Full Length Research Paper

The influences of relationship marketing strategy and transaction cost on customer satisfaction, perceived

risk, and customer loyalty

Cheng-Feng Cheng* and Ai-Hsuan Lee

Department of International Business, Asia University, Taiwan

Accepted 25 January, 2011

This study attempts to develop the conceptual model for explaining consumers’ preference toward retailers based on the relationship marketing strategy and transaction cost theory. Specifically, this study investigates the impacts of relationship marketing and transaction cost on customer satisfaction and perceived risk. In addition, the influences of customer satisfaction and perceived risk on customer loyalty deserve further consideration. To assess the applicability of this conceptual model, this study confined the research scope to shopping malls. The results show that relationship marketing significantly has positive effect on customer satisfaction and negative effect on perceived risk. As to influence of transaction cost, it significantly has negative effect on customer satisfaction and positive effect on perceived risk. Furthermore, both relationship marketing and transaction cost could influence customer loyalty through customer satisfaction or customer’s perceived risk.

Key words: Relationship marketing strategy, transaction cost, customer satisfaction, perceived risk, customer loyalty.

INTRODUCTION

Business strategies can play a critical role in consumer’s preference or choice of sales channel (Muthitachaoen, Gillenson, and Suwan, 2006). Thus, it is important for sales channels to become aware of the consequences of strategies as they face an increasingly challenging marketing environment (Pappu and Quester, 2006). Luo and Donthu (2007) indicated that exchange relationships as to buyers and sellers involved some levels of social interdependence and economic. Accordingly, exchange relationships can be explained based on social exchange theory and transaction cost theory (Kanagal, 2009).

Specifically, consumers may rely on relationship with sellers and cost of shopping to make choices of sales channels (Muthitachaoen et al., 2006). In this regard, this

*Corresponding author. Email: cheng-cf@asia.edu.tw or cheng.cf@msa.hinet.net. Tel: +886-4-23323456 ext.20048. Fax:

+886-4-23321190.

study attempts to explore the roles of strategies in rela- tion to customers’ relationships and costs (i.e., strategies of relationship marketing and transaction cost) acting on their behaviors.

The concept of relationship marketing receives increa- sing attention from academics and practitioners (Ndubisi, 2007) and has played a lead role in the marketing subject (Andersen, 2002). Relationship marketing strategy is one weapon for many firms to survive in the highly competitive marketplace (Adjei, Griffith, and Noble, 2009;

Armstrong and Kotler, 2009). It is deemed as the key functionality in enhancing business performance (Kanagal, 2009). Muthitachaoen et al. (2006) indicated that a superior sales channel possesses an ability to pro- vide its customers with interactive communications and a supportive sales environment. The sales channel can obtain quality sources of marketing intelligence for better planning of marketing strategies by virtue of building relationships with customers (Ndubisi, 2007).

Additionally, transaction cost theory is a framework be

longing to the New Institutional Economics paradigm (Jonees and Leonard, 2007). It can explain why a consumer favors a particular form of transaction (Teo and Yu, 2005). The role of transaction cost acting on the choice of sales channel can be described in two ways.

First, transaction costs are incurred throughout the whole purchasing decision process (Jeon and Kim, 2008).

These costs include the access to imperfect and costly information, search activities, expenditures to overcome location boundaries to transact with sellers, transaction fees, time, and other psychological costs (Jeon and Kim, 2008; Rabinovich, Bailey, and Carter, 2003). Transaction cost theory posited that consumers would prefer con- ducting transactions in the most economic way (Teo and Yu, 2005).

Second, transaction cost theory suggested that econo- mic agents tended to develop safeguard mechanisms to lessen the information asymmetry problem occurred in the inefficient market (Williamson, 1991). Specifically, since consumers are worse able to evaluate products than agents who participant in the added value chain (such as retailers, distributors, producers), they may use the brand of sales channel as a signal of unobservable product quality (Fernández-Barcala and González-Díaz, 2006). As a result, transaction cost plays an important role in customers’ choice of sales channel based on these two rationales. Rao, Goldsby, and Iyengar (2008) concluded that transaction cost theory could help explain consumer choice of sales channel.

In order to identify the roles of relationship marketing and transaction cost acting on the customer’s choice of sales channel, this study explores their influences on common outcome variables of consumer behavior inclu- ding customer satisfaction, perceived risk, and customer loyalty. Customer satisfaction and perceived risk repre- sent the positive and negative evaluations of purchasing decisions, whereas customer loyalty represents the goal which the firm endeavors to pursue. Pappu and Quester (2006) admitted the importance of customer satisfaction and stated that retail sector particularly spent consi- derably measuring customer satisfaction. Teo and Yeong (2003) supported the powerful effect of perceived risk during consumer decision-making process. Some studies examined the impact of relationship marketing or transac- tion cost on customer loyalty (e.g., Adjei et al., 2009;

McDowell and Voelker, 2008; Williamson, 2008; Warner and Hefetz, 2008). In virtue of the importance of these three outcome variables of consumer behavior, this study attempts to develop an integrated research model and discuss the influential effects of relationship marketing and transaction cost on customer satisfaction and perceived risk, as well as their impacts on the customer loyalty.

For empirically investigating the validity of the research model, this study confines the research scope to the con- text of shopping malls or department stores. It is necessary to specify the type of sales channel in that the inter- relationships involved in the research model may varies

with the type of sales channel. For example, Pappu and Quester (2006) found that the relationship between customer loyalty and customer satisfaction was different between department stores and specialty stores. The advantage of choosing shopping malls as a research ob- ject lies in variety of product categories. Thus, the effect of product categories can be eliminated from this study.

This study attempts to make some contributions in aca- demic and practical purposes. First, this study focused on the roles of relationship marketing and transaction cost from the customer’s perspective. Many studies discussed these issues in the business-to-business context (e.g., Andersen, 2002; Anvari and Amin, 2010; Kim, 2007;

McDowell and Voelker, 2008; Williamson, 2008). We not only switch the focus to business-to-consumer context, but also reify the concepts of relationship marketing and transaction cost. Specifically, these two concepts are quantified and become practical strategies which the firms can adopt. Second, transaction cost theory is often applied to explain the motivation of online shopping (e.g., Jeon and Kim, 2008; Jonees and Leonard, 2007;

Muthitachaoen et al., 2006). However, transaction cost as to brick-and- mortar channels becomes larger than online channels and cannot be ignored. Third, Hedhli and Chebat (2009) stated that mall managers endeavored to develop strategies in order to procure a sustainable competitive advantage over different competitive retail formats. Our findings may offer some suggests to mall managers in pursuit of their goals.

To accomplish these objectives, the remainder of this study is structured as follows. First, it begins by conduc- ting literature reviews relevant to relationship marketing, transaction cost, customer satisfaction, and the perceived risk on the customer loyalty to develop the major hypotheses and conceptual framework. In addition, we describe the methodology of empirical analysis and give our results. Finally, the conclusions and implications of this study are discussed.

THEORETICAL CONSIDERATIONS AND

HYPOTHESES

Relationship marketing is defined as a strategy to attract, identify, establish, maintain, and enhance customer relationships to create value for customers by virtue of marketing activities and a series of relational exchanges that have both a history and a future (Andersen, 2002;

Kanagal, 2009; Ndubisi, 2007). Accordingly, relationship marketing here is used to describe the quality of relation- ship between the shopping mall and its customers.

Armstrong and Kotler (2009) considered relationship mar- keting as a kind of index for customer satisfaction, and they believed that the maintenance of excellent relationship marketing between the enterprise and customers would be beneficial in increasing customer satisfaction. Cus- tomer satisfaction here refers to customer’s retrospective and cumulative evaluations of satisfaction with a shopping

shopping mall (Johnson, Sivadas, and Garbarino, 2008;

Pappu and Quester, 2006). Scholars of this realm com- monly believed that letting customers maintain a pleasant mood throughout the shopping period is also a very important link. Its main effect was about being able to continue the effective public rating and satisfaction level (e.g., Armstrong and Kotler, 2009; Kotler and Lane, 2009;

Naeem and Saif, 2010). The final value of relationship marketing usually is to effectively strengthen or increase the long term customer satisfaction and customer loyalty, as well as continuing to supply high satisfaction level to customers (Adjei et al., 2009; Armstrong and Kotler, 2009). In the context of customer satisfaction, Casalό et al. (2008) believed that the affection realm of customer satisfaction mainly included the economic aspect and non-economic aspect. Bodet (2008) measured customer satisfaction by the satisfaction of specific trade and the overall satisfaction.

In addition to enhancing the levels of customer satisfaction, this study argues that relationship marketing is capable of reducing the levels of perceived risk.

Perceived risk denotes that the customer have a subjective expectation of negative consequences and a feeling of psychological uncertainty regarding the ser- vices or purchasing process provided by a shopping mall (Johnson et al., 2008; Yen, 2010). Wilson (1995) believed that relationship marketing was performed based on trust relationship which is characterized by low levels of perceived risk. Kotler and Lane (2009) further suggested that the core of relationship marketing was trust and commitment. When the levels of trust and commitment are lower than the risk, the perceived risk will increase.

Sheth and Parvatiyal (1995) explored the antecedents of relationship marketing, and believed that the relationship marketing strategies could possibly help to intensify the customers’ understanding and trust toward the enter- prise, and thus, it could possibly ease off the perceived risk felt by the customers.

Furthermore, Kotler and Keller (2009) indicated that relationship marketing was mainly to match the customers’ needs and the service promise, so that the customer loyalty would increase. Customer loyalty is defined as the feeling of attachment to, affection, or the tendency to be loyal to a shopping mall, which can be demonstrated by the intention to purchase from the mall as a primary choice (Pappu and Quester, 2006; Yen, 2010). It is deemed as the central concept as speaking of relationship marketing (Johnson et al., 2008). Andersen (2002) argued that the purpose of relationship marketing strategy was to create customer’s commitment. Likewise, Anvari and Amin (2010) proposed that relationship marketing could foster customer loyalty. Ndubisi (2007) offered empirical evidence and found that the components of relationship marketing could affect the customer loyalty in Malaysia. Based on these regards, we develop the following hypotheses.

H1a: Relationship marketing is positively related to the

customer satisfaction.

H1b: Relationship marketing reduces the customers’

perceived risk.

H1c: Relationship marketing is positively related to the customer loyalty.

Transaction cost theory posited the features of transaction, including asset specific, uncertainty, frequen- cy, and search (Fernández-Barcala and González-Díaz, 2006; Teo and Yu, 2005). Specifically, a transaction can be described as specific or non-specific asset involved, rare or frequent, low or high uncertainty, and easy or difficult to search (Teo and Yu, 2005). These features of a transaction incur transaction costs comprising co- ordination, search, and monitoring costs (Kim, 2007; Teo and Yu, 2005). The coordination cost is defined as the cost or effort in relation to all the information processing necessary to coordinate the transaction that perform in a way the customer wants (Luo and Donthu, 2007). Search cost involves the expenses incurred in determining where the required products or services are available (Rao et al., 2008). Monitoring cost describes the time and effort used to ensure that the terms of the transaction are met customer’s needs and wants (Teo and Yu, 2005).

The commonness for relationship marketing and tran- saction cost lies in the exchanged relationship between both exchanged parties. One of features of transaction proposed by transaction cost theory is the asset specific, which refers to investments that are specific to a focal relationship with counterpart and impose switching costs (Athaide, Stump, and Joshi, 2003; Jonees and Leonard, 2007). The asset specific is akin to the nature of relationship marketing. Thus, it is assumed that there is association between relationship marketing and transaction cost. The rationale behind this argument consists in the quality of relationship resulting from mall’s relationship marketing strategy. Trust and communication are the underpinnings of relationship marketing (Ndubisi, 2007). In other words, relationship marketing strategy can create trust relationship and open communication. By virtue of trust relationship, both parties can exchange voice in an openness way (Rampersad, Quester, and Troshani, 2010). Therefore, the problem of information asymmetry occurred in the transaction can be overcame.

In this case, the good relationship can decrease the probability of opportunism and thus the costs of transactions (Teo and Yu, 2005). Thus, the relationship marketing can reduce customer’s transaction cost in the context of shopping mall.

H1d: Relationship marketing reduces the transaction cost.

Transaction cost includes coordination, search, and monitoring costs (Kim, 2007; Teo and Yu, 2005). These costs occurred in the shopping process may influence customer’s evaluation (Oliva, Oliver, and MacMillan, 1992). Specifically, when customers spend less efforts

and time to shop and purchase, they will feel more satis- fied. Likewise, Su, Comer, Leethe (2008) found that the perceived costs and benefits of the information search process and the decision-making process would affect the degree of satisfaction. The argument that the lower transaction cost leads to higher customer satisfaction is recognized in both business and customer contexts (Bharadwaj and Matsuno, 2006; Jonees and Leonard, 2007; Kim and Li, 2009).

Williamson (2008) believed that the amount of transaction cost depended on the trading complicacy, meaning the more complicated the trading process, the more the transaction cost. Transaction cost involves the existence of imperfect and costly information available to customers (Rabinovich et al., 2003). The information asymmetry increases the probability of opportunism (Fernández-Barcala and González-Díaz, 2006). Accor- dingly, when customers feel there are too many uncertain factors or results unfavorable to the customer, they perceive high risk (Kotler and Lane, 2009).

When an enterprise faced a complicated market and environment, the transaction cost would be the main factor that should be considered (McDowell and Voelker, 2008). When the customers have less trust on the name brand, the enterprise and the product provider, there is a possibility to influence the purchase willingness, customer satisfaction, or loyalty due to the transaction cost (Dick and Basu, 1994). The relationship between the transaction cost and customer loyalty in other service contexts rather than shopping malls was recognized by previous studies. Oliva et al. (1992) proposed that inter- play of transaction cost and the level of satisfaction could lead to brand loyalty or to brand avoidance in the service industries. Lee and Cunningham (2001) argued that the transaction cost and switching cost were the critical determinants of service loyalty in the context of banks and travel agencies. Kim and Li (2009) found the transac- tion cost negatively affected the customer loyalty as purchasing travel products over the Internet. However, Shen and Chiou (2009) found that the asset specific investment, which was the component of the transaction cost theory and constituted the switching cost, could positively influence the user’s intention to stay with the blogging community. Although customer loyalty can be enhanced by decreasing customer costs within service industries, this relationship is embedded within and in- fluenced by the organizational context (Colwell, Hogarth- Scott, Jiang, and Joshi, 2009). Thus, it is necessary to investigate this relationship in the context of shopping malls. According to the aforementioned viewpoints, we propose the following hypotheses.

H2a: Transaction cost reduces the customer satisfaction.

H2b: Transaction cost increases customers’ perceived risk.

H2c: Transaction cost reduces the customer loyalty.

Researchers in the fields of satisfaction have focused on

the antecedents and consequences of satisfaction from the perspectives of customers or employees (e.g., Armstrong and Kotler, 2009; Hoq and Amin, 2010; Jones and Sloane, 2009; Liu and Yen, 2010; Martínez-Ruiz et al., 2010; Naeem and Saif, 2010). As to the consequen- ces of satisfaction, research has focused on loyalty, retention, or performance. Customer satisfaction is a generally acknowledged important premise of customer loyalty (Hoq and Amin, 2010; Kotler and Lane, 2009).

Armstrong and Kotler (2009) believed that the customer satisfaction and loyalty are very practical interactions, and the satisfaction level has a positive influence on the loyalty level. Oliver (1999) proposed that satisfaction level could be developed and turned into loyalty. Bodet (2008) engaged in measuring the transaction and overall satisfaction and indirectly observed that satisfaction level would increase the customer’s loyalty level.

In addition, numerous studies have found a significant impact of customer’s perceived risk on customer evaluation, decision making, or loyalty (e.g., Alfnes et al., 2008; Armstrong and Kotler, 2009; Liu and Yen, 2010;

Mayer et al., 1995). Hence, perceived risk can predict the levels of customer loyalty and satisfaction. While satis- faction plays the role of approach mechanisms toward a product purchasing, the perceived risk functions as an avoidance mechanism (Cowart, Fox, and Wilson, 2008).

Accordingly, perceived risk may result in a lower level of customer loyalty (Chaudhuri, 1997; Yen, 2010) in that it prevent customer from repeating purchasing behavior.

Alfnes et al. (2008) purposed that risk preferences were important for consumers’ choices and consumers’

willingness to pay for products. While previous studies found that perceived risk was the antecedent to online shopper’s satisfaction (Balasubramanian, Konana, and Menon, 2003; Udo, Bagchi, and Kirs, 2010), others found that the mixed results in relation to the association between perceived risk and satisfaction in other context (Cockrill, Goode, and Beetles, 2009; Quintal and Polczynski, 2010). This study reexamines this association and argues there is a negative influence of perceived risk on consumer satisfaction, in that high perceived risk denotes adverse perception. Based on these regards, we develop the following hypotheses.

H3: Customer satisfaction is positively related to the customer loyalty.

METHODOLOGY

The objective of this study is to explore the influences of relationship marketing and transaction cost on consumer satisfaction, perceived risk, and thus consumer loyalty in terms of the context of shopping mall. To examine these interrelationships of research model empirically, this study employed an Internet-based questionnaires survey and collected primary data via e-mail invitations. The sampling method involved convenient sampling and snowball sampling. We sent acquaintances the e-mail invitations to ask them to respond questionnaire and further forward the e-mail invitations to their acquaintances. The qualified participants were

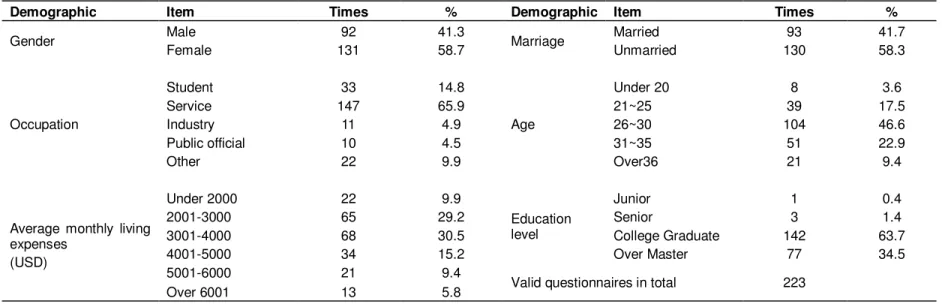

Table 1. Sample profile.

Demographic Item Times % Demographic Item Times %

Gender Male 92 41.3

Marriage Married 93 41.7

Female 131 58.7 Unmarried 130 58.3

Occupation

Student 33 14.8

Age

Under 20 8 3.6

Service 147 65.9 21~25 39 17.5

Industry 11 4.9 26~30 104 46.6

Public official 10 4.5 31~35 51 22.9

Other 22 9.9 Over36 21 9.4

Average monthly living expenses

(USD)

Under 2000 22 9.9

Education level

Junior 1 0.4

2001-3000 65 29.2 Senior 3 1.4

3001-4000 68 30.5 College Graduate 142 63.7

4001-5000 34 15.2 Over Master 77 34.5

5001-6000 21 9.4

Valid questionnaires in total 223

Over 6001 13 5.8

customers of shopping malls. The participants were asked to respond questionnaire items based on latest experiences of shopping in malls or department stores. In other words, the evaluative objects for participants were the malls or departments in which they shopped recently.

There were 258 questionnaires returned in total, while deducting 35 invalid ones in which there were questions not being answered or answers repeated, or being taken out due to the reverse item principle. Finally, a total of 223 valid questionnaires were analyzed. Table 1 shows the sample characteristics, in which most of the respondents are women (58.7%), singles (58.3 %), 26-35 year olds (69.5%), those with a college education (63.7%), service (65.9%), those with monthly living expenses between US$

2,001 and US$ 4,000 (59.7%).

The measurements related to research constructs were developed based on previous studies. The items were selected and filtered according to the definitions of constructs. We also invited two experts to participate in the process of selecting appropriate items. As to relationship marketing, this study developed 15 items to measure trust, commitment, communication, and conflict management which are the major dimensions of relationship marketing

based on Ndubisi (2007). Regarding the assessment of transaction cost, this study developed 13 items based on Teo and Yu (2005) and Kim (2007) to measure coordination cost, search cost, and monitoring cost.

According to Laroche et al. (2004) and Suki and Suki (2007), 13 items were developed to measure financial risk, performance risk, privacy risk, psychological risk, and time risk in terms of the perceived risk. Furthermore, 12 items were adopted from Bodet (2008), Casalό et al.

(2008), and Russell-Bennett et al. (2007) to measure customer satisfaction and customer loyalty. All of the items were measured on seven-point Likert scales.

RESULTS

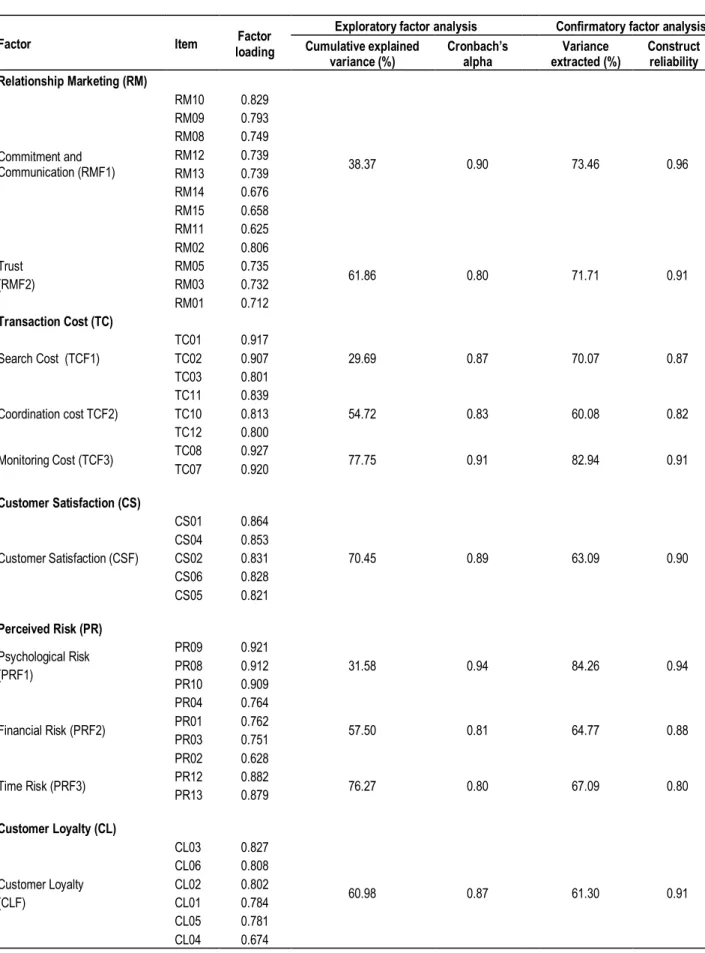

This study develops a theoretical model to explore the roles of relationship marketing and transaction cost. In order to examine identify the construct validity and reliability, this study performed exploratory (EFA) and confirmatory factor analysis (CFA). In terms of result of EFA,

according to the criteria as suggested by Hair et al.(2010), the KMO values of research variables which reached more than 0.815 conformed to the verification of factor analysis. The reliability and validity for the constructs are shown in Table 2. The reliability of the measurement items were verified by Cronbach’s alpha coefficients. The alpha values for all research constructs were greater than 0.8. Following Hair et al. (2010), these high alpha values suggested that the research constructs constructs all have high internal consistency among the research items.

Furthermore, the validity of the construct was measured by the explained variance of each factor. The cumulative percentage of total variance extracted by factors all followed the requirements suggested by Hair et al. (2010), indicating that the reliabilities and validities of these constructs are acceptable.

In terms of CFA, overall fit indexes indicate

Table 2. Results of factor analysis.

Factor Item Factor

loading

Exploratory factor analysis Confirmatory factor analysis Cumulative explained

variance (%)

Cronbach’s alpha

Variance extracted (%)

Construct reliability Relationship Marketing (RM)

Commitment and Communication (RMF1)

RM10 0.829

38.37 0.90 73.46 0.96

RM09 0.793 RM08 0.749 RM12 0.739 RM13 0.739 RM14 0.676 RM15 0.658 RM11 0.625

Trust (RMF2)

RM02 0.806

61.86 0.80 71.71 0.91

RM05 0.735 RM03 0.732 RM01 0.712 Transaction Cost (TC)

Search Cost (TCF1)

TC01 0.917

29.69 0.87 70.07 0.87

TC02 0.907 TC03 0.801

Coordination cost TCF2)

TC11 0.839

54.72 0.83 60.08 0.82

TC10 0.813 TC12 0.800 Monitoring Cost (TCF3) TC08 0.927

77.75 0.91 82.94 0.91

TC07 0.920 Customer Satisfaction (CS)

Customer Satisfaction (CSF)

CS01 0.864

70.45 0.89 63.09 0.90

CS04 0.853 CS02 0.831 CS06 0.828 CS05 0.821 Perceived Risk (PR)

Psychological Risk (PRF1)

PR09 0.921

31.58 0.94 84.26 0.94

PR08 0.912 PR10 0.909

Financial Risk (PRF2)

PR04 0.764

57.50 0.81 64.77 0.88

PR01 0.762 PR03 0.751 PR02 0.628

Time Risk (PRF3) PR12 0.882

76.27 0.80 67.09 0.80

PR13 0.879 Customer Loyalty (CL)

Customer Loyalty (CLF)

CL03 0.827

60.98 0.87 61.30 0.91

CL06 0.808 CL02 0.802 CL01 0.784 CL05 0.781 CL04 0.674

Table 3. Correlation among research constructs.

Construct 1 2 3 4 5

1 Relationship marketing 1.00 0.13 0.54 0.02 0.02

2 Transaction cost -0.36 1.00 0.28 0.14 0.02

3 Customer satisfaction 0.73 -0.53 1.00 0.01 0.57

4 Perceived risk -0.15 0.38 -0.12 1.00 0.01

5 Customer loyalty 0.15 -0.14 0.76 -0.12 1.00

Table 4. Results of path analysis.

Relation Std. Coefficient C.R.

Path Analysis

H1a Relationship marketing → Customer satisfaction 0.791*** 7.971 H1b Relationship marketing → Perceived risk -0.191** -2.024 H1c Relationship marketing → Customer loyalty 0.080 0.343 H1d Relationship marketing → Transaction costs -0.146* -1.837 H2a Transaction costs → Customer satisfaction -0.158** -2.219

H2b Transaction costs → Perceived risk 0.292*** 3.112

H2c Transaction costs → Customer loyalty -0.036 -0.399

H3 Customer satisfaction →Customer loyalty 0.156*** 6.999

H4 Perceived risk → Customer loyalty -0.143** -1.965

H5 Perceived risk → Customer satisfaction -0.116* -1.695

Model Fits

GFI 0.927

AGFI 0.910

NFI 0.917

RMSEA 0.044

Chi-square 226.551

Degree of freedom 128

CMIN/DF 1.770

* represents P < 0.1, ** represents P < 0.05, *** represents P < 0.01.

with the data, that the research model is reasonably consistent with all the fit indexes close to or better than the recommended values (chi-square = 1151.07, p < .05, df = 722, chi-square/df = 2.09, GFI = 0.86, AGFI = 0.83, NFI = 0.86, and RMSEA = 0.06). Table 2 provides the results of variance extracted by CFA and construct reliability and shows that each value is higher than 50.00% and 0.70, indicating acceptable convergent validity and reliability for each factor. According to Hair et al., (2010), the value of variance extracted of a construct in Table 2 is larger than the corresponding interfactor squared correlation values (i.e., values above the diagonal) in Table 3, suggesting acceptable discriminant validity. Therefore, tests of hypotheses were undertaken while using factors of these constructs in assessing the interrelationships among the research variables.

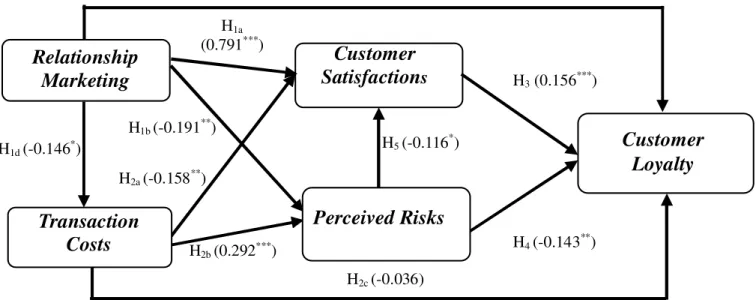

In order to assess the fitness of the model, this study used structural equation modeling (SEM) to investigate the hypothetic relationships. The results are shown in Table 4. The results indicate that the chi-square for the

tested model is 226.55 with 128 degrees of freedom.

Furthermore, an excellent overall fit of the measurement model is suggested by goodness-of-fit index (GFI = 0.93), adjust goodness of fit index (AGFI = 0.91), and normed fit index (NFI = 0.92). Residual index such as root mean square error of approximation (RMSEA = 0.04) was less than 0.05. These results suggest an adequate fit of the proposed model to the data. To clarify, the results of hypothetic relationships are displayed in Figure 1.

Table 4 and Figure 1 shows that relationship marke- ting had a positive and significant influence on customer customer satisfaction (β = 0.791, p < 0.01), and a negative and significant influence on perceived risk (β = -0.191, p < 0.05). However, relationship marketing had no significant influence on customer loyalty (β = 0.080, p

> 0.1). Thus, H11 and H12 are supported, whereas H13 is not supported. Likewise, the relationship marketing had a negative and significant influence on the transaction cost (β = -0.146, p < 0.1), indicating that H14 is supported

Figure 1. Results of path analysis.

supported. In addition, transaction cost had a negative and significant influence on customer satisfaction (β = - 0.158, p < 0.05), and a positive and significant influence on perceived risk (β = 0.292, p < 0.01). However, transaction cost had no significant influence on customer loyalty (β = -0.036, p > 0.1). Thus, H21 and H22 are supported, whereas H23 is not supported. Moreover, customer satisfaction had a positive and significant influence on customer loyalty (β = 0.156, p < 0.01).

Perceived risk had a negative and significant influence on customer loyalty (β = -0.143, p < 0.05) and customer satisfaction (β = -0.116, p < 0.1). Accordingly, H3, H4 and H5 are supported.

DISCUSSION

Based on the results of previous research, this study extends the knowledge of relationship marketing and transaction cost to develop the conceptual model to explore the antecedents of customer loyalty via interme- diary variables of customer satisfaction and perceived risk. We examine the intermediary roles of customer satisfaction and perceived risk on the relationships among relationship marketing, transaction cost, and cus- tomer loyalty. Several conclusions can be derived from the empirical results. First, both relationship marketing and transaction cost had no significant direct effects on customer loyalty. Although the result is different from the viewpoints of Armstrong and Kotler (2009), the result shows that it is possible for the customer to have positive impression toward the business when the customer feels satisfied with the business’s relationship marketing.

Andersen (2002) argued that pursuing relationship

building with customers was not always desirable. In other words, there is no guarantee that relationship marketing will have a positive and direct influence on customer loyalty, unless customers are satisfied with the firm’s relationship marketing strategies. Therefore, custo- mer loyalty needs to be increased by other variables.

Besides, transaction cost had no significant influence on customer loyalty. This research result was different from the viewpoints of Dick and Basu (1994), McDowell and Voelker (2008), Warner and Hefetz (2008), and Williamson (2008).

Second, both relationship marketing and transaction cost had significant effects on customer satisfaction and perceived risk. This result indicates that the business’s relationship marketing strategies indeed help increase the customer satisfaction on one hand, and reduce the customer’s transaction cost and perceived risk on the other hand. As to the influences of transaction cost on customer satisfaction and perceived risk, transaction cost has negative influence on customer satisfaction, but positive influence on perceived risk. Third, customer satisfaction had significant effects on customer loyalty.

This result is same as the viewpoints of Bodet (2008) and Oliver (1999), meaning higher customer satisfaction will further help increase customer loyalty which is services’

ultimate goal. Forth, the results show that perceived risk (morale hazard, financial risk, and time risk) had signify- cant influences on customer satisfaction and customer loyalty. This result corresponds to the viewpoints of Laroche et al. (2004), Mayer et al. (1995), and Oliver (1999).

Fifth, although the empirical results reveal that relation- ship marketing has no significant influence on customer loyalty, relationship marketing has positive influence on

Customer Satisfaction s

Perceived Risks

H2c (-0.036) H1a

(0.791***)

H4 (-0.143**) H3 (0.156***)

Customer Loyalty

Transaction Costs Relationship

Marketing

H1c (0.080)

H2b (0.292***) H2a (-0.158**)

H1b (-0.191**)

H1d (-0.146*) H5 (-0.116*)

customer satisfaction. In addition, both of customer satisfaction and perceived risk have significant influences on customer loyalty. Therefore, relationship marketing has influence on customer loyalty through customer satisfaction and perceived risk. Similarly, transaction cost has influence on customer loyalty through customer satisfaction and perceived risk. Accordingly, both relationship marketing and transaction cost have influences on customer loyalty through customer satisfac- tion or customer’s perceived risk. In other words, both of customer satisfaction and perceived risk have significant mediated influences on the relationships among relation- ship marketing, transaction cost, and customer loyalty.

MANAGERIAL IMPLICATIONS

The findings of this study provide several implications that benefit to malls managers in several ways. According to the impacts of relationship marketing, recruitment or training of human resources is a very important device to enhance trust, commitment, communication, and conflict management of relationship marketing strategies. In the initial period of employee recruitment, an aptitude test is needed. Through this test, employee with suitable aptitude for the business can be selected, and then orientation training is given. In addition, the service should establish an excellent audit system and increase the hidden appraisal of mysterious customers. Through this process, every employee’s service situation toward the customers could be understood or recorded. Thus, rewards or correction can be given according to the performance appraisal. Besides, executing relationship marketing often needs to be tied-in with the customer’s consumption habit and the data sources. When the busi- ness is promoting commercial activities and marketing projects, these could serve as data sources for reference.

Second, transaction cost has a negative influence on customer satisfaction and a positive influence on the customer’s perceived risk. This result implies that in the process of pre-ordering, returning, and exchanging goods, the business should effectively establish an elec- tronic system, allowing customers to have easy access to product search. On the other hands, the business could establish cooperation with home delivery and logistics providers so that pre-ordered or returned goods could arrive in time as planned. This course of action enables a large decrease in customers’ perceptions toward transac- tion cost, and thus an increase in customer satisfaction.

The process of checking bills is too long, and it would cause the customers to waste unnecessary time. If the business could effectively develop an overall online payment system, it would simplify the payment procedure and time. In other words, it would simplify the purchasing procedure and reduce unnecessary waiting time. As a result, the customers would have more time to browse different counters.

Third, as for the customer suggestions and comments,

usually the information counter, suggestion box, and building management personnel are unable to effectively give an instant answer to the customers. If customer service hotlines could be added, then the service counter personnel could directly and immediately respond to the customers in cases of customer complaints. This could also allow customers immediately suggesting service weaknesses that need an improvement, and it could allow service personnel immediately comforting the negative emotions experienced by customers due to an unpleasant shopping process. If the business has too many fascinating exhibitions of products and provides too many things to browse, customers who want to have a quick shop may feel a waste of time in searching pro- ducts. It would indirectly make the customers think that the circulation design of the shopping mall is bad, and that it is not easy to browse and search for products.

Thus, we recommend the business manager to establish a guideline facility or place the layout in a place where it’s easy to see. The guide machine will not only make it more convenient for customers to find commercial goods, but also provide the customers with the newest information and special activity announcements.

Finally, both relationship marketing and transaction cost can produce indirect influences through customer satisfaction and perceived risk on customer loyalty. This result implies that business manager can focus on relationship marketing (e.g., trust, commitment, communi- cation, and conflict management) and reduce transaction cost (e.g., coordination cost, search cost, and commu- nication cost) during purchase process to capture more customer satisfaction and reduce customer’s perceived risk. Accordingly, the business can enhance the chance to obtain the customer loyalty.

LIMITATION AND FUTURE RESEARCH

This research placed emphasis on probing into the relations among relationship marketing, transaction cost, customer satisfaction, perceived risk, and customer loyalty. Nevertheless, there were lots of factors that influenced the customer’s loyalty. This research recommends future researchers to include other potential factors into consideration, such as perceived value. On the other hand, the cause-effect relations of the research structure could also be revised so that one could deeply evaluate and analyze the relevance between every research dimension. This research mainly adopted the methods of giving web questionnaires and engaged in a sampling toward customer groups. We recommend future researchers to adopt other research methods, such as the case study method, observation method, data based analysis, interview method, or other qualitative analysis methods. This research had limited manpower and time.

Therefore, it’s difficult to adopt an overall sampling method. Hopefully, future researchers would engage in stratified sampling in order to reduce the error value of

research results.

REFERENCES

Adjei MT, Griffith DA, Noble SM (2009). When do relationships pay off for small retailers? Exploring targets and contexts to understand the value of relationship marketing. J. Retail., 85: 493-501.

Alfnes F, Rickertsen K, Ueland Ø (2008). Consumer attitudes toward low stake risk in food markets. Appl. Econ., 40: 3039-3049.

Andersen PH (2002). A foot in the door: Relationship marketing efforts towards transaction-oriented customers. J. Mark. Focused Manag., 5(1): 91-108.

Anvari R, Amin SM (2010). Commitment, involvement and satisfaction in relationship marketing. Interdiscip. J. Contemp. Res. Bus., 1(11):

51-70.

Armstrong G, Kotler P (2009). Marketing: An Introduction 5th ed.

Prentice-Hall. N.J.

Athaide GA, Stump RL, Joshi AW (2003). Understanding new product co-development relationships in technology-based, industrial markets. J. Mark. Theory Pract., 11(3): 46-58.

Balasubramanian S, Konana P, Menon NM (2003). Customer satisfaction in virtual environments: A study of online investing.

Manag. Sci., 49(7): 871-889.

Bharadwaj N, Matsuno K (2006). Investigating the antecedents and outcomes of customer firm transaction cost savings in a supply chain relationship. J. Bus. Res., 59(1): 62-72.

Bodet G (2008). Customer satisfaction and loyalty in service: Two concepts four constructs, several relationships. J. Retail. Consum.

Serv., 15: 156-162.

Casalό L, Flavián C, Cuinalíu M (2008). The role of perceived usability, reputation, satisfaction and consumer familiarity on the website loyalty formation process. Comput. Hum. Behav., 24: 325-349.

Chaudhuri A (1997). Consumption emotion and perceived risk: A macro-analytic approach. J. Bus. Res., 39(1): 81-92.

Cockrill A, Goode MMH, Beetles A (2009). The critical role of perceived risk and trust in determining customer satisfaction with automated banking channels. Serv. Mark. Q., 30(2): 174-193.

Colwell S, Hogarth-Scott S, Jiang D, Joshi A (2009). Effects of organizational and serviceperson orientation on customer loyalty.

Manage. Deci., 47(10): 1489- 1513.

Cowart KO, Fox GL, Wilson AE (2008). A structural look at consumer innovativeness and self-congruence in new product purchases.

Psychol. Mark., 25(12): 1111- 1130.

Dick A, Basu K (1994). Customer loyalty: Toward an integrated conceptual framework. J. Acad. Mark. Sci., 22: 99-113.

Fernández-Barcala M, González-Díaz M (2006). Brand equity in the European fruit and vegetable sector: A transaction cost approach.

Int. J. Res. Mark., 23(1): 31-44.

Hair JF, Black B, Babin B, Anderson RE (2010). Multivariate Data Analysis 7th ed. Pearson Prentice Hall. Upper Saddle River. NJ.

Hedhli KE, Chebat JC (2009). Developing and validating a psychometric shopper-based mall equity measure. J. Bus. Res., 62 (6): 581-587.

Hoq MZ, Amin M (2010). The role of customer satisfaction to enhance customer loyalty. Afr. J. Bus. Manage., 4(12): 2385-2392.

Jeon S, Kim H (2008). Exploring online auction behaviors and motivations. J. Fam. Consum. Sci., 100(2): 31-40.

Johnson MS, Sivadas E, Garbarino E (2008). Customer satisfaction, perceived risk and affective commitment: An investigation of directions of influence. J. Serv. Mark., 22(5): 353-362.

Jonees K, Leonard LNK (2007). Consumer-to-consumer electronic commerce: A distinct research stream. J. Elect. Com. Organ. 5(4):

39-54.

Jones RJ, Sloane PJ (2009). Regional differences in job satisfaction.

Appl. Econ., 41: 1019-1041.

Kanagal N (2009). Role of relationship marketing in competitive marketing strategy. J. Manag. Mark. Res., 2(1): 1-17.

Kim SK (2007). Relational behaviors in marketing channel relationships: Transaction cost implications. J. Bus. Res., 60: 1125- 1134.

Kim YG, Li G (2009). Customer satisfaction with and loyalty towards online travel products: A transaction cost economics perspective.

Tour. Econ. 15(4): 825-846.

Kotler P, Lane K (2009). Marketing Management 13th ed. Pearson Prentice Hall.

Lee M, Cunningham LF (2001). A cost/benefit approach to understanding service loyalty. J. Serv. Mark., 15(2): 113-130.

Liu CH, Yen LC (2010). The effects of service quality, tourism impact, and tourist satisfaction on tourist choice of leisure farming types. Afr.

J. Bus. Manage., 4(8): 1529-1545.

Luo X, Donthu N (2007). The role of cyber-intermediaries: A framework based on transaction cost analysis, agency, relationship marketing and social exchange theories. J. Bus. Ind. Mark., 22(7): 452-458.

Martínez-Ruiz MP, Jiménez-Zarco AI, Barba-Sánchez VB, Izquierdo- Yusta A (2010). Store brand proneness and maximal customer satisfaction in grocery stores. Afr. J. Bus. Manage., 4 (1): 64-69.

Muthitachaoen A, Gillenson ML, Suwan N (2006). Segmenting online customers to manage business resources: A study of the impacts of sales channel strategies on customer preferences. Inf. Manage., 43(5): 678-695.

Naeem H, Saif MI (2010). Employee empowerment and customer satisfaction: Empirical evidence from the banking sector of Pakistan.

Afr. J. Bus. Manage., 4(10): 2028-2031.

Ndubisi NO (2007). Relationship marketing and customer loyalty. Mark.

Intel. Plan., 25(1): 98-106.

Oliva TA, Oliver RL, MacMillan IC (1992). A catastrophe model for developing service satisfaction strategies. J. Mark., 56(3): 83-95.

Oliver RL (1999). Whence consumer loyalty. J. Mark., 63: 33-44.

Pappu R, Quester P (2006). Does customer satisfaction lead to improved brand equity? An empirical examination of two categories of retail brands. J. Prod. Brand Manag., 15(1): 4-14.

Quintal VA, Polczynski A (2010). Factors influencing tourists' revisit intentions. Asia Pac. J. Mark. Log., 22(4): 554-578.

Rabinovich E, Bailey JP, Carter CR (2003). A transaction-efficiency analysis of an Internet retailing supply chain in the music CD industry. Decis. Sci., 34(1): 131-172.

Rampersad G, Quester P, Troshani I (2010). Examining network factors: Commitment, trust, coordination and harmony. J. Bus. Ind.

Mark. 25 (7): 487-500.

Rao S, Goldsby TJ, Iyengar D (2008). The marketing and logistics efficacy of online sales channels. Int. J. Phys. Distrib. Log. Manag., 39 (2): 106-130.

Russell-Bennett R, McColl-Kennedy JR, Coote LV (2007). Involvement, satisfaction, and brand loyalty in a small business services setting.

J. Bus. Res., 60: 1253- 1260.

Shen CC, Chiou JS (2009). The effect of community identification on attitude and intention toward a blogging community. Internet Res., 19(4): 393-407.

Sheth JN, Parvatiyar A (1995). Relationship marketing in consumer markets: Antecedents and consequences. Acad. Mark. Sci. J., 23:

255-272.

Su HJ, Comer LB, Lee S (2008). The effect of expertise on consumers' satisfaction with the use of interactive recommendation agents.

Psychol. Mark., 25(9): 859- 880.

Suki NM, Suki NM (2007). Online buying innovativeness: Effects of perceived value, perceived risk and perceived enjoyment. Int. J.

Bus. Soc., 8: 81-94.

Teo TSH, Yu Y (2005). Online buying behavior: A transaction cost economics perspective. Int. J. Manage. Sci., 33: 451- 465.

Teo TSH, Yeong YD (2003). Assessing the customer decision process in the digital marketplace. Omega. 31(5): 349-363.

Udo GJ, Bagchi KK, Kirs PJ (2010). An assessment of customers' e- service quality perception, satisfaction and intention. Int. J. Inf.

Manage., 30(6): 481-492.

Warner ME, Hefetz A (2008). Privatization and its reverse: Explaining the dynamics of the government contracting process. J. Publ. Adm.

Res. Theo. 14: 171-90.

Williamson OE (2008). Outsourcing: Transaction cost economics and supply chain management. Supply Chain Manag., 44: 5-12.

Williamson OE (1991). Strategizing, economizing, and economic organization. Strat. Manage. J., 12(1): 75−94.

Wilson DT (1995). An integrated model of buyer-seller relationships. J.

Acad. Mark. Sci., 23: 335-345.

Yen YS (2010). Can perceived risks affect the relationship of switching costs and customer loyalty in e-commerce? Internet Res., 20(2):

210-224.