or promises made with customers. Only when customers trust the bank can they be satisfied with the service.

To satisfy the customer in banking industry the services need to meet customers’ demand, e is provided quickly, provided without any fault or error, the staff consults suitable service with customers’ purpose and the bank provides data accurately and quickly.

Staff Conduct: This includes the ability to solve problems quickly, resolve effectively complaints about the credit grant; the willingness to help customers and respond to customers’ request for credit grant with a nice attitude, good communication skill and good knowledge to answer all customers’ queries about credit service (Avkiran, 2002). In other words, staff conduct is the response of the bank to customers’ demands. Customers will feel satisfied if staff has good conduct. the items include: Staff solves customers’ complaints appropriately

Staff is knowledgeable (consult customers with the best service), Staff does the service accurately and quickly, Staff answers customers’ queries, Staff is ready to serve customers

The item for Convenience includes: The convenience in all transactions, The bank has convenient location for customers to do all transactions, The bank has a widespread network of agents, Business hours are convenient and suitable, Easy-to-use communication system

Easy and quick transaction procedures, The bank has instant information about balance and account

Competitiveness in price:Competitiveness in loan interest and relevant fees.This is the new variable to be considered in the theoretical model. Due to the fluctuations of the financial market in Vietnam and the business culture, customers always compare the interest rate and transaction fee among different banks. Therefore, attractive interest rate and transaction fee will keep customers satisfied. the item as: The bank has a flexible price policy, The bank has competitive interest rate, Transaction fees are acceptable,

Assurance: This is the factor that creates trust for the customers. They can feel assured if the staff is professional, competent and knowledgeable; have good conduct and communication skills, which make them feel safe whenever using the services. There are four items as: The staff is polite to customers, Customers feel safe when they do transactions with the bank, The staff always provides necessary information for customers, The staff answers customers’ queries accurately, clearly.

Empathy is the caring for the customers and being nice to them so that customers feel that they are important and welcomed anytime. Human is the key to this success; by caring more for customers, the bank will increase the empathy for their customers: The staff pays individual attention to customers, The staff understands clearly customers’ demands, The staff always pays special attention to customers, Customers do not have to wait long to be served. and The staff is always caring for customers.

2.4. Customers’ satisfaction

There are many different definitions of customers’ satisfaction as well as arguments. Many famous researchers said that satisfaction is the difference between customers’ expectations and actual perception. Customers’ Satisfaction can be difined as in following sections. According to Fornell, Rust, and Dekimpe, (2010), stated that satisfaction or dissatisfaction after using the service, was defined as customers’ reactions about the difference between expectations before using the service and actual perception after using it. Hoyer and MacInnis (2001) stated that satisfaction can be attached with a feeling of acceptance, happiness, assistance, excitement. Hansemark and Albinsson(2004) suggested

reaction to the difference between what customers expect and what they receive, for a service to meet certain demands, objectives or desires.” According to Zeithaml, (2000) they menioned that customers’ satisfaction is the evaluation of customers towards a certain product or service that has met their demands and expectations.

Satisfaction is the subjective feelings that customers have towards the bank after they have used the products/services of the bank. Satisfaction can have direct effects on customers’ attitude and behaviors. If customers are satisfied, they will continue to use the service when they have demands. Otherwise, they will come to another organization that provides a similar product/service .

Kotler, P.(2000) defined “Satisfaction is a feeling of satisfaction or dissatisfaction of a person, by a result of the comparison between actual perception of a service in connection with their expectations,” Hence, from the above definitions, it can be concluded that Satisfaction is a subjective state and feeling of customers towards the service provider or product supplier after customers have used the service/product.

Stauss and Neuhaus (1997) categorized customers’ satisfaction into three types of satisfaction, and from each of the factors may have influencesthe service providers. According to Carmel,(1985). The three types of satisfaction are 1) Demanding customer satisfaction: satisfaction that is demanding and is reflected through increasing use of services. For customers that have demanding satisfaction, they will have good relationship with the service providers and they have mutual trust. These customers can easily become loyal customers of the bank as long as they realize that businesses have much improvement in the services. The demanding side is also reflected in the increasing use of the service. 2) Stable customer satisfaction: With customers who have stable satisfaction, they will feel satisfied with what is happening and does not want any changes in the way the service is provided. Therefore, these customers will appear to be nice, have high trust with the bank and can easily use bank’s services.3) Resigned customer satisfaction: these customers do not have much trust in the business and they think it is difficult for the businesses to change the services according to their demands. They feel satisfied not because their demands are completely satisfied but because the businesses cannot improve more. Therefore, they will not give feedback and they will ignore business’ efforts.

Stauss and Neuhaus (1997) also stated that customers’ satisfaction also have greatly on their behaviors. Only customers stated “very satisfied” can become loyal and always support the bank business. Therefore, business need to make customers completely satisfied with bank services in order to promot those consumers stay longer with the bank. It is interesting to know that mostly customers answered the degree of datsifactions equal to under the level of general satisfied, they were intented to leave the business anytime. Hence, satisfactions is highly related to the loalty of bank consumers especially for the the groups ofcorporate customers.Satisfaction of business customers: Business customers’ satisfaction are uniquely the satisfaction of a group of people in the organization (including: Chairman – the Board of Director, Chairman – Member council, Director, Chief accountant …).

CHAPTER III: METHODOLOGY

3.1 Research framework

The purpose of this study is to examine the relationships between service quality and satisfaction for the corporate consumer in Banking: The case of VietinBank in Hanoi, Vietnam.

Figure 3.1: Research frame work

For reaching the research objective this study to answer following questions and hypothesis. Research questions and hypothesis were listed in below:

Research questions1: Does factors of credit service quality have impacts on satisfaction of corporate customers at VietinBank, Hanoi Branch?

H1a: Trust is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch . H1a H1b H1c trust assurance price convenient service staff conduct Satisfaction Consumer behaviors or Consumer sociodemographic information H1e empathy Service Quality H1d H1f

H1b: Staff conduct is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1c: Convenient service is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1d: Price is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1e: Assurance is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1f: Empathy is related to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch

H1g: Service quality has impact on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

Research questions 2: Does consumer behavior information has impacts on satisfaction of corporate customers at VietinBank, Hanoi Branch?

H2a: There is a difference between time with bank and satisfaction for corporate customers at VietinBank, Hanoi Branch.

H2b: There is a difference between numbers of transactions and satisfaction for corporate customers at VietinBank, Hanoi Branch.

3.2 Sample collection:

Sample is collected randomly from the list of customers at the Hanoi branch in recent three years. Sample size is at the minimum the number of variables multiplied with 5. Therefore, the ample size here is 300 respondents. To avoid invalid responses, the respondents were chosen to be 25 companies. Questionnaires were be sent to the email of each company as registered in customer list, after that, the researcher made phone calls to confirm the receipt of the questionnaires. The survey was conducted in May, 2015 weeks; the delivery and collection of the questionnaires was conducted in 01 from May 20 to 27, 201.

After that, researcher spent time to summarize the questionnaires and eliminate invalid responses.

3.3. Instrument design:

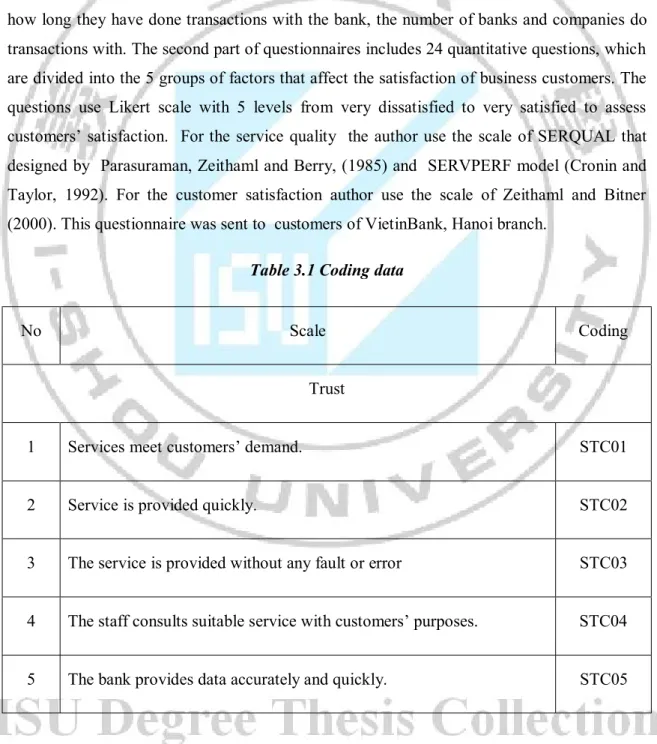

The questionnaire was designed to consist of 32 research questions to measure factors that bring satisfaction to customers. The questionnaire is divided into two parts; the first part includes quantitative questions to classify respondents. As the research participants are business customers, the questionnaires classify them basing on the following information: form of organization, size of capital, average amount of borrowed capital in recent three years, how long they have done transactions with the bank, the number of banks and companies do transactions with. The second part of questionnaires includes 24 quantitative questions, which are divided into the 5 groups of factors that affect the satisfaction of business customers. The questions use Likert scale with 5 levels from very dissatisfied to very satisfied to assess customers’ satisfaction. For the service quality the author use the scale of SERQUAL that designed by Parasuraman, Zeithaml and Berry, (1985) and SERVPERF model (Cronin and Taylor, 1992). For the customer satisfaction author use the scale of Zeithaml and Bitner (2000). This questionnaire was sent to customers of VietinBank, Hanoi branch.

Table 3.1 Coding data

No Scale Coding

Trust

1 Services meet customers’ demand. STC01

2 Service is provided quickly. STC02

3 The service is provided without any fault or error STC03

4 The staff consults suitable service with customers’ purposes. STC04

Staff conduct

6 The staff is willing to help customers PCPV01

7 Staff lets you know when service will be done. PCPV02

8 Service is provided quickly. PCPV03

9 Staff is friendly with customers PCPV04

10 The bank always tries to solve customers’ difficulties PCPV05

Convenience

11 The bank has a widespread network STT01

12 Simple transaction procedures and all necessary services are provided STT02

13 Convenient business location STT03

Price competitiveness

19 The bank has competitive interest rate CTG01

20 Transaction fees are reasonable CTG02

Assurance

14 Staff is polite to the customers. SBD01

25 Customers feel secure when doing transactions with the bank SBD02

16 The staff always provides customers with necessary information. SBD03

17 The staff answers accurately and clearly all queries SBD04

Empathy

18 Staff pays individual attention to customers SCT01

19 Staff understands customers’ demands SCT02

20 Staff pays special attention to customers SCT03

21 Staff solves problems quickly. SCT04

Satisfaction

22 The bank meets customers’ demands. SHL01

23 I am satisfied with the bank’s services. SHL02

3.4 Analysis

3.4.1 Reliability analysis

To test the reliability of scale this study use the cronbach’s Alpha to check ask

recommended by Numally ( 1978) all variable should have the cronbach’s Alpha value

bigger than .6.

3.4.2 Regression analysis

To answer the Research question 1: Does factors of credit service quality have

impacts on satisfaction of corporate customers at VietinBank, Hanoi Branch? the

regression method is taken.

3.4.3 ANOVA

ANOVA was used to test research questions Two in this study. ANOVA was

used to examine hypothesis:

H2a: There is a difference between time with bank and satisfaction for corporate customers at VietinBank, Hanoi Branch.

H2b: There is a difference between numbers of tracstions and satisfaction for corporate customers at VietinBank, Hanoi Branch.

CHAPTER IV: ANALYSING AND FIDING

This chapter presents the major findings of this study. The results are summarized in three sections: rate of response Consumer behavior information, and hypotheses testing results.

4.1 Descriptive statistics

4.1.1 Rate of Response

300 were collected from the respondent, 255respondents finished the survey count for 85% of response rate. There are 207 respondents with the usable questionnaire in this study count for 81% (207/255) of usable rate.

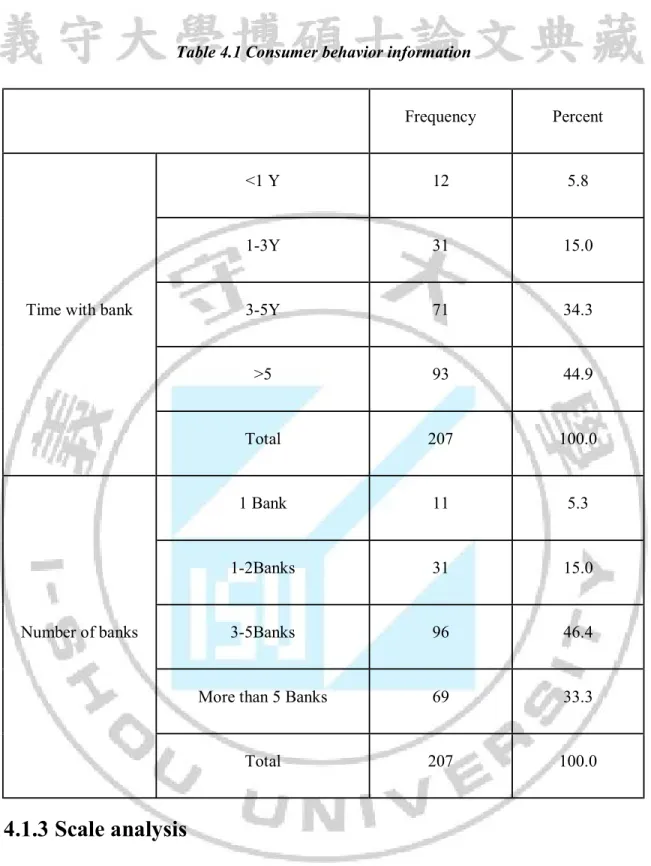

4.1.2 Consumer behavior information

During 207 customer were asked for complete the survey there are 5.8% customer have under 1 year transaction with Vietinbank, 15% have 1-3 years, 3-5 year count for 34.3% and customers who have more than 5 year deal with Vietinbank in this study is 44.9% indicate the longtime transaction in this study.

Related to the number of bank that customer have transaction with, the result shows that there are 5.3% of customers who only work with 1 bank, 1-2 bank is 15%, while 3-5 banks count for 46.4% and more than 5 banks in this study is 33.3%, indicates the multiple bank transaction of customers. Table 4.1 shows the results

Table 4.1 Consumer behavior information

Frequency Percent

Time with bank

<1 Y 12 5.8 1-3Y 31 15.0 3-5Y 71 34.3 >5 93 44.9 Total 207 100.0 Number of banks 1 Bank 11 5.3 1-2Banks 31 15.0 3-5Banks 96 46.4

More than 5 Banks 69 33.3

Total 207 100.0

4.1.3 Scale analysis

To analyzing the scale of questionnaires this study use the descriptive statistics, the results indicate that all most item have the mean value bigger than 3 indicate the good fitness of questionnaires. Table 4.2 shows the results of scaling.

Table 4.2 Descriptive Statistics N Mean Std. Deviation STC1 207 3.62 1.059 STC2 207 3.53 1.032 STC3 207 3.44 .988 STC4 207 3.54 1.032 STC5 207 3.56 1.059 PCpV1 207 3.34 1.146 PCPV2 207 3.32 1.036 PCPV3 207 2.94 .976 PCPV4 207 3.54 1.181 PCPV5 207 3.37 1.199 STT01 207 2.86 1.102 STT02 207 3.02 .997 STT03 207 2.92 1.072 CTG01 207 3.02 1.436 CTG02 207 3.12 1.268

CTG03 207 3.12 1.091 SBD01 207 3.12 .950 SBD02 207 3.26 .989 SBD03 207 2.98 1.344 SBD04 207 3.01 1.307 SCT01 207 3.04 .952 SCT02 207 3.37 1.048 SCT03 207 3.11 .923 SCT04 207 2.83 1.042 HL1 207 3.18 1.116 HL2 207 2.95 1.025 HL3 207 2.88 1.106 Valid N (listwise) 207

4.2 Reliability analysis

Cronbach's alpha is used to test statistics on the level of reliability and relationship between the observed variables in the scale. It said the rigor and consistency in the answers to ensure respondents understood the same concept.

correlation between the value of each variable with the value of all answer variables. This method allows us to eliminate unsuitable variables which do not reflect the tested factors in the research model; otherwise, we cannot know exactly variance or errors of variables. Accordingly, only variables with Corrected Item-Total Correlation> 0.3 and Alpha factor > 0.6 are acceptable and suitable to be taken to the next analysis steps. (Nunnally&BernStein, 1994).According to many researches, if Cronbach’s alpha is from 0,8 upwards, the scale is good and reliable.

The surveyed data is analyzed by SPSS V20.0 and shows the Cronbach’s Alpha result as follows: all Cronbach’s Alpha are >0,7 indicate the good fitness and suitable factors are analyzed.

Table 4.3 Cronbach's alpha result

Variable Cronbach anfa

Staff conduct 0.86 Trust 0.87 Convenience 0.79 Price competitiveness 0.79 Assurance 0.70 Empathy 0.82 Service quality 0.89 Satisfaction 0.83

4.3 Regression result

For answer the research question 1 does factors of credit service quality have impacts on satisfaction of corporate customers at VietinBank, Hanoi Branch, simple regressions is taken to test the hypothesis H1a-H1g

H1a: Trust has impacts on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

The results of the regression analysis indicated the Trustand satisfaction for the corporate consumers together explained 22.3 percent of the variance (Adj R2 = .223, F (1, 205) = 60.201, p< .001). The data revealed that Trust significantly predicted overall satisfaction for the corporate consumers (ß= .476, p< .001) (Table 4.4). The results provided a support of hypothesis H1a, showing that Trust has impacts on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

Table 4.4 the regression of Trust and satisfaction

Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) 1.087 .253 4.288 .000 Trust .541 .070 .476 7.759 .000 R2/Adjusted R2 .227/223 F/Sig. 60.201/0.00

a. Dependent Variable: satisfaction

The results of the regression analysis indicated the Staff conduct and satisfaction for the corporate consumers together explained 51.7 percent of the variance (Adj R2 = .517, F (1, 205) = 221.257, p< .001). The data revealed that Staff conduct significantly predicted overall satisfaction for the corporate consumers (ß = .720, p< .001) (Table 4.5). The results provided a support of hypothesis H1b: Staff conduct has impacts on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

Table 4.5 the regression of Staff conduct and satisfaction

Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) .533 .172 3.095 .002 Sta.cond. .748 .050 .720 14.875 .000 R2/Adjusted R2 .519/517 F/Sig. 221.257/0.00

a. Dependent Variable: satisfaction

H1c: Convenient service has impacts to the satisfaction for the corporate onsumers of VietinBank, Hanoi Branch.

The results of the regression analysis indicated the Convenient service and satisfaction for the corporate consumers together explained 44.5 percent of the variance (Adj R2 = .445, F (1, 205) = 166.200, p< .001). The data revealed that Convenient service significantly predicted overall satisfaction for the corporate consumers (ß = .669, p< .001) (Table 4.6). The

results provided a support of hypothesis H1c: Convenient service has impacts to the satisfaction for the corporate onsumers of VietinBank, Hanoi Branch..

Table 4.6 the regression of Convenient service and satisfaction

Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) .607 .192 3.160 .002 Convenien .681 .053 .669 12.892 .000 R2/Adjusted R2 .448/445 F/Sig. 166.200/0.00

a. Dependent Variable: satisfaction

H1d: Price has impacts to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

The results of the regression analysis indicated the Price and satisfaction for the corporate consumers together explained 12.7 percent of the variance (Adj R2 = .127, F (1, 205) = 30.957, p< .001). The data revealed that Price significantly predicted overall satisfaction for the corporate consumers (ß = .362, p< .001) (Table 4.7). The results provided a support of hypothesis H1d: Price has impacts to the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

Table 4.7 the regression of Price and satisfaction Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) 1.878 .211 8.909 .000 Price .382 .069 .362 5.564 .000 R2/Adjusted R2 .131/127 F/Sig. 30.957/0.00

a. Dependent Variable: satisfaction

H1e: Assurance has impacts to the satisfaction for the corporate onsumers of VietinBank, Hanoi Branch.

The results of the regression analysis indicated the Assurance and satisfaction for the corporate consumers together explained 30.6 percent of the variance (Adj R2 = .306, F (1, 205) = 90.335, p< .001). The data revealed that Assurancesignificantly predicted overall satisfaction for the corporate consumers (ß = .553, p< .001) (Table 4.8). The results provided a support of hypothesis H1e: Assurance has impacts to the satisfaction for the corporate onsumers of VietinBank, Hanoi Branch.

Table 4.8 the regression of assurance and satisfaction Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) .920 .226 4.078 .000 assurance .673 .071 .553 9.504 .000 R2/Adjusted R2 .306/302 F/Sig. 90.335/0.00

a. Dependent Variable: satisfaction

H1f: Empathy has impacts on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

The results of the regression analysis indicated the empathy and satisfaction for the corporate consumers together explained 33.2 percent of the variance (Adj R2 = .332, F (1, 205) = 103.474, p< .001). The data revealed that Empathy significantly predicted overall satisfaction for the corporate consumers (ß = .579, p< .001) (Table 4.8). The results provided a support of hypothesis H1f: Empathy has impacts on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

Table 4.9 the regression of Empathy and satisfaction Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) .898 .213 4.209 .000 assurance .682 .067 .579 10.172 .000 R2/Adjusted R2 .335/332 F/Sig. 103.474/0.00

a. Dependent Variable: satisfaction

H1g: Service quality has impact on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

The results of the regression analysis indicated the Service quality and satisfaction for the corporate consumers together explained 73.5 percent of the variance (Adj R2 = .735, F (1, 205) = 573.309, p< .001). The data revealed that Service quality strong significantly predicted overall satisfaction for the corporate consumers (ß = .858, p< .001) (Table 4.8). The results provided a support of hypothesis H1g: Service quality has impact on the satisfaction for the corporate consumers of VietinBank, Hanoi Branch.

Table 4.10 the regression of Service quality and satisfaction Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) -1.337 .184 -7.257 .000 serqual 1.347 .056 .858 23.944 .000 R2/Adjusted R2 .737/735 F/Sig. 573.309/0.00

a. Dependent Variable: satisfaction

4.4 ANOVA result

For answer the research question 2: Is there any difference between behavior(time with bank & nubers of traction) and satisfaction for corporate customers at VietinBank, Hanoi Branch? the ANOVA method is taken.

H2a: There is a difference between time with bank and satisfaction for corporate customers at VietinBank, Hanoi Branch.

An alpha of .05 was used for each analysis for each one-way ANOVA. Tukey’s HSD procedure was used to conduct pairwise comparisons following the ANOVA tests ( Table 4.11). The time with bank includes: < 1 Y, 1-3Y, 3-5Y and >5 years. The result indicated that

(F(3, 203) = .394, p=.757 >0.05 ). Since Vietinbank in the recently have good customers care policies, So the satisfaction level of customers is always higher day by day, so the result indicates that there are no significant different level of satisfaction in VietinBank.

Table 4.11 difference between time with bank and satisfaction

ANOVA

satisfaction

Sum of Squares df Mean Square F Sig.

Between Groups 1.048 3 .349 .394 .757

Within Groups 179.730 203 .885

Total 180.777 206

H2b: There is a difference between numbers of transactions and satisfaction for corporate customers at VietinBank, Hanoi Branch.

An alpha of .05 was used for each analysis for each one-way ANOVA. Tukey’s HSD procedure was used to conduct pairwise comparisons following the ANOVA tests ( Table 4.12). Numbers of transactions includes: <1 Bank, 1-2Banks, 3-5Banks, More than 5 Banks. The result indicated that people of different Numbers of transactions have different level of satisfaction in VietinBank. ((3, 203) = 26.000, P.=0.00).

The table 4.12 shows that the customer who have transactions with 3-5 or more than 5 banks have more satisfaction level ( M=3.0174 for 3-5Banks and M = 3.5024) than others ( 1-2 banks).It can be conclude that H2b is supported with statement that there is a difference between numbers of transactions and satisfaction for corporate customers at VietinBank, Hanoi Branch.

Table 4.12 difference between numbers of transactions and satisfaction

ANOVA

satisfaction

Sum of Squares df Mean Square F Sig.

Between Groups 50.181 3 16.727 26.000 .000

Within Groups 130.597 203 .643

Total 180.777 206

Table 4.13Post hoc test difference between numbers of transactions and satisfaction

Satisfaction

Tukey HSD

Number N Subset for alpha = 0.05

1 2

1 Bank 11 1.7879

1-2Banks 31 2.2688

3-5Banks 96 3.0174

More than 5 Banks 69 3.5024

Sig. .126 .121

Means for groups in homogeneous subsets are displayed.

a. Uses Harmonic Mean Sample Size = 27.013.

b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed.

CHAPTER VCONCLUSION

5.1. Summary of the research

VietinBank, Hanoi branch works in Hanoi, the cultural – economic – political centre of the country, where there are many big businesses, financial organizations. This brings many opportunities for VietinBank, Hanoi branch to develop; however, it also has to face many challenges. The branch has only operated for 20 years, however, it has made impressive contributions to the development of Vietinbank, the economy of Hanoi and of the country. Such achievements have been accomplished thanks to the branch’s efforts such as, promoting capital mobilization, introducing appropriate credit policies to ensure customers’ satisfaction.

In this study on “Service quality and satisfaction for corporate consumers: the case of

Vietinbank”, the researcher collected data, prsented descriptive statistics and conducted

reliability analysis, regression analysis and ANOVA. It should be noted that customers’ satisfaction was impated by 6 quality service factors (Staff conduct, Trust, Convenience, Price competitiveness, Assurance, Empathy) and service quality as overal. ANOVA result show that there is a difference between numbers of transactions and satisfaction for corporate customers at VietinBank, Hanoi Branch.

Therefore, making customers satisfied should be considered a frequent and long-term task. As the business environment always changes, research results should be applied flexibly and appropriately. Finally, the results from this research can be used to build development orientaation for the bank. These results allow the bank to understand more customers’ demands for credit service, their evaluation of the service quality. Using such data, the bank can improve the service quality and improve customers’ satisfaction, contributing to the development of VietinBank in the financial market.

5.2 Recommendations

It is very important for the bank to compete and retain corporate customers, as well as develop new customers who have good financial capability and feasible business plans/projects. The bank needs to have various forms of capital mobilzation, especially from

savings of the public, and have implement effective marketing strategies to achieve its objectives. The bank needs to make the transactions convenient but effective for customers.

Solutions for convenience factor:

1:Improve technology infrastrucutre:The bank provide convenient services to customers but also need to ensure security, towards a modern banking system. The development of technology infrastructure depends largely on the whole system, however, the applicaton of technology in transactions such as sending and receiving documents, online application can make the transactions more convenient for customers, contributing to customers’ satisfaction. as the result of research question 1

2: Implement current services, providing customers with sufficient information through a team of competent and knowledgeable staff as the result of research question 1

2. Result of research question 1 sugesst that guarantee commitments made with customers, in time and quality. Monitor closely transactions to know customers’ evaluation; evaluate staff basing on their mistakes in transactions. Avoid mistakes in transactions by having a transaction officer to re-check.

3. The Result of research question 1 sugesst that Vietin Bank should improve price competitiveness and at the same time achieve business results.

4. Reduce operation cost but still maintain good operation; Encourage staff to be economical

Carry out support programs of the state to bring to customers low-fee sources of capital.Compare the price with competitors to adjust the price to suit the market

5. As the Result of research question 2, segment the market, identify target group of customers and develop some suitable promotion programs.Organize annual customers’ conference to identify customers’ needs to design programs that meet their needs.

5.3 Thesis contribution

Scientific value: The thesis systematizes literature about commerical corporates and the improvement of corporate customers’ satisfaction of commercial banks.

Application: The thesis analyzes and evaluates the influences of credit services on improving corporate customers’ satisfaction of commercial banks at VietinBank, Hanoi branch. On the basis of that, it gave some suggestions for the future directions and specific solutions to increase corporate customers’ satisfactions for VietinBank, Hanoi Branch.

5.4 Limitation of the research

The research still have some limitations as follows: The survey was conducted with closed questionnaires with 180 companies, therefore, the results do not represent all businesses that use credit service at Vietinbank, Hanoi branch. . As the scope of the research is still limited, the research cannot provide every information.

The time of the research is still limited; the level and skills of the research are still limited, the research is not invested, therefore, it is not very objective.

From these limitations, it can be concluded that to have accurate and specific figures about the satisfacition of business customers, the bank needs to have more appropriate strategies and policies; they need to conduct researches and surveys with a broader scope to generalize customers’ satisfaction with credit service at commerical banks.

REFERENCES

Avkiran, N. K. (2002). Credibility and staff conduct make or break bank customer

service quality. Journal of Asia-Pacific Business, 3(3), 73-91.

Barney, J. (1991). Firm resources and sustained competitive advantage.Journal of

management, 17(1), 99-120.

Boyer, K. K., & Hult, G. T. M. (2005). Extending the supply chain: integrating

operations and marketing in the online grocery industry. Journal of Operations

Management, 23(6), 642-661.

Carmel, S. (1985). Satisfaction with hospitalization: a comparative analysis of three

types of services. Social science & medicine, 21(11), 1243-1249.

Caruana, A., Money, A. H., & Berthon, P. R. (2000). Service quality and

satisfaction-the moderating role of value. European Journal of marketing,34(11/12), 1338-1353.

Clow, K. E., & Vorhies, D. W. (1993). Building a competitive advantage for service

firms: measurement of consumer expectations of service quality.Journal of services

marketing, 7(1), 22-32.

Cronin Jr, J. J., & Taylor, S. A. (1992). Measuring service quality: a reexamination

and extension. The journal of marketing, 55-68.

Deming, W. E., & Medina, J. N. (1989). Calidad, productividad y competitividad: la

salida de la crisis. Ediciones Díaz de Santos.

Duc, V. H., & Thien, N. D. (2013). A new approach to determining credit rating & Its

applications to Vietnam’s listed firms.

Fornell, C., Rust, R. T., & Dekimpe, M. G. (2010). The effect of customer satisfaction on

consumer spending growth. Journal of Marketing Research,47(1), 28-35.

Giàu, N. V. (2013). ON IMPLEMENTATION OF THE MONETARY POLICY IN

2009 AND DIRECTION FOR DEVELOPMENT OF THE BANKING SYSTEM

AND FINANCE MARKET IN 2010. Journal of Economic Development, (185), 5-8.

Grönroos, C. (1982). An applied service marketing theory. European journal of

marketing, 16(7), 30-41.

Hoyer, W. M. (2001). D. 2001, Consumer Behavior.

Kerr, E. A., Krein, S. L., Vijan, S., Hofer, T. P., & Hayward, R. A. (2001). Avoiding

pitfalls in chronic disease quality measurement: a case for the next generation of

technical quality measures. The American journal of managed care, 7(11), 1033-1043.

Kotler, P. (2000). Marketing para o século XXI: como criar, conquistar e dominar

mercados. Futura.

Lehtinen, U., & Lehtinen, J. R. (1982). Service quality: a study of quality dimensions.

Service Management Institute.

Leisen, B., & Vance, C. (2001). Cross-national assessment of service quality in the

telecommunication industry: evidence from the USA and Germany.Managing Service

Quality: An International Journal, 11(5), 307-317.

Leung, S. (2009). Banking and financial sector reforms in Vietnam. ASEAN Economic

Bulletin, 26(1), 44-57.

Lewis, R. C., & Booms, B. H. (1983). The marketing aspects of service

quality.Emerging perspectives on services marketing, 65(4), 99-107.

Nunnally, J. C., Bernstein, I. H., & Berge, J. M. T. (1967). Psychometric theory(Vol.

226). New York: McGraw-Hill.

Parasuraman, A., Berry, L. L., & Zeithaml, V. A. (1991). Refinement and

reassessment of the SERVQUAL scale. Journal of retailing, 67(4), 420.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1985). A conceptual model of service

quality and its implications for future research. the Journal of Marketing, 41-50.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1988). Servqual. Journal of

retailing, 64(1), 12-40.

Peeler, D. H., Bolam, K. M., Borgen, J. A., & Ribando, P. P. (1996). U.S. Patent No.

5,575,762. Washington, DC: U.S. Patent and Trademark Office.

Sasser, W. E., Olsen, R. P., & Wyckoff, D. D. (1978). Management of service

operations: Text, cases, and readings. Allyn & Bacon.

Stauss, B., & Neuhaus, P. (1997). The qualitative satisfaction model.International

Journal of Service Industry Management, 8(3), 236-249.

Thang, L. C., & Quang, T. (2005). Human resource management practices in a

transitional economy: a comparative study of enterprise ownership forms in

Vietnam. Asia Pacific business review, 11(1), 25-47.

Vargo, S. L., & Lusch, R. F. (2004). The four service marketing myths remnants of a

goods-based, manufacturing model. Journal of service research,6(4), 324-335.

Vu, H. T., & Turnell, S. (2010). Cost efficiency of the banking sector in Vietnam: A

Bayesian stochastic frontier approach with regularity constraints.Asian economic

journal, 24(2), 115-139.

Watson, G. (2004). The legacy of Ishikawa. Quality progress, 37(4), 54.

Zeithaml, V. A. (2000). Service quality, profitability, and the economic worth of

customers: what we know and what we need to learn. Journal of the academy of

marketing science, 28(1), 67-85.

Zeithaml, V. A., Bitner, M. J., & Gremler, D. D. (2006). Services marketing:

Integrating customer focus across the firm.

Appendix Questionnaire

I am a Vietnamese graduate student of International Master of Business of

Administration program, I-Shou University, Taiwan. My master thesis is about

“Service Quality and Satisfaction for Corporate Consumer: The Case Study of

Vietinbank.” Please take about 10 to 15 minutes to answer all of the questions in my

survey. The answers will only be used for academic purposes and will be strictly

confidential. Thank you in advance for your time and help.

Part I. Consumer behavior information

Question 1: Time with the bank?

Less than1 year

1-3 year

3-5 year

More than 5 years

Question 2: Number of banks that customers do transaction with?

1 bank

1-2 banks

3-5 banks

Part II Service quality and satisfaction

Please tick the answer for you agreement from 1

-

Totally disagree to 5 - Totally agreeTrust

1 Services meet customers’ demand.

1 2 3 4 5

2 Service is provided quickly.

1 2 3 4 5

3 The service is provided without any fault or error

1 2 3 4 5

4 The staff consults suitable service with customers’ purposes.

1 2 3 4 5

5 The bank provides data accurately and quickly.

Staff conduct

6 The staff is willing to help customers.

1 2 3 4 5

7 Staff lets you know when service will be done

1 2 3 4 5

8 Service is provided quickly.

1 2 3 4 5

9 Staff is friendly with customers

1 2 3 4 5

10 The bank always tries to solve customers’ difficulties

Tangibles

11 The bank has adequate facilities and all necessary services

1 2 3 4 5

12 The bank has modern equipment and machinery

1 2 3 4 5

13 The staff is knowledgeable and can solve problems quickly.

1 2 3 4 5

14 Staff dresses professionally.

1 2 3 4 5

15 Transaction counters are arranged scientifically, conveniently.

1 2 3 4 5

Convenience

17

Simple transaction procedures and all necessary services are provided

1 2 3 4 5

18 Convenient business location

Price competitiveness

19 The bank has competitive interest rate

1 2 3 4 5

20 Transaction fees are reasonable

1 2 3 4 5

21 The bank has flexible interest rate policy

1 2 3 4 5

Assurance

22 Staff is polite to the customers.

1 2 3 4 5

23 Customers feel secure when doing transactions with the bank

1 2 3 4 5

24 The staff always provides customers with necessary information.

1 2 3 4 5

25 The staff answers accurately and clearly all queries

Empathy

26 Staff pays individual attention to customers

1 2 3 4 5

27 Staff understands customers’ demands

1 2 3 4 5

28 Staff pays special attention to customers

1 2 3 4 5

29 Staff solves problems quickly.

1 2 3 4 5

Satisfaction

30 The bank meets customers’ demands.

1 2 3 4 5

31

I am satisfied with the bank’s services

1 2 3 4 5

32 I will continue to use services of the bank.