Department of Business Administration

I-Shou University

Master Thesis

The relationship of service quality and the customer

satisfaction with ATM service at Vietcombank

Advisor

: Ph.D CHIAO-PING BAO

Advisor

: D. NGUYEN QUANG VINH

Graduate Student

: LE NGOC VU

Acknowledgement

In fact, my success is contributed by help from teachers, family and friends. With the deepestgratitude, I would like to thank teachers in the International Department of Hanoi business and technology University, doctors and professors of I-Shou university who gave priceless knowledge to us during our study at the University. I would like to thank Mr Pham Quang Vinh, my teacher and professor Chiao Ping Bao who guided me through my graduation paper. Without their advices the graduation paper cannot be completed. The essay “The relationship of service quality and the customer satisfaction with ATM service at Vietcombank” was fulfilled in 3 months. Due to the limits in my knowledge, mistakes are inevitable therefore I would like to listen to contributions of teachers and friends to perfect my knowledge.

Abstract

The purpose of this study is to analysis the relationship of servqual model and customer satisfaction. There are 369 customers were conducted survey. The regression model indicates that two variables do not have positive r elationship with customer satisfaction includes Responsiveness (RS), Assurance (AS) So in this research deleted them in the regression moll. The other three variables remaining factors have a positive relationship with customer satisfaction: Reliability, Empathy and Tangible. Also the overall service quality has a positive relationship with the the customer satisfaction. Beside the study also shows that there is not significant difference between male and female in customer satisfaction, result also indicates that customer age, experience and education group do not have different level of satisfaction. However, The result indicates that customer in different job status and income have different level of satisfaction.

Table of Contents

Acknowledgement ... ii

Abstract ... ii

Table of Contents ... iv

List of Tables ... vi

List of Figures ... vii

Chapter I INTRODUCTION ... 1

1.1 Background ... 1

1.2 Research objective ... 2

1.3 Research question ... 2

1.4 Implication of research ... 3

Chapter II. LITERATURE REVIEW ... 4

2.1 Overview of service quality ... 4

2.1.1. Service concept ... 4

2.1.2 The characteristics of the service: ... 4

2.2 ATM Banking service ... 5

2.2.1 Concept of ATM service ... 5

2.2.2. Classification of payment cards ... 5

2.2.3. Bank card services ... 6

2.3 Service Quality and customer satisfaction in ATM banking service... 6

2.3.1 Service quality concept ... 6

2.3.2 The concept of service quality of ATM card ... 7

2.4 The relationship between service quality and customer satisfaction ... 7

2.5 Service Quality model ... 8

2.6 Research model and hypothesis ... 8

Chapter 3: RESEARCH METHODOLOGY ... 10

3.1. Research design ... 10

3.1.1. Selection of research models ... 10

3.1.2. Questionnaire Design Process ... 10

3.1.3. Variable construct ... 10

3.2. Sample ... 12

3.3.1. Descriptive statistics ... 12

3.3.2. Scaling ... 12

3.5.3. Factor analysis ... 12

3.3.4. Analysis of variance ... 13

Chapter IV DATA ANALYSIS ... 14

4.1 Respondent profile. ... 14

4.2. Reliability Analysis ... 15

4.3 Factor analysis ... 16

4.4 Variables correlation... 18

4.5 Regression ... 20

4.5.1 The impact of service quality factors on customer satisfaction... 20

4.5.2 The impact of overall service quality factors on customer satisfaction ... 23

4.6 Anova – t-test result ... 24

Chapter V CONCLUSION AND RECOMMENDATION ... 29

5.1 Conclusion ... 29

5.2 Recommendation ... 30

5.3 Implication of research ... 31

5.4 Limitation and future research ... 31

Reference ... 33

List of Tables

Table 3.1 Variables and items. ... 10

Table 4.1: Respondent profile ... 14

Table 4.2 Cronbach's Alpha result ... 15

Table 4.3. KMO and Bartlett's Test for the independent variables ... 16

Table 4.4. Factor analysis results of the independent variables ... 16

Table 4.5 Rotated factor matrix of the independent variables ... 18

Table 4.6 Variable correlation ... 19

Table 4.7. Model summary variable regression ... 20

Table 4.8. ANOVA result of Multiple variable regression model ... 20

Table 4.9 Multiple variable result ... 21

Table 4.10 Model Summary ... 21

Table 4.11 ANOVA ... 22

Table 4.12 Multiple variable result ... 22

Table 4.10 the summary of regression model of overall service quality and customer satisfaction ... 23

Table 4.11. ANOVA of overall service quality and customer satisfaction ... 23

Table 4.12 The regression of overall service quality and customer satisfaction ... 24

Table 4.13 Differences between gender and customer satisfaction ... 25

Table 4.14 The differnent of customer satisfaction among age group ... 25

Table 4.15 The differnent of customer satisfaction among Experience in using ATM .. 26

Table 4.16 The differnent of customer satisfaction among Education level ... 26

Table 4.17 The differnent of customer satisfaction among job status ... 26

Table 4.18 Post hoc test of differnent of customer satisfaction among job status ... 27

Table 4.19 The differnent of customer satisfaction among income per month ... 27

List of Figures

Chapter I INTRODUCTION

1.1 Background

In terms of the current economic integration, the development of high quality services has created superiority and tremendous competitive advantage. All sectors themselves are huge transformation economy before such conditions integration. Previously a number of sectors in the economy have not paid adequate attention to develop their own competitive advantages, the day before individual conditions of each enterprise integration need to find a foothold in the minds of consumers to be able to continue to stand firm in the competitive environment of economic integration. In order to have a foothold in the consumer's mind the need for enterprise business strategy of their own. One thing is undeniable though businesses operating in the manufacturing or commercial enterprise, the service issue a very important issue as well as a decision on the status of the business to customers. Especially for those companies that are operating in the financial sector such as banking industry because of this huge decision for the development of the economy.

The activities of non-cash payments in Vietnam have been many positive changes; have a faster growth rates; creating a change in awareness, habits of citizens and businesses; meet the needs of economic development (Adger, 2010). Notably, active bank card payments are increasingly important contribution, is favored by usability and convenience brought. More than 10 years ago, ATM is still a new payment facility to customers in Vietnam (Trung, 2011). However now a day, there are a big number of cards issued in the bank. According to statistics of the State Bank (2015), as of June 2014, more than 50 organizations registered credit card issuer with more than 70 million cards issued. As assessed by a market research company Research & Markets in US, Vietnam card market is the most dynamic market in the world and is entering the race to win the market competition between domestic banks and the banks out. According to Blecher, Liber, Ross and Birckmayer, (2013), the Vietnam card market will maintain growth of two digits in the next year. This is confirmed the quality of ATM services will be the determining factor of success or failure of e-commerce.

Bank cards continue to be a multi-purpose means of payment, utilities, being commercial banks (CBs) focused on development, with rapid growth. By the end of the month 03/2013, there were 52 organizations registered to issue cards, the number of cards issued by 48 organizations reach over 57.1 million cards (up 38.5% compared to end of 2011) with about 378 card brands, including most of the debit card (accounting for 93.6%), credit cards (3.1%); Bank card services help banks develop more channels to raise capital and develop more

value-added services with many different utilities provided to customers (State Bank, 2015). Besides the development of the number of cards, commercial banks increasingly interested in improving the quality of services by increasing the ability to pay for cardholders through the issuance of co-branded payment cards and multi-application links with other organizations, such as schools, taxi companies, airlines ...; focus on increased safety, security of payment cards such as chip technology applications and the issuance of payment cards, such as issuing and accepting EMV chip card payment.

In recent years, some research has focused research on substances ATM services. It is constantly researching the following: The study "Quality of service, satisfaction and loyalty of clients at the private bank in Ethiopia" (Banking service quality, customer satisfaction & loyality in Banking Sector Ethiopian) of the author Sata Mesay Shanka conducted in Ethiopia in 2012. The aim of the study is to measure the service quality of private banks in Ethiopia, while investigating the relationship between service quality and satisfaction, loyalty the client's. In the Journal of Business Science from the University of Commerce, the study "Assessing the quality of retail services of commercial banks and customer satisfaction based on the model Servperf". The authors Pham and , Nguyen (2014), University of Economics - National University, have used the model as the basis Servperf to build the scale and find out the relationship between service quality and employee satisfaction. However, studies have focused research on service quality or overall retail service quality rather than insist on a specific aspect of ATM service quality. In addition, This paper studies a different problem is the quality of service at VietcombankATM cards and use SERVQUAL model for developing the research model.

1.2 Research objective

On the theoretical of service, quality of service, the service model, these factors should affect the customer satisfaction, this study have the flowing objective:

- Identification of factors that measure the quality of service measurement of VietcombankATM card and the satisfaction of the customers using the ATM services.

- Building a model research quality of VietcombankATM services. - Construction and adjustment scale of VietcombankATM services.

- Evaluation of customer satisfaction about service quality of VietcombankATM

1.3 Research question

To obtain the research objective the research questions (RQ) were listed in below.

- Is there any relationship between tangible factor and customer satisfaction about service quality of VietcombankATM

- Is there any relationship between reliability factor and customer satisfaction about service quality of VietcombankATM

- Is there any relationship between responses factor and customer satisfaction about service quality of VietcombankATM

- Is there any relationship between assurance factor and customer satisfaction about service quality of VietcombankATM

- Is there any relationship between empathy factor and customer satisfaction about service quality of VietcombankATM

- Is there any relationship between overall service quality and customer satisfaction about service quality of VietcombankATM

- Are there any difference among customer demographic with the level of customer satisfaction about service quality of VietcombankATM ?

1.4 Implication of research

This research will help to complete of defining a full and accurate the factors that impact on the quality of the ATM services, from this research result the bank will have the right to improve the service quality and customer satisfaction. In addition, on the basis of the study, the authors propose a number of measures to improve the quality of VietcombankATM services.

Chapter II. LITERATURE REVIEW

2.1 Overview of service quality

2.1.1. Service concept

According to Zeithaml (2000): "Service is the act, process, and how to perform a certain task in order to create value for customer to satisfy the needs and expectations of customers ". According to Kotler and Armstrong (2004): "Services are activities or benefits that businesses can offer to customers to establish, strengthen and extend the relations and long-term cooperation with customers";

In summary, there are many concepts of speech services under different angles but overall achievements are: Service operation is intended to meet certain needs of man. Characteristics of the service is non-existent in specific product types (tangible) such goods directly but it serves certain needs of society.

2.1.2 The characteristics of the service:

Service has features that distinguish compared to commodities. That is the characteristic: invisibility, emptiness separation between supplier and consumer calculated uneven quality, not spare, no change of ownership calculation as noted in the research of Schulz and Brenner, (2010).

- Invisible

Goods with shape, size, color and even smell. Customers can review, evaluate whether it is appropriate for my needs. Conversely, identifiable intangible service, making the customer's senses are not aware of before purchasing service. This is a big problem when selling a service considering selling a tangible commodity, because service demanding customers try before buying, feel the quality is difficult, hard to choose

- Integral between supplier and consumer

Goods are produced concentrated in one place, and then transported to where they are needed. When out of the production line, the merchandise is complete. Such, manufacturers can achieve economies of scale by concentrating production, batch, quality management and product focus. Manufacturers also can produce when convenient, and then stored in warehouses and sell them when the need arises. Therefore, they are easy to implement supply-demand balance. But the process of providing the service: Service providers and customers have contact with each other to provide and consumer in the place and time that works for both parties. For some of the Services, the customer must be present during the process of providing service.

- Uneven in quality

Service cannot be provided in bulk, concentrated as commodity production. Therefore, suppliers difficult quality control according to a uniform standard. On the other hand, the customer's perception of service quality strongly affected by the skills, attitudes provide. Health, the enthusiasm of the staff in the morning and the afternoon may vary. Therefore, difficult to achieve uniformity in quality within a day.

- Non-reserve

Service only exists at the time it is offered. Therefore, service cannot mass production to take on stocks, while market demand is for sale.

2.2 ATM Banking service

2.2.1 Concept of ATM service

Currently, the world has a lot of the concept of payment cards, each different wording to highlight a certain content of payment cards in Vietnam, the concept of payment cards stipulated in Article 2 Regulation issuing, billing, usage and service providers supporting agro bank cards, issued together with decision No. 20/2007 / QD-NHNN dated 15/05/2007 of the Governor of the State Bank Vietnam countries, namely: bank cards are those issued by issuers of cards issued to perform card transactions under the conditions and terms agreed by the parties. From the perspective of consideration, the different studies were presented with the concept of different cards. But in short, the natures of the card as a means of payment, payment of which the user can use to meet the needs of its consumers, including cash withdrawals or use it as a tool to implement the automated services by banks or other credit institutions provide. Card is the currency incomplete; it is a symbol of the commitment of the bank or issuer of payment protection funds used by the cardholder's bank cash card holder's loan or the card holder was deposited in the bank (Sullivan, 2002).

Thus, in view of the thesis can summarize the concept of the card as a means of non-cash payments are issued by banks, financial institutions or companies. Card is used to pay for goods and services without using cash. NE card is also used to withdraw cash at correspondent banks or automated teller machines. The amount of payments or draw to stay within the balance in deposit accounts or credit limit granted under the agreement signed between the bank that issued the card and the cardholder. Besides, the card is also used to perform useful services through automated trading systems at ATMs.

2.2.2. Classification of payment cards

As research of Inotay, Parragh, Barkoczy, Kokovai, Fuko, Kapitany, and Lipcsei, (2003) payment cards is cassified in to 03 categories: 1) Embossing Card; Magnetic Stripe; EMV chip card standards (abbreviated as chip cards - smart cards). 2) Divided by entities issuing 02

Category: Cards issued by banks and held by non-card-issuing bank. 3)Classification according to the territorial scope of use there are 02 kinds of cards: Debit Card and Card International NIA. 3) Analysis on the nature of payment cards in 03 categories: Credit card; Debit Card and Prepaid Card

2.2.3. Bank card services

In the research of Bounie, and François, (2006), bank card services are considered the possibility of a customer can perform payment transactions, transfers, withdrawals, statement printing, at any automated teller machine of the bank that customers without having to deal with bank employees. Characteristics of bank card services include: Card Services is based on a modern technology platform, Bank card service is a package of products and services, thus requiring the bank to regularly supplement and improve service quality. Bank card services include: Withdraw cash, Transfer, Payment and Paying via account

In addition to the most basic services, when customers use ATMs, banks also provide other services such as query account information, check balances, transaction statement printing, ...

2.3 Service Quality and customer satisfaction in ATM

banking service

2.3.1 Service quality concept

Zeithaml (1988) explains: The quality of services is customer appreciation for the great super Vietnam and the whole of an entity. It is a kind of attitude and the result from a comparison between what was expected and our perception of things get. Lewis and Booms said service is a measure of the level of service given to the customer matches the expectations of customers. The creation of a quality service to meet the expectations means customers a uniform way. According Lehinen (1982): Quality of service must be assessed on two aspects: (1) the process of providing services, (2) the results of the service. Grönroos (1984) also suggested that the two aspects of quality of service: (1) the technical quality and (2) functional quality. Related technical quality of what should be the quality of service and voice functions are served like.

Zeithaml, Berry and Parasuraman (1988) the security quality of service means that the gap expected product and customer service awareness, sense when using their products and services through the hatch. Parasuraman, Berry, and Zeithaml, (1991) explains that to know the predictions of the best customers is to identify and understand their expectations. The development of system-defined expectations is essential. And right after that we have a quality strategy for effective service. This can be considered as the most general concept, covers the full meaning of service customer standpoint, the customer is the center.

The evaluation of quality of service to be a difficult problem because the service is invisible, they together heterogeneous and they are inseparable. For a long time, many researchers have tried to define and measure service quality, so there are many different approaches to the quality of service. There authors suggest that the quality of service that meets the needs and expectations of customers. Meanwhile, other researchers believe that customer satisfaction is the main difference between the consumer feel that service and their expectations prior to the service. And Parasuraman, Zeithaml, and Berry, (1988) argued that "Quality of service is the gap between customer expectations and their perception when used through service". This is a concept widely accepted.

In the research scope of this study with a view towards quality customer service is meant to meet the expectations of customers, satisfy customer needs. Therefore, quality of service is determined by the customer when service providers meet the needs of customers.

2.3.2 The concept of service quality of ATM card

Quality of service is the ability to respond cards ATM services to the expectations of customers using ATMs, or in other words it is the entire operation, the added benefit that the bank gives customers to establish, consolidate and expand long-term partnerships with customers through creating customer satisfaction (Passas, Paskalis, Vali and Merakos,1997).

The track, to fund implementation, maintenance, maintenance of bank ATM was done more often; time troubleshooting, process and answer inquiries complaint be shortened; ATM networks more reasonable allocation; reduce overcrowding at the ATM ... Card Services helps banks develop retail banking services, giving people the ability to access and use the utility's financial services and banking contributing to the development-oriented non-cash payments.

2.4 The relationship between service quality and customer

satisfaction

Many practical study of the relationship between service quality and customer satisfaction. Cronin and Taylor (1992) has tested this relationship and concluded that the perceived quality of service leads to customer satisfaction. Studies have concluded that the quality of service is the money to the satisfaction (Cronin and Taylor, 1992; Spreng and Mackoy, 1996) and is the main factor affecting satisfaction compression.

Motto of the company is to satisfy the business needs of the customer because the customer is the source of revenue and profits of the company. When customers are satisfied with the services or goods of the company, the ability to continue shopping they buy high. Moreover, when they meet, they tend to speak well of the company's services to other customers.

Satisfaction of consumers for services is emotional for companies providing services based on each contact or transaction with that company (Bitner and Hubbert, 1994).

Quality of service and satisfaction, but two different concepts, but closely related to each other in the study of service (Parasuraman et.al , 1988). The former make research showed that quality of service is the cause of satisfaction (eg Cronin & Taylor, 1992). The reason is related to the quality of the service provided while satisfaction evaluation only after the use of such services. If quality entertainment experience improved but not based on the needs of the customer, the customer will never be satisfied with the service. Therefore, when using the service, if customers perceive high quality services, they will be satisfied with the service. Conversely, if customers perceive low quality services, then the dissatisfied will appear.

2.5 Service Quality model

SERVQUAL model (Parasuraman, 1988) is a model of service quality research dissemination and application of most of the EFA marketing research. According to Parasuraman, quality of services in general cannot identify which depends on the customer's perception of service and the feeling that this is a review of many factors. SERVQUAL hard carriage model built on quality of service perspective feel that the comparison between the expected value, expectation (expectation) and the value customers perceive (Perception).

SERVQUAL consider two main aspects of service quality service is the result (outcome) and service providers (process) was studied through twenty two scales of five criteria: credibility (reliability) , efficiency in service (responsiveness), the tangible (tangibles), assurance (assurance) and sympathy (empathy).

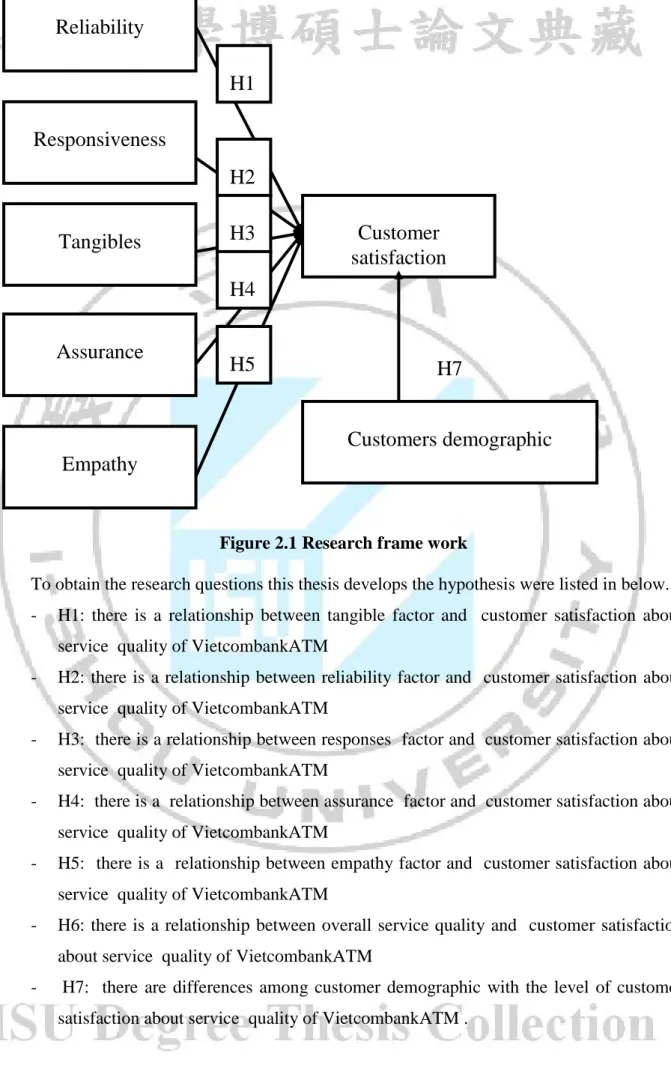

2.6 Research model and hypothesis

This chapter presents the theoretical basis of the ATM, service quality and customer satisfaction when using ATMs of Vietcombank. Quality of service depends on the distance between the level of internal customer expectations with service and their perceived level of service. There are many models of quality of service measurement: SERVQUAL model consists of five major components, such as component reliability, efficiency in service sectors, tangible media components, component service capability, component sympathy. Quality of service modeled technical quality and functional quality has two components: technical quality and functional quality. Based on studies of model quality banking services, the authors come up with research models VietcombankATM services.

Reliability

Responsiveness

Tangibles

Assurance

Empathy

Customer

satisfaction

Customers demographic

H1

H2

H3

H4

H5

H7

Figure 2.1 Research frame work

To obtain the research questions this thesis develops the hypothesis were listed in below. - H1: there is a relationship between tangible factor and customer satisfaction about

service quality of VietcombankATM

- H2: there is a relationship between reliability factor and customer satisfaction about service quality of VietcombankATM

- H3: there is a relationship between responses factor and customer satisfaction about service quality of VietcombankATM

- H4: there is a relationship between assurance factor and customer satisfaction about service quality of VietcombankATM

- H5: there is a relationship between empathy factor and customer satisfaction about service quality of VietcombankATM

- H6: there is a relationship between overall service quality and customer satisfaction about service quality of VietcombankATM

- H7: there are differences among customer demographic with the level of customer satisfaction about service quality of VietcombankATM .

Chapter 3: RESEARCH METHODOLOGY

3.1. Research design

3.1.1. Selection of research models

To make a survey, the authors selected models perceived service quality was building based on SERVQUAL model (Parasuraman et al, 1985).

3.1.2. Questionnaire Design Process

The design phase questionnaire:

The questionnaire was designed and tested through a number of stages to ensure that the information needed to collect reliable service of process data analysis. Develop questionnaire-based raw information to be collected in the theoretical model and the relevant prior studies. In this step the author also consult experts.

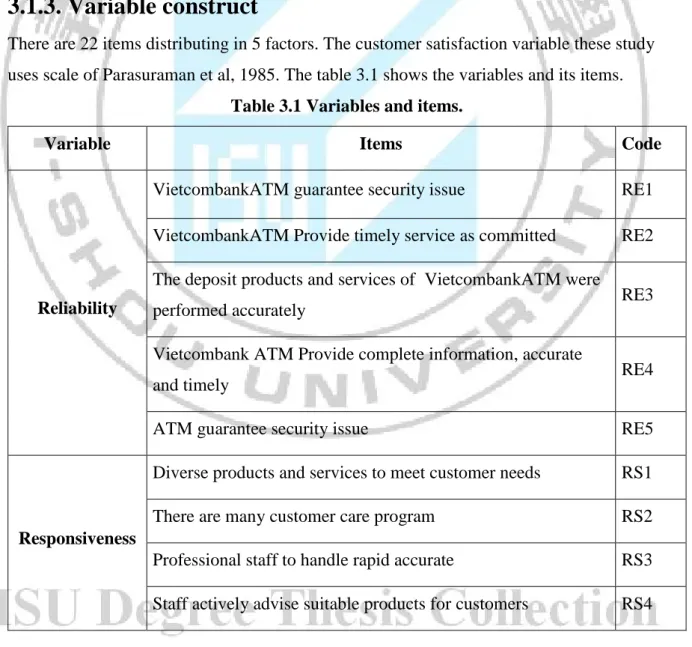

3.1.3. Variable construct

There are 22 items distributing in 5 factors. The customer satisfaction variable these study uses scale of Parasuraman et al, 1985. The table 3.1 shows the variables and its items.

Table 3.1 Variables and items.

Variable Items Code

Reliability

VietcombankATM guarantee security issue RE1 VietcombankATM Provide timely service as committed RE2 The deposit products and services of VietcombankATM were

performed accurately RE3

Vietcombank ATM Provide complete information, accurate

and timely RE4

ATM guarantee security issue RE5

Responsiveness

Diverse products and services to meet customer needs RS1 There are many customer care program RS2 Professional staff to handle rapid accurate RS3 Staff actively advise suitable products for customers RS4

Variable Items Code

Assurance

Staff ready to serve and assist customers AS1 Resolve complaints quickly and rational AS2 Guide to procedures for clients fully understandable AS3 The staff is professional and qualifications AS4

Empathy

Enthusiastic, considerate and fun staffs EM1 Employees interested in the individual requirements of the

customer EM2

Always listen to customers EM3

Always polite, friendly customer EM4

Tangible

The location of transaction is convenience and in accordance

with customer needs TA1

Spacious transaction, using modern technology TA2 Nice layout of the counter, identifiable for Customers

reasonable TA3

The staff dresses polite TA4

Paper forms to be used in transactions were designed easily

TA5

Customer satisfaction

VietcombankATM offers more benefits than my cost CS1 VietcombankATM is the best among competing banks CS2 VietcombankATM is much better than what I expected CS3

Overall I satisfied with service of Vietcombank CS4

Likert scale was used to measure the perceived level of customer and their satisfaction about the quality of ATM services, which from 1 "strong disagree ' to 5 “'strong agree”. The survey was conducted customers during the period from May to July, 2015 in Hanoi.

3.2. Sample

Population: The purpose of the study was to assess the level of customer satisfaction of with ATM of Vietcombank. So the study sample was identified as customer who are using ATM service of Vietcombank

First samples taken at random from 200 to 400 samples, then based on the standard deviation and inference to determine the samples to be taken. Within the scope of this study with resource limitations, the authors selected sample size was 400 The questionnaire will be delivered to customers .

3.3 Methods of analysis

The data collected are cleaned and analyzed with the aid of SPSS software using analytical methods. Include:

3.3.1. Descriptive statistics

Samples collected will be conducted in accordance with the statistical classification variables. The basis for classification include: Gender, age, education, work placements and work experience. Also scoring average, maximum value, minimum value and standard deviation of the answers in the questionnaires collected.

3.3.2. Scaling

Factors inspection is done by Cronbach`s Alpha scales. These variations are observed not guarantee minimum reliability will be removed from the scale and does not appear in the analysis of factors. In this study, Cronbach's alpha coefficient was taken as the minimum at 0.6. Variables Cronbach's alpha coefficient of less than 0.3 is considered junk variable.

3.5.3. Factor analysis

After the observed variables were tested using Cronbach's Alpha scale, they will be included in the explore factor analysis (EFA). Factor analysis will help authors observed variables collapsed into more significant variables in explaining the research model.

Some standards apply when analyzing EFA research as follows:

- Inspection of the suitability of factor analysis of sample data via the KMO. If greater than 0.5, the KMO factor analysis is appropriate, whereas if the value is less than 0.5 KMO factor analysis method is not appropriate.

- The number of factors: The number of factors that are determined based on the index eigenvalue represent the fraction of variation explained by each factor. - The Explained variance criteria: Total variance extracted must be greater than 50%. - Criticized coefficient method Principal components factor with Varimax rotation to ensure that the amount is the smallest factor.

3.3.4. Analysis of variance

For the test of the difference between the overall research expertise this study use T-test and analysis of variance (ANOVA), testing is also used to directly compare the value p- corresponding value. To consider the difference occurs in the category involving three or more groups are using Post Hoc Test by Tukey to assess value.

To test the relationship among factors and job satisfaction of employees in the research model, this study is using methods of correlated with the correlation coefficient "Pearson correlation coefficient", that is denoted by "r ". Values in the range between -1 ≤ r ≤ 1.

If r> 0 expressed positively correlated. Conversely, r <0 represents the inverse correlation. Value r = 0 indicates that the two variables do not have a linear relationship.

1: The relationship between the two variables tighter 0: the relationship between two variables as weak

The level of significance "sig" of the correlation coefficient, as follows: - <5%: fairly tight correlation

- <1%: very tight correlation

The next step, using methods of multiple linear regression to determine the meaning and linear correlation of the variables in the model.

Chapter IV DATA ANALYSIS

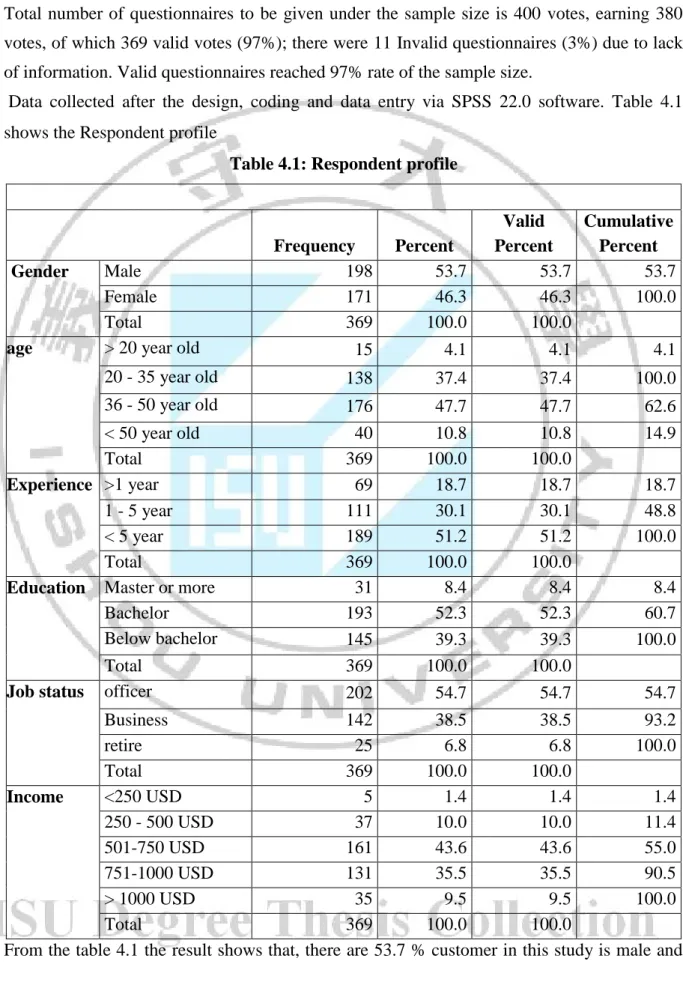

4.1 Respondent profile.

Total number of questionnaires to be given under the sample size is 400 votes, earning 380 votes, of which 369 valid votes (97%); there were 11 Invalid questionnaires (3%) due to lack of information. Valid questionnaires reached 97% rate of the sample size.

Data collected after the design, coding and data entry via SPSS 22.0 software. Table 4.1 shows the Respondent profile

Table 4.1: Respondent profile

Frequency Percent Valid Percent Cumulative Percent Gender Male 198 53.7 53.7 53.7 Female 171 46.3 46.3 100.0 Total 369 100.0 100.0

age > 20 year old 15 4.1 4.1 4.1

20 - 35 year old 138 37.4 37.4 100.0 36 - 50 year old 176 47.7 47.7 62.6 < 50 year old 40 10.8 10.8 14.9 Total 369 100.0 100.0 Experience >1 year 69 18.7 18.7 18.7 1 - 5 year 111 30.1 30.1 48.8 < 5 year 189 51.2 51.2 100.0 Total 369 100.0 100.0

Education Master or more 31 8.4 8.4 8.4

Bachelor 193 52.3 52.3 60.7

Below bachelor 145 39.3 39.3 100.0

Total 369 100.0 100.0

Job status officer 202 54.7 54.7 54.7

Business 142 38.5 38.5 93.2 retire 25 6.8 6.8 100.0 Total 369 100.0 100.0 Income <250 USD 5 1.4 1.4 1.4 250 - 500 USD 37 10.0 10.0 11.4 501-750 USD 161 43.6 43.6 55.0 751-1000 USD 131 35.5 35.5 90.5 > 1000 USD 35 9.5 9.5 100.0 Total 369 100.0 100.0

female is 46.3%. Related to age of customer, the result shows that customers below 20 year old is 4.1% , from 20 - 35 year old is 37.4, 36 - 50 year old is 47.7 count for the young age of customer in this study and customer who is over 50 year old is 10.8%.

In this study, the ATM card using experience of customer is also asked, the result indicate that customer who have lest than 1-year experience is 18.7%, from 1- 5 years experience is 30.1% and the biggest number is belong to more than 5 year with 51.2% indicates long time experience of customer in this study.

Related to education of customer, this study shows that people who have Master or more is 8.4%, customers who have Bachelor degree is 52.3% and Below bachelor degree is 39.3%. Total 369 customer who is surveyed, there are 54.7% is officer, customer who is working in business area is 38.5% and customer who is retired counted for 6.8%

This study also conduct the survey related to customer income per month, from the table 4.1 show that customer who has < USD is 250 just 1.4%, from USD 250 - 500 is 10%, the biggest number in this study is customer who has USD 501-750 and the second is customer who get income per month with USD 751-1000 counted for 35.5% and > 1000 USD 9.5%. is

4.2. Reliability Analysis

According to Nunnally and Bernstein (1994), the scale research should be a preliminary assessment by Cronbach's alpha coefficient. Cronbach's alpha coefficient of variation value in the range [0-1]. Cronbach's alpha coefficient as high as possible, however if Cronbach's alpha coefficient is too large (> 0.95) showed more variation in scale no different from each other. Scale reliability Cronbach's Alpha well as variability in the range of 0.70 to 0.80. If Cronbach's Alpha is > = 0.60 is acceptable scale in terms of reliability. The variables used Cronbach's alpha measure correlation coefficient of total variable> = 0.30 is satisfactory, if a variable has a correlation coefficient of total variation <0.30, the variable measuring unsatisfactory.

Table 4.2 Cronbach's Alpha result

Variable Number Cronbach's Alpha

Reliability 5 .935 Responsiveness 4 .883 Assurance 4 .808 Empathy 4 .849 Tangible 3 .897 Customer satisfaction 4 .918

variable (Reliability, Responsiveness, Assurance, Empathy, Tangible, Customer satisfaction) Have good internal consistent with Cronbach's Alpha from .808 to .936.

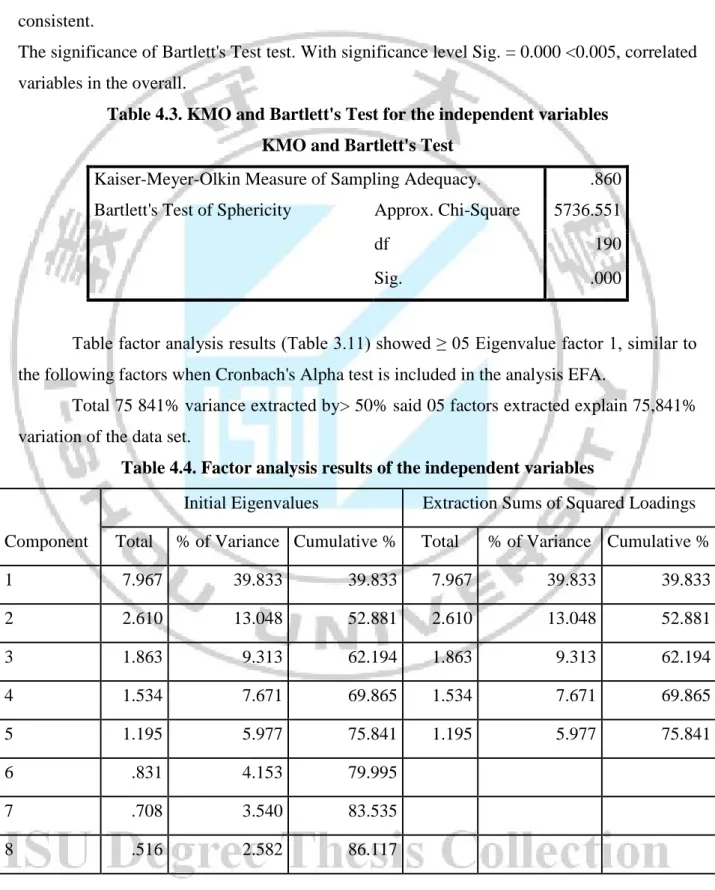

4.3 Factor analysis

Factor analysis was performed with 20 variables observed variables independent of achieved results as follows:

KMO = 0.860 coefficient (between 0.5 and 1) should assert factor analysis in this study is consistent.

The significance of Bartlett's Test test. With significance level Sig. = 0.000 <0.005, correlated variables in the overall.

Table 4.3. KMO and Bartlett's Test for the independent variables KMO and Bartlett's Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. .860 Bartlett's Test of Sphericity Approx. Chi-Square 5736.551

df 190

Sig. .000

Table factor analysis results (Table 3.11) showed ≥ 05 Eigenvalue factor 1, similar to the following factors when Cronbach's Alpha test is included in the analysis EFA.

Total 75 841% variance extracted by> 50% said 05 factors extracted explain 75,841% variation of the data set.

Table 4.4. Factor analysis results of the independent variables

Component

Initial Eigenvalues Extraction Sums of Squared Loadings Total % of Variance Cumulative % Total % of Variance Cumulative % 1 7.967 39.833 39.833 7.967 39.833 39.833 2 2.610 13.048 52.881 2.610 13.048 52.881 3 1.863 9.313 62.194 1.863 9.313 62.194 4 1.534 7.671 69.865 1.534 7.671 69.865 5 1.195 5.977 75.841 1.195 5.977 75.841 6 .831 4.153 79.995 7 .708 3.540 83.535 8 .516 2.582 86.117

Component

Initial Eigenvalues Extraction Sums of Squared Loadings Total % of Variance Cumulative % Total % of Variance Cumulative %

9 .441 2.203 88.320 10 .374 1.872 90.193 11 .327 1.637 91.829 12 .321 1.607 93.436 13 .272 1.359 94.795 14 .220 1.098 95.893 15 .183 .916 96.808 16 .176 .880 97.688 17 .135 .677 98.365 18 .125 .624 98.989 19 .112 .561 99.550 20 .090 .450 100.000

Rotated Component Matrixa removed the variable with loading factor coefficient less than 0.5. The remaining factors are factor loaded > 0.5: ensure the practical implications of EFA. Looking at the table 4.5 we see the influence of 05 factors were extracted from the observed variables of the scale components.

Factor 1 is the sum of 05 observed variables are RE1, RE2, RE3, RE4 RE5 of Reliability scale (RE).

Factor 2 is the sum of 04 observed variables are RS1, RS2, RS3 RS4 of , Responsiveness scale (RS).

Factor 3 is the sum of 04 observed variables are AS1, AS2, AS3, AS4 of the Assurance scale (AS).

Factor 4 is the sum of 04 observed variables are EM1, EM2, EM3, EM4 of Empathy scale (EM).

Factor 5 is the sum of 03 observed variables is TA1, TA2 TA3 of Tangible scale (TA)

Thus, after analyzing the factors explored EFA, with all 05 factors were extracted based on 20 variables observed similarities with the elements after testing was included in the analysis EFA. 05 factors will be included in the regression

Table 4.5 Rotated factor matrix of the independent variables Rotated Component Matrixa

Component 1 2 3 4 5 RE1 .710 RE2 .856 RE3 .862 RE4 .835 RE5 .705 RS1 .797 RS2 .824 RS3 .750 RS4 .782 AS1 .893 AS2 .877 AS3 .593 AS4 .843 EM1 .748 EM2 .782 EM3 .770 EM4 .658 TA1 .867 TA2 .884 TA3 .851

Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. a. Rotation converged in 6 iterations.

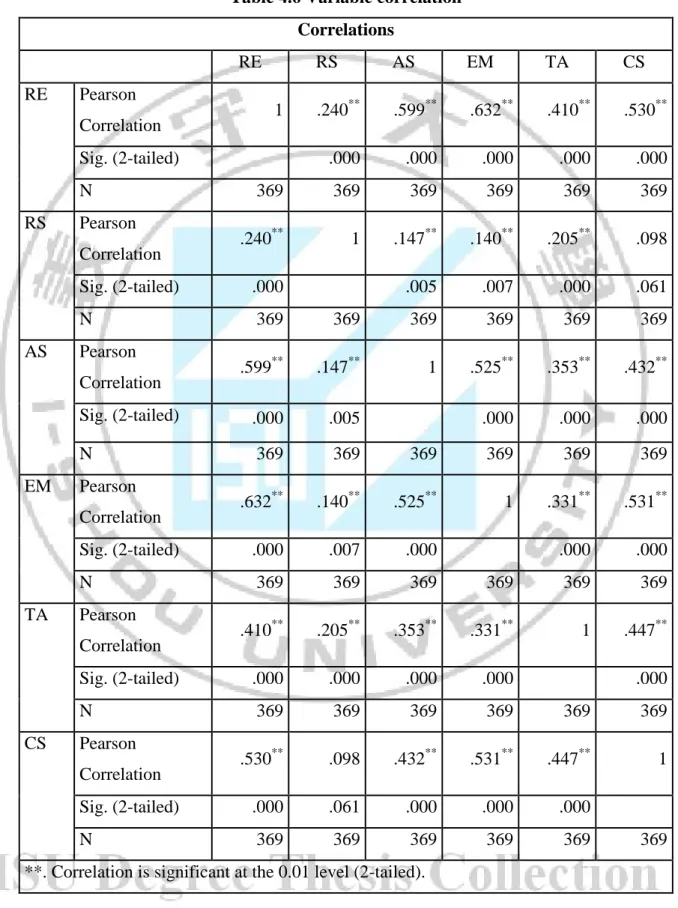

4.4 Variables correlation

Pearson correlation analysis to determine the linear relationship between the dependent variable and the independent variables before conducting regression analysis. Correlation analysis was performed between the dependent variable is customer satisfaction (CS) and the independent variables are: Reliability scale (RE), Responsiveness scale (RS), Assurance scale (AS), Empathy scale (EM) and Tangible scale (TA)

Correlation analysis results presented in Table 4.6 shows that the independent variables have fairly strong linear correlation with the dependent variable, the correlations are statistically significant at the 1% level of significance achieved. Moreover, the correlation coefficient between the independent variables are not too large value, so the possibility of multicollinearity phenomenon is negligible.

Table 4.6 Variable correlation Correlations RE RS AS EM TA CS RE Pearson Correlation 1 .240 ** .599** .632** .410** .530** Sig. (2-tailed) .000 .000 .000 .000 .000 N 369 369 369 369 369 369 RS Pearson Correlation .240 ** 1 .147** .140** .205** .098 Sig. (2-tailed) .000 .005 .007 .000 .061 N 369 369 369 369 369 369 AS Pearson Correlation .599 ** .147** 1 .525** .353** .432** Sig. (2-tailed) .000 .005 .000 .000 .000 N 369 369 369 369 369 369 EM Pearson Correlation .632 ** .140** .525** 1 .331** .531** Sig. (2-tailed) .000 .007 .000 .000 .000 N 369 369 369 369 369 369 TA Pearson Correlation .410 ** .205** .353** .331** 1 .447** Sig. (2-tailed) .000 .000 .000 .000 .000 N 369 369 369 369 369 369 CS Pearson Correlation .530 ** .098 .432** .531** .447** 1 Sig. (2-tailed) .000 .061 .000 .000 .000 N 369 369 369 369 369 369

4.5 Regression

4.5.1 The impact of service quality factors on customer

satisfaction

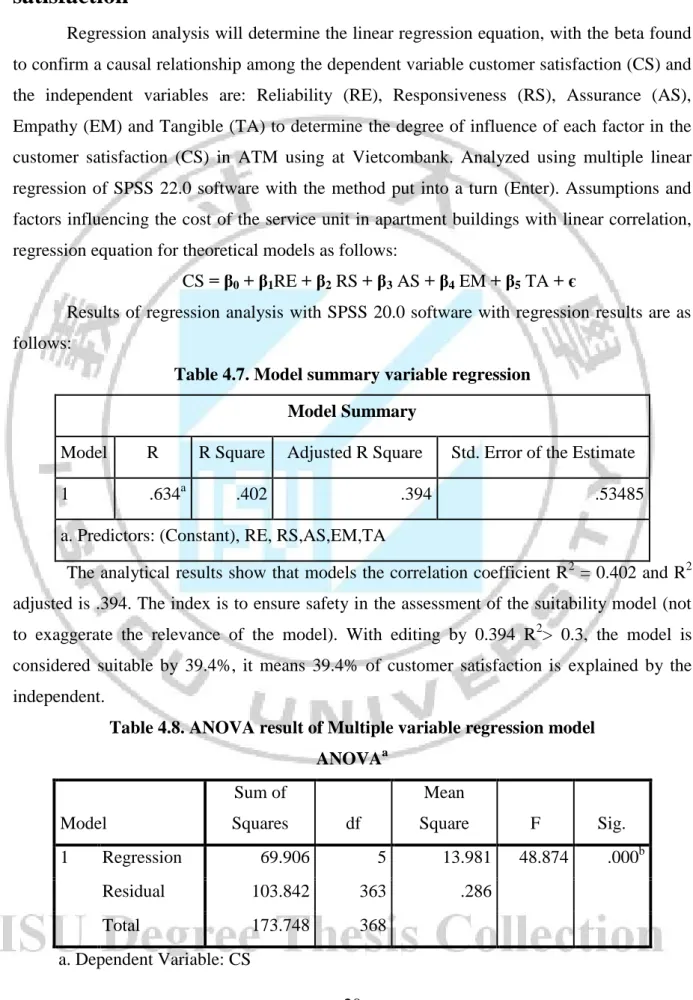

Regression analysis will determine the linear regression equation, with the beta found to confirm a causal relationship among the dependent variable customer satisfaction (CS) and the independent variables are: Reliability (RE), Responsiveness (RS), Assurance (AS), Empathy (EM) and Tangible (TA) to determine the degree of influence of each factor in the customer satisfaction (CS) in ATM using at Vietcombank. Analyzed using multiple linear regression of SPSS 22.0 software with the method put into a turn (Enter). Assumptions and factors influencing the cost of the service unit in apartment buildings with linear correlation, regression equation for theoretical models as follows:

CS = β0 + β1RE + β2 RS + β3 AS + β4 EM + β5 TA + є

Results of regression analysis with SPSS 20.0 software with regression results are as follows:

Table 4.7. Model summary variable regression Model Summary

Model R R Square Adjusted R Square Std. Error of the Estimate

1 .634a .402 .394 .53485

a. Predictors: (Constant), RE, RS,AS,EM,TA

The analytical results show that models the correlation coefficient R2 = 0.402 and R2 adjusted is .394. The index is to ensure safety in the assessment of the suitability model (not to exaggerate the relevance of the model). With editing by 0.394 R2> 0.3, the model is considered suitable by 39.4%, it means 39.4% of customer satisfaction is explained by the independent.

Table 4.8. ANOVA result of Multiple variable regression model

ANOVAa Model Sum of Squares df Mean Square F Sig. 1 Regression 69.906 5 13.981 48.874 .000b Residual 103.842 363 .286 Total 173.748 368 a. Dependent Variable: CS

b. Predictors: (Constant), RE, RS,AS,EM,TA

ANOVA analysis showed that F is significant at 0.000 level, suggesting that building the regression model is consistent with the data collected and the factors are statistically significant at the 5% significance. Thus, the factors for the independent variable in the model with factors related to the dependent variable.

Table 4.9 Multiple variable result Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) 1.229 .222 5.537 .000 RE .211 .057 .221 3.726 .000 RS -.059 .044 -.056 -1.339 .181 AS .069 .049 .074 1.409 .160 EM .286 .056 .278 5.139 .000 TA .248 .045 .250 5.492 .000 a. Dependent Variable: CS

From the table 4.9 shows total five variables that affect the customer satisfaction are included in the regression model, deeming that there are two variables are not significance affected on customer satisfaction with P- value> 0.05 (Responsiveness (RS), Assurance (AS) so we deleted them in the regression model. The three remaining factors have impacted on customer satisfaction: Reliability (Beta = .221), Empathy (Beta =.278) and Tangible scale (Beta =.250) with the P value significant at <0.05 level.

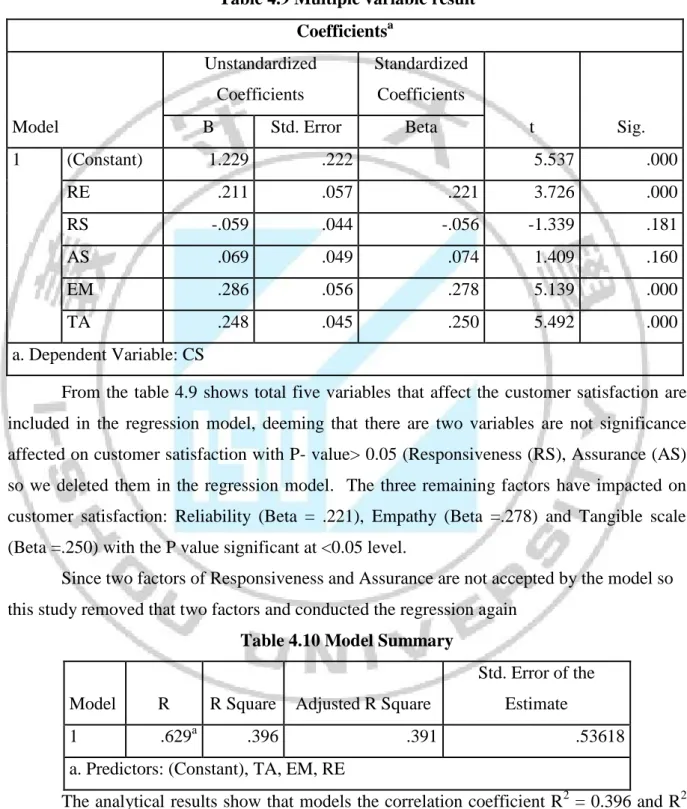

Since two factors of Responsiveness and Assurance are not accepted by the model so this study removed that two factors and conducted the regression again

Table 4.10 Model Summary

Model R R Square Adjusted R Square

Std. Error of the Estimate

1 .629a .396 .391 .53618

a. Predictors: (Constant), TA, EM, RE

The analytical results show that models the correlation coefficient R2 = 0.396 and R2 adjusted is .391. The index is to ensure safety in the assessment of the suitability model (not to exaggerate the relevance of the model). With editing by 0.391 R2> 0.3, the model is considered suitable by 39.1%, it means 39.1% of customer satisfaction is explained by the

independent.

Table 4.11 ANOVA

Model Sum of Squares df Mean Square F Sig. 1 Regression 68.816 3 22.939 79.792 .000b

Residual 104.932 365 .287 Total 173.748 368

a. Dependent Variable: CS

b. Predictors: (Constant), TA, EM, RE

ANOVA analysis showed that F =79.792 is significant at 0.000 level, suggesting that building the regression model is consistent with the data collected and the factors are statistically significant at the 5% significance. Thus, the factors for the independent variable in the model with factors related to the dependent variable.

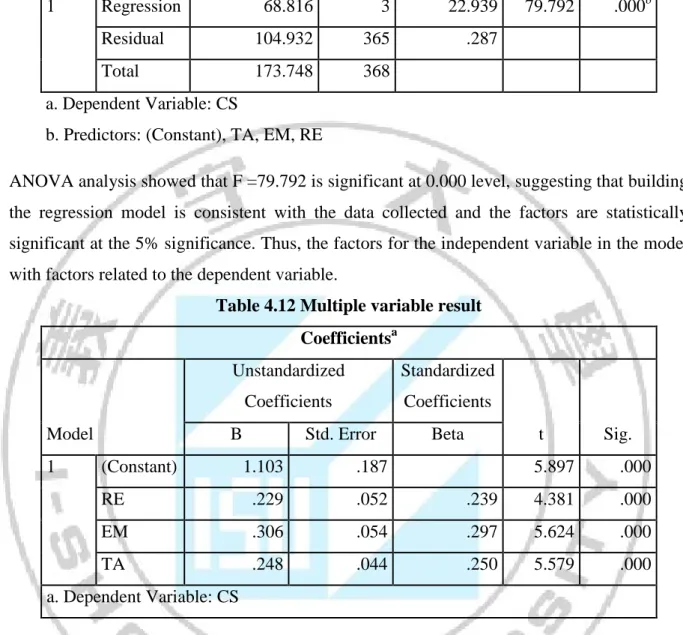

Table 4.12 Multiple variable result Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) 1.103 .187 5.897 .000 RE .229 .052 .239 4.381 .000 EM .306 .054 .297 5.624 .000 TA .248 .044 .250 5.579 .000 a. Dependent Variable: CS

From the table 4.12 shows total three varibles that affect the customer satisfaction are included in the regression model, The three remaining factors have impacted on customer satisfaction: Reliability (Beta = .239), Empathy (Beta =.297) and Tangible scale (Beta =.250) with the P value significant at <0.05 level.

CS = 1.103+ .239 RE + 0,297EM + 0,250 TA + є

The regression equation shows that three factors in the model are positive influence on customer satisfaction with VietcombankATM service. and the degree in order from high to low as follows: Empathy (1) (beta = 0.297); (2) Tangible (beta = 0.250) and (3) Reliability (beta = 0.239). This means, in the context of other factors constant, then when factors Empathy improved by 1 unit, the customer satisfaction level will increase 0.297 units; the factor Tangible improved by 1 unit, the customer satisfaction level will increase 0.250 units

and when factor Reliability improved by 1 unit, the customer satisfaction level will increase 0.234 units. So this study indicates that hypothesis H1 ; H4 and H5 are supported by the model while H2 and H3 are not supported.

4.5.2 The impact of overall service quality factors on customer

satisfaction

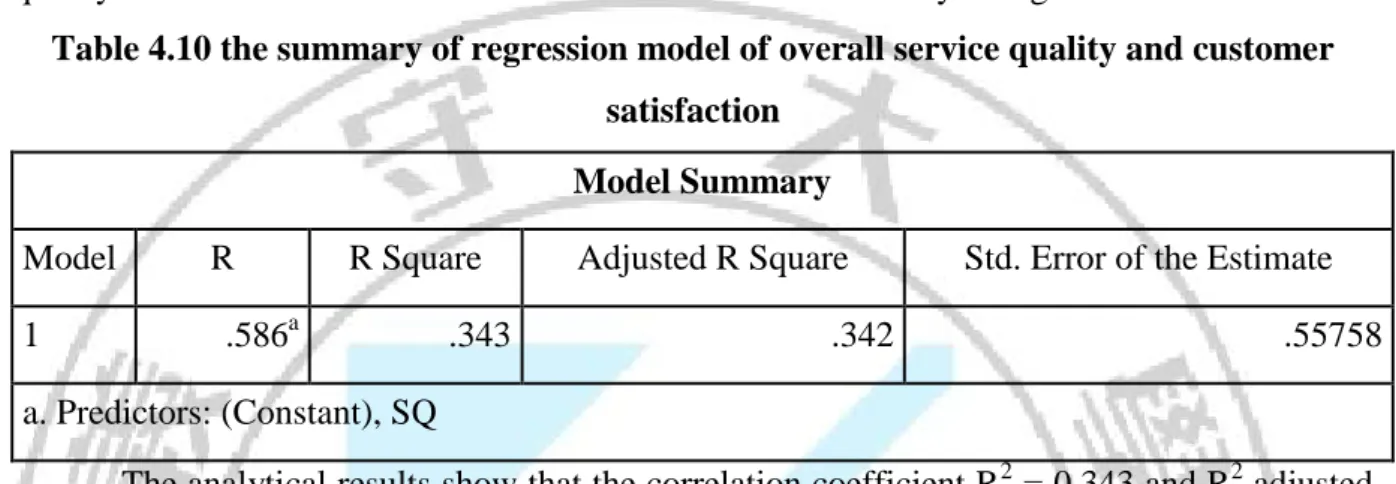

For testing the H6, this study is conducted the single regression between overall service quality and customer satisfaction. Table 4.10 shows the summary of regression model

Table 4.10 the summary of regression model of overall service quality and customer satisfaction

Model Summary

Model R R Square Adjusted R Square Std. Error of the Estimate

1 .586a .343 .342 .55758

a. Predictors: (Constant), SQ

The analytical results show that the correlation coefficient R2 = 0.343 and R2 adjusted is .342. The index is to ensure safety in the assessment of the suitability model (not to exaggerate the relevance of the model). With editing by 0.343, the model is considered suitable by 34.3%, it means 34.3% of customer satisfaction is explained by the independent variable (overall service quality).

Table 4.11. ANOVA of overall service quality and customer satisfaction

ANOVAa

Model Sum of Squares df Mean Square F Sig. 1 Regression 59.651 1 59.651 191.871 .000b

Residual 114.097 367 .311 Total 173.748 368

a. Dependent Variable: CS b. Predictors: (Constant), SQ

ANOVA analysis showed that F = 59.651 is significant at 0.000 level, suggesting that the regression model is consistent with the data collected and the factors are statistically significant at the 5% significance. Thus, the factors for the independent variable in the model with factors related to the dependent variable.

Table 4.12 The regression of overall service quality and customer satisfaction Coefficientsa Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) .985 .215 4.582 .000 SQ .826 .060 .586 13.852 .000 a. Dependent Variable: CS

From the table 4.12 shows that overall service quality affect the customer satisfaction with bate = .586 ( P<0.05). So it can be concluded that the overall service quality have strong impact on customer satisfaction ( H6 is supported)

4.6 Anova – t-test result

For testing the hypothesis H7: there are differences among customer demographic with the level of customer satisfaction about service quality of VietcombankATM , t-test and Anova is used to test the differences between Socio-demographics (gender, age, education, experience, job status and income) and customer satisfaction with VietcombankATM.

To apply or perform a one−way ANOVA, certain assumptions (or conditions) need to exist. If any of the conditions are not satisfied, the results from the use of ANOVA techniques may be unreliable. The assumptions are:

- Each sample is an independent random sample

- The distribution of the response variable follows a normal distribution

- The population variances are equal across responses for the group levels. This can be evaluated by using the following rule of thumb: if the largest sample standard deviation divided by the smallest sample standard deviation is not greater than two, then assume that the population variances are equal.

Given that you are comparing independent groups, the null and alternative hypotheses are: H0: 1 - 2 = 0

H1: 1 = 2 # 0

In other words, the null hypothesis is that at all of the groups' population means are equal. The alternative is that they are not all equal; there are at two population means that are not equal to one another.

+ The differences between gender and employee loyalty

alpha of 0.05, the independent t-test indicate the that the average level of satisfaction of male (M= 3.9558, SD=.67938) is not difference from female (M= 3.9079, SD=.69710), t (1) = .667, p>0.05 (table 4.13). It can be concluded that there is not significant difference between male and female in customer satisfaction.

Table 4.13 Differences between gender and customer satisfaction Group Statistics

Gender N Mean Std. Deviation Std. Error Mean t Sig. (2-tailed) CS Male 198 3.9558 .67938 .04828 .667 .505

Female 171 3.9079 .69710 .05331 .666 .506

+ The differnent of customer satisfaction among age group

To test the different of customer satisfaction among age group, the ANOVA with 0.05 sig. is taken ( table 4.14) age group include: > 20 year old, 20 - 35 year old, 36 - 50 year old and < 50 year old. The result indicates that customer in different age group do not have different level of satisfaction (F= 1.954; P>0.05).

Table 4.14 The differnent of customer satisfaction among age group ANOVA

CS

Sum of Squares df Mean Square F Sig. Between Groups 2.746 3 .915 1.954 .121 Within Groups 171.002 365 .468

Total 173.748 368

+ The differnent of customer satisfaction among Experience in using ATM

To test the different of customer satisfaction among Experience in using ATM , the ANOVA with 0.05 sig. is taken ( table 4.15) Experience in using ATM include: >1 year, 1 - 5 year and < 5 year . The result indicates that customer in different Experience in using ATM do not have different level of satisfaction (F= 1.352; P>0.05)

Table 4.15 The differnent of customer satisfaction among Experience in using ATM ANOVA

CS

Sum of Squares df Mean Square F Sig.

Between Groups 1.274 2 .637 1.352 .260

Within Groups 172.474 366 .471

Total 173.748 368

+ The differnent of customer satisfaction among Education level

To test the different of customer satisfaction among Education level, the ANOVA with 0.05 sig. is taken ( table 4.16) Education level include: Master or more, Bachelor and Below bachelor . The result indicates that customer in different Education level do not have different level of satisfaction (F= 1.772; P>0.05)

Table 4.16 The differnent of customer satisfaction among Education level ANOVA

CS

Sum of Squares df Mean Square F Sig. Between Groups 1.666 2 .833 1.772 .172 Within Groups 172.082 366 .470

Total 173.748 368

The differnent of customer satisfaction among job status

To test the different of customer satisfaction among job status , the ANOVA with 0.05 sig. is taken ( table 4.17) job status include: Officer, Business and Retire.The result indicates that customer in different job status have different level of satisfaction (F= 3.106; P<0.05)

Table 4.17 The differnent of customer satisfaction among job status ANOVA

CS

Sum of Squares df Mean Square F Sig. Between Groups 2.900 2 1.450 3.106 .046 Within Groups 170.848 366 .467

Total 173.748 368

To find the detail of different of customer satisfaction among job status, post hoc test with LSD - method is used. The result indicates that customer who are Retire group have more

Business group are people who is using the ATM every day for their transaction while the Retire group do not have much transaction with ATM.

Table 4.18 Post hoc test of differnent of customer satisfaction among job status Multiple Comparisons

Dependent Variable: CS LSD

(I) Job (J) Job Mean

Difference (I-J) Std. Error Sig.

95% Confidence Interval Lower Bound Upper Bound Officer Business -.08079 .07482 .281 -.2279 .0663 Retire -.35129* .14485 .016 -.6361 -.0664 Business Officer .08079 .07482 .281 -.0663 .2279 Retire -.27049 .14819 .069 -.5619 .0209 Retire Officer .35129* .14485 .016 .0664 .6361 Business .27049 .14819 .069 -.0209 .5619 *. The mean difference is significant at the 0.05 level.

The differnent of customer satisfaction among income

To test the different of customer satisfaction among income, the ANOVA with 0.05 sig. is taken ( table 4.19) income per month include: <250 USD, 250 - 500 USD, 501-750 USD, 751-1000 USD, > 1000 USD The result indicates that customer in different income have different level of satisfaction (F= 2.866; P<0.05)

Table 4.19 The differnent of customer satisfaction among income per month ANOVA

CS

Sum of Squares df Mean Square F Sig. Between Groups 5.306 4 1.326 2.866 .023 Within Groups 168.443 364 .463

Total 173.748 368

To find the detail of different of customer satisfaction among income, post hoc test with Tukey HSDa- method is used. The result indicates that customer who have income permonh

(P<0.05). This may come from the frequency of using and amount of money in ATM card, the people who have less than USD 250 will do not have money for saving and less the ATM transaction, while the people who have more than USD 1000 per month is belong to the rich in Vietnam, with them ATM card is not so important since they also rarely transition through the ATM.

Table 4.18 Post hoc test of differnent of customer satisfaction among income

(I) Income (J) Income Mean

Difference (I-J) Std. Error Sig. <250 USD 250 - 500 USD .95405* .32413 .003 501-750 USD .72609* .30891 .019 751-1000 USD .69962* .30997 .025 > 1000 USD .58571 .32523 .073 250 - 500 USD <250 USD -.95405* .32413 .003 501-750 USD -.22797 .12402 .067 751-1000 USD -.25444* .12665 .045 > 1000 USD -.36834* .16040 .022 501-750 USD <250 USD -.72609* .30891 .019 250 - 500 USD .22797 .12402 .067 751-1000 USD -.02647 .08004 .741 > 1000 USD -.14037 .12687 .269 751-1000 USD <250 USD -.69962* .30997 .025 250 - 500 USD .25444* .12665 .045 501-750 USD .02647 .08004 .741 > 1000 USD -.11390 .12944 .379 > 1000 USD <250 USD -.58571 .32523 .073 250 - 500 USD .36834* .16040 .022 501-750 USD .14037 .12687 .269 751-1000 USD .11390 .12944 .379

Chapter

V CONCLUSION AND RECOMMENDATION

5.1 Conclusion

The aim of this study is to analysis the factor affects on customer satisfaction, this study uses the Servequal model to validate the satisfaction level of customer while using the ATM service. There are 369 customers were conducted survey. The result shows that 05 factors that affect the customer satisfaction are included Reliability, Responsiveness, Assurance, Empathy and Tangible. The regression model indicates that 02 factors are not significance affected on customer satisfaction with P- value> 0.05 (Responsiveness (RS), Assurance (AS)). The three remaining factors have impacted on customer satisfaction: Reliability (Beta = .221), Empathy (Beta =.278) and Tangible (Beta =.250) with the P value significant at <0.05 level. Also the overall service quality affect the customer satisfaction with bate = .586 ( P<0.05). So it can be concluded that the overall service quality has strong impact on customer satisfaction (H1 is supported). This result consistent with the study of Lee and Hwan (2005), their study has used models in their research SERVPERF of banking services in Taiwan. The result was confirmed Hwan Lee and reliability are of this model and detect termites are the relationship between service quality, customer satisfaction and profitability at banks. In Vietnam, most notably the study of Nguyen, Chaipoopirutana and Howard (2011) assess the quality of banking services in Vietnam using SERVQUAL model. This study was conducted on 400 customers in Vietnam and shown that customer loyalty to the bank with the same dimensional relationship to the quality of service they receive, besides, quality of banking services is also an important role for building the image of the bank.

Beside the study also shows that there is not significant difference between male and female in customer satisfaction, result indicates that customer in different age group do not have different level of satisfaction, the result indicates that customer in different Experience in using ATM do not have different level of satisfaction. The result indicates that customer in different education level do not have different level of satisfaction. However, The result indicates that customer in different job status have different level of satisfaction and also The result indicates that customer in different income have different level of satisfaction

5.2 Recommendation

With the goal of building a Vietcombankto be the largest modern banking group with leading in reliability, quality and efficiency, the bank should do as flowing :1) Expand the network and upgrade the banking channels in the province along with the rapid development of products and services of the bank on the basis of modern technologies.

Proactive, positive application of advanced technology in governance, innovation creativity private businessman, ... Advance the branch operation in particular and contribute to the activities of VietcombankAdvance the closer to domestic standards and internationally. 2) Continue to develop the model of branch mix includes wholesale banking and retail, and strengthen cooperation linkages to maintain supremacy in the province and in the system.3) Strengthen training, retraining and recruiting new staff for the branch, to create a high-quality human resources of the branch, to meet the development needs and improve the quality of business operations of the branch as well as meet the requirements of integration and the possibility of friction with the fiercely competitive environment.4) Continue to improve environmental, professional working style and modernity, associated benefits of workers with professional work to provide psychological stability and a level playing field to attract talent. 5) Building modern trading space, spacious, continuous improvement, advanced technology application in management and banking business in order to diversify the products and services of the branch and customer diversification. 6) Restructuring the organization and management system modeled to customer orientation and according to the standards of modern banking. Healthy financial system and moving towards achieving the targets under international rules on banking. 7) Perception becomes clearer direction on client objectives, the next time, the branch continues to conduct research on customer satisfaction with customer care programs periodically to improve and enhance the quality volume of services, and strengthen relationships with customers, especially large customers.

Complete and further improve the information infrastructure to meet the volume of transactions, account quantity increases more and more, to minimize network congestion due to overload. Also regularly upgrade machinery informatics systems meet standards: modern, fast processing speed, matching orientation modernize banking technologies.

Promote the local banking services especially internet banking, e-banking to the bank can provide information to customers as quickly as possible. Customers can perform their transactions at the workplace. Also pay attention to the quality of data safety and security of IT systems, severely dealt with cases of delay in providing services to customers.

for the purpose of "complete business results and achieve higher profits" to the goal of "maximum satisfaction of customer needs so that complete business plan, growth profit". Consolidate the good image of the bank in customer. Such as: building a good image in the customer's mind, unity of brochures, layout counters, convenient parking as well as the type, quality of service, working style ... ; Respect the commitments with customers; Promoting social contributions and community for the implementation of programs such as fundraising for scholarships, organizing sports activities for the purpose of charity, funded public projects ... Look at the factors affecting customer satisfaction on service quality

Regularly organize promotional programs such as bonus interest rates for older customers, bonus interest rate for customers with high deposit the balance, gifts, lucky draw bonus, the bonus awarded in interest and foreign tourism ...

Increase the customer service facilities. Because of the rush hour, customers often have to wait long until your session is unavoidable, so affiliates should increase the installation of additional amenities such as televisions with rich canal system, alarm magazine updated daily, drinking water serving customers ... to create a sense of comfort to the customer over a period of waiting.

5.3 Implication of research

This research meets the objective evaluation of customer satisfaction through the construction of analytical models and thereby determining factors are affecting customer satisfaction. With the results of which will make banks evaluated the providers of their unit, from which view of making measures to improve customer satisfaction using the service.

5.4 Limitation and future research

The survey has contributed positively to the bank customer in understanding and recognizing its position, but also has a certain number of limitations:

Due to limitations on the ability to research conducted on only 400 customers (369 valid question) and individual customers are not yet able to assess the full overview of customer transactions at Vietcombank. So to repeat the study with a larger sample size, diversification of target customers, not just individual customers to generalize the typical components of the scale.

Study only consider using banking services and transactions, not yet understand all the customer satisfaction in relation to the business, financial potential, ethnic factors…

Research focuses on the use of customer service at Vietcombankin Hanoi should not yet be assessed on customers in the whole country and other local in as the prospect unused banking

services. So to repeat the study with a larger scale for a better overview of customer satisfaction for the quality of banking services.

Through regression analysis in chapter 4, the regression model adjusting coefficient R2 = .394 means that .39.4% of variation customer satisfaction be explained by three independent variables above, while others variation customer satisfaction be explained by other factors not included in the model. Therefore there should be further studies on customer satisfaction on the quality of banking services, which, in addition to the components in Servqual scale, researchers need additional explanatory variables into the model to model regression with higher relevance.